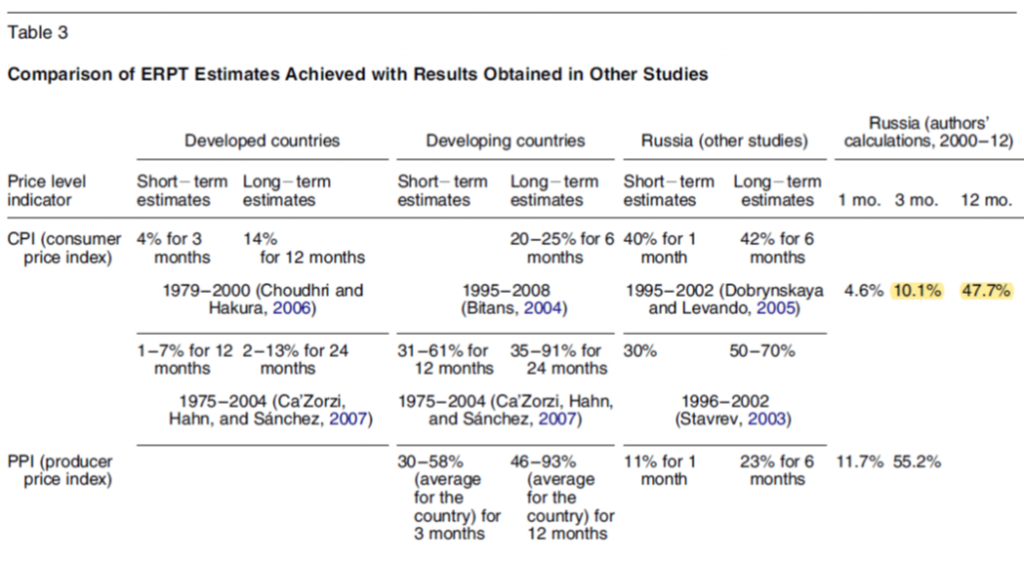

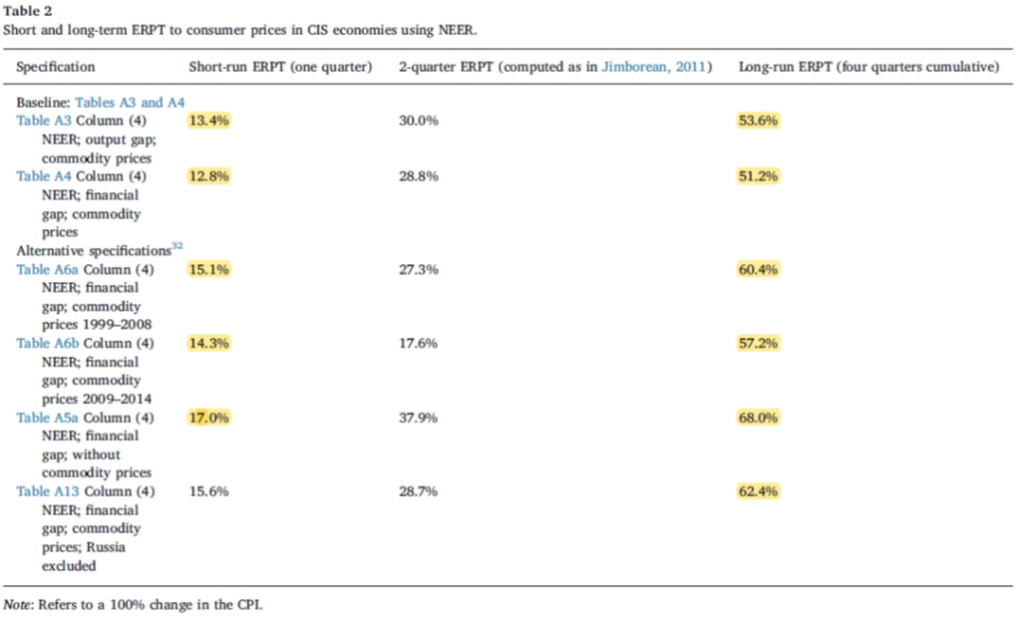

For Russia, it’s maybe 10%-17% for 1 quarter, 50%-70% for 4 quarters.

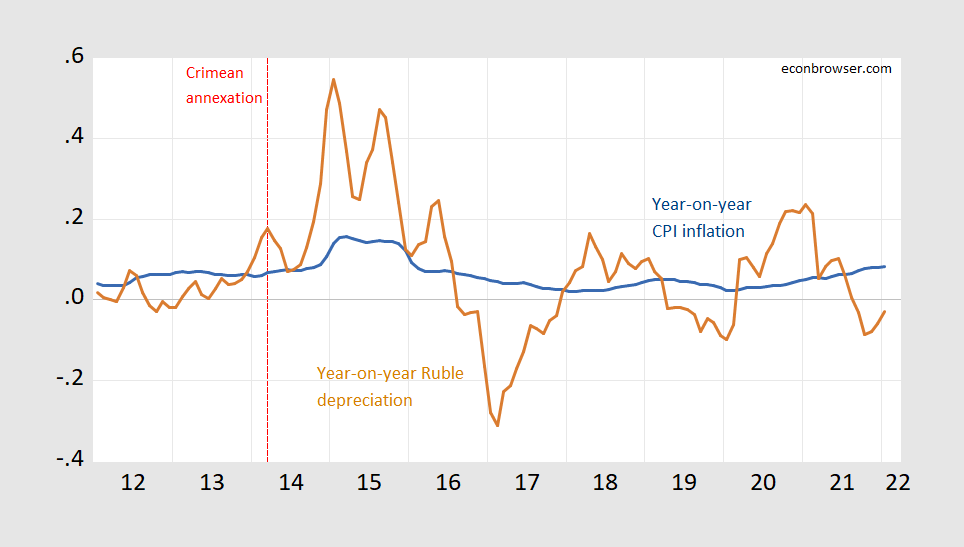

Figure 1: Year-on-year nominal trade weighted Ruble depreciation (brown), year-on-year CPI inflation rate (blue), both calculated in log-difference terms. Red dashed line at annexation of Crimea. Source: BIS, OECD via FRED, and author’s calculations.

Over the past week, the Ruble has depreciated about 36% in log terms. What does that imply for the CPI?

From Iu. Ponomarev, P. Trunin & A. Ulyukaev (2016) Exchange Rate Pass-Through in Russia, Problems of Economic Transition, 58:1, 54-72; a 100% change in exchange rate induces a 10% change in CPI after 1 quarter, 48% after 4 quarters.

This study uses data 2000-2012. That means it excludes the 2014 depreciation.

From Comunale, M. and Simola, H., 2018. The pass-through to consumer prices in CIS economies: The role of exchange rates, commodities and other common factors. Research in International Business and Finance, 44, pp.186-217; a 100% change in trade weighted exchange rate causes a 13%-17% change in CPI after 1 quarter, 51%-68% after 4 quarters in 7 Commonwealth of Independent States countries, 1999-2014. Note that removing Russia results in slightly higher pass-through, so this suggests that Russian pass through using this methodology and sample is a little bit lower.

This study only catches the earliest part of the 2014 depreciation.

What will happen to inflation? if 4 quarter pass through is about 0.5, then if the current level of the Ruble is sustained, the 36% depreciation will induce an 18% increase in the price level above what it otherwise would be. That would be added to a January inflation rate of 1% m/m (not annualized).

The short term matters a lot right now. Russia’s citizenry is unhappy with the war already. The unhappier, the better, and the war needs to end soon.

Based on ruble losses so far, in 3 months (which is too long), there would be something like a 4% to maybe 7% acceleration of inflation (annualized), on top of the recent 8.7% rate? Not confident of my math here.

That’s not a murderous rate of inflation, though it’s bad enough. If all goes well, the ruble will continue to sink and inflation will accelerate even more. We need to make sure it does.

Malenkov, Khrushchev and Gorbachev were all booted from office. Play it again, Vladimir.

Hyperinflation perhaps

I’m unsure whether I agree with the amplitudes of your inflation forecasts.

One, Crypto. Two, in the two prior incidents, Putin wasn’t in cahoots with China and Iran (uses crypto to evade sanctions),

Reasons to doubt cryptocurrenciescwill help much in preventing inflation:

Press reports indicate Russia is being shut out of Bitcoin and perhaps other cryptocurrencies.

However much cryptocurrency Russia has access to, it has lost access to much of its currency reserve.

The inflationary impact is largely through the ruble and the ruble has cratered.

Cryptocurrencies aren’t magic.

Iran is shut out of a good bit of the global financial system, but would happily sell Russia some oil.

As Menzie previously pointed out, China may noy be offering Russia much wiggle room on sanctions.

Of course you don’t. Even as you have no clue – none at all.

I think the Russian people “get it”, how bad this invasion of Ukraine is. And it’s somewhat unfortunate that the Russian people have to suffer on the reason of their D-head leader. But we have to bet if they suffer enough, they’ll go out on the streets to protest and also do consumer boycotts. That’s what one would HOPE/wish

Moses,

It may take awhile for many Russians to figure out what is going on, although indeed it seems many are demonstrating and over 6000 have now been arrested for doing so. I am not sure about now, but aside from those who listen to still-semi-independent Ekho Moskvy as late as yesterday most would hear or see that there is only a “special militaty operation” in the eastern part of Ukraine around the Donbas republics to protect them against genocidal attacks ordered by the neo-Nazi terrorist drug addicts in Kyiv. But then they are certainly noticing things like lines at banks and have heard their futbol team is being booted out of the World Cup, this latter being what may really make some sit up, kind of like people in the US only starting to take the pandemic seriously when it shut down professional basketball games.

Crude Oil Apr 22 (CL=F)

NY Mercantile – NY Mercantile Delayed Price. Currency in USD

100.81+5.09 (+5.32%)

As of 09:06AM EST. Market open.

Russian inflation may be severe, but it looks as if we might have some more in the near future.

We are fortunate that natural gas prices have been relatively stable recently, but still up over 60% versus last year this time. Any speculation what happens to prices with a Russian stoppage of NG to Europe?

Natural Gas Apr 22 (NG=F)

NY Mercantile – NY Mercantile Delayed Price. Currency in USD

4.4370+0.0350 (+0.80%)

As of 09:06AM EST. Market open.

With Russia and Ukraine comprising 30% of the world’s wheat exports, we can expect food prices to start rising again soon.

Chicago SRW Wheat Futures,May-2 (ZW=F)

CBOT – CBOT Delayed Price. Currency in USX

982.75+48.75 (+5.22%)

As of 09:06AM EST. Market open.

This looks like a bumpy ride, globally, for awhile.

https://fred.stlouisfed.org/graph/?g=Mxmi

January 30, 2018

Consumer Prices for China, India, Brazil, South Africa and Russia, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=KsXu

January 30, 2018

Consumer Prices for China, India, Brazil, South Africa and Russia, 2007-2021

(Percent change)

https://news.cgtn.com/news/2022-03-01/China-s-manufacturing-PMI-edges-up-to-50-2-in-February-182xLPw6b4I/index.html

March 1, 2022

China’s manufacturing PMI edges up to 50.2 in February, beating forecast

China’s factory activity in February expanded again, with manufacturing recovering steadily after the Spring Festival holiday, data from the National Bureau of Statistics (NBS) showed on Tuesday.

The official manufacturing Purchasing Managers’ Index (PMI) edged up to 50.2 in February from 50.1 in January. It is above Reuters’ estimate of 49.9.

Manufacturing and business activities had slowed down due to the Spring Festival holiday. In February, the production index was 50.4, down 0.5 percentage points from the previous month.

The new orders index was 50.7, up 1.4 percentage points from the previous month, returning into the expansion range. It indicated that market demand for the manufacturing industry increased after the holiday, according to Zhao Qinghe, a senior statistician at the NBS.

https://news.cgtn.com/news/2022-03-01/China-s-manufacturing-PMI-edges-up-to-50-2-in-February-182xLPw6b4I/img/2d8fbc11f7bd4103a52b73490a1a68db/2d8fbc11f7bd4103a52b73490a1a68db.jpeg …

https://english.news.cn/20220301/ac810b53de79419897633655988ae21b/c.html

March 1, 2022

China’s non-manufacturing sector gains steam in recovery

BEIJING — China’s non-manufacturing activities saw an uptick in February, indicating an accelerated pace of recovery, official data showed Tuesday.

The purchasing managers’ index (PMI) for China’s non-manufacturing sector came in at 51.6 in February, up from 51.1 in January, the National Bureau of Statistics (NBS) said.

A reading above 50 indicates expansion, while a reading below it reflects contraction.

The non-manufacturing sector overall picked up its recovery pace last month, according to NBS senior statistician Zhao Qinghe….

https://news.yahoo.com/ukrainian-president-zelensky-raises-fist-124323814.html?fr=sycsrp_catchall

I was lucky enough to watch Zelensky address the European Parliarment live. A brave speech even as Putin is committing horrific war crimes against his people.

While the Europeans gave this brave leader a standing ovation, Trump trolls like Bruce Hall whine about paying a little more for a loaf of bread.

pgl,

Aaah, but have you seen him on the Ukrainian version of Dancing with the Stars in 2006? Pretty hot.

I refuse to watch these shows. But a good soccer game is another thing

pgloser,

“Whining”??? LOL! You spin faster than a neutron star. This post is about inflation, albeit Russian inflation. So a comment about the spillover is “whining”? You’ve got some odd prismatic lenses that you’re wearing.

So nice that you were able to take time off from day trading to watch Zelensky’s speech. He was so excited about the sanctions, eh?

https://nypost.com/2022/02/26/ukraine-president-volodymyr-zelensky-declines-us-evacuation-offer/

I am just calling you out on who you are. Making jokes over this is disgusting but hey that and wiping Putins butt are your only 2 talents

“I am staying in the government quarters together with others,” Zelensky said in a video address early on Friday. “The enemy has designated me as target number one, and my family as target number two.”

Zelensky is the opposite of you. Brave and principled whereas you hide in your basement spreading Putin lies.

BTW – we are giving him ammunition which has your master (Putin) throwing temper tantrums. Of course I’m sure you are about to do the same as you cannot stand being called out for being the lying weasel you are.

US following Germany’s lead.

The Associated Press was first to report the Stingers would be part of a $350 million tranche of supplies U.S. President Joe Biden authorized last week. Defense News confirmed the report with an administration official granted anonymity to discuss the sensitive matter.

The U.S. decision follows Germany’s announcement it will send 500 Stinger missiles and 1,000 anti-tank weapons to Ukraine, marking a reversal of Germany’s long-standing policy of never sending lethal munitions to war zones.

https://news.yahoo.com/amid-fears-russian-air-dominance-211503747.html

Finally, an admission that meeting force with force rather than down-the-road-impact sanctions is required… and should have been done weeks ago. Looks as if some of that powder has been shaken off the wigs by criticism. The question is: is it too late now? It may be. Just how fast can those missiles be delivered and distributed to the forces on the ground?

https://www.pbs.org/newshour/world/russia-pummels-ukraines-no-2-city-as-convoy-nears-kyiv

Speaking of inflation:

https://tradingeconomics.com/ukraine/currency

Bruce,

Ah, we jump from all but supporting to Putin to complaining that more lethat weapons were not sent earlier. As it is, I agree stingers should have been sent earlier, not sure why they were not. But then you are wrong to suggest that only sanctions have been proposed and no “meeting force with force.” We have been sending anti-tank javelins for some time, which have reportedly been put to good use. Of course, most of us remember that the president you admire withheld Congressionally approved such javelins to Zelensky when he demanded oppo research on the Bidens out of Zelensky, something I imagine you approved of. I think that president got impeached for that, So really, you are the last person here who should be preaching about any failures to meet force with force.

As it is, I happen to support imposing a no fly zone, which has been called for by Zelensky, but it looks like that will not happen.

Bruce’s boy Trump would have given Ukraine nothing while Germany would still on the sidelines. Bruce knows this but the lying weasel will never admit it

Bruce wants to say it is late. It seems Putins pet poodle has not been told that the tank convey is stalled lacking gas and food. Bruce seems all thrilled at Putins military but we should break this to him slowly not to get him angrier. But the Putin war machine is rather rusty

Defense experts note how easily your idea would turn into Russia shooting down our planes. What then? Declare World War 3?

‘Speaking of inflation:’

Gee Putin invasion is creating economic difficulties for Ukraine. No surprise but I’m sure you and Putin are having a grand party celebrating their misery. Yes – you are beyond disgusting.

what’s the pass through from NYMEX to US consumers? April WTI was up $4.13 to $95.72 yesterday, now trading around $104; April gasoline was up more than 2% to $2.9325 and it’s up more than 7% today to $3.1353 a gallon…April diesel was up 4.5% to $2.9313 yesterday and is now over 7% higher at $3.1433… May wheat was up 8.5% to $934-0 yesterday, it’s now around $984….that’s up about 25% since this started, & more than double its price prior to 2020..

rjs: In addition to Jim’s estimates, see one recent take on pass-through to gasoline. https://econbrowser.com/archives/2021/11/oil-price-pass-through-into-gasoline-prices

See also http://yilmazkuday.blogspot.com/2021/11/pass-through-of-shocks-into-alternative.html

We pay a little more for bread. Ukrainians are paying with their lives

That’s not during wartime conditions.

Steven Kopits: Those Yilmazkuday pass through estimates I cited in response to rjs‘s question about the US are for the United States. I don’t think the fact that the world is in a war means we don’t use those pass through estimates for the US. I agree that the pass through estimates for Russia (Ponomarev et al, Comunale and Simola) are probably going to be less appropriate for Russia under such severe sanctions – but what would you use?

I have to wonder if Steve ever bothers to read before he reacts.

I would probably refrain from an estimate for the moment. Which I have.

“For Russia, it’s maybe 10%-17% for 1 quarter, 50%-70% for 4 quarters.”

This does not seem right to me. For imported goods, the price pass-through will be immediate. No one is going to gradually increase prices on imported goods if they do not know about resupply, when and if at all, and at what price. They will adjust their prices immediately, very possibly even higher than current exchange rate considerations due to hoarding or speculative effects.

For non-traded goods, it is hard to see the inflationary impulse. Can a haircutter raise their prices in this environment, when all their customers are spending their spare cash on food and essentials? I would not think so.

The effects we’re seeing here are not monetary phenomena. They are real phenomena. That is, there really are not foreign customers for rubles and no foreign sources of hard currency. The budget constraint domestically is otherwise unchanged. The fact that the price of toothpaste may triple does not mean wages with triple. Indeed, wages may be falling as the price of toothpaste triples.

Now, it is fair to assume large, unsterilized monetary accommodation by the Russian central bank at some point. They will simply start printing rubles to pay for stuff, and that could well lead to inflation, indeed, hyperinflation. But I think that is still in the future.

The fact that something doesn’t seem right to you is neither here nor there. You’re just some guy. The estimates you are questioning are based on actual analysis of data.

Russia has a relatively low reliance on imports, but Rusia has long had a relatively low reliance on imports, including during the period included in the studies Menzie has referenced.

The trade-off in a currency crisis is typically between inflation and recession, but in the short run, you typically get both. Russia’s is a special case, because Russia has already lost access to the reserves an interest-rate defense is meant to preserve. That makes Russia more vulnerable, not less.

Oh, and war itself tends to be inflationary, which would suggest the pass-through estimates from oher periods may be too low.

I don’t think the comps that Menzie is citing are comps. These assume normal exchange rate movements in open economies, not a collapse of trade and effective autarkies.

I can speak from experience in Hungary, if the borders were closed to trade, the price of imported goods would soar overnight and would exceed in all likelihood the actual currency depreciation. Meanwhile, people would be losing their jobs and the economy would rapidly fall into recession. This means less purchasing power would be left to buy non-tradeable or domestically produced goods. On the other hand, the price of import substitutes would certainly rise. Food could be quite expensive. In any event, I think you would have a quite diversified economic impact. This would be offset by unsterilized, or perhaps lightly sterilized, injections of cash into the economy. The associated inflation rate could fall into a very wide range. Assuming this scenario plays out, I would think the 18% inflation anticipated above could be far, far below the actual number experienced.

Did it ever occur to you that the price of nontradeables might also be affected. ltr provides an interesting discussion ala Krugman who explains the economics. Not that the Village Idiot formerly from Princeton would ever understand it.

The prices for non-tradeables would be a function of 1) supply of those; 2) demand for those, and 3) overall price levels. Let’s take haircuts as an example.

Given a collapse of import/export markets and the banking system, I would expect demand for haircuts to decline due to crowding out by increases in the prices of imports. The supply of haircuts would depend on alternative employment opportunities and whether haircutters were killed or otherwise disabled. In the short term I would expect supply unchanged and demand to fall. Therefore, price pressures would be negative.

Having said that, I think monetary accommodation will be coming swiftly. Therefore I expect an inflationary environment, and I would guess 18% is on the light side, based on what we know today, which admittedly is not much. Again, it’s the falling knife problem.

Steven,

Of course Hungary is a far more open economy than is Russia’s. Surprised to see you say food prices would soar so much. Thought Hungary very food productive, long the most ag successful of the old CMEA bloc of countries. Old Soviet joke from Brezhnev period: “Comrade, we need to increase the production of oranges!” “Does Hungary produce oranges?”

Broadly I would agree with you, Barkley. I think at least some food stuffs would become more expensive due to 1) hoarding, 2) loss of imports at the margin. But you’re right, I think, in that some products may face deflationary pressures even as some see their price go up substantially. In any event, I think it’s hard to make forecasts for Russian inflation just now, and I don’t think a peacetime pass-through model is an appropriate analytical tool in the circumstances.

I do expect material unsterilized stimulus from the Russian central bank, and I would expect some impressive inflation as a result, again depending on how long the conflict lasts.

Gee Steve. Real numbers contradicting your pet theory? I guess facts are lying

https://krugman.blogs.nytimes.com/2010/03/18/stagflation-versus-hyperinflation/

March 18, 2010

Stagflation Versus Hyperinflation

By Paul Krugman

Hyperinflation is actually a quite well understood phenomenon, and its causes aren’t especially controversial among economists. It’s basically about revenue: when governments can’t either raise taxes or borrow to pay for their spending, they sometimes turn to the printing press, trying to extract large amounts of seignorage — revenue from money creation. This leads to inflation, which leads people to hold down their cash holdings, which means that the printing presses have to run faster to buy the same amount of resources, and so on….

Nice discussion. Someone should inform the Village Idiot formerly from Princeton that this applies to the prices of nontradeable goods too

BTW, for those of you who do not know it, the worst hyperinflation of all time was in Hungary in 1947. At its culmination they were putting exponents on exponents on currency, and there were five quintillion pengo notes.

https://www.imf.org/en/Publications/WEO/weo-database/2021/October/weo-report?c=922,&s=TM_RPCH,TX_RPCH,BCA,BCA_NGDPD,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2021

Volumes of imports & exports of goods & services * and Current Account balance & percent of Gross Domestic Product for Russia, 2007-2021

2021

Imports ( 17.3)

Exports ( 3.2)

Current Account balance ( $94.6)

Current Account balance percent Gross Domestic Product ( 5.74)

* Percent change

https://www.nytimes.com/2022/03/01/opinion/ukraine-russia-war-economy.html

March 1, 2022

War, what is it good for?

By Paul Krugman

The Ukrainian miracle may not last. Vladimir Putin’s attempt to win a quick victory on the cheap, seizing major cities with relatively light forces, has faced major resistance, but the tanks and big guns are moving up. And despite the incredible heroism of Ukraine’s people, it’s still more likely than not that the Russian flag will eventually be planted amid the rubble of Kyiv and Kharkiv.

But even if that happens, the Russian Federation will be left weaker and poorer than it was before the invasion. Conquest doesn’t pay.

Why not? If you go back in history, there are plenty of examples of powers that enriched themselves through military prowess. The Romans surely profited from the conquest of the Hellenistic world, as did Spain from the conquest of the Aztecs and the Incas.

But the modern world is different — whereby “modern,” I mean at least the past century and a half.

The British author Norman Angell published his famous tract “The Great Illusion” in 1909, arguing that war had become obsolete. His book was widely misinterpreted as saying that war could no longer happen, a proposition proved horribly wrong over the next two generations. What Angell actually said was that even the victors in war could no longer derive any profit from their success.

And he was surely right about that. We’re all thankful that the Allies prevailed in World War II, but Britain emerged as a diminished power, suffering through years of austerity as it struggled to overcome a shortage of foreign exchange. Even the United States had a harder postwar adjustment than many realize, experiencing a bout of price increases that for a time pushed inflation above 20 percent.

And conversely, even utter defeat didn’t prevent Germany and Japan from eventually achieving unprecedented prosperity.

Why and when did conquest become unprofitable? Angell argued that everything changed with the rise of a “vital interdependence” among nations, “cutting athwart international frontiers,” which he suggested was “largely the work of the past forty years” — beginning around 1870. That seems like a fair guess: 1870 was roughly when railroads, steamships and telegraphs made possible the creation of what some economists call the first global economy:

https://static01.nyt.com/images/2022/03/01/opinion/krugman010322_1/krugman010322_1-jumbo.png?quality=75&auto=webp

Steamships made war obsolete.

In such a global economy, it’s hard to conquer another country without cutting that country — and yourself — off from the international division of labor, not to mention the international financial system, at great cost. We can see that dynamic happening to Russia as we speak.

Angell also emphasized the limits to confiscation in a modern economy: You can’t just seize industrial assets the way preindustrial conquerors could seize land, because arbitrary confiscation destroys the incentives and sense of security an advanced society needs to stay productive. Again, history vindicated his analysis….

https://www.gutenberg.org/files/38535/38535-h/38535-h.htm

1910

The Great Illusion

A Study of the Relation of Military Power to National Advantage

By Norman Angell

https://www.gutenberg.org/files/38535/38535-h/38535-h.htm

1910

The Great Illusion

A Study of the Relation of Military Power to National Advantage

By Norman Angell

SYNOPSIS

What are the fundamental motives that explain the present rivalry of armaments in Europe, notably the Anglo-German? Each nation pleads the need for defence; but this implies that someone is likely to attack, and has therefore a presumed interest in so doing. What are the motives which each State thus fears its neighbors may obey?

They are based on the universal assumption that a nation, in order to find outlets for expanding population and increasing industry, or simply to ensure the best conditions possible for its people, is necessarily pushed to territorial expansion and the exercise of political force against others (German naval competition is assumed to be the expression of the growing need of an expanding population for a larger place in the world, a need which will find a realization in the conquest of English Colonies or trade, unless these are defended); it is assumed, therefore, that a nation’s relative prosperity is broadly determined by its political power; that nations being competing units, advantage, in the last resort, goes to the possessor of preponderant military force, the weaker going to the wall, as in the other forms of the struggle for life.

The author challenges this whole doctrine….

So, a couple of points.

First, aggressive wars are assumed to be the result of excessive population, most notably of fighting age young men. This condition was true in 1910, not met today. What is the impetus for war among aging countries with declining populations?

Second, this: “a nation’s relative prosperity is broadly determined by its political power; that nations being competing units.” This is a kind of zero sum, mercantilist view; today we would attribute growth to liberal institutions, ie, solid domestic property rights. After all, China rose to be a prosperous country without a notable military or much international political power. Even more true for Hong Kong or Singapore. As for Russia, plenty of firepower, itty-bitty economy.

A couple of incredibly irrelevant points to this issue right now. I get you want to pretend you are the only smart person ever but that is exactly why you come across as the Klass Klown.

Your cherry picked a quote asserting the quote was something the author believed in order to be the smarter person in the room disagreeing with this alleged belief. Read the first line in the next paragraph:

‘The author challenges this whole doctrine….’

Could you once bother to read an entire discussion before jumping in with your usual worthless babble? DAMN!

“First, aggressive wars are assumed to be the result of excessive population, most notably of fighting age young men. This condition was true in 1910, not met today. What is the impetus for war among aging countries with declining populations?”

Could it be that the GENERAL assumption “aggressive wars are assumed to be the result of excessive population” is nonsense? High share of young men may explain some wars, but not all.

In modern time other strategic reasons (resources, control of terrain) may lead to war…

I was addressing this past of ltrʻs quote:

“They are based on the universal assumption that a nation, in order to find outlets for expanding population and increasing industry, or simply to ensure the best conditions possible for its people, is necessarily pushed to territorial expansion and the exercise of political force against others (German naval competition is assumed to be the expression of the growing need of an expanding population for a larger place in the world…”

I think an excess of young men has, in fact, been a driver of conflict. Lebensraum for Germany, for example. When the Ottomans attacked Hungary, they would come with young soldiers in the off-season when there was no harvesting. Thus, they had in effect excess labor available for use in war. So, yes, I think the availability of young men who may otherwise be hanging about is indeed an enabler, if not driver, of wars traditionally.

Paul Krugman:

The British author Norman Angell published his famous tract “The Great Illusion” in 1909, arguing that war had become obsolete. His book was widely misinterpreted as saying that war could no longer happen, a proposition proved horribly wrong over the next two generations. What Angell actually said was that even the victors in war could no longer derive any profit from their success.

And he was surely right about that….

[ Krugman’s column is brilliant, as is the completely germane analysis by Angell. ]

Krugman on Angell:

https://www.nytimes.com/2008/08/15/opinion/15krugman.html?ref=opinion

August 15, 2008

The Great Illusion

By Paul Krugman

https://www.nytimes.com/2012/07/02/opinion/krugman-europes-great-illusion.html

July 1, 2012

Europe’s Great Illusion

By Paul Krugman

https://www.nytimes.com/2014/08/18/opinion/paul-krugman-why-we-fight.html

August 17, 2014

Why We Fight

By Paul Krugman

https://www.nytimes.com/2014/12/22/opinion/paul-krugman-putin-neocons-and-the-great-illusion.html

December 21, 2014

Conquest Is for Losers

Putin, Neocons and the Great Illusion

By Paul Krugman

Yes, Ma’am.

The west will put Russia into the Saddam Hussein box and throw away the key for twenty years. The economic and military cash, treasure and opportunity cost to Russia might reasonably be estimated in the 100% of GDP range over the long term time horizon.

Win or lose, this war will be a disaster for Russia.