Productivity and costs for 2019Q4 were released yesterday.

Figure 1: Nonfarm business sector output per hour (blue), compensation deflated by CPI (brown), and compensation deflated by nonfarm business sector implicit price deflator (green). Source: BLS via FRED, author’s calculations.

Where NFB output per hour is QNFB/LNFB, real compensation is WNFB/P, and product wage is WNFB/PNFB.

Productivity has grown 34 percentage points more than the real wage, calculated using the CPI (urban all). Theory indicates that the marginal productivity of labor, ∂Q/∂L, (output per hour measures average productivity) should equal the product wage, not the real wage (which depends on the consumption basket). Still the product wage (really compensation) has grown 10 percentage points less than productivity, since 1980Q1 (in log terms).

The CPI is a Laspeyres price index, so overstates inflation. Using a chain-weighted index (the personal consumption expenditure deflator, from the NIPA) reduces the gap between productivity and real wage, but does not eliminate it.

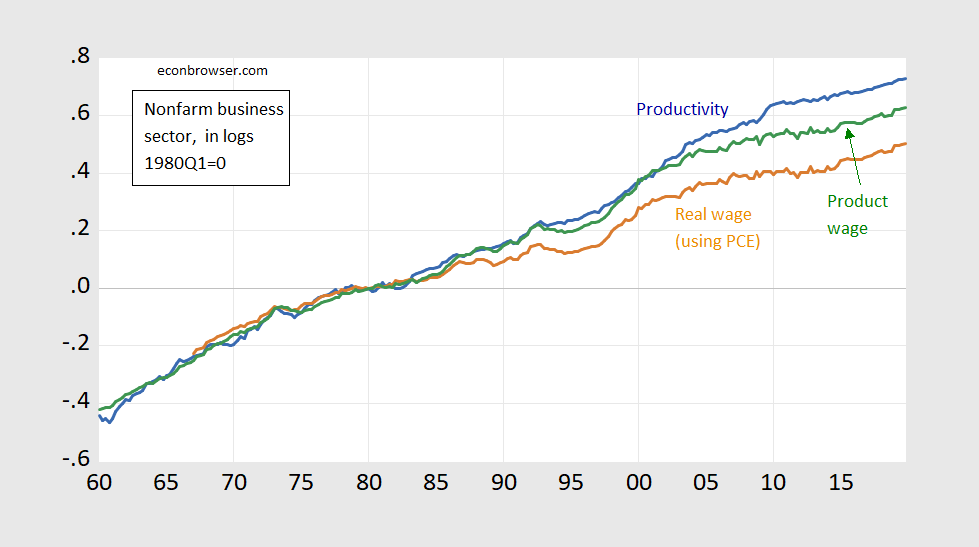

Figure 2: Nonfarm business sector output per hour (blue), compensation deflated by personal consumption expenditure deflator (brown), and compensation deflated by nonfarm business sector implicit price deflator (green). Source: BLS via FRED, BEA, author’s calculations.

The gap between productivity growth and real wage is then only 23 percentage points, since 1980Q1.

FRED publishes Nonfarm Business Sector: Real Output Per Hour of All Persons (OPHNFB)

https://fred.stlouisfed.org/series/OPHNFB

In the last year of the Obama Administration, this real output per hour series grew by 1.25%. Trump tells us Obama gave him a failing economy. OK – Trump lies about everything. Let’s see how this progressed since. 2017 saw it grow 1.32% but in 2018 it grew by a mere 1.03%. Now the latest release had it growing by 1.79% for 2019. We’ll have to see how it performs in the last year of the reign of King Donald I.

pgl: Blue line in Figure 1 is OPHNFB.

hanks for the clarification. I thought that is how you measured productivity.

BLS releases employment report for January 2020:

https://www.bls.gov/news.release/empsit.nr0.htm

Payroll survey shows employment grew by 225 thousand.

Household survey has employment to populatio ratio rising from 61.0% to 61.2%.

It’s not that my sentiments aren’t on your side, but from a pure reality standpoint, you’re making some very risky assumptions there related to our new King’s time in office.

Li WenLiang is a hero for humanity. Dead now. So much for being a hero.

Thanks for a thought-provoking figure. Equality of the product wage and the (putative) marginal product of labor is not a theory–it is a hypothesis that depends on something like perfect competition and a well-behaved production function. Both assumptions are questionable to put it mildly. Much evidence suggests short run returns to labor are constant or increasing and that mark-ups are large and probably countercyclical so that real product wages are procyclical. Interesting thing about the graph is the apparent increase in mark-ups, despite the ostensibly ‘tight’ labor market in recent years.

With the rise in compensation unit labor costs are now rising much faster than prices ( non farm deflator).

The spread between the growth in unit labor costs and prices is a major determinate of profits growth and the widening negative spread now implies that the widely expected rebound in profits in 2020 will not materialize.

Interestingly, the spread as a leading indicator of profits has a great record but you have to be very careful about revisions to the last observation.