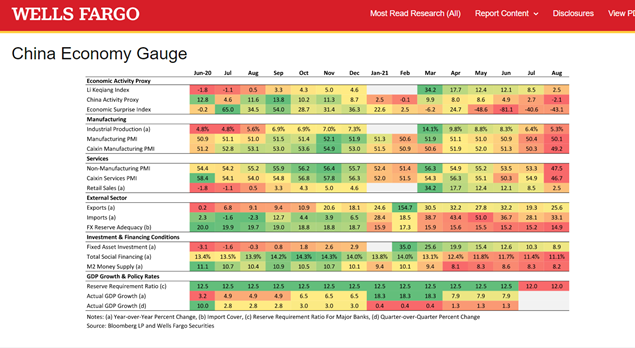

Wells Fargo Economics analyses the extent of the current slowdown, and contemplates the impact on regional economies. Here’s the heat map:

Source: McKenna/Guo, “China Economic Gauge and Sensitivity”, Wells Fargo Economics, 20 Sep 2021, Figure 1.

From the report:

Our dashboard (Figure 1) suggests the short-term outlook for China’s economy is indeed deteriorating, consistent with the multiple downward revisions we have made to our GDP forecast over the past few months. Given the signals our gauge is showing, we believe easier monetary policy could be the next major policy move from the PBoC, and another RRR reduction could be imminent as authorities look to offset some of the deceleration.

This report is in line with the Goldman Sachs report (discussed here).

Wells Fargo highlights Singapore, South Korea and Chile as most sensitive to growth developments in China (on the basis of exports). Looking more broadly at “beta’s” of equity returns and currency values as well as export dependence, the list of at risk countries expands to include South Africa, Brazil and Russia as well.

“we believe easier monetary policy could be the next major policy move from the PBoC, and another RRR reduction could be imminent as authorities look to offset some of the deceleration.”

My understanding (please correct me if this is wrong) is that interest rates in China are not as low as interest rates in the US so there may be some scope for easy money.

Another concern for the People’s Bank is the near bankruptcy of Evergrande. Have these analyzes commented on the latter?

A lot of buzz today is that the fairly sharp drop in stock markets around the world has been mostly driven by reports of the worsening problems of Evergrande, with the crypto and oil markets also making noticeable drops (although both Brent and WTI still above $70 pb). The other buzz is that the markets don’t like GOP gaming on raising the debt ceiling, which should simply be abolished. I am not sure why Dems seem to be holding back from just sticking that into the reconciliation so as to stop letting McConnell’s contradictory noises spook people.

“I am not sure why Dems seem to be holding back from just sticking that into the reconciliation so as to stop letting McConnell’s contradictory noises spook people.”

I’m not either but there is a buzz that Schumer has something up his sleeve to get this down leaving Senator Turtle out in the cold. Why we do this debt ceiling dance in the 1st place is beyond me.

Why we do this debt ceiling dance in the 1st place is beyond me.

Frankly, it’s part of a pretend game that has been going on for many decades, regardless of which party is in control of Congress.

“We’ll pretend that we still have the ‘power of the purse’ and are a co-equal branch of the Federal Government.”

The reality, as we all know is quite different. Congress is the petulant, aging badly, junior partner.

An efficient, well-run government would operate far more rationally, but the American public, by word and deed, made it clear from the earliest days of our history that didn’t really want that. What is unacceptable in corporate America is desirable in political America.

Ah well, it is what it is….

they [congress] pretend they “sett the value of the currency”…….

Which member of Congress stated they set the value of the currency?? Name one name,

Now now, Moses. Paddy here has said that what Congress is pretending to do is to “sett” the value of the currency. This is clearly something different from and far more important than any ability merely to “set” the value of the currency as you ask him to identify a member making such a claim. We must keep this important distinction in mind, or we shall get nowhere with this discussion, :-).

Yellen apparently thinks it’s important enough that she was the driving force behind this letter/letters:

https://home.treasury.gov/system/files/136/Former-Treasury-Secretaries-Letter-to-Congressional-Leadership-on-the-Debt-Limit-9-22-21.pdf

Even Sensitive Stevie Mnuchin signed it. He says it was signed in special dedication to all UCLA students.

https://www.international.ucla.edu/burkle/multimedia/189606

I am a bit surprized that Wells Fargo mentions monetary easing but not (as reresented in the quote from the report) fiscal policy. Evergrande’s predicament is the result of a decision to curtail risky behavior among construction firms. That decision has meant cutting back on credit to risky builders and speculation among investors. Easing monetary policy sees contradictory. Not that monetary easing won’t be undertaken, but housing construction is a big component of economic growth in China and if it slows,expanding bank credit without also increasing social spending seems pretty one-sided.

I’ve read suggestions that the Evergrande workout will involve making home buyers (nearly?) whole, wiping out equity, and bond-holder losses on the order of 75%. Making home buyers whole would mean burdening other construction firms with Evergrande’s housing contract liabilities – which I believe is the bulk of $305 billion in liabilities. That’ll put a hitch in their giddy-up for quite some time. Cut the reserve requirement? Sure, but not massively given policymakers’ worry over bad credit. Won’t fiscal policy be a big art of the solution?

@ macroduck

This is the major “take away” from Pettis’ thoughts, though reading this specific/entire Twitter feed is worth it, along with the links:

https://twitter.com/michaelxpettis/status/1439851291547635714

The thing to remember about Pettis is, he’s not some white guy who once went to a McDonald’s outside some 5-star hotel in Shanghai, passing himself off as an “expert on China” by reading off clichés. He’s spent a major portion of his adult life there, and knows how to straight state the truth without pissing off the locals (which is actually a major task in word play and semantics over there).

Based on far less knowledge, I agree with Pettis. Two factors allowed Lehman to cause massive harm. One was transmission through overnight lending; whose collateral was no longer good? That was a big structural problem. The other was the realization that government would allow the failure. The two were related.

There is very little question that China’s government lacks the tools or the intent to keep financial channels open.

There will be consequences, naturally. There are funds open to individual investors, “wealth management products”, which held Evergrande debt, so there will be a contractionary wealth impact. Holders of home purchase contracts face loss or uncertainty hich is likely to have q contractionary effect. Other builders mqy be saddled with Evergrande’s housing contracts and the terms under which that happens will determine the value of those firms and their ability to produce. Collateral has been reduced. So systematic effects, but the government has the ability to limit systemic spread.

Am I the only one surprised that Australia wouldn’t have been spotlighted by Wells Fargo as one of the nations “sensitive to growth developments in China”??

Where’s Not Trampis when you need him??

https://www.theguardian.com/business/grogonomics/2021/sep/21/unemployment-in-australia-only-45-wait-until-i-stop-laughing

https://news.cgtn.com/news/2021-09-21/Chinese-mainland-reports-72-confirmed-COVID-19-cases-13Jjsr7hebm/index.html

September 21, 2021

Chinese mainland reports 72 new COVID-19 cases

The Chinese mainland recorded 72 confirmed COVID-19 cases on Monday, including 42 cases of local transmission of the virus, all in southeastern Fujian Province, the latest data from the National Health Commission showed on Tuesday.

In addition, 13 new asymptomatic cases were recorded, while 349 asymptomatic patients remain under medical observation.

This brings the number of confirmed COVID-19 cases on the Chinese mainland to 95,810, with the death toll remained at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-09-21/Chinese-mainland-reports-72-confirmed-COVID-19-cases-13Jjsr7hebm/img/5981f0932b234f34b38d7627b6d14189/5981f0932b234f34b38d7627b6d14189.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-09-21/Chinese-mainland-reports-72-confirmed-COVID-19-cases-13Jjsr7hebm/img/ac96fa8026944ea3a408d0c7741f0697/ac96fa8026944ea3a408d0c7741f0697.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-09-21/Chinese-mainland-reports-72-confirmed-COVID-19-cases-13Jjsr7hebm/img/5e9cdd22ed824230ab95493854f5f4b1/5e9cdd22ed824230ab95493854f5f4b1.jpeg

http://www.news.cn/english/2021-09/21/c_1310200700.htm

September 21, 2021

Over 2.18 bln COVID-19 vaccine doses administered in China

BEIJING — Over 2.18 billion COVID-19 vaccine doses had been administered in China as of Monday, data from the National Health Commission showed Tuesday.

[ Chinese coronavirus vaccine yearly production capacity is more than 5 billion doses. Along with over 2.18 billion doses of Chinese vaccines administered domestically, more than 1 billion doses have been distributed to 100 countries internationally. ]

must you repeat this on every one of dr. chinn’s posts? as pointed out already, these are posts from cgtn.com and news.cn, both of which are media propaganda arms of the ccp.

https://www.worldometers.info/coronavirus/

September 21, 2021

Coronavirus

United Kingdom

Cases ( 7,496,543)

Deaths ( 135,455)

Deaths per million ( 1,983)

China

Cases ( 95,810)

Deaths ( 4,636)

Deaths per million ( 3)

1. The tools Chinese monetary authorities have are not the precision weapons (by comparison) available to the Fed. We’re talking stone-age hammers: lend more to THIS kind of company, and less to THAT kind.

2. Interest rate levels adjustments have a big impact on borrowers able to get loans from banks. In other words, SOEs and a few big private companies. For the most part, access to loans is far, far more important than the price of money.

to their credit, the chinese can impart policy that is not deemed “fair” to all involved. we would not promote this in the usa, as it allows government to pick winners and losers. but that can, and is, done in china on a routine manner. now they make make poor decisions on who should win or lose. but when they make reasonable decisions, the impacts can be significant and fast.

As to the intersection of Covid and Evergrande, well, uh oh?

https://voxeu.org/article/can-china-s-outsized-real-estate-sector-amplify-delta-induced-slowdown

I realize linking to Rogoff raises the risk of getting side-tracked, but maybe we can let him slide just once?

“With real estate production and property services accounting for 29% of GDP – rivalling Ireland and Spain at their pre-financial crisis peaks – it is hard to see how a significant slowdown in the Chinese economy can be avoided even if banking problems were contained.”

Figure 2 is instructive. I get China likely needed a lot more housing for its urban areas but DAMN!

Given our Princeton Steve is playing Chicken Little over the US housing boom as it is 2007 all over again (it’s not) and given Princeton Steve has utter disdain for China, why isn’t his hair on fire over this issue?

The charts in the Rogoff article ( linked in an earlier comment) show that China has a relatively high square footage of housing per person and a very high share of housing construction in output after a sharp acceleration in housing construction. Taken togeher, these facts suggest that housing demand has been pulled forward in time. Pulling consumption forward, with debt as the driver, is the Mian and Sufi recession formula :https://press.uchicago.edu/ucp/books/book/chicago/H/bo20832545.html.

Evergrande may be a symptom of a wider adjustment away from the over-production of housing in China. Rogoff’s final paragraph seems to take such an adjustment for granted. If that’s the case, then how does China (or does China) maintain growth after the adjustment?

Just a comment here that probably none of us are in a position to figure out clearly what is the implication of what is going on with Evergrande. I bet even Brad Setser does not know, who knows more than any of us.

I have published several papers on financial markets in China, mostly with Chinese coauthors. It is now getting to be about 4 years since I was last there, but in all of the last several times the people I was interacting with, high-level economists, would tell me about how worried they were about the size and unknown nature of the hidden part of the Chinese financial market. I also note that there have been several real estate crashes in China, although none of them really triggering seriously broad economic or financial effects even in China, much less elsewhere. But my interlocuters were all worried about the Chinese financial system more broadly.

Now clearly Everrande is much larger than any entity like this to be i ndanger of collapse, and there have been some dramatic events, such as people actually demonstrating outside its offices due to some of its refusals to pay some people. I have been trying to figure out what is going on, but I do not have a handle on it. I think there several aspects of this that are important that we simply do not know about. One of those is the relation of Evergrande to that large and scary-to-Chinese economists hidden financial system. After all, that was a crucial element of how the real estate decline in the US starting in 2006 became the global Great Recession. Clearly there is a potential for some very large problems coming out of this. But then again, maybe the Chinese authorities will be able to paper it over, buy people out, whatever, as they have done in preciousl real estate crashes.

Who would you say, is the Chinese economist you enjoyed co-writing an academic paper with the most in the last 25 years?? Or before if you prefer.

Moses,

Not going to answer this, although my publication record is readily easily found (and it is irrelevant anyway). Do not wish to get anybody in trouble, anymore than I am going to say whom I talked with in China who have expressed concern about the state of Chinese financial markets. In case you have not noticed, relations have become somewhat dicey recently , and there seems to be a wave of general repression and purges going on there. Suspect I shall not be back, although I do not rule it out. But foreign travel period has become a major hassle.

Less than two weeks ago I failed to make it to a conference in Italy because my required-for-flying 72 hour PCR Covid test results did not come back until 2 hours and 2 minutes after my plane was supposed to take off from Dulles. Did still participate in the conference via Zoom, but needed to talk to some people there in person regarding certain matters (I hold a high position in the society that the conference was for and needed to take care of society business). No, not going to name it either. Your track record of trying to make fusses over such things involving me is just too long and well known, although perhaps you are trying to be friendly now. That would be most welcome, if true.

I thought so. Your comment speaks for itself. But jolly good show.

Moses,

Getting back to the main point rather than any personalities, This is one of those cases where I have learned enough to know that there is a heck of a lot that I do not know, despite my various publications, and not too many others do (and those that do are keeping their mouths shut, I think). The Chinese economy is going through a lot of big changes, with some of them not getting all that much attention.

So at the last live AEA meetings in San Diego in early 2020, just before the pandemic broke out big time I saw a presentation on how industrial organization in China is changing enormously and fairly rapidly. Supposedly large-scale structures are being developed that look like Japanese vertical keiretsu, pulling lots of the formerly local former TGVs into complicated supply chain networks, with these generally being run at the top by somebody who is if not an outright top CCP person then somebody closely connected to somebody who is.

I have seen nothing else anywhere on this development and do not know if it is true or not. But the authors were credible types, including a couple from PRC itself. A lot is going on, and there is a lot most of us do not know.

Thanks for not pushing me on personalities.

that is kind of like asking a father of two who his favorite child is. not a really good question, if you are looking for an honest response. it only serves to embarrass somebody.

I think I may have found the answers of which Chinese economists Barkley Junior co-wrote his papers with. Don’t quote me on this, it’s not 100% certain yet. I have to double check with David Ignatius’ moles at the CIA.

https://www.news.com.au/world/coronavirus/global/allegations-first-superspreader-covid-event-occurred-in-wuhan-military-games-in-october-2019/news-story/d7a612421bc888367020b7e3b8f5f072

This is top secret, so we can’t mention the names here. Writing academic papers with Barkley is risky in “the deep state” and spy communities. And who wrote the papers is so irrelevant, I don’t even know why Junior brought it up. This is Agent 88 signing off. Dear CONTROL, don’t take any wooden nickels and watch out for oil-slick sprayers from the back of Aston Martin cars.

Moses Herzog: You should read this article with the same critical eye you apply to articles from Fox News. See this Wikepedia entry on the news.com.au

@ Menzie

The entire point of quoting the article was its very absurdity. As in the same absurdity it takes to think Covid-19 came from a research lab, or the type of absurdity it takes to put up a fake front you’re “protecting Chinese colleagues” when he’s written an extremely small number of papers with them in the last 30 years. Do you think we could count on one hand the number of Chinese economists he’s co-written academic journal published papers with?? Not to mention the fact probably ZERO of them have a connection to the real estate market in China or construction research in China. Don’t bet your next paycheck on that one hand finger count Menzie. Having a PhD does not give Barkley the right to proclaim anything more than surface knowledge of a pretty complex topic. I’m willing to be educated, but I don’t see you doing many posts on petroleum engineering Menzie. The man needs to stay in his lane, he’s mostly embarrassing himself.

BTW, Menzie, all of this is stated with a high degree of respect to you, i.e. this is one of those things we will always have to “agree to disagree on”. But Barkley is “the Larry King” of name-droppers here on this blog. That is to say, trying not to be overtly vulgar, Barkley nearly reaches climax every time he can mention some colleague he “knows” (that probably amounts to, he talked a total of 4 minutes with them at two academic conferences). Now we’re supposed to believe a group of people he rarely co-authors academic papers with, is being “protected” by withholding their name~~~again to “protect” them. Menzie coming from “the Larry King” of name-droppers here on the blog, that one is a laugh riot. But not really the giggles type laugh riot, more like the open groaning type as you look off into the distance.

Moses,

Gosh, for a second I thought you were being reasonable and maybe even friendly. But, no, you are just playing your usual third rate vendetta games. I kind of suspected as much. Your questions/demands were all about trying to set yourself up to make some snotty remarks, as you have done.

As it is, this set looks pretty silly. You accuse me of being a name dropper, but in this case I have dropped no names even as you demanded names. You have accused me of claiming to have some deep knowledge of the Chinese economy that I do not have, when much of what I said here is that I do not know what is going on right now, although indeed I am pretty sure I know more about the Chinese economy than most commenting here. It may be that you are unhappy that I have suggested that others here also do not know what is going on, as we have had some folks here going on quite assertively about what is going on and patting each other on the back about how much they know. But I shall not name any names.

You then drag in this weird article that is supposed to be about economists I know. I did not see any Chinese economists quoted in that article. Of course somehow you think you are going to score points by bringing up the issue of where the Covid-19 virus started, with you regularly proclaiming that I have said it came from a lab, which you here ridicule. My line on this all along has been that we do not know, and that is what most official sources also say. You are the one who is full of it with your apparent claim that it could not have come from a lab.

And if you think you are going to impress people by sneering at David Ignatius, then you are even more out of it than this last bit makes you. He is probably the most respected observer/reporter/columnist on the US intelligence establishment there is at this point anywhere. You do not like some of his views, but you most certainly have provided zero evidence that he is wrong in his reporting or does not know what he is talking about. Indeed, on this matter that you keep harping on, I cited him as a source that US intel was not ruling out the Wuhan lab as a source of the virus. That report came at a time when in fact most people were ruling out the lab as a source, especially you. But it turns out he was dead right. US intel was still viewing the lab as a possible source and still does, and that view has now come to be widely accepted and is now the official public view of the US government. ignatius was totally right, and you have been totally dead wrong. Again, neither I nor Ignatius have said that it did come from the lab, as you keep falsely claiming, yet more blatant lying out of you, Moses. Our view is that it is unkonwn at this time where it came from, but the lab as a possible source cannot be ruled out.

Again, for the nth time, I do not think we shall ever learn the source for the obvious reason that the Chinese have either destroyed crucial evidence or are covering it up. it will remain a mystery, unfortunately.

I am sorry that my hope that you might be taking me up on my peace offering has not happened, and that you are just wallowing in your same old worthless lying and sick games.

https://fred.stlouisfed.org/graph/?g=GBiT

August 4, 2014

Real per capita Gross Domestic Product for China, India, Indonesia, Philippines and Thailand, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=GC6H

August 4, 2014

Real per capita Gross Domestic Product for China, Indonesia, Philippines, Thailand and Malaysia, 1977-2020

(Indexed to 1977)

[ Evidently the Chinese know how to grow, what matters lots and lots and lots. ]

ltr,

That a nation is rapidly growing does not mean that it cannot have serious financial crises. The US was growing rapidly during the last portion of the 19th century, but had two major crashes followed by deep depressions in the 1870s and the 1890s. And this was when the gold standard was in place, which many think provides some sort of financial stability (obviously not). So, bottom line, that China is growing rapidly does not immure it from financial crises, indeed, rapidly growing economies can be open to the sorts of destabilizing deals and scams that can lead to crises. History is full of this sort of thing, well beyond late 19th century US.

I note that this has nothing to do with official national debt levels, which you posted as some sort of supposed evidence that China is not susceptible to a crisis. Ooooh, Japan has a national debt level over 200% of GDP while PRC is at 70%! So, do you seriously think this means Japan is in greater danger of a financial crisis than PRC? If so, you are pretty isolated.

As it is, I can say very definitely that very serious people in China have been very worried about the size, nature, and operations of the shadow financial sector in the PRC. These people do not know fully what is going on with it, but what they know has them very worried.

It may be that PRC’s “paleolithic” monetary policy, or more likely the more advanced parts of its policies, will be able to handle this situation. But the stats you have provided here provide absolutely zero evidence or assurance that whatever their policies are will be able to handle this situation, although maybe they will.

“That a nation is rapidly growing does not mean that it cannot have serious financial crises. The US was growing rapidly during the last portion of the 19th century, but had two major crashes followed by deep depressions in the 1870s and the 1890s.”

Thanks for saying this. It seems JohnH thinks this period in US macroeconomic history is some vindication for the gold standard. You know he is wrong. EVERYONE knows he is wrong. But he kept repeating this nonsense over and over.

Wrong again, pgl. I pointed to that period as an example of a time when there was rapid growth without inflation, which casts doubt on most current economists curious, unprovable belief that some inflation is necessary for economic growth.

Piketty also pointed out that inflation is a twentieth century phenomenon, used by many European countries to deflate the value of their war debt.

“I pointed to that period as an example of a time when there was rapid growth without inflation, which casts doubt on most current economists curious, unprovable belief that some inflation is necessary for economic growth.”

Your usual dumb reply. No one is saying we need inflation for long-term economic growth. We are saying devotion to a zero inflation target is suboptimal macroeconomic policy. But leave it to the most clueless troll ever (you) to not get the difference. And leave it to the most clueless troll ever that we were on a gold standard back then – which contributed to the business cycle messes Barkley.

Maybe you should just stop as it is clear to EVERYONE that you know NOTHING about either long-term growth or macroeconomics.

And exactly why is zero inflation sub-optimal? The industrialized world experienced no inflation in the nineteenth century, but experienced robust growth. When prices went up, they came back down. Add per capita GDP in Japan is rising despite zero inflation.

Methinks 20th century economists observed growth and inflation and somehow managed to conclude that the two were linked.

BTW I never argued for a gold standard…that’s just a figment of pgl’s imagination. Japan’s low inflation shows you can attain zero inflation with fiat money.

“JohnH

September 23, 2021 at 11:36 am

And exactly why is zero inflation sub-optimal?”

Just wow. Thanks for letting know the obvious – you have never bothered to read any real economics in your life. Volumes of literature on this topic – none of which our village idiot has ever bothered with.

If companies need a way to give some workers pay raise when there is no inflation, , they could always invest in increasing productivity, and use the gains to reward the most productive workers. But passing productivity gains along to workers has not been the American way for decades, so to avoid this obvious solution liberal economists have devised a workaround—a little inflation! Why not let the more productive workers mostly keep pace with inflation while letting others fall behind? Gotta punish them workers! Meanwhile the corporations pocket productivity gains…Not a very convincing argument as to why inflation is”necessary”…unless you really are a corporate shill.

Gotta love this: “ Has economics become a new theology? Some comments about the practice of modern economists and medieval theologians

In this paper, parallels between the practice of medieval theologians and modern economists are made, showing the striking similarities between them. Exploring these links further shows that these links go much more profound and are functional to the central ideological role both played in their respective historical contexts. Moreover, it is argued that this ideological role may explain the remarkable grip neoclassic economics has on the academy for now over a century. The neoclassic approach has nearly completely removed alternative perspectives from the academy, notably the historical school of economics, despite its inability to adequately describe the economic process in its socioecological, historically changing dynamics. Despite the numerous internal and external critiques it has received since its inception. Thereby, in this paper, an ironic paradox is shown: modern economics, by grounding itself on the mechanistic methodology, set forth by those like Galileo, Kepler and Newton, which has dethroned the medieval theology- grounded depiction of reality, ended up becoming a new theology.”

http://www.paecon.net/PAEReview/issue97/Stahel97.pdf

Piketty in his latest book noted something similar.

Personally I suspect it’s more akin to Freudian theology, which tells a great story and has been widely used in literary criticism and by psychotherapists, but has been largely debunked by psychologists.

https://fred.stlouisfed.org/graph/?g=GcFr

August 4, 2014

Real per capita Gross Domestic Product for United States, United Kingdom, Germany, France, Japan and China, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=GcFx

August 4, 2014

Real per capita Gross Domestic Product for United States, United Kingdom, Germany, France, Japan and China, 1977-2020

(Indexed to 1977)

[ https://news.cgtn.com/news/2021-03-05/China-sets-GDP-growth-rate-at-over-6-percent-for-2021-Premier-Li-Ynm6r6XoGc/index.html

March 5, 2021

China targets GDP growth of over 6% in 2021 as economic recovery gathers steam

By Yao Nian and Yang Jing ]

“China targets GDP growth of over 6% in 2021”

Trump told us we would get 6% growth per year for his entire first term. How did this Trump target work out?

https://fred.stlouisfed.org/graph/?g=Gb0g

January 30, 2018

Consumer Prices for China, United States, India, Japan and Germany, 2017-2018

(Percent change)

https://fred.stlouisfed.org/graph/?g=mGFd

January 30, 2018

Total Reserves excluding Gold for China, United States, India, Japan and Germany, 2007-2021

[ Paleolithic Chinese monetary policy sort of works. ]

https://www.imf.org/en/Publications/WEO/weo-database/2021/April/weo-report?c=924,134,534,158,111,&s=GGXWDG_NGDP,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2021

General government gross debt as a percent of Gross Domestic Product for China, Germany, India, Japan and United States, 2007-2021

2021

China ( 70)

Germany ( 70)

India ( 87)

Japan ( 256)

United States ( 133)

“Japan ( 256)” is your international metric for defending China’s debt/GDP ratio? This is the kind of apples to oranges intellectual garbage we would expect from JohnH.

It is interesting that Japan has been able to raise its per capital GDP about 1.4% per year over the last decade with no inflation and a high GDP to debt ratio.

It must have a lot of economists scratching their heads. I mean, how can Japan do the unthinkable and grow its per capita GDP with no inflation? And whatever happened to the notion of crowding out?

JohnH: General comment – when we are citing debt-GDP numbers, it would be useful to standardize, or at least notate. Japanese *net* debt to GDP was about 170% in 2020. US *net* debt to GDP is about 100% right now (gross includes intra-Federal-government debt, net “nets” out that debt, and is called “debt held by the public” in US Treasury documents).

Thanks for making my point more precisely. Note how JohnH resembles Judy Shelton. Adherence to a zero inflation target solves the business cycle. Except it did not work so well in Japan after all. But please do not burst JohnH’s little bubble here.

“whatever happened to the notion of crowding out?”

I guess you are unaware of the fact that Japan does not need to spend as much of their income on defense that we do. So yea – less defense spending increases national savings leaving more resources for investment.

But hey – you flunked basic economics so please do not let me interrupt your mindless lectures on economic growth or any other economic topic.

Pgl thinks we “need to spend as much of (our) income on defense (as) we do!” Gotta keep those merchants of death happy…it’s our sacred obligation!!!

BTW. Who has a clue as to how much we spend??? DOD can’t even pass an audit!!! But do you see establishment economists like Krugman complaining?

Defense.gov –

The first department wide audit of the Defense Department covered $2.7 trillion in assets and $2.6 trillion in liabilities for fiscal year 2018, making it most likely the largest known audit of an organization in history, according to David L. Norquist, DOD’s comptroller and chief financial officer.

Myth: A disclaimer of opinion is a result of fraud or mismanagement of DOD assets, so financial statement audits uncover fraud.

The auditors found no evidence of fraud. While independent audits serve an important purpose and may prevent or detect fraud, the primary purpose of a financial statement audit is not to detect fraud. Receiving a disclaimer for a first-year financial audit of a massive enterprise was expected. This is also consistent with other federal agencies undergoing initial financial statement audits. For example, it took the Department of Homeland Security 10 years to obtain a clean opinion and it is a much smaller, newer and less-complex organization than DOD.

In the initial years of these audits, an intent to disclaim does not represent a setback. The department will use the audit findings to establish a baseline and guide corrective actions. A disclaimer does not indicate, nor is it evidence or proof, that there is fraud or mismanagement.

Myth: Receiving a disclaimer must be a big surprise and represents a setback toward achieving the department’s goal of a clean audit opinion.

Receiving a disclaimer for a first-year financial audit of a massive enterprise was expected. This is also consistent with other federal agencies undergoing initial financial statement audits. For example, it took the Department of Homeland Security 10 years to obtain a clean opinion and it is a much smaller, newer and less complex organization than DOD. In the initial years of these audits, an intent to disclaim does not represent a setback. The department will use the audit findings to establish a baseline and guide corrective actions.

Myth: DOD does not know where it is spending its dollars.

The department knows where its money is spent. The audit did not identify instances where DOD does not know where obligated dollars are being spent. The audit findings highlight the fact that the department doesn’t always record the receipt of goods and services in a timely and accurate manner in the appropriate property management systems. To address these challenges, DOD has made it a priority to consolidate its financial systems to force discipline and integrity of data at the enterprise level.

There’s more …

‘Pgl thinks we “need to spend as much of (our) income on defense (as) we do!” ‘

What a stupid childish comment. Except most children do not LIE this way. Hey troll – try growing up. And then learn how to READ. DAMN!

It was ltr who published the debt ratios.

And I never advocated for a zero inflation target. I only pointed out that there are notable instances of robust economic growth with no inflation. I just don’t think that +/- 2% inflation is worth obsessing about, as the Fed did for most of the last decade. Increasing wages in line with productivity growth is worth obsessing about but seems to get a small fraction of the attention given minor changes in inflation.

“And I never advocated for a zero inflation target.”

Seriously? Could you contact that other JohnH and tell him to stop putting up dumb comments under your name?

How many times do you have to repeat something before pgl stops misrepresenting what you say? Apparently,it’s infinite.

Repeat: I never advocated for a zero inflation target.

But I do think that efforts to get companies to pass along productivity gains to workers deserves a lot more attention than obsessing about fine tuning low inflation rates.

JohnH: If you write (on 9/23):

Then one might be excused for thinking that you are advocating zero inflation.

https://www.imf.org/en/Publications/WEO/weo-database/2021/April/weo-report?c=924,134,534,158,111,&s=NID_NGDP,NGSD_NGDP,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2021

Total Investment & Gross National Savings as a Percent of GDP for China, Germany, India, Japan and United States, 2007-2021

2021

China

Total Investment ( 43.7)

Gross National Savings ( 45.2)

Germany

Total Investment ( 21.5)

Gross National Savings ( 29.1)

India

Total Investment ( 30.1)

Gross National Savings ( 28.9)

Japan

Total Investment ( 25.4)

Gross National Savings ( 29.0)

United States

Total Investment ( 21.6)

Gross National Savings ( 17.5)

You are the queen of misleading ratios!!! Gross v. net?

And of course China seems to save a lot because there is a huge portion of there spending and consumption that is not counted in the official GDP figures.

I guess international comparisons is not your forte.

This “great mother” left 4 school age children with no mother. Another terrific example of Republican “family values”

https://www.dailymail.co.uk/femail/article-10009793/Mother-four-unmasked-unmuzzled-unvaccinated-dies-COVID-19-age-40.html

When Krystal Lowery’s 4 children reach adulthood and go through all the speed bumps of life without their mother, they can think back with pride on her “independent thinking” which caused her to croak from Covid-19 at the age of 40. Krystal Lowery is no sheep. She’s dead and cold in the ground, But she’s no libtard sheep.

how could that be, cali is controlling the virus?

With people like Krystal Lowery walking around, how would you propose California do that?? I’m not exactly a Gavin Newsom fan, but at least he’s provided pretty good verbal guidance, even if his actions fell short a couple times. That beats, say, for example, intentionally and consciously lying about death count numbers. California is about 20th out of the 50 states in per capita deaths related to Covid-19, if we adjust for the amount of international travelers visiting California in comparison to say Arkansas, 20th ranking out of 50 is probably pretty damned good.

BTW, this also reminds me of the typical redneck Republican’s version of shooting down assertions. Taking a single data point (say for example a day’s weather in January to argue against global warming) to argue against the entire science community’s conclusions. Asinine is the kindest way to describe this manner of argumentation.

I lucked out and happened to get the Moderna nearby me a few months back. It was no “plan”, in fact I had originally thought I would try to get AstraZeneca’s. But I went to a pharmacy with a kind south Asian Dr. who is “on the ball” and I knew I could get it free. It appears the difference between Moderna and Pfizer is not large enough to get upset about, still it’s interesting:

https://www.nytimes.com/2021/09/22/health/covid-moderna-pfizer-vaccines.html?auth=login-email&login=email

I’ll be waiting quite awhile before getting the booster (I’m foreseeing in my mind something like late 2022 to get the booster as far as my own personal timeline), but still wearing a mask in most social interactions.

anne/ltr’s writing style has always been very distinctive and obviously hers, whether not it fits whatever stereotype you have in your vacuous head about gender-related writing styles, Moses.

https://fred.stlouisfed.org/graph/?g=Faer

August 4, 2014

Real per capita Gross Domestic Product for China, India, Brazil, Turkey and South Africa, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=Faeu

August 4, 2014

Real per capita Gross Domestic Product for China, India, Brazil, Turkey and South Africa, 1977-2020

(Indexed to 1977)

[ What matter the Paleolithic policy, since China knows how to grow. ]

The point is of course that China has spent more than 40 years learning how to grow and the learning has stuck. Chinese economic policy is fitted to China and allows for a range of problems which will be pragmatically handled and learned from in turn. Also, the Chinese have protected markets against all sorts of disruptions. Policy makers are actually highly conservative in terms of protecting markets and growth. After foretelling the collapse of the Chinese economy repeatedly these last 40 years, I would think at least ever so few of the dour economists who have been so incorrect might ask why now might not be the time of collapse so long awaited.

Stealing ideas and processes from western corporations dumb enough to do “joint ventures” in China has paid off well. Congrats for finding the dumbest people at the networking get togethers. I know Spavor and Kovrig had a blast.

https://www.npr.org/2021/08/11/1026611064/a-court-in-china-sentences-a-canadian-businessman-to-11-years-in-prison

https://www.voanews.com/a/east-asia-pacific_voa-news-china_canadians-two-michaels-ordeal-exposed-dark-side-china/6203716.html

my understanding is that ltr resides in the usa, but seems to have a disdain for the usa and a crush on china. i just wonder why ltr remains in a place where he/she feels rather uncomfortable and targeted? it does seem that if you believe china is such a superior place to be, one would want to relocate. just curious why you have not done so, ltr?

I don’t think we “know” that, anymore than we “know” “ltr” is “Anne”. I read an “Anne’s” comments on a different blog than Mark Thoma’s, but pretty certain they indeed were the same one. But the word box and style dialogue between that blog and Thoma’s blog matched up quite well. The word order and way are quite different here. I don’t think “ltr” is Anne. He could be American Chinese, but I lean towards something else going on here.

Moses,

Well, I do not think anybody will ever hire you to be an editor of anything. Your claim that somehow ltr and anne use different “word order” is just totally ridiculous. The word order is identical. The patterns are identical. Both are given to posting piles of wonky data, even repeatedly. Both when criticized too hard retreat to accusing others or racism or sexism and at other times claiming to be “afraid” of people making mean comments, which is uttterly absurd and always has been. The views are the same on pretty much everything, and so is the word order, with the only exception on views being the more fervent pro-Chinese views of ltr, although anne was always very pro-PRC She just did not in the past so blatantly repost propaganda from the CCP.. These claims by you are just abysmally stupid.

Sorry, fool, ltr is anne and is almost certainly female. But we have seen you completely out of touch with reality over long periods of time on quite a few matters I shall not list here now. But your ongoing insistence that ltr is not only not anne but not a woman is just hilaeiously goofy, although noting can proved on this matter, of course.

“Yeah…… it’s wuhdicuwuhs!!!!” “It’s hilaeiously [sic] goofy,” and “noting [sic] can proved on this matter”

Too bad a PhD from the Antebellum period just isn’t what it used to be. Check in with the preeminent linguist pgl and get back to us Junior.

I hope this thought isn’t filtered, but speaking in very general terms women write differently than men. That is not to place any “value judgements” or say one is better than the other, They are just generally different. “ltr” does not write like most women do. This is why I used to strongly believe “pgl” was a woman. The style is just different. I highly highly highly highly doubt “ltr” is a female writer. But then I thought for a very extended period of time “pgl” was a woman. So make that out for whatever it’s worth. Probably, to you, not much.

https://www.language-expert.net/do-men-and-women-write-differently-read-sexed-texts-and-alans-comments/

Oh my, Moses, you are back to posting things you do not read thoroughly enough. This link starts out by citing a study by some Israeli linguists that claims one can with 80% accuracy forecast who is writing what. Then at the end the author takes apart their arguments. You did not notice that?

There has been a long running debate about this with people making various claims. But one problem is that rately do these people compare men and women writing about the same topic. Even the examples given in your link show the problem, with a woman writing about going to meet her fiance’s family and the man writing about some lumberjacking equipment or smoething. Of course it is going to look different, aside from the obvious buzz words.

But is you have people writing about the same thing, these differences tend to disappear. I shall in fact throw at you that I have been an economics journal editor for a good 20 years. I have read thousands of economics papers. I have news for you. When people are writing about economics, there are very few if any discernible differences in the writing styles of men and women.

And that is the issue here. You are somehow claiming that we can determine that ltr (who you claim is not anne, despite the overwhelming similarity of their writing styles) or maybe it is you that can determine, the gender of ltr and that it is male. Do you admit that anne was probably female? Again, there is nobody here not even your most loyal lapdogs, who will agree with your that their writing styles are at all different. Theu are absolutely identical.

But, even if it were true that ltr and anne had different writing styles, just what about ltr’s style that you learned from reading about this Israeli study that was criticized (or maybe your other vast array of linguistic knowledge) has you determining that ltr has a male style? And how does ltr’s male stylel differ from anne’s female style, especially when most of us think their styles are absolutleey identical?

You are just making yourself look more and more foollsh and silly with this nonsense. But we know that once you get yourself convinced of something, even when everybody else tells you you are wrong, you do not budge. In this you again show your resemblance to our most recent president. The Arizona fraudit showed him 360 more votes behind Biden, but he is declaring they found election fraud and that the election results should be deceertified. Looks like you on several issues you have gone on about here lately, with this “ltr is a man” right up there.

Moses,

I shall add a bit more on this matter of gender and writing, especially regarding economics. So one of the stereotypes that this half-baked literature is that men are more impersonal and going on about quantities of things, so using words like “more” more than women do, whereas women like to introduce personal anecdotes as they write about people. La de da.

So this brings up this problem of what people are writing about, with some of these supposed differences between the genders on writing having to do with the differences between what they write about. But when people write about the same kinds of things these differences can kind of disappear. So indeed we are dealing with people writing about economics, which is a heavily quantitative subject, notoriously viewed as overly cluttered with men and lots of allegations of sexism, some of those showing up on this site.

So we get that the women who go into economics or even just write about economics are going to use language that men are supposed to use, quantitative language given the quantitative nature of the subject. So we see both anne and ltr writing lots about quantitative stuff. One of her signatures is to post these sets of data, lots of it. She did it all the time on Economists View as anne, and she does it all the time here as ltr. Indeed, while sometime she cherry picks stuff on China, mostly it is useful information and she has generally played it straight, admitting when she is wrong, aside from matters involving China. In any case, if her interest in numbers and data s masculine, it was for “anne” of Economists View, just as much as it is for “ltr” of Econbrowser now.

Just to show more how this silly this stuff is let me note a readily available case: George Akerlof and Janet Yellen, who happen to be married to each other. Both have written and published a lot that is publicly available, as well as a lot jointly. But looking at things they have written separately I would note that one finds George more likely to engage in personal anecdotes and say “I” like women are supposed to do when he tells them. OTOH, she does not do that, tending to stick to business as it were, the woman known for always having done her homework and always totally prepared in meetings. Both of them know their math and know numbeers. Heck, Janet used to go to Columbia U. to take nonlinear differential equations when she was a senior in high school in Brooklyn. But we are back to this problem of self-selection, that women in economics are much more likely to be quantitatively oriented. And, again, if you were to play this stereotype game with these two, you might be more likely to say that George was the woman and Janet was the man.

@ Barkley Junior

Junior says: “Oh my, Moses, you are back to posting things you do not read thoroughly enough.”

That’s an ironic complaint from you Junior, since the Quora link you gave to obfuscate from a direct link to a journal paper you never read, nearly gave the polar opposite of your views.

I read the notes to the blogger’s post. But it’s important to remember, he never actually disproves the Israeli’s research with the algorithm. If the blogger, Mr. Alan Perlman, really would like to disprove the 80% number I guess he can attempt to use the algorithm on texts of his own choosing. I suspect the results will be nearly the same (maybe some small +/- error, or variation, around the 80%). If I wanted I could have directly hunted down the Israeli paper, the point of the link is to encourage thought. Sometimes I link to papers, blog posts, etc to encourage readers’ thought and contemplation, not just to cherry-pick someone echoing my own thoughts~~you should try that method out sometime.

I suspect this may be the paper Mr. Perlman refers to, but can’t be 100% certain as he’s slightly vague and doesn’t provide a link:

https://citeseerx.ist.psu.edu/viewdoc/download;jsessionid=533BA3C27E7933392FF2B5077D1E2991?doi=10.1.1.136.9952&rep=rep1&type=pdf

If you believe “men and women write the same”, I encourage you to write as many peer-reviewed papers as you can on the topic. Maybe the 2 (???) Chinese economists you have written papers with in the last 30 years (specializing in ???) realty bonds or Chinese mainland property investment can help you out with the math to prove “women and men write the same”. I’ll be waiting on your great paradigm shift in gender communications with great enthusiasm.

Moses,

It is clear from the link that this Israeli study did not correct for what people are writing about. I have noted this must be done for any study on this to be taken seriously. That they can forecast 80% accurately is easily explained by this difference in the type of topic each gender is more likely to be writing about (and they do tend to write about different topics).

So the problem here is do women writing about economics differ noticeably from men doing so. My claim, which this clearly seriously flawed study fails to do, is that when women choose to write about a topic that uses lots of supposedly masculine quantitative words as economics does, then the women choosing to write about it write in a manner very similar to how men do. I am basing this on having read indeed thousands of economics papers, with a substantial chunk of those by women. You have not done that, nor have these Israelis comparing women writing about visiting their fiance’s families with men writing about lumberjack equipment.

Again, the bottom line here is you claiming somehow to be able to see that ltr is a man based on how she writes here, even though you are so stupid you cannot get it that she writes in a style that is absolutely identical to that of anne of Economists View.

Again, get to a bottom line. Do you want to claim that George Akerlof writes in a more masculine way according to the stereotypes promulgated by these clowns doing this poorly done study than does Janet Yellen? I know you have not read enough by either to make that judgment. But I can tell you that it is George who uses personal pronouns and tells personal anecdotes while Janet does not. All you are doing by pushing this stuff is to remind everybody here what a screamingly sexist clown you are. It is pathetic.

I shall add another layer on the matter of Akerlof and Yellen, certainly one of the smartest married couples on the ;planet. They rather curiously exhibit an odd pattern of sexism I have long been aware of that I am sure you are not, and maybe few here are. This is the syndrome of brilliant husbands being absent-minded and thus irresponsibly relying on a well organized wife to keep them functioning properly. This is a syndrome most common when the husbands are especially involved in mathematics, where indeed a lot of the smartest are really pretty out of it in many ways. And George, who is widely regarded as one of the nicest people in the entire economics profession, a genuinely profoundly nice guy, also happens to be a seriously absent-minded professor type. He indeed has and does rely heavily on his super well organized wife to keep him fully functional. I have indeed heard it up close that such an attitude by such husbands relying on such wives is a deeply sexist syndrome. But it is sort of an esoteric one, and may not be inconsistent with George writing “more like a woman” than does his super capable and organized wife, who is never caught off guard or unprepared by anybody.

On some B-movie antenna channel, They were just showing Michael K. Williams in my favorite film his was ever in, Emilio Estevez’s “The Public”. Great movie. He was perfect for that part of “Jackson”. Very likable character.

*he was ever in.

On the important matter of Evergrande and Chinese real estate, another complicating factor and why I at least am making no predictions involves something I have seen no commentators mention, certainly not our self-styled “experts” here who pat each on the back about their great knowledge. The legal framework of real estate property rights in the PRC is probably the most complicated in the world. This partly reflects that PRC is a transition economy that never had a full political change. This means that it combines elements of the previous system with the newer system, not to mention all the complications arising from the more decentralized nature of the system in PRC (keep in mind that Evergrande is based in super free market Shenzhen).

Just to note one item rarely mentioned, although it is true in other places, including Hong Kong while the British still ruled it: officially all land remains ultimately collectively owned. The “property market” is a matter of all sorts of usufructory rights that are being boutght and sold with all sorts of conditions on them. We see that sort of thing actually even in New York City sometimes, and also London. But PRC has categories of ownership that simply do not exist anywhere else, odd middle ground formulations between private and collective. This also is true of laws regarding wenterprises, with some of them taking forms that do not exist anywhere else, particularly some of the former TGVs. This is a very complicated matter, one I am aware of but do not know the full details of.

The relevance for the Evergrande situation is that we simply do not know the forms of property ownership, much less their financial arrangements, that Evergande has. All of this will impact what happens and what the government will do (or try to do). But few of us know much useful about it. I am fully aware of my limits of knowledge on this, even if some others here are not.

I will add one more point. I brought up the matter of the shadow financial markets in China, noting that people I know there have expressed concern about this matter to me in the past. While I am in communication with some of these people in China, I do not discuss this matter with any of them. Such conversations are only for face to face.

So, I am only noting what is appearing in newspaper reports, in this case WaPo. So a plain news report there has noted that the PRC government may be about to let Evergrande go under, with them supposedly thinking they can contain the fallout. Maybe they can. But the report also noted that one reason the government is not keen on supporting Evergrande is that apparently they have been engaging in a lot of questionable ways of raising money. This sounds to me like they are seriously involved in that shadow financial sector that has serious people over there nervous, to put it mildly.

So I definitely do not know the details of this. It may well be that the PBOC has all this under control, as I am sure those who tell ltr what to post here, would assure us. They know all the implications arising from these unorthodox financing arrangements that Evergrande has been indulging in. And maybe they do. But, then again, maybe they do not.

So, the clear “takeaway” here is you know nothing about it. Glad we got that one resolved. See if you can state that in less words than “Moby Dick” next time.

And you and somebody else also do not know anything about it, although the two of you have been making various apparently definitive pronouncements about it while slapping each other on your backs.

At the very least, we have the courage of our convictions, which will be proven or disproven over time by the markets. That’s better than long-form essay of milquetoast, then later proclaiming after the fact how events turned out was “how I always thought it would go”. That’s a large part of the reason why your profession gets a lot of the “ivory tower” resentment.

[edited MDC]. Just don’t tell me you knew about it later.

Moses,

I have explained reasons why serious observers are being cautious about making srrong pronouncements about this one way or another, aspects of the Chinese financial system and property markets that neither of you seem to have little to no idea about, not to mention nearly all the commentaries I see in the media, even though you have spent serious time in China, and I have on several occasions in rhe past indicated that I respect quite a bit that you have to say about Chinese matters based on your experiences there. But apparently you were teaching people who were not high level knowledgeable economists English rather than learning about aspects of the Chinese economy that are not widely reported on in the western media, meaning that you need to rely on such media now to make these definitive pronouncements you are so proud of now.

As of now it looks like most of the world stock markets at least have decided that the PBOC knows about all this and will be able to stay on top of it and whatever fallout might come from Evergrande’s problems, which included a failure to make an imporant interest payment on Friday, although there is a 30 day window on that one before that failure officially becomes a default. Probably the PBOC does have a pretty good idea the degree to which Evergrande’s property holdings are tangled in legal complications and also the degree to which their reportedly fishy financial arrangements are tangled in problematic ways in the shadow financial system. They are reportedly looking over their shoulders hard at avoiding having a collapse of Evergrande resemble the collapse of Lehman back in 2008 in terms of consequences. But again, I can say that serious people in RRC have been worried for some time precisely about that latter point, that nobody may be on top of what is really going on in that shadow financial sector, and, no, I am not currentrly in communication with the people that I know abut this to get any useful inside information on this that would justify making some strong assertion about this.

It may make you feel like a Real Man to make assertions about things when you do not know what you are talking about. But personally I prefer to note how and why I do not feel like making such assertions when I know enough to know that I do not know enough to do so with any reasonable confidence to do so.

The cool things one learns when one reads enough nonsense here. Like all women have the same writing style. And one can stay in one’s lane when going all over the map on almost every topic in the universe.

Or my favorite – one can advocate zero inflation for an entire century without advocating a zero inflation target! And we thought the Grumpy Economist was insane!