The debate over the role of expectations in inflation determination [e.g., discourse over Rudd’s working paper] gives me a sense of deja vu. That being said, it’s always useful to see what the data say, when running a simple OLS regression on a basic expectations augmented Phillips curve (without a statement on forecasting, which often includes conditioning on future developments). I examine PCE inflation over the 1986-2021Q2 period.

Consider:

The left hand side variable is the 4 quarter change in the log CPI. The value of coefficient on oil prices is sum of four coefficients on 4 first differences of log oil prices. u-hat is the gap between observed official unemployment rate and what CBO now terms the noncyclical unemployment rate. (I am using CPI inflation expectations to predict PCE inflation; the former averages about 0.43 percentage points higher than the latter over this sample period.)

Using Michigan one year CPI inflation expectations:

Adj-R2 = 0.43, SER = 0.008, DW = 0.312, sample 1986Q1-2021Q2. Bold denotes significance at the 10% msl using HAC robust standard errors.

Using the Survey of Professional Forecasters median expectations:

Adj-R2 = 0.75, SER = 0.005, DW = 0.554, sample 1986Q1-2021Q2. Bold denotes significance at the 10% msl using HAC robust standard errors. [u-hat coefficient corrected 10/12]

Inflation expectations come in with statistical significance in both cases. However, the estimated coefficients are well below unity (which one might expect in the simple expectations augmented Phillips curve). The Michigan survey coefficient is statistically significantly different from unity, while the SPF estimate is just significantly different at the 95% level. (By the way, one might expect a downward bias if the expectations proxy is measured with error, and uncorrelated with the other right hand side variables.)

How stable are these estimates? Using recursive 1-step ahead Chow tests, the Michigan survey based equation exhibits breaks in 1996 and 2009 (at the 1% level). For the Survey of Professional Forecasters based equation, no breaks at the 1% level are detected, although several at the 5% level.

How “influential” are expected inflation proxies in determining actual inflation? One way to assess this is to scale the beta coefficients by standard deviations, to generate a “standardized beta”. One can then compare the standardized beta coefficient for expected inflation against those for the other variables.

For the equation using Michigan expectations, the standardized coefficient is 0.33, with the 1st, 2nd, and 3rd lag of oil price growth being slightly larger. When using the SPF median, the standardized coefficient is 0.67, much larger than any other coefficient (0.43 for the 3rd lag of oil price growth).

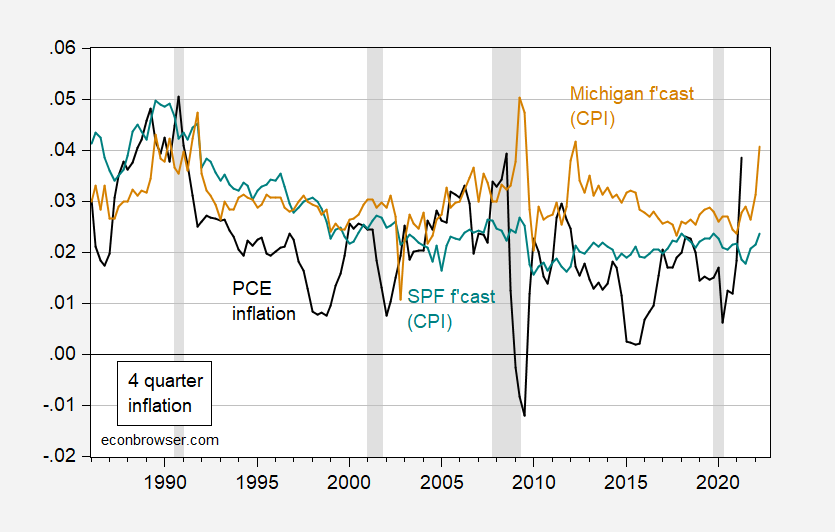

In some ways, this is not too surprising, given the the way expectations and actual inflation comove.

Figure 1: PCE price index inflation (black), Survey of Professional Forecasters median inflation (teal), Michigan Survey of Consumers (tan), all four quarter changes. Survey series pertain to date forecasted (i.e., 2022Q1 observation is the 2021Q1 forecast of 2022Q1 4 quarter inflation). NBER defined recession dates shaded gray. Source: BEA, MIchigan Survey, Philadelphia Fed/SPF, NBER and author’s calculations.

So, I think expectations (measured by survey data) are empirically linked to actual inflation outcomes. I’ve not established a causal link (which is for instance in the Friedman-Phelps story). Nor have I established that expectations measures would help in forecasting; that depends (at least in part) on other factors, including the extent and nature of measurement error.

Addendum, 10/12, 10am Pacific:

Reader Marco Bassetto asks why not include lagged inflation. That’s a good question; lags could be motivated by nominal rigidities a la Taylor or Fischer – and that specification is similar to one used by Blanchard, Cerutti and Summers (2015). So without further ado, I augment the two estimated equations with the four quarter inflation rate, lagged four quarters:

Using Michigan one year CPI inflation expectations:

Adj-R2 = 0.66, SER = 0.006, DW = 0.669, sample 1986Q1-2021Q2. Bold denotes significance at the 10% msl using HAC robust standard errors.

Using the Survey of Professional Forecasters median expectations:

Adj-R2 = 0.77, SER = 0.005, DW = 0.682, sample 1986Q1-2021Q2. Bold denotes significance at the 10% msl using HAC robust standard errors.

The message from these regressions is that lagged inflation does enter significantly — although why it does might be because of nominal rigidities like overlapping contracts, or because survey based expectations measures are measured with error, and are themselves correlated with lagged inflation. A related point is that the SPF measure retains its significance, while the Michigan (consumer) measure does not. So, which expectations measure you pick matters.

(On the other hand, the activity variable — the unemployment gap — is wrong signed, albeit not significantly so.)

“I’ve not established a causal link (which is for instance in the Friedman-Phelps story).”

Perhaps Milton Friedman’s seminal contribution to macroeconomics. And yet we saw Econned (who apparently worships Friedman) all fascinated that someone might be questioning this effect. Go figure!

PaGLiacci, Do you dream about me at night or is it only your waking hours when you obsess over me? hate yo break it to you, but I’m not too fond of clowns. HonkHonkHonkHonk

Also, your comment is nonsensical. It’s sad. Tragically sad.

Another serious conversation from the Klass Klown.

pgl,

Uh oh, now you are in trouble. At least he did not call you a troll. But then he has assured us that he has never called anybody a troll, and somebody like him with “con” in his fake name always tells the truth.

Barkley Rosser,

How did you achieve a life in academia despite being so adult at reading comprehension? I’m serious. I’ve never claimed that I have never called anyone a troll. I challenge your senile brain to provide a single instance of such. I’ll wait.

Actually, Econned, what we are waiting for here with you is for you to provide some reason why anybody should take you remotely seriously after you slammed our estimable co-host, Menzie, in a massively stupid and insulting way that was completely out of line. He runs this site in a very tolerant and fair way while coediting a leading field journal, having a career that has been involved deeply in policy as well as academia, and has a string of publications in leading journals with many thousands of citations, as well as being located in a top economic department.

You are here with your fake name that has “con” in the middle of it, but have given us zero reason to believe you know much of anything, although you are pretty sharp with your trolling on occasion. So, have you ever held a job that had anything to do with economics in any sector, government, private, or academic? Do you edit a journal? How about publications, got any of those, even if they are not in refereed academic journals or books from respected presses? And, yeah, how about citations? Got a few thousand of those?

Oh, right, you did tell us you read all the papers cited in the Rudd papet, and, heck maybe you did and sort of understood most of them, even if you have no credentials whatsoevet in economics. that we are aware of. But then you posted a link here claiming ludicrously that somehow he is one of the world’s three leading experts on inflation, when he has been a thoroughly minor and obscure player on this up- to now, with this paper now getting attention his main claim to fame (which does have good footnotes, btw). You somehow declared bizarrely that because he is a permanent staff member at the Board of Governors research shop and has been quoted a few time in FOMC minutes that indeed supports this ridiculous claim you linked to, and somehow decided that clearly made him superior in knowledge to Menzie because, gosh, Menzie has only been a Visiting Scholar there, something that Nobel Prize winner, George Akerlof has also been

So, go ahead, Econned, tell us why we should take anything you say remotely seriously after you have pummeled us not only with a string of lies but a pile of completely baseless insults against our capable and honorable co-host? We are waiting, troll.

Barkley Rosser,

I do appreciate tacit acknowledgment that you’re unable to support your claim. This makes you a liar.

Econned,

Which claim do you claim I am lying about? That you linked to an absolutely idiotic tweet by Claudia Sahm claiming that Rudd is one of the three leading experts on inflation in the world? That you have regualarly accused others of being trolls even for posting without your nvitation? That you are completely out of line in your deununciation of Menzie that could not have been more baseless? Oh, that you have not answered any questions regarding why anybody here should consider you to be an expert on economics such as your educational or professional background, not to mention any accomplishments such as journal editing, publishing, or the thousand of citations your publications you have received?

I coudl go on. That is not a complete list of the insjulting lying trollish gaarbage you post here regularly. So, buster, just what is it I might have gotten inaccurate in all this?

Barkley Rosser,

Again with your inability to read???? Seriously, how are you this awful at reading comprehension?

You claim “But then he has assured us that he has never called anybody a troll”

I clearly state “I’ve never claimed that I have never called anyone a troll. I challenge your senile brain to provide a single instance of such. I’ll wait.”

How difficult is this to comprehend? It is seriously a pity to watch your senile brain attempt to function online. I wish you all the best and can’t wait to see how you (again) attempt to change the topic.

Econned,

Look, you are a worthless and disgusting bucket of slime. You answer nothing that is asked of you, nothing. So, sorry, I am not going to go chasing around to find this or that thing you demand. You are not in charge here with your repeated lying.

Apoloigize to Menzie, you utter scumbag. You are utterly beneath contempt.

Barkley Rosser,

Again. YOU made the claim. And YOU are unable/unwilling to support the claim. Why? Because YOU are the one who is lying.

PaGLiacci, You can’t just can’t get me out of your empty brain.

Lord – this back and forth with Barkley was a total waste of time. Alas, this type of nonsense is all you ever do.

Sorry dude – but there are so many worthless trolls out there that you in the pack of a very long line.

https://www.nytimes.com/2021/10/11/opinion/nobel-prize-economics.html

October 11, 2021

Doing Economics as if Evidence Matters

By Paul Krugman

Nobel Memorial Prizes in economics are given for long-term research, not for economists’ role in current debates, so they don’t necessarily have much bearing on the political moment. You might expect the disconnect to be especially strong when the prize is given mainly for the development of new research methods.

And that’s the case for the latest prize, awarded Monday to David Card, Joshua D. Angrist and Guido W. Imbens, leaders in the “credibility revolution” — a change in the way economists use data to assess theories — that has swept economics over the past generation.

It turns out, however, that the credibility revolution is extremely relevant to current debates. For studies using the new approach have, in many though not all cases, strengthened the argument for a more active government role in addressing inequality.

As I’ll explain, that’s not an accident. But first, what’s this revolution all about?

Economists generally can’t do controlled experiments — all we can do is observe. And the trouble with trying to draw conclusions from economic observations is that at any given time and place lots of things are happening. For example, the economy boomed after Bill Clinton raised taxes on high incomes and reduced the budget deficit. But did these fiscal policies cause prosperity, or was Clinton just lucky in presiding over a tech boom?

Before the credibility revolution, economists basically tried to isolate the effects of particular policies or other changes by using elaborate statistical methods to control for other factors. In many cases that’s still all we can do. But any such attempt is only as good as the controls, and there is typically endless room for dispute about the results.

In the 1990s, however, some economists realized there was an alternative approach, that of exploiting “natural experiments” — situations in which the vagaries of history deliver something close to the kind of controlled trial researchers might want to conduct but can’t.

The most famous example is the research that Card conducted along with the late Alan Krueger on the effects of minimum wages. Most economists used to believe that raising the minimum wage reduces employment. But is this true? In 1992 the state of New Jersey increased its minimum wage while neighboring Pennsylvania didn’t. Card and Krueger realized that they could assess the effect of this policy change by comparing employment growth in the two states after the wage hike, essentially using Pennsylvania as the control for New Jersey’s experiment.

What they found was that the increased minimum wage had very little if any negative effect on the number of jobs, a result confirmed since by looking at many other instances. These results make the case not just for higher minimum wages, but for more aggressive attempts to reduce inequality in general.

Another example: How can we assess the effects of safety net programs that aid children? Researchers have taken advantage of natural experiments created by, among other examples, the gradual rollout of food stamps in the 1960s and 1970s and several discrete jumps in Medicaid’s availability in the 1980s. These studies show that children who received aid became much healthier, more productive adults than nonrecipients.

And such studies make a strong case for the Biden administration’s Build Back Better initiative, which emphasizes investment in children as well as in conventional infrastructure.

Finally, big changes in unemployment insurance over the course of the pandemic — a huge increase in generosity, then a sudden cutoff, then a partial restoration, then another cutoff, with some states cutting benefits sooner than others — provide several natural experiments letting us test whether, as conservatives always insist, unemployment insurance deters the unemployed from seeking new jobs.

Well, the data provide a clear answer: While there may be some disincentive effects from unemployment benefits, they’re small.

Overall, then, modern data-driven economics tends to support more activist economic policies: Raising wages, helping children and aiding the unemployed are all better ideas than many politicians seem to believe….

Should you not include actual inflation lagged by 4 quarters on the right-hand side? Otherwise, you are attributing all of the persistence in inflation to “expectations.”

Spoken like an old fashion Keynesian from the 1960’s! Actually John Taylor’s overlapping contracting model might give a thumbs up to what you are suggesting.

Marco Bassetto: Good point – see the addendum.

I always realize I’m incriminating myself on my own lack of knowledge on these things, which I am certain is cause to be derided by certain social corners of this blog (though I feel for as high as Menzie’s knowledge base is, he has always been kind and gracious towards me in this aspect, among other aspects, which I greatly appreciate that graciousness to a degree that might surprise Menzie). But I wanted to post this paper which is related to a topic which has been nagging away at me for sometime. And I’m posting it, in the name of sharing knowledge, being that dumb kid in the back of the class asking the question 2-3 other students were curious about but afraid to ask, and in hopes that there are just a few other “Joe Six-Packs” out there, who like me regularly read Menzie’s blog with great enjoyment and edification.

https://www.montana.edu/cstoddard/2013-562/documents/oh%20no.pdf

I’m about to get sauced, so hope this will be my last contribution here for roughly the next 36 hours. Kids, Uncle Moses does not “recover” from the drinksies like he used to.

Moses,

Well, as Card and Krueger (1994) showed, sometimes when one gets the “wrong” sign, one ends up going to shake the hand of the King of Sweden some time later, if one lives long enough.

Pretty good line. And although a slight exaggeration, probably a decent thread of truth your line.

(I will argue to my dying day, as a wannabe~~but not~~economist, that credentialed/academic economists never get enough credit for their terrific dry humor.)

http://www.news.cn/english/2021-10/12/c_1310240433.htm

October 12, 2021

America’s super rich hold 27 pct of national wealth, more than middle class combined

WASHINGTON — The top one percent of American earners now holds a bigger share of U.S. wealth than all of the country’s middle class, according to a recent Bloomberg report. *

America’s super rich held 27 percent of national wealth as of June, a figure for the first time higher than that of the U.S. middle class, or the middle 60 percent of households regarding income distribution by economists’ definition, which saw their combined assets drop to 26.6 percent of national wealth, Bloomberg cited Federal Reserve data as saying.

“The data offer a window into the slow-motion erosion in the financial security of mid-tier earners that has fueled voters’ discontent in recent years,” Bloomberg said in the article published on Saturday.

The erosion of the U.S. middle class’ wealth has continued through the COVID-19 pandemic, despite trillions of U.S. dollars in government relief, the report said.

* https://www.bloomberg.com/news/articles/2021-10-08/top-1-earners-hold-more-wealth-than-the-u-s-middle-class

https://fred.stlouisfed.org/graph/?g=DDif

January 30, 2018

Share of Total Net Worth Held by Top 1%, Top 90 to 99% and Top 50 to 90%, 2007-2021

https://fred.stlouisfed.org/graph/?g=DDj3

January 30, 2018

Share of Total Net Worth Held by Top 1%, Top 90 to 99% and Top 50 to 90%, 2007-2021

(Indexed to 2007)

Speaking of inflation expectations and Card, Angrist and Imbens, the Fed has launched a natural experiment in its own ability to change inflation expectations.

The Fed has gone from a policy of aimin to keep consumer price inflation near (or returning it to) 2% to a policy of aimin to keep average inflation near 2%. If inflation expectations are influenced by this change, we should be able to see a difference in the behavior of inflation. If the Fed’s new operational regime works, inflation should experience negative feedback, remaining nearer to 2% through thick and thin, and returning toward 2% more rapidly after shocks.

I have me doubts, don’tcha know, but let’s see what happens.

I’ll feel A LOT better if/when Lael Brainard takes over the horse reins.

An appointment of Brainard would probably have the most impact on bank regulation, as Elizabeth Warren has emphasized in her critique of Powell. Otherwise I doubt it will make much difference as macro policy of the Fed is really driven by the FOMC, a bunch of serious egomaniacs not open to being ordered about by the Chair. It is almost certainly the case that the most influential person on that body, even when he is not voting, is Jim Bullard, and that is likely to remain the case whoever gets appointed to be Chair.

I’m not knowledgable enough about Fed politics to argue Bullard with you, however I think (slight) power shifts happen between regions. The only thing I might argue with you, is it all seems to go back to the Chair, because the Chair is the person who has to “face the music” with the public and Congress. And Alan Blinder was no lightweight. And when Alan Blinder let Greenspan know how he felt about rates, Blinder was told to “go fly a kite” and so Blinder left to “go fly a kite”. Keep in mind, Blinder is one of my heroes/idols, so none of the above facts are said in criticism of Blinder. It’s just hard reality of the events that occurred.

*between “Fed regions” I should have specified.

macroduck,

My guess is that to the extent people are even paying attention to what the Fed is saying its target is, this shift from a 2% point target to a 2% average target is not gong to make any difference at all, not even for the well-informed professional forecasters.

One virtue of that paper by Rudd, which did have good footnotes, btw, was that it downplayed the ability of the Fed to manipulate inflation expectations of anybody.