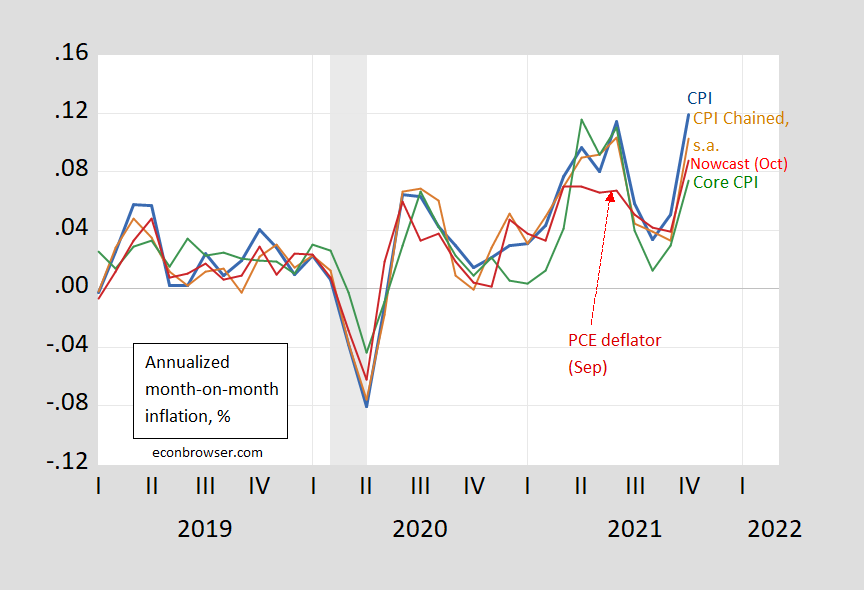

Headline CPI exceeded expectations substantially, with m/m 0.9% vs. 0.6% expected. Core was 0.6% vs. 0.4% expected (Bloomberg consensus). The persistence in the gap will depend in large part on oil price’s evolution. Year-on-year core matches levels last seen in 1991; but still far below the 1970’s.

Figure 1: Month-on-month inflation of CPI (blue), chained CPI (brown), core CPI (green), personal consumption expenditure deflator (red). Chained CPI seasonally adjusted using X-12/ARIMA X-11. PCE deflator October observation is nowcast as of 11/10. NBER defined recession dates (peak-to-trough) shaded gray. Source: BLS, BEA, Cleveland Fed, NBER, and author’s calculations.

The big gap is between CPI and core CPI, highlighting the role of energy prices. This shows up in levels.

Figure 2: CPI (blue), chained CPI (brown), core CPI (green), personal consumption expenditure deflator (red). Chained CPI seasonally adjusted using X-12/ARIMA X-11. PCE deflator October observation is nowcast as of 11/10. NBER defined recession dates (peak-to-trough) shaded gray. Source: BLS, BEA, Cleveland Fed, NBER, and author’s calculations.

Core CPI has lagged CPI by a cumulative 1.3 percentage points (log terms) since 2020M02. The source of the differential is clear:

Figure 3: Headline-core CPI year-on-year inflation differential (blue, left scale), oil price (WTI) year-on-year growth rate (tan, right scale). NBER defined recession dates (peak-to-trough). Source: BLS, NBER, author’s calculations.

So much hinges on what happens to oil prices, and energy prices generally. As of now, oil prices are in backwardation, with nearby futures (December) at 81.44, March futures at 77.67.

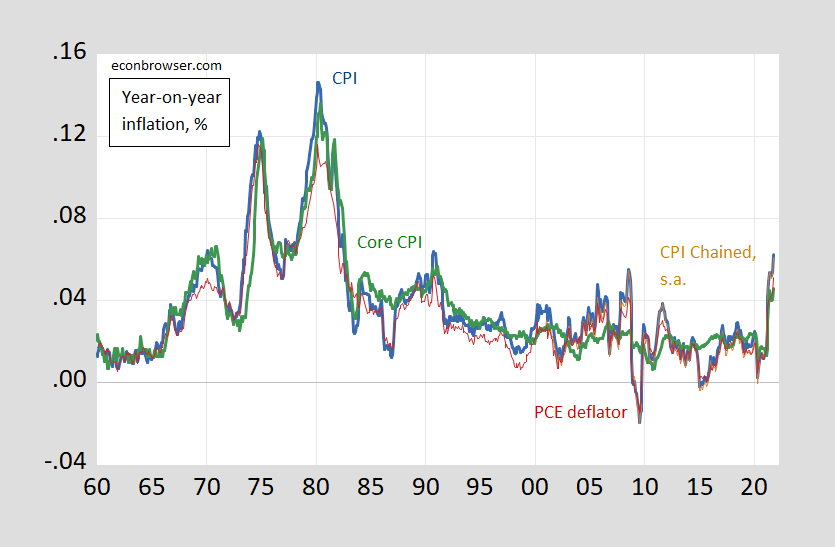

Last point: It’s useful to have a longer perspective, before making comparisons to the 1970’s.

Figure 4: Year-on-year inflation of CPI (blue), chained CPI (brown), core CPI (green), personal consumption expenditure deflator (red). Chained CPI seasonally adjusted using X-12/ARIMA X-11. PCE deflator October observation is nowcast as of 11/10. Source: BLS, BEA, Cleveland Fed, and author’s calculations.

an important point was made today on bloomberg radio. a significant portion of the country has never experienced inflation, period. so you will get plenty of people possibly overreacting to the situation. those with a longer horizon (as prof chinn shows in figure 4), you will find another cohort of people who have dealt with inflation. those people are not worried today, but they do have a concern about what the future could hold.

there are people on this blog who complained for years that low interest rates were damaging those in retirement. well savings bonds are now paying over 7% annually. are you satisfied now? or are you complaining because interest rates are too high?

Seems like baffling needs to be educated on what those 7.12% bonds are really composed of. “ The composite rate for Series I Savings Bonds is a combination of a fixed rate, which applies for the 30-year life of the bond, and the semiannual inflation rate. The 7.12% composite rate for I bonds bought from November 2021 through April 2022 applies for the first six months after the issue date. The composite rate combines a 0.00% fixed rate of return with the 7.12% annualized rate of inflation as measured by the Consumer Price Index for all Urban Consumers (CPI-U). The CPI-U increased from 264.877 in March 2021 to 274.310 in September 2021, a six-month change of 3.56%.” https://www.treasurydirect.gov/news/pressroom/pressroom_comeeandi1121.htm

Get it? The REAL rate of return is 0…ZERO! Sure, I-bonds are an excellent hedge against inflation, but they are no way to build retirement savings. In fact you lose money in real terms when you cash the bonds out and have to pay federal taxes on the interest earned.

“Get it? The REAL rate of return is 0…ZERO! ”

show me another ultra safe investment today that pays over 7%, even in nominal terms.

actually, my point is that there are people on this blog who complained that rates were too low. and there are people on this blog who now complain rates are too high. on occasion, it is the same person. the point is some people simply complain, no matter the condition. thanks Johnh, for being such a good example.

“but they are no way to build retirement savings.”

i was pretty clear in my comment this applied to “those in retirement” not simply building a retirement fund. you were either very eager to simply argue with me, or lacked reading comprehension. but i will accept your apology since “Seems like baffling needs to be educated” was incorrect.

https://fred.stlouisfed.org/graph/?g=sVz7

January 15, 2020

Consumer Price Index and Consumer Price Index Less Food & Energy, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=FmWS

January 15, 2020

Consumer Price Indexes for Food and Energy, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=Fn2B

January 15, 2020

Consumer Price Indexes for Rent and Owners’ Equivalent Rent, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=ECQX

January 30, 2020

Consumer Price Indexes for New and Used Cars & Trucks, 2020

(Percent change)

6.2% year on year inflation means that the value of the national debt was reduced by over $1.5 trillion.

The austerians should be rejoicing.

every mortgage holder should be rejoicing.

https://news.cgtn.com/news/2021-11-10/China-key-CPI-indicator-jumps-1-5-in-October-154jxLxeahW/index.html

November 10, 2021

China’s PPI surges to record high at 13.5%, CPI up 1.5% in October

China’s factory-gate inflation hit a record high in October, while consumer prices rose slightly amid public concern over food shortages, data from the National Bureau of Statistics (NBS) showed on Wednesday.

The country’s official producer price index (PPI), which reflects the prices factories charge wholesalers for their products, rose by 13.5 percent in October from a year earlier, hitting the highest level since the compiling of data began in October 1996.

https://news.cgtn.com/news/2021-11-10/China-key-CPI-indicator-jumps-1-5-in-October-154jxLxeahW/img/690d0ce93d7d48439f687d77c5386933/690d0ce93d7d48439f687d77c5386933.jpeg

PPI growth in October was 2.8 percentage points higher than that in September, and above the 12.3 percent predicted by Bloomberg.

NBS data on Wednesday also showed that China’s consumer price index (CPI), a major gauge of inflation, went up by 1.5 percent in October from a year ago, up from 0.7 percent in September.

https://news.cgtn.com/news/2021-11-10/China-key-CPI-indicator-jumps-1-5-in-October-154jxLxeahW/img/760f7ef1ebcf4c74bce51a500fccad25/760f7ef1ebcf4c74bce51a500fccad25.jpeg

This was above the 1.4 percent gain estimated by Bloomberg.

“In October, affected by factors such as special weather, contradictions between supply and demand of some commodities as well as rising costs, CPI rose slightly,” said Dong Lijuan, a senior statistician with the NBS.

As a key component of the country’s CPI, pork prices dropped 44 percent year on year, compared with a 46.9 percent plunge in September. China has been buying up pork to support prices that declined earlier this year and resulted in heavy losses for farmers….

Chinese authorities are treating production price pressures as short-term and controllable sector by sector, using national stores and making sure that company supplies are smoothly reduced. As price pressure in a sector eases, national surpluses are added to again. Producer price pressures in China have so far only mildly affected consumers. The consumer price index should be up at 3% this year.

I have not seen any indication that this is driven by anything permanent. It still seem to be mostly temporary supply chain problems. Wage increases do seem to be real. However, they are not exceeding productivity gains, so there should be plenty of space to absorb that without need to increase prices. My main concern is that a lot of businesses have found supply shortages to be very convenient. It allowed them to jack up prices and profits. They may not like to have the supply chain problems solved, if they can make bigger overall profits on lower sales.

I appreciate this a lot to think about you give good context .