From the Independent Institute, “The Moment Janet Yellen Moved for ‘Greasing the Wheels’ with Inflation”, discussing a 1996 meeting of the Fed:

Ms. Yellen proceeds to make the scholarly case for 2 % inflation as the preferred target based on what she describes as a “greasing-the-wheels” argument. Citing an academic paper co-authored by her husband, well-known economist George Akerlof, Ms. Yellen suggests that “a little inflation lowers unemployment by facilitating adjustments in relative pay in a world where individuals deeply dislike nominal pay cuts.”

The theory assumes that workers resist, and firms are unwilling to impose, nominal pay cuts even when firms are experiencing losses—an assertion that aligns with Keynesian notions about “sticky wages” despite an economic downturn.

Two observations:

- George Akerlof is a well-known economist. He is also a Nobel laureate in economics.

- Shelton writes as if downward nominal wage rigidity is a “theory”, essentially ridiculing the idea. In reality, it’s an observation, validated by overwhelming amounts of evidence in the US and other advanced economies.

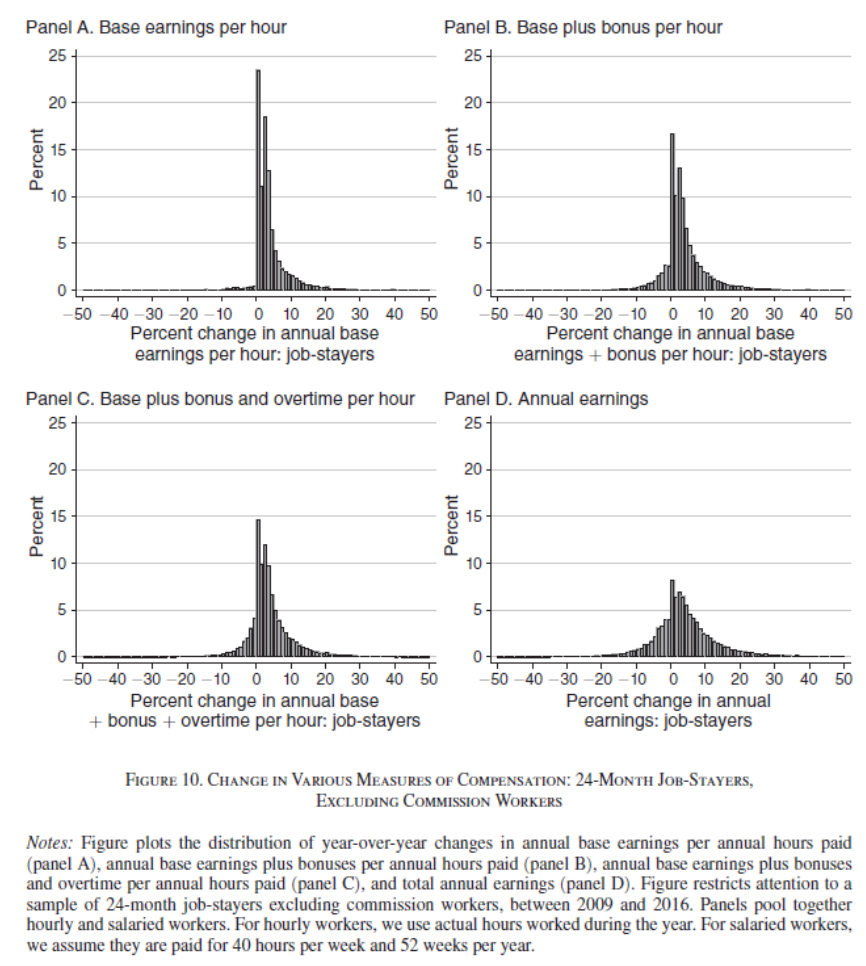

On this second observation, a very large empirical literature has documented downward wage rigidity, mostly based on survey data. The latest research — using administrative rather than survey data — still indicates a lot of downward rigidity on hourly compensation (less so on total compensation); from Grigsby et al. (AER, 2021) [ungated version]

Source: Grigsby, Hurst, Yildermaz (2021), ungated 2020 version.

Finally, while Dr. Shelton disparages the 2% inflation rate (on the Personal Consumption Expenditure deflator, not the CPI) as not “price stability”, 2% might not be too far off. That’s because there’s probably some upward bias to any government price index because of the failure to capture quality changes and the introduction of new products. For the CPI, one estimate cited is 0.3 to 1.4 percentage points bias (see discussion in Goshen et al. (JEP, 2017).

Since Dr. Shelton has expressed her disbelief in government statistics, it is strange that she has not noted this possibility.

Wow. Just wow. It never occurred to me that nominal wage rigidity was ever in serious doubt.

“Since Dr. Shelton has expressed her disbelief in government statistics, it is strange that she has not noted this possibility.”

Slipped her mind, obviously. I saw this happen to “Princeton”Kopits once when he was discussing confidence intervals. Southern evangelicals forgetting donald trump screwed around on his pregnant wife with a porn star. The “slipped my mind” phenomena is a common occurrence. A PhD mathematical economist not recalling SAAR is always assumed in headline quarterly GDP. Reagan forgetting (pre-Alzheimers) he had a biological daughter from his first marriage.

Yeah, pretty common…… “Slipped my mind” phenomena.

Thanks for including this article. From my experience in corporate America, Yellen’s argument is somewhat specious. Firms have no problem controlling wages. . In a downturn, they can give raises to a select few, none to most, and reduce the work force, replacing them as necessary at much lower wages than the ones who got fired. Older folks usually got replaced by younger ones, who earned less. That’s certainly how the Fortune 200 company where I spent much of my career managed it labor costs. Today it would probably just send the jobs abroad—new hires at a much lower cost than those let go.

Cost of labor dropped when necessary. And the most critical employees got rewarded. The average employee was stuck, and just had to buck up. Resistance was futile. No one else was hiring.

I expect that Yellen’s argument more accurately reflects jobs in government and academia, where I believe pay scales are more rigid.

Could it be that the “sticky wage” problem is not a generalized problem but simply one found mostly in academia, where economic theory is of course cooked up?

As to the difference between 7 cents and 13 cents, it makes a big difference if you’re talking about the minimum wage or about the average Social Security benefit, which is roughly equivalent to the min8mum wage. Not everyone can blithely shrug off the long-term corrosive effects of inflation.

JohnH: The data set used in the Grigsby et al. is drawn from ADP. ADP is the largest single processor of check payments in the United States, servicing private firms.

Nothing I said contradicted the idea that wages may be sticky on an individual basis. What I pointed out is that companies have a lot of latitude in controlling the mix of workers and the wages they earn. In effect real wages for a corporation may drop by managing the mix of people on the payroll., even though no individuals’ wages declined (except for the ones who left or were fired.)

In addition, many companies have performance based compensation, particularly for highly compensated employees. Salesmen receive commissions. In good years total compensation rises; in bad years it falls, even though base salaries remained the same.

As a result, poorly performing companies can and do regularly lower the effective wages they pay though they may have never lowered anyone’s pay. While individuals’ wages may be sticky, a corporation’s labor per cost per employee is much less sticky.

JohnH,

Oh, so you agree with Shelton that it was terribly irresponsible of Janet Yellen suggest a 2 percent inflation target rather than a zero percent one, given that the downward nominal stickiness of wages is semi-illusory in the private sector due to the ability of companies to fire workers and hire new ones at lower levels? I’ll let her husband, George Akerlof, know about this profound insight of yours next time I communicate with him and suggest that he tsk tsk his wife for taking his work so seriously.

Make sure you spell George’s last name correctly too. And oh yea – when discussing UK labor markets, make sure you carefully review what ONS actually has to say because JohnH gets that wrong too.

@ JohnH

I’m all for attacking authority and the power structure when it is applicable. I’ll show up, purchase swag, and wear little bells on my shoes. I don’t think targeting educators in higher education is the right tact here. Certainly if you want to attack higher education, you need to get out your scalpel and put away the machete.

Ackerlof: “If productivity growth is slow (as it was from the early 1970s through the mid 1990s in the United States) and there is no inflation, firms that need to cut their real wages can do so only by cutting the money wages of their employees.” https://www.nobelprize.org/uploads/2018/06/akerlof-lecture.pdf

This is simply not true. Anyone who has ever worked in management at a corporation knows that companies have a lot of latitude on labor costs without ever having to resort to lowering anyone’s wage. That is particularly true now that unions have largely disappeared in corporate America.

I should also add that in 2015-2016, the UK simultaneously experienced zero inflation and the highest labor participation rate since records started being kept on labor participation. And productivity growth was very low. Under the Ackerlof scenario, labor participation should have declined and unemployment risen markedly.

JohnH: “Akerlof” not “Ackerlof”

yoy UK CPI inflation 2015, 2016: 0.5%, 1.8%

UK unemployment rate 2015, 2016: 5.4%, 4.9% – low, but not lower than 4.8% in 2004.

See FRED.

UK Office of National Statistics, January, 2016: “The employment rate (the proportion of people aged from 16 to 64 who were in work) was 74.1%, the joint highest since comparable records began in 1971.”

“The Consumer Prices Index (CPI) rose by 0.3% in the year to January 2016, compared with a 0.2% rise in the year to December 2015.”

https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/january2016

JohnH: Well, data get revised. See https://fred.stlouisfed.org/series/GBRCPIALLMINMEI

Even though he could not manage to spell the man’s name correctly, at least he provided a link to this excellent lecture. May I suggest JohnH actually READ the entire discussion as opposed to pretending he knows more about labor economics than either Akerlof or Yellen.

As far as JohnH getting ANY UK labor market data correct, some of us have been waiting for many years to see him admit that UK real wages fell under Cameron.

JohnH cherry picks ONS data all the time but this one was funny as his January 2016 link said explicitly it was not the latest release. I hit the link provided in his link for the latest release and this popped up:

https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/may2021

Note the graph that shows inflation for the past decade. It contradicts what JohnH tried to portray. But there is nothing new here – he cherry picks to misrepresent quite often.

JohnH is trying to school you with his cherry picked use of ONS data:

https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment/timeseries/mgsx/lms

Oh wait – this graphs shows the unemployment rate from 1971 to the current period. And yes the UK has seen this rate fall below 4% quite a few times. But JohnH wants us to believe that his period where this rate was 5% was the best UK labor market ever.

I really do not know what to say. Is he lying or is his ability to do actual research really this awful?

BTW the labor force participation rate under Jimmy Carter was really high relative to the past too but that did not mean we did not have an unemployment issue.

“I should also add that in 2015-2016, the UK simultaneously experienced zero inflation and the highest labor participation rate since records started being kept on labor participation. And productivity growth was very low. Under the Ackerlof scenario, labor participation should have declined and unemployment risen markedly.”

You of all people should not pretend to be an expert on the UK economy. After all you claimed repeatedly that real wages did well under Cameron even though they fell by 10%.

BTW – ONS has this handy chart showing the nominal growth of average weekly earnings:

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/timeseries/kac3/lms

You might note when Cameron’s fiscal austerity that you so praised hit nominal earnings fell rather dramatically. Yes nominal earnings started rising but at first at less than the rate of inflation (I have already provided the latest from ONS on inflation with a graph going back 10 years which showed you lied to Menzie on this score).

Before you start citing ONS data again – you might want to check what it actually shows. Maybe this way you will not embarrassment yourself with more of your stupid lies.

“corrosive effects of inflation”.

Don’t you love how JohnH just ignores or misrepresents real world data preferring write lines like this. JohnH used to insist to EV readers that the Cameron fiscal austerity helped UK workers by keeping inflation low all the time he brushed off the fact that real wages fell by 10%.

I guess JohnH applauded Ford’s stupid WIN buttons even though people like Paul Krugman now how the recession lowered real earnings. But no – JohnH claims Krugman never wrote about the weak growth of real earning during the 1970’s.

“In a downturn, they can give raises to a select few, none to most, and reduce the work force, replacing them as necessary at much lower wages than the ones who got fired. Older folks usually got replaced by younger ones, who earned less.”

Wait – he finally gets that recessions might be the problem not inflation. Of course most companies lay off junior workers first but of course we see JohnH worked for a company that defied labor union rules. Funny that he never mentions the name of the corrupt company he worked for.

Pgl has a vivid imagination about what I said.

JihnH? Now there was a dude name JohnH who made this claim repeatedly over at EV. But of course you will continue to deny this as you have never had an ounce of credibility on anything.

Critically explanatory, Judy Shelton was a member board of directors and Chair of the National Endowment for Democracy (NED). The point being that the purpose of NED is subversion of governments that are not NED approved. The attacks on American economic institutions by Shelton, are in keeping with the international government attacks of NED. The idea that Shelton might be an objective policy analyst strikes me as ridiculous, but Shelton has obviously been found important for select policy subversion purposes.

I’m not in the habit of poking fun of those who practice English as a second language. However, I cannot tell if this is a murderous use of pronouns, or an old standby tool of propagandists—circular logic. “Attacks of NED”??? or Attacks by NED”?? Because “of” makes zero sense with the rest of your stance here

*murderous use of prepositions, excuse me

Anyone buying my summer heat affecting my brain excuse again?? Actually, nevermind

Oh, it is not a problem, Moses. We already know that you never have a mind, :-).

I have to wonder if Uncle Moses even gets his BFF is a gold bug.

@ Barkley Rosser

Do you know how many times people have skipped over gobbledygook word errors and typos you have made on this blog (including myself out of a courtesy you don’t deserve) but we could bank JPMorgan Chase’s bank reserves you weren’t going to pass that one up. But I’ll leave it to you and pgl to show up for the “drive by”. I deserve it here, so enjoy it please most petty and pretentious of PhDs living (and that’s saying a lot). Please enjoy.

@ pgl

I think JohnH is like many people in this world~~still learning. But my thought on it is, if a man is at the library, or sitting behind a major city newspaper reading and commenting, he’s probably going to learn more if he doesn’t have some 6 year old girl wandering around his chair trying to impress him with burp noises and telling him his hat looks funny. pgl, please see if you can take away any deep thoughts from this simplistic allegory and how you behave on this blog with imaginations that that impresses anyone.

The only thing more pathetic would be a PhD making long blatherings on a blog to a racist from New Jersey that he agrees WTI will make it to $100, when in fact the reality is, we are in a transitory inflation context (a large segment of that being reflation) in which that scenario of $100 WTI is near absurdist. .

“Moses Herzog

June 29, 2021 at 11:05 am

@ Barkley Rosser

Do you know how many times people have skipped over gobbledygook word errors and typos you have made on this blog”

Oh my – you have made old Uncle Moses mad. Never mind most people skip over just about every one of his long winded rants. Especially his incredibly inept basketball analysis.

@ pgl

What??? No false accusations of “racism” today from pgl because someone on the blog had a differing view of something?? I feel so let down…….. pgl, Check and see if Menzie thinks Andrew Cuomo is “our nation’s leader on Covid-19 response policy” and if he doesn’t you can report Menzie to the Southern Poverty Law Center for an Asian hate crime.

Oh, Moses, you again did not notice the “:-)”? Well, have some 🙂 🙂 :-).

There, do you get it now?

🙂

@ Rosser

“Moses Herzog

June 29, 2021 at 11:24 am

@ pgl

I think JohnH is like many people in this world~~still learning.”

Are you effing kidding me? You are more uninformed on this than you are on the game of basketball. Excuse me you little twit but you did not endure this man’s lies, repeated insults at economists for no reason, and brazen stupidity over at EV for many years. Everything I have accused this troll of misrepresenting is based on the parade of intellectual garbage that you have no clue about. So when you are totally clueless about a discussion – have the effing decency to butt out.

Then again if you take my advice – it might be the case you never say another word as you strike me as the most clueless clown ever. Just saying.

https://www.nytimes.com/2020/07/22/opinion/federal-reserve-judy-shelton.html

July 22, 2021

God Help Us if Judy Shelton Joins the Fed

Trump’s latest unqualified nominee to the Federal Reserve Board must be rejected.

By Steven Rattner

Having failed in past attempts to put unqualified ideologues on the Federal Reserve Board, President Trump is giving it another try — and is closer to victory than previously.

The nominee in question — Judy Shelton, known for taking long-discredited positions on the monetary system — makes Mr. Trump’s earlier rejected choices seem almost conventional. Among other heretical stances, she has supported the abolition of the Federal Reserve itself, putting her in a position to undermine the very institution she is being nominated to serve.

“Why do we need a central bank?” Ms. Shelton asked in a Wall Street Journal essay * in 2009….

* https://www.wsj.com/articles/SB123811225716453243

Your link takes us to an interesting discussion by David Henderson who clearly get monetary policy better than Judy Shelton ever could.

“In reality, it’s an observation, validated by overwhelming amounts of evidence in the US and other advanced economies.”

Of course Shelton pays no attention to actual evidence preferring to make up her own statistics. And leave it to JohnH to back her with his uninformed observations.

Consider this key paragraph which I guess is Shelton’s indictment of any inflation rate above zero:

“Why, though, do we accept a definition of “price stability” that amounts to deliberate reduction of the purchasing power of our nation’s monetary unit of account? For anyone inclined to save their dollars for future use, the programmed annual diminution of the dollar as a store of value constitutes an expropriation of wealth by a government agency.”

My Lord – this woman has never read even Irving Fisher’s 1907 writing. Does she not even have the mental capacity to realize that if a 2% rise in expected inflation tends to raise nominal interest rate by 2%. Which means of course that the real interest rate is not affected by the choice between whether we target 2% inflation v. zero inflation?

And to think Donald Trump wanted to put such a mental midget on the FED.

https://www.marxists.org/reference/subject/economics/keynes/general-theory/ch17.htm

1936

The General Theory of Employment, Interest and Money

The Essential Properties of Interest and Money

The fact that wages tend to be sticky in terms of money, the money-wage being more stable than the real wage, tends to limit the readiness of the wage-unit to fall in terms of money. Moreover, if this were not so, the position might be worse rather than better; because, if money-wages were to fall easily, this might often tend to create an expectation of a further fall with unfavourable reactions on the marginal efficiency of capital. Furthermore, if wages were to be fixed in terms of some other commodity, eg. wheat, it is improbable that they would continue to be sticky. It is because of money’s other characteristics — those, especially, which make it liquid — that wages, when fixed in terms of it, tend to be sticky.

— John Maynard Keynes

Yep – Akerlof and Yellen are channeling the brilliance of Lord Keynes. But to hacks like Shelton and of course JohnH – these eminent economists know nothing about the real world. I guess devotion to the gold standard never dies.

http://www.xinhuanet.com/english/2021-06/29/c_1310034209.htm

June 29, 2021

Over 1.2 bln doses of COVID-19 vaccines administered in China

BEIJING — Over 1.2 billion doses of COVID-19 vaccines have been administered in China as of Monday, as the country continues to ramp up its inoculation drive, the National Health Commission said Tuesday.

[ Chinese vaccines are being administered domestically at a rate of 20 million doses daily. Internationally, over 450 million doses of Chinese vaccines have been distributed. ]

I shall add a broader observation on this discussion. This may have been one of the most ipportant applications of behavioral macroeconomics in policy making we have seen, with George Akerlof probably the most open and explicit advocate of this, the title of his AEA presidential address some years ago. Downward nominal stickiness of wages is supposedly irrational on the part of workers, supposedly showing them subject to “money illusion,” whereas expectationally rational workers ought to be willing to accept nominal wage cuts in the face of declining aggregate demand in order to preserve their jobs. But they don’t. It is indeed a long known empirical fact that the vast majority of workers become quite upset when their nominal wages are cut.

And managers are by and large rational enough to know this, so they avoid cutting nominal wages because they understand that it “damages morale,” which in turn damages productivity. When Truman Bewley did his authoritative study on this matter that was published as a book, in which he did widespread surveying of managers to find out their views on the matter, this was by far the leading reason they gave, a fear of damaging worker morale that would damage productivity. Maybe the workers were/are somehow irrational or poorly informed or whatever. But the rational managers understand that this is the view of the workers and so rationally deal with it by avoiding cutting nominal wages as much as they can, even though that leads to them laying off workers. Obviously those workers are unhappy, but their loss of morale does not affect productivity because they are not working. And the fear of becoming unemployed also helps keep the workers still employed who have not had their nominal wages cut, working harder so as not to lose their jobs.

Yellen was not a coauthor on the famous paper she cited in 1996 to Greenspan and other Fed leaders, which was coauthored with George at Brookings with Dickens and Perry. But she had previously coauthored several papers with him on precisely why workers did not like to have their nominal wages cut. This discussion involved all sorts of things regular economists ignored or dismissed as “irrational,” but there they were relevant because they drove actual worker behavior. So this involved all sorts of matters regarding social interactions and feelings of worth and this and that, these things that underly that morale problem Bewley identified. This is core behavioral macroeconomics.

I note, and have noted this here quite recentlyi actually, that under different corporate forms there can be different outcomes, something JohnH might recognize. So cooperatives, such as we see a lot of in the US northwestern plywood industry, are much better at sharing pay cuts to preserve their jobs. The pay cuts are not being imposed from above by a distant and alien management. They are coming about as a mutually agreed upon response to the changed situation. I note that in Germany the kurzarbeit reforms led to it being easier for these kinds of adjustments to be made at the time of the Great Recession, and indeed Germany had a much smaller decline in employment than did other high income nations at that time, although it suffered a more comparable decline of GDP.

I lived in Northern Cal during the computer/internet/technology boom where a lot of R&D engineers were getting decent pay combined with lavish employee stock option compensation. I will need to get back to everyone with the name of a brilliant explanation of why there was so much stock option compensation but it went like this. If these firms raised wage compensation during the boom, they would have a hard time reversing the surge in total compensation. But stock option compensation sort of takes care of itself if the firm’s fortunes falls off the gravy train.

pgl,

Good point. The widespread use of stock options is clearly a form of quasi-cooperatives, making the workers part owners, although operating somewhat differently than full-blown cooperatives where the workers are the total owners. Especially for most of those Silicon Valley startups there was/is a lead owner, the founder/entrepreneur. But those people figure it out that when the firm is young and small, it can be very productive make into a quasi-cooperative by making a substantial portion of the compensation come in the form of stock options.

Off topic but interesting. When the news came out that Bolton was writing his tell all book – Trump got so angry that he told aids he hoped Bolton would get COVID-19.

How does this not end badly?

https://1.bp.blogspot.com/-VC0dLtETHB4/YNsxHW8OFXI/AAAAAAAA6Cc/iR6QTD3S0BgGktJUdL6jWLXhU7LTsg_5QCLcBGAsYHQ/s1025/RealApr2021.PNG

Steven,

I note that indeed the more important number, the price/rent ratio, has also gotten very high, back up to 2006 levels.

How might this not end “badly”? Because this time we do not have the involvement of massive amounts of shadow banking and highly leveraged forms of derivatives out there ultimately based on flaky mortgages just about to collapse. For that matter I am unaware of there being lots of flaky mortgages either. Back in 2006 they were handing out no-down-payment mortgages to people whose incomes they barely checked on, with the assumption that they would be able to refinance later with a further rise of the bubble. I am unaware of any evidence of that sort of thing going on. Even if housing prices go down, we are unlikely to see people suddenly unable to make their mortgage payments.

The housing market is looking like a potential trouble spot, with Jim Bullard at the St. Louis Fed where all those FRED stats get put out noting it as why he forecast a likely sooner upward move of interest rates, although still some ways off. It looks more threatening than the oil markets, even though crude has been creeping up and there are people out there joining you in your forecast of $100 a barrel… But then, even if that happens not lilkely to be all that big of a deal because, as you well know, we have seen crude quite a bit above that for extended periods without the economy tanking.

“I note that indeed the more important number, the price/rent ratio, has also gotten very high”

It has increased but at least you get that rents are higher then they were 15 years ago and this matters. Princeton Steve has ducked this point every time I raise it.

But I trust you know that mortgage rates are less than half what they were in 2006. At least in Finance 101 – discount rates matter too. Another point Princeton Steve does not get.

pgl,

Mortgage rates were very low for several years prior to 2006, with some figuring this was Greenspan not wanting to have W make the complaint that his father did in 1992 about restraining the economy, that year when as James Carville put it, “it’s the economy, stupid.” But in fact the Fed, partly worried about the housing bubble, did start raising interest rates in 2006, which in fact led some observers to pinpoint that a what triggered the end of the bubble and the beginning of the decline of the housing market.

I note also that back at that time it was the low interest rates prior to 2006 that underlay Jim Hamilton’s argument that the housing market may not be a bubble, with me debating the matter vigorously with him at the time.

If mortgage rates double that would impact housing valuations. But of course we have been wondering when interest rates would shoot back up for the last decade.

https://fred.stlouisfed.org/series/MORTGAGE30US

I had to check the data but it seems 30 year mortgage rates back in the day never dropped below 5.2%. FYI – mortgage rates today are a lot lower.

pgl,

Link did not work. So Jim Hamilton was completely out of his mind to suggest the rates were low enough to justify housing prices in 2005-06?

Now it is the case they rose in 2006, right? Certainly the Fed raised the ffr in 2006. My suspicion is that one reason Fed people are being so cautious about rate increases, even as they have moved forward a bit when they might go up a bit, is memory of pushing rates up pretty sharply back in 2006 and got a mess. Instead we have Bullard mumbling about maybe stopping buying MBSs sometime.

And this is in a situation where do not have this pile of over-leveraged derivatives out there based on mortgages or any evidence of lots of bad mortgages out there either, as I noted above.

Oh Lord – the Chicken Little drop out from Finance 101.

Let’s see, real rents are quite high and the cost of capital is quite low. But in the Princeton Steven school of Finance for Morons, this does not change the value of the asset?

What part of the Discounted Cash Flow model do you not understand? Or maybe the question should be do you understand any part of DCF?

Barkley Rosser

June 29, 2021 at 6:29 pm

pgl,

Link did not work. So Jim Hamilton was completely out of his mind to suggest the rates were low enough to justify housing prices in 2005-06?

****

Link is working for me. Interest rate were not at historical lows but they were lower than they were in the 1990’s. If you take the way back machine back to 2005 a lot of people were agreeing with Dr. Hamilton back then. Of course some economists disagreed. As I recall, the issue was whether real rents were about to rise or not. They didn’t rise nearly enough to justify those housing prices.

pgl,

Well, I am not going to go dragging back through all that. I simply remember it because I was a player in the debates, one of the early ones not only to call the housing bubble but to call that its collapse was going to wreak serious havoc in the financial markets and the economy. People who have been given more public credit on this matter, like Dean Baker, recognize that and have even said I called things more accurately than he did.

Anyway, I do not remember anybody going on about how rents were going to rise, nobody at all. Maybe you somehere, pgl, without me catching it. No, the defenders of it not being a bubble were overwhelmingly following the Jim Hamilton line, the one you are pushing now, that it was not a bubble because interest rates were so low. And it seems that indeed part of the reason that the Fed started raising rates was precisely out of increasing worry about the housing market, although those increasing rates almost certainly were important in halting the rise of housing prices.

To the extent there was something else behind the Fed making its move to raise rates it was also the increasing publicity about the massive increase in completely flaky mortgages, with publicity about that really taking off in 2005. I regularly tracked the Saturday Real Estate section of the Washington Post, and I remember that the first time I began to think the end of the bubble was coming and that it was clearly becoming unsustainable was somewhere in mid-2005 when I saw a story in that WaPo Saturday real estate section about how the vast majority of mortgages being issued in the Washington metro area were “unconventional,” including with a majority of them having no down payments. It was pretty clear that the mortgage side of it was coming completely unhinged. That something like that does not seem to be remotely going on is I think a much stronger argument against some impending super painful collapse of housing markets than your rather strained argument that current prices really are not bubbly at all because interest rates are just so gosh darned low, although I grant they are lower now than they were back then.

Oh, I should not waste my time given how utterly worthless he is, but I shall note that Moses has outright lied about my position. He claimed somewhere above that I “support” Steven Kovits’s $100 per barrel crude oil price forecast. I have said that it is possible, but that I think it is unlikely. That has been my position since he came out with it and remains my position. What has changed is that when I first said that almost nobody was supporting his position and crude prices were somewhat lower than they are now. What has happened is that not only have crude prices gone up somewhat, but there are now some people out there (I closely follow certain blogs about the oil industry) who are spouting Steven’s forecast, and I noted their existence. But my position remains unchanged: while I think it is possible, I think it is unlikely If Moses wants to spin that as me “supporting” Steven’s position, well, I shall simply cite pgl’s regular observations about some of Moses’s consumption habits as possible explaining this misperception on Moses’s part, not that this is the only matter on which he has pushed lying crap about me, and repeatedly.

Biden is in La Crosse Wisconsin (Menzie’s neck of the woods) promoting his American Jobs Plan. He just ticked off a bunch of numbers as to how much additional tax revenues taking the corporate profits tax rate back to 28%, getting rid of GILTI, and having that 15% global minimum tax rate – all ideas I highly endorse.

But his numbers suggest we will get over $2 trillion in new tax revenues. Damn – I bet the Republicans scream SOCIALISM. Of course this is over a 10 year period so we are actually talking about something just over $200 billion a year or only 2% of GDP. Corporate profits taxes of late have been only 1% of GDP so he wants to take this up to around 3% of GDP, which strikes me as a modest and sensible goal. Maybe alone it will not pay for all of what Bernie Sanders wants to do but it will pay for a lot.

It seems to me Shelton is referencing sticky wages in an attempt to support her general gripe about inflation – not so much that she does or doesn’t support the concept. But who really knows. But certainly we agree that there are “theories of nominal price rigidities” and a need for “careful theoretical consideration over the correct notion of “wage rigidity”” as noted in Grigsby, Hurst, Yildermaz (2021).

Econned,

And as Menzie has noted this is not just a matter of “theories,” although there are some competing ones out there, but of facts. And it has long been known that it is a very hard empirical fact that in general in the US nominal wages are downwardly sticky and have been for as long as anyone has been gathering data. This new paper by Grigsby et al usefully breaks this down into more detail about how this operates for different cases, with this looking to be more its contribution than some adjudication of “theories,” with Shelton providing zero sensible discussion of theories anyway, with, as again Menzie noted, she seems to have brought that up more as a claim that they might not actually be downwardly sticky, with that claim “just a theory,” just as creationists like to say that “evolution is just a theory.”

Agreed. Econned talk about theories but this paper was quite clear that they reviewed evidence from ADP. I guess Econned got confused in a manner similar to JohnH think ADP was a new theory and not the provider of data. But who knows!

Nah. pgl is wrong. Again.

I’m wrong but you are incapable of saying why? For such an arrogant dude – your incompetence is staggering.

And as I noted, to me it seems that Shelton was pointing to stickiness as a way to support her primary argument in railing against central banks targeting rates of inflation above 0% as she notes at the paragraph’s conclusion “Under such conditions, inflation can provide the cover for achieving real wage cuts without imposing the psychological blow of reducing nominal pay; that is, if inflation were 6%, a firm could increase the nominal amount it pays workers by 5% to achieve a real wage cut of 1%. Were there zero inflation, the firm would have to cut nominal pay by 1% to achieve the same real wage cut.” so maybe she isn’t claiming it “just a theory,” just as creationists like to say that “evolution is just a theory” afterall?

As an aside, only those who confuse scientific theory with hypotheses thinks such rubbish as “evolution is just a theory”.

“her primary argument in railing against central banks targeting rates of inflation above 0%”

FYI I have noted her primary argument here is just stupid. Irving Fisher 1907? Hello? Shelton does not get that a 2% rise in expected inflation increases nominal interest rate by 2% thereby leaving real returns unaffected. Do you understand this very basic concept? Maybe not!

Me? I’m not Shelton. Get. With. The. Program. PLEASE.

“EConned

June 29, 2021 at 5:21 pm

Me? I’m not Shelton. Get. With. The. Program. PLEASE.”

As usual you are so all over the map that you might end up on another planet. You really are incompetent as it gets.

“only those who confuse scientific theory with hypotheses”

This from someone who thinks M*V = P*Q is a scientific theory. Seriously?

Again, pgl is…….. wroooooooooooong!

“EConned

June 29, 2021 at 5:24 pm

You can’t read for crap. ”

This from someone who never learn to write.

Econned,,

And in so noting you reveal yourself to be a pathetic idiot.

Go back and read carefully Menzie’s post, which clearly lays it out. But if you do not get it, go read the original paper from 1996 by Akerlof, Dicekns, and Perry that Yellen cited in her discussion then with Greenspan and crew that led to a change in Fed views and policy.

So, in case you have trouble reading or thinking, the original Akerlof et al argument was ultimately microeconomic. In a world where nominal wages are downwardly sticky for whatever reason, in order to achieve micro efficiency in labor markets with changes in relative real wages across sectors, it is advisable to have a low level of inflation to allow this to operate.

That is it. Get it? Shelton sure as heck did not, not even close.

You can’t read for crap. How are you an academic? It’s a serious question I wish You could answer in earnest. But I’m sure you’ll make a reply about Ernest Hemingway. Sigh.

I was going to disagree with this charge that he is a pathetic idiot but his latest comments are really beyond dumb. So yea – you are correct.

Oh a waste of time, but, ECoonned, you provide zero evidence that I do not know how to read this. What I wrote is completely consistent with what Menzie posted. You are the one who seems unable to figure it out.

As it is, I know this paper very well, and it is partly because I know George Akerlof very well, and I have known him well for a very long time.

As it is I was aware of this important time it was being written. I had George in to JMU to give a talk. He spoke on that paper, which was not yet published. I spoke at length with him about it then. I knew it then and I know it now, very very well.

You are just completely out of it. You want to make this stupid remark? Then try to lay out just exactly how I did not read it correctly. You are not even remotely close to understanding what this argument is about.

“The goal of this paper is to measure the extent of nominal wage rigidity using micro data from the United States. Doing so is challenging given the complex nature of worker compensation which includes guaranteed contract earnings as well as commissions, tips, bonuses, performance pay, and overtime premiums.”

Interesting statement. Walter Wessel years ago tried to explained why higher wage floors (minimum wages for example) have little employment effects but arguing firms lower fringe benefits instead. Alas he only considered perfectly competitive labor markets while this thinking was extended to monopsony markets.

Shelton’s just a theory! As I noted earlier Irving Fisher back in 1907 wrote a Theory of Interest which among other things noted that a 2% increase in expected inflation tends to increase nominal interest rates by 2%, which means real rates are not affected. Somehow the basic theory is something Judy Shelton never grasped. But maybe Econned could enlighten us on this with his magical Quantity Theory of Money!

Clown school is back in session with professor pgl at the lectern. Today’s lesson is honk honk!!!

I bet you get lonely at preK as no one wants to play in the sand box with you.

Oh Lord – the Chicken Little drop out from Finance 101.

Let’s see, real rents are quite high and the cost of capital is quite low. But in the Princeton Steven school of Finance for Morons, this does not change the value of the asset?

What part of the Discounted Cash Flow model do you not understand? Or maybe the question should be do you understand any part of DCF?

Airline travel must be back as United just spent $35 billion on 270 new planes:

https://skiesmag.com/news/united-airlines-adds-270-airbus-boeing-aircraft-to-order-book/

That is about $130 million per plane. 200 from Boeing and 70 from Airbus.

https://twitter.com/paulkrugman/status/1410206402950451209

Paul Krugman @paulkrugman

Reading Abutaleb and Paletta’s “NIghtmare Scenario” about Trump’s response to Covid, and what’s striking to me at least is the key role played by economic charlatans and cranks

7:59 AM · Jun 30, 2021

“Airline travel must be back as United just spent $35 billion on 270 new planes … That is about $130 million per plane. 200 from Boeing and 70 from Airbus.”

No, those are phony PR numbers. Actual prices are kept strictly confidential by agreement and only released at a much later time, sometimes years later. The article carefully says “a deal worth some $35 billion.” What they didn’t say is that it is worth $35 billion only if paying list price. The journalist didn’t get that number from Boeing or United because it is under a non-disclosure agreement. The journalist generated that number themselves using the official “list” price and multiplying it by the number of airplanes. Nobody pays list price. Typical discounts are at least 50% on big deals and in this case a desperate Boeing in dire straits due to years of delays and safety groundings most certainly discounted even more than 50%.

Gee I have written on the lease to buy decision using a per plane price tag in the $125 million range. Maybe I should be sued for writing a misleading paper. Dude – if you buy a new 737 Max for a mere $100 million – please let us know.

“Boeing in dire straits”. Really? Airbus isn’t.

Careful, pgl. You are entering Kopits territory here. I don’t know what “paper” you wrote but you seem to have about as much insight into the aviation industry as Kopits does about the oil industry.

https://www.reuters.com/article/us-boeing-737max-exclusive/exclusive-boeing-nears-737-max-order-from-southwest-worth-billions-sources-idUSKBN2B22OQ

“Each 737 MAX 7 carries a list price of roughly $100 million, though such jets usually sell for less than half their official value with typical market discounts, according to aircraft industry sources.”

https://www.cnbc.com/2021/03/29/southwest-airlines-adds-100-orders-for-boeing-737-max-jet.html

“The Max 7 planes have a list price of $99.7 million apiece, but airlines usually get steep discounts for large orders — particularly in the market devastated by the coronavirus pandemic …Ishka, an aviation data and advisory firm, values newly-delivered Max 8 aircraft, which make up the bulk of Boeing’s Max backlog, at about $43 million, down from $50 million before the pandemic.”

https://www.wsj.com/articles/the-boeing-737-max-question-is-about-price-not-sales-11607022092

“Each MAX costs around $125 million, but planes are usually sold at around half of their list price.”

Listed in the leagues of Princeton Steve – damn that hurts. I will say that if an analyst does not know the value of the leased equipment, the rest of the analysis is junk science. Then again my paper had to do with intercompany leasing where most analyses are so bad they would make Princeton Steve look like a Nobel Prize winner.