For now, we know as of 2019Q4, we’re not in a recession, according to Jim’s analysis. But Q4/Q4 GDP growth fails to hit Trump targets (again!), business cycle indicators continue to plug along, but RV sales plunge 16% y/y. And yield curve inverts (again)! Is it flight to safety or lower expected future short rates?

Figure 1: Q4/Q4 GDP growth (blue bar), Troika forecast from Mid-Session Review FY2019 (orange line), and Trump-Pence campaign promise (red dashed line).

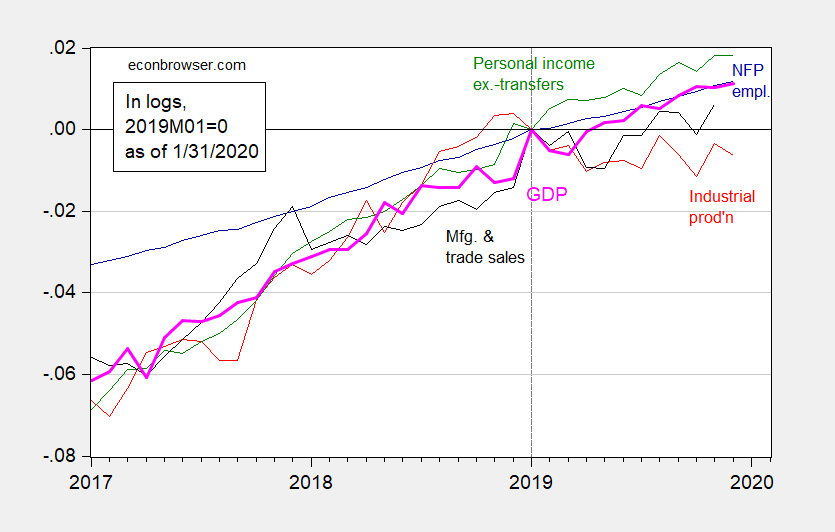

Figure 2: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2019M01=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (1/29 release), and author’s calculations.

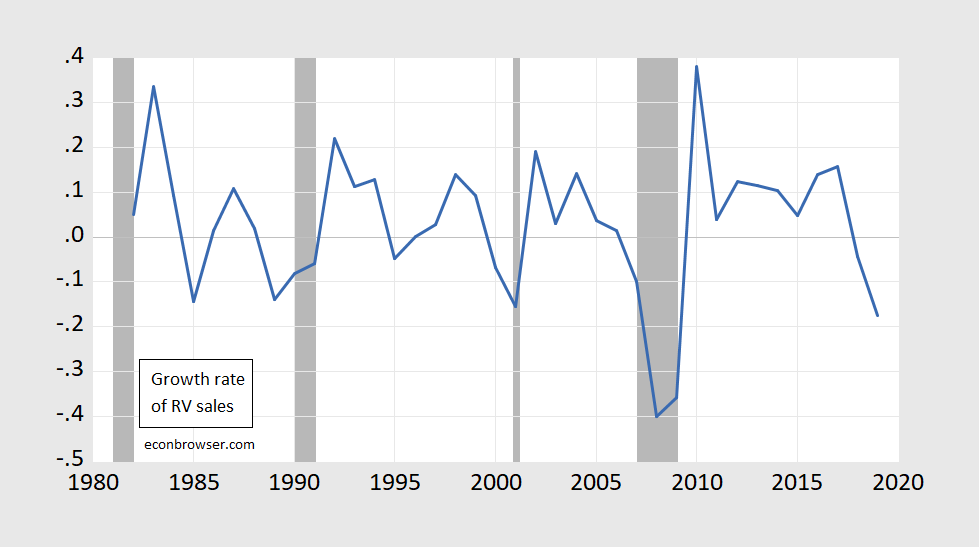

Figure 3: Y/Y growth rate of sales of recreational vehicles (blue), NBER defined recession dates (gray). Source: rvia.org and author’s calculations.

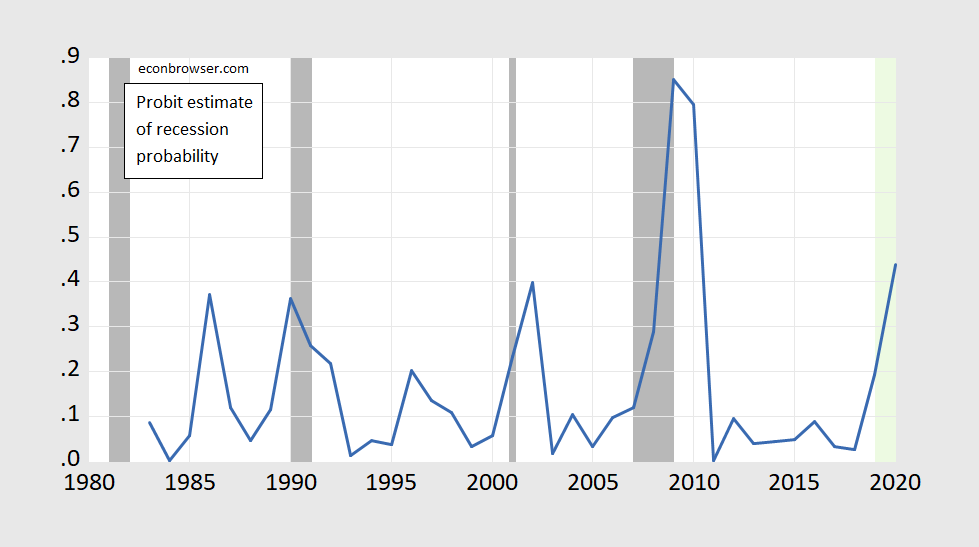

Figure 4: Predicted recession probabilities from simple probit of recession on one lag of sales growth rate (blue). NBER defined recession dates shaded gray. Light green denotes forecast.

Notice that this probabiity assessment is not subject to the changing behavior of the term premium over time.

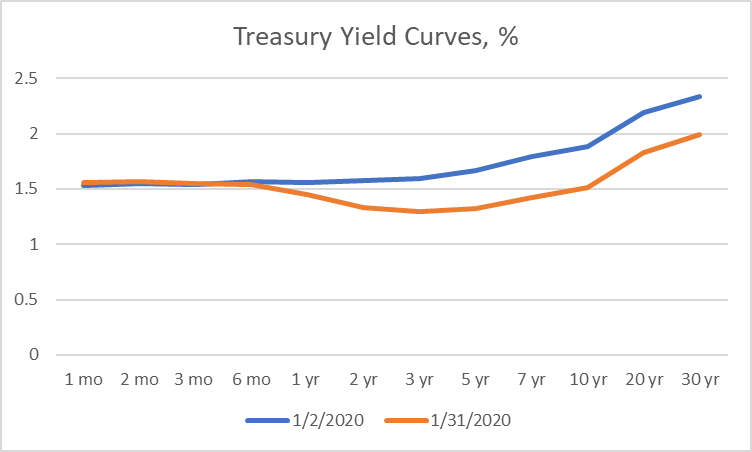

That being said, there has been action on the yield curve front over the month of January.

Figure 5: Yield curve on 1/2/2020 (blue) and on 1/31/2020 (orange). Source: Treasury.

By the end of January, the yield curve is inverted (relative to 2 months) all the way out to somewhere between 10 and 20 years. Placing in the context of a longer time period:

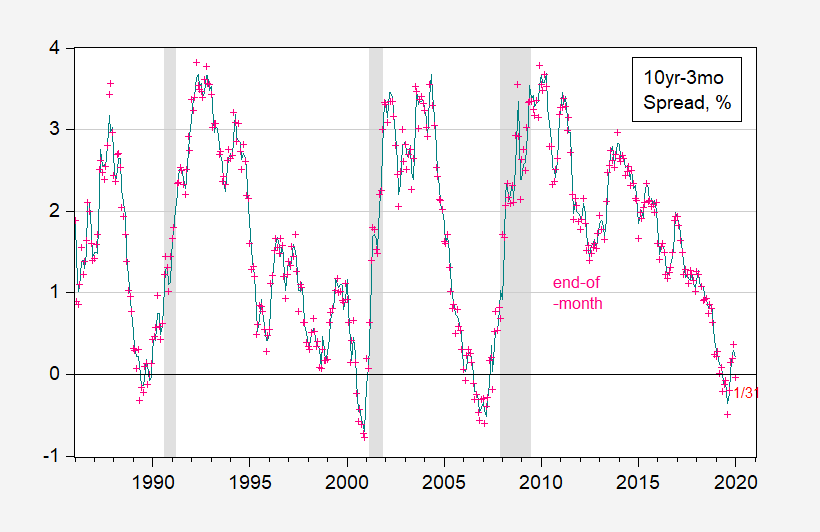

Figure 6: 10 year-3 month constant maturity Treasury spread, monthly average (blue), end of month (pink +). NBER recession dates shaded gray. Source: Fed via FRED, Treasury, and author’s calculations.

The average values of the term spread suggest a slight upward move in the probability of recession in 12 months, once again using a plain vanilla probit.

Figure 7: Probability of recession in 12 months (blue), and within 12 months (red) using probit based on 12 month lagged 10yr-3mo term spread. NBER defined recession dates shaded gray. Light green shading denote forecasted values. Source: author’s calculations.

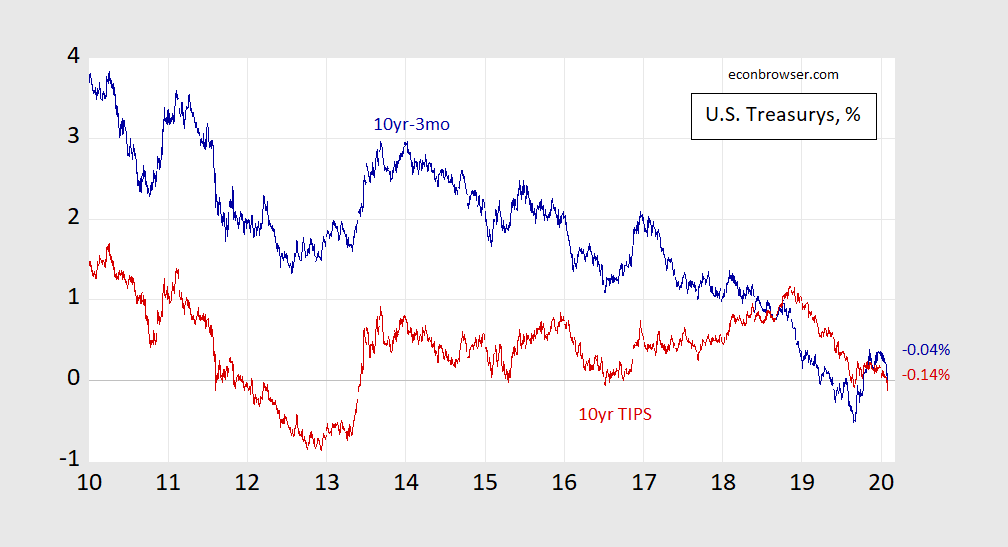

Last bit of information: Not only is the 10yr-3mo spread negative, so too is the TIPS 10 year (real) yield.

Figure 8: 10 year-3 month Treasury term spread (blue), and 10 year TIPS yield (red). Source: Fed via FRED, Treasury, author’s calculations.

Probit regression. That’s the terminology I was having a hard time remembering the other day. [ self-disappointed sigh……… ]

Can anyone here (including the hosts of the blog if the spirit so moves them) answer me a riddle?? Why does the Chinese government bother having Belgian custodial accounts in USA treasuries, when everyone and their brother knows about this little facade/charade?? This has been a question of curiosity burning in my mind for awhile now. In other words, why have the accounts in Belgium when everyone seems to be able to figure out when they are purchasing and selling anyway??? WTF am I missing here in this cute Chinese government puzzle??

Putting aside any motive to hide reserve activity (controlling the RMB), China has a wealth fund which invests overseas. That wealth fund clears some of its activity through Euroclear, a big trade clearing outfit in Belgium.

@ macroduck

That tells me maybe “the who” of my question, it doesn’t tell me “the why” of having custodial accounts there. You would agree this isn’t just the convenience of having Euroclear execute the trades?? I appreciate your attempt to answer my query but I guess my question is why keep on doing it this way when the “hiding” of U.S. Treasury purchases/sales doesn’t appear to be working??

If the motive is to invest rather than hide, then Belgium makes sense, and doesn’t need further explanation. Only if there is an assumption of deceptive intent, poorly executed, is there a question as to why. Is China prone to persistent clumsy deception?

I suppose behind you question is why Treasury holdings outside the US? At a guess, simplicity, and perhaps cost minimization. Treasuries are so widely held and so widely available that there may often be no advantage to holding them in the U.S. China’s reserve authority may choose to purchase at auction and leave Treasury holdings in the Fed’s custody, while other official Chinese accounts, with their own investment mandates, may find it more convenient to purchase them outside the U.S.

Just as a thought, only one-the-run Treasuries are available at auction. If an account has a duration need that is better met with off-the-runs, that could be a reason to “buy local”.

In my initial response, I said I was putting aside any notion of hiding transactions. I realize that may be a mistaken premise, but it would mean China’s reserve managers are dumb. I’m guessing they aren’t.

In the old days, there might have been a desire to keep some dollar holdings outside of U.S. jurisdiction, to avoid confiscation. I know our politicians can be dumb a lot of the time, but even they would need to reach a new low to freeze China’s holdings.

the belgians also have a pretty good system of tracking collateral for loans, especially the use of treasuries and such for collateral. it may be possible that with all of the loans through its belt and road program, client nations feel better posting collateral through belgium firms rather than directly with china? agree it is an odd situation. don’t necessarily agree that it is part of a bigger more complicated strategy by the chinese. they started doing this a decade ago, and may simply be a legacy action continuing today.

Saw this graph in my email, it looks more impressive if you start it from the 2015 time frame:

https://fred.stlouisfed.org/series/TREAST

You can adjust it to “start” from the 2015 time frame with the “slider” or “scroll” type thingy just below the graph on the left and see how different the graph looks.

The Philly Coincident Index has deteriorated over the last year. In Dec 2018 it showed only two states in red/pink and one state in gray. The most recent Dec 2019 map shows eight states in red/pink and three states in gray. The economy is definitely soft. I would worry about some exogenous shock tipping the economy into recession. And there are plenty of potential exogenous shocks haunting us; e.g., a global or regional pandemic, Brexit, failing Italian banks, Iran unchained, Trump unchained, etc.

@ 2slugbaits

Your boy Biden has been positioning himself as “I’m the electability guy”. How does he do that if he can’t win elections??—-once he loses Iowa and New Hampshire, that sales pitch doesn’t work so well.

John Kerry may enter this race.

as i said before, mayor pete is probably the best all around candidate but is still rather green. however, he appears to be showing he is a legitimate contender today rather than tomorrow. most likely because he is not “too old” or “too left”. sanders and warren fall into this category. biden was considered the safety feature if there appears no other electable candidates. mayor pete seems to be filling that gap, to biden’s detriment. i still don’t see how sanders or warren can win a general election. their selection will hand trump an easy win. democrats have a rather bare cabinet of candidates. even bloomberg will get a good look, because while he is also “too old”, he is not “too left”. makes you wish for another candidate like kerry or gore. both would have probably won if they ran against trump.

@ Baffling

Not to belabor the point (I am afraid I will be by the time late March rolls around) but have you asked yourself how a homosexual candidate does in the Deep South?? Don’t think too long now or you’re apt to convince yourself Mike Huckabee would vote for Amy McGrath and give yourself a brain aneurysm.

@ Baffling

My favorite part of tonight’s (February 7th) debate is Pete Buttigieg’s Oscar-worthy performance that he gives a damn about blacks sitting in jail for eternity for using marijuana:

https://theintercept.com/2019/11/26/pete-buttigieg-south-bend-marijuana-arrests/

This is similar to Bloomberg’s random “stop and frisk” of any black New Yorker. Now he has to answer for it. Well Mike Bloomberg at least admits what he did, while Buttigieg lies and plays a game of Three Card Monte on the debate stage. How dumb are you?? If you think Buttigieg ever gave a damn about blacks rotting in prison in South Bend, Indiana, I’d love you to put up $40 for my game of Three Card Monte.

https://www.youtube.com/watch?v=o2kO_5cNF5k

Same with Senator Warren, she thinks if she doesn’t shake Bernie’s hand, you’re going to forget she made 6-figures as a corporate lawyer. In America is this an easy game to draw the village idiot into playing?? YES, as is apparent by at least one commenter on this blog.

Steady growth continues, propped up by an unsustainable and inefficient form of deficit spending. So, when the wheels come off this summer, we will be well and truly up a creek.

“unsustainable and inefficient form of deficit spending.”

What evidence is there that our deficit spending is unsustainable or inefficient?

Interest and inflation rates are low. Last time I checked the dollar is still the world economy’s reserve currency and our printing press is still working.

John B. Taylor joined some fellow right wing hacks who used to be economists to talk about the alleged debt crisis:

https://siepr.stanford.edu/news/debt-crisis-horizon

“George Shultz, honorary chair of the SIEPR Advisory Board, and SIEPR senior fellows Michael Boskin, John Cochrane, John Cogan, and John Taylor, team up to write this Washington Post editorial. They say it’s time to act now — before a debt crisis hits.”

Of course these right wing hacks wrote this some 3 months after they conned us into the Trump tax. Before December 2017 Cochrane was dismissing any debt crisis. Of course once they got their tax cut for rich people, they totally switched their tunes in order to advocate slashing Social Security etc.

Back in early 2018 – I nailed Cochrane’s flip flopping and incoherent babbling as I provided a critical review of his source for deficit hysteria:

https://angrybearblog.com/2018/02/a-critical-review-of-jeffrey-mirons-call-to-slash-entitlements.html

My other post on Cochrane’s flip flopping where I respond to his initial claim that deficits are no worries:

http://econospeak.blogspot.com/2018/02/fiscal-stability-or-dire-straights-john.html

It is amazing that he could so quickly flip flop but I guess he has to answer to his political masters. It is even more that he can be more incoherent on what turns out to be a present value calculation. One would think someone who teaches finance would not write such babbling BS.

Speaking as someone who only has their measly bachelor’s degree in finance, I think when people who specialize in finance try to cross over to economics it often causes them “fits” and “issues”. They have a tendency to connect dots that often do not connect. I suspect this is a disease that Cochrane and our word slurring muddle head Mr. Kudlow share. He did write a great book on asset valuation though.

Cochrane fancies himself an economist. He seems to think we can magically increase long-term growth by getting rid of regulations. He explains this by some weeds in the garden “theory”, which caused almost every real economics to start laughing out loud at him. No Cochrane is a right wing tool parading as an economist with a background in finance.

If the deficits were funding infrastructure and other long term investments in future economic benefit (including preventative healthcare, education of the young, and the like), then the deficits would be reasonable in a low rate climate like we have. Instead, we are throwing money at people who will allocate it for their own personal gain, at best. The nation will not benefit over the long term from current spending, tax policy, or the misguided reallocation of wealth to those who are already wealthy..

Exactly! Thanks for the clarification of your original comment.

I got what you were aiming at the first time Willie, but some are eager to throw tomatoes here. Still, clarification is always good.

Efficiency I this context should mean deficit in relative to GDP out. Standard fiscal multiplier assumptions probably don’t work right now because the Fed is accommodative and market rates are low, so I do not want to claim that fiscal multipliers in this cycle are the same as would be historically normal at this point in the cycle. However, there is almost certainly less productive slack in the economy now than in recession or early in recovery from recession. That strongly suggests that the multipliers at work now are not as high as they would have been in 2009, or 2013. Second-round effects are likely to be lower now than when slack is high. In that sense, inefficient is a reasonable word to use.

MMT-ish arguments often focus on negative consequences; there is no neo-liberal-claptrap harm from deficits. That’s fine, but when it comes to fiscal efficiency in the near term, in the U.S, and most domestic economies, the question is almost entirely about positive consequences. If we have a high multiplier, we have high fiscal efficiency. If we have a lower multiplier, without regard to whether there is crowding out, we have less efficient fiscal policy.

Sorry, not “domestic economies.” That should be “developed economies.”

Can anyone up Wisconsin way tell me what they think of “Big Brother” hard root beer?? There is a local grocer that stocks it and I’m teetering on the fence about getting some, but someone online said it tasted like wintergreen tobacco chew. It’s hard for me to believe it’s that bad. Help a genial degenerate spend his disposable income wisely here and throw me a bone on what it tastes like?? Worthy or not?? It’s $8 here for a bottled 6-pack.

If anyone knows any “off the beaten path” streams covering the caucus tonight let me know. In the golden days of the internet seems like there were a lot, but they seem to get thinner every year as the big media outlets bully them or scalp the talent:

https://fivethirtyeight.com/live-blog/iowa-caucus-2020-election-live/

If it was JUST University student voters participating in the Iowa caucus tonight what would it look like?? Grinnell College (a great place to send your children to) gives a good approximation:

https://twitter.com/AndrewSolender/status/1224505757577744387

This is almost more “mainstream” than I actually like, but if you like video style presentation this is one of the better ones:

https://www.youtube.com/watch?v=OjAXcibX19Q

Rush Limbaugh says he has advanced Lung Cancer. Personally I think Limbaugh is exaggerating his illness and it’s all stuff Rush made up:

https://www.huffpost.com/entry/limbaugh-accuses-fox-of-e_n_32326

I bet Limbaugh just fakes all this and exaggerated what the doctor said so he can lay in bed taking painkillers

https://www.theguardian.com/world/2003/oct/11/usa.julianborger1

Limbaugh is obviously a lazy bum. Raising all of our private health insurance premiums because he wants hard-working Americans to fund his hillbilly heroine joyride.

I would normally pity anyone on the verge of death. But Rush brought this illness on himself. And no sane person is going to miss the garbage he spreads on his radio show.

I just hope Limbaugh’s 4th wife isn’t taking this too hard. She’s missing feeling his hands glide over her skin and his masculine bulk laying over her during those special intimate times. We all can sense Limbaugh must have been an incredibly romantic man. I’m imagining all the things Limbaugh must have forfeited just considering her feelings. No cigars or smoking when he visited her separate bedroom. Scolding his cat whenever it pooped or peed in her room. Never using the N-word when they were together at public events. Heartbreaking.

Wait…… am I already using past tense verbs?? Excuse me.

Well, Limbaugh now has a Medal of Freedom that was hung around his neck during a SOTU to great, if not universal, applause.

Hung by the FLOTUS no less.

I think Troy Price is Debbie Wasserman Schultz’s nephew. Or did they say Troy was Steve Harvey’s nephew??

https://twitter.com/brianneDMR/status/1224590583194423297

https://youtu.be/0ElbCVzcBOU?t=52

Sanders tried to fix(which Buttigieg [edited for spelling – MDC] copied) the Iowa caucus. It explains a lot of the captain prescent Jerry rigging. Sad night for progtards. Social Nationalism is the future or I should say returning to Social Nationalism is the only way for Democrats in the future.

WTF? You must be using an iPhone app to create your comments. I suspect some 400 pound man lying in his bed in China has high jacked your app!

I looked at the data again. On a computer instead of the phone this time. Funny how much more you can see on a bigger screen. Looks like the orange guppy administration hasn’t screwed things up economically too badly yet. But, those forward looking regressions sure look like a problem. The magic cloudy plastic crystal ball still says downturn of some magnitude coming this summer. My expectation is that it will be shallow.