From Deutsche Bank on Sunday:

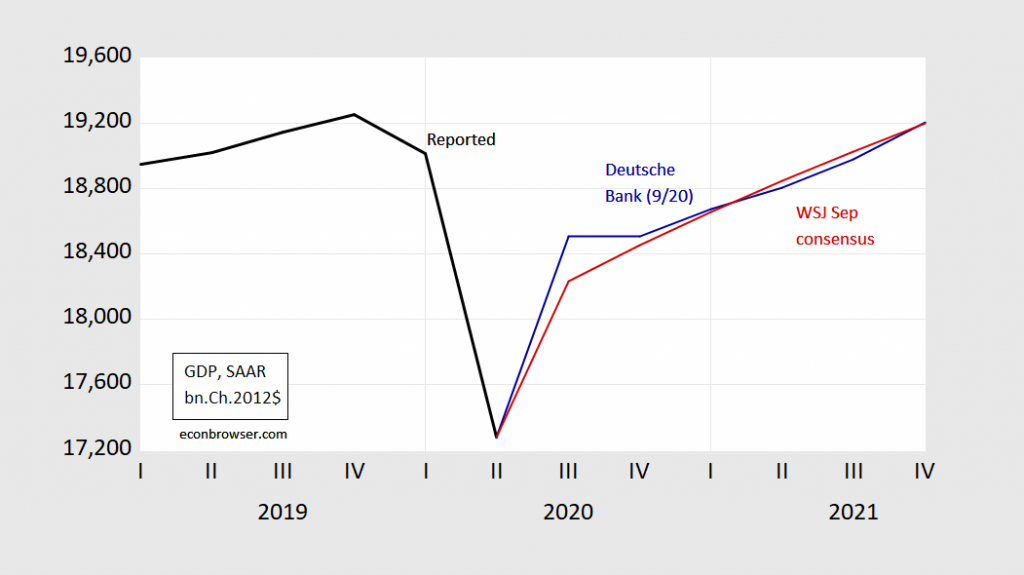

In the US, fiscal uncertainty is a major issue. As outlined above, we now assume that significant further support will not be forthcoming until after the election. The resulting drop in income support for households is already beginning to depress activity and we see GDP growth slowing to near zero in Q4 as consumer spending slides. Growth will pick up in Q1 with some post-election fiscal support.

This manifests in zero (0) growth in 2020Q4.

Figure 1: GDP (black), Deutsche Bank (blue), WSJ September consensus (red), all in billion Ch.2012$, SAAR. Source: BEA 2020Q2 2nd release, DB World Outlook Update (Sep 20, 2020), WSJ September survey, author’s calculations.

Today, Bloomberg notes:

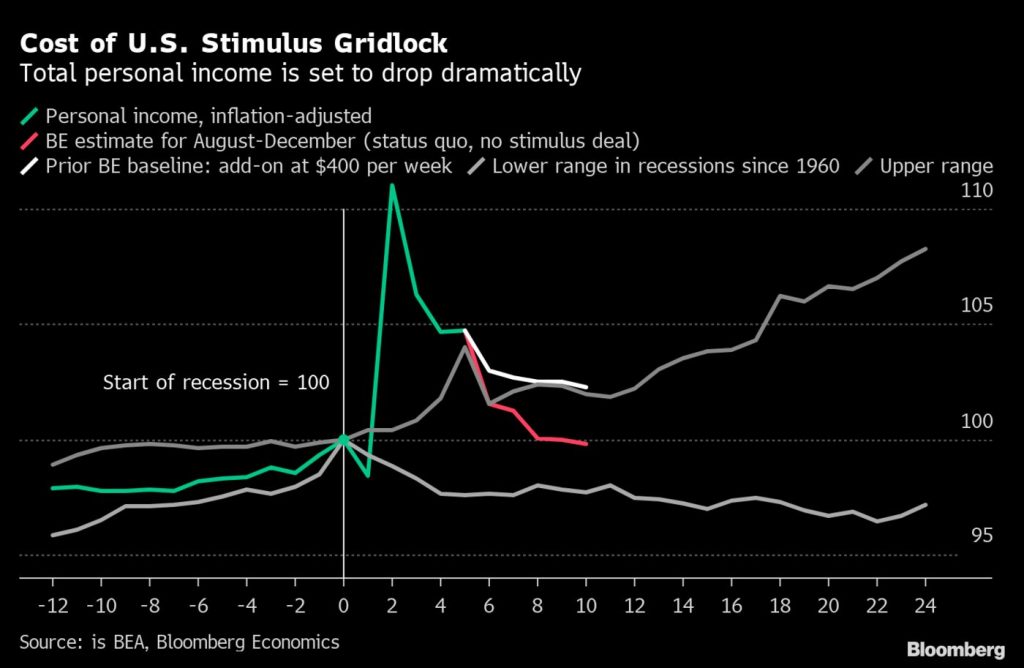

After four rounds of U.S. aid totaling nearly $3 trillion, fiscal stimulus is running out: Bloomberg Economics’ analysis shows that under a no-stimulus baseline scenario through year-end, total income flowing to households will transition from unprecedentedly strong for a recession, to just so-so. That in itself would be enough to subtract 5 percentage points from fourth-quarter gross domestic product compared with a counterfactual scenario that includes an extension of stimulus measures. Funding problems for states and small businesses are poised to add to the drag.

This point is illustrated in the figure depicting personal income around recessions:

What do academic economists think? From the latest round of the IGM/FiveThirtyEight Covid-19 panel:

The results also bring into focus how the economists are viewing the election results and overall political climate. We’ve written many times that they believe an infusion of additional money from Congress — whether in the form of enhanced federal unemployment insurance or another series of stimulus payments — is paramount to stabilize the economy through the recovery. According to our survey results, the biggest economic risk for 2021 is the possibility that no additional stimulus is passed by November 2020. And the economists see Democrats’ control of Congress as having a significant effect on growth potential in 2021, likely because they have been much more willing to pass government spending bills. (Note that even if Joe Biden wins the presidency but the Senate doesn’t flip to the Democrats, 94 percent of our panelists said their outlook for 2021 would remain essentially the same as it is now.)

“I think that failing to pass fiscal stimulus is the biggest downside risk,” said Jonathan Wright, an economist at Johns Hopkins University who has been consulting with FiveThirtyEight on the survey. “And that’s probably made more likely by the RBG fight.”

In other words, no additional fiscal stimulus now is a recipe for flatlining in Q4.

If Biden wins and the Dems take back the Senate, you can bet your bottom dollar that CoRev will be out there marching on the Capitol lawn wearing his Tea Party tri-cornered hat from 2010. Suddenly he’ll be an avowed deficit hawk. Or as I heard one Republican knuckle dragger explain, deficits are okay when the economy is strong because that’s when you can afford more spending, but during tough economic times government must tighten its belt. Economic geniuses one and all.

Kudlow is even worse. He believes in pay as you go (paygo) when it comes to government spending. But there is never any paygo for him when he is shilling for tax cuts for rich people.

Won’t work. The key is to sniff what the Indies are feeling. Obama ignored them in 2009-10 with healthcare reform when they wanted the 1.3 trillion dollar reinvestment program Obama had planned to bring in 2011.

Obama created his own mess, Biden has learned from it. Trump won Independents 47-42% over Clinton. Right there was the election issues that night. They represent a 3rd of the electorate and will not be ignored.

The concern now is that the Senate will be consumed with getting another right wing judge on the Supreme Court and will basically ignore any fiscal issues. The heck with the economy as long as McConnell can kill Obamacare and Roe. MAGA!

Uh, dude, the Supreme Court can have its jurisdiction revoked. Yes, it can. Revoking it on stuff like Health Care and fiscal policy is starting now.

The US Constitution (Art. III, sect. 1) vests all judicial power in the Supreme Court.

U.S. Constitution, Art. III, section 2 establishes the jurisdiction of the Supreme Court:

The judicial Power shall extend to all Cases, in Law and Equity, arising under this Constitution, the Laws of the United States, and Treaties made, or which shall be made, under their Authority;-to all Cases affecting Ambassadors, other public ministers and Consuls;-to all Cases of admiralty and maritime Jurisdiction;-to Controversies to which the United States shall be a Party;-to Controversies between two or more States;-between a State and Citizens of another State;-between Citizens of different States;-between Citizens of the same State claiming Lands under Grants of different States, and between a State, or the Citizens thereof, and foreign States, Citizens or Subjects.

Consequently, the jurisdiction of the Supreme Court cannot be revoked without a Constitutional Amendment.

The legislature has attempted to limit the jurisdiction of Article III courts in the past by creating administrative tribunals, known as Article I courts. However, under the doctrine of Separation of Powers, the US Supreme Court has determined that review of determinations made by Art. 1 courts must be available in Article III courts. (The Marathon Pipeline bankruptcy case is illustrative). Consequently, serious restrictions on the jurisdiction of the Supreme Court would be overturned as unconstitutional by the US Supreme Court, unless the Constitution itself were amended.

Congress does have the power to revoke the jurisdiction of the Circuit Courts and the District Courts, because those are the creation of Congress to begin with.

I cannot see any method, short of Constitutional Amendment, to revoke the jurisdiction of the Supreme Court.

If you believe that revoking the jurisdiction of the Supreme Court can be done by Congress, I would like to hear your theory.

B.A. Badger This is incorrect. You need to keep reading the rest of Section 2. It says:

In all the other cases before mentioned, the Supreme Court shall have appellate jurisdiction, both as to law and fact, with such exceptions, and under such regulations as the Congress shall make.

“…with such exceptions” as the Congress shall make. In ConLaw this has been interpreted as distinguishing between justiciable matters and political matters. The Court can only overturn laws that fall within the Court’s justiciable matters. In fact, the most conservative justices have relied upon this very distinction as an excuse for not ruling against conservative political issues.

A perhaps orthogonal comment:

Despite an election being held during in the depths of the Great Depression, Herbert Hoover received 39.7% of the popular vote. Worth noting, that while Hoover only carried, except for Pennsylvania, were in New England, he got from a third to nearly half the vote in the other states, outside of the South.

I would argue that Hoover actually out-performed considered the situation. Perhaps paychecks matter less than what would we think.

I’ll give one example from the 1932 election. Hoover carried Pennsylvania, despite the fact that unemployment had exploded from 411,000 in 1930 to 1.3 million by 1932; 37.3% of the total working population.

Apologies for the typos, etc – written on a phone.

You aren’t going to get flat lining, but slower growth. I don’t think it really matters in the end, all distortions end and this one will be faster than 2009. The economy had some bubbles. Auto, CRE were absolute no doubters. CRE really is showing its problem. Way to much building up into the 2nd quarter of 2019.

The thing is, Covid just sped things up and the recession happened incredibly fast.