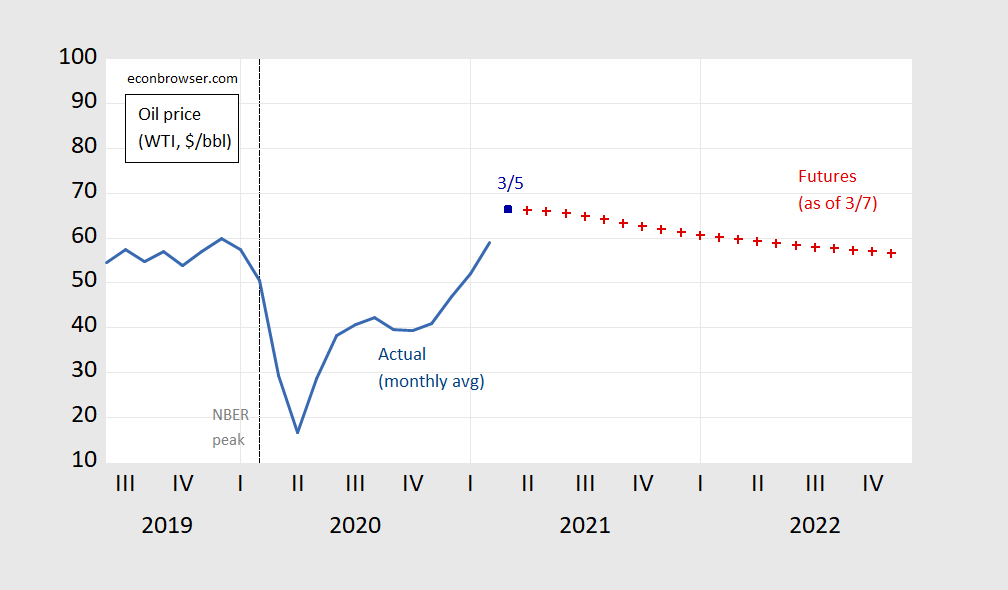

As of March 7th:

Figure 1: Oil price, monthly average of daily spot, $/bbl (blue), spot close on 3/5 (blue square), and futures price (red +). Source: FRED, Bloomberg, NYMEX via ino.com.

Jim on contango and backwardation, which cites Chinn et al. (2005) (an extended version published as Chinn and Coibion (2014).

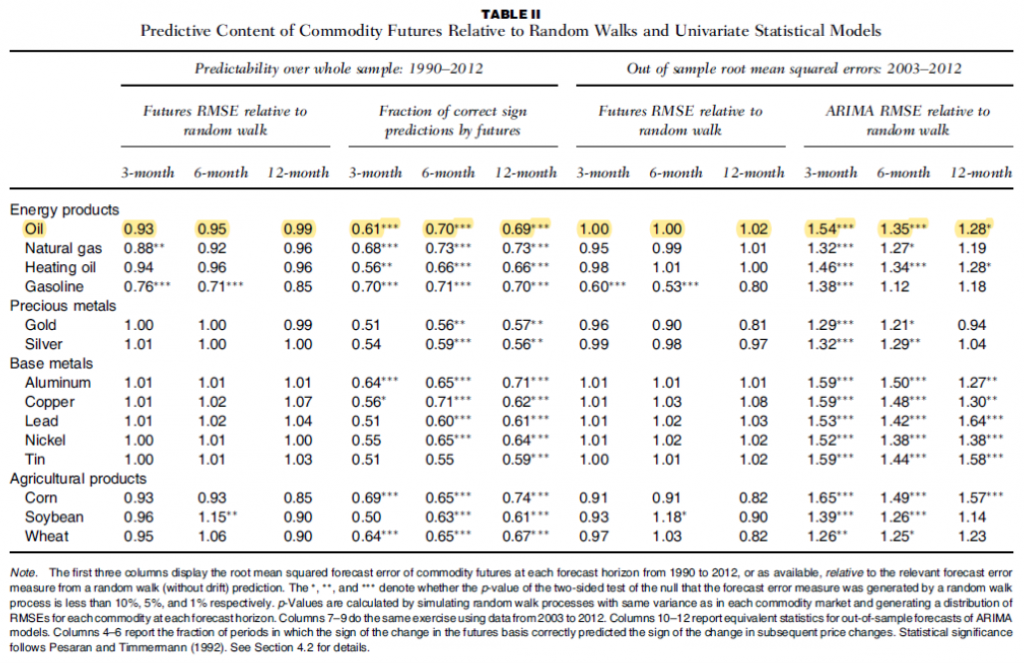

Should we place much faith in futures? Chinn and Coibion evaluate the relative performance of futures, random walk and ARIMA models for several commodities, including petroleum.

Source: Chinn and Coibion (2014).

In sample, oil futures do pretty well on direction-of-change metrics. Out of sample (2003-12), futures do as well as a random walk.

Gee – this is not making the case that the market expects $100 a barrel for oil. Of course Princeton Steve has been banging the drum that oil prices are about to explode. His only evidence was the futures price for April delivery without mentioning the other future prices your graph shows.

I’ll chalk that ruse from Princeton Steve is just another lie.

This is what I wrote last Thursday (quoting myself from a day earlier):

WTI stood at $61.50 / barrel when we issued our weekly assessment of EIA oil markets data yesterday [Wednesday, March 3]. Nevertheless, we stated that, “We might expect WTI at $64 / barrel this time next week, and $65-66 / barrel would not be surprising.” We did not need a week. Less than twenty-four hours later, WTI had surged above $64 / barrel. It could rise far above this level, and with shocking speed.”

As I write, WTI is trading at $67.50.

https://www.bloomberg.com/energy

I’ll do the analysis and publish on how we get to $100.

Quoting yourself? Seriously? Like you are some sort of authority? Of course you failed to note the comment I’m talking about. Go figure!

With corrected italics:

WTI stood at $61.50 / barrel when we issued our weekly assessment of EIA oil markets data yesterday [Wednesday, March 3]. Nevertheless, we stated that, “We might expect WTI at $64 / barrel this time next week, and $65-66 / barrel would not be surprising.” We did not need a week. Less than twenty-four hours later, WTI had surged above $64 / barrel. It could rise far above this level, and with shocking speed.”

As I write, WTI is trading at $67.50.

https://www.bloomberg.com/energy

I’ll do the analysis and publish on how we get to $100.

Menzie!

You are treading on Jim’s turf here. Tsk, tsk.

Barkley Rosser: I figure since I’m relying on his analysis (hence the link), I’m good!

Ah, the good old days before you were around here, Menzie, :-). I actually remember this post, pretty heavy duty.

Oil going down today, although does not mean that much. One weird thing going on nobody commenting on is a noticeable decline in gold price, not below $1700 and declining, at a ten month low.

“the good old days before you were around here, Menzie”

Ever thought of a career in diplomacy??

Moses Herzog: He was joking. The time between when the blog started and when I joined was 3 months.

I thought that Professor Hamilton made an interesting comment in his 6/12/2005 entry.

“…[A]nalyzing it [contango and backwardation] the way I have done here clarifies a

key point that is often missed in this literature, which is that the relation between the

expected December spot price and the June price of a December futures contract has nothing to do

with storage cost or convenience yield, because you can arbitrage a discrepancy between the

expected December spot price and the futures price without ever having to store the oil

physically for any length of time or miss selling a drop to a single customer. Anybody can

participate in this arbitrage, over and above whatever you’re already storing or not storing in

June or selling or not selling in December. Whenever the December spot price that you’re

expecting as of June exceeds the June price of a December futures contract, there’s an expected

profit to be made from buying that futures contract.”

The big question is how to gain confidence in the expected future commodity price.

Had a colleague who once did have to pay storage costs. She had given up on some FCOJ going into the money, so stopped paying attention…

“Hey lady, where you want this OJ?”

Nobody forgets twice.

Forgive the wondering, but I wonder if oil prices would be more stable and stay lower were the United States for several years not intent on sanctioning or economically limiting a number of countries with the largest of oil reserves. Sanctions directed at prime oil and gas producers could present an important problem for sanctioned and non-sanctioned countries.

https://fred.stlouisfed.org/graph/?g=pJk5

January 15, 2018

Prices of Oil and Natural Gas, 2000-2020

(Indexed to 2000)

Several years ago, I remember that the Kennedy family would donate heating oil to the homes of poorer families in New England. The Kennedys would always thank Venezuela for supplying low price oil. Then with repeated sanctions on Venezuela the Kennedy program was stopped, and I thought that regrettable.

Commodity price volatility is not limited to oil. And this volatility predated the US trying in vein to reign in nations that sell oil. After all this is a world market and the US is not even the number 1 player either on the supply or the demand side.

Has Joe Manchin turned progressive?

https://www.axios.com/newsletters/axios-am-548763be-230d-400a-8aa8-4ef8ebe48781.html

He wants a $4 trillion infrastructure bill fully paid for by repealing Trump’s tax cuts and raising the corporate tax rate from 21% to 25%. Of course he adds the qualification that he will support this only if Biden and him can get Republican support. Good luck with that!

I know little of course, but I do know that the United States has used sanctions to importantly lower the supply of oil from a number of countries having great reserves. Simply harming the economies of sanctioned countries is an important cost, but limited energy resource developing countries can be especially vulnerable to changes in the cost of oil. Then too, the US has stopped construction of important natural gas pipelines to Western Europe.

Limiting the supply of oil through sanctions must have price effects, possibly severe effects in and beyond a sanctioned country, and would seem to deserve consideration.

“Limiting the supply of oil through sanctions must have price effects, possibly severe effects in and beyond a sanctioned country, and would seem to deserve consideration.”

Seriously? It is a world market. The last time I saw anything remotely close to these claims was the price controls in the late 1970’s which had modest and only temporary price effects. The reason there is not much consideration for your bizarro theory is that price differentials are generally modest reflecting shipping costs.

on the other side, it serves as an impetus for the usa mainland to continue to develop renewables and eliminate the dependency of oil, especially foreign oil. ltr, many of the nations you are referencing are not good international neighbors to begin with. why would you support iran and Venezuela to freely operate given their poor behavior? do you have another method of deterrence?

There is a body of knowledge on this, ltr. In general, sanctions on purchases have not proved effective. Sanctions on sales, as we see with Iran, can work.

OK but I guess you do not know that every economic transaction represents both a sale and a purchase. Now there may be reasons not to see this in the Holy Grail of the perfectly competitive D = S model except you see through the entire world through those glasses.

Here you go.

http://www.prienga.com/blog/2021/3/8/explaining-the-road-to-100-oil

Sorry dude – no one here reads your garbage. So cease your pathetic self promotion and be a good boy and go lie with your friends on Fox and Friends.

there is nothing beneficial about oil at $100. it is a tax on the working class. the only positive is that high oil, and gas, prices continue to assist in the transition to an electric society. i remember not too long ago when steven giggled at the thought of electric cars and tesla impacting the market. are you still giggling steven? ALL of the major auto companies are moving to electric, and will be completely electric probably inside a decade. it will not be a gradual transition. and we have a president in office who will most likely implement policies that speed up the adoption. steven, you were very wrong about the importance of oil and the unimportance of companies like tesla.

Baffs,

I agree with you. High oil prices are not good. By extension, neither are high fuel taxes, tolls or carbon taxes. All true, with respect to the economy and in terms of regressive effects.

EVs are still not cracking much over 2% of car sales.

https://www.wsj.com/articles/electric-vehicles-are-the-u-s-auto-industrys-futureif-dealers-can-figure-out-how-to-sell-them-11615113000?mod=searchresults_pos7&page=1

I have felt that the move to EVs would be more ‘push’ — from high oil prices — than ‘pull’ from improved batteries and government subsidies. I personally felt this provided the Biden administration an opportunity to be both pro-oil — which may become a political imperative if I believe my own oil price forecast — and pro-EV as the chief solution to increasingly unaffordable oil.

steven, that 2% will grow when biden supports the expansion of EV charging infrastructure. and demand for EV will grow with high oil prices. the changes will be dramatic. once EVs encounter about 10% of new cares sales, it will be the point of no return. they will dramatically grow to 50% of new car sales within a couple of years. demand will probably exceed supply for a good while.

tesla is in a position to be a game changer. i would imagine they will reach the situation where the power wall drops quite a bit in price. couple that with solar roof, and before long the cost to “fuel” an EV will essentially be free. that will be used to cover the cost of solar panels and power wall over a 5-10 year timeframe. at that point, homeowners will have a “free” power backup system and daily renewable energy source. this will have an impact on housing power costs as well. the electric/solar ecosystem is going to be a game changer, sooner rather than later. economically, it will create more discretionary funds for people.

You are debating on Telsa with a fool who does not even get that the value of an asset tends to rise when either:

cash flows rise or

discount rates rise

Of course I am saying Stevie pooh is utterly incompetent on the topic of housing prices. So why would anyone care what this moron has to say about electric vehicles?

All speculation, Baffs. After 120 years of trying, EVs are still inferior to ICE engines.

More likely, we would see an extended period of adaptation accompanied by protracted ‘secular stagnation’. (Where did that phrase go? Oh, yes, it disappeared when oil prices fell.) This would involve lower productivity growth and would be visible in declines in vehicle miles traveled and airline traffic. It would involve societal stress, just as did the period 2005-2017, which of course ended with the election of Donald Trump.

Over time, society would adapt to lower mobility and EVs would become better adapted to changing circumstances. But I would not expect the transition to be free or easy.

“After 120 years of trying, EVs are still inferior to ICE engines.”

absolutely false. i think it is time you spend some effort and investigate the state of the art in EV motors. an ICE is not even comparable anymore. In fact, the real disappointment is that after 120 years ICE engines have made such little progress in efficiency. at this point, the EV is a far superior vehicle. the only difference is ICE vehicles have 100 years of infrastructure supporting them. but that is also changing very quickly.

“All speculation, Baffs. ”

this is the type of response i would expect from entrenched interests. trying to cast doubt on the inevitable. but as i told you a couple of years ago, times they are a changing. the entire electric/auto ecosystem that brings solar roof, battery backup and electric vehicle is short of one time to make it irresistible. right now a tesla car is not permitted to be used as backup support for the house. as soon as tesla permits this, then the car doubles as a vehicle AND power wall. that will change the attractiveness of the ecosystem dramatically. and it is only a matter of time.

2% of sales, guy. That’s not because people are mean, it’s because they can do simple math. After nine years of production, Tesla’s cranking at around 500,000 vehicles per year. Not bad, but that’s most of the sales of all global brands combined. It’ still a very small fraction of total cars sales.

Could EVs get better? Sure. Are they competitive today? No, not for 98 of every 100 buyers.

“2% of sales, guy. That’s not because people are mean, it’s because they can do simple math.”

it is due to price. which is dropping. it won’t be a linear change. and right now, that 2% is controlled by capacity, not demand. but tesla is building factories in austin, germany and china. as capacity grows, so will market share.

https://www.consumerreports.org/hybrids-evs/evs-offer-big-savings-over-traditional-gas-powered-cars/

and if you can do the math, it favors EVs. steven, you seem to be in denial of where this is going, and at what speed. four years of biden policy will have a tremendous impact.

https://finance.yahoo.com/quote/TSLA?p=TSLA

You might want to point out to bubble brain Princeton Steve the fact the Tesla had almost $2 billion in operating profits on over $31 billion in sales last year. Tesla is turning competitive which is why its market value is now $666 billion ($693 a share). Not as high as that frothy $880 a share but an indication that the market expects Tesla’s profitability will continue to improve.

You might want to point out basic financial information to this bubble brain but his incredibly stupid writings on the housing market proves to me a long time ago that Princeton Stevie flunked Finance 101 and is somehow proud that he is even dumber than Lawrence Kudlow.

Steven,

I do not rule out $100 per barrel, especially as I am aware that the price of oil can move very sharply over short periods of time, even if we have not seen so many such sharp moves recently. But the several hundred percent upward spikes in 1973 and 1979 should be kept in the back of peoples’ minds, although we have also seen sudden collapses as well, e.g. 1930, 1986, and pretty rapid in 2008, although I am not at all forecasting anything along such lines in the near future, with two of those tied to going into major economic declines and we are clearly going the other way, although by how much is certainly an important part of this.

On your supply discussion I found one especially odd note, this treating OPEC as if it is some single decision making entity. That has not been true for quite some time, if it ever was (maybe in 1973 and for awhile afterwards). Your discussion makes clear that you are focusing on Saudi Arabia, which of course has long been the dominant player in OPEC, but it is not all of OPEC. I note that oil prices starting falling again after a short spike after that Houthi attack on Ras Tanoura.

In another comment I noted that there are several players in OPEC who might have some flexibility to produce more and might be inclined to do so, although there are limits to their abilities to do so, namely Libya and Iraq. The former I think is too bogged down in its internal wars to do so all that much, but Iraq might be in a position to do so more, with things quieter there than in the past. It is easy to forget that both they and Iran are well below previous levels of production, and while I think that Iran may well be constrained by ongoing sanctions (I worry Biden may not get it together to get back in the JCPOA before a hawk gets elected there in Iran and sanctions remain), Iraq is not so constrained, and really does have some substantial potential, not to mention its Kurdish part in the north, which admittedly has some problems due to the hostility of the Turks.

In any case, talking about “OPEC” as some unified decision making entity is clearly misleading and leaving out some crucial loose ends.

You actually took the time to read Steve’s nonsense? OK.

“On your supply discussion I found one especially odd note, this treating OPEC as if it is some single decision making entity.”

As you rightly note – it is not. Even if it were a lot of oil is produced by non-OPEC nations including the US. It may not be a perfectly competitive market but ignoring the basic supply curve is Stevie seems to do so is really dumb.

pgl,

You have been around long enough here to know that I have been discussing/debating issues about oil and energy markets, especially the former, with Steven Kopits since the days before Menzie was a co-blogger here. I have on more than one occasion said that I respect Steven’s level of knowledge regarding these markets, even when I disagree with him as I often have, with this clearly the most important thing his consulting company did and maybe still does, advising on these markets, even if he is getting things wrong. I think he is less knowledgeable on some other topics, on some of them embarrassingly so, but I am not going to go on about that now.

I will note that in contrast to many others who have commented here from more on the conservatibe/rightist direction, many of whom seem to have totally disappeared since the election, Steven on several occasions expressed disagreement with actions or positions of our most recent POTUS.

As for me, I have long been interested in oil markets, with this more a topic of actually published research earlier in my career than recently, dating back 40 years, and over a half century of closely following them, with my undergrad senior honors thesis actually on the history oil price changes in the Middle East back in 1969 (where I accuratley called that OPEC would assert its power and push oil prices up), and where I have also spent some non-trivial amounts of time, although also not recently. People here have been told that my personal interactions with Jim Hamilton predated not only this blog but even the beginning of blogs, and some of those earliest interactions involved discussions of oil markets and their impact on the economy.

So, I do not think it servers much purpose telling people not to read things he posts wherever about the oil industry. He may be wrong, but he is well informed on that at least, and has been one of the most so here since essentially the beginning of this blog. And I have always found him to be open to fairly reasonable discussion and debate at least on this issue since the beginning of this blog.

All well said. Look – I would not mind his self promotion if he did not attack our host on the excellent posts here. Quite often these attacks only show Stevie is clueless on the topic he is claiming to be some sort of authority (which of course he is not). Now if he decided to show a little more respect to our host, then maybe I will lay off my criticism of him.

Over 18,000 views for the piece this early am. It will go higher.

Gloating about views? Did you advertise the post on Parler for the MAGA crowd or what? Number of views does not mean it is a worthy post. After all – Trump’s tweets get millions of views.

Barkley –

This goes back to Jim’s inoculation theory (my phrase) which holds that an oil price previously achieved will not lead to an oil shock subsequently. (Jim may want to specify here.) The world saw and lived with $100-115 / barrel Brent from 2011-H1 2014, so that’s not a number we are unaccustomed to dealing with. I don’t believe that an oil price up to $115 Brent would sink the global economy. If I were advising OPEC, that would be my short-term target price.

As for OPEC decision-making: Let’s not confuse power with interests. I am not contending that the Saudis have the power to coerce the rest of OPEC+. Rather, I am arguing that Saudi policy is beneficial to OPEC+. So, bear in mind that the EIA in the Feb. STEO is forecasting sub-$50 WTI on the back of 3.5 incremental mbpd from OPEC from now to mid-year. Let’s say that price / quantity point is correct. We’re now at a bit under $65 WTI. Thus, by this math, a reduction of output by 10% is worth 30% in increased prices. That’s easy. The cartel is better off with lower output and higher prices — the very reason for the existence of a cartel!

So I think OPEC+ more or less holds together if in fact restricted production leads to materially higher prices, because that maximizes revenues to the cartel members.

Steven,

I am not making a forecast about what will happen to oil prices in the near future as a lot of things seem to be in the air, although I note they were falling again today. But then I do not own a company that gets paid money to make forecasts so I can do that and get away with it.

Anyway, in the near term OPEC, let us pretend that it actually is a functioning entity, which it sort of is, as a whole can make more money by cutting production some, at least in the short term before non-OPEC members like US do not ramp up to offset. But even without the outsiders messing things up, OPEC faces the eternal prisoner’s dilemma problem here, that it will pay small members of the cartel to cheat some, and OPEC really has no mechanism for making them stay in line. So if OPEC sets out to cut production by 10%, Iraq could easily increase production enough to make that cut be only 7%, which would still lead to a price increase, but not as large as otherwise, but with Iraq coming out well ahead of where it would have been if it had not cheated.

I agree that world economy can probably manage $100 or even $115 per barrel oil, which is not as much as it used to be anyway in real terms, although such an outcome would indeed put some short term upward pressure on global price levels.

The OPEC+ cartel has hung together quite well during the downturn, when cheating was certainly possible. Cheating is partially possible today, although much harder to do undetected than, say, fifty years ago. Cheating of 100 kbpd does not change the aggregate outcome.

The cartel must look to Saudi Arabia. Current prices are only possible because the Saudis announced a production cut of 1 mbpd right into the teeth of a recovery. Saudi Arabia can also crash prices if it so chooses. Participants are aware of that, and also aware that any window to make excess profits may well be fleeting. If they screw up here, they may not see high oil prices for another 3-4 years, depending on what happens in the Permian.

I would add that OPEC’s situation is somewhat different than it was in the 1970s. A lot of these producers are mature and don’t have easy upsides in production anymore. Iraq may be an exception, but a lot of the producers have settled in at largely stable production numbers for many years now. I don’t think that rush for increased volumes is quite what it was in 1979. Cooperation is easier to deliver, if the incentives are properly aligned.

The United States has in fact used sanctions to limit or even prevent the selling of oil by a number of countries with large oil reserves. These sanctions have indeed harmed the economies of the countries in question, and a number of other countries caught in the effect. Possibly punishing entire peoples with sanctions is ethically warranted, possibly harming other peoples, especially in less developed countries, is warranted, but sanctions are intended to be effective and the effect really is there.

Please forgive me. I am awfully sorry to be so often wrong, but learning rightness is difficult. I will continue to try, however.

https://fred.stlouisfed.org/graph/?g=qjYx

August 4, 2014

Real per capita Gross Domestic Product for Dominican Republic and

Cuba, 2000-2018

(Percent change)

https://fred.stlouisfed.org/graph/?g=qjYz

August 4, 2014

Real per capita Gross Domestic Product for Dominican Republic and

Cuba, 2000-2018

(Indexed to 2000)

[ Cuba gained importantly from trade in oil for medical services, and growth in Cuba slowed significantly as sanctions against a partner country limited trade in oil. Of course, non-oil sorts of sanctions have been imposed directly on Cuba. That Cuba has managed to grow so well relative to the Dominican Republic which has been the fastest growing country in Latin America since 1971 is interesting. ]

Venezuela’s oil problems have little to do with the US and everything to do with the nature of governance there.

Pre-Chavez, Venezuela was producing about 3.2 mbpd. Last month, it produced 0.5 mbpd. Textbook example of the maladies of socialist ownership.

Steven,

Venezuela’s problems are not due to “maladies of socialist ownership.” It is due to cronyism and corruption. The oil industry of Venezuela has been largely state-owned, that is “socialist” by the technical definition of that term, which has also been the case for most OPEC members since the early 1970s (I note that Venezuela was one of the two co-founders of OPEC in 1960, the other being Saudi Arabia). So it is not this state ownership that is the problem.

Things went bad after Chavez go tin because he removed the capable technocrats and replaced them with incompletent political cronies who began engaging in all sorts of corruption. This only got worse after Maduro got in.

I shall grant some increase in “socialism” in that previously foreign private companies were allowed to operate in some peripheral parts of the Venzuelan oil industry, and they basically got either shut down or taken over. But that is about it.

trump has shown that cronyism and corruption in government is not limited to a socialist type government. it also occurs in a free market democracy. the damage he has done to the technocrats in america will be felt for years.

You are correct. PDVSA was the successor to the various oil companies in Venezuela owned by the majors prior to 1976. These were nationalized, but were left intact and undisturbed, and PDVSA prospered by and large.

After Chavez was elected to power, PDVSA became a political tool and was effectively run down to its current state under Maduro.

From its nationalization, PDVSA operated under center left or center right under the Democratic Action and Copei political parties, respectively.

Hugo Chavez and Nicolas Maduro were the only socialists in power after the nationalization of PDVSA, and they trashed the company. I stand by my statement.

Socialist ownership cannot produce oil? Damn – you excel in stupidity. The Soviet Union knew how to make money off of selling oil. Yeltsin not so much. But then Mr. KGB (Putin) took over and Russia is back in the oil game. So yea socialists can make money off of oil. After all – you make money on ‘consulting’ as they are fools out there you actually think you know something. Duh!

“Hugo Chavez and Nicolas Maduro were the only socialists in power after the nationalization of PDVSA, and they trashed the company. I stand by my statement.

I see Stevie – all socialists are identical? Lord – your ability to double and triple down on utterly stupid statements is amazing.

The reason there is not much consideration for your bizarro theory…

[ Calling an argument bizarro is important.

Still, oil sanctions against Venezuela evidently stopped the Kennedy family in donating heating oil to lower income New England households. Oil sanctions evidently limited growth in Cuba. And, I even think that oil sanctions have over time increased oil prices internationally. China has even been making sure that oil or gas sanctions to come against any country will be of little domestic consequence. ]

Venezuela and the Kennedy family? Neither one has that much of an effect on the global price of oil. I’m sorry but this repetitive stuff is nothing more than babble. Please stop.

I will admit that we imported $36 billion of oil from Venezuela 10 years ago but if you bother to check – this was a mere 11% of our oil imports back then:

https://www.census.gov/foreign-trade/statistics/product/enduse/imports/c0000.html

Venezuela oil imports may be a big deal if you are a Citgo refinery (their US affiliate) but come on – it is a drop in the bucket when compared to what the US consumes in oil each year.

I have no clue why you are babbling about this but it has become a total waste of space.

The reason there is not much consideration for your bizarro theory…

…this repetitive stuff is nothing more than babble.

I have no clue why you are babbling about this but it has become a total waste of space.

[ Please forgive me for wasting space, because I have no proper space appreciation since I was raised by space wasters. I will however try to learn. I promise, but please do keep on insulting me because I so need that and the stream of insults has been wonderous. ]

What is interesting is that the Chinese are concerned enough about the use of sanctions on a range of countries, that the matter has just been discussed at the general assembly. Usually such a matter would not be openly discussed, but the seriousness calls for an open strategy of response. The point is that the United States has used oil and gas sanctions to undermine or limit growth in a number of countries with important reserves and to the extent that the sanctions are successful they obviously effect international prices. Failing to recognize the effects of US policy on oil and gas prices over time strikes me as curious, especially so for sanctions.

Fine, now resume the insults which I so obviously deserve. Try to be clever though.

fine, china seems to be concerned about abusive behavior of america. care to comment on the usa concerns about abusive behavior of china?

https://www.cnn.com/2021/03/09/asia/china-uyghurs-xinjiang-genocide-report-intl-hnk/index.html

ltr, what are your thoughts on the genocide occurring in china? or is that topic outside the bounds of your inquisitive mind? perhaps this should also be discussed by the general assembly? would you agree?

Would taking 11% of US oil imports from the market and taking more exports from another supplier with the largest proven reserves of any country from the market internationally make any difference? I would say the country in question would be badly harmed and harm shared in different ways internationally.

Return now to insults.

When the United States uses a range of sanctions against countries that have large oil reserves and production capacity, the sanctions are meant to have an economic impact and do have such an impact broadly in a sanctioned country and indirectly in a range of other countries. I do understand and know the importance of this.

Please try to understand.

ltr,

US sanctioning an oil-producing nation, such as Iran, can certainly negatively impact that nation’s economy. It does not have much impact on world oil prices.

This is untrue. Iran holds 2 mbpd of spare capacity. The release of this capacity could reduce oil prices by, say, $10 / barrel and would quite possibly bar the road to $100 oil as a result of its strategic ramifications.

Analysts often talk about the impact of incremental supply as though the effect were always constant. The price impact of adding or subtracting incremental supply can be highly dependent on the particular circumstances. I would also add that the press often talks about OPEC as having power or not having power, as though this were some permanent state one way or the other. OPECs power is also highly situational. Sometimes it has leverage, sometimes it doesn’t. It depends on the circumstances. Right now, OPEC has leverage.

Steven,

Yes, I shall go along with that. Only caveat is that the impact of the sanctions on the Iranian economy is far greater than on the world economy, but indeed iran does have spare capacity not being utilized due to the sanctions, enough that could impact world oil prices.

Heck OPEC’s problem in the 1980s was that Iran and Iraq were the next largest producers after KSA and were both cheating on their quotas to buy arms to fight their war with each other. Saudis propped the price up for several years by cutting back and cutting back, but by 1986 they had enough and were facing internal budget pressures, so King Fahd expanded production, which crashed the price sharply, with it basically staying down after that all the way through the 1990s.

“The release of this capacity could reduce oil prices by, say, $10 / barrel and would quite possibly bar the road to $100 oil as a result of its strategic ramifications.”

I guess you are too dense but you are now making Barkley’s basic point as to the implausibility of your $100 a barrel forecast.