Some observations: (1) The blockbuster number (943 K vs 870K fm Bloomberg consensus) has to be kept in perspective, as NFP employment is far below trend, (2) high contact intensive services employment was recovering quickly through the reference period before the delta variant surge, (3) both average nominal wages and aggregate hours continued to rise, and (4) average real wages likely stabilized in July, at about 1.5% above 2016-19 trend.

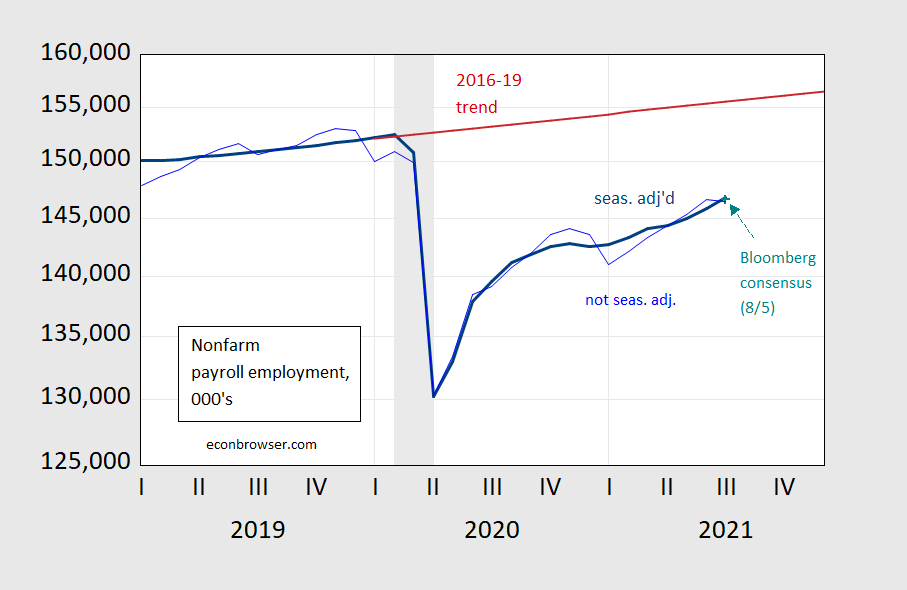

Figure 1: Nonfarm payroll employment, seasonally adjusted (bold blue), seasonally unadjusted (light blue), Bloomberg consensus of 8/5 (teal +), 2016-19 stochastic trend (red), all in 000’s. NBER defined recession dates shaded gray. Source: BLS, Bloomberg, NBER and author’s calculations.

Despite the large number, employment in the big picture does not look much above expected (from the Bloomberg consensus), and remains 5.7 million shy of peak (3.8% in log terms). Employment is 5.8% below the 2016-19 trend. Note that the seasonally adjusted and not seasonally adjusted series agree on the levels of employment, as do the 12 month percentage changes.

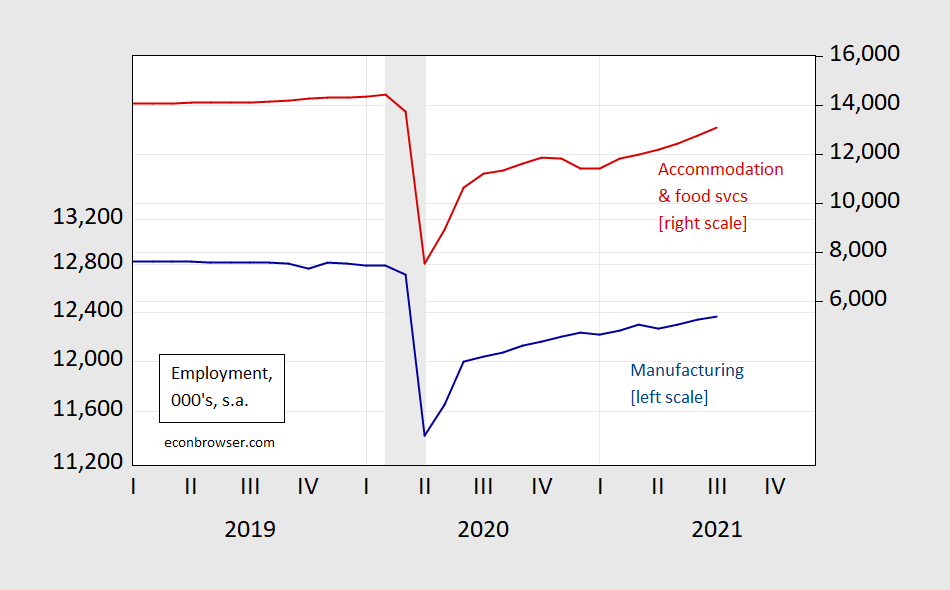

The sectoral distribution of growth is also remarkable. Manufacturing continues to grow as it has, after a couple of hiccups, but accommodation and food services have really staged a comeback – at least through the 2nd week of July (the reference period).

Figure 2: Manufacturing employment, (dark blue), accommodation and food services (red), all seasonally adjusted, in 000’s. NBER defined recession dates shaded gray. Source: BLS, Bloomberg, NBER and author’s calculations.

Nonetheless, accommodation and food services employment remains 9.7% (1.3 million) below peak, while manufacturing employment is only 3.4% below (433 thousand). And this is before the impact of the delta variant was being felt in terms of risk averse behavior in high contact activities, occurring toward the end of July.

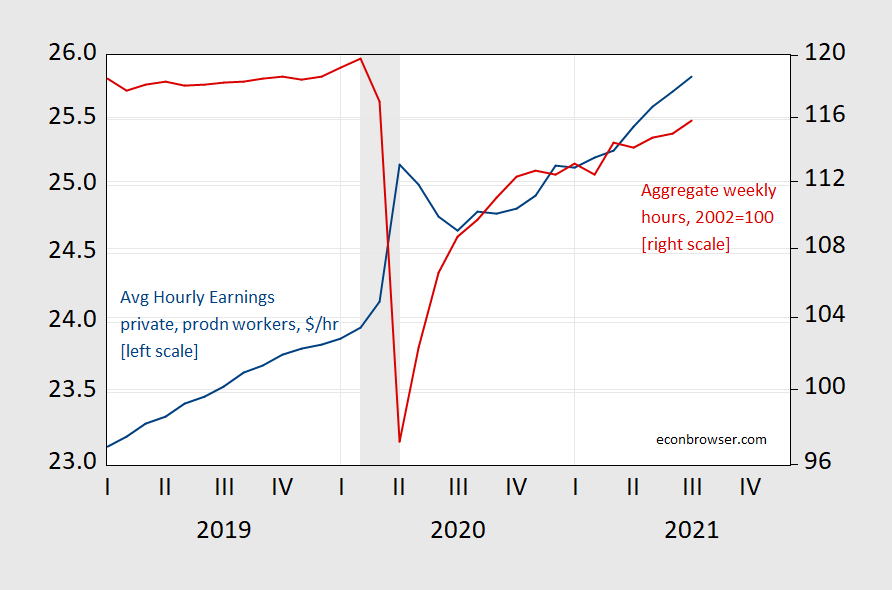

Aggregate weekly hours continued its climb, and hence too did (composition unadjusted) average hourly earnings.

Figure 3: Average hourly earnings, $/hr (blue, left log scale), aggregate weekly hours index, 2002=100 (red), both seasonally adjusted. NBER defined recession dates shaded gray. Source: BLS, NBER.

With rapid see-saws in inflation taking place, it’s important to think about real earnings (it would be better to look at earnings by categories or by income deciles, but I haven’t had a chance to do that). Figure 4 shows real average hourly earnings, calculated using the CPI-all (and the Philadelphia Fed’s nowcast for July).

Figure 4: Real average hourly earnings in total private sector, 2019$/hr, seasonally adjusted (blue), real earnings based on Philadelphia Fed nowcast (teal +), and 2016-19 stochastic trend (red), both on log scale. NBER defined recession dates shaded gray. Source: BLS, Philadelphia Fed, NBER, and author’s calculations.

Real average hourly earnings have come down substantially — of course not adjusted for composition. They now seem to be relatively flat going from June to July. If the July nowcast proves accurate, then real average hourly earnings are only about 1.5% above the 2016-19 trend.

As noted in this post, reported CPI probably understated inflation in 2020, and overstated inflation in 2021. If that is the case, then the fall in real average earnings since 2020M04 is probably smaller, and the deviation relative to trend in July 2021 larger.

Update, 8/6 4:30pm Pacific:

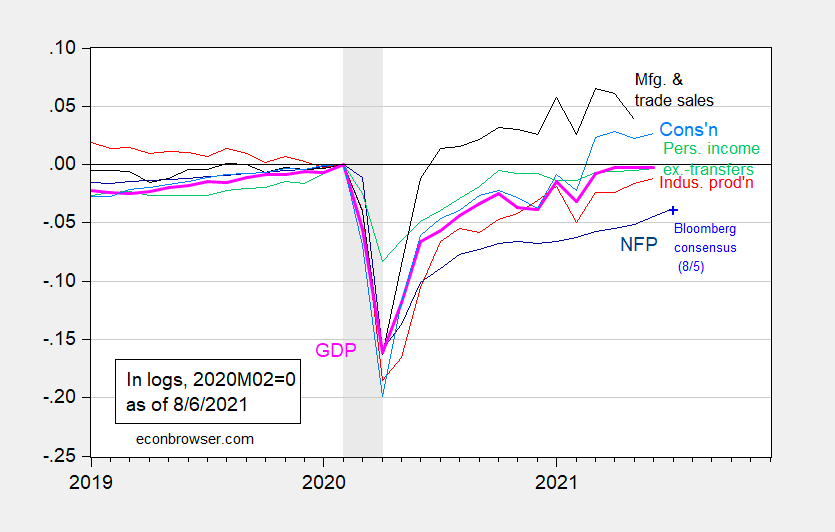

Here is nonfarm payroll employment in the context of some key indicators followed by the NBER BCDC.

Figure 5: Nonfarm payroll employment from July release (dark blue), Bloomberg consensus as of 8/5 for July nonfarm payroll employment (light blue +), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (8/2/2021 release), NBER, and author’s calculations.

Speaking of composition, “The Economist” is apparently suggesting that a rapid U.S. recovery may lead to faster productivity growth: https://www.economist.com/finance-and-economics/2021/08/07/americas-roaring-recovery-might-carry-lessons-for-future-recessions

It’s behind a paywall and I’m not, so I don’t know what the argument is. There are two I can think of — one good and one bad. The good argument is that economies running near or above “potential” tend to increase productivity faster than less hot economies. The bad one is a shorter-term argument based on aggregate data, without considering composition. We lost a ton of low-end service jobs (waiters, janitors, cooks, hotel staff), which removed a good bit of low-productivity hours from the productivity calculation. Big step upward in measured productivity: https://fred.stlouisfed.org/series/OPHNFB

Now, I think it would be great to have a secular shift toward higher output jobs, but so far any shift has largely been cyclical. Today’s data show that the composition of employment is shifting back toward the pre-pandemic situation, which will cut down on productivity gains.

And hourly wage gains, but less so. Hourly earnings for leisure and hospitality workers rose 0.9

Speaking of composition, “The Economist” is apparently suggesting that a rapid U.S. recovery may lead to faster productivity growth: https://www.economist.com/finance-and-economics/2021/08/07/americas-roaring-recovery-might-carry-lessons-for-future-recessions

It’s behind a paywall and I’m not, so I don’t know what the argument is. There are two I can think of — one good and one bad. The good argument is that economies running near or above “potential” tend to increase productivity faster than less hot economies. The bad one is a shorter-term argument based on aggregate data, without considering composition. We lost a ton of low-end service jobs (waiters, janitors, cooks, hotel staff), which removed a good bit of low-productivity hours from the productivity calculation. Big step upward in measured productivity: https://fred.stlouisfed.org/series/OPHNFB

Now, I think it would be great to have a secular shift toward higher output jobs, but so far any shift has largely been cyclical. Today’s data show that the composition of employment is shifting back toward the pre-pandemic situation, which will cut down on productivity gains.

Recovery will also cut down on average hourly earnings gains as composition shifts, but not completely. Restaurants are paying up for workers. Hourly earnings for leisure and hospitality workers rose 0.9% on the month and are up 9.6% on the year. Manufacturing up 0.5% m/m, 3.3% y/y. All private employees 0.4% and 4.0%.

https://fred.stlouisfed.org/graph/?g=lSy9

January 30, 2018

Manufacturing and Nonfarm Business Productivity, * 1988-2021

* Output per hour of all persons

(Percent change)

https://fred.stlouisfed.org/graph/?g=lSyd

January 30, 2018

Manufacturing and Nonfarm Business Productivity, * 1988-2021

* Output per hour of all persons

(Indexed to 1988)

https://cepr.net/the-saving-rate-is-still-high-evidence-on-the-post-pandemic-economy/

August 1, 2021

The Saving Rate is Still High: Evidence on the Post-Pandemic Economy

By Dean Baker

An important item in the GDP report released this week, that received little attention, is that the saving rate is still well above the pre-pandemic level. For the second quarter as a whole the saving rate was 10.9 percent. If we just look at the month of June alone, the last month in the quarter, the rate was still 9.4 percent. This compares to an average saving rate of 7.5 percent in the three years prior to the pandemic.

For those not familiar with this economic concept, the saving rate is the percent of after-tax income that is not spent. To be clear, not spent means literally that people did not use it on consumption. If they used their income to pay for rent, buy a car, pay for their college, this would all be counted as consumption….

Productivity in the Pandemic

One hugely important point that has not gotten nearly enough attention is the sharp uptick in productivity since the pandemic began. GDP in the second quarter was 0.8 percent higher than in the fourth quarter of 2019. On average, we had 4.4 percent fewer people employed in the second quarter of 2021. If there was no change in average hours worked, that would imply an increase in productivity of more than 5.0 percent, almost 3.4 percent on annual basis.

Of course, there was some increase in average hours and other factors, like the self-employed and the government sector, complicate the calculation. However, productivity clearly grew far more rapidly than the 1.0 percent annual rate for the decade prior to the pandemic.

This is a huge deal in the context of inflation fears. The 1970s stagflation was associated with a sharp slowing in the rate of productivity growth, from an average annual rate of 3.0 percent in the period from 1947 to 1973, to just over 1.0 percent from 1973 to 1980. If we can sustain even a modest uptick in productivity growth from the pre-pandemic pace, it will go far towards eliminating the risk of inflation.

It’s also worth noting the latest GDP data, which include the comprehensive revisions to data from 2019 and 2020, shows a sharp increase in the profit share of corporate income in the first quarter of 2021. The profit share rose to 25.5 percent in the first quarter of 2021, compared to an average of 23.9 percent in 2020.

This rise in profit shares goes directly at odds with the idea that excessive wage growth will lead to higher prices, producing a wage-price inflationary spiral like we saw in the 1970s. In the 1970s, the profit share of income fell.

The Economist –

“Perhaps growth in expanding, high-productivity industries, which can afford to pay higher wages, will continue, leaving fewer people willing to fill low-productivity, low-wage service-sector jobs. Where past jobless recoveries might have encouraged the creation of more low-wage services jobs, a faster expansion today might break the link, perhaps forcing employers in these industries to automate instead.”

Real wages are down a bit since Trump’s last quarter in office…and dropping. The increase in inflation is likely to exacerbate the drop.

https://fred.stlouisfed.org/series/LES1252881600Q

Democrats face a real challenge, particularly if real wages drop another 5% per cent returning them to Obama era levels. (They have already dropped 5% since their peak.)

You can be certain that Republicans will use the numbers to evoke nostalgia for the Trump economy (pre-pandemic.)

And you can also bet that the oligopolists who dominate the economy will use inflation as an excuse to boost prices and profits while granting “generous” but wage increases that lag inflation and are below it (except of course for select, “highly productive” employees, like CEOs. As someone once said, inflation is essential for economic growth because it allows “highly productive” employees to be motivated and rewarded, while limiting the real wage increases of the less productive hoi polloi.

Class warfare at its best!

JohnH,

Ah, ever the Tramp defender. But there is another explanation for this that has nothing to do with inflation but that is obvious and you missed it. It is that a disproportionate number of those laid off in the pandemic were low wage workers, so, duh, the median real wage rose during it, and now that it has pulled back a lot of those laid off are being rehired so that the median goes back down again.

Indeed, there is a study out of a place you claim to admire, EPI, that says exactly this. It came out on May 20, 2021:

epi.org/publication/swa.2020-employment-report .

OK Barkley, let’s leave out all the pandemic numbers. Under Trump (3 years pre-pandemic) real wages grew 3.7%. Under Obama (8 years), they grew 2.6%. If real wages fall more than 3% for the reasons you cite, they’ll be below Trump’s 4Q19 figure. That spells trouble, like it not…call me a Trump supporter for pointing out reality, or not.

You can bet that Republicans will exploit it.

Facts don’t have a partisan bias. Personally, I like what Biden’s trying to do, but Democrats tend to get complacent when GDP is growing nicely. They harbor the illusion that the economy performs better under Democrats. But GDP is only a measure of how well the affluent are doing, since they are the minority that takes home most of national income. Democrats need to keep their eyes on the ball—it’s the economy, stupid. And by “the economy,” they should be conjuring up images of the “kitchen table” —median real wages and real median household income.

John, c’mon. Wages rise faster as the labor market tightens. Trump followed Obama, so wages rose faster under Trump. The length of the expansion is all that is needed to explain wage patterns, and there is no evidence that Trump had any effect on the length of the expansion.

Economics drives politics far more than politics drive economics during expansions. During recessions and recovery, it can be the other way around. Obama was inaugurated during a recession, so credit may go to him. Trump was innaugurated when expansion was already quite mature.

By the way, it is not an illusion that the economy performs better under Democrats. It may be a coincidence, but it isn’t an illusion.

I agree that the relationship between a President and performance of the economy during his tenure is vastly exaggerated. I mean, Democrats cite how badly the economy did under Trump, and they’re right, although the poor performance was COVID-related (force maneuver.) Trump OTOH claims that people were better off under him than ever before, and they’d be right. Statistics bear that claim out, though it could be argued that the Fed and the Obama years set the table for Trump’s success.

However, perceptions matter. And people do care about how well they are doing, particularly if they are not doing well. Fact is, people did not do well under Obama. Incomes stagnated. And Obama responded with benign neglect, as did Hillary. The affluent we’re doing fine, and that was all that mattered to them. The ‘deplorables’ could go pound sand.

But Trump appeared to care. He appealed to the deplorables. He talked about how the economy affected them, as if he actually cared (which he didn’t.) And the economy performed under Trump, though Trump perhaps deserves no credit at all. Lots of voters remember that they were better off than ever before under Trump. And if they don’t remember, Republicans are sure to remind them.

So Democrats are in a bind. Lots of people remember stagnation under Obama and his indifference. And they remember Trump’s seizing the issue and the economic success under him. So Biden is under the gun. He has to deliver or else Democrats are toast.

However, Democrats prefer to deflect attention to anything but the economy—particularly to racism, Putin, etc. They simply have had no coherent economic message for a long time. And if oligopolists take advantage of inflation to make ordinary Americans worse off, there will be hell to pay…and Democrats will be frozen like deer in the headlights. Their highly compensated, highly credentialed base will still be doing fine, and, unless sclerotic octogenarians leading things have an epiphany, and learn how to talk about the economy, they’ll soon be consigned to the dustbin of history.

Force majeure, not maneuver…stupid spell checker

JohnH,

The big problem is that while indeed the economy continued to grow under Trump and real wages rose, virtually every serious study made shows that the effects on the economy of Trump’s trade war were negative, with the exception of handfuls of workers in a few industries. But the joke is that even in some of the industries he was trying to protect the net effect was negative due to pushback from other nations.

Oh, and he did help out some who were hurt by his policies, such as soybean farmers, but had to do so by passing special legislation to simply outright give these people money. The effect of his trade war was to hurt them.

All his “seeming to care,” which seems to really impress you, was just another of his 30,000 plus lies. Why are you such a sucker that you fall for that rank and stinking scheiss?

The old political catechism was that politics (especially local politics) was all about paychecks – except in the South, where the bottom line was always about race.

It’s quite arguable, convincingly I fear, that in modern times, politics is all about social values, not income. Or to put it more crudely: it’s all about dead babies, not wages.

I used to resist the notion that James Davis Hunter et al, were right the great Culture War – our era’s Civil War – being so predominant.

Not anymore.

I don’t think race explains why the Rio grande valley went for Trump or why so he got so many more votes in 2020. The idea that millions of closet racists suddenly decided to show up in 2020 is not plausible. The but the fact that millions of voters had been better off under Trump than ever before is highly plausible, much as Democrats hate to admit it, preferring to attribute everything to racism, even Latinos voting for Trump.

I am sorry that you quite misunderstood my statement.

I will assume that it was accidental.

shrug

JOhnH,

No, JohnH,, most polls suggest that is not it, or certainly not the whole story or most of it. The Biden people messed up with Hispanics, not getting their communications with them going at all well, a big mistake. So Trump people blanketed places like Rio Grande valley and South Florida with stories of how socialist Biden is, and it got bought. That is it pretty much.

We can certainly disagree about this. Surprisingly little research has been done on it.

But according to CNN exit polls, “Americans who voted for President Donald Trump care predominantly about the economy, while those who voted for Democratic nominee Joe Biden care predominantly about racial inequality, according to CNN’s exit polls.

62 percent of Trump voters ranked the economy as the most important issue, followed by 17 percent for crime and safety, 8 percent for healthcare, 5 percent for the coronavirus, and 3 percent for racial inequality.”

https://www.msn.com/en-us/news/politics/cnn-exit-poll-finds-biggest-issue-for-trump-voters-is-the-economy-biden-voters-is-racial-inequality/ar-BB1aFtkH

So, if Democrats are truly serious about attracting Trump voters, maybe they should talking about the economy? It’s really strange that they have had no coherent economic message for so long, despite its Importance to so many voters.

John, I’m trying to cut you some slack, but we’ve all seen your sort of schtick before. Pretend objectivity while offering biased claims as if they are facts. An instance or two:

“no coherent economic message” Infrastructure. Social spending, including extended jobless benefits in states run by Democrats. Vaccination. Vaccination is a truly coherent economic message.

“Democrats prefer to deflect attention to anything but the economy.” Biden doesn’t run to a microphone with near the frequency that Trump did, but when he does, he talks mainly about Covid and economic programs. Bernie and Ocasio-Cortez and their buddies talk endlessly about the economy.

“Lots of people remember stagnation under Obama and his indifference.” Lots, you say? You’ve counted them? Do these same people believe that Covid vaccines make their bodies magnetic and that death panels are a big part of Obamacare? Perhaps you meant to say “Lots of people got together and re-elected Obama.” Or “Obama’s approval rating at the end of his term was quite high.” Or “The term ‘Obamacare” went from being a burden to Democrats to being a boon once the public realized what it really is.” Those statements all have the virtue of being objectively correct and verifiable.

Then there’s the other element to your schtick. When called on your efforts to distort the facts, you claim Democrats are PERCEIVED to be what Republicans claim them to be. Well la dee dah! That is no more than to say that Republican politicians lie about Democrats and their voters believe them. Funny how, instead of calling out Republicans for lying, you blame Democrats for the effect of the lies.

Tell ya what — How about the next time you want to claim that lots of people think or say or believe or do something, you tell us who those people are and how you know? ‘Cause you see, one of the symptoms of your “Oh, I’m just saying stuff everybody knows” style is the avoidance of falsifiability. People REMEMBER that Obama was indifferent, even if he wasn’t. LOTS of people remember, however many or few that might be. Save it for the rubes.