Surveys indicate some acceleration, vis a vis last month.

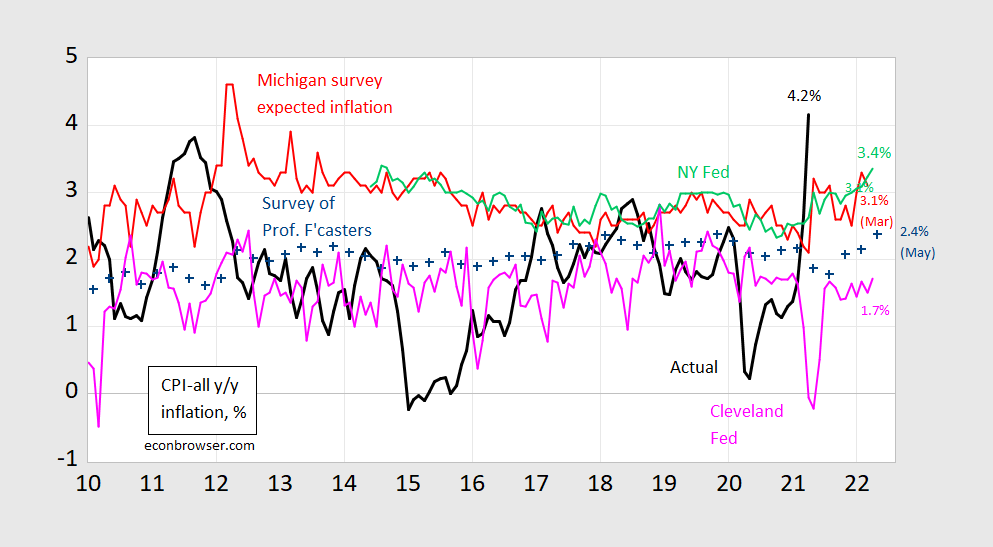

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink). Source: BLS, University of Michigan via FRED, Philadelphia Fed Survey of Professional Forecasters, Philadelphia Fed, NY Fed, and Cleveland Fed.

While economists’ and household views of CPI inflation over the next year have risen, the economists’ median estimate remains lower, at 2.37% in May, up from 2.15% in February.

Why might short term expected inflation (i.e., in one year) be higher than before? One can decompose things into constituent parts from the Phillips curve:

Where f is the slope of the Phillips curve, z is the cost-push component, a function of the growth rate of input prices.

Differences in the anticipated inflation rate can be attributed to differences in each part:

Hence, faster actual inflation over the next year could be because: (1) long term expected inflation could be higher, (2) the slope of the Phillips curve is steeper than thought, (3) The output gap is expected to be bigger than previously anticipated, or (4) cost-push shocks, z (oil, input prices rising) are larger.

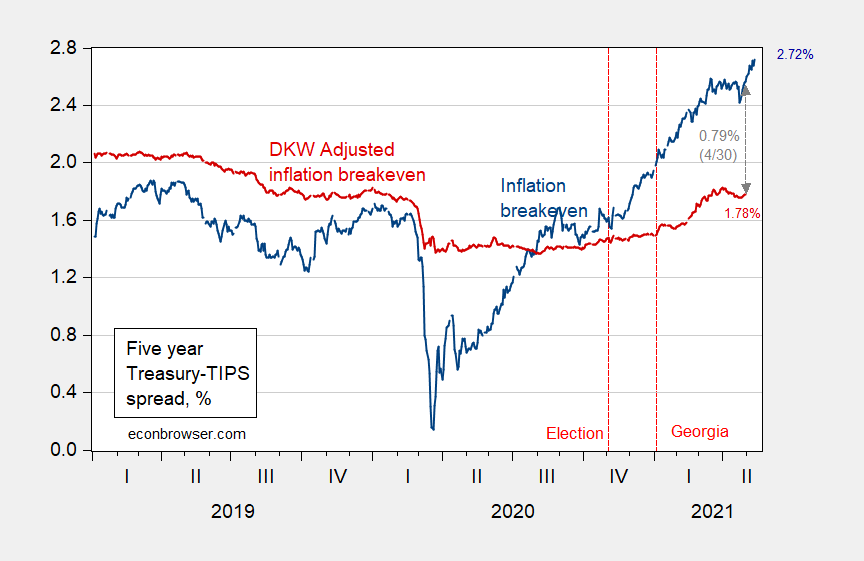

For longer term expectations, one can refer to market based measures – here at the five year horizon.

Figure 2: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by term premium and liquidity premium per DKW, all in %. Source: FRB via FRED, KWW following D’amico, Kim and Wei (DKW) accessed 5/5, and author’s calculations. [updated 5/19 11:50am Pacific]

While there has been an increase in long term expected inflation as indicated by a simple break-even calculation — about 1 percentage point from the election to end-April; the adjusted series shows a much smaller increase — a 40 bps increase.

From mid-February to end-April, the increase as been 20 bps. Similarly, the Survey of Professional Forecasters has raised the 2021-25 headline CPI inflation rate by 20 bps, from 2.20% to 2.40%, going from February to May.

Hence, in principle, the acceleration could be accounted for by a higher expected long term inflation rate, without appeal to fears of overheating, belief in steeper Phillips curve, or more cost-push shocks.

Everyone regular on the blog is familiar with me being Mr. Amateur/Wannabe economist. I think I got “most” of this, although that equation I want to digest more, but I think I get the gist. Here is my take after getting about 75%–80 of the above post (the broad outlines). Obviously I believe in a higher expected long term inflation rate (not in general, but compared to where we were pre-vaccine). In other words it’s very easy to believe in a pretty quick reflation rate (In my subjective opinion a more accurate terminology than “inflation”). I also believe, to a tiny tiny tiny tiny degree in “cost-push shocks”. In the current context I do NOT buy into the Philips curve having any impact, and I do not believe in “overheating” (again in the current context).

I’ve always, for an extended time frame, believed the output gap is quite large, and I’m happy to be corrected if anyone can find comments of mine that said otherwise (I don’t think you’ll find them, anyone is welcome to do a web search)

“I’ve always, for an extended time frame, believed the output gap is quite large”. As you know our host often provides us a comparison of real GDP to the CBO estimate of potential real GDP and I see why but there is something amiss here. I went back and looked at these series for two key periods.

During Clinton’s entire first term, real GDP exceeded this measure of potential. But I do not recall accelerating inflation back then. Do you?

We clearly had excess aggregate demand starting in early 1966. But by the CBO measure, the excess demand was massive. Now as far as those liberal economists advising LBJ, they told him that some sort of demand restraint was needed. We could have raised taxes but there was character named Norman Ture – the godfather of supply side economics – who dismissed this idea. Now the FED did raise interest rates in 1966 which would have been the right thing to do but the clueless politicians all went crazy and that FED chickened out.

“During Clinton’s entire first term”

Edit needed – I was looking at his 2nd term.

2.2%. 2.4%. I say tomato, you say tomatoe. Of course Trumpians are all screaming HYPERINFLATION!

pgl,

Irregardless it is “I say tomatoe and you say tomahto,” all that screaming about inflammable hyperinflation, :-).

Are you trying to enflame me or inflame me??

Wait, I’m doing what a narcissist does and assuming every conversation relates to himself. How did this happen??

Ah come on man. His comment was funny.

Apparently world renowned economist Bruce Hall believes we’re staring at inflation greater than 5 percent: https://econbrowser.com/archives/2021/05/cpi-inflation-rates-month-on-month#comment-253094. Like CoRev, Bruce Hall still thinks it’s 1979 and Bill Miller is Fed chairman.

See the latest post which is a “tribute” to CoRev’s economic insanity.

“I would guess that the winners in a >5% inflation scenarios would be those in the higher income brackets while the losers would be in the lower income brackets who tend to have fewer assets and relatively fixed incomes.”

WTF? Bruce Hall and JohnH did a Vulcan Mind Meld or what? Could someone tell our village idiot that Social Security benefits are indexed?

BTW those who have a lot of long-term government bonds might just seen their values decline if inflation takes off. Yea I get these simple realizations are too much for Bruce “no relationship to Robert” Hall.

i like to get the inflationistas to put a number on it, rather than bloviate about the horrors of high inflation as a generalization. once they start to put a specific number and time frame in their argument, you begin to see just how absurd there arguments actually are. bruce hall wants to enact inflation fighting against a hypothetical 5% inflation when we are at half that value in a temporary spike. it is just insanity. even IF we were to achieve 5% inflation, it would only be temporary and thus not really detrimental to the real economy. 5% inflation cannot be sustained until we see corresponding wage growth. once that happens consistently, then we can consider action.

https://fred.stlouisfed.org/graph/?g=E4pc

January 15, 2018

Monetary Base, M2 Money Stock and Consumer Price Index, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=E4pk

January 15, 2018

Monetary Base, M2 Money Stock and Consumer Price Index, 2000-2021

(Indexed to 2000)

https://www.globaltimes.cn/page/202105/1223616.shtml

May 16, 2021

Steel prices fall in China after govt efforts to curb months-long surge

Drop pressures some firms, but helps market stability: analysts

Steel prices in China have been pulling back significantly following months of soaring levels, a trend that is even creating pressure on certain companies, especially small and medium-sized players in the sector, industry representatives said.

The price drops came after Chinese authorities launched a new round of measures to curb soaring prices in a bid to ease the cost pressures on downstream industries like electronics producers. The measures, while affecting certain firms in the short term, will ensure long-term stability for the steel sector and related industries, analysts said.

The steel industry experienced a roller-coaster weekend with declines in certain segments. For example, rebar price fell 20-120 yuan ($3.1-18.6) per ton in several major domestic cities, after reaching a new high ignited by a global demand rebound and rising inflation posed by US monetary easing.

The sharp drops were the first in months as the government sought to discourage speculation, sending a strong message of how China was doing its part in stabilizing the market. Several Chinese steel industry insiders said that they expected more price declines….

As with energy and food prices, Chinese policy has increasingly meant focusing on specific sectors in moderating price increases. General monetary policy is left alone, while a sector such as steel or soybeans is the focus. This policy has dampened general price movements significantly:

https://fred.stlouisfed.org/graph/?g=viCv

January 30, 2018

Consumer Prices for China and India, 2017-2021

(Percent change)

it is interesting this post is meant to demonstrate chinese success with the economy. and yet the majority of folks in china will move their money out of the country if given the chance, because they do not trust the government with respect to their savings. i guess you could say that china uses capital controls as a form of monetary policy, and it is by no means focused on a specific sector.

There we have it, folks. If only Biden would ask the PRC to annex the US and turn over control over our economic policy and everything else to Xi Jinping, steel prices would go down.

Nixon did price controls. And he was a conservative? Biden has not and yet he is the socialist?

https://fred.stlouisfed.org/graph/?g=BqLg

August 4, 2014

Real per capita Gross Domestic Product for China and United States, 1977-2019

(Percent change)

https://fred.stlouisfed.org/graph/?g=BqLm

August 4, 2014

Real per capita Gross Domestic Product for China and United States, 1977-2019

(Indexed to 1977)

[ A prominent, influential University of California economist wrote precisely 5 years ago that Xi Jinping would lose China from a decade to half a century. I prefer to describe just how remarkably successful China has been economically these last 44 years, thinking that understanding the success could be ever so valuable to other developing countries. ]

how many millions died during the economic programs instituted by the chinese communist party over the past 50 years? there has been a significant cost to the “remarkably successful” policies of china. there were famines and social unrest that should not have occurred with a “remarkably successful” policy. should these other developing countries also go through a great leap forward and cultural revolution? following in the footsteps of mao will only recreate the destruction he did to his own country.

https://fred.stlouisfed.org/graph/?g=AkXA

August 4, 2014

Real per capita Gross Domestic Product for China, India, Brazil, Turkey and South Africa, 1977-2019

(Percent change)

https://fred.stlouisfed.org/graph/?g=AkXG

August 4, 2014

Real per capita Gross Domestic Product for China, India, Brazil, Turkey and South Africa, 1977-2019

(Indexed to 1977)

The pipeline shutdown may induce higher publc expectation of inflation, as gasoline price fluctuations account for a lot of the short-term fluctuation in public (U Much) inflation expectation.

Chip shortage is still with us, cutting into auto output (small dent in GDP growth) and boosting auto prices (substantial contribution to a small acceleration in inflation).

A persistent shortage of qualified truck drivers is leading to a rise in transport costs: https://www.dat.com/industry-trends/trendlines.

This is a curiosity, as wage restraint is part of the reason for the shortage of drivers. (It’s a hard life which often pays poorly over the long run, even if some drivers do well some of the time.) Curious because this means an effort to restrain costs of one input leads to a supply constraint which drives up prices. Freight companies might prefer to increase capacity, but high freight rates mean high margins on lower volumes, so there is limited incentive to raise wages. It’s a funny old world.

I can’t help myself – Look at that load-to-truck ratio! Can we please put some more drivers on the road? That’s some serious bottleneck stuff right there.

I don’t disagree with anything you say, in fact pretty vehemently agree. I have lots of opinions on this topic, but it’s better not to get me going. I would limit my thoughts to next time you see a truckdriver at a truckstop or a public rest area and he looks disheveled, and he hasn’t taken a shower in the last 72 hours, just tell him you appreciate the type of work he does and his economic contributions. Even if he replies with a curt grumble like a tactless clod, I promise you it meant a lot to him. Someday he/she might help you when you got caught in a bad flood:

https://gfycat.com/wellmadedisgustingfirefly-califonia-wholesome-help

“Freight companies might prefer to increase capacity, but high freight rates mean high margins on lower volumes, so there is limited incentive to raise wages.”

somehow this has been ingrained into the imagination of many managers around the country. the bean counters have been quite effective in getting people to focus on efficiency at the expense of growth. i guess growth is a riskier proposition than improved efficiency, at least in the short run. but these are self inflicted wounds. i get tired of hearing from business owners who complain about the lack of workers, but when asked if they have increased pay to attract more workers (or retain existing workers) you get a blank stare into space.

Back in the late 1990’s there was a huge demand for people who got internet/telecom/computer designing. But the hi tech companies did not want to lock in the expectation of high wages. So they paid the R&D kids with employee stock options. I wonder if truckers would accept payment in this form.

A large portion of them are privately held. CRST is privately held and so is Schneider. Nearly all of them are infamous for being very crappy to drivers. The one exception might be JB Hunt, which when I drove was nearly considered a dream job (if your only goal was staying in the industry). That may have changed, but the best jobs were basically JB Hunt, and any company that was still predominantly union. The truckers’ unions were broke around the same time Reagan killed off the air-traffic controllers union. I mean there’s always exceptions yes?? I’m sure you could name a few small outfits that are/were good to their drivers. But speaking realistically you had 3 choices when I drove (I’d be shocked if it’s changed significantly since I drove).

A) Work for JB Hunt

B) Get yourself a Union job.

C) Get treated like a sack of shit.

Those were basically your options, with a very few oddball exceptions. I think what most drivers wanted (when I drove certainly I thought it was important) was a high matching number for your 401K. Most finance people will tell you, it’s dumb to invest in the same field that you work in, because when there’s a downturn in your field, you get the “double-whammy” with your equity holdings. Had I stayed in driving the semi, I would have tried to get where I could choose my own funds outside the plan. It’s been too many years now, but it may have been limited to the investment funds “in the plan”. That’s another way they put the screws to people at that time, is they would get kick backs from the insurance companies for only giving workers choices offered by the insurance company or investment company they made their arrangements with. I don’t know how common that little trick is now, certainly wouldn’t be surprised if that’s still prevalent in trucking and many fields of work that offer “a plan”. But probably easier to transfer it out now to make your own choices on the funds you go in.

One thing that to me is kinda funny, and I wonder how many people notice this or might be tempted to agree. If you’re judging right inside this one moment, only from the recent numbers, the Cleveland Fed number is way off, but if you look at it over the long haul, I would still take that Cleveland Fed number on inflation forecasts over any of the numbers presented in that top graph to predict the “actual” number. Now, I’m not saying that’s better than the KWW or the DKW stuff, but I would say if you’re looking for the lazy man’s route, the Cleveland Fed number is pretty damned good.

https://fred.stlouisfed.org/graph/?g=vjHg

January 15, 2018

Producer Price Index for Transportation and Warehousing, 2007-2021

(Indexed to 2007)