The economy is collapsing. That’s not news. What is interesting is that nonresidential fixed investment has been falling since 2019Q1.

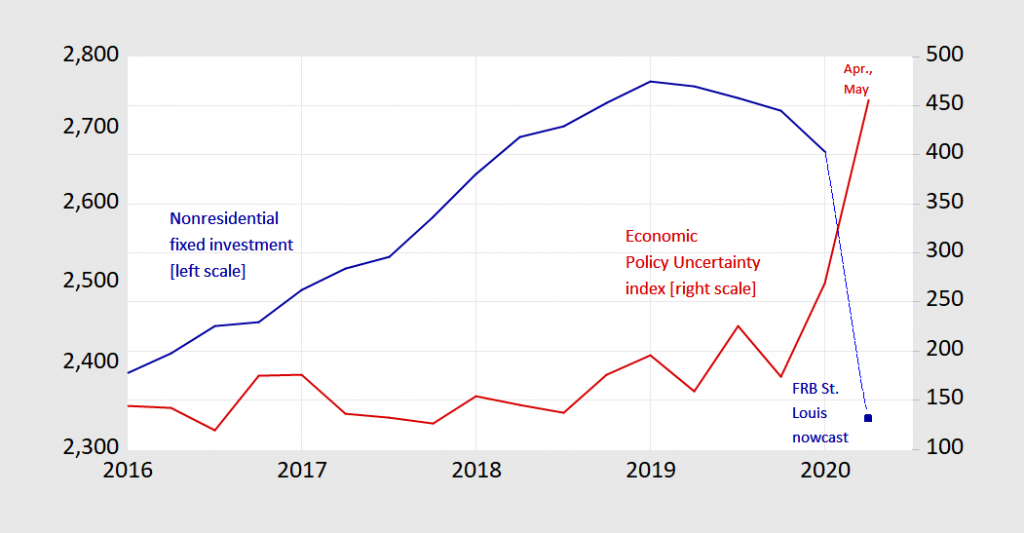

Figure 1: Nonfarm fixed investment in billions Ch.2012$ SAAR (blue, left log scale), and Economic Policy Uncertainty index (red, right scale). 2020Q2 investment is St. Louis Fed nowcast as of 6/1; 2020Q2 EPU is for first two months, as of 6/1. Source: BEA 2020Q1 2nd release, St. Louis Fed FRED, policyuncertainty.com and author’s calculations.

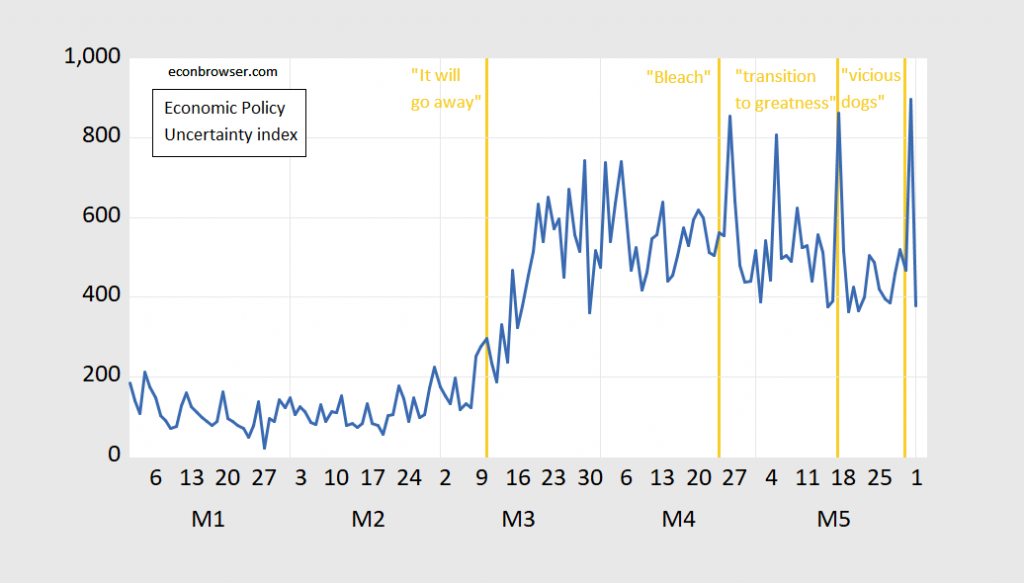

Policy uncertainty seems poised to remain high, given underlying conditions, and Mr. Trump’s inability to implement coherent health and economic policies and tendency to exacerbate civil disorder.

Figure 2: Economic Policy Uncertainty index, daily (blue), as of 5/31/2020. Source: policyuncertainty.com.

Will policy uncertainty be a sufficient drag to make the recovery a determined “L”? One thing to remember: while services and nondurables consumption is about 3 times as large as nonresidential investment and durables consumption, the standard deviation of changes are respectively $80 billion (SAAR) and $47 billion (2016-2020).

If Republicans continue to obstruct transfers to the states, it is hard to see what supports sustained recovery.

I have long used corporate profits as the primary determinate of business fixed investments and after tax profitswith IVA CCadj peaked in the fourth quarter.

Interestingly, this profits measure as a percent of GDP actually peaked in 2012 at some 10.6% of GDP and is now 7.6 % of GDP

So based on this approach I am not surprised by weak capital spending.

From 1950 to 2000 economic profits as a share of GDP bounced around 6%. It rose sharply from 2000 to over 10% in 2012 and I wonder if it is returning to the old 6% norm. The sharp rise from 2000 to 2012 was due as much to weak GDP growth as anything business did to improve profits. It was just that profits growth slowed less than GDP growth.

The share of fixed investment going to depreciation has risen as the share of computers and other tech items in fixed investment has risen. Some of that depreciation cost is from firms writing down and replacing serviceable but less sophisticated tech in an effort to gain an edge. One possible response to the Covid shock is to do less toward gaining an edge, more toward protecting against further shock. Under normal circumstances, that greater share of equipment replacement in fixed investment would stabilize the series. In this shock, we are stuck guessing about the effect.

My guess is that this shock will be a game-changer as firms seek ways to lower their exposure to pandemic – we are pretty reliable about fighting the last war. Profits will remain a strong cyclical driver of investment, but secular trends are probably in for serious change. That could be bad for productivity growth,

https://www.cnbc.com/2020/06/02/gdp-is-now-projected-to-fall-nearly-53percent-in-the-second-quarter-according-to-a-fed-gauge.html

atlanta fed predicts a 53% collapse in gdp.

the nation is ravaged by a deadly virus. huge demonstrations against police brutality and systemic racism in the nation. and the economy is collapsing at rates never seen before. truly, how much more damage can trump inflict and yet his supporters still view him as a “winner”.

private bone spurs uses force to clear out and arrest demonstrations near the white house so he can photo-op standing with a bible at a burnt church. seriously, this sounds like the storylines from a banana republic. what is wrong with the republican party? idiots.

A curious detail that has been trickling out without getting major media attention is that when Trump’s federal forces attacked the peaceful protesters i Lafayette Park and also on the property of St. John’s Church, several of the people on the church’s grounds were priests and church members who were dealing with some medical people. So Trump had his forces attack priests and parishioners peacefully on their own church grounds to remove them so he could go and stand uninvited there to hypocritically hold a Bible over his head.

No wonder the bishop was upset.

Trickling out? I dunno, maybe I pay attention to different sources. The Episcopal bishop was livid. So was the Catholic bishop after cadet bone spurs had another photo-op at a Catholic property dedicated to John Paul II. He’s systematically alienating all except the narrowest base of white evangelicals. I have my personal opinion regarding the sincerity of their Christian faith, but that’s not so relevant here.

What concerns me now is the cornered rat behavior. trump is failing and he knows it. His handlers know it. Most of the nation knows it. Expect all kinds of diversionary stunts for the next five months leading up to the election. Then buckle up for a really bizarre lame duck period if he loses in the Electoral College. That’s not a given. If he is reelected, then expect his entire second term to be one step crazier than we are seeing even now.

Back to economics – that’s got to weigh heavily on our economy and the world economy. Remember in 2010 when the GOP was complaining about “uncertainty?” Well, here it is, writ large. I would be surprised if any sane business invested much for a while now, because almost anything could happen. The political climate will continue to weigh heavily on the economy until we are somehow back to sanity. Whatever that means these days.

And, for Mr, Kopits, if we have inflation, I’ll be happy to eat a couple of hats. Nobody is buying. We will eventually get an inflationary period, but it’s going to take a whole lot of time for the damage that’s being done right now to result in inflation. I personally expect deflation more than inflation right now. Without a massive federal deficit, it would be here.

Willie,

This detail has not received major coverage. That the DC Episcopal bishop was unhappy with Trump’s actions got headlines, but the focus was on how he was not saying Christian things, not on how his forces had violently forced church personnel and members off their property so he could do so. As it is, in today’s WaPo, there was a detailed story about it, but it was buried inside the Metro section. Really.

And if one watches only Fox News, one does not even know that peaceful protesters were violently attacked at all. One sees Trump declaring himself a “law and order president” and then one sees him standing with that upside-down and backwards Bible in front of the church, with this being praised as him supporting a church that was supposedly nearly burned to the ground by evil antifa “terrorists.” This then gets followed by repeated reports of the population supporting Trump’s call for the US military to take over local law and order functions in many cities.

I do not watch TV at all, but do read newspapers, the Economist, Reuters and the like. It makes for a skewed idea of what is or isn’t being reported on from what you are saying.

Lack of ignorance is hardly bliss.

The latest is that the unidentified forces working for Barr and Trump have expanded the “zone” surrounded by fence around the White House so much it now contains St. John’s church. Earlier today the Episcopal bishop tried to enter the grounds with some others and was forbidden from doing so, with her then sitting down on the ground and holding a vigil We shall see how much coverage that gets.

Of course they call it “the presidents’ church,” so maybe Trump thinks that he owns it.

trump wants to cause enough unrest in dc to arrest protestors, since they will be prosecuted in dc under federal courts rather than state courts. he has the ability to charge them with felonies and lock them up for a very long time. he has already stated this is his goal, to set a fierce example as a means to put down protestors in the rest of the country. he needs to show the states how ruthless they should be. rick stryker would be proud of his putin and xi inspired padawan.

Are we about to get a big surge of inflation?

Steven Kopits: Neither market expectations (5 yr break-evens using TIPS) nor survey-based measures of households and/or economists suggests a rise in inflation. Rather all measures of expected inflation have declined since the onset of the pandemic *and* central bank responses. If you are seeing somebody predict a big surge of inflation, they are probably also trying to sell you gold.

driving around town i would be hard pressed to say the economic activities that i am seeing would lead to inflation. maybe the cybermarket is much stronger? but i don’t see it in the real market.

The only parts of the economy that look at all inflationary seem to be in certain food items, such as meat, and also in certain items tied specifically to the pandemic, such as toilet paper. Otherwise, it looks very non-inflationary, and the price increases in those sectors will probably pass, unless we get a sustained collapse of certain sorts of food production.

Steven,

There are some sectors where prices do appear to be rising. Those where this involves supply problems may see those prices remain higher, with certain food items such as meat sticking out as likely candidates. But more broadly it would appear deflationary pressure may be greater than inflatrionary, despite oil getting back upo to around $40 per barrel.

I own a small business in NJ, and live in Brooklyn. I see no inflation on the horizon. As a small business owner, one of my biggest expenses is rent, and that is falling (one bright spot during this otherwise bleak time is my lease is ending. If my rent would be higher by more than $800/month). I expect that it will be much easier to hire labor in the coming months than in the last 2 years, and wage pressure will be greatly reduced. Just my perspective. I love this blog and Prof. Chinn’s perspectives, and hope I can continue to contribute my small business perspective here and there .

This WSJ article captures my feelings. I am looking at the DOW at levels of one year ago, with 40 million people out of work. Oil has been rising steadily, when oil prices at this level should bring large volumes of shut-in capacity back on line at a time when global oil demand still appears to be down 10-20%. It’s hard to reconcile capital markets activity with the objective economic reality. That’s why I noted it.

The Nearly Nihilistic Market Rally

The world is in a state of nearly unparalleled turmoil—except for financial markets, which seem blithely unaware. The S&P 500 was up a further 0.8% Tuesday, following a 0.4% gain Monday. That makes for a 10-day gain of nearly 5%.

That might seem illogical, but it isn’t. Markets care about one set of policy developments to the exclusion of everything else: namely, the fact that government rescue measures seem to be working, at least to the extent of avoiding worst case scenarios.

The U.S. is being rocked by protests of a scale not seen for half a century and Washington and Beijing are facing off over Hong Kong, all amid a raging pandemic. But even the riskiest corners of markets are ticking away from distressed levels. The spread between safe U.S. Treasury bonds and U.S. high-yield bonds, excluding energy, metals and mining, is down to around 5.5 percentage points. It reached a high of 9.7 percentage points in late March.

Month-on-month change in U.S. personalincomes

Source: Federal Reserve Bank of St. Louis

%

1991

’95

2000

’05

’10

’15

’20

-7.5

-5.0

-2.5

0.0

2.5

5.0

7.5

10.0

12.5

Markets have often shrugged off geopolitical stress—North Korean missile strikes, clashes in the Middle East—but the gap between what’s happening in the world and in the market seems extreme even by those standards. Analysts note that a year’s earnings doesn’t matter much to a company’s valuation under a discounted cash flow model. As long as earnings bounce back next year—or even the year after—a likely lower-for-longer interest rate is enough to justify gravity-defying stock markets.

So it matters a great deal, to the exclusion of almost everything else, that the rebound is indeed relatively quick. If the first stage of the rebound was about the realization that central banks would take extraordinary measures to prevent market distress and widespread defaults, the second hinges on the ability of policy makers to engineer a rapid rebound within a year or so, largely with fiscal policy.

Data released late last week offered ballast for optimists: Despite a wholesale collapse in production, personal incomes rose by 10.5% between March and April, as stimulus checks hit mailboxes.

The fiscal backdrop has been generally encouraging elsewhere too: the European Union’s pooling of financial resources for a €750 billion ($840 billion) recovery plan outstripped expectations. Japan also announced a 117 trillion yen ($1.077 trillion) recovery plan, of which more than a quarter will be direct spending.

But the next developments bear watching. U.S. partisan conflict over what stimulus comes next has risen. How much the next round of spending will pare back generous jobless benefits which end in July, and how spending will be used to encourage a return to something more closely resembling normalcy, has yet to be seen.

What happens with stimulus policies and incomes isn’t the only thing that matters, of course. But as long as the spread of the coronavirus is seen as under control in advanced economies, and a vaccine is expected to arrive eventually, it will be quite close to the only thing that matters for markets.

https://www.wsj.com/articles/the-nearly-nihilistic-market-rally-11591177302

That doesn’t admit there is structural damage. Most of those guys are retail junk and they will get slaughtered. Personal income was down 6% as wel!. Those transfers are lifeless. It will collapse ala 2008. Just a lazy post.

How will mr market handle the drop in profits and earnings for public traded companies? This will ultimately control where the market goes, unless we get a wholesale change in acceptable p/e multiples

The market knows there are no losers. Fed Reserve has welfare programs for Mr. Market, not main street.

In our low inflation world over half of the annual increase in the not seasonally adjusted core CPI occurs in the first quarter. Doubling the first quarter NSA core CPI gives you an amazingly accurate estimate of the annual core CPI change. We have first quarter CPI data and it implies that core CPI will be lower in 2020 than it was in 2019.

Maybe, but this situation is not like usual recessions.

The extraordinary nature of this downturn is good to keep in mind, but the relationship Spencer points out is quite strong – I’ve kept an eye on it since I first saw Spencer mention it. The place to put your money is on weak consumer goods pricing.

“An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.”

-Laurence Peter

And perhaps that’s good enough.

i think you have to accept either that:

1. Frivolous money that can’t sports-bet in Vegas now plays on Wall Street and dwarfs ‘real’ money.

or

2. The rumored ‘plunge protection team’ of the 2000 tech bust is a reality and alive and stronger than ever.

or

3. A lot of investors believe that a large part of bail-out program money ends up collecting in stock values and outweighs actual lost profits.

Are 2) and 3) mutually exclusive?

But yeah, stories in the press running along the lines of “the stock market is cheap/expensive because pricing has diverged from economic activity” fall apart if they fail to account for effects of tax and monetary policy and implicit guarantees.

I don’t pretend to equities market expertise, but I do know that perceived safety matters in times of crisis. The U.S. has performed badly in dealing with public health in the pandemic; the plunge protection response has been much better. The S&P500 total return so far this year (June 3) is -3.8%, the Nikkei is -4.3%, the DAX -4.9%, the FTSE down 15.9%. There is clear more to those performances than public health response, though the Kospi, down just 2.1%, suggests public health response matters a good bit. The U.S. tends to act more quickly to protect financial market stability than other major economies.

“The U.S. has performed badly in dealing with public health in the pandemic; the plunge protection response has been much better. ”

and this is what is adding to the social problems we are seeing today. most of the people in the recent protests have not seen much benefit from the plunge protection response. poor people and minorities took the brunt of the unemployment hit, but have very little exposure to a recovering stock market. on the other hand, those same people also took the brunt of the pandemic. both of these issues were directly impacted by actions the trump administration chose to take (protect the economy) and chose not to take (protect health).