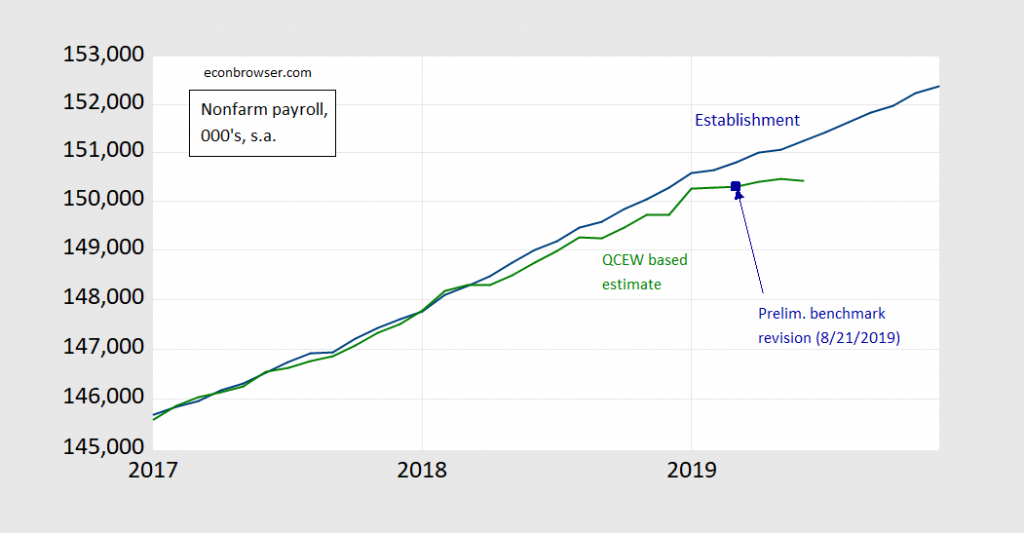

Friday’s estimate of nonfarm employment will incorporate a benchmark revision, based on unemployment insurance and tax data extending up to 2019Q3. What will we see? Here’s an informed guess, based on what we see now (see the green line in Figure 1).

Figure 1: Nonfarm payroll employment (bold blue), August 2019 preliminary benchmark revision for March 2019 NFP (dark blue square), implied NFP using Quarterly Census of Employment and Wages (QCEW) (bold green). Source: BLS via FRED, BLS and author’s calculations. Data used [xls]

The green line is what I guess it’ll be, using the seasonally adjusted QCEW’s historical relationship with nonfarm payroll employment. Here’s the raw material used to obtain this guess:

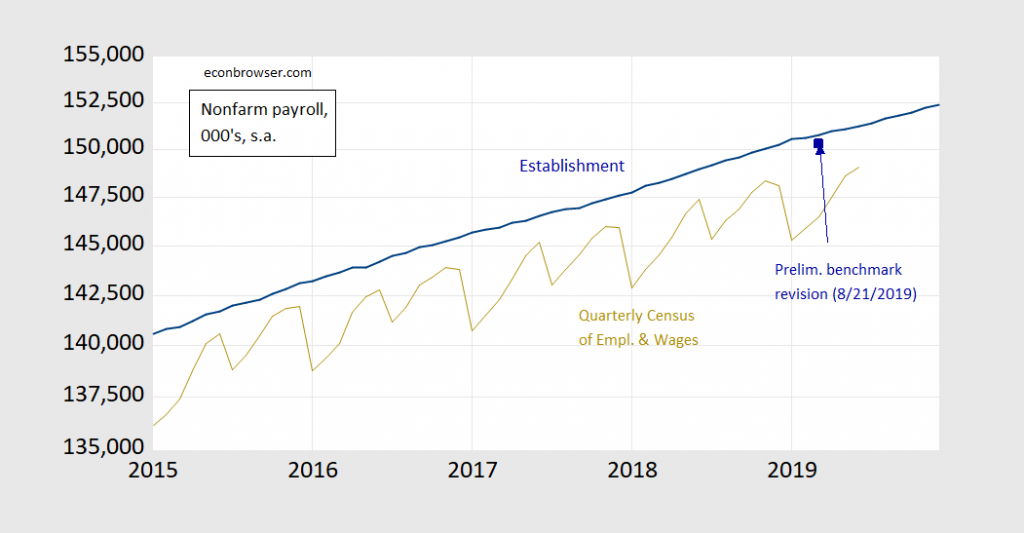

Figure 2: Nonfarm payroll employment (bold blue), Quarterly Census of Employment and Wages (QCEW) (brown). Source: BLS via FRED, BLS and author’s calculations. Data [xls]

Obviously the seasonality in the QCEW series makes interpolation by related series a little more complicated. I applied Census X-13 to the log QCEW series, but using a simple log-log regression with seasonal dummies will yield a similar result, particularly for the first six months of 2019 (which are the important ones).

Try it yourself! Nonfarm payroll, preliminary benchmark, and Quarterly Census data all here. More on how the BLS will “wedge-in” the revisions, and what an ARIMA on the fitted NFP looks like, in this post. (Surely I could obtain more efficient estimates, using a single step procedure instead of the two-step and three-step procedures I use in this post.)

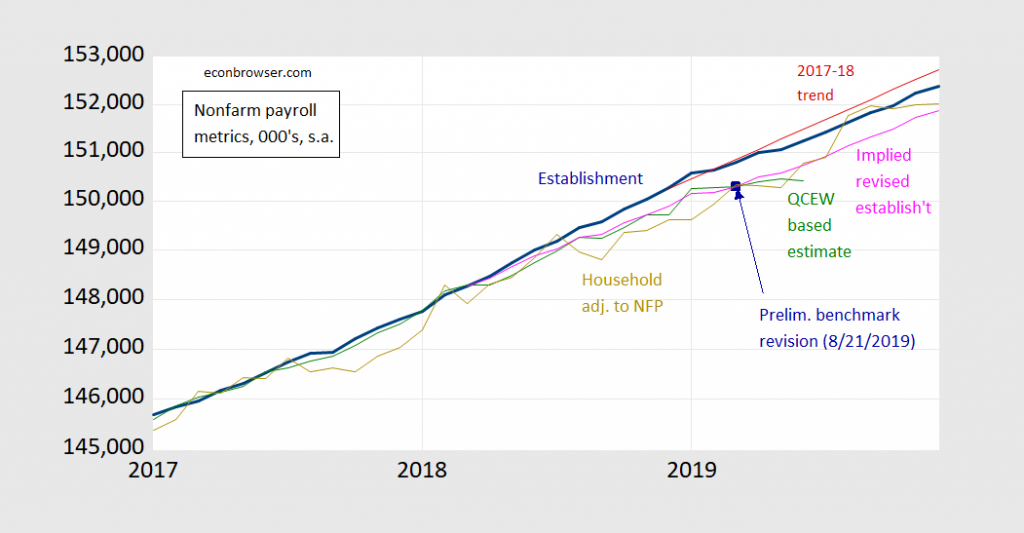

(BLS will wedge in the revision for 2018 — this is my guess of how things will look (pink line)):

I am game to “try it yourself” but the data links seem not to work as of about 1:38 PM PST.

May need to ask some questions as part of the “try it yourself” exercise.

AS: Sorry, I have now uploaded the data. Try again, please.

“Obviously the seasonality in the QCEW series makes interpolation by related series a little more complicated.”

How did Menzie know the exact comment I would make after reading this?? (self-deprecating humor there folks)

“Try it yourself! ” Is Menzie mocking me now?? Really?? Is Menzie mocking me now?? He knows I’ve had “R” now for months and still can’t wing this. Is this…….. ??

This post is making me feel like Menzie is Keith Morrison, and I’m the white trash goofball he’s interviewing.

https://www.youtube.com/watch?v=K5Lv6t0moFY

Hey!!!! Wait a second……. [connecting the dots in my head ]

@ Menzie

Menzie, have you seen the 10-year or 5-year chart for the Chicago PMI?? That’s an interesting looking little chart.

https://tradingeconomics.com/united-states/chicago-pmi

New York PMI also not looking good.

http://www.ismny.com/wp-content/uploads/2020/02/2020_ISM-NewYork_January-ROB_v02.pdf

New York PMI also not looking good.

http://www.ismny.com/wp-content/uploads/2020/02/2020_ISM-NewYork_January-ROB_v02.pdf

It’s funny you said that, because nearly two seconds after I posted that, I saw a graph which stated the other regions were performing better than Chicago’s. Either way, as an important fulcrum point (or should I say tipping point) on 2020 votes in Ohio, Michigan, Wisconsin etc the Chicago PMI being negative alone by itself is worth noting. That said, I appreciate the link and your making the point on the NY area.

Professor Chinn,

Referring to Figure 1

If I understand correctly, the August 31, 2019 BLS revision shows the March 2019 reduction of PAYEMS at -501,000. My efforts estimated the adjustment at -484,000 for March 2019. Extrapolating to June 2019, I get a revised estimate of 150,417,000 compared to PAYEMS reported at 151,252,000 or a decrease of 835,000. Is this estimate in the “ball park”?

I’m so jealous of you when you crunch these. I wish I was joking, but I am supremely jealous of you on this. I guess I only have myself to blame for not working harder on “R” or the econometrics textbook. Although unless I can get that reboot disc to work I’m gonna have to search those out again. That Notre Dame prof’s text probably isn’t free anymore either. Man……..

Moses,

No need to be jealous. I am using EViews, which is a lot easier to use than R. Also, I may be off the mark on the analysis. EViews is a bit pricey, but I got my copy by commenting a few years ago on EViews 9 beta version resulting in a lottery award of a copy of the EViews 9 program.

Moses Herzog AS is right, EViews is much easier to use. But if you’re not into writing R scripts, which can be tricky, and if you’re only looking for some basic statistical functionality, then you might try using the GUI package for R, called Rcmdr:

https://cran.r-project.org/web/packages/Rcmdr/index.html

Personally I don’t use it and I’ve only played around with it a little, so I can’t say much about it one way or the other. Based on the R literature it’s supposed to be about the best attempt to GUI-ify R. There’s also a vignette that explains how to use it:

https://cran.r-project.org/web/packages/Rcmdr/vignettes/Getting-Started-with-the-Rcmdr.pdf

I’m probably gonna stick with R studio at this point. Although I gotta double check and see if I DL’ed that X whatchamacallit thing that will fuddle things up if you don’t have it, it’s small program that will F everything up if you don’t have it, even with R studio and with R. I gotta reload all those damned packages since my other comp broke down (you even have to re-download that every time you update your OS which I think is weird since you don’t have to do that for most programs). But I would have probably had to review the concepts and because my hardware is up to date now I should be able to get tons more of those packages to work now. Last 2 days I just been bookmarking all the R studio stuff related to econometrics. I’m half tempted to skip Stock and Watson on the basis some of the R econometrics sites will run through the material and it will be semi-redundant but that’s probably wishful thinking and I will need to rocket through (as best as I can “rocket” through) the Stock and Watson before actually executing the packages or I won’t be able to conceptualize and set up the problems ad-lib or “off hand” unless I have the econometrics concepts down. I’m gonna check that Rcmdr stuff out though. Certainly have it as a plan B. I remember seeing that Rcmdr “command” when I was skimming sites the last couple days and it caught my eye. Thanks again for the thought and the link.

@ 2slugbaits

“XQuartz” is the name of the program I went blank on. They say like if you update from Mojave to Catalina for example, same computer but new OS, you have to re-download the “XQuartz”. See, I wager a lot of people don’t even get the XQuartz, and some have it but maybe aren’t aware they have to re-download if they upgrade the OS. Some of this stuff isn’t “that” hard, but if you aren’t super careful reading up it makes everything you do after that futile. Maybe I’m wrong and 99% of people do that and know it. If I was a wagering man I’d say way more hit snags on that than people imagine when using this stuff—especially if not learning in a classroom environment where the teacher/prof know, because every damn class he teaches there’s always 8 kids out of 30 that F— that up and don’t download the XQuartz, or other type things that a certain segment of students will get snagged on.

AS: Pretty close to my estimate, -829,300.

Let’s just falsely assume Troy Price could pass a high school level management course and everything had gone well yesterday, as Troy baby verifies every negative stereotype under the sun and blames having his head in his own nether-regions on an app. Would this number prove what a farce the whole caucus process was to begin with??

https://twitter.com/ForecasterEnten/status/1224832302922051586

CNN is hypothesizing that 62% of the precincts is ALL we are getting today (Tuesday) and that Troy Price and the DNC will report the rest of the numbers tomorrow. WOW, this is the type of ClusterF— that would make Debbie Wasserman Schultz green with envy. But it’s not Troy Price’s fault, it’s an app he introduced to managers less than 16 hours before they would use it. Helluva job by Troy.

https://www.youtube.com/watch?v=h9pXS5RgfGg

https://www.npr.org/2020/02/04/802583844/what-we-know-about-the-app-that-delayed-iowas-caucus-results

https://www.latimes.com/business/technology/story/2020-02-04/clinton-campaign-vets-behind-2020-iowa-caucus-app-snafu

From the LA times story:

“Shadow started out as Groundbase, a tech developer co-founded by Gerard Niemira and Krista Davis, who worked for the tech team on Clinton’s campaign for the 2016 Democratic nomination.”

Gosh…….. Gee…….. this is shocking,

Dear Folks,

It is probably too much to ask if there are figures for Christmas sales, which seem to be driving the seasonality. But is there any research on what drives the Christmas sales, so that there is a story as opposed to just trying to deseasonalize by various techniques? A nice glossary of these sorts of technical approaches, which mentions the inevitable TRAMO-SEATS from the Bank of Spain, is at

https://www.census.gov/srd/www/x13as/glossary.html

J.

https://fivethirtyeight.com/features/our-final-forecast-for-the-iowa-caucuses/?cid=taboola_rcc_r

One of the pols presented had Buttigieg near the lead……… and Biden in 3 or 4.

Disclaimer: I tend toward Sanders, I will vote in democrat in NH. on Tuesday.

@ ilsm

It’s still hard for me to believe you are an Air Force guy (much less an American person) , unless you are literally bi-polar, and even then. Do you realize how much this comment contradicts multiple other comments you have made on this same blog?? I’m half tempted to ask Menzie if you’re at least using the same IP address each time you phone in here. But I know he’d semi-rightly say you might be using a VPN so it doesn’t matter anyway. This is actually probably you because at least you are consistently bat sh– crazy if nothing else.

@Moses,

Most of the polls had Buttigieg 4th or 5th. Sad is the kerfuffle over the app looks……. no Ukrianians to blame in Iowa! 71% in after 48 odd hours. The coverage in NH starts 11 Feb at 6PM EST run by the towns’ and NH state process, I hope.

“Bat sh– crazy”, is Pelosi acting in her “disruptive child” state ripping up her hard copy of the SOTU on national TV. She is representative of many of her constituents since Nov 2016.

I don’t know your expectations or stereotype of retired military, there are a few such as Andrew Bacevich who question the forever wars. Most of us toed the line [as we did at our induction] and retired ASAP!

Do you think a Bernie Bro [I was in 2016 and intend to be next Tuesday] could be lock step with the “bat sh– crazy” democrat party of the past 38 months?

Cheers,

Moses,

I realize that as an old Berniebro you find it hard to accept that at least as far as the Dem nomination goes you and ilsm might be on the same page. I agree that he has made a lot of apparently contradictory statements. But I think you need to keep in mind that he is an embittered veteran of US Mideast wars. This has made him in many ways sometimes appearing to be pro-Trump and especially pro-Russia. But in 2016 there were embittered Bernie supporters who voted for Trump, and Bernie’s dovish on foreign policy positions regarding MENA should be OK with ilsm, and Bernie is also probably less anti-Russia than almost any candidate except possibly Trump and Tulsi Gabbard. So, not quite as wacko as one might think.

JBR,

Seeing a point as pro Russia or pro Trump obscure questions concerning diverse interpretations of the “common defense” or the popular, post modern euphemism “national security” and what are interesting “threats” and what are not worth the cost of an economic/military response. I am skeptical of a lot coming out of Atlantic Council as one example. I have participated in technical solutions to operational capacity questions that do not answer the need.

“Logisticians are a sad and embittered race of men who are very much in demand in war, and who sink resentfully into obscurity in peace. … They disappear in peace because [during] peace [war] is mostly theory. The people who merchant in theories, and who employ logisticians in war and ignore them in peace, are generals.”…..

“In war, they must stride more slowly because each general has a logistician riding on his back and he knows that, at any moment, the logistician may lean forward and whisper: “No, you can’t do that.” Generals fear logisticians in war and, in peace, generals try to forget logisticians.”

http://www.logisticsworld.com/logistics/quotations.htm

Those of us logisticians who were ‘promoted’ to DoD system acquisitions and “tilted” with operators and acquirers who aspired to be generals in program office often became deeply sad and embittered…….

I observe that there will be a lot of logisticians saying: “No, you can’t do that.” in the future. Risky supply chains and neglected lines of communications……

@ Barkley Rosser

Aside from an attempt to make Bernie seem not vigilant on the Russia issue, this is a fair comment by you and semi-insightful. I see your point here.

While we are on the topic, I am wondering why one offers to shake the hand of an orange being they deem a threat to democracy and a threat to the nation?? I guess only whatever private school she attended, her sorority sisters, or Oprah Winfrey could tell us for certain the exact reasoning there. How did she think that one would go?? If you’re as insightful on this as you were ilsm’s frame of reference, I’m going to work hard and see if I can get you guru status at the Harrisonburg chapter of Hindus.

Moses,

On Pelosi, note that she has at times threatened to disinvite him from delivering a SOTU. She is the one in charge of this and the host(ess) of the speech. So, as someone basically well-mannered, given that she did invite him in the end to give the speech, as host(ess) she offered her hand as is proper for somebody to do in such a situation. That he did not take it set the situation moving that eventually led to her ripping up the copy of the speech he gave her when he refused to shake her hand.

She has been willing to cooperate with him at times on specific issues, including on passing a budget and most recently on approving the USMCA after making some improvements on it. Needless to say, Trump never gave her or the Dems any credit for any of that.

I listened to Steve Rattner on Trump’s dishonest claim that he turned an awful Obama economy into a roaring economy. He was being interviewed on Morning Joe – which I guess is run by a bunch of commies even if the host was a conservative Republican when he was in office. Steve cited the average monthly employment increases in Obama’s last three years to Trump’s over the past three years. I decided to double check his data going to FRED:

https://fred.stlouisfed.org/series/PAYEMS

All Employees, Total Nonfarm (PAYEMS)

From December 2013 to December 2016, employment rose by 8.043 million (over 223 thousand per month). From December 2016 to December 2019, employment rose by 6.95 million (193 thousand per month).

OK for someone who wears his MAGA hat too tight, it does appear 193 is WAAAAY bigger than 223!

@pgl,

I will wear a red hat to vote for Bernie on Tuesday, there is no MAGA, an AF unit cap of an old outfit, a KC-135 hitched to an F-15 on the front.

What do you expect from inside the beltway? DoD contribution to GDP is rising some oif it from writing checks for F-35’s that have hundreds of “issues”.

Politicians tooting their horns, ae for an audience. So, Trump is acting like a politician!

You do realize my comment had more to do with employment growth than whatever dunce cap you happen to be wearing. Maybe you should lay off the vodka.

@pgl,

I was unbalanced by the imagery of tight MAGA hat, I had not thought it possible. As to vodka, last I had was 1975.

I like it with the cranberry juice. I am a fruitarian when drinking vodka. I’m sorry, what were we talking about?? hahahaha

https://www.youtube.com/watch?v=5C6EwLTAvHc

Should we expect a stock market correction based upon the upcoming negative adjustment to PAYEMS on Friday?

Look at the median number from the broker/banker forecasts. The post announcement moves are usually based on market expectations which are usually already “baked in” to prices. It’s not up or down but how it compares to what market participants were expecting. Also keep in mind sometimes these things leak out. There have been stories of Federal Reserve officials leaking data, etc. People will argue it’s relatively rare, but Just something to keep in mind. Even 1 or 2 players can move things if they have non-public info beforehand and make large enough bets.

What I am not certain about is how well known the PAYEMS adjustment data are and to what extent the information is incorporated into the markets. If we assume the adjustment’s are well known, then I would think there should be very little market action due to the reduction in PAYEMS from what has been previously reported.

What web site do you use for the “.,,,median number from the broker/banker forecasts” ?

“Trading Economics” is a site that gets quoted on here regular. You want to look at themes recent “consensus” number. There’s another British Asian guy who has a channel on Youtube and tweets regular but I’ve temporarily forgotten his name. If you type keep words together with “Bloomberg” all in inside ONE quotation mark you’re very apt to find a Bloomberg article which will give a number as well. I will hunt a little here and try to give you 2-3 before 4pm central time.

*Their recent consensus. Still haven’t got used to the spell correct on this thing, I think I do better without it.

Bloomberg’s survey of economists issuing they anticipate an increase of 163,000.

https://www.barrons.com/articles/januarys-u-s-jobs-report-comes-friday-heres-what-to-watch-51580994024

As it says in the article the Wednesday ADP number is supposed to be a “hint” but they also warn not to put too much weight on it based on the differences in tabulation. Diane Swonk says the payroll revisions will have a major shift downward, but again I am just parroting the article above.

FX Street has a. number similar to Bloomberg’s 160k for “expected”— notice they mention the ADP number again, which apparently came out yesterday. I’m assuming FX’s “expected” number is also a consensus number. Most market participants are going to use that as their “marker”. So, again, it’s not up or down, it’s how close it matches relative to market expectations. Can I say 100% how that jives with the market?? No, but I’d say “the market” or “Mr. Market”, his expectations are pretty damned close to that consensus number. What you find is that unless it’s a very shocking number or markets are jittery, by later the same afternoon, whatever hit the market has taken on those NonFarm Jobs numbers has already vanished. Unless you’re thinking of doing a quick “in and out” morning trade I wouldn’t even bother with it.

He tends to tilt things to the overly optimistic side, because he’s trying to encourage commission trades, but Steven Cheung is not a bad one to monitor on market numbers for a broad overview—again either on his Twitter or his Youtube channel “Amplify Trading”. He was quoting an expected number of 156k slightly earlier in the week:

https://www.amplifytrading.com/post/the-macro-menu-3-7-february-2020

https://www.youtube.com/watch?v=HRaL2p22Q1E

https://twitter.com/AWMCheung

I’ve always found your comments (and Frank’s in Georgia) related to the regressions and OLS and that stuff encouraging to my own sad attempts, so I Hope this is helpful in some small way to you AS.

@ AS

Damn it all anyway, I forgot to put the FX Street link in, anyways you can see it with your own eyes with some extra supplemental info:

https://www.fxstreet.com/analysis/nonfarm-payrolls-preview-get-ready-for-some-action-this-time-202002061450

Moses,

Thanks.

The Diane Swonk comment seems to indicate that those “in the know” have already incorporated the PAYEMS adjustment into the market sentiment, as would be likely.

AS: I suspect the deviation from the anticipated m/m *change* will dominate, unless the revision relative to March 2019 is a lot different from the preliminary benchmark revision.

Thanks for the comment.

What you say makes sense given that most knowable upcoming events are incorporated into the markets as you have indicated in the past.

My question related to how much the markets are affected by “less informed” investors, not by sophisticated folks like economists or professional money managers. I assume that less informed investors are not aware of the upcoming PAYEMS adjustment. Perhaps the amount of assets controlled by less informed investors is not sufficient to jolt the markets

@ AS

Menzie may have a drastically different take on this, but I would say, with the exception of extreme events, such as the 2008 derivatives crisis, even the more educated investors take economic numbers as so much white noise. Certainly bond investors are going to pay close attention because the margins are more narrow on interest rates. I’m certain you can search out guys (money/fund managers) that increase cash ratios when a lot of economics numbers are bad, but it’s my observation (certainly with their clients’ money, which is how most of this goes) the adjustments are minimal. You’re only apt to see a heavy move to cash after the damage is done to equities, not based on any economic numbers. The “actual” number was 65,000 higher than the consensus number (225k minus 160 k, correct??), and you see that the market is down 0.30% for today last I checked. Now you can argue the revision played into that. The bottom line is, there was no way in hell “you” were gonna make money off that deal.

Hi Moses,

I was not about to try to make money from the PAYEMS adjustment, just musing about what may happen. Is it the “rational expectations” hypothesis that says all relevant data is incorporated into market values.