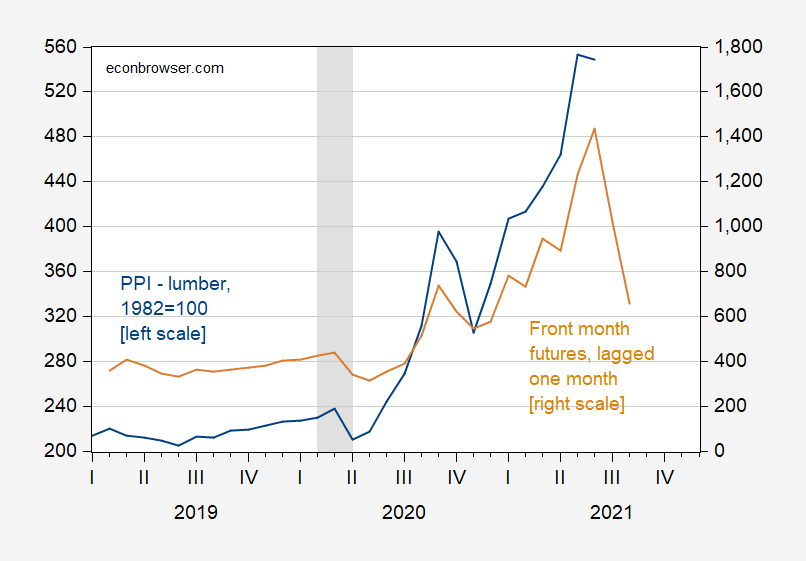

Calculated Risk (h/t pgl) noted the decline in futures lumber prices. Joseph has argued that this won’t necessarily show up in actual prices paid by the consumer for a while. I don’t have retail prices, but I have the BLS measure one step removed from consumers, the PPI for lumber.

Figure 1: PPI for lumber and softwood (blue, left scale), and front month futures, lagged one month (brown, right scale). NBER recession dates shaded gray. Source: BLS via FRED, macrotrends.com, NBER and author’s calculations.

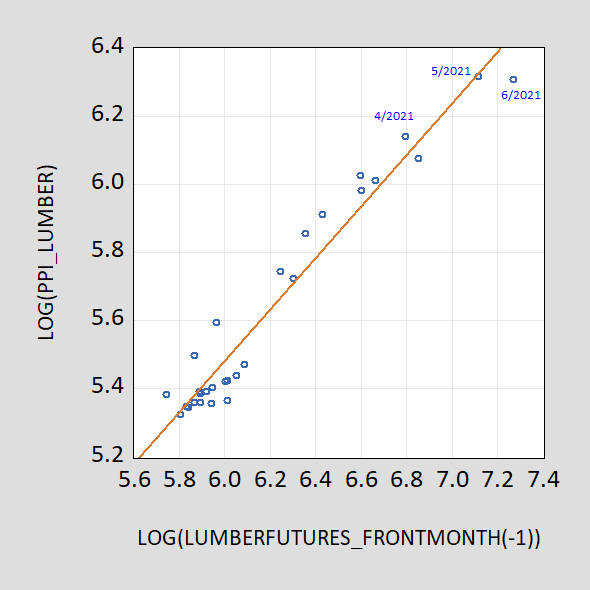

The correlation between the two variables seems pretty obvious, but just to illustrate the tightness of the fit, here is a scatterplot.

Figure 2: PPI for softwood lumber against front month futures for softwood lumber lagged one month, both in logs. Futures data is monthly average of daily data.

In my June post, I noted that a one percent futures basis (approximately log futures minus log current spot) does not necessarily imply a one percent decline in lumber prices, as would be implied in a risk-neutral efficient markets setting. Mehrotra and Carter (2017) find that over the 1995-2013 period, at two months horizon, a one percentage point basis implies a 0.55 percentage point decline. This implied a 7% decline in the June PPI. As it turned out, the actual change was 7.3%.

Here I take another approach. Given the evidence of nonstationarity of both the PPI and futures in this sample period, I use the following equation in log first differences to forecast:

Δppi_lumbert = 0.01 +0.67Δlumber_futuret-1

Adj-R2 = 0.64, SER = 0.054, DW = 2.27, Nobs = 28. bold denotes significance at the 1% level using HAC robust standard errors.

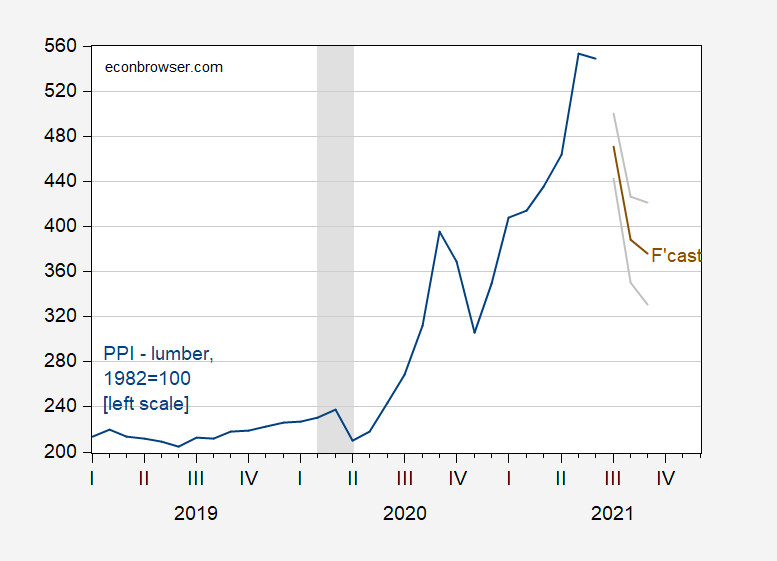

This regression yields the following forecast:

Figure 3: PPI for lumber and softwood (blue, left scale), and forecast (see text) (dark brown,), and +/- 1 standard error (gray). NBER recession dates shaded gray. Source: BLS via FRED, NBER and author’s calculations.

The model forecasts a 15.3%, 19.3%, and 3.2% in July, August and September, respectively (all calculated as log differences). The forecast brings the September PPI to the average of December 2020/January 2021 levels.

‘Joseph has argued that this won’t necessarily show up in actual prices paid by the consumer for a while.’

Maybe not but JohnH has his new ‘theory’ that oligopolists will never lower lumber prices. Of course his new theory has no explanation why they did not raise prices until recently. It must be nice to live in a world where one just makes it up as it goes. After all economists do not understand market power the way JohnH does (even if he is incapable of explaining his new theory).

Of course pgl has no explanation whatsoever of why local retail lumber prices have yet to drop. He can only argue that I should not believe my lying eyes. But I’m not the only one to notice lumber price dynamics.

https://www.probuilder.com/why-builders-wait-see-lower-lumber-prices

This is not the first time that retail prices have been very, very sticky at local building supply retailers as they allegedly worked off a large inventory of product bought at significantly higher prices.

These companies seem to operate very differently than gas stations which raise prices on whiff of a producer price increase and lower them almost as fast.

Basking in his ivory tower, pgl probably ha no idea where go to and buy a 2×4 to check the prices for himself.

JohnH: I’m not disputing the prices at the stores you use haven’t dropped as much as futures and the PPI. But unless you believe there is hysteresis in retail level of lumber prices relative to wholesale, then eventually the retail price will converge to the PPI. Could be true, but I don’t know of any academic work that verifies what you are then asserting.

JohnH has an “interesting” theory about retail gross margins. Let me lay out a simple example before going into JohnH’s massively contradictory theory.

Let’s say the wholesale price was originally $40 per unit and the retail price was originally $50 per unit. This gross profit ($10 or 20%) must cover operating expenses which includes labor as well as pesky things like indirect taxes and transportation costs. Let’s say Lowe’s is a lot like always low wages Walmart and pays workers only $5 per unit and can avoid taxes and transportation costs. Its operating margin = $5 per unit or 10% of revenues.

Now in JohnH’s world, an imposition of something like a 25% tariff is going to eat into Lowe’s gross profits wiping out entirely its operating profits. Yes he argued that many times. But if the cost of the good rises, it will be completely passed through. An odd contradiction it seems.

Now to the dynamics. Let cost of goods temporarily rise. Lowe’s profits go through the roof even though it is paying more. And when prices go back down, its profits really soar as it has discovered it has massive market power. Now why it did not know that before the pandemic is an odd one for this little theory. I guess he thinks the CEO of Lowe’s was really stupid before 2020.

This is an indeed a puzzling theory in my view. But hey – let JohnH write a paper on his new found theory and submit it to the AER. You think they would publish it?

Ridiculous! “Now in JohnH’s world, an imposition of something like a 25% tariff is going to eat into Lowe’s gross profits wiping out entirely its operating profits.“

No one argued that! pgl sure does like to lie about what others say.

And for a product like washers and dryers that consumers may buy only a handful of times in their entire lives, economists sure did make a righteous and indignant uproar about a tariff increase that amounted to a hill of beans and in no way affected Lowe’s profitability.

“No one argued that! pgl sure does like to lie about what others say.”

JohnH did argue this over and over. But of course he now denies that he did. One confused dude he isl

“And for a product like washers and dryers that consumers may buy only a handful of times in their entire lives, economists sure did make a righteous and indignant uproar about a tariff increase that amounted to a hill of beans and in no way affected Lowe’s profitability.”

How many JohnH’s are posting under the same name. There was this dude claiming to be JohnH that claimed the entire incidence of these tariffs were borne by Lowe’s. THIS JohnH is now claiming he did not make any such claim.

I wish the various dudes posting under this name would make up their confused minds.

What’s hilarious here is that laundry equipment is so inconsequential that the BLS doesn’t ever bother to assign it a weight in its calculation of the CPI. Same is probably true of Lowe’s, which could easily absorb some of the increase in tariff costs

For such a trivial item, some economists like Krugman, made a tremendous uproar over a supposed 25% increase in retail prices, all thanks to Trump’s tariff. pgl even went so far as to say that it would bankrupt Lowes if they had to absorb the cost.

Truth be told, prices rose 7% in 2018 and then dropped 2% in 2019, and then rose about 2% in 2020, far from some economists’ fearmongering number of 25%.

https://www.in2013dollars.com/Laundry-equipment/price-inflation

Now the best part is that prices have risen 18.46% in 2021, probably due to COVID related supply chain issues coupled with increased demand. But where are the economists who are shocked, just shocked at the outrageous rise in the prices of laundry equipment? Answer: Nowhere to be found!!! So much for their faux concern about the price of laundry equipment!!!

Could economists please focus on what’s important? And could they at least be consistent in their attention and concern about outrageous retail prices?

Table 2. Consumer Price Index for All Urban Consumers (CPI-U): U. S. city average, by detailed expenditure category

https://www.bls.gov/news.release/cpi.t02.htm

Major Appliances .079%

Laundry Equipment [blank]

Pretty inconsequentail!

“Same is probably true of Lowe’s, which could easily absorb some of the increase in tariff costs”.

JohnH-1 told us Lowe’s absorbed all of the tariff increase.

JohnH-2 told us Lowe’s absorbed none of these additional costs and denies he ever said the former.

Now THIS JohnH is back peddling having the retailer absorb at least part of additional costs.

I do think we need an old fashion baseball program to keep track of all the contradictions from the many versions of JohnH!

Thanks to pgl for clearly explaining to exactly how he distorts what other say, creating blatant misrepresentations and mischaracterizations.

I say, “ Lowe’s could easily absorb some of the increases in tariff costs,” a statement that is valid. Washers and dryers are a small part of their vast product line.

Pgl claims I said, “Lowe’s DID absorb.” Later he adds that I claimed that it would lead to their bankruptcy!!! (Totally fictitious secretions.)

Now pgl claims that I said that Lowe’s DID NOT absorb those costs (another totally fictitious assertion.)

But his mischaracterizations and misrepresentations—par for the course—were an attempt to obscure the real takeaways: many economists hyped an issue that was really of no consequence to consumers, to the big box vendors, or to the overall economy. What were they thinking?

As for pgl, he lies like Trump and Giuliani. Is there something in the New York water?

“JohnH

August 8, 2021 at 5:37 pm

Thanks to pgl for clearly explaining to exactly how he distorts what other say, creating blatant misrepresentations and mischaracterizations.”

You are still denying that you earlier claimed retailers would absorb 100% of the Trump tariffs? Damn – your denial rivals Andy Cuomo’s claims that he never sexually harassed women!!!!

Look saying stupid things are one thing. But then lying trying to deny you said those stupid things? You are indeed a worthless troll.

In the case of the other building material—I believe it was asphalt shingles bought when oil prices were high—the expectation among retailers’ employees was that would take years to work off the inventory, because so much had been stocked. This was some time after oil prices had dropped. My expectation was that prices should have dropped. But the expectation was among employees was that prices would remain high until the high priced stock was depleted.

The article I linked to describes the same process for lumber, though it make not take so long, depending on inventory levels.

Has there been any academic research into the efficiency of markets for building materials and retail price responsiveness to changes in producer prices?

National Association of Homebuilders economist David Logan explains what’s going on.

https://nahbnow.com/2021/07/why-builder-lumber-prices-remain-higher-than-headlines-suggest/#comments

Buying power, which ordinary consumers lack, is a significant factor.

“Buying power, which ordinary consumers lack, is a significant factor.”

If consumers lack buying power as you suggest the demand for these products would be lower. But that contradicts just about every story on the current market. How confused can you get? Never mind – dumb question as you are serially confused.

Try reading your own links. Such as:

“Retailers generally have less buying power than wholesalers have selling power. In such a scenario, the retailer (e.g., lumberyard) is said to be a “price taker.”

Wait – you said they were oligopolists. Also – note the charts in this link are showing a modest price decline that you said would never happen.

Thanks again for an interesting discussion even if you did not understand this one either.

There is academic work regarding the point John has made. This piece, for instance, finds that prices rise respond faster to input increases that decreases: https://www.jstor.org/stable/10.1086/262126

This supports John’s claim, as does industry reporting. I don’t think john is arguing against standard economics, but rather that lags need not be symmetrical between periods of rising and falling prices. That’s not a hard claim to swallow. The mechanism cited in articles John links to — merchants wanting to charge replacement cost when prices are rising and purchase cost when prices are falling — sounds like what I’d want to do if I had inventory to manage.

macroduck: I stand corrected. Peltzman does note, however, that inventories don’t seem to matter to adjustment pace (if I read the paper right), and inventories is what I think JohnH was alluding to as a reason for the asymmetry.

I’m okay with asymmetry. It’s the pace that seems to be at issue. I don’t have enough spikes in the data to estimate an asymmetry in lumber, but if someone wants to input the futures data, I’d be willing to take it…

Let’s be clear – this is about the timing of the short-term dynamics. Prices do fall. What did JohnH try to tell us. Lumber prices will not fall. BIG difference. Of course he is now denying that he ever said that but he did.

This 2000 JPE paper attracted the attention of the Justice Department who commissioned this discussion of why prices rise faster than they fall:

https://www.justice.gov/atr/why-prices-rise-faster-they-fall#:~:text=Typically%20prices%20are%20found%20to%20rise%20faster%20than,more%20so%20than%20are%20wholesale%20price%20increases.%22%202.

Interestingly this paper noted assymetric price transmission (APT) occurs in competitive markets as well which undermines that weird oligopoly theory JohnH is pushing. It does consider other possible reasons for APT.

BTW – even the 2000 JPE paper noted prices fall within a few months.

It looks like pgl could be just plain wrong yet again. Lumber prices have not fallen much at the retail level, which is the point I was trying to make. IOW retail prices have been sticky. And they may not fall for some time”

“Lumber prices have fallen, but the stage is set for a potential 65% rally through the end of the year, an expert says.”

https://www.msn.com/en-us/money/topstocks/lumber-prices-have-fallen-but-the-stage-is-set-for-a-potential-65-rally-through-the-end-of-the-year-an-expert-says/ar-AAMMreC

But pgl,, ever the knnow-it-all, argued that lumber prices would fall right back to where they were last year. Of course, eventually they probably will drop to last year’s level. Eventually we’ll all die…

That is an interesting discussion. Did you read it? If you did – you clearly did not understand what it said. For one – it did note retail prices have at least started to decline. And it had an interesting discussion of the dynamics which is not even remotely what you asserted. You claimed that retail prices will permanently be high but that is not what this discussion is saying at all.

But thanks for an interesting discussion even if you have no clue what it said (as usual).

No one claimed that retail prices on lumber would be forever high. Another total lie by pgl. But the articles did make my point that prices will remain high until the existing, high cost inventory gets depleted, something that pgl can’t seem to understand.

“No one claimed that retail prices on lumber would be forever high.”

Oh yes you did. But I can see why you deny your past really dumb statements.

Ever notice that when pgl gets challenged, his lying gets increasingly strident and his lies get more and more extravagant and fanciful?

It makes you wonder if this “progressive growth liberal” is not just a GOP plant who’s goal is to constantly attack people and make Democrats’ boosters’ seem as unhinged as Trump’s own.

“JohnH

August 6, 2021 at 4:35 pm

Ever notice that when pgl gets challenged, his lying gets increasingly strident and his lies get more and more extravagant and fanciful?”

Seriously? You are the one that is denying what you said. But like a little child caught with his hand in the cookie jar you come out screaming liar liar pants on fire. It never changes. You say something really stupid and then deny doing so when your stupidity is exposed. Hint – don’t say stupid things and you will not have to deny it later. That would save the rest of us a lot of time.

“These companies seem to operate very differently than gas stations which raise prices on whiff of a producer price increase and lower them almost as fast.”

The oil sector is perfectly competitive but the lumber sector is some vast cartel? Someone has Flown Over the Cuckoo’s Nest! What’s next? A claim that the smart phone market is perfectly competitive?!

JohnH,

It is my understanding that pgl works in the private sector, not in acadremia. He is therefore not in an “ivory tower,” much as you might like to imagine that he is.

Some in the corporate sector got tired of me actually telling the truth so yea they accused me of being in ivory tower quite a bit.

Trump’s 2017 tax cut for the rich included something called the Foreign Derived Intangible Income provision which gave a 13.125% tax rate on certain forms of corporate income. The OECD declared this to be a Harmful Tax Practice noting it will be eliminated. Of course the entire 2017 tax cut for the rich should be abolished.

https://www.oecd.org/tax/beps/harmful-tax-practices-peer-review-results-on-preferential-regimes.pdf

Thanks for this post Menzie. It’s a clear description of gravitational effects on the price of an abundant commodity. If demand stays strong I predict lumber to average around $600 per thousand b.f. through next year. Higher than the trend last decade but that reflected lingering effects of the housing crash.

http://www.xinhuanet.com/english/2021-08/06/c_1310111821.htm

August 6, 2021

Over 1.74 bln doses of COVID-19 vaccines administered in China

BEIJING — More than 1.74 billion doses of COVID-19 vaccines had been administered in China by Thursday, the National Health Commission said Friday.

[ Chinese coronavirus vaccine yearly production capacity is now over 5 billion doses. Along with over 1.741 billion doses of Chinese vaccines administered domestically, another 750 million doses have been distributed internationally. A number of countries are now producing Chinese vaccines from delivered raw materials. ]

https://news.cgtn.com/news/2021-08-05/Xi-Jinping-sends-message-to-intl-COVID-19-vaccine-meeting-12u3XcrwA8g/index.html

August 5, 2021

Xi Jinping: China to provide 2 billion COVID-19 vaccines to the world this year

China will strive to provide 2 billion doses of COVID-19 vaccines to the world and offer $100 million to the COVAX project throughout this year, Chinese President Xi Jinping said on Thursday in a written message to the first meeting of the International Forum on COVID-19 Vaccine Cooperation.

Xi recalled that at the Global Health Summit in May, he announced China’s five initiatives to support global solidarity in the fight against the pandemic, including the initiative to set up an international forum on vaccine cooperation for vaccine-developing and producing countries, companies and other stakeholders to explore ways of promoting fair and equitable distribution of vaccines around the world.

As the world has seen repeated resurgence and frequent mutations of the coronavirus, Xi voiced the hope that the forum can take a new step forward for fair access to vaccines around the world, inject new momentum for solidarity and cooperation among developing countries, and make a new contribution to the early victory in humanity’s fight against the pandemic.

China always stands for the vision of building a community of common health for mankind, Xi said, adding that China has provided COVID-19 vaccines to the world, especially to other developing countries, and conducted joint vaccine production.

“That is what it means to make vaccines a global public good,” he stressed….

https://www.nytimes.com/2021/08/06/world/africa/covid-19-global-hunger.html

August 6, 2021

No Work, No Food: Pandemic Deepens Global Hunger

Relentless waves of the virus, combined with crises caused by conflict and climate change, have left tens of millions of people around the world on the brink of famine.

By Christina Goldbaum

Photographs by Joao Silva

EAST LONDON, South Africa — Even as thousands died and millions lost their jobs when the Covid-19 pandemic engulfed South Africa last year, Thembakazi Stishi, a single mother, was able to feed her family with the steady support of her father, a mechanic at a Mercedes plant.

When another Covid-19 wave hit in January, Ms. Stishi’s father was infected and died within days. She sought work, even going door to door to offer housecleaning for $10 — to no avail. For the first time, she and her children are going to bed hungry.

“I try to explain our situation is different now, no one is working, but they don’t understand,” Ms. Stishi, 30, said as her 3-year-old daughter tugged at her shirt. “That’s the hardest part.” …

ltr,

“fair and equitable” Sure. PRC is distributing them for pay, not donating them like the US is.

ltr,

This is a bit off, and I do not expect you to respond to it, but during the now nearly done Olympics apparently (according to today’s Washington Post) there has been a major outbreak of ORC citizens harassing on the internet gold medal winners from other nations who have beaten PRC athletes in certain competitions, such as the Japanese table tennis team that unexpectedly defeated the top PRC team. I already think it is bad for drooling nationalists in any nation to harass Olympic athletes for any reason, and we have had quite a few Americans giving some of our ahtletes heck over various things. But it is far worse for them to harass the athletes of other nations who defeat their athletes. This is completely unacceptable and just plain disgusting, and it is only people from the PRC engaging in this sort of thing.

I understand that this is only a small number of people out of the large population of PRC, most of whose citizens are decent people. But it is a sign of the degeneration that is going on to Chinese culture and society under the dictatorial rule of Xi Jinping that you constantly defend. No amount of economic growth justifies this sort of conduct anymore than it justifies what is being done to many Uyghurs in Xinjiang.

If one is upset that another athlete beat you – train harder. Of course there is this American league team in my city where the fans think they should win the World Series every year. Yankees Stadium sucks and the beer cost $9 for stupid Budweiser.

https://www.bls.gov/news.release/empsit.a.htm

BLS just released the July employment report. Payroll survey says 943 thousand new jobs. Household survey showed even more employment increase with the employment to population ratio increasing from 58.0% to 58.4%. Unemployment rate fell even as the labor force participation rate increased.

Figure 3 looks about right according to the people I know in the residential building trades. Although the futures bode well, retail prices still haven’t come down yet and there are extreme shortages of the most basic lumber materials like plywood. Even if willing to pay 400% price premiums, they still can’t get materials. It looks like it is going to be toward the end of this year before things return to something like normal.

This has a big impact on residential investment in GDP. The people I talk to have put many of their projects on hold or slow walk this year. I would hope for a pretty good rebound in residential investment later this year as this backlog clears.

The backlog will eventually clear and those sky high prices will eventually come down.

If you are on Dean Baker’s email list, you got his latest on the labor market. Lots of interesting details with this being the section that caught my interest:

Mixed Evidence on the Labor Shortage Story

The Employment Cost Index (ECI) for the second quarter showed that many of the claims about soaring labor costs were not true. The ECI rose just 0.7 percent in the quarter and is up just 2.9 percent over the last year. However, wages do appear to be rising rapidly at the bottom.

Pay for production and nonsupervisory workers in leisure and hospitality is up 13.0 percent from its year-ago level. It has been rising at an annual rate of 24.3 percent for the last three months (May, June, and July) compared with the prior three months (February, March, April).

The average hourly wage overall is up 4.0 percent for the last year. That is somewhat more rapid than the pre-pandemic clip but can certainly be supported by the rapid productivity growth we have seen in the pandemic. It is important to remember that there was a large shift from wages to profits in the first quarter.

Note the FRED reports PPI for June 2021 and this reporting was just a shade lower than the very high lumber index for May. Maybe the July reporting will be even lower but my point is that future prices are a signal where spot prices might go.

That some retailers have not reduced their prices to pre-pandemic levels should be a surprise and is certainly not evidence that high retail prices are here to stay. And yet at least one person here is claiming this new theory has been vindicated. Seriously?

An update on that semiconductor shortage that has Bruce Hall freaking about:

https://asia.nikkei.com/Business/Tech/Semiconductors/TSMC-to-increase-auto-chip-output-by-60-in-2021

Taiwan Semiconductor’s production is at 160% of its pre-pandemic level. The Semiconductor Industry Association is saying production is for other suppliers. Of course when President Biden calls on more American semiconductor production, Bruce Hall objected. Go figure!

:”JohnH

August 8, 2021 at 8:24 am

It looks like pgl could be just plain wrong yet again. Lumber prices have not fallen much at the retail level, which is the point I was trying to make.”

Of course I have never made the claim that retail lumber prices have fallen to pre-pandemic levels so this starts with a flat out lie. They have fallen a bit but JohnH did try to tell us they would never fall. He denies that now which of course is more dishonesty. And he did try to concuct some bizarre oligopoly theory which this shape shifting clown now runs away from.

And so it goes with his incessant nonsense and utter dishonesty.