IHM/Markit (aka Macroeconomic Advisers) releases July GDP:

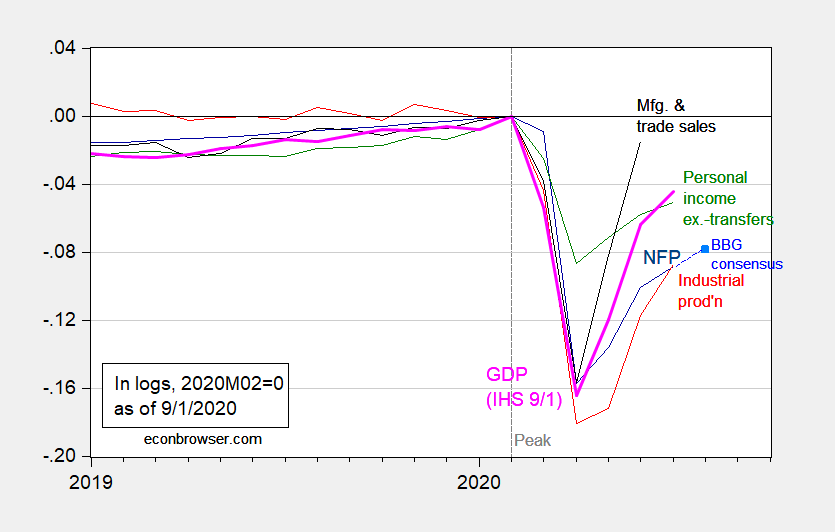

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus for August employment as of 9/1 (light blue square), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink), all log normalized to 2019M02=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (9/1 release), NBER, and author’s calculations.

The reverse radical takes shape…

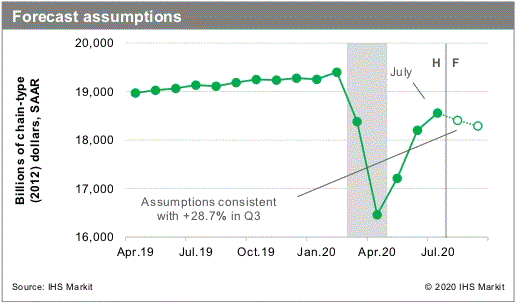

IHM/Markit notes that the monthly GDP estimate implies a modest downturn in August and September numbers, given the current tracking estimate for quarterly GDP.

The 28.7% forecast for Q3 is consistent with GDPNow released today, at … 28.7%.

Update, 7:35 Pacific:

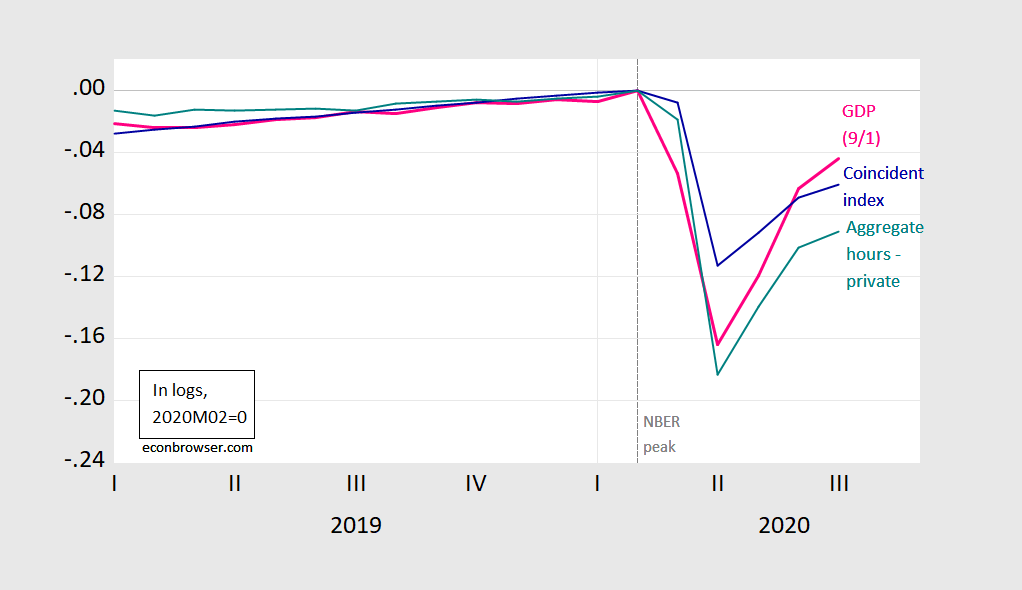

And here are some alternative indicators.

Figure 2: Monthly GDP in Ch.2012$ (pink), Philadelphia Fed Coincident Index for US (blue), Aggregate hours of all private employees (teal), all log normalized to 2019M02=0. Source: Macroeconomic Advisers (9/1 release), Federal Reserve Bank of Philadelphia, BLS, NBER, and author’s calculations.

If the deep shutdown trough had not happened, the slowdown in the third quarter is about what my cloudy plastic crystal ball was telling me would happen. A shallow decline starting in about Q2 and continuing to sometime in Q3 or Q4.

Instead, we get the reverse radical, V with a droopy side, or something similar.

The droop will start showing up in surveys in October.

TR,

The “droop” is already clearly visible for GDP. Look at what Menzie posted above. Are you as blind as Lying Troll Moses Herzong?

I’m not defending what Rage said, but in fairness, if we’re talking post-April, the droop in GDP is only in the forecasts.

But then, a “mathematical economist” should be able to read a simple line graph, so what am I saying??

Well, L.T. Moses, perhaps we should get what Willie meant and what The Rage means by “droop.” Willie previously used it several times apparently approvingly in connection with my claim that we are having a V “that flattened.” So I have interpreted “droop” to be flattening. And that has definitely already happened for GDP in the graphs shown here.

If, however, one interpets “droop” to be an actual decline, then that is merely forecast by IHM/Markit. That has long been called a “W,” incluiding by Menzie, although given that it does not seem to go down nearly as rapidly as the earlier decline or the bounceback, I have taken to calling it the “wiggly W,” although nobody else has picked up on that. But that is what the forecast by IHM/Markit looks like to me.

I have said this is possible, but I have not called whether it is going to happen or not. All I called, which has happened, has been the “V that flattened,” whether ot not the flattening constitutes a “droop” or not, which I think Willie meant by it (he also called it a “fat lip” at one point), or what exactly The Rage means by it.

There may be some confusion over what some people mean here by “droop,” but I think you will have trouble maintaining that I have somehow been unable to “read a simple graph.” GDP, at least (aome components have behaved differently) has been a V that flattened, but the possible decline into a possible “wiggly W” is merely a forecast as of now.

Are you able to admit yet that I have been right about what has happened with GDP, Moses? Just what are you saying?

@ Barkley Junior

I think as a student your class would be a living hell with your errors in grading what people write, but I think auditing your class would be near as good as watching Seinfeld re-runs. The never ending run-on of bloopers and gaffes you make, on something as simple as reading a graph, and then the 10 minutes explanation on why your error was perfect, Do you notice students putting their hands over their mouths a lot and their faces getting a little pink while you talk?? I mean, not just on the days you wear the leather pants.

So, does this mean that IHM/Markit is calling for the “wiggly W,” or will we just get the “flattened V,” which I guess they, or somebody, is now calling the “reverse radical”? Really, it is hard to keep up with all these monikers.

Junior, Did you start this vindictive rumor???

https://www.politico.com/news/2020/09/01/trump-health-mini-strokes-406953

Really Barkley, sinking to ageism just because you don’t like someone. That’s disgusting. Who would use such a tactic against someone online?? I can’t imagine. OK Junior, you better get back to watching Lawrence Welk archives and take your afternoon nap. If you’re feeling more crotchety than usual and your intestines are obstructed you can go ahead and have 2 glasses of prune juice instead of just one.

Trump’s politicalization parade in Kenosha featured the owner of a camera shop which has been looted. Except the supposed owner did not own the camera shop:

https://talkingpointsmemo.com/news/kenosha-shop-owner-was-replaced-in-trumps-damage-tour-after-declining-to-be-featured

‘A Kenosha business owner rebuked President Donald Trump for appearing to use his leveled shop for political gain after he refused to participate in the President’s tour of the city’s damage and was later replaced by a man who was misrepresented as the shop’s current owner. Tom Gram who owns an old camera shop that was leveled in fires last Monday after protests broke out in the Wisconsin city told an NBC-affiliate in Milwaukee that he immediately refused when the White House called on Monday, asking if he would accompany the President on a tour that would showcase his leveled business. “I think everything he does turns into a circus and I just didn’t want to be involved in it,” Gram told WTMJ-TV.’

So who was featured as the owner? It seems the former owner is a Trump sycophant. John Rode III retired in 2011 and sold the business to Tom Gram.

‘“I just appreciate President Trump coming today; everybody here does,” Rode — Gram’s false stand-in– said in the clip. “We’re so thankful that we got the federal troops in to help because once they got here, things did calm down quite a bit.” President Trump also introduced Rode as the “owner of Rode’s Camera Shop,” during a round table conversation on Tuesday.’

Trump and his sycophants lie about everything!

What’s up with manufacturing and trade sales? Is that such a weak sector that it didn’t have far to fall and hasn’t had far to recover?

What interests me is whether the pre covid slope will return or the economy will shift to permanent lower level and slope. Zero Root?

The latter is more likely the longer the current collapse lingers. I continue to be depressed about the economy. Needless to say, Powell helped the DOW and I would like some light on that.

Anyone?

Cares inflated the money supply. Fed just monetized securities.

ECK:

I’m not sure what you’re asking but I’ll give you my 2¢. It’s highly likely I’m channeling Krugman here.

We learned from the Great Depression (and similar events in other countries since then) that recovery from a financial crash will be very slow and will cause a lot of economic pain for a long time. We learned from the Great Recession that rescuing the financial sector may be enough to technically stop the drop (GDP may start rising again) but it’s not enough to restore economic activity to its prior level, so economic distress will continue outside of the financial sector.

In other words, stopping the financial crash is a necessary but not sufficient condition for alleviating the pain in the real economy. To do that, we need fiscal policy to replace the purchasing power that the rest of the economy can no longer muster on its own.

To summarize, the Fed’s actions were and are a necessary preliminary but they can’t finish the job with monetary policy alone. The Fed has set the table; it’s up to the executive and legislative branches to sink the rest of the balls. Since April, the executive and half of the legislative have refused to do so.