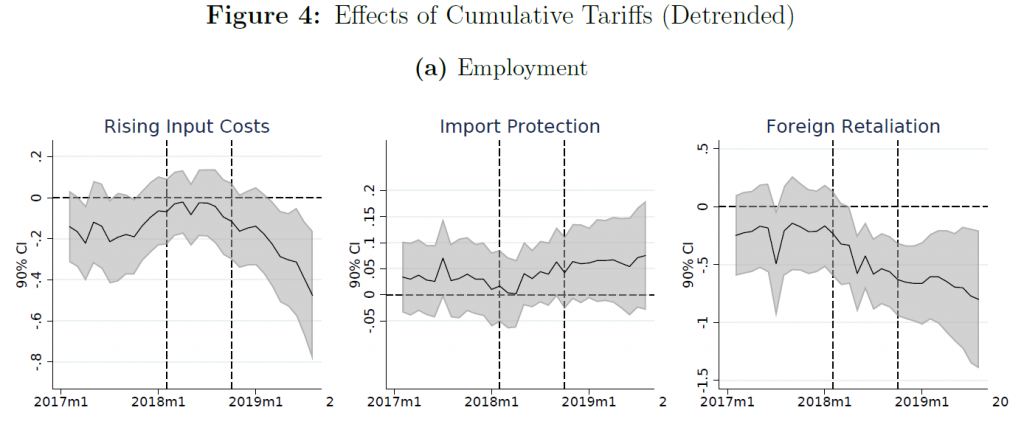

Net impact on employment from Trump’s trade war and associated retaliation:

Source: Flaaen and Pierce, 2019.

From Flaaen and Pierce:

Since the beginning of 2018, the United States has undertaken unprecedented tariff increases, with one goal of these actions being to boost the manufacturing sector. In this paper, we estimate the effect of the tariffs—including retaliatory tariffs by U.S. trading partners—on manufacturing employment, output, and producer prices. A key feature of our analysis is accounting for the multiple ways that tariffs might affect the manufacturing sector, including providing protection for domestic industries, raising costs for imported inputs, and harming competitiveness in overseas markets due to retaliatory tariffs. We find that U.S. manufacturing industries more exposed to tariff increases experience relative reductions in employment as a positive effect from import protection is offset by larger negative effects from rising input costs and retaliatory tariffs. Higher tariffs are also associated with relative increases in producer prices via rising input costs.

How about what countries are gaining as a consequence of US tariffs? From Nicita (2019):

Since mid-2018 the United States of America and China have been locked in a trade confrontation which has resulted in several rounds of retaliatory tariffs. This paper investigates the impact the United States tariffs on China on United States imports. This paper finds that United States tariffs against China have resulted in a reduction in imports of

the tariffed products by more than 25 percent. The analysis finds that China’s export losses in the United States have resulted in trade diversion effects to the advantage of Taiwan Province of China, Mexico, the European Union and Viet Nam among others. The analysis also finds that those effects have increased over time. The analysis finds some preliminary evidence that Chinese exporters may have started to bear part of the costs of the tariffs in the form of lower export prices. Overall, the results indicate that the United States tariffs on China are economically hurting both countries. United States losses are largely related to the higher prices for consumers, while China’s losses are related to significant export losses.

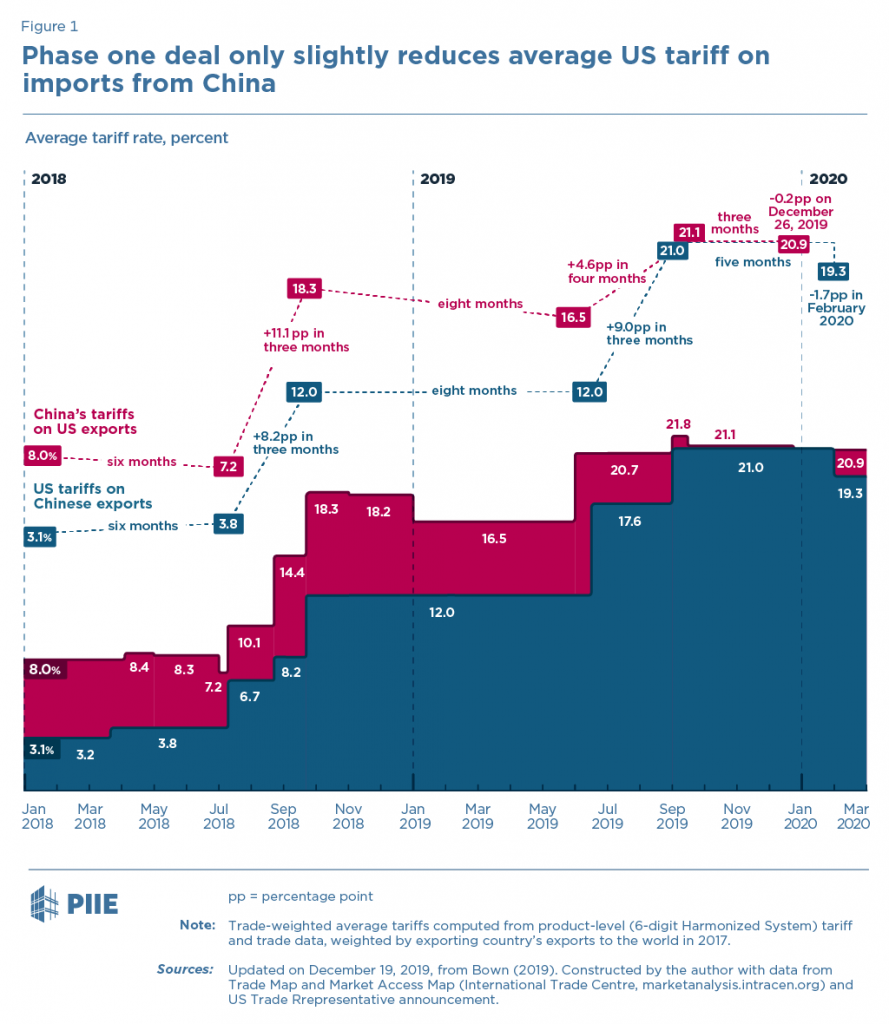

Lot’s more out there. One thing to remember: As Chad Bown says, “Phase One China Deal: Steep Tariffs Are the New Normal”.

The fed paper is super interesting.

I highlighted on my modest blog today after seeing it at Brad’s. Great minds think alike

I don’t know where Menzie is getting all this negative trade news. FOX Business is saying goods being transported by train has increased drastically in recent months, and this morning Ed Hanson sent me this link he got from CoRev:

https://www.altnews.in/freight-train-traversing-the-famous-tehachapi-loop-in-us-viral-as-china-germany-train-route/

Where is Menzie getting all his liberal fake news?? Shameful. Thank goodness I know how to source my news well after CoRev showed me all his soybean links.

[to be clear, Moses Herzog is making a joke here — no link was sent by Ed Hanson — MDC]

Wouldn’t you know. That “famous tehachapi loop” is located in recession ravaged California, in Kern County, still the most prosperous agricultural county in the US. ( Where, btw, it’s estimated that about 25% of the ag work force is undocumented but apparently contributing quite nicely to that prosperity and, likely to the traffic on that famous loop).

Moses

I have never sent you a link since years ago when I brought attention of Prof. Hamilton’s daughter to you, and that was through normal econbrowser topic replies.

So I have no Idea who sent the link you reference.

So, if this is your usual lousy sense of humor, it is not appreciated.

And if so I ask Menzie to remove the post.

Ed

https://www.cnbc.com/2019/12/30/battery-developments-in-the-last-decade-created-a-seismic-shift-that-will-play-out-in-the-next-10-years.html

Off topic, but for those who question renewables, electric cars and batteries, looks like you are wrong about the future. Fossil fuels and oil will be looked back upon with disdain within a decade. Steven, corev, rick et al, your reputations will be worthless based upon your current choices.

Soybean “update”. ‘Bout 5 days old article:

https://www.reuters.com/article/us-china-economy-trade-soybeans/chinas-november-soybean-imports-from-u-s-rise-as-tariff-free-cargoes-arrive-idUSKBN1YT04Y

I’m reading an old October NYT in the late hours here, trying to clear a path through papers strewn on the floor. Krugman says the bailout for U.S. farmers is now twice what the auto bailout was under President Obama. Does anyone know where we find the agriculture bailout numbers to confirm that?? Is there a USDA website that quotes the numbers, or…….. ?? I don’t doubt the validity of the number, I’m just wondering where one goes to get that number??

Follow-up question—why isn’t Romney bitching about this bailout??

Moses,

you seem to forget.

Bail outs for farmers are good. They are the salt of the earth. Auto workers are not. Beside they are Castrated. ( get it)