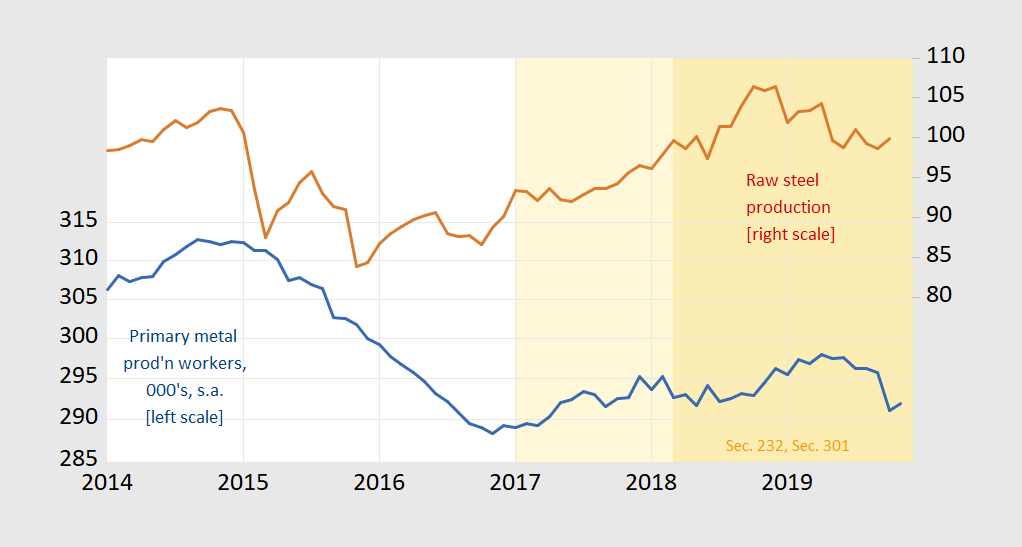

Raw steel production is down, as is primary metal employment.

Figure 1: Primary metal production workers (NAICS 331), 000’s s.a. (blue, left scale), and raw steel production index (NAICS 3311, 2pt.), 2012=100 (brown, right scale), both on log scale. Light orange is Trump administration; orange is since implementation of Section 232. Source: BLS, Federal Reserve Board, via FRED.

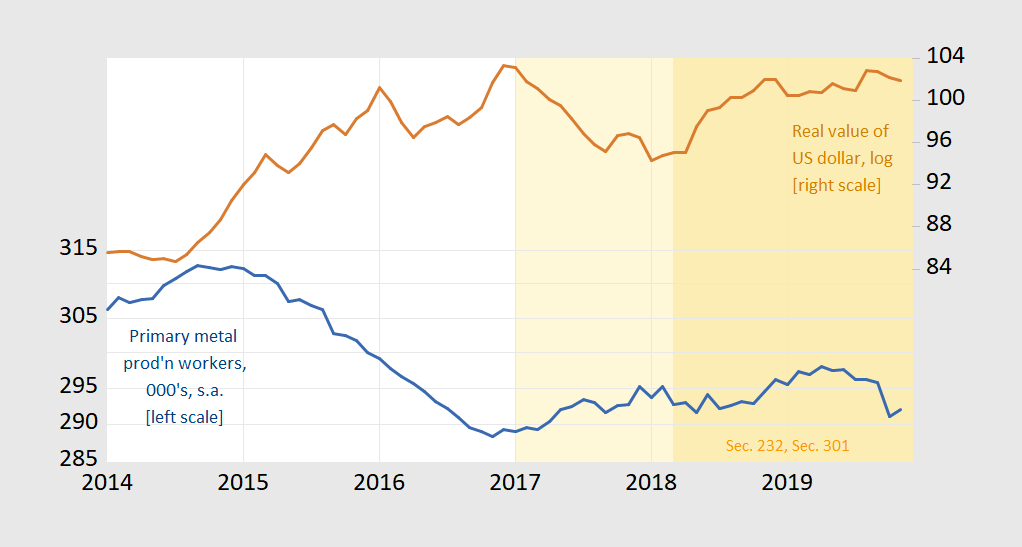

In 2015-17, it could be argued that the strong dollar drove the decline in employment in those years.

Figure 2: Primary metal production workers (NAICS 331), 000’s s.a. (blue, left scale), and real value of US dollar against broad basket of currencies, March 1973=100 (brown, right scale), both on log scale. Light orange is Trump administration; orange is since implementation of Section 232. Source: BLS, Federal Reserve Board, via FRED.

The recent decline in employment occurs against a backdrop of a roughly stable dollar.

But the Trumpster are more concerned about stock valuations than employment so how is AK Steel doing?

https://finance.yahoo.com/quote/AKS/

Not so great either.

So the steel tariffs have been an employment bust. However, I’m sure companies getting tariff exclusions are doing fine. https://www.pbs.org/newshour/economy/why-trump-tariffs-havent-revitalized-american-steelmakers

No worries, ask the MAGA voters, coal is booming now like never before.

If things get real bad, the unemployed steel workers can move to Cleveland:

https://themindunleashed.com/2019/12/cleveland-church-homeless.html

It is the season for giving after all. Maybe the great Ohio Republican John Kasich can lead a prayer meeting about it, where he can do a “product placement” mid-prayer for his most recent book.

Correlates to rig count

WTF? Oh yea – you need an invite to Fox & Friends. Never mind.

Interesting:

https://www.youtube.com/watch?v=2zMLmOukbco

Let’s say that we go through several state primaries, past “super Tuesday’ or a significant portion of states, and Bernie has got a 5% lead on Warren. At what point does she concede and possibly hand her votes/delegates to Bernie?? If she for example agreed to be his VP, or if she gave him a strong verbal endorsement, do Warren’s votes jump over to Sanders or to Biden?? I think you’re talking about a group already inclined to be “progressive” rather than the Biden “I can snag the reasonable Republicans” camp. So then what happens?? In my personal opinion, this may be THE BIGGEST OPEN QUESTION in the 2020 presidential race right now. If ALL of Warren’s voters (or even say 85%) jump over to Bernie, I think Biden’s goose is cooked. And that’s assuming we don’t even have any more Biden early dementia howlers.

The fall in steel production and employment was primarily caused by the oil price collapse of 2015-16.

Could you please at least TRY to explain your comment here? It is sort of like the joke my stats teacher used to quip – U.S. GDP is highly correlated with the number of fish in Brazil. He was kidding of course but you seem to actually think you have some great insight here. Of course if you cannot even be bothered to explain the linkages, it is nothing more than the usual stupid trolling we get from Princeton Stevie boy.

Here is one serious discussion:

https://www.fedsteel.com/our-blog/how-does-the-cost-of-oil-affect-the-steel-industry/

Check it out as it is arguing that the lower oil prices would make producing steel less expensive, which should have the opposite effect of the weird claim you are peddling.

Leave it to Forbes to provide some support for your weird argument:

https://www.forbes.com/sites/greatspeculations/2014/11/17/why-weak-oil-prices-could-negatively-impact-u-s-steel/#2d893b695273

The current environment of low oil prices has raised concerns about the sustainability of the roust growth in oil and gas production in the U.S. The rate of oil and gas production in the U.S. has a direct impact upon the fortunes of U.S. Steel’s Tubular Products division. The Tubular Products division produces and sells seamless and electric resistance welded steel casing and tubing (commonly known as oil country tubular goods or OCTG), standard and line pipe, and mechanical tubing. These goods are primarily sold to customers in the oil, gas and petrochemical markets, the production facilities for which are located mainly in the U.S.

Right – that’s the argument.

the reason for the failure of the tariffs was simple. Companies import steel too so their products cost more and therefore lost customers. also, those laid off employees will not be consuming steel i.e. cars, and appliances that have steel on them. Also, truck drivers lost jobs due lack demand *=(see Celadon). the trucking companies are not producing trucks which use…steel. Also, the other side has a vote. China increased tariffs on American agricultural products which put farms out of business. they also consume steel in the form of tractors and harvesters. Thus, the trade war is a big negative.

You get the concept of intermediate goods. I know this is a big request but could you please explain this basic concept to those pretend economists in the White House.

What about the extra sales of red dunce caps?? Have you included that in your analysis?? Liberal fake news.

I thought Ivanka had that red dunce caps made in China.

In fairness I do think they are made in USA now—after David Letterman and others gave them hell on all the trump products made overseas you had to know they were gonna short-circuit that one. You better believe that would have never changed if they didn’t know they were going to be called out on it during any election/campaign. Wait for them to head straight back to Vietnam textiles the second after there are no votes riding on it.

Dear Folks,

I think I know what Philip Malter has in mind: high oil prices lead to demand for steel for drilling rigs and hydraulic fracturing, and these are presumed to be the main drivers for steel demand. It is not easy to find data for this, and it seems unlikely, though it is conceivable. What is more readily apparent is the cutback in demand from China and reduced automobile demand elsewhere. This is discussed in

https://www2.deloitte.com/content/dam/Deloitte/ru/Documents/research-center/metals-1h-2019-en.pdf

Julian

A useful comment. Thanks for this link to Deloitte’s partner over there apparently in Russia. Note his findings will be published by the Russian media! Global production and consumption rose to around 1.8 million metric tons – a new record. But note almost all of that increase came from the increase in Chinese production. He is also noting that while the price of raw materials have risen, he expects that the price of steel will fall. No wonder steel companies are all upset!

His figure 3 is interesting. Chinese production represented 51% of world production whereas North American production was only 7%. Of course China is consuming a lot of steel.

It seems 2018 was a good year for U.S. steel producers but not for Canadian producers. I can see why European nations might want steel tariffs to protect their companies but the idea that U.S. steel companies need protection strikes me as a bit absurd.

Now his take on U.S. consumption is interesting. He claims that the energy sector contributed to an increase in steel consumption but declining car and housing sales might tend to offset that if interest rates stayed high. But of course recently U.S. interest rates have declined. He also adds that the higher steel prices (from Trump’s stupid tariffs) will hurt steel demand. Gee a Russian accounting partner knows about the law of demand but our stupid President does not?