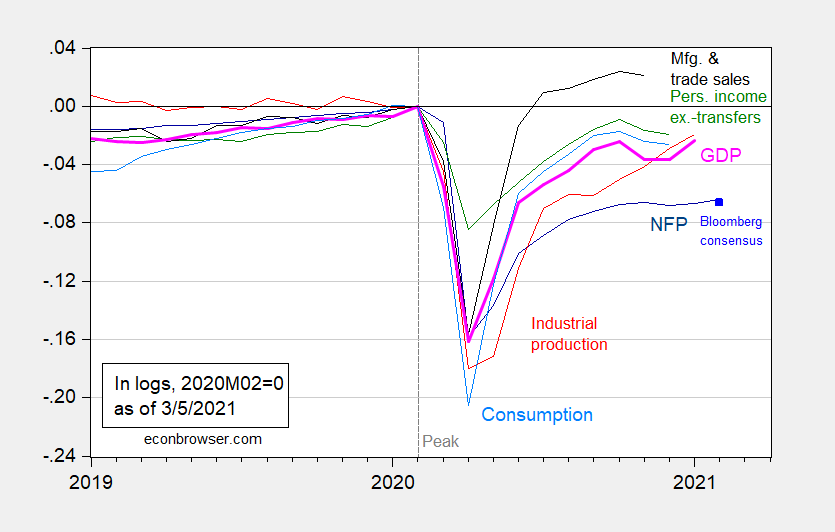

The Bloomberg consensus is for an increase of 674 thousand jobs in March (GS says 775K). That’s heady news, offsetting the somewhat less upbeat news from the estimate of February monthly GDP released by IHS Markit today – a decrease of 0.9% after upward revision in January’s figure by 0.3% (not annualized). Even if expectations are met, employment will still be 5.8% below that recorded at the NBER peak in February 2020. In the context of key macro indicators followed by the NBER Business Cycle Dating Committee:

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus as of 4/1 for March nonfarm payroll employment (light blue square), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (3/1/2021 release), NBER, and author’s calculations.

Atlanta Fed GDPNow (4/1) is for 6% in Q1; NY Fed (3/26) is at 6.1%. IHS Markit nowcast as of today is 5.2% (all figures SAAR).

Bloomberg consensus “heady news”? Well, if the median estimate proves correct, yes. We ain’t there for another few hours.

GDP looks about like what my non-technical cloudy plastic ball said. I expect more jaggedness over the next few months as a fourth wave of COVID fights with vaccine progress. If Biden’s infrastructure bill somehow gets through the Senate, it will still be at least a quarter before it has an effect. Then the effect will steadily increase for a year or two. The cloudy plastic ball is optimistic for a change.

Before everyone goes bananas about the good job report for March 2021, the employment to population ratio for the 25-54 may have increased from 76.5% to 76.8%, it was 80.5% in January 2020. Still a long ways to go.

BTW Mitch McConnell was whining just yesterday that raising the corporate tax rate from 21% to 28% to pay for the infrastructure proposal, it would cripple a fragile economy. Odd – he said the economy was roaring when he decided to vote against tax breaks for the little guy.

Trump toady and Florida Congressman (for now) Matt Gaetz is certainly pumping a lot of money into the prostitute industry:

https://talkingpointsmemo.com/news/gaetz-sent-money-to-women-using-cash-apps

Oh wait – he says he is not spending his own money. That’s right – he is using taxpayer funds to pay for these orgies.

Gaetz is also supposed to be engaged. Someone should have rented Guide for the Married Man (1963) for this idiot. Cash apps? Can you say “follow the money” (even though Nixon was sort of devoid of any sexuality whatsoever).

The latest employment numbers probably mean that Pres. Biden’s infrastructure proposal is DOA in Congress. Maybe he gets some money for roads, bridges and the grid based on earmarks, but the big initiatives won’t happen. GOP will oppose everything unless corporations put pressure on them. The good news on jobs is bad news for the economy.

Why DOA? As Biden noted, the last bill was temporary relief. This spending is to cover the next 10 years. Now McConnell was telling us just yesterday that the recovery was so fragile that asking for any increase in taxes paid by the rich would derail the economy. And now the message is that the economy is too strong? Flip flops so artistic that he should start a pancake pantry.

it’s gonna have a hard time with the far green left once they see how big a carbon footprint it really has…

Wasn’t Mayor Pete supposed to come up with Build Back Better in a way that would make even the far left happy? Please be specific as where he failed.

roads and bridges to start with. that means asphalt and concrete. US oil from shale is as thin as gasoline, so to get your asphalt you have to go to someplace where the have it in quantity, like the Venezuelan or the Canadian tar sands…for concrete, you can’t make it without cement, and to get cement you have to incinerate limestone at high temperatures, which takes a lot of fossil fuel energy…then there’s the issue with cement production itself…burning limestone produces lime and carbon dioxide.. ie, CaCO3 > CaO + CO2

so just the roads and bridges part of the plan has an enormous carbon footprint…from there, just go down the list of what else they’re proposing, and imagine how much asphalt, concrete, steel, copper, aluminum , and other materials will be needed…i can’t think of anything one can do in building or rebuilding infrastructure that doesn’t have a big carbon footprint, starting with wherever the material is mined with heavy equipment….that probably makes this proposal one of the most environmentally damaging in US history in the short term, even if enough renewable energy infrastructure is included to reduce emissions in the long term…

True. However , the majority of spending under Biden’s infrastructure plan is not traditional infrastructure – certainly not a majority going to asphalt and concrete. Gathering up votes means spending on roads and bridges as well as broadband. Progressives are learning to give and take. Better than Republicans, anyhow.