From FT today, “Economists predict at least two US interest rate rises by end of 2023”:

Elevated inflation will compel the Federal Reserve to raise US interest rates at least twice by the end of 2023, according to a new poll of leading academic economists for the Financial Times. The inaugural survey conducted by the FT and the Initiative on Global Markets at the University of Chicago’s Booth School of Business points to a potentially more hawkish path for monetary policy than indicated by the Fed’s chair, Jay Powell.

…

The FT-IGM US Macroeconomists Survey polled 52 academic economists on the likelihood that the Fed’s main policy rate would indeed be higher by 0.50 percentage points by the end of 2023, as the dot plot indicated. A majority said the likelihood of a move of that size or greater was above 75 per cent, and a large minority put it as high as 90 per cent.

The ungated survey can be found here. Some points that were of particular interest to me:

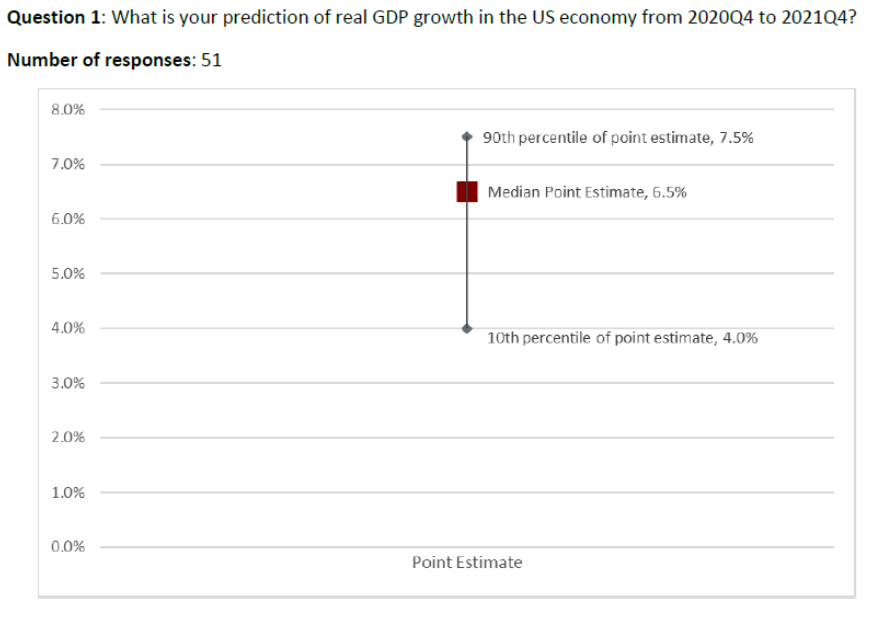

- GDP q4/q4 growth in 2021

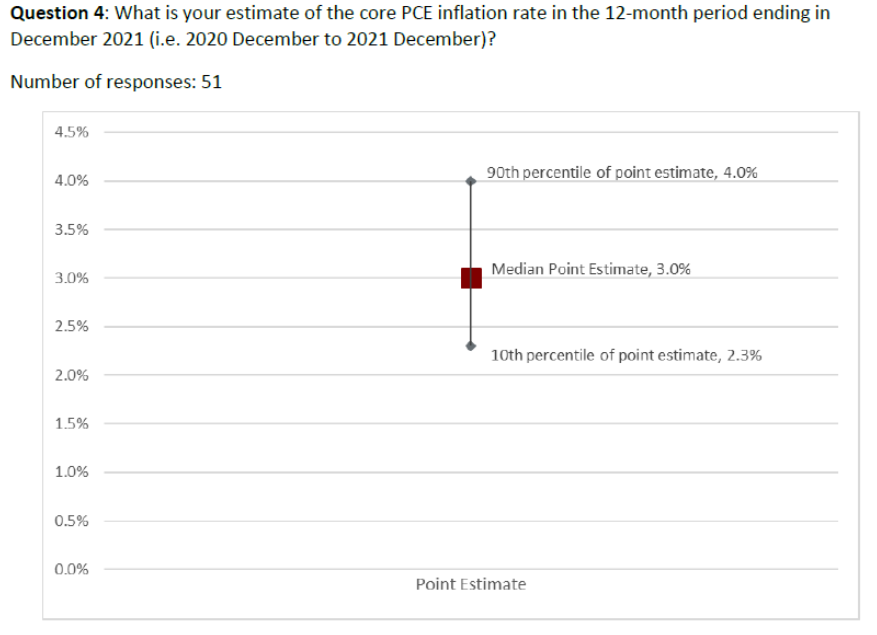

- PCE 12 month inflation in 2021

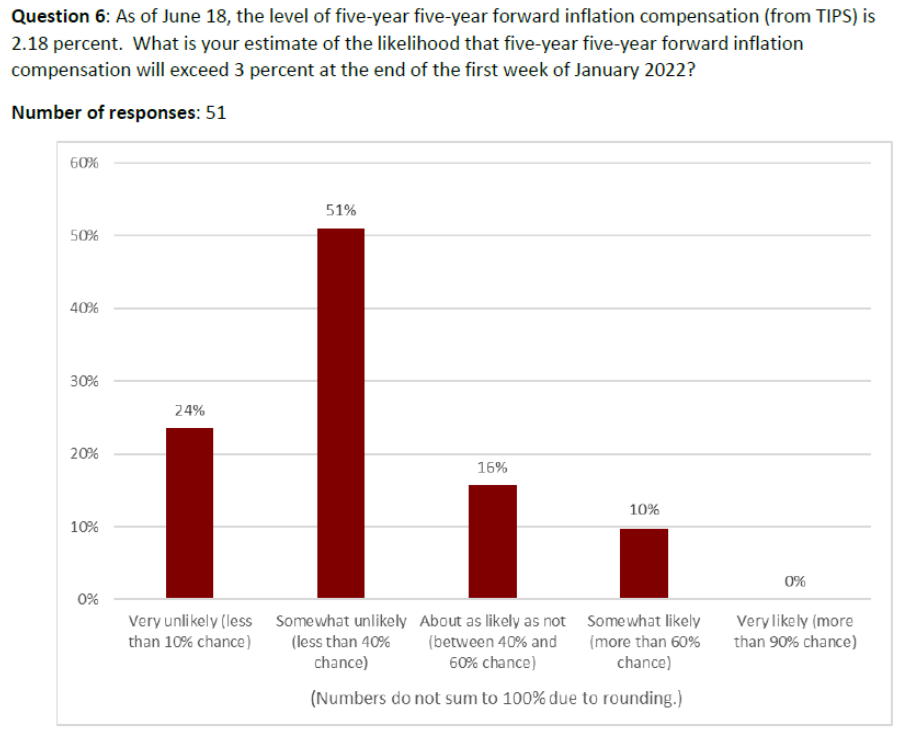

- Long term inflation expectations

These are addressed in the following graphs from the survey results.

Source: FT-IGM survey, June 2021.

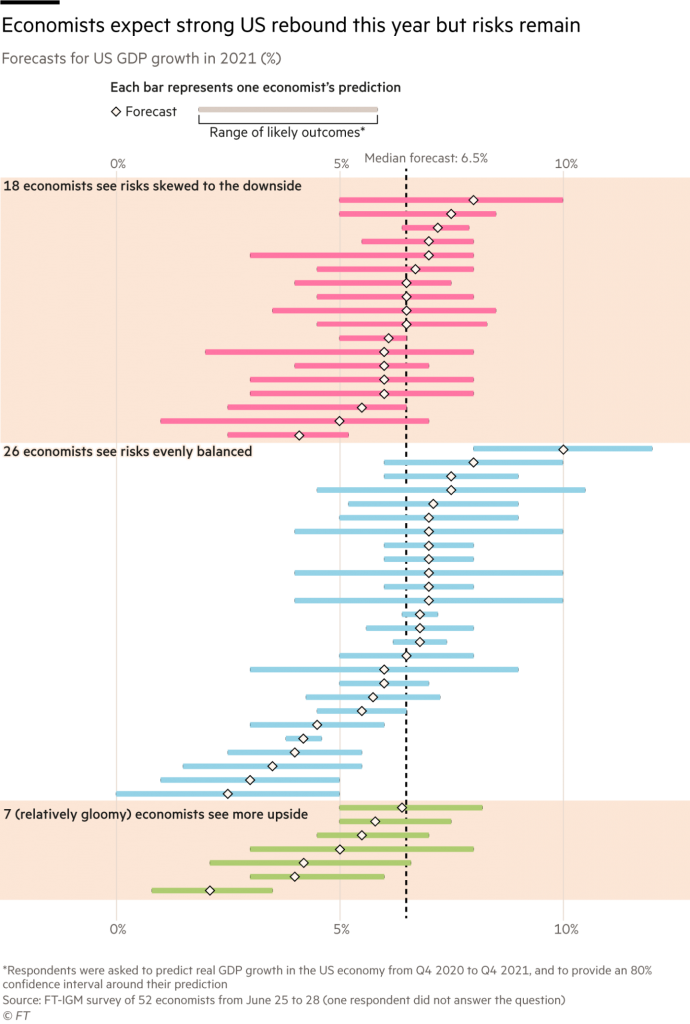

Greater detail on what the individual survey respondents thought about growth, and upside/downside risks, is shown in this graph from the FT article.

Source: FT, June 30, 2021.

My forecast is pretty close to median, and though my forecast is skewed to the downside, I’m not anywhere as pessimistic (at the 90% bound) as some respondents. It’s interesting that there is such a wide dispersion for some respondents – we know GDP growth was about 1.5% in Q1 (all growth rates not annualized), nowcasts are for about 2% in Q2, so we have about half of the Q4/Q4 growth already pretty much known. So some forecasters must be thinking about big possible negatives (like delta variant, rest-of-world developments).

Source: FT-IGM survey, June 2021.

Median estimate for core PCE inflation is 3%, a bit below my estimate at 3.3%.

Source: FT-IGM survey, June 2021.

Thinking about the possibility of a sustained increase in inflation, a critical factor is long term expected inflation (see the framework explained in graphical terms). Here, respondents seem to think inflation expectations are well anchored.

Update, 1pm Pacific:

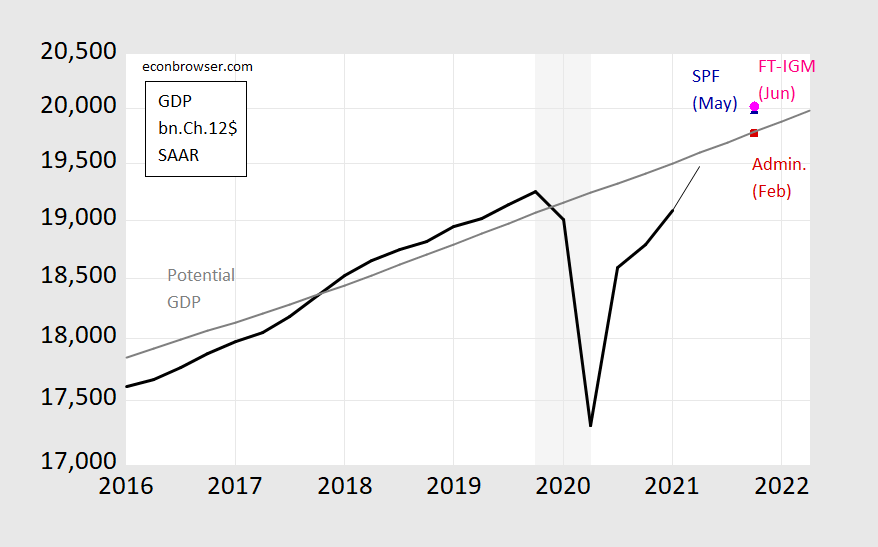

Here’s implied GDP levels using SPF, FT-IGM, Admin/Troika forecasts for growth.

Figure 1: GDP as reported (black), Atlanta Fed nowcast (thin black line to 2021Q2), Administration (red square), Survey of Professional Forecasters (blue triangle), FT-IGM (pink circle), and potential GDP as estimated by CBO (gray line). NBER recession dates assuming trough at 2020Q2. Source: BEA, Atlanta Fed as of 6/25, OMB FY’22 Budget, Philadelphia Fed SPF (May), and FT-IGM survey (June), CBO Economic Outlook (February), and author’s calculations.

The implied year-end output gap is about 1% using either the SPF or FT-IGM survey.

“Question 8: What is your estimate of the likelihood that the US Federal Reserve will raise the Federal funds rate by 50 basis points or more above its current level by the end of 2023”

Even if this is raised by 100 basis points, this is not a lot of monetary tightening. The doomsayers that the sky is falling (e.g. Princeton Steve and his phony housing bubble nonsense) is not getting a lot of love from this crew.

Try to remember, “Princeton”Kopits specialty is Spanish people’s death certificates. If he finds a corpse in Puerto Rico and there’s no paperwork, it counts as one extra trump voter in Maricopa County. Then the cadaver remnants are processed into an orange tanning lotion for MAGA Cosmetics LLC.

“It is dangerous always to associate the easing or the tightening of monetary policy with a fall or a rise in short-term nominal interest rates.”

“…nominal interest rates are not good indicators of the stance of policy, as a high nominal interest rate can indicate either monetary tightness or ease, depending on the state of inflation expectations. Indeed, confusing low nominal interest rates with monetary ease was the source of major problems in the 1930s, and it has perhaps been a problem in Japan in recent years as well.”

EConned: A *change* in nominal interest rates, given current levels of inflation, are however good indicators.

Menzie…

I’ll add another quote from the same source on the same day:

“ Ultimately, it appears, one can check to see if an economy has a stable monetary background only by looking at macroeconomic indicators such as nominal GDP growth and inflation.”

So two questions for you,

1) do you not consider the “only” from the above to mean “only”?

2) do you not consider the quote from my first comment “It is dangerous always to associate the easing or the tightening of monetary policy with a fall or a rise in short-term nominal interest rates.” to reference “a *change* in nominal interest rates”?

Econned: After reserach, I find the first quote you gave was from Mishkin’s textbook; this second quote is from James A. Dorn. In re: two questions, (1) yes, but I think he’s wrong. (2) the quote from Mishkin is right – but we live in 2021, and inflation is low enough that going from one day to the next, a 50 bps drop is a real drop.

Menzie:

1) I’m pretty sure the 2nd quote was from Bernanke and not Dorn.

2) no one is saying it wouldn’t be “a real drop” – whatever that means. But rather it nominal interest rates aren’t a reliable tool in assessing the stance of monetary policy.

3) are you seriously going the “this time is different route” and *implicitly* assert that, prior to the publication of Mishkin’s best selling textbook, inflation was never “low enough that going from one day to the next, a 50 bps drop is a real drop”? You cannot be serious.

EConned: My mistake, it is Bernanke as quoted by Dorn; It is Bernanke (2003) discussing Friedman’s framework — pre-Global Financial Crisis.

By “real” I mean “inflation-adjusted”.

I don’t understand your point (3). He warned about applying the criterion each and every time. What I’m saying is that *in this instance*, one can equate a nominal increase of 50 bps with an inflation-adjusted increase.

Menzie,

Remember that your initial reply suggesting “A *change* in nominal interest rates, given current levels of inflation, are however good indicators” was an attempted refutation of my quoting Bernanke and Mishkin.

At least you’re on record In asserting your view that some of the world’s *eminent* researchers of monetary policy are “wrong” in suggesting the stance of policy should not be based on nominal rates – you are explicit about Bernanke being “wrong” and strongly suggestive that Mishkin is as well. That’s what research and debate are all about!!!

EConned: (1) Mishkin wrote (having used the textbook in my money and banking courses) that it would be wrong to *always* equate the level of interest rate with the stance of policy. However, the *change* in nominal policy rate in a context of low inflation would be a situation where one could equate tightening with policy rate increase. (2) I think Bernanke would extend and revise his assertions about stable monetary policy detection in the wake of the Global Financial Crisis. After all, after 18 years, some views are likely to have been modified after a sufficiently large previously unforeseen event.

Menzie,

Here’s a post-financial crisis quote from yet another *eminent* scholar of monetary policy for you (and, of course, pgl) to dispute…

“But the nominal policy rate is not a good measure of the stance of monetary policy.”

For full disclosure, and to address Menzie’s shiftiness in attempting to backpedal and change the discussion, this same expert does follow up the above with the following: “ The real policy rate, the policy rate minus actual inflation, is a better measure.” But, as anyone can plainly see from this discussion, the real fed funds rate was never the subject at hand until our host shifted the goalposts.

EConned: “shiftiness”?

I think it was shifty for you to attempt to change the subject mid conversation. The conversation was clearly about the nominal fed funds rate and not the real red funds rate (not to mention the IGM survey is about assessing likelihood that “the US Federal Reserve will raise the Federal funds rate by 50 basis points or more above its current level by the end of 2023?” – so you must be asserting that the FOMC raises the real fed funds rate). Also, your first comment was on “nominal rates” and initial reference to ‘real’ was that “inflation is low enough that going from one day to the next, a 50 bps drop is a real drop” and you suggest later that “ By “real” I mean “inflation-adjusted”.” So is your suggestion that a 50 bps drop in nominal rates is a drop in real rates because inflation is low??? Okay…

And how will you decided the most recent, post-great recession, quote from an *eminent* scholar of monetary policy is wrong? Let us know – we can’t wait to hear!!!

“no one is saying it wouldn’t be “a real drop” – whatever that means.”

One of econned replies to our host. Of course most of us here know real means inflation adjusted. Most of us here also know that FRED provides time series on things like TIPS and expected inflation.

I have no idea whether econned is really this incredibly stupid or he is just being an internet troll. But his latest line of quoting without attribution followed by some dumb aha is really a total waste of time – even for him.

Of course he will probably retort saying I’m wrong without explaining what I’m allegedly wrong about. Yes – he is that incompetent.

Not quite. The reason I say “whatever that means” is because Menzie’s initial replay was about nominal rates. As such, it didn’t matter if Menzie meant inflation-adjusted or he meant impactful within the context of the conversation (a concept you struggle to grasp). Moreover, the 50bps was specifically about the fed funds rate which is nominal (I wonder if this was Menzie attempting to obfuscate but that’s pure speculation). And if we are really expected to accept such a change while keeping ceteris paribus, only you would be that incompetent. Again, have a good day & stop attributing the easing or the tightening of monetary policy with a fall or a rise in short-term nominal interest rates.

@ EConned

I thought I was supposed to be the grumpy/angry guy on this blog?? Dude, don’t be stepping on my brand identity.

“ I thought the fallacy of identifying tight money with high interest rates and easy money with low interest rates was dead. Apparently, old fallacies never die.”

On and on with the quotes without any proper attribution. This is your game? Sorry but it is childish, stupid, pathetic, and it also opens you up to being accused of cherry picking. Are you incapable of proper attribution or what?

It’s not “improper”. Improper would be misattributing the quotes or providing erroneous quotes.

And I do it precisely bevause I know that it ruffles your feathers. Good day & stop attributing the easing or the tightening of monetary policy with a fall or a rise in short-term nominal interest rates.

EConned: Well, I’ll say it’s for sure confusing trying to figure out who you’re quoting either approvingly or disapprovingly…

I did not use the term “improper”. I guess your reading skills are even worse than your research skills.

Menzie – well, I’ll say that’s irrelevant…

pgl – if you feel what I’m doing isn’t proper, doesn’t that mean it’s improper? Please put away your clown nose… Good day & stop attributing the easing or the tightening of monetary policy with a fall or a rise in short-term nominal interest rates.

It’s interesting IGM changed platforms off of 538. It seemed like a good marriage, but apparently not getting the attention they wanted. Hooking up with FT should help there. I myself enjoy reading the survey, especially when I can connect specific economist names with specific forecasts. Though of course I know the whole point is to get an amalgamated type number.

I still read it, but I’ve lost a lot of respect for Nate Silver and 538 over the last roughly 5 years. They have gotten so wishy-washy on forecasts, screaming out endless conditional factors to their political forecasts. We “get it”—predicting the future is hard because there’s TONS of variables. But how can I respect it when you ever get it right, when all you (Nate Silver) EVER want to do is hand me excuses for why you might get it wrong?? Yet not addressing the real problem—they are crappy at surveying rural voters. Quit telling me you can’t make a good forecast, but won’t make the extra effort to survey folks you know you are leaving out. Silver has known this for at minimum 5 years, yet still sticks his thumb up his……

Well, this finally and conclusively proves it beyond all doubt. The Chinese are right. 8 really is a lucky number. Roll me an eight baby!!!!!!! Roll Uncle Moses an eight!!!!

https://www.nytimes.com/2021/06/30/us/politics/donald-rumsfeld-dead.html

[ In my best Rick Flair high pitched voice ] Wooooooohhh!!! Drinks on the house baby!!!!

Does anyone know how many points Trae Young had in the Atlanta Hawks 22 point win over the Bucks?? I can’t seem to find it online……… pgl tells me Trae is a superstar player, so I know the Atlanta Hawks couldn’t have won the game by 22 points without Trae “Flop Fella” Young. Nobody shoots free throws like my man Trae the Flopman.

dnp

Well, I’ll be damned……. The Atlanta Hawks beat Milwaukee by 22 points and Trae “Flop Fella” Young didn’t even enter the game to play?? Weird….. He’s like, an all-star, and stuff……. Well, not really because the NBA doesn’t want Floppers in their all-star game…… but still pgl says he’s the 2nd greatest point guard next to Russell Westbrook, so that has to mean something.

Hmmmmmmm….. that’s so weird.

Of course I never said anything you have been attributing to me here. But of course your pointless little lies will continue since you have never understood the game of basketball in the first place. Is there a point to this pathetic stupidity of yours? Yea we get you hate certain players and we get you could care less about playoff basketball but damn – try enjoying the play before you get drunk and angry all over again.

“Of course I never said anything you have been attributing to me here”

I’m so glad that the supreme hypocrite of this blog noticed that, because you do it all the time to everyone else on this blog, regular. How does that medicine taste?? I suggest everyone on this blog give you your same prescribed medicine, until you learn that is what 12 year olds do.

Thanks but maybe you need to spell this out (did not play) because Uncle Moses is even dumber than even Donald Trump when it comes to sports. And me thinks he hates black players even more than Trump does. Sort of like – just shut up and dribble I guess.

Are you that drunk and stupid? He was injured. And as usual the worst basketball analysis ever is a continuing source of sheer laughter so much my side hurts.

@ pgl

Oh!!!! I get it!!!! Because Trea Flopman was injured his team won by 22 points while he wasn’t playing. NOW I understand why the Atlanta Hawks had a large margin win with Trae the Flopper not even playing. I thought it might have been just because Trae “Flop Fella” Young didn’t play at all in Game 4 that Atlanta won by 22 points. You say it was the injury that produced the large point margin win for Atlanta. I didn’t know injuries helped to produce large positive point margins for the team with the injured player. Everything becomes clearer and the haze of basketball departs when you, and your hero, ESPN’s Stephen “Women Provoke Violence Against Themselves” Smith explain it for me. Learning so much from you about basketball pgl. It’s almost like attending a Stephen “Women Provoke Violence Against Themselves” Smith hosted symposium on women’s gender studies. The endless knowledge you drop is precious.

You have some serious emotional problems. It is a shame as most of us are enjoying these playoffs while you just go on and on with your weird hate for certain members of the NBA. Please seek professional help.

@ pgl

Yes, because people who are “well adjusted” emotionally spend 3/4 of their days on a blog excoriating anyone with differing views. Nothing about you there speaks of someone who is emotionally unbalanced. It is interesting that one of your top 3 regular accusations others on this blog is that they are crazy. Did you meet your monthly quota for yelling out “racist!!!!” and you grabbed for the next word in your Daffy Duck lexicon?? What descriptor/word would you guess off-hand is what mental hospital patients call their doctors and family members who have them institutionalized??? Any adjectives popping to mind there??

Do I need to give you the first letter of the word since you’re so daft you were the last citizen of New York state to figure out Andrew Cuomo is a flaming POS ???

These two links explain who commenter pgl thinks you should listen to for basketball “analysis”:

https://www.theatlantic.com/culture/archive/2014/07/stephen-a-smith-is-sorry-you-thought-he-said-women-provoke-domestic-abuse/375093/

https://www.washingtonpost.com/news/early-lead/wp/2016/06/17/stephen-a-smith-mansplains-how-to-be-a-good-nba-wife-to-ayesha-curry/

pgl going full fanboy on his ESPN hero for “basketball analysis”: “But could you please appear on First Take and repeat your stupid rants as I would love to see Steve A. Smith dress you down as only he can.”

https://econbrowser.com/archives/2021/06/everything-is-relative#comment-254230

Yes, “only” pgl’s hero Stephen ‘Women Provoke Violence Against Themselves” Smith can dress me down. Only pgl’s basketball guru Stephen “Keep The Wifey’s Mouth Shut” Smith can “dress people down” the way pgl likes it to be done.

You really do have emotional issues. Seek help before the men in the white coats take you away.

Clyburn stealing all his worst ideas from Nancy Pelosi now.

https://sports.yahoo.com/clyburn-backs-opponent-bernie-sanders-132530435.html

I know this will offend some people, and I’m sorry/not sorry, but you’re looking at exhibit A on why Blacks often get nowhere in the political process. They see someone who represents their own views, who is a true advocate, intelligent, articulate. and is leading in her political contest. Someone who knows what it takes to choke off police violence at the most sensitive striking zone—its funding. And what happens??~~wait for it…… wait for it….. wait for it….. wait for it…… one of the most powerful Black men in all of America can’t wait to cut Nina Turner off at the knees.

But when another twenty years goes by, and Blacks haven’t made the progress they aspired to…… the protégés and fans of Clyburn will still be scratching the side of their head going “Gosh, what happened??” Here’s what happened—you went and p*ssed on your best allies. Anyone who can articulate the problem and solve the problem—and take action, and they can’t wait to cut off their own nose because they might offend such-and-such. I’d say it’s the modern version of grinning on command and doing a tap-dance, but I guess the more contemporary comparison would be being a large northern California city DA or the AG of California and enthusiastically putting your own people in the local jailhouse—with a smile frozen on your face. Refusing to see new court case evidence that gets incarceration rates of Blacks going down—with a smile froze on your face. That way, you can make “progress” the “proper way”.

Did anyone else just hear that??? It sounded like a shoe dropping to the floor.:

https://www.reuters.com/world/us/trump-organization-cfo-expected-be-charged-thursday-wsj-2021-06-30/

“The charges by a Manhattan grand jury against the Trump Organization and its CFO Allen Weisselberg are expected to be unsealed on Thursday. Weisselberg is expected to surrender to authorities on Thursday morning, the person said, and will be formally charged in the New York Supreme Court in Manhattan on Thursday afternoon.”

2:15PM EDT

So they had a lot of ledgers and spreadsheets on how Allen Weisselberg was able to receive compensation in kind and declare none of it as taxable income. Tax cheats normally do not make their tax evasion so brazenly obvious. But of course the defense attorneys act like evading taxes on $1.7 million is petty cash.

What strikes me as extremely odd about this, the story, yes, made the front page of the NYT. But it is in the very lower right hand corner in relatively small print. I picked up the paper and for about 3 minutes thought I had picked up the wrong paper (yeah, OK, I’m slow sometimes). Am I the only person who think that’s completely psycho not to put that at the TOP of the front page?!?!?!?!!

http://www.xinhuanet.com/english/2021-07/01/c_1310038478.htm

July 1, 2021

Over 1.24 bln doses of COVID-19 vaccines administered in China

BEIJING — More than 1.24 billion doses of COVID-19 vaccines had been administered in China as of Wednesday, the National Health Commission said on Thursday.

[ Chinese vaccines are being administered at a rate of 20 millions doses daily domestically. More than 450 million doses of Chinese vaccines have been distributed internationally. ]

China is nearly as good at doing official death counts as “Princeton”Kopits.

If Chinese officials are passing out vaccine with only a 50% protection rate, this pretty much implicates that lockdowns are going to be necessary if Delta has entered into mainland China (I haven’t been reading much on it, I assume Delta has entered China and spreading fast). You’re either going to have to have lockdowns over a substantial portion of coastal China, and/or old people and those with bad immune systems will start dropping like flies. Now I am well aware mainland Chinese like to hide away old people in the dungeon portion of the apartment house and pretend they don’t exist, and this is normal operating procedure. But if the elderly interact with the grandkids, or are fed by their middle aged children who do all the shopping in public markets, you’re going to play hell protecting them from dying from the Delta variant.

I suspect we won’t know the large numbers of dead in China, due to both the original Covid-19 and the Delta variant, until YEARS after those virus caused deaths have tapered off. Think of how long it took for the west to piece together the “reeducation camps” for Uyghurs which now when looked at from satellite images, look like the human version of a gigantic ant colony. So figuring out all who have died from the Covid-19 and variants inside of China’s borders is going to be years into the future, if ever. Even well known officials and celebrities have a “magical way” of disappearing in China when they upset the bureaucrats in Beijing. How much easier to make the average person dying from Covid-19/Delta and their corpses disappear into thin air. This is in fact, “normal operating procedure” in China, sans virus.

https://twitter.com/R_Mc_Lean/status/1410588470540648450

R Mclean @R_Mc_Lean

‘The chancellor was downbeat on the prospects for a new regulatory deal with the EU, but insisted the City of London was well placed to serve a fast growing Chinese “financial services market with total assets worth £40tn”.’

https://www.ft.com/content/a571fcea-a4eb-484a-9227-cae47c5368ef

Sunak * insists UK must bolster China ties as access to EU markets declines

Chancellor says City is well placed to serve Beijing’s financial services as hopes of regulatory deal with Brussels fade

* Rishi Sunak, Chancellor of the Exchequer

9:17 AM · Jul 1, 2021

I just read that despite some cutbacks due to Brexit, the EU exports more to UK than it does to PRC.

Krugman’s economic geography might explain this.

Importantly enough, I have daily records of all coronavirus cases, symptomatic and asymptomatic, detected in China extending from January 2020 through July 1, 2021. I also have Chinese vaccination records.

I have often set down timely data on Econbrowser, since the data are critically important.

https://www.worldometers.info/coronavirus/

June 30, 2021

China

Cases ( 91,780)

Deaths ( 4,636)

https://www.worldometers.info/coronavirus/

July 1, 2021

China

Cases ( 91,792)

Deaths ( 4,636)

Deaths per million ( 3)

What is terribly important as well, is to point out that at the UN Human Rights Council meetings last week, the ambassadors of 90 countries wrote or spoke on behalf of and in praise of the human rights record of China. Every predominantly Muslim country in attendance supported the human rights record of China, with Egypt and Pakistan, representing about 330 million predominantly Muslim citizens, drawing special attention. Kazakhstan, bordering Xinjiang, is supportive of China, Indonesia, a country of more than 275 million, Malaysia, and on and on. * What is actually happening in Xinjiang is a marvel of development that promises to continue indefinitely.

* https://www.globaltimes.cn/page/202106/1226834.shtml

June 22, 2021

More than 90 countries express support to China amid rampant anti-China campaign at UN human rights body

By Liu Xin

The Chinese, as many peoples, are especially caring for the very young and older people. There is social security or pensions indexed to inflation, there is medical care, there are social centers and on… Immediately when Chinese physicians found the coronavirus was a particular problem for older men and women, special protective care was taken and special attention continues. Simply look to life expectancy and notice how sharply that has grown in China. Also, look to infant mortality where the decline is gratifying and impressive. Yes, a country that is now 1.4 billion that was fearfully poor but that has ended severe poverty is necessarily respectful of human rights beyond age limits:

http://www.xinhuanet.com/english/2021-06/24/c_1310024904.htm

June 24, 2021

The Communist Party of China and Human Rights Protection — A 100-Year Quest

From State Council Information Office of the People’s Republic of China

Contents

Foreword

I. For People’s Liberation and Wellbeing

II. The Principle of Respecting and Protecting Human Rights Embedded in Governance

III. Ensuring the People’s Position as Masters of the Country

IV. Making Comprehensive Progress in Human Rights

V. Protecting the Basic Rights of Citizens in Accordance with the Law

VI. Advancing Human Rights Around the World

VII. Adding Diversity to the Concept of Human Rights

Conclusion

“EConned

July 1, 2021 at 11:28 am”

He quotes someone who he cannot bother to name but did this clueless troll actually READ what he quoted. Gee – real interest rates might matter. Something neither this troll nor Judy Shelton ever understood. Even though someone told us that back in 1907. That someone for Econned limited education was Irving Fisher.

1) I clearly stated within the context of the discussion which was about nominal rates.

2) who cares about Shelton (other than you and Menzie)?

3) you’re not supposed to snort your clown makeup

EConned: In the context of the FT-IGM poll, 50 bps higher is tighter than 0 bps higher for a given level of expected inflation. It might or might not be tighter than policy is now — but as long as expected y/y inflation does not rise more than 50 bps from the current 4% (Michigan), then it’ll be tighter.

https://fred.stlouisfed.org/graph/?g=DvHM

January 30, 2018

Life Expectancy at Birth for China, India, Brazil, Mexico and South Africa, 1977-2019

https://fred.stlouisfed.org/graph/?g=vX8P

January 30, 2018

Infant Mortality Rate for China, India, Brazil, Mexico and South Africa, 1977-2019

“EConned

July 1, 2021 at 11:08 am

Not quite. The reason I say “whatever that means” is because Menzie’s initial replay was about nominal rates. As such, it didn’t matter if Menzie meant inflation-adjusted”

Oh wait – now this arrogant know nothing troll says it does not matter whether it was a change in nominal v. inflation adjusted rates. I guess he is too stooopied to realize that he has now contradicted the rest of his worthless babble.

Ah, yes, you conveniently ignore the last part of the very sentence you’ve decided to quote (now this is improperly citing one’s comment). Clown class is in session, folks!!!

You of all people should be careful about accusing others of misrepresentation. Your entire rant here has been to bait and switch our host on what he was saying. And you call me a clown? You are beyond Stooopid.

“EConned

July 1, 2021 at 1:48 pm

pgl – if you feel what I’m doing isn’t proper, doesn’t that mean it’s improper? Please put away your clown nose”

Econned should know about clown noses as I’m sure he knows that I have been constantly asking this arrogant idiot to note the title and author of what ever paper he is allegedly references. Maybe I should call this an appropriate attribution. Of course this will not stop this troll from twisting those terms too. This is what he does – argue nonsense for no reason.

Is he an attorney as that is what these worthless clowns do all time. Such a pointless waste of time.

pgl – you’re the one who started everything by getting your undies in a wad because you’re upset with my decision to not provide a quote’s source. The simple answer is to ignore me but you seem incapable of doing so. Honk honk.

As stated previously, the free rent inside your empty head is appreciated. You’re the easiest clown to clown that there is.

My apologies to the legal profession. Econned is not just any attorney. No – he is more the Bruce Castor type – a pointless idiot.