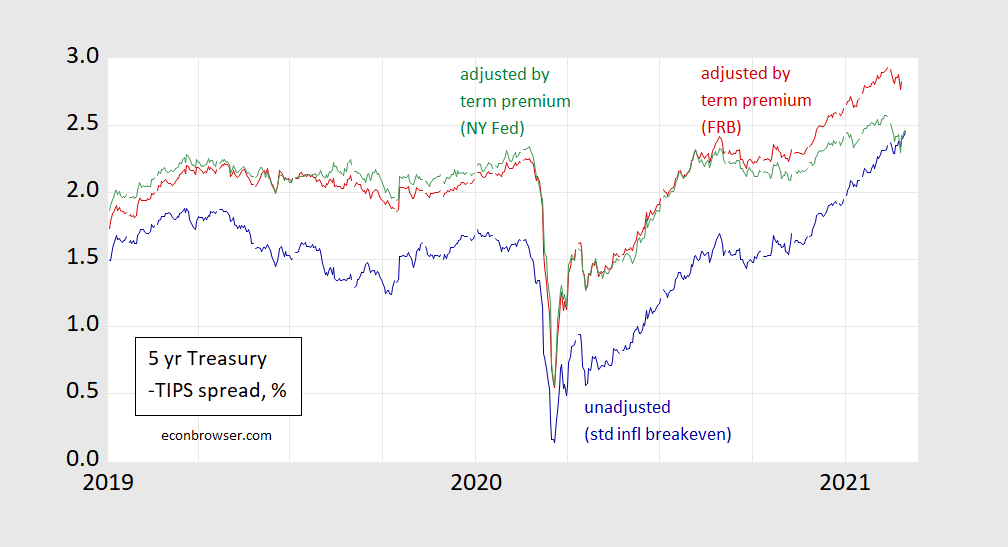

A typical market-based measure of expected inflation is the inflation breakeven calculated by subtracting the TIPS yield from Treasury yield at corresponding maturities. The breakeven spread is shown as the blue line in Figure 1.

Figure 1. Five year inflation breakeven calculated at five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by Kim-Wright term premium (red), and adjusted by Adrian-Crump-Moench term premium (green), all in %. Source: FRB via FRED, NY Fed, and author’s calculations.

The breakeven series has clearly been on the rise. However, what does this series measure?

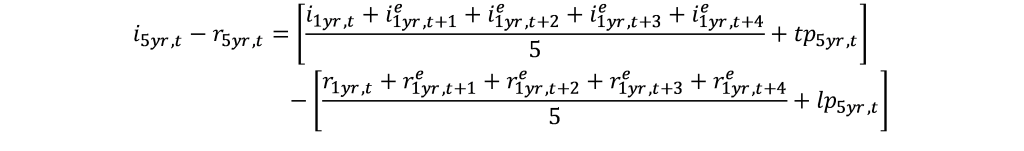

For the five year maturity, this spread is:

Where i is the nominal yield, r is the real (TIPS) yield, tp is the term premium due to inflation risk, and lp is the liquidity premium associated with the relative thinness of the TIPS market. Using the Fisherian relationship for nominal and real yields, we find the spread is:

Notice that only if the term premium and the liquidity premium move exactly together (or both are always zero) will the spread equal expected inflation. This point is stressed by Kim, Walsh, and Wei (2019) and Andreasen, Christensen and Riddell (2020), the latter who also show that the adjusted spread better predicts inflation. I don’t have estimates of the liquidity premium for 5 year TIPS, but I do have estimates of the term premium on 5 year Treasurys. The implied inflation rate holding at zero the liquidity premium is shown as red line (using the Fed’s Kim and Wright three factor model of the term premium) and green line (using the NY Fed’s Adrian, Crump and Moench five factor model).

While expected inflation is higher when adjusting for the term premium, the increase in the expected inflation is less: 60 bps (FRB) or 30 bps (NY Fed) vs. 90 bps (unadjusted spread). And the adjusted spread has been declining in the last two weeks (thru 3/3).

Impounding what I have termed the liquidity premium into what Sirio Aramonte and Fernando Avalos call an inflation risk premium, they write:

In a simple textbook setting, the inflation risk premium would only reflect the compensation that investors demand for holding nominal Treasuries, over and above the compensation for expected inflation. In this case, the only drivers of the risk premium would be investors’ perceptions of risk and their risk appetite. In practice, however, the measured inflation risk premium can also reflect a variety of additional drivers. In the US case, these include imbalances between the demand for and supply of Treasuries and TIPS, or the relative liquidity of the underlying markets.

The net supply of Treasuries and TIPS to private investors stems from the interaction of US Treasury issuance patterns and Federal Reserve purchases. As the US central bank swiftly expanded its holdings of TIPS and Treasuries in response to the Covid-19 emergency, the corresponding bond amounts available to investors dropped substantially in the first quarter of 2020 (Graph D, centre panel). From mid-2020, however, issuance of Treasuries picked up, with auction sizes increasing by between 20% and more than 50% by the end of 2020, depending on the tenor. At the same time, the auction sizes of TIPS remained stable. Since the Federal Reserve maintained a relatively large and steady pace of purchases that somewhat exceeded TIPS issuance but not the expanded issuance of Treasuries, the amount of Treasuries available to investors recovered quickly (Graph D, right-hand panel, red line), while the corresponding TIPS volume stagnated (blue line).

This combination of higher supply of Treasuries and lower supply of TIPS is likely to have contributed to the higher measured inflation risk premium. To the extent that the appetite for inflation hedging remained constant or rose, which appears likely given the macroeconomic and policy backdrop, investors would bid down the yield on the limited amount of TIPS available. The relatively low liquidity of the TIPS market would amplify this effect. At the same time, investors would ask for an increasingly higher compensation to hold the quickly expanding amount of Treasuries. All these mechanisms would contribute to the rise of the break-even rate for given inflation expectations, thus boosting the measured inflation risk premium [emphasis added by MDC].

So, not only is it possible that expected inflation is less than the conventionally calculated inflation break-even (given the TIPS liquidity premium is likely positive), it might have been decreasing most recently (at least going through 3/3).

“The breakeven series has clearly been on the rise.”

Yes this is a proxy for expected inflation. Note this proxy is not much higher than it was a few years ago. A mild rise in expected inflation might even be a good thing. We certainly are not yet in hyperinflation land even if a few of the Usual Suspects are screaming “danger, danger, danger”.

https://fred.stlouisfed.org/graph/?g=qfC8

January 15, 2018

Ten-year breakeven inflation rate, 2017-2020

https://fred.stlouisfed.org/graph/?g=qfmb

January 15, 2018

Five-year breakeven inflation rate, 2017-2020

As has been discussed here many times, we’re still in the situation where inflation and inflation expectations have been very low for a long time, to the extent that the Fed had difficulty raising inflation up to its target rate. Thus, I have a hard time believing that inflation will suddenly jump up to alarming levels or that people will suddenly raise their expectations by several percentage points, regardless of the efforts of the debt Eeyores and the oil price Eeyores.

However, since there is a Democrat in the White House, and Democratic control on both sides of Capital Hill, I’m sure that the various Murdoch properties will do their best to elevate the concerns of the Eeyores. Those Murdoch entities will surely spontaneously birth a plethora of inflation Chicken Littles, and that could be enough for inflation expectations to be a little higher than the fundamentals (including recent history) would suggest they should be. After all, I’ve read that Larry Ludlow works for Murdoch now, so we should expect much more ‘analysis’ and ‘forecasting’ that are unencumbered by either data or logic.

Larry Ludlow? OK – he is a clown so let’s mock his name!

Must have been autocorrect. I made the effort to get his name correct. I’ll make fun of his perfect record of being wrong but not of his name

Oil prices are apparently a big part of the rise in TIPS yield. Both have risen pretty steadily since the election, evem before control of the Senate was clear.

I’m not sure how much Eyore-ness is at work. Holders of TIPS are paid for realized CPI inflation. The yield on a five year TIPS reflects inflation over 5 years, not in 5 years. Today’s oil prices are strongly reflected in TIPS pricing because today’s inflation matters to the payment stream from the TIPS.

That’s one reason short-term swings in TIPS should be handled carefully when assessing inflation expectations over the time frame relevant to policy making.

In short, inflation hedging for this quarter focusses on inflation in this quarter.

Yes, market expectations of inflation have been rising, pushing up into the neighborhood of 2.3%. about where they were in 2013 when the price of oil was in the neighborhood of $120 per barrel. Rate of inflation never go that high. People at the Fed, led by Jim Bullard, have been expecting a short term increase in the rare of inflation this year, with supply issues playing an important role in that. Looks like that is happening.

The question becomes will that rate stay there or go higher? The fiscal stimulus this year will help it do so, but without any further stimulus and assuming supply constraints get corrected as the pandemic gets more under control later this year, we could easily see the rate of inflation fall back some again.

Speaking of the fiscal stimulus did you catch that line from Mitch McConnell where he asserted that “top liberal economists” said it was “wrong”? OK Mitch name names – who was this top liberal economist and point to what he or she specifically said. Else – the Republican leader in the Senate once again lied to the Senate.

I’m assuming that McConnell was referring to Larry Summers. The problem is that Summers’ concern isn’t with the overall $1.9T price tag, but with some of the particular components of the American Rescue Plan. In fact, Summers and Furman recently argued that the era of ultra-low interest rates calls for more reliance upon fiscal spending:

https://www.brookings.edu/wp-content/uploads/2020/11/furman-summers-fiscal-reconsideration-discussion-draft.pdf

Once again Republicans have that they don’t have the head for the subtleties of macroeconomics.

It is not McConnell’s lack of understanding. Look McConnell lies on the premise that his voters are that stupid.

Are these researchers “at the Fed” who “have been expecting a short term increase in the rare of inflation this year“? I ask because the committee’s most recent SEPs have displayed projections of a steady (and non-transitory) increase in both core and headline PCE.

“market expectations of inflation have been rising, pushing up into the neighborhood of 2.3%. about where they were in 2013 when the price of oil was in the neighborhood of $120 per barrel.”

True and the price of oil just over half of that now. The ever confused Princeton Steve was babbling about how higher oil prices was about to lead to nasty macroeconomic consequences but today he is telling us consumer price inflation is not a danger. Now rising housing prices are about to lead to a disaster. Of course with higher rental rates and low real interest rates – fundamentals predict higher housing prices. If asset prices are following fundamentals, this is ain’t a bubble. Once Princeton Steve gets past his chicken little the sky is falling, maybe this incompetent consultant can stop contradicting himself and start paying attention to basic financial economics.

Krugman’s latest is both funny and quite good:

https://paulkrugman.substack.com/p/how-not-to-pay-for-building-back

Funny in part because of Dr. Evil’s concern that the debt/GDP ratio is forecasted by CBO to reach 200% in 30 years. But then he notes this is because CBO is assuming real interest rates will be much higher than they are today – which Krugman doubts.

Non-interest spending as a share of GDP is not forecasted to rise that much even if we go progressive with build back better. So fiscal hawks – you guys are in deep trouble when Austin Powers gets his mojo back. Well Krugman did not write about mojo but his latest blog is a must read.

Again, I am not sure why the fixation with consumer price inflation, when the risk appears to be more asset inflation, notably stocks and houses. My house value has been rising about $3,000 per week since July. Last time we had a housing crisis, we had no meaningful consumer price inflation, and dramatic home price inflation, which precipitated the GFC and a de facto depression. So which risk should we be managing? Inflation? Or the risk of yet another financial crisis?

I think it’s the latter.

You do have the tendency to grind your stupidity to death. Prices of what we consume is not the same thing as asset values. But of course you would have us measure the rise in the price of stocks and even gold. Yea houses have a higher value now than they did a few years ago – so do many stocks. But that does not mean goods prices have risen.

Now if you want to talk about rental rates then yea – they have risen. But of course higher rental rates and lower real interest rates predict a rise in housing values. So I guess you can’t handle those realities as you have been harping on some alleged housing bubble. But it ain’t a bubble if valuations are following fundamentals.

Then again I have read enough of your incoherent babbling to realize you have no clue what the fundamentals even are. And you charge people for your confusing consulting advice? You must have some really dumb clients.

So you don’t see a risk in rising asset prices. Well, we differ there. I do.

A risk? WTF are you babbling about? Fundamentals would suggest the observed increase in housing prices. But I guess they do not teach basic finance at the Princeton school of incompetent consulting. I repeat – if asset values are following the fundamentals then it ain’t a bubble. Do we need to give you a free copy of Finance for Dummies?

Bill McBride provided us this link to an oldie but goodie on the fundamentals of housing values:

https://www.frbsf.org/economic-research/publications/economic-letter/2004/october/house-prices-and-fundamental-value/

I would suggest that you take the time to actually READ basic applied financial economics. You might finally learn something. But maybe not.

One can always note that housing prices have risen relative to their April 2012 levels but so have rents. The ratio of housing values to rents has increased by 10% and that’s it. Back in April 2012, the mortgage rate was rather low at 3.8%. Later it has been incredibly low near 2.7%.

Now if you do not realize that such a drop in interest rate would increase the housing value to rent ratio by at least 10% – then you are really too stupid to be commenting on these issues.

Fundamentals dude – learn them. Damn!

So you’re saying that, in the middle of some kind of downturn warranting a stimulus of 14% of GDP, it makes sense for real national housing prices to be above their 2007 peak? You think that ends well?

I don’t.

https://1.bp.blogspot.com/-E0Vc7QMt30U/YDU-B5hKlpI/AAAAAAAA4SQ/HYJvjYFG4X8v1WnqCLBCf1QPxz_czAyGQCLcBGAsYHQ/s1022/RealDec2020.PNG

“Steven Kopits

March 7, 2021 at 11:02 am

So you’re saying that, in the middle of some kind of downturn warranting a stimulus of 14% of GDP, it makes sense for real national housing prices to be above their 2007 peak?”

You just babble on and on with meaningless rants like these in the presence of evidence germane to measuring the fundamental values in the standard finance model???

Are you really this incredibly stupid? Rants over economics and market evidence. Is that how you run your consulting business? Anyone that pays for your consulting is a fool.

Please desist babbling about topics you clearly do not understand. After all – you should not embarrass your mother this way.

“their 2007 peak”

Interest rates in 2007 were in excess of 6%. They are less than 3% today.

Real rents today are substantially higher than they were in 2007.

Of course I’m pointing out fundamentals to the dead tree bark Princeton Steve has for brains. Yes I know none of this will sink into this fool’s mind so I’m done with this waste of my time.

“So you’re saying that, in the middle of some kind of downturn warranting a stimulus of 14% of GDP, it makes sense for real national housing prices to be above their 2007 peak? ”

steven, i think you inadvertently made a valid point in your comment. “some kind of downturn”. you are admitting we have a downturn, but we do not necessarily know the nature of this downturn. it is not the typical downturn we have seen in the past, either a business cycle or financial crisis. the downturn is quite focused on particular sectors of the economy. and those sectors need support. others sectors are performing in a stunning fashion in comparison. and these tend to be wealthier folks. so it does not seem unusual at all to think that housing, supported by a wealthier sector of the population, continues to outperform while others struggle immensely. on the other hand, if we do let the struggling sector continue to fade, it will most certainly impact even the strong performers. same thing happened in the financial crisis. the week areas were not isolated, and eventually spread their problems elsewhere.

as for the 2007 peak? why would you not expect housing to be at a greater valuation 13 years later? even in real terms. not sure you can use this as an excuse to call a bubble.

Everyone repeat after me. We do not have an inflation crisis. We do not have a housing crisis. We do get a lot of dumb comments from the Usual Suspects. But hey!

with the greatest respect Steve is not talking about the CPI but housing prices. I think he raises a good point. rises in housing prices would lead to ,ore inequality

If he were talking inequality that would be one thing. The problem is that he refuses to accept the fact that market fundamentals can account for the rise in housing valuations. Yes Princeton Steve has turned into a bubble brain.

in this case surely asset price inflation is as bad as rising inflation

Granted higher housing prices can be an issue for the inequality debate. But note Stevie pooh does not care about the issue of inequality one bit.

What he is doing here is playing Chicken Little screaming housing bubble. As I noted – the fundamentals are driving up housing prices so it is not a bubble. Of course Princeton Steve flunked Finance 101 so he is incapable of grasping the fundamentals.

Before anyone comments on rising housing prices, the data presented by Bill McBride here should be addressed:

https://www.calculatedriskblog.com/2021/02/real-house-prices-and-price-to-rent.html

Yes – housing prices have risen in real terms. But note that the increase in the value to rent ratio is a lot more modest. In a word, real rental rates have risen. And of course, everyone that does even basic finance knows that lower real interest rates should raise the value to cash flow ratio (here housing price/rental ratio).

Anyone who repeatedly claims we have a housing bubble does not get basic finance and has not been properly following market data.

https://talkingpointsmemo.com/news/mccarthy-ridiculed-for-reading-dr-seuss-while-senate-debated-pandemic-relief-bill

Kevin McCarthy is spending his time reading Green Eggs and Ham? Now it would be nice if he read the closing pages of this Dr. Seuss classic to Ted Cruz as something tells me that Cruz’s parents never finished read the entire tale to him when he was a child.

https://www.washingtonpost.com/business/2021/03/06/biden-stimulus-poverty-checks/

March 6, 2021

Biden stimulus showers money on Americans, sharply cutting poverty and favoring individuals over businesses

The $1.9 trillion package enjoys wide support across the country, polls show, but it comes with political and economic risks.

By Heather Long, Alyssa Fowers and Andrew Van Dam

President Biden’s stimulus package, which passed the Senate on Saturday, represents one of the most generous expansions of aid to the poor in recent history, while also showering thousands or, in some cases, tens of thousands of dollars on Americans families navigating the coronavirus pandemic.

The roughly $1.9 trillion American Rescue Plan, which only Democrats supported, spends most of the money on low-income and middle-class Americans and state and local governments, with very little funding going toward companies. The plan is one of the largest federal responses to a downturn Congress has enacted and economists estimate it will boost growth this year to the highest level in decades and reduce the number of Americans living in poverty by a third….

Helping the poor and setting the stage for a Biden boom. I guess that explains why McConnell had to oppose this bill at every turn.

I’m sure that Mcconnell intends to try to make Biden a one-term President; it’s just that this time he wasn’t stupid enough to say it out loud like he did with Obama. If he needs to tank GDP, employment, and incomes in order to achieve this, it’s a small price for Mcconnell to pay. He doesn’t care about the wellbeing of the rest of us, only about his own political power.

P.S. I think it’s quite rich that he’s now complaining that the ARP was done without GQP participation after he made it clear from the beginning that he wanted no part of any new spending. He’s really mastered the ‘art’ of shameless, brazen hypocrisy.

He’s really mastered the ‘art’ of shameless, brazen hypocrisy.

PRECISELY!

https://fred.stlouisfed.org/graph/?g=x2gN

January 30, 2018

Case-Shiller Composite 20-City Real Home Price Index, 2017-2020

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=x1E2

January 30, 2018

Case-Shiller Composite 20-City Home Price Index / Owners’ Equivalent Rent of residences, 2017-2020

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=x1I3

January 30, 2018

Case-Shiller Composite 20-City Real Home Price Index, 2007-2020

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=rdkG

January 30, 2018

Case-Shiller Composite 20-City Home Price Index / Owners’ Equivalent Rent of residences, 2007-2020

(Indexed to 2007)

Note the fact that Case-Shiller Composite 20-City Home Price Index / Owners’ Equivalent Rent of residences increased by almost 37% since April 2012. But Princeton Stevie cannot understand that this is part of the reason why real housing prices have increased by 50% since then. No – he cannot get the role played by lower real interest rates in the rise in housing prices.

No to this incompetent consultant, it cannot be the fundamentals as it has to be a housing bubble.

I would think people who are this bad at basic financial economics would stop commenting on an economist blog.

Christians against voting rights?

https://ifapray.org/blog/pro-gop-group-targets-house-dems-over-hr1-reform/

Oh wait – the old South had white Baptist churches who did all they could to restrict the rights of those who attended church on those black Baptist churches. Now these modern day KKK members should relax about Lindsey Graham as he has announced that he will fight against voting rights. After all if blacks in South Carolina were allowed to vote freely, Graham would lose his precious Senate seat.

In 2014 Krysten Sinema called raising the minimum wage a no brainer:

https://www.bing.com/search?q=kyrsten+sinema+minimum+wage&qs=AS&pq=kyrsten+sinema+mini&sc=3-19&cvid=2FEFD16D528840E8957F9BE144684F9F&FORM=QBRE&sp=1

In 2021 Senator Sinema voted against raising the minimum wage. Way to go Senator – you have no brain!

As for the stock market Robert Shiller’s cyclically adjusted price-to-earnings ratio is at 35, which is twice the long term average. The ratio is in effect higher than 35 since we are passing through a period of relatively slow growth for nominal GDP. The point for me would be look for slower stock market growth in the coming decade:

https://fred.stlouisfed.org/graph/?g=r4TQ

January 15, 2018

Wilshire 5000 Total Market Index, 2007-2018

(Indexed to 2007)

On the matter of those short-term supply problems that are helping to push prices up, there was another long article in the Washington Post about the problems in global shipping, which have apparently gotten worse due mostly to pandemic-related problems. The bottom line of the article is that the global shipping industry is “in total chaos.” It will take some time for this to get straightened out, but when it is, that will help reduce the neo-inflationary pressure.

Last i checked there was an excess supply of ships so shipping companies were incurring severe operating losses. But that was pre-pandemic.

Sorry, latest article was in NY Times, not WaPo from two days ago in Business section, “I’ve Never Seen Anything Like This”: Chaos Strikes Global Shipping.” The situation has gotten worse since the WaPo story in late January.

I tried to read that NYTimes piece online but their damn paywall popped up.

@ pgl

Some public libraries offer expanded access. Now unless they don’t offer this in NY state area because of a concentrated number of subscribers in the NY state area, I would be shocked as hell if your Brooklyn library or the main NYC library don’t offer this. This is one of those things I really hesitate to share, as I am afraid if too many people take advantage of it, they will withdraw this service. You will laugh at me, but do me a favor and give it a try, but “keep it under your hat” please.