Today, we are pleased to present a guest contribution written Hiro Ito (Portland State University) and Robert N. McCauley (formerly Bank for International Settlements). The views presented represent those of the authors, and not necessarily those of the institutions the authors are or were affilliated with.

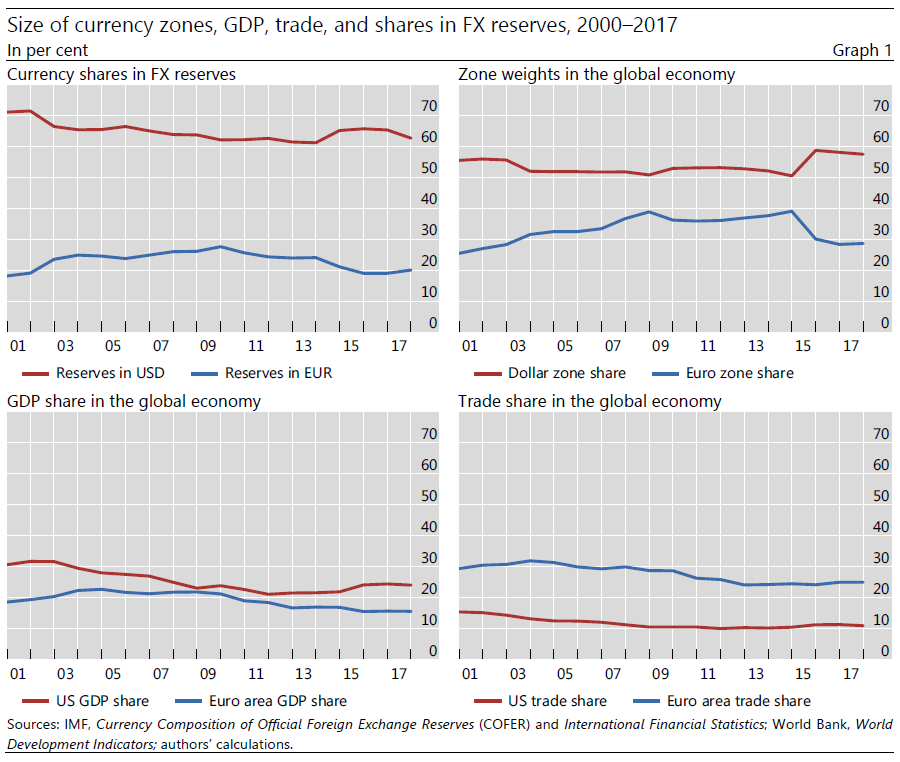

Since 1945, the US dollar has dominated the international monetary and financial system. The dollar plays a particularly outsized role in official foreign exchange (FX) reserves. Scholars find it puzzling that its share has persisted at about two thirds of the total. After all, the US share of both world GDP and global trade has declined post-war. However, when researchers seek to understand the dollar’s predominance in FX reserves, they quickly encounter severe data limitations that greatly impede empirical analysis.

We attempt to remove this impediment in a new working paper. To do so, we compile a data set from annual reports, financial statements and other relevant sources for 58 central banks across the world (in 1999–2017. This data set makes a big contribution. The IMF’s Currency Composition of Official Foreign Exchange Reserves (COFER) data generally disclose only aggregates for the entire world, advanced economies and emerging market economies, not data on individual economies.

Our dataset includes 13 advanced economies; 45 “emerging and developing economies”, as defined by the IMF. By region we have 10 Asian-Pacific; 12 African and Middle Eastern; 6 Western European; 17 Eastern European and Central Asian; and 12 Western Hemisphere (We exclude issuers of the key currencies: the United States, the euro area, and Japan).

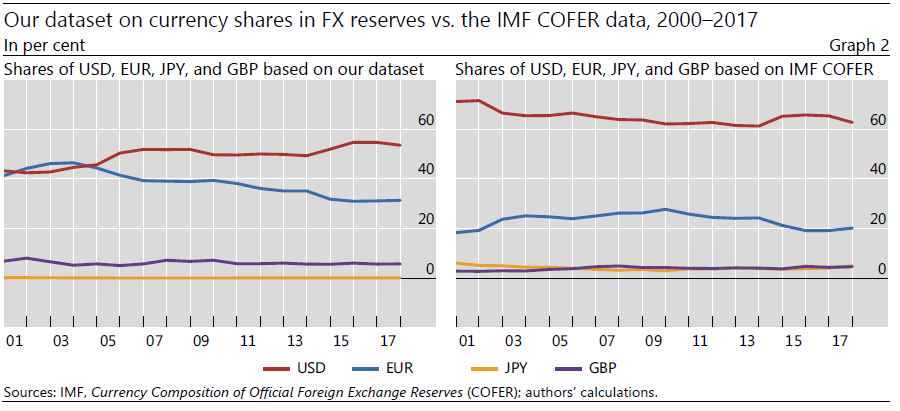

Our aggregate USD and EUR shares demonstrate a waning European selection bias in disclosure of currency weights (Graph 2). While the IMF COFER shows the USD share has been on a slightly declining trend in the 60-70% range, it starts in our dataset from low levels (ie, 40-45%), and rises in the late 2000s and the mid-2010s. The contrast between our data and the COFER data arise mainly because our dataset, especially in the early years, over-represents European countries that tend to disclose their reserve currency composition. Our lower USD share also arises from our exclusion of Japan and the euro area, whose reserves well exceed US reserves, and which hold high shares (90%?) of USD in their FX reserves.

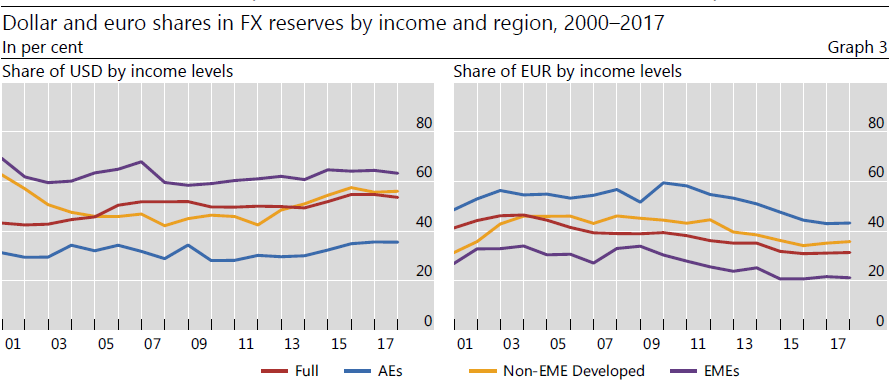

Across income groups, EMEs have held persistently high USD shares in their reserves (Graph 3, top left panel). Non-EME developing countries do not have as high USD shares as EMEs do. AEs hold lower USD shares on average, which reflects that many are (non-euro area) European countries in Northern and Western Europe.

Using this data set, we find that the greater the co-movement of the domestic currency with the dollar (euro), the higher its dollar (euro) share of FX reserves. This finding holds in both the cross section and the panel. This makes sense. If a currency varies less against the dollar than against other key currencies, then an FX reserve portfolio with a large dollar share poses less risk when returns are measured in domestic currency. We also find in smaller samples that the higher the dollar-denominated (euro-denominated) share of exports, the higher the dollar (euro) share in FX reserves. The effect of currency anchoring appears to be on a par with that of the unit of account in trade as determinants of reserve composition.

This post written by Hiro Ito and Robert N. McCauley.

Discussion mentioned records since 1945, but data focused on last two decades. A curious point is that British pound much more widely used than Japanese yen, even though Japanese economy has been larger than the British one for a long time. If one were to go back to 1945, one would find pound sterling much more important.

Point here is that there is a lot of persistence in terms of which currencies get used in reserves. Once a currency is important it remains important for a long time. This explains both the higher rates of USD but also of the pound sterling, whereas even though it is nominally the second largest economy and in PPP terms the largest, the Chinese yuan/rmb simply is not used as a reserve currency, although that also reflects China’s continuing limits on capital mobility.

Two notes here from goofball Uncle Moses,

I thought upon reading the blog summary above by Ito and McCauley “Isn’t this closely related to the work of Gita Gopinath?? And sure enough, I couldn’t get past page 1 of the paper on BIS without seeing Gopinath’s name referenced, which made me feel good that I’m not obsessing too much. (OK, I admit I’m obsessing, don’t tase me bro)

One of our great bloggers is “retiring”. I’m assuming just from his work at University of Oregon and not from blogging at least intermittently. I think he knows he has a following that would be sad if he left blogging altogether. Hopefully he will take pity on those of us “with nothing better to do” than check his posts..

https://economistsview.typepad.com/economistsview/2019/12/32-years.html

It will be a real loss if Mark stops blogging. As it is, I am concerned something is going on with him. He has not blogged as much recently as he used to. And he is retiring at a pretty young age, just turning 63 today (Dec. 15).

@ Barkley Rosser

I’m gonna be my usual overly blunt self here. I like Mark Thoma, I think he is a good human being, conscientious about his job, and even extremely kind and gracious when he feels that kindness is not being wasted down a drain pipe. But I think he can strike different people (i.e. students) different ways. I suspect he has a low tolerance for students who aren’t swinging the bat hard. I suspect that’s a decent % of his students fall under that category (of not swinging the bat very hard), and when he sniffs lack of effort he lets them know “in no unclear terms”. He’s had grandchildren recently which he has intimated is a significant part of him tapering off on his posts.

All of that is coming from someone who has never so much as shared a “hello” with Professor Thoma, so take it for what it’s worth. I think it’s more mental exhaustion and a little tired of repetitive work than health issues. I hope whatever the deal is, Thoma keeps blogging at least in an intermittent way, as he contributes greatly to the general conversation and the blog is a great amalgamator of knowledge.

I remember he took the loss of his partner hard. Those are life changing experiences. I know, been there done that.

I thought this is one of the better articles I have seen, as far as breaking down the progress of the RMB as an international currency in very understandable terms. Some really outstanding graphs and visuals presented. I may have even spotted the names of a certain Mr. McCauley and certain Mr. Frankel.

https://www.rba.gov.au/publications/bulletin/2018/sep/rmb-internationalisation-where-to-next.html

Damned heretics……

But in a more serious note, I noticed someone from Virginia who often likes to discuss things they have little knowledge of said the following:

“the Chinese yuan/rmb simply is not used as a reserve currency,”

I bet that would be interesting news to the IMF, who as I understand it hold 10% of the weight of their SDRs in RMB:

https://www.imf.org/en/About/Factsheets/Sheets/2016/08/01/14/51/Special-Drawing-Right-SDR

It might also be interesting news to our “dear friends” in Russia, who hold 14% of their reserves in CNY, vs only 6.6% of their reserves in GBP.

https://www.reuters.com/article/us-russia-nwf-forex/russia-to-cut-share-of-us-dollar-in-national-wealth-fund-mulls-other-currencies-idUSKBN1XN1JY

But Barkley says “the Chinese yuan/rmb simply is not used as a reserve currency”

I guess these little known fly-by-night outfits of Russia and IMF better get with Barkley’s program.

Moses,

Yes, the yuan/rmb has become part of what backs the IMF SDR, but the SDR is not itself used as a reserve currency, although it is unit of account for loans made by the IMF.

The article under discussion here is focusing on the use of currencies by central banks as a part of their reserves. For that use, the Chinese yuan/rmb remains barely above zero. It is not even shown in the figures in the paper under discussions and for good reason. Where you can see this is in Figure 8 of your link. Yuan/rmb has a slight usage, but it is less than 1 percent, still far behind the passe UK sterling pound and more recently used Japanese yen, much less the more heavily used euro and still-dominant USD.

What is going on with the yuan/rmb as noted in your link is increasing use for trade, especially in East Asia as well as Australia. In that role in the region it is becoming very important. It is also the case that China holds lots of assets in many of the nations in the region. But what is not going on yet beyond some barely minimal amount is the yuan/rmb being used as a reserve currency. And your link notes as did I that one of the things holding that back is the continuing presence of exchange controls in China.

Useful to read Eswar Prasad’s assessment (p210) and my comments (p257), of this SF Fed volume.

1) not accessible

2) from 2015. Sorry, largely worthless.

So, Moses, for the record in this idiotic game you insist on continuing to play that I have made multiple efforts to end, Yes!!! I recognize that after so much effot on your part you have finally scored a point! I did make an actually false statement when I said that the PRC/yuan/rmb “is not used as a reserve currency.” I hope this great victory, which you will probably bore the heck out of readers here many times with finally gets you a prom date.

So, i think I could have made my statement perfectly correct by adding a mere four words at the right locations. One would have been to make clear that this was only true for “national central banks.” The other was to replace “not” with “rarely.”

So my big mistake was that like most people in a discussion about a paper I was using the paper’s view of things, which sis not include IMF data for reasons I shall discuss further, being focused as I was on national central bank usage of currencies as “reserve currencies.” IN that context my error was failing to note that while the paper completely ignored the y/rmb for its total cjurrnt irrelevance in that role, there is indeed a minscule, less than 1 precent use, oof it as national central bank reserve currency. But I was following the paper Menzie poste, which did not even mention it, given its curren t irrelevance now.

Regarding the IMF matter, well, the paper did not consider it, and, frankly, I did not think about it at all when I made my post. So, wow, Moses, a big point for you that I failed to drag in something the authors of the paper under consideration had dismissed and were not considering at all. Why was that?

Well, the matter of the IMF reserves is a matter of very high level and long runiing political matters. It has nothing to do with the considerations that individual national central banks deal with, those that continue to favor the pound sterling by a lot over the y/rmb. So a few years ago very reasonably the IMF recognized the rising importance of China in the global political economy and that indeed the old post WWII setup for the SDR was out of date, and that the y/rmb should be officially part of the official international system as represented by the IMF’s SDR. But, Moses, the SDR is not a traded currency. It is used as a numeraraire for IMF loans. So the y/rmb now plays 1 10 percent tole in the value of such loans. But that is mot remotely the same as national central banks deciding on the basis of market forces to hole y/rmb as al reserve currency, which they are not doiing beyond some miniscule amount.

A bit more on the role of the yuan/rmb at the IMF. It constitutes 10.92 percent of the weight in the basket of five currencies that determine the eschange value of the IMF currency, the SDR. However, that is not the percent of reserves held by the IMF that are yuan/rmb, those two functions being separate.

I have just checked. The yuan/rmb only constitutes 1.85 percent of the IMF foreign exchange reserves, not much more than one finds in the national central banks. It is used as a reserve currency by the IMF and other central banks, but only a little bit.

@ Barkley Rosser

I’m happy to let regular readers or even Menzie (although I think collegial considerations have him tilting some way) tabulate “points” between you and me. I’ve never turned it into an ego thing—which makes it much easier to stick to reality of any pathway of reasoning, It also inclines me to less blathering about topics I am not fully-versed on, with the sole intention of impressing people I don’t even know. As for you, I recommend more vitamin B-12 and vitamin E, maybe one of each every two or three days—or even better, just vegetables with those nutrients in them. Not so you can tabulate points with anyone who told you you were wrong, but for better reading retention.

Look, Moses, I have offered on several occasions to have a truce with you and have at those times even apologized for roughing you up at times. You have never accepted these offers and have soon after they were made resumed making personal attacks on me. Many of these have been not remotely factually based, although in contrast to me, you have never apologized for anything, and seem to be quite proud of not doing so.

I noted this point about points, because, frankly, you have almost never won any of our arguments or scored any points, despite constant and repeated efforts to show that I am wrong about this or that or am otherwise a bad guy or whatever. So, I thought I would note that finally you were right about something, even if it turns out not to be much of a big deal.

Oh, yes, you have caught me making misspellings and putting non-functioning links for urls, but I think few take those matters as seriously as you do.

Anyway, today I am not going to waste more time yet again by offering to have a truce. You are just too far gone into your obsession.

Oh, and just for the record, let it be clear that I only go after you in defense. You are the one always initiating attacks and persona criticisms, always. Maybe you can explain why you are so obsessed with doing this? Can you?

Mark Thoma has retired from the UO. They might have a job opening for Prof Chinn.

@ dilbert dogbert

I think this is probably an attempt at humor on your part, but will go ahead and say UW-Madison is probably a better job. If someone has the rankings of the different economics departments though I’m very willing to be swayed on this with objective facts.

Something I agree with you on, Moses. Not only is U.Oregon lower ranked than UW-Madison, but the state is having a major fiscal crisis that includes demanding state employees pay a lot more for their pensions. There are some in other parts of the internet claiming this is why Mark is retiring now. I do not know, but it is certainly not a bad time to retire from this perspective there, and not a particularly good time for somebody coming in at a senior level unless they make a really good offer, not all that likely given the current situation in OR.

Been to Eugene? It’s an hour from the spectacular Oregon coast, hour and a half south of Portland. at the southern end of the Willamette Valley. Not far from skiing and the Columbia River. Did I mention fishing for you name fish. Then there’s U of O smack dab in the middle of all that and Oregon State not far away.

It’ll do.

I’m trying to imagine all the guys at the University of Chicago Booth School packing their bags for University of Hawaii and it’s not clicking for me somehow. I think my father took some classes there and enjoyed it, but I think his context was slightly different.

This may be an extreme example, but I think it makes the point pretty clearly.

Not to belabor the issue, but I will anyway. Dr. Rosser mentioned pension issues as a factor. That being the case, having to contribute (more) toward retirement is certainly a quality of life issue, one being faced by state employees almost everywhere.

When faced with such, other considerations certainly are important, overall quality of life being one. And, from my limited observations, paying more for a pension while living in Eugene (in western Oregon) may not be that big an issue.

In fact, if faced with choosing , say, UCLA, or Cal (Berkley), or U of Oregon, I personally would have a hard time rejecting Duckland. (Throwing in either UC San Diego or UC Santa Barbara would, however, make the choice much more difficult).

BTW, both Oregon and Wisconsin are beautiful places, but not in the same way(s). Not even close, especially when you’re considering the area(s) west of the Cascades.

UO is a get out of Wisconsin free card.

@ dilbert dogbert

Other than the cold/snow Wisconsin is a great place. It ranks well in most categories. The weather and scenery are probably better in Oregon, but for someone as scholarly geared as Professor Chinn is I don’t think this weighs too highly. In my mind’s eye (and overly active imagination) I saw Menzie either going back to Washington state or California when he retires, or taking some kind of emeritus type job at UC, where he could still write papers and not burn the candle at both ends like some 25 year old. Or maybe he could get emeritus status at UW-Madison and still spend most of his time on the coast?? Some profs can probably “get away with” that. But I think Menzie’s still “a ways off” yet on that life change. Although donald trump and MAGA have probably stolen some life vigor for all of us, aye?? Kinda feels like it here, especially without some strong drink handy.

There is another UW out here in Seattle. I do not know much about the economics department.

@ Willie

The deciding indicator could be when was the last time Menzie went to Kau Kau BBQ for his Thanksgiving turkey?? Enquiring minds wanna know……..

They had a story about this on Germany’s version of the BBC, and I thought it was interesting. A guy named “Midway Dude” and a place online called “tree hole”. I liked this story very much, and I admire this guy for taking the risk he is taking:

https://supchina.com/2019/12/05/tree-hole-mainland-chinese-confess-support-hong-kong-protesters/

https://chinadigitaltimes.net/2019/12/translation-netizens-voice-support-for-hong-kong-protesters/

Again, I am not comparing myself to this great man, I am just a person who appreciates their privacy, but sometimes there is a constructive use of anonymity. Anonymity even has a positive function in sophisticated societies. That function and utility should be respected. It is often those who abuse their authoritarian powers who fear anonymity the most.