In an earlier post from last December, I noted the correlation between growth in RV sales and recession. Extrapolating October YTD data for 2018 as a whole, I obtained 11% probability of recession. Extrapolating June YTD data for 2019 (thanks to reader AS for compiling the time series data), I obtain 70% probability of recession for 2020.

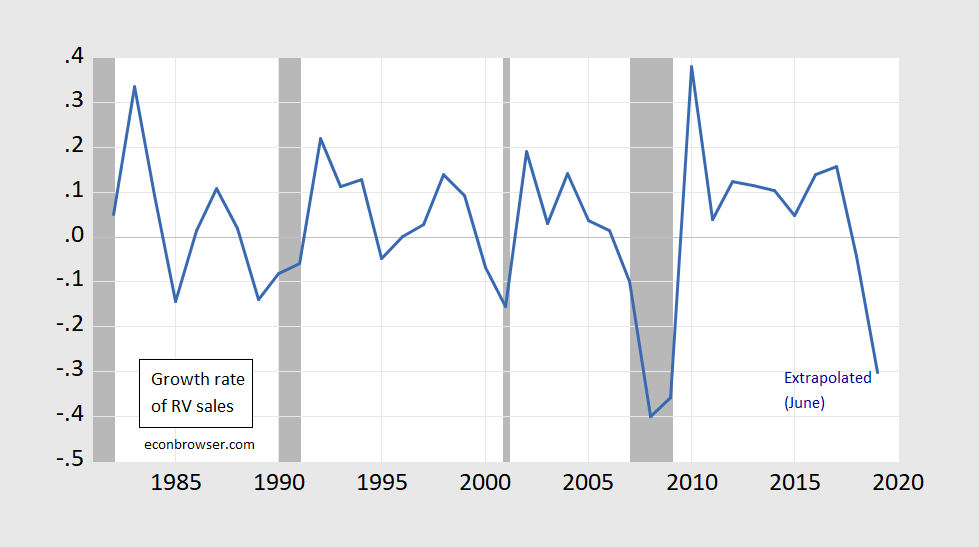

Here’s the time series:

Figure 1: Growth rate of Recreational Vehicle sales, in log first differences (blue). NBER defined recession dates shaded gray. 2019 observation extrapolated based on first six months’ data. Source: rvia.org, NBER, and author’s calculations.

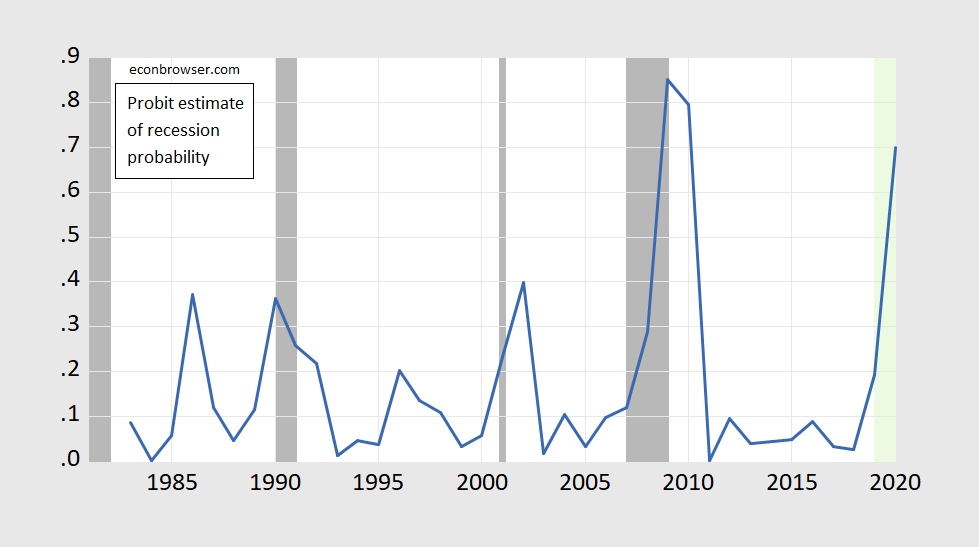

I estimate a probit regression over 1983-2019 period:

Pr(recessiont) = -1.09 – 5.36(salesgrowtht-1) + ut

McFadden R2 = 0.26, NObs = 37. Bold denotes significant at 5% significance level. Figure 2 shows the relevant predicted probabilities. (Pretty close to AS’s results, if I use exact formula instead of log approximation for growth rate)

Figure 2: Probability of recession predicted by probit regression (blue). NBER defined recession dates shaded gray. 2020 prediction based on 2019 observation extrapolated based on first six months’ data. Source: rvia.org, NBER, and author’s calculations.

The probability of recession in 2020, assuming the rest of 2019 is the same as the first half in terms of RV unit sales, is 70%.

Professor Chinn,

Glad my answer came close to yours (big relief), otherwise I may need to quit posting and move to the back of the class.

Other than using the annual percent growth versus the log approximation, I assumed that the ratio of June YTD sales for 2019 would be the same as the ratio of June YTD 2018 / December 2018 YTD. June 2018 YTD sales were about 53.4% of total 2018 sales. I thought that perhaps most RV sales occur during the spring and summer months. Although seeing that the first six months of 2018 were 53.4% of total sales, sales seem fairly evenly distributed between the first and second halves of the year.

I called the RV Association a few days ago and left a message to see if we could get more historical data. No return call, so I assume my call was a bust.

AS: Good to hear. I assume that since the RVIA usually charges money for the detailed data (as far as I can tell), they are unlikely to part with the data gratis. But no harm trying!

@ AS and Menzie

“AS” strikes me as a diligent guy, maybe there is a way around this “lag” in the RV data?? Would there be a way to keep very current data on Elkhart Indiana RV sales?? Use it as a kind of “sample pool” for the entire market and “extrapolate” from that?? You could use local Elkhart prices (monthly, even weekly changes in current sales adverts—monthly or even weekly changes charted and then do a regression on the data?? The number of models listed in local Elkhart publications/adverts for “month/week X” , and the average market price in local Elkhart publications/adverts for “month/week X”?? I think there is something to be had there.

“More than 80% of recreational vehicles sold in the U.S. are produced in Indiana, and roughly 65% of those come from Elkhart County, according to data from the RV Industry Association.

Wholesale shipments of RVs are down 20.3% so far this year, the Indianapolis Star reported. Companies such as Elkhart-based Thor Industries Inc. have slashed output and cut back the work week to slow production.”

https://www.journalgazette.net/news/local/indiana/20190825/dip-in-rv-sales-out-of-elkhart-a-warning

Theoretically you could phone up that Ball State economist during his office visit hours, be upfront about why you’re calling and ask him the best local publications where the data (market prices on RVs, or any indirect indicators of recent sales, such as number of individual models profiles in sales handouts/adverts) could be culled. Something tells me there is a way to do that for the diligent armchair economist out there who doesn’t mind one or two long distance phone call bills as part of his query. Just something to gnaw on there.

Moses,

Actually, July 2019 monthly dats is now available on the site, https://www.rvia.org/news-insights/rv-shipments-july-2019 .

I think what we were hoping to get was monthly data from the past, perhaps back to the 1980s or prior.

From what I see, monthly data is available back to January 2017.

The RVIA says that sales are sensitive to the population 35 to 54 and to baby boomers who are retiring. Anyone know how to quickly find such data?

I tried to use the Census site to find above data, but could not. Kaiser Foundation provides the 35 to 54 age data for the period 2008 tp 2017.

Using FRED data series for total population: POPTHM, for the period 2008 to 2019 (estimated 2019), the hit to the RV industry for 2020 if there is a recession seems even more dramatic than the estimated decline for 2019. I used a recession indicator and the growth in population. It would be nice to use the regressors that RVIA suggests.

@ AS

I guess what I was imagining was something like a “NOWcast” for RV sales. But maybe that’s unrealistic. I know what you were going for, was trying to think of other ways you could get a similar answer on recession chances WITHOUT the RVIA historic data. I sympathize with your efforts. I will hunt for 20 minutes for your RVIA data during my night owl web wanderings. But since neither you nor Menzie could find it, it’s probable my efforts will be fruitless. I will give it “the old college try” though. Sometimes you can find data you didn’t think was there in “strange corners” of the internet.

Aren’t RVs popular in middle America? Where are they made? If we had a middle America recession offset nationally by a boom in California and Manhattan, something tells me this would be really bad news for Trump. Like California and NY are going red anyway?!

A lot of RVs are assembled in Elkhart, IN. Time to start looking at the local economy in that area for a tip off.

Assembly is IA and IN. Consumption is more widespread but still heaviest in the states carried by Trump. This speaks to a fairly widespread reduction in consumer confidence that hasn’t manifested in other metrics yet.

My wife ran a rental booking agency for private owners of RVs for about 25 years. Strangely, it seemed recession-proof. We’d pretty much book anything we had available from March through October. There were always new owners coming on as others stopped renting theirs out. It was a cost-effective way to have an RV for a vacation and a good way to make the payments on the RV. Toward the end, just before we sold the business in 2008, we noticed that more people were buying trailers with all of the amenities of a motorhome, but at a much more affordable price. I think was due to the emergence of large, powerful SUVs and the increasing popularity of pickup trucks that made it practical to tow a 25-30′ trailer.

The picture in this article gives a good representation of that change: https://www.curbed.com/2019/6/17/18682121/rv-campers-industry-economy-economic-impact-jobs-2018

Towables are still king

Despite the craze over van life, towable RVs still made up the vast majority of RVs this past year. A total of 482,389 RVs were manufactured in the U.S. in 2018, and towable vehicles (think Airstreams, fifth wheels, and teardrops) accounted for 88 percent of shipments to dealers. Class B vans may be hot, but they have a long way to go before they make up even half of all manufactured campers.

Also, The RV Industry has slowed slightly

Despite being down 4 percent from record-breaking numbers in 2017, the number of manufactured RVs show that the industry has tripled in size since the Great Recession of the late 2000s. In 2009, RV companies only shipped out 165,700 new units compared to 2018’s total of over 482,000 units.

So, I’m not sure if this “leading indicator” is indicating much yet. I’d get concerned if there was a precipitous drop-off in RV purchases.

Bruce Hall: You don’t consider a 26% drop in sales in the first six months of 2019 relative to 2018 a precipitous drop-off? That’s about 1.2 standard deviations from mean growth rate.

Okay, I’m convinced. Going to cash now.

Thor Industries (THO) is a major player in the RV sector. Skip Single Statistic Bruce “no relationship to Rpbert” Hall’s focus on renting which does not lead to a single new sale for Thor. Let’s instead look at its stock price:

https://finance.yahoo.com/quote/THO/

$155.44 per share on 1/15/2018 but only $43.56 a share today. We’ll let Bruce’s wife explain the implications of this fact to him!

“My wife ran a rental booking agency for private owners of RVs for about 25 years.”

Good for her but did she explain the basics of renting. You get to use it without buying a new vehicle. In other words, renting has even less than to do with producing new goods than when someone buys an existing house from another person. You see – there was some really dumb person pretending to be you that claim higher sales of existing homes added to GDP. That person was dumber than a rock but hey back to your better half. Did she also ran an agency for booking vacation time shares? I hope she explained that did not build any new building either. Then again I can see why your wife would not waste her valuable time trying to explain really basic economic concepts to hubby.

OMG – Bruce Hall cannot even read the title of his own link:

‘The RV industry is slowing down after 10 years of growth’

And its main message confirms what Menzie is saying:

‘Still, the 4.1 percent drop in shipments from 2017 to 2018 shows that the industry has slowed off of its record-breaking years, and this could show that the overall economy is slowing. RV sales can be an excellent indicator of economic health in the U.S. When RV sales do well, the economy follows; when RV sales fall, the economy could be in trouble, too. Shipments from throughout the first few months of 2019 have also been lower than 2018, demonstrating what some are calling a “growth hangover” from the boom years post-recession. Will the numbers bounce back? We’ll have to see how the last two quarters of 2019 shake out.’

Bruce Hall has a real talent for selectively cherry picking small quotes to totally distort what his own link was really saying. I guess he thinks we are too stupid to read the entire article for ourselves. Hey Brucie – we are onto your dishonesty.

pgl When RV sales do well, the economy follows; when RV sales fall, the economy could be in trouble, too.

Yep. Thor’s “beta” is 2.22.

https://finance.yahoo.com/quote/THO/key-statistics/

That is an equity beta but I noticed they paid off all of their debt so their unlevered beta is also that high. Which puts their cost of capital near 15% if one assume an equity risk premium = 5% and a risk-free rate = 4%.

I am not particularly familiar with this indicator. How did you extrapolate forward? Naively, I’d imagine seasonality with lower sales for the months leading into winter.

Ian Fellows: Naive extrapolation — assumed YTD June 2019 ratio to YTD June 2018 (thus addressing seassonality) applies to entire 2019. That ratio as 26%, so assumed 2019 as a whole was 26% lower than 2018. Could’ve done something more sophisticated, but probably would’ve been less transparent.

In laws–3 sets– quite happy with “5th wheels” but not doing lots of traveling. (One east coast, others west).

Now that I think about it, I’m not seeing the numbers of RV’s previously encountered. Those I do see almost always towing small auto.

Been a while since I pulled into a service station and was blocked at 3 pumps by an RV. Will be on the road Friday to Reno and will pay attention to traffic headed there and to Tahoe.

That sounds like fun. Been there but largely didn’t get to enjoy it because it was work-related. I think I walked to a movie theater in Reno to watch “Analyze This”. In some ways it feels like just yesterday, in other ways it seems like a Billion years ago. My impression though was Reno was a nice city. It seems to have a lot of the same gambling aspects. At the time I remember wondering why people would choose LV when they could get the less hectic version. I mean there’s only ONE aspect there where LV has them beat (hell, that’s probably a “draw”/tie there when you really get down to it). I’m weird though, I always thought if I did any gambling in Nevada it would be purely sports wagers as I feel I’m semi good at it. My wallet would be cleaned out in minutes playing Poker. I also get severe temporary depression watching old people throw away their money on slot machines like zombies. It literally depresses me watching those damned idiots. I usually don’t have empathy for extremely stupid people but that one always gets to me.

To whoever said that RVs were a ‘middle America kind of thing’, it’s probably more accurate to say RVs are less of a Northeast thing–they are quite popular on the West Coast (emphatically not Trump country) and, basically, in most of the country outside the northeast corridor. To whoever said they were waiting for a precipitous drop off in RV sales–it’s already happened in the first six months of the year–shipments to dealers down 20-25%. (I think the host of this website noted that). In addition, anecdotally, the backlogs in the small custom manufacturers (direct to consumer) are beginning to dry up and you are beginning to see RV manufacturers fail. Finally, you’ve got to be careful to distinguish RVs from manufactured housing, which the RVIA numbers, at least, do.

I’d be curious to know how sales of, say, large recreational watercraft are doing. Big ticket discretionary consumer durables should a pretty good leading indicator of consumer confidence, and AFAIK, the consumer is all that’s keeping the economy moving forward at this point.

My only point was that they are produced in middle America. Where they are enjoyed is a different matter.

RV ownership typically requires a decent plot of unused ground to store the RV. That limits their attractiveness in places with high land costs. Rural and exurban areas are more likely to be populated by people with the land to store one. For whatever reason, those people were more likely to be Trump supporters. I don’t know if that will hold if things fall apart for them.

The President’s net approval ratings have consistently held in a range associated with recessions for previous presidents. If we enter an actual recession, the president may struggle to hold 30% approval, versus a bit under 42% now.

Hard to win with his current -12.3% net approval rating as it. And it’s gotten worse. The whole Greenland thing took a bite out of Trump, as has the Mooch. Right now, the perception is that the president is operating entirely on his own, with effectively no input or support from staff. It feels like a one man show, with that one man exhibiting increasingly erratic behavior.

Well golly gee – you need to make more appearances on Fox & Friends so you can peddle your fake analysis in support of MAGA!

The topic got me to thinking about horses and horse trailers. Most likely a lagging indicator. Back in 09 when we moved to the Gamma Quadrant, there were stories in the community of abandoned horses. Two women went riding at a local park and returned to find a strange horse in their trailer.

The RV slowdown is a result of producing an inferior product due to demand. As a full time Airsteamer I can tell you this decline is self induced.

Stop trying to create something that isnt there. The economy WILL erode if you keep creating unsubstantiated doubt.

If this product is so inferior – why did sales double from 2008 to 2018?

Continuing with the discussion of Thor’s beta and the implied cost of capital, we get a somewhat different picture looking at Winnebago:

https://finance.yahoo.com/quote/WGO/

Equity beta is only 1.28. And with $291 million in debt as opposed to market equity just over $1 billion, the unlevered beta for this company is only 1.

One should note that its stock valuation has dropped a lot of late, which was my original point. But Bruce “no relationship to Robert” Hall is not worried by the RV sector as his wife is still leasing RVs. I’m sure the wife is a smart girl which leaves us all wondering why she deals with such a dolt for a husband!

A colleague told me he thinks we are going to have a recession in 2021, not 2020, based on RV sales. He’s an engineer, but doesn’t have any more credentials as a tea leaf reader than I do. I am convinced that it’s going to happen about 12 months from now, give or take a quarter. We look at the same data and come to different conclusions.

“It’s tough to make predictions, especially about the future” attributed to Yogi Berra.

If you come across a fork in the road – take it.

Yogi Berra and Satchel Paige would be my guiding philosophers if Alfred E. Neumann didn’t exist.

If it does start in 2020QIII, let’s hope the gurus at NBER do not wait until December of 2020 to make their call. Come on fellows – with BIG data, let’s stay on top of these things!

Bill McBride just put up information about the Chemical Activity Barometer. The relationship between the CAB and industrial production is clear, with the exception of a manufacturing trough in 2016. Without that trough, who knows what the 2016 outcome would have been. It’s also not clear to me why that trough happened. What is clear is that if the CAB continues to drop, industrial production will also likely decline. More tea leaves that say downturn coming.

One other thing – the general public doesn’t need the NBER to tell them things have fallen apart. My take is that the usual denials that we are in a recession don’t end until the recession is well underway, and maybe even technically over. When a recession is officially declared, it is almost assuredly over, even though the misery is just started because the economy has to dig out of the hole its in before it feels like prosperity to the average person.

I agree, Willie. The public largely is unaware and does not care what official whoevers say about whether or not the US is in recession. The pocketbook issue has always been about how people feel that they themselves and those very close to them (family members and very closest friends) are doing economically, job status, real income, stocks, and so forth. What is being reported in the media or on evonoblogs or by NBER are irrelevant, although they might be somewhat influenced by loud propaganda from one side or the other if they are really strongly committed partisanly (see farmers continuing to support Trump even as they are hurting economically because, as Lindsey Graham, the sacrifice is necessary or worth it or whatever). But again, while those people may not be voting for their own economic best interest, they are judging it by what they are personally experiencing/observing in their own lives, not what they hear through media of whatever sort.

Hey – let’s take Republican toadie but rather decent economist Greg Mankiw. He claims he called the 2001 recession even before George W. Bush took office. Mankiw not only has his own methodology, his disdain for Trump runs even deeper than my disdain.So maybe the October Surprise will be a NYTimes oped by a Republican economist declaring we are already in a recession. Whew – can you imagine the Trump twitter tirade!

If the economy turns down and threatens the orange guppy’s chances, our saving grace will be the orange guppy’s physical cowardice and unalloyed greed. He has too many interests in other countries to start a war somewhere. His properties would be sitting duck targets. He and his jet setting family would also be in the crosshairs of an enemy if he picked the wrong fight. It would be ironic.