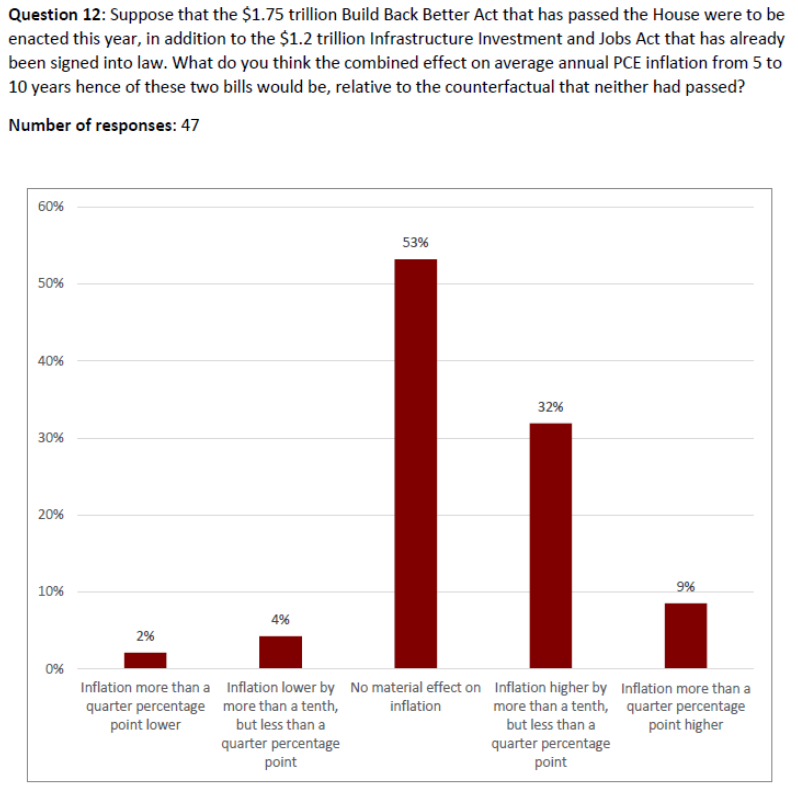

From the FT-IGM US Macroeconomists Survey:

Source: FT-IGM US Macroeconomists Survey, December 2021.

Hence, in contrast to worries voiced by some observers, the medium term impact of the Build Back Better Act combined with the already passed Infrastructure Investment and Jobs Act is not widely shared by academic economists, with the modal response “no material effect on inflation”. (This is a longer horizon than that best analyzed by short run macroeconometric models, see this post.)

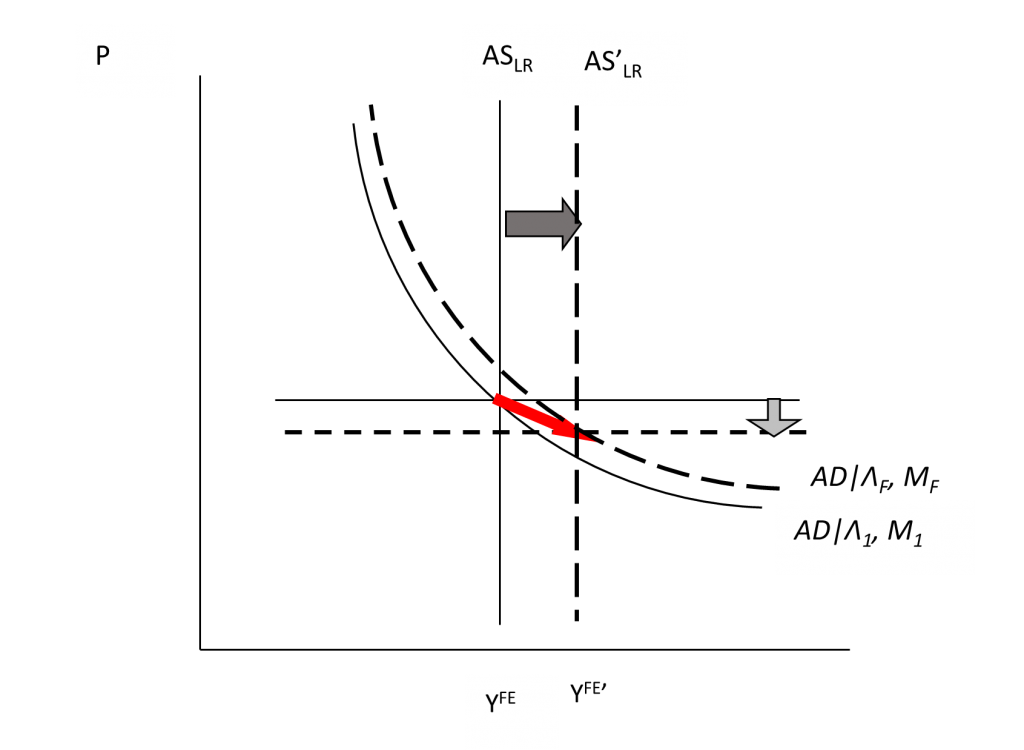

How can this be? It’s useful to remember that the longer term output effects of infrastructure investment are estimated to be fairly high. Hence, increasing investment in public capital can lead to relatively large impact on output over time, as shown in the below aggregate demand-aggregate supply graph.

Figure 1: One interpretation of the medium run impact of effective infrastructure investment spending.

In this interpretation, the long run aggregate supply curve shifts from ASLR to AS’LR (dark gray arrow), i.e., full-employment GDP rises, even as the Aggregate Demand curve shifts out (light gray arrow). Since the shift in the long run AS curve is large, then in this case, downward pressure on the price level occurs (or more accurately, downward pressure relative to the no-infrastructure investment).

If the impact on on full-employment GDP is smaller (relative to the shift in the AD curve), then the net impact could be zero or positive for inflation.

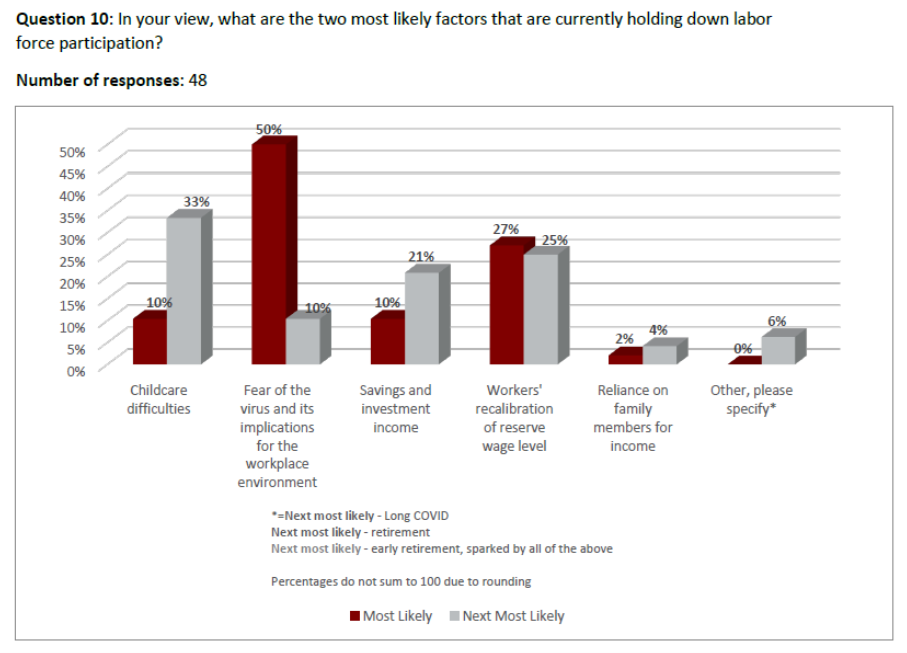

What about arguments that the BBB Act contains lots of spending that does not conform to the types of infrastructure considered in typical studies of infrastructure investment? It’s important to remember that temporary shocks (higher reservation wages can shift up the short run aggregate supply line — i.e., the flat line in Figure 1). Why might those reservation wages be higher? Question 10 in the survey addresses that question.

Source: FT-IGM US Macroeconomists Survey, December 2021.

The second most likely factor identified in the survey is childcare difficulties. To the extent that BBB can mitigate some of these restraining factors on labor force participation, then in both the short and medium run, inflationary pressures can be relieved. For instance, over 15% of the latest iteration of proposed BBB is for universal pre-K and affordable child care.

Build Back Better may further reduce inflation by lifting supply to meet demand. Policies to support pre-K, child care, and long-term care, for example, may help parents and caretakers to remain in or re-enter the workforce; support for housing construction may reduce rental prices; and investments or support for infrastructure, research, and other capital may boost labor productivity. However, many of these potentially inflation-moderating aspects of Build Back Better are generally longer term polices that are unlikely to have much short-term effect on supply.

Will not the ultimate impact on inflation depend on taxes and the overall fiscal stance going forward?

If deficit-financing of expenditures is perceived to be endless, some will expect loser monetary policy to keep debt management costs manageable. Or perhaps inflation expectations will shift higher and the market will drive up borrowing costs to cover that expected inflation. The US central bank will then follow with tighter monetary policy.

Mr Poole,

During those 70 years, the US economy grew by an average 3.1% in real terms, the PCE deflator rose by the same amount, and the unemployment rate was 5.8%.

The debt held by the public increased in 65 of the last 70 years. Call it the norm, or call it endless.

During that time, interest payments on the federal debt have averaged less than 1.8% of GDP, and were last above that average rate in 2001.

Erik,

A relatively small part of BBB is deficit financed, which should limit inflationary effects.

More importantly, we have been through a long period of what, by normal “rules”, is relatively stimulative monetary policy and substantial deficits, while inflation was either falling or below target. Contrary to all the politically stoked headlines, it is not clear what part policy plays in our current bout of inflation. The shift in demand from services to goods is Covid inspired and has driven up goods prices. The recent rise in energy prices are not obviously driven by fiscal policy.

We are taught to think monetary policy is a powerful determinant of inflation, and that monetizing government debt is highly inflationary, but evidence for these views is scant in developed economies in recent decades.

Macroduck,

You talk as if the overall fiscal stance does not matter.

BLS releases the November CPI summary:

https://www.bls.gov/news.release/cpi.nr0.htm

Take a look at what they really said before the news wires start chirping HYPERINFLATION.

I confess to being surprised that gasoline prices are up as much as reportted, although apparently the non-seasonally adjusted increase was less than last month’s at 2.6%. Still I have seen no gasoline price increases at all where I am and crude prices stopped rising in late October, as I was the first to note here, and two weeks ago took a sharp drop, although rising in last few days as people are downplaying omicron. But they are still more than $10 lower than peak in October.

So where are all these gasoline prices rising? I have seen reports in the last few days of them actually declining as gas purchased at old much higher crude prices now about used up. But I confess to being mystified at this part of the report.

Menzie,

Would you mind providing your response to question #10 and the related empirics supporting your view? While I’ve enjoyed the IGM surveys since their inception, and the new(er) macro panel is a great addition, this question #10 seems too much normative economics than positive economics and possibly (likely?) in an area where the panel experts don’t engage in active research themselves on this specific question. But maybe I’m being too critical. I do get that these surveys are all about the expectations/forecasts of economists, but this question isn’t one I would place much value in as is. As such, I find it interesting you called it out.

To be clear:

Question 10: In your view, what are the two most likely factors that are currently holding down labor force participation?

There is little research on what is driving labor force participation? I too would like to see our host let us know what the profession has produced on this issue to date.

It’s good to hear you’re not worried about inflation.

It does seem that there has been research on the effect of child care policies and labor force participation rates. This is just one of the links that I discovered using a magical tool called Google:

https://aspe.hhs.gov/reports/effects-child-care-subsidies-maternal-labor-force-participation-united-states

Now I suspect that the researchers would find highly insulting the suggestion that there findings are “normative”. I would tell them to relax as I doubt Econned knows what this term even means.

Of course there’s been research “ on the effect of child care policies and labor force participation rates” but this isn’t necessarily the same as analyzing the “most likely factors that are currently holding down labor force participation.”

Now I suspect that the PaGLiacci would find highly insulting the suggestion that their comment was largely “irrelevant”. I would tell them to relax as I doubt PaGLiacci knows how to comment any other way.

So much for a real conversation from our loud mouth little baby! Do look up the term “normative” before the next time you misuse it!

EConned: Then see Pitts/Atlanta Fed (Sep 2021), Lim, Zabek (October 2021) for some positive analysis, which I believe informed the respondents (what I believe positive) analyses.

I suddenly find myself wondering what Jesus Christ (or fill in your personal choice) would think of the term normative as it’s used in Economics. Surely he would curl up his nose, grimace at the “grotesque” thought, and go “Ick!!! I’m not eating this school cafeteria food, next time I’m bringing a sack lunch.”

Yes, I “get it”, economists don’t want to break any “professional rules”. Surely dead Grandpa Milton (the man who largely became an economist by way of wanting to contribute to the World War II effort and stop the mass killing of Jews) just really would feel anyone who brings these “normative” things up is somehow “letting the discipline down”.

I made an egregious error here, Friedman had already become an economist. Somehow I had gotten it mixed up in my head his work for the National Resources Planning Board was motivated by the war, but that came later when he joined the U.S. Treasury. I think my point still holds to a degree, though I got my facts wrong. My apologies.

https://link.springer.com/article/10.1007/s11150-016-9331-3

More on this research which Econned has mislabeled as “normative”.

I never once labeled this research as normative. I stated that the answers based on he question is normative.

Reading comprehension is important.

So you can read the minds of the participants? You must be some all knowing wizard.

https://www.nytimes.com/2021/11/22/opinion/biden-infrastructure-spending.html

I guess I’ll go ahead and declare myself the idiot in the room and say I obviously understand the AD and AS. But can someone please explain to me what the symbols mean after the slash following the AD on the right hand margin of the graph??

It always kills me on this blog that when I ask an earnest question all of the sudden none of our resident know-it-alls can connect their keyboard to their monitor.

I’m not strong on notation, or I’d pitch in. You inow AD and you know 1 and F. That’s all I’d be willing to comment on.

@ macroduck

Well, You’re pretty sharp as I have it gauged, so at least a feel a lot less dumb if you’re missing part of it. I think the upside down V must be lamda, and that a very decent chance it means the rate of change along the “AD” curve, rather than a “shift”, but I’m mostly just guessing. FE= full employment, LR= Long run. I mean I figured out the the stuff a 1st grader could tell you, it’s the right hand margin has me duped. But you’ve been good for my psyche anyway.

Moses Herzog: Capital lambda is sum of autonomous spending (e.g., government spending on goods and services, or government transfers, that are exogenously determined), capital M is nominal money supply. In a standard IS-LM, AD-AS model, these are the variables that shift an AD curve, so the curve title is understood as “the aggregate demand curve drawn conditional on a given level of autonomous spending and nominal money stock”.

It’s much appreciated Menzie. I was indeed digging a little bit before asking, rather than my usual lazy style of just asking you. I assume this is relatively common textbook lingo or symbol. Maybe the use of lamba in so many other contexts threw off my Google search for this. I’m gonna hunt some more. But I think I got the broad meaning, In defense of myself i did think M could mean money supply, but the truth is I had no concrete idea.

It is appreciated Menzie, I hope that comes across as genuine.

https://fred.stlouisfed.org/graph/?g=JJq2

January 4, 2018

Employment-Population Ratios for White and Black Men & Women, * 2017-2021

* Employment age 20 and over

https://fred.stlouisfed.org/graph/?g=JJqx

January 4, 2018

Employment-Population Ratios for White and Black Men & Women, * 2017-2021

* Employment age 20 and over

(Indexed to 2017)

https://www.washingtonpost.com/business/2021/12/09/long-covid-work-unemployed/

December 9, 2021

Long covid is destroying careers, leaving economic distress in its wake

Suffering from debilitating exhaustion and pain for months, patients find themselves on food stamps and Medicaid

By Christopher Rowland – Washington Post

Across America, many of the nearly 50 million people infected with the coronavirus continue to suffer from some persistent symptoms, with a smaller subset experiencing such unbearable fatigue and other maladies that they can’t work, forcing them to drop out of the workforce, abandon careers and rack up huge debts.

Hard data is not available and estimates vary widely, but based on published studies and their own experience treating patients, several medical specialists said 750,000 to 1.3 million patients likely remain so sick for extended periods that they can’t return to the workforce full time….

https://www.nytimes.com/2021/12/10/opinion/inflation-economy.html

December 10, 2021

Wonking Out: The inflation suspense goes on

By Paul Krugman

Today’s consumer price report came as a huge surprise to almost everyone — because the numbers came in almost exactly in line with expectations, which basically never happens. Analysts whose job is to forecast what official numbers will say a few hours before they come out — a job of dubious usefulness, but whatever — expected the one-year rate of inflation to come in at 6.8 percent; it came in at … 6.8 percent. “Core” inflation that strips out volatile food and energy prices came in right on expectations too.

If there was any information content in today’s release, it was that extreme scenarios in both directions became a bit less likely. There wasn’t anything in the report suggesting that inflation is rapidly spiraling upward; nor was there anything lending comfort to those hoping to see inflation fade away in the next few months. For what it’s worth, financial markets appear to have taken onboard the reduction in risks of really high inflation: “breakeven rates,” which measure market expectations of the inflation rate over the next few years, came down modestly. But nothing major happened.

That said, the headline number is highly likely to come down over the next few months, if only because the big run-up of oil prices from their pandemic lows seems to have gone into reverse:

https://static01.nyt.com/images/2021/12/10/opinion/krugman101221_1/krugman101221_1-jumbo.png?quality=75&auto=webp

Oil wells that end well?

Some other components may also be coming down — or will at least stop rising rapidly. Hyun Song Shin, head of research for the influential Bank for International Settlements, recently made the case that a lot of recent inflation reflects the “bullwhip effect”: panic or at least precautionary buying of goods that seem to be in short supply, which intensifies the shortage. Remember last year’s toilet paper shortage?

Shin points out, among other things, that shipping costs, while still very high, seem to have peaked:

https://static01.nyt.com/images/2021/12/10/opinion/krugman101221_2/krugman101221_2-jumbo.png?quality=75&auto=webp

Containers contained?

But even if you try to adjust for special circumstances, underlying inflation appears to be running high by recent standards, maybe around 4 percent instead of the 2 percent that is the Federal Reserve’s target and has been the norm since the mid-1990s….

The BBB bill contains a significant amount of non-traditional “infrastructure” features which would be interesting to attempt to analyze for “non-inflationary” impacts.

That $72,000 SALT provision will benefit the high rollers in places like New York and California (hmmm), but what does that really do for economic growth (Trump was severely panned for giving tax breaks to the wealthy and corporations). Then there is the redistribution of money from high income individuals and corporations to pay for pre-K. Sounds good, but will that really result in a lot of people entering the workforce. Pre-K is usually less than a full work day, so maybe some part time work?

Then there is the paid family leave provision. That’s a definite cost element for employers so do they just eat the costs or pass them on in the form of inflation to their customers?

Some bennies for seniors, but I’m not seeing that expanding the economic output that much.

Definite wealth redistribution features which might result in some increased spending by the recipients, but does that have a negative impact on the spending by the contributors?

This bill doesn’t seem to hit the “real” infrastructure sweet spots that make commerce more efficient and, thereby, reduce costs and lower prices (like addressing supply chain logistics). Maybe BBB isn’t.

You are apparently not aware that there has already been legislation funding infrastructure of the type you think hits the “sweet spot”. Passed earlier this year? Roads, bridges, ports, water and sewer plant? Missed that? You should look into it.

You have ,of course, cherry-picked the parts of the bill that Republicans object to, rather than giving a balanced assessment. You’ve ignored Menzie’s points while slyly suugesting the opposite of his informed view.

I’m curious as to why you’re pretending the infrastructure bill doesn’t exist. Are you really just whistling past the sewage treatment plant – afraid that, if we improve sewage treatment, your comments will disappear?

Bennies for seniors? Damn – Kelly Anne Conways’ emails to you are getting dumber and dumber. Please tell your master than the good middle class home owners in New Jersey are insulted by this nonsense that they are rich high rollers.

But am I impressed that you managed to copy and paste so many Alternative Facts!

“Pre-K is usually less than a full work day, so maybe some part time work?”

that is completely inaccurate. based on the world you lived in 30 years ago. not today.

“The BBB bill contains a significant amount of non-traditional “infrastructure” features …”

I don’t want the next 30 years compromised because bruce hall lives in the 1960’s. necessary infrastructure changes every decade. if you cannot keep up with the times, then stay silent. I don’t need old people telling me what is necessary over the next 30 years, when that old person will be dead. either keep up with the times, or stay silent. smartphones and the internet have arrived in spite of people like bruce hall. quit holding us back.

I ran across this which is an interesting analysis of HR 5376 which compares the House version as passed to a version that would make the provisions permanent (such as Child Tax Credit and Child Care and Preschool funding). The thought being that once passed, they would continue to be funded because they are so essential to the economy.

https://www.cbo.gov/system/files/2021-12/57673-BBBA-GrahamSmith-Letter.pdf

Phillip L. Swagel uses a 10-year figure to capture the “deficit” which most people define as an annualized flow? I guess Kelly Anne Conway needs to take your shoes off so you can count past ten!

Cleveland Fed has 10 year inflation at 1.75%

Childcare cost is a huge issue that needs to be fixed in the usa. It is a big hindrance for middle income families. Since it costs more than minimum wage, quality childcare is really unavailable to most low income families. And we know poor children suffer in the long run as a consequence. Good workers are constrained by the lack of quality affordable child care.

The lamba symbol stands for rate of change?? Rate of change for what?? I feel like I am being very slow-minded here. Rate of change of “M”?? But what is “M”??

It seems odd to me that both “child care difficulties” and “fear of the virus” have such big gaps between ” most likely” and “next most likely”. As if views fall into two camps on these issues. Either fear of the virus is really important, not important – same for child care.

Ah but that is your normative view. Never mind it is back up by the economic research on the impact of child care. Econned cannot stand it that research leads to something Biden’s economists have been suggesting for the entire year so research must be tagged normative in his right wing warped little mind.

Actually, you’re absolutely wrong about “Econned”.

Again, you’re wrong.

Shocking.

《changing relative prices become noise that makes it difficult to see that demand and supply conditions are largely independent of price levels and exchange rates.》

《the slopes of demand and supply curves are so hard to estimate that they are essentially unobservable. 》

https://onlinelibrary.wiley.com/doi/full/10.1111/j.1540-6261.1986.tb04513.x

Are you just handwaving furiously about noise?

It is remarkable that you are aware of the existence of Black’s “noise” paper, but can’t be bothered to read it. For instance:

“In my model of inflation, noise is the arbitrary element in expectations that leads to an arbitrary rate of inflation consistent with expectations.”

Black doesn’t caim inflation as reported is obscured by noise, which is your claim. He claims that expectations include an arbitrary element which has an effect on future realized inflation. To cite Black as if he supports you views is either dishonest or misinformed – perhaps both. Certainly, claiming Black’s views support your own when you haven’t bothered to understand Black’s views is dishonest.

How do you live with your own hypocrisy – accusing others of misusing economics when all ou ever do is misuse economics?