Regarding a report released by the International Trade Commission, The Coalition for a Prosperous America – a pro-protection organization led by a former Nucor CEO/Chairman – notes Government Study Shows Free Trade Deals Produced Little Benefit Except for Multinationals :

…the national GDP rose by a laughably small 0.5% between 1985 and 2017, with real income rising a measly 0.6%. Still, the wage increases went almost entirely to white-collar labor, further exacerbating racial and income inequality.

Imports rose by a factor of more than 2 to 1 more than exports. This means domestic production was displaced while tens of thousands of workers were laid off in the automotive and other important manufacturing sectors.

Although some of the literature used in the report dates back to 2002, the studies were conducted at the peak of the neoliberal consensus on economic globalization. This was arguably the high-water mark for free trade evangelism and should be considered a good rearview look into what these deals achieved, did not achieve; how they can be improved upon; and who was impacted by them, for better or for worse.

On the other hand, The Hill has an opinion piece which takes a different view:

These may not seem like big numbers, but they’re impressive when you consider a few facts about U.S. free trade deals.

First, with the exception of the U.S.-Mexico-Canada Agreement (USMCA), the U.S. doesn’t have free trade deals that look like big economic prizes. The list includes Bahrain, Chile, Jordan and Oman, not the European Union (EU) or Japan. Forging closer political ties with countries in the Middle East and Latin America, rather than gaining market access, has been the motivation for most U.S. free trade deals to date.

USMCA, which doesn’t factor in the ITC’s estimates, reveals several challenges inherent in the study. One is that, like the North American Free Trade Agreement (NAFTA) before it, the majority of USMCA’s chapters tackle non-tariff barriers and other issues that are difficult to quantify. Unlike tariffs, they don’t work through prices. They’re about cutting red tape and making regulations more transparent, for example. The ITC concedes that this prevents a fuller accounting of the benefits of trade liberalization. That’s putting it mildly.

Second, U.S. free trade deals have recently gotten deeper and broader, but USMCA isn’t accounted for in the study, and President Trump withdrew from the Trans-Pacific Partnership. This leaves the ITC looking at a handful of outdated agreements, like U.S.-Korea from 2012. The reality is that, without modern “WTO plus” provisions, free trade deals can’t help but reinvent what the U.S. already gets through the WTO, making them less beneficial.

The International Trade Commission report actually notes:

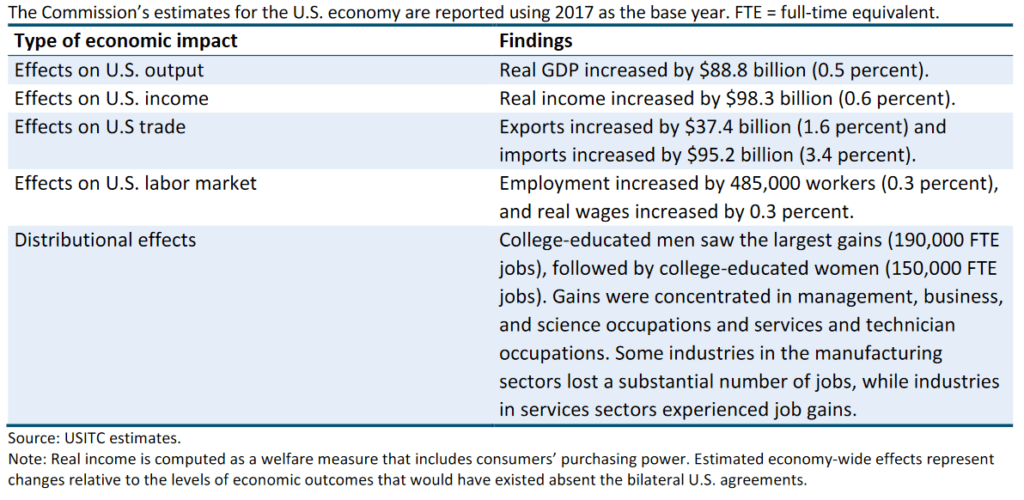

The Commission estimates that, to the extent quantifiable, the agreements have had a small but positive effect on the U.S. economy. In 2017 (the base year), they led to an estimated increase in U.S. real GDP of $88.8 billion (0.5 percent) and in aggregate U.S. employment of 485,000 full-time equivalent (FTE) jobs (0.3 percent), based on a model that assumes the economy is at its long-run full employment level. U.S. trade agreements have also had a positive effect on U.S. imports and exports as well, especially with U.S. FTA partners. The Commission also finds, however, that the gains in jobs were not distributed evenly, with the biggest gains in employment estimated for college-educated male workers.

The results are presented in Table ES-1:

As a fourth viewpoint, I’d say 0.5% of US GDP is actually non-trivial, especially given the fact that that’s a lower bound since many NTB removal effects are omitted.

Aside: If the Rashomon reference eludes, there’s always The Outrage.

Nucor is concerned about income inequality? I don’t think so.

“I’d say 0.5% of US GDP is actually non-trivial”

Surely, you are joking, right? You are talking about a 0.5% increase in GDP in over 30 years of trade agreements? A period in which we have had several major wars, government shutdowns, wild swings in deficit spending, major tax increases and major tax decreases and you think they are able to tease out a 0.5% increase in GDP over 30 years?

Oh, well, let’s take it at face value.

<i<Distributional effects: College-educated men saw the largest gains (190,000 FTE jobs), followed by college-educated women (150,000 FTE jobs). Gains were concentrated in management, business, and science occupations and services and technician occupations. Some industries in the manufacturing sectors lost a substantial number of jobs, while industries in services sectors experienced job gains.

So using their numbers, 70% of the jobs went to 30% of workers with college education. It’s indisputable that the gains from the trade deals greatly increase income inequality. Which should be no surprise because those college educated people were the one’s writing the trade agreements.

And economists could do us all a favor and stop using the term “free trade”, if they want to be honest. There’s nothing free about it at all. Each agreement is thousands of pages of trade restrictions deciding who are going the the winners and losers in the deal. And in all cases the winners are going to multinational corporations and white collar workers and the losers, at least in the U.S., are going to blue collar workers.

The deals are all about making it safe for multinationals to build factories overseas and protections for intellectual property that benefits white collar workers and almost nothing about worker rights like minimum wages or unions or safe working conditions or environmental protections. They would more accurately be called protectionist than free trade, protecting trade for the winners.

The last 40 years have been a disaster for the middle and lower class as more and more of the national income has been transferred upward. These trade deals aren’t the whole story but that are certainly a part of it.

“I’d say 0.5% of US GDP is actually non-trivial”

Surely, you are joking, right? You are talking about a 0.5% increase in GDP in over 30 years of trade agreements? A period in which we have had several major wars, government shutdowns, wild swings in deficit spending, major tax increases and major tax decreases and you think they are able to tease out a 0.5% increase in GDP over 30 years?

Oh, well, let’s take it at face value.

<i<Distributional effects: College-educated men saw the largest gains (190,000 FTE jobs), followed by college-educated women (150,000 FTE jobs). Gains were concentrated in management, business, and science occupations and services and technician occupations. Some industries in the manufacturing sectors lost a substantial number of jobs, while industries in services sectors experienced job gains.

So using their numbers, 70% of the jobs went to 30% of workers with college education. It’s indisputable that the gains from the trade deals greatly increase income inequality. Which should be no surprise because those college educated people were the one’s writing the trade agreements.

And economists could do us all a favor and stop using the term “free trade”, if they want to be honest. There’s nothing free about it at all. Each agreement is thousands of pages of trade restrictions deciding who are going the the winners and losers in the deal. And in all cases the winners are going to multinational corporations and white collar workers and the losers, at least in the U.S., are going to blue collar workers.

The deals are all about making it safe for multinationals to build factories overseas and protections for intellectual property that benefits white collar workers and almost nothing about worker rights like minimum wages or unions or safe working conditions or environmental protections. They would more accurately be called protectionist than free trade, protecting white collar interests and trading away blue collar interests.

The last 40 years have been a disaster for the middle and lower class as more and more of the national income has been transferred upward. These trade deals aren’t the whole story but that are certainly a part of it.

And enough of the “free trade” lie, please. That’s neoliberal propaganda.

joseph You are talking about a 0.5% increase in GDP in over 30 years of trade agreements?

I’m not following you. My reading is that the 0.5% figure represents an annual contribution, so over 30 years the accumulated increase in GDP would be about 15% of GDP in 2017.

trade deals aren’t the whole story but that are certainly a part of it.

But it doesn’t follow that lower classes would have been better off without trade deals. Lower classes tend to get screwed no matter what.

It is 0.5% of GDP per year. The trade losses are a flow and so is GDP. Joseph is right on the economic loss issue so why are you confusing matters? Now the distributional issues are a lot more complex. But a little levity ala James Tobin who quipped it takes a heap of Harberger triangles (which this is) to fill one Okun’s gap. An update:

https://poseidon01.ssrn.com/delivery.php?ID=927103126008002091098016122093092011118033030042010043122092076030065113094090112010026005017013006005055070123100114004106088055066031061002124123121120086085083116004008057000090104098025125065126071110121120081093071009027117081124099102066027022092&EXT=pdf&INDEX=TRUE

Nope, they aren’t claiming 0.5% per year. They are claiming 0.5% cumulative GDP above the baseline for 2017 and a cumulative increase of 485,000 jobs as a result of 30 years of trade deals.

joseph I agree that NUCOR is claiming the study only found a cumulative rise in GDP of 0.5%; but if you look at the actual ITC report it appears to say something quite different. My reading of the ITC study is that they did a counterfactual analysis that estimated what real GDP in 2017 would have been if the trade agreements over the previous 30 years had not been implemented. The $88.8B lift in GDP applies to 2017’s real GDP and is not the cumulative increase in GDP over 30 years.

A quick back-of-the-envelope calculation ought to convince you that the authors of the report (as opposed to the misinformation from NUCOR) did not mean cumulative rise in GDP of only $88.8B over 30 years. That would be only $88.8B / 30yrs = $2.96B/yr. If jobs were 485,000, that would only be $2.96B / 485,000 = $6103 per year per job. And oh by the way, the report specifically says that their job numbers represent full-time equivalents, so that would work out to: $6103 / 2080hrs/yr = $2.93/hr. I don’t think so.

2slugbaits, joseph, JohnH et al.: I concur with 2slugbaits and pgl in terms of reading the ITC report (and I’ve had some experience reading such reports). The way to read it is 0.5% of GDP per year for 2017. It might be bigger or smaller as a percentage of GDP for other years, but I’d guess smaller for preceding years on average, as the FTAs cumulate. On the other hand, Nafta was the biggie, so you can date the lion’s share from some years after Nafta’s implementation. [amendations in italics – mdc]

You’re not saying pgl is wrong in his statement above are you???

Moses Herzog: pgl — who I think is in agreement with 2slugbaits on how to interpret the quantity — is also right. I have amended comment to reflect this.

I am FULLY aware that GDP is measured and thought of as a flow. However, from my view this is slightly misleading in this context. As when we discuss many years, prior years’ GDP has major impact on future years’ GDP which also effects investment capital, and the symbiotic snowball (again when discussing multiple years) thereof between investment capital etc. and GDP.

2slugbaits: “My reading is that the 0.5% figure represents an annual contribution, so over 30 years the accumulated increase in GDP would be about 15% of GDP in 2017.”

This is just daft. There isn’t an increase of GDP of 15%. GDP is a flow and you are treating it as a stock to mislead people. To say that 2017 GDP is up 15% is just a lie. Now being caught in your mistake (or deception, your pick) you are trying to reframe your previous claim to cover up your idiocy.

Did you read the comment just below that I posted yesterday. I’ll quote it again since you may have missed it:

“To be clear, what they are claiming is that for the year 2017, that GDP is 0.5% higher than it would be without 30 years of trade deals. Keep in mind that over that period real GDP increased from 8 trillion to 18 trillion per year and they are attributing 0.09 trillion of that increase to trade deals.

And they are claiming to extract that $90 billion number from a period in which we have had several major wars, government shutdowns, wild swings in deficit spending, major tax increases and major tax decreases involving many trillions of dollars.

To me. the bottom line is that they are admitting that the effect of trade deals on GDP is so small as to be immeasurable within the data noise. Meaning that all of the promises of the neolibs regarding “free trade” are just as empty as the claims that the Trump tax cuts increased capital investment and paid for themselves.”

The report doesn’t give a confidence interval for their 0.5% number but I wouldn’t be surprised if included zero or even a loss.

joseph: Say US GDP were constant, and relative to counterfactual gains were constant at 0.5% per year, then 30 x 0.5% = 15% of 2017 GDP.

Now, GDP has been growing, and probably in early years of each FTA, the gain relative to counterfactual was smaller than it was say 20 years after implementation.

So the proper calculation would be summationoperator(percent gain each year x GDP in each year) divided by GDP in 2017 — that would probably be less than 15% of US GDP in 2017. But the biggie is Nafta. So you could take lets say 0.4% of GDP in each year since say 2000 (say 20 years) and come up with a number — it likely wouldn’t be 15% but it could be pretty significant.

For me, I prefer flow-to-flow comparisons, but the alternative stock-flow is not “wrong” as long as people understand what the heck is done.

joseph There isn’t an increase of GDP of 15%. GDP is a flow and you are treating it as a stock to mislead people. To say that 2017 GDP is up 15% is just a lie.

I never said that GDP was up by 15%. I thought it was pretty clear that I was responding to your initial comment that the cumulative gains from 30 years of trade agreements only amounted to 0.5% of 2017 GDP. I’m the one who said that the authors of the report actually meant 0.5% per year. You were the one claiming that they meant total cumulative gains were only 0.5% of GDP. You seem to double down on that with your later comment:

Nope, they aren’t claiming 0.5% per year. They are claiming 0.5% cumulative GDP above the baseline for 2017

If that’s what the ITC report actually said, then I would agree with you that the benefits were trivial. And that’s how NUCOR seems to have interpreted the report. But my reading of the ITC report is that they meant GDP was 0.5% higher in 2017 than it would have been absent the trade agreements. In a simple model that would mean the 0.5% increased flow would increase the sum of economic benefits by 15% of GDP over 30 years. Now I agree that the trade deals weren’t implemented at the same time and GDP growth was uneven over the last 30 years, but you can also turn the counterfactual forward. In other words, if we eliminated all of those trade agreements and reverted back to the situation prior to 1987, then 30 years from now we would have accumulated welfare loses equal to 15% of 2017’s GDP. Those welfare losses would have been spread out over 30 years, but when converted to a stock variable like wealth that loss is pretty significant.

“I agree that NUCOR is claiming the study only found a cumulative rise in GDP of 0.5%; but if you look at the actual ITC report it appears to say something quite different.”

Gee Nucor is spinning? I’m shocked. Joseph not only seem to be rehashing their spin but he clearly missed the cultural background implicit in the clever title of this post. Lobbyists lied? Stop the presses!

Whatever. When results are so low that they fall in the range of .005, they are often classified as immaterial or just random noise.

Putting this into perspective, a financial transactions tax of 0.1% could raise about enough to offset the gains and replace some lost tariff revenue and offshored profits. Best of all it would address inequality and target those who made out like bandits in one fell swoop.

Yet compared with the stampede to enact “free” trade, the silence surrounding a financial transactions tax is deafening, even among economists.

https://theappeal.org/the-lab/policy/the-case-for-the-financial-transaction-tax-in-2021/

JohnH: Suggest you consider:

There was a recent spate of discussion about this during the Trump administration, but didn’t go far. Too many folks from financial sector maybe. Coalition for a Prosperous America has a paper advocating such a measure.

You do know that things like unrenumerated reserve requirements (a la Chile) are essentially financial transactions taxes, even if they don’t have the primary goal of raising revenues.

“When results are so low that they fall in the range of .005, they are often classified as immaterial or just random noise.”

When I begin to think you cannot write anything more stupid, you prove me wrong. Come on dude – we are talking about $100 billion a year.

Half a billion disappears in the rounding when you report on a $21 Trillion economy.

Even the CBO’s budget projections don’t report fractions of billions.

“we are talking about $100 billion a year.”

ZOMG! $100 billion a year!

There is not place in the report that says that the increase was $100 billion per year. It is a point estimate that says the cumulative effect of 30 years of trade agreements was an increase of $90 billion for the year 2017. For the other years you can only guess.

But, whatever, the point is that $90 billion out of $18 trillion is a tiny amount. The report doesn’t say what the confidence interval is but, I’m just guessing here, since guessing seems to be the rule of the day, that the confidence interval might include zero or less.

In other words, the GDP benefits of the trade agreements is so tiny as to be unmeasurable. That is not what the “free traders” promised.

‘JohnH

July 11, 2021 at 1:19 pm

Half a billion disappears in the rounding when you report on a $21 Trillion economy.’

Excuse me but 0.5% of GDP is not $500 million. Try $100 billion.

You did flunk preK arithmetic!!

“And in all cases the winners are going to multinational corporations and white collar workers and the losers, at least in the U.S., are going to blue collar workers.”

Real Median Personal Income has increased substantially over the past 40 years. https://fred.stlouisfed.org/series/MEPAINUSA672N

It has declined during recessions, but not during implementation of new trade agreements, such as NAFTA. Facts are such inconvenient things.

Of course real income rose. That alone does not provide evidence that free trade was the driver. But then again – this is a clever way of using the usual JohnH spin against this spinner!

To be clear, what they are claiming is that for the year 2017, the level of GDP is 0.5% higher than it would be without 30 years of trade deals. Keep in mind that over that period real GDP increased from 8 trillion to 18 trillion and they are attributing 0.09 trillion of that increase to trade deals.

And they are claiming to extract that $90 billion number from a period in which we have had several major wars, government shutdowns, wild swings in deficit spending, major tax increases and major tax decreases involving many trillions of dollars.

To me. the bottom line is that they are admitting that the effect of trade deals on GDP is so small as to be immeasurable within the data noise. Meaning that all of the promises of the neolibs regarding “free trade” are just as empty as the claims that the Trump tax cuts increased capital investment and paid for themselves.

“Lower classes tend to get screwed no matter what.”

You state that as if it were some law of nature. The screwing doesn’t just happen. It is the direct result of deliberate policy decisions. Economists painting rosy pictures of globalism and “free trade” deals were active participants in the screwing. Don’t forget all the vocal public shaming by economists of the trade deal pessimists as ignorant luddite protectionists.

I’m extremely sympathetic to these type of arguments, trust me. I remember a time when I would have put a lot of thought into voting for Ross Perot and even Pat Buchanan based on their public stances on trade. But you might ask yourself, around the mid to late 1980s were you complaining about the cheap products at Wal Mart?? Were you or your neighbors refusing to purchase shirts, trousers, toys, electronics made in China because you didn’t want America losing jobs?? I think you’re a generally honest person joseph, but count me a cynic if you answer “Yes” to that question. Sure, there were some holdouts, but a good 8 out of 10 Americans (including rural America) were happily running down to the nearest Wal Mart to purchase those cheap foreign made goods.

You know what semi-random thing I was just wondering, and mind you, this would have been slightly before Wal Mart had really taken over retail and brought downtown storefronts to their knees. I had a Steve Austin “6 Million Dollar Man” doll as a child, it would have been only slightly bigger then the stereotype Barbie doll, with red jogging suit and red sneakers with three white stripes on the side , and the arm had this thing with plastic bendable or pliable skin that when you pulled back towards his elbow it would show the electronic (“bionic”??) parts of his forearm. I wonder where that thing was made (outside USA or not) ?? Next to my John Deer Tractor (you can still find those) one of my favorite toys. I also had an Evil Knievel “doll” attached to a motorcycle that you somehow “revved” (rubbing the tires backward on the floor as I remember in a kind of “wind-up” fashion) and then it would shoot across a flat floor maybe 20 feet if you could ever get the damned thing to stay upright. Shall I go down farther on my list of favorite toys?? Gosh you guys bore easily.

joseph You state that as if it were some law of nature.

In market economies it is pretty much of a natural law. That’s why we need positive laws to correct unjust outcomes.

I figured that the free trade fundamentalists would be in an uproar, something that has yet to happen.

In any case the former Nucor chairman’s statement is consistent with what Stiglitz has been saying for years. Since these deals were negotiated largely in secret on behalf of large corporations, it’s absolutely no wonder that they were the prime beneficiaries. What’s tragic is that this was known well before the deals were done, but the general consensus among economists was that they were good deals, and they were endorsed with little mention of the downsides, which were well known.

As for the strategic benefits—using access to the American market to bring China into the US fold, as had been done previously with the formerly great colonial powers—how did that turn out? And the desire to bring American-style freedom, democracy, and human rights to China, how did that turn out? It was pretty much a resounding foreign policy fiasco all around.

I have a feeling that historians will look back and see China PNTR and the Iraq War as major turning points in America’s position in the world. Interestingly, both ventures were undertaken after duplicitous sales jobs to win over the acceptance of the American people.

I hope you know that Nucor’s sector is consolidating which means even more monopoly power benefitting their shareholders not their workers. It turns out that some protectionist moves benefit the well to do and not the working class.

https://finance.yahoo.com/quote/NUE

Nucor’s stock price when from $60 a share at the start of the Trump regime to its current $97 a share making their equity worth quite a lot. If anyone thinks their lobbying here is in the interest of workers rather than their shareholders, I have a bridge to sell you.

“I have a feeling that historians will look back and see China PNTR and the Iraq War as major turning points in America’s position in the world.”

Equating trade with invading another nation is both stupid and disgusting. Especially from some ono who just gloated he purchases cars from the Japanese.

Is there any way to calculate what non-tariff barriers to trade removal effects would have been??

Is there any way to calculate the social costs of “free” trade—rising worker discontent and the emergence of Trump? I bet it would exceed half a billion dollars!

Trump emerged because he serially lied. As in telling workers he has their back but in reality gave all sorts of goodies to the rich and corrupt. Of course Nucor’s spinning is a lot like Trump’s lies. It is a pity that someone as smart as you fell for it.

Trump excelled as a con man because he understood what bugged people and proposed (falsely) taking care of it. “Free” trade is one of things that still bugs people. And it quite rationally made people question the honesty and integrity of elite “experts” who embraced “free” trade with little regard for its downsides.

Speaking of bugging people:

‘integrity of elite “experts” who embraced “free” trade with little regard for its downsides’

A blatant lie that you have repeated thousands of times.

https://fred.stlouisfed.org/graph/?g=m6zz

January 15, 2018

Real Median Weekly Earnings, * 1980-2020

* All full time wage and salary workers

(Percent change)

https://fred.stlouisfed.org/graph/?g=m6zC

January 15, 2018

Real Median Weekly Earnings, * 1980-2020

* All full time wage and salary workers

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=lMkk

January 15, 2018

Real Median Weekly Earnings for men and women, * 1980-2020

* All full time wage and salary workers

(Percent change)

https://fred.stlouisfed.org/graph/?g=lMkl

January 15, 2018

Real Median Weekly Earnings for men and women, * 1980-2020

* All full time wage and salary workers

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=lT8R

January 15, 2018

Real Median Weekly Earnings and Nonfarm Business Productivity, * 1980-2021

* All full time wage and salary workers & output per hour

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=npB2

January 15, 2018

Real Median Weekly Earnings * and Real per capita Gross Domestic

Product, 1980-2021

* All full time wage and salary workers

(Indexed to 1980)

Historical Real household income by quintile gives another valuable perspective…and illustrates just how stagnant income has been for most Americans (while corporate profits have soared.)

https://www.advisorperspectives.com/dshort/updates/2020/09/17/updated-u-s-household-incomes-a-50-year-perspective

See my reply to Paul Mathis

July 10, 2021 at 5:32 pm

He is using your usual rhetorical BS to claim free trade led to rising real income. But a change in real income or the distribution thereof is caused by a variety of factors. Paul proved nothing. And as usual – neither have you.

Folks – can you all figure out the cultural reference our host alluded to

But we can agree that corporate profits soared right after China PNTR while labor’s share of national income declined. Coincidence? Only to diehard free trade fundamentalists.

Corporate profits have soared because we have allowed companies like Nucor to have monopoly power. And the trade protection they are advocating is one way to limit competition. Of course we would not expect a village idiot to get this basic point.

“economists basically shrug their shoulders when mention is made of those hurt by “free” trade”

Another blatant lie. Of course our host has decided to call this BS out.

I can, pgl. Most famous movie out of Japan by Kurosawa from 1950, I believe. Shows different people recounting a set of events with each of them seeing them quite differently.

Real wages up.

Employment up.

Incomes up.

What’s not to like?

And, as for the “Lower classes tend to get screwed no matter what” nonsense, remember this:

The less well-off buy cheaper-than-made-in-America products because they HAVE TO.

No one ever shopped Wal*Mart because they didn’t like the selection at Saks Fifth Avenue.

When imports reduce the cost of living of the least well-off among us, only the churlish call it a loss.

Whose real wages are up? Can we all say Stopler-Samuelson which Krugman notes is one of the four pillars of modern international trade theory. Yes workers may be getting their apparel for 5% less but when they wages have fallen by 10%, then they are worse off.

As Marie Antoinette once said, “Let them read Stolper Samuelson…”

Lord – you make some of the dumbest comments ever. But then I guess you never got the point of their paper. Babble on in your utter ignorance.

Sorry that pgl’s skull was to thick to get the analogy. So I’ll spell it ou.

Well, economists basically shrug their shoulders when mention is made of those hurt by “free” trade—kind of like Marie Antoinette telling the starving masses to eat cake, which was even less available than bread.

JohnH: I wish you would stop characterizing all economists as as being disinterested in the welfare of those hurt by trade competition. In my experience, there is a mix of views, and trade economists are usually the most nuanced in their views.

@ Menzie

With all due respect Menzie, Is this an example of the “nuance” to which you were referring??

https://www.nytimes.com/1993/09/17/us/a-primer-why-economists-favor-free-trade-agreement.html

https://www.latimes.com/archives/la-xpm-1993-09-04-mn-31519-story.html

I tried to get the full list of economists and failed, the 1993 list I mean. How “strange” that list of economists/letter is difficult to find online now…… The LA times commentary has a very abbreviated list. The sounds being made by economists who were anti-NAFTA was pretty damned muted at the time. I lived it man, I read a decent amount, and the only hurt noises I remember was coming from the 3/4ths empty seating stands of the Labor Unions after Reagan decimated them around 1984.

It’s also interesting to note~~Joseph Stiglitz now badmouths NAFTA, after admitting rather sheepishly the CEA he himself was on recommended NAFTA to the President for it “geopolitical benefits” [insert laughter here ] I wonder how often Stiglitz mentions this fact in his paid lectures?? Shall I use the fingers of my left hand to count the number of times?? Or is Stiglitz originally backing it on the CEA and then after the fact acting like his 1993 physical personage was taken over by aliens your version of “a mix of views”??

Who’s real wages fell by 10%?

Before Barkley once again has to lecture me – his last name is Stolper. And here is a nice discussion of his theorem with Samuelson:

https://www.economicsdiscussion.net/theorems/stolper-samuelson-theorem-sst-theorems-economics/26931

The point of this post it seems to be that certain people spin things. And people here are repeating their spin? Could you dudes first check what Rashomon was besides a 1950 Japanese movie. I don’t have the Siskell and Ebert review handy but here is a clip from Wikipedia:

Every element is largely identical, from the murdered samurai speaking through a Shinto psychic, the bandit in the forest, the monk, the rape of the wife and the dishonest retelling of the events in which everyone shows his or her ideal self by lying. The film is known for a plot device that involves various characters providing subjective, alternative, self-serving, and contradictory versions of the same incident. Rashomon was the first Japanese film to receive a significant international reception; it won several awards, including the Golden Lion at the Venice Film Festival in 1951, and an Academy Honorary Award at the 24th Academy Awards in 1952, and is considered one of the greatest films ever made. The Rashomon effect is named after the film.

https://www.nytimes.com/1951/12/27/archives/the-screen-in-review-intriguing-japanese-picture-rashomon-first.html

December 27, 1951

Rashomon

By BOSLEY CROWTHER

A doubly rewarding experience for those who seek out unusual films in attractive and comfortable surroundings was made available yesterday upon the reopening of the rebuilt Little Carnegie with the Japanese film, Rasho-Mon. For here the attraction and the theater are appropriately and interestingly matched in a striking association of cinematic and architectural artistry, stimulating to the intelligence and the taste of the patron in both realms.

Rasho-Mon, which created much excitement when it suddenly appeared upon the scene of the Venice Film Festival last autumn and carried off the grand prize, is, indeed, an artistic achievement of such distinct and exotic character that it is difficult to estimate it alongside conventional story films. On the surface, it isn’t a picture of the sort that we’re accustomed to at all, being simply a careful observation of a dramatic incident from four points of view, with an eye to discovering some meaning—some rationalization—in the seeming heartlessness of man.

At the start, three Japanese wanderers are sheltering themselves from the rain in the ruined gatehouse of a city. The time is many centuries ago. The country is desolate, the people disillusioned, and the three men are contemplating a brutal act that has occurred outside the city and is preying upon their minds.

It seems that a notorious bandit has waylaid a merchant and his wife. (The story is visualized in flashback, as later told by the bandit to a judge.) After tying up the merchant, the bandit rapes the wife and then—according to his story—kills the merchant in a fair duel with swords.

However, as the wife tells the story, she is so crushed by her husband’s contempt after the shameful violence and after the bandit has fled that she begs her husband to kill her. When he refuses, she faints. Upon recovery, she discovers a dagger which she was holding in her hands is in his chest.

According to the dead husband’s story, as told through a medium, his life is taken by his own hand when the bandit and his faithless wife flee. And, finally, a humble wood-gatherer—one of the three men reflecting on the crime—reports that he witnessed the murder and that the bandit killed the husband at the wife’s behest.

At the end, the three men are no nearer an understanding than they are at the start, but some hope for man’s soul is discovered in the willingness of the wood-gatherer to adopt a foundling child, despite some previous evidence that he acted selfishly in reporting the case….

Now that is a movie review! I may have to find this movie and watch it!

So I made my comment above before seeing all this commentaty.

Yes, it is a truly great movie I have seen several times. Some see it as representing a deep aspect of Japanese culture, their ability to elements of different cultures into theirs, such as having an alphabet that is really three alphabets or that most Japanese follow both Shintoism and Buddhism, going to the appropriate temple for different events in their lives (Shintoism gets weddings and births while Buddhism gets funerals). This is seen in their ability to draw in western influences after the Meiji restoration while maintaining their culture, and again after the period of US rule after WW II, with the movie coming out near the end of that period of rule.

Indeed, my wife and have a footnote on the movie and this aspect of what it says about not only Japanese culture but the evolution and nature of the Japanese economic system in our textbook on comparative economics. One can also see this element of Japanese culture in the ambiguities that appear in Japanese Zen koans.

In April 2011, Congress and President Obama stopped Chinese participation in International Space Station exploration as well as Chinese work with NASA. In July 2021, China has a rover on Mars, a rover on the far side of the moon, an exhibit of freshly retrieved moon strata at a just completed planetarium in Shanghai and China has an orbiting manned international space station. There is an advanced global positioning system, an advanced climate monitoring satellite system, an observatory currently searching out pulsars…

The point is that President Clinton did not give China permission to develop in 2000 by allowing for “permanent normal trade relations,” and trade with China in turn did not limit American development. There is every reason for America to welcome close developmental relations with China, and stereotypes that are making this impossible currently are decidedly unfortunate and will prove so.

An interesting consideration for me is that for all the skeptical American writing on trade advantages, the Chinese are determined to extend trade and policy is directed towards trade extension from Europe through Latin America. Laos is as important to trade with for the Chinese as Germany, from a policy perspective. Why then, given American trade concerns, are the Chinese cultivating trade?

2slugbaits: “My reading is that the 0.5% figure represents an annual contribution, so over 30 years the accumulated increase in GDP would be about 15% of GDP in 2017.”

Menzie Chinn: “Say US GDP were constant, and relative to counterfactual gains were constant at 0.5% per year, then 30 x 0.5% = 15% of 2017 GDP.”

Come on, Menzie. I’m usually on your side on this stuff but this is beneath you, defending 2slugbaits absurd claim.

Assume GDP were constant? And ignore the fact that GDP was less than half 30 years ago?

Assume the gain is 0.5% per year? When 30 years ago the only trade deal considered in the report was with Israel?

Let alone the absurdity of confusing stocks and flows. I mean you can come up with all sorts of absurd numbers if you just sum up a lot of small differences over a long period and compare it to the final year. Heck, why not say that over 200 years the gain is 100% of GDP? Now that’s an impressive number!

Then you go on to concede these real considerations but why the reluctance to just call 2slugbaits BS what it is.

I truly do not understand the stubbornness on this. The report makes a point estimate for 2017 of a gain of 0.5% plus or minus ??? I am not impressed, especially considering the great harm done by the agreements. That’s not what the economists promised. So which Rashomon character does that make me?

joseph: You didn’t recount my other calculation, which stressed Nafta, and took into account adjustment time.

Personally, 0.5% gain when not taking into account most NTBs, is substantial. I’ll also note that these are neoclassical gains, and as one who took a class with Harvey Leibenstein, eliminating X-inefficiency is also not to be sniffed at.

“as one who took a class with Harvey Leibenstein, eliminating X-inefficiency is also not to be sniffed at.”

He introduced this concept as early as 1966. And the US steel sector (as in Nucor) may be the classic example. Shielded from competition by trade protection as well as being allowed to consolidate has given them market power which has allowed shareholder value to stay high even though the US steel sector has lagged in innovations. This is the point I have tried to convey but then the Usual Suspects including JohnH ain’t listening.

Harvey Leibenstein?? Since when did we start listening to guys with traditionally Irish last names?? Next thing you’ll be telling me his middle name was Eugene and he was born in the Irish Borough of Brooklyn with a strict Irish Shtetl education. Those Irish and their wild adventures to Coney Island!!!! I mean really. This isn’t where you go for great analysis. That’s like saying you went to France to learn how to make chocolate soufflé. Really Professor Chinn, such nonsense.

https://brooklynjewish.org/neighborhoods/

joseph This is getting ridiculous. I did not say that GDP would increase by 15% over 30 years; I said the accumulated increase in GDP would be about 15%. I was responding to your claim that the accumulated increase in GDP was only 0.5% after 30 years. I suggested that the 0.5% figure represented an annual rate and was not the accumulated sum of GDP increases, which is how you seemed to have interpreted the ITC report. It should have been obvious that I was not saying trade deals increased GDP by 0.5% each year. If I had meant that, then I would have used (1.005)^30 rather than 0.5% * 30 years. And since the 0.5% figure represents a level shift in GDP, interpreting a 0.5% increase each and every year would also require brand new trade deals (i.e., new positive shocks) equal in scope each and every year.

Believe it or not, I am fully aware that GDP was lower 30 years ago than it is today. My point was to show that the accumulated welfare loss is not trivial. If looking back 30 years causes you heartburn, the do the same calculation going 30 years forward. Either way the point is the same.

As to stocks and flows, there is nothing wrong with summing flows to arrive at a stock variable that captures total welfare loss over some horizon. That’s exactly what 0.5% * 30 years does.

Our Productivity commission has looked at a few ‘fee trade’ deals and found they are duds. this is because they create trade diversion not trade creation. I am assuming this is occurring here yes.

As long as NAFTA has been a focus, the problem has been not in the United States but in Mexico:

https://fred.stlouisfed.org/graph/?g=yRv7

August 4, 2014

Real per capita Gross Domestic Product for Mexico as a percent of Real per capita Gross Domestic Product for United States & Exports of Goods and Services by Mexico as a percent of Gross Domestic Product, 1992-2019

(Indexed to 1992)

https://fred.stlouisfed.org/graph/?g=yRvc

August 4, 2014

Real per capita Gross Domestic Product for Mexico as a percent of Real per capita Gross Domestic Product for United States & Exports of Goods and Services by Mexico as a percent of Gross Domestic Product, 1992-2019

(Indexed to 1992)

“Personally, 0.5% gain when not taking into account most NTBs, is substantial.”

But back in 1994 the Council of Economic Advisors wrote in their annual report that the Uruguay Round of GATT alone would contribute 0.9% to 1.7% to GDP by 2004. And here we are supposedly celebrating one-half to one-third of that lofty promise after not only GATT but NAFTA and other trade agreements?

Is $90 billion a big number? Well, if we had real free trade, for example free trade in medical doctors so that doctor fees were similar to other developed countries, we would save $200 to $300 billion a year.

Or if we had real free trade in pharmaceuticals we could save $200 to $400 billion a year.

But the results we got should not be surprising. The classical justification for open trade says that for a developed country low skill prices will decrease and high skill prices will increase. So they knew exactly what they were doing, a transfer in income from the non-college educated, 70% of the workforce, to the college educated, 30% of the workforce. And that was considered a good deal because guess who of those two were doing the negotiations?

It didn’t have to be that way. Instead of negotiating so that multinationals could just have access to the cheapest labor in the world they could have instead negotiated minimum wages or union protections or environmental standards.

Or instead of negotiating extended intellectual property monopolies, which is anything but “free trade”, they could have negotiated, for example, to reduce China’s currency manipulation. I know that it’s considered rude to mention currency manipulation today, but back in 2000 – 2008 it was clear that China was executing an attack on manufacturing that resulted in a sudden loss of 4 million mostly union manufacturing jobs in the U.S. U.S trade representatives’ choice there was an obvious case of protecting white collar workers IP and throwing blue collar workers under the bus. Instead of trading less IP for less currency manipulation they chose to trade more IP protection for more currency manipulation.

And 2slugbaits says screwing the lower class just happens!. It doesn’t just happen. It’s deliberate policy.

indirectly related topic

The NYT says just under 30% of Canadian workers are union members versus 11 percent of American workers. I wonder if we took a survey of the level of happiness of workers of the two nations whose would rank higher?? Hmmmmmm…….. I really really “wonder”…….

https://www.monster.ca/career-advice/article/happiness-at-work-ca

“The worldwide study results show that Canadians are the most likely nation to say they either love their jobs or like them a lot. According to the survey the Netherlands were the next happiest nation at work with 57% saying they either love or like their employment, followed by India (55%), US (53%), UK (46%), France (43%) and Germany (34%).

US respondents were the most likely to say they dislike their jobs, with 15% saying they didn’t like, or hated their current role. This was followed by UK (12%), Germany (10%), France (9%), Canada and the Netherlands (both at 7%) and India (5%).”

https://www.prnewswire.com/news-releases/why-people-are-happy-or-not-301215280.html

I think the context in which these questions or surveys are asked creates a kind of misinformation. That is, at companies without unions, people learn not to complain or to appear passively or numbingly “happy” because they know complainers can be punished, fired, or replaced. But members of strong labor unions know that one of the best ways of effecting change is appearing angry or unhappy with whatever aspects of work (however “small” or “minor”) they are dissatisfied with or see nudge room for improvement. This paper kind of discusses that distortion effect in happiness of Union workers:

https://journals.sagepub.com/doi/pdf/10.1177/0959680118817683

2slugbaits: “This is getting ridiculous. I did not say that GDP would increase by 15% over 30 years; I said the accumulated increase in GDP would be about 15%.”

But that 15% number you pulled out of your — hat — is just ridiculous. Nowhere does the report say that the gain was 0.5% for each of the last 30 years. As I pointed out, 30 years ago the only trade agreement included in the report’s calculations was with Israel. Did that trade agreement alone increase GDP by 0.5%. I mean, you could guess some numbers but 0.5% for each of the last 30 years is most assuredly more wrong than right. And then the more obvious error is that 30 years ago real GDP was less than half it was in 2017, making your 15% number even more ridiculous.

So why would you make such a misleading statement to give the impression that the reported increase is more significant than it is. 15% of GDP. Wow, that’s a big number.

It makes no sense to compare sum up a small surplus each year and compare it to some arbitrary year in the future. That’s pure deception. As I pointed out, you could just as well said that the accumulated surplus will be 100% of GDP in 200 years. Now that’s impressive.

If you honestly want to compare 30 years of accumulated surpluses, and accepting your dubious math at face value, then you should compare them to the accumulated GDP over that same interval. And the answer you come out with is, oddly enough, 0.5%, not 15%.

It’s a trivial amount, barely distinguishable from zero if you include any confidence interval on the number. Even then, it is one-half to one-third the rosy promises used to sell the policies to the public.