From Hakan Yilmazkuday, “Oil Price Pass-Through into Consumer Prices: Evidence from U.S. Weekly Data”, forthcoming in JIMF:

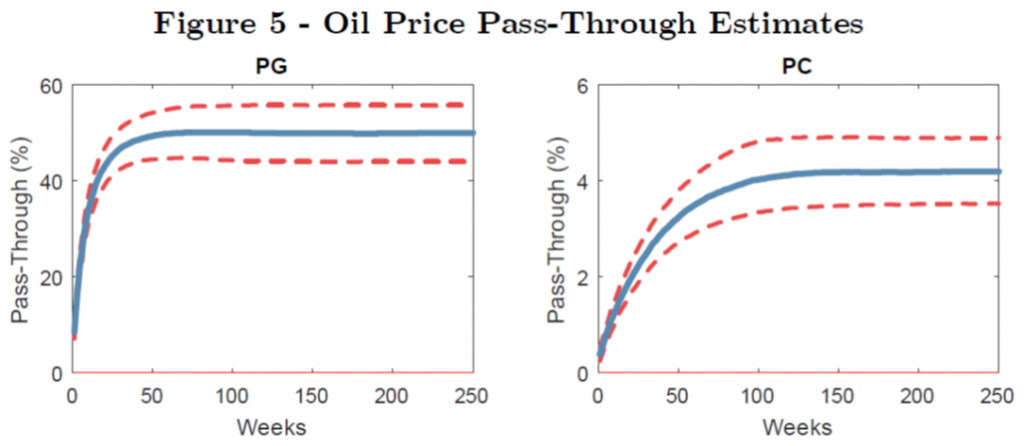

P G [Pass through into gasoline] is about 13% (meaning that doubling oil prices results in about 13% of an increase in gasoline prices) only one week after an oil price shock, increasing to 24% after one month, and 37% after three months. P G has a long-run estimate of about 50% (measured after five years), which is in line with the share of oil in the retail price of gasoline (paid at the pump, according to EIA). About 26% of this long-run estimate is achieved only one week after the oil price shock, about 47% of it is achieved after one month, and about 99% of it is achieved after about a year, suggesting that the effects of oil prices are reflected in gasoline prices in a relatively small amount of time. The 68% credible intervals highly support these estimates.

The author also estimates the impact on consumer prices.

Source: Yilmazkuday (2021).

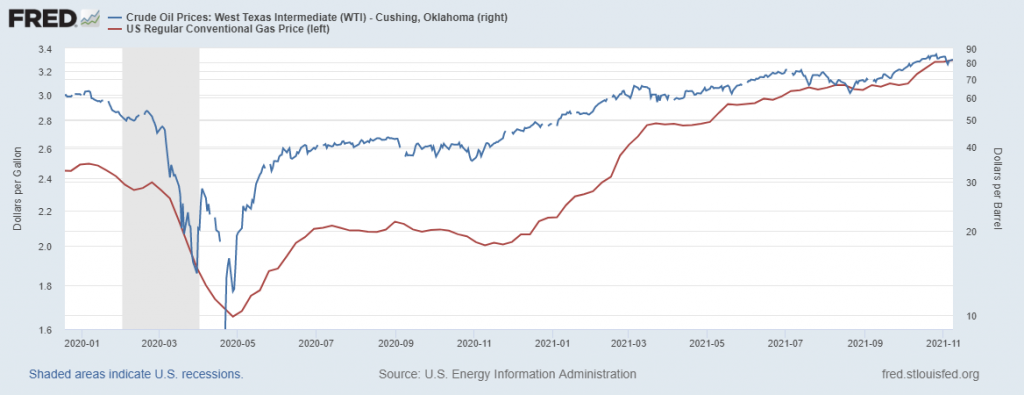

The price of WTI has roughly doubled over the past year; using the estimated pass through, gasoline prices should have risen by about a dollar (0.5 x 100% x $2 = $1). Conventional gasoline prices have risen from about $2 to $3.30.

Recent declines in oil prices should exert downward pressure on gasoline prices eventually.

For a breakdown of costs for a gallon of gas as of September 2021, see this DOE EIA infographic (h/t pgl).

Addendum:

Previous posts on pass through (from Jim H.), here, here and here.

Higher oil prices would mean lower refinery margins if pass through were less than complete. This is what we saw in 2008.

Now gasoline prices have reached $3.30 per gallon and may fall in the future. Princeton Steve’s $4 forecast seems to be as flaky as his latest bagel.

《The price of WTI has roughly doubled over the past year; using the estimated pass through, gasoline prices should have risen by about a dollar (0.5 x 100% x $2 = $1). Conventional gasoline prices have risen from about $2 to $3.30.》

But wasn’t the doubling gradual, not a single shock, therefore now we should only be seeing the rather small effect of a slight increase in the price per barrel of oil from z year ago, on this date? In other words, your reasoning implies oil doubled all at once on one day a year ago, but since instead the rise has been gradual, we are in fact seeing a much greater pass-through than the study predicted?

Did all economists fail Basic Logic 101, eh?

rsm: Yes, a change is not the same as a SVAR defined shock. That why’s (1) I say roughly consistent, and (2) since oil prices have been roughly constant for a month, one can say gas prices should have risen about nil. In fact they rose 3%. Given the imprecision of estimates (i.e., there are (n this case) standard errors for the estimates of the coefficients in the SVAR, and hence confidence intervals for the impulse response functions (which are nonlinear functions of the underlying coefficient standard errors).

EIA has been putting out data like this gasoline pump since January 2000:

https://www.eia.gov/petroleum/gasdiesel/

Dr. Hamilton has been using this data to note how gasoline prices are co-integrated with oil prices. My dumb down version of what his research shows is that the price of a gallon of gasoline = $1 + oil price per barrel/40 where the $1 covers taxes ($0.40), refinery margins ($0.30), and distributor margins ($0.30).

So if oil sells for $80 a barrel, gasoline should be $3 a gallon with oil making 2/3 of this prices, refinery margins and distribution margins being 10% each and taxes making up the difference.

Now there is a lot of variability in these figures and it seems the refinery and distribution shares right now are a bit high.

Now all due apologies to Dr. Hamilton for providing the dumb down version. Maybe he will grace up with an update of his research!

Crude oil prices have been gradually declining for the last three weeks. Gasoline prices continued to increase for the first week or so of that period, but have since been largely flat, or even beginning to slightly decline. Of course there are tremendous local variations on all this, which complicated the matter, with indeed there being standard errors on estimates as one samples for what is happening to gasoline prices across the country, although there are no such on crude oil prices, which are what they are, no sampling or errors involved.

“Did all economists fail Basic Logic 101, eh?”

No but you flunked this course. Try reading the past blog posts on this issue by Dr. Hamilton. You might figure out that things like refinery margins, distribution margins, and taxes matter and the former two are not exactly a fixed constant.

BTW – you earlier claimed that higher GDP growth caused more suicides and drug overdoses. Of course we are still waiting for any evidence to back up with absurd claim. And do provide the standard errors.

rsm,

Wow! You are right. “ALL” economists fail Basic Logic 101 along with Statistics 101. After all, no standard error involved here with a sample of one! And you have a spline in your back!

Oh, and I forgot: we also have ALL failed Reading Comprehension, somehow amazingly enough numbered “101”!!!!! Just a giant pile of failures at pretty much everything, including clearly all those recipients of the fake news Sveriges Riksbank Prize in Economic Science in Memory of Alfred Nobel. What a collection of failed losers!

As for me, I am no good at Economic Logic because, as Moses Herzog likes to point out, I am Barkley Junior, so I only know things about mathematical logic, :-).

Russia and Saudi Arabia are sure to do everything in their power to keep prices low enough to keep shale from rearing its ugly head. And China will help by buying all it can from Iran at deeply discounted prices.

Crocodile tears for shale’s predicament…

If Russia and Saudi Arabia were consistent in their behavior, your claim might be supportable. However, as recently as 2019, the two were utterly at odds. The assertion that they will reliably coordinate to determine market outcomes doesn’t match the evidence. So nice try at joining the grown ups. Here’s a suggestion – lose the cock-sure attitude and you might sound more like you know something. Yes, it is an oil-sector truism that Saudi Arabia would pike to undermine shale production/fracking/marginal well production, so nice truism. Reality has been more complicated.

In JohnH’s follow-up there was a paragraph that supports what you said:

‘Saudi Arabia is more dependent on higher oil prices than other key OPEC+ members. The IMF estimates Saudi Arabia’s fiscal breakeven oil price is about $80, higher than other large OPEC producers such as Iraq and the United Arab Emirates. Russia’s, in contrast, is around $40.’

The World Bank publishes a statistic called oil rents/GDP for various nations. This ratio is very high for nations like Saudi Arabia and Iran but is rather modest for Russia. Oil export revenue is important for Russia but it is not the only action in their economics whereas Saudi Arabia has very little else in terms of income.

The big theme in JohnH’s “expert analysis” of Saudi and Russian decisions on oil supply is that these two nations are cock sure that US shale oil will not see a revival when prices rise above $80 a barrel. Of course none of these Nobel prize winning articles bothered to show us what is happening to shale oil production – so permit me:

https://finance.yahoo.com/news/u-shale-oil-output-surges-201842101.html

Hey is not 2019 yet but it sure looks like shale oil production is rising!

Pgl celebrates environmentally catastrophic shale oil!!…par for the course for our self-anointed “progressive growth liberal,” who sounds more like a West Texas wild chatter all the time. BTW it was the article I linked to that asserted that Saudi Arabia seems comfortable that shale will not be rearing its ugly head any time soon, for reasons pgl doesn’t understand.

Right on cue:

‘JohnH

November 14, 2021 at 11:36 am

Pgl celebrates environmentally catastrophic shale oil!!…’

I have NEVER endorsed the use of shale oil and this troll knows it. But of course his usual economic stupidity has once again been shown to be just that. So this pathetic excuse for a child starts accusing someone of being a sell out.

Hey JohnH – EVERYONE knows you are a clown. So chill out and relax. DAMN!

This is really funny. I just checked the financials for EOG Resources – the leading publicly traded shale oil company. JohnH is cock sure that shale oil is in the tanks. Before the pandemic, this company had over $17 billion in sales with a really nice profit margin in 2019. OK its financials for 2020 were brutal.

But their latest 10-Q shows that over the last 9 months their sales and profits are going to be near 2019 levels.

JohnH is certainly cock sure of himself even if he gets just about everything wrong.

A good piece on Saudi Arabia’s stance on shale.

“ With shale not seen as a concern for now, calls in OPEC+ for more rapid output hikes have faded.

“The feedback we have from shale has been that investors are focused on recovering their capital, even with high prices, no increase in production is expected in the short term,” said another OPEC+ source.”

https://www.reuters.com/business/energy/with-shale-subdued-saudi-russia-become-more-comfortable-with-oil-rally-2021-11-03/

That said, it’s a sure bet that Saudi Arabia and Russia will do everything in their power to keep prices low enough to keep shale from rearing its ugly head again. This effectively puts a limit on how much higher oil prices can go.

Gee that little quote does not appear in this Reuters article. The only thing remotely close is this paragraph:

‘All oil producers suffered a drop in income during the pandemic and the price rally has allowed them to rebuild their balance sheets.’

Are you generally in the habit of misrepresenting what your own sources have said?

Try reading the whole article….

“JohnH

November 14, 2021 at 11:40 am

Try reading the whole article….”

And you must have made this little quote up. Not accusing you of being dishonest as this could be chalked up to your serial incompetence.

You seem pretty confident that the US shale market will stay in the tank. Did you even bother to check on the financials for EOG Resources and Pioneer Natural Resources? They are after all the two main shale oil companies and are both publicly traded.

Now their stock price did fall in March 2020 – the beginning of the pandemic. No surprise. But both of them have seen a tripling of their stock prices since then. Its seems higher oil prices have given them comfort that they can profit by producing shale oil.

Of course leave it to you to not check basic economic facts.

Well, if investment in shale increases, you can bet that Russia and Saudi Arabia will increase output.

The whole point of this is that oil prices are unlikely to rise much. Many OPEC members may need the revenues, but they certainly don’t want US shale production.

And we certainly don’t need it either, though pgl thinks that more environmentally catastrophic shale production is great!!!

My comment on refinery margins was based on this Feb. 2011 report from EIA, which includes a lot of interesting information for the period up to 2009:

https://www.eia.gov/finance/performanceprofiles/refining_marketing.php

I tried to find a more recent update of this report to no avail. Maybe our blog hosts know if EIA has updated this report.

Steve Bannon indicted for criminal contempt of Congress:

https://www.justice.gov/opa/pr/stephen-k-bannon-indicted-contempt-congress

Hopefully this traitor will be tossed in jail followed by Mark Meadow. Lock them up! Lock them up!

here is eia on propane/heating oil pricing:

https://www.eia.gov/petroleum/heatingoilpropane/

going in to winter distillate fuel stocks are down 25% at 125Mbbl, 5 Nov balance sheet.

usa commercial crude stocks are down 11% at 435 Mbbl, and strat petroleum reserve is down 4.5% at 609Mbbl

i believe the year earlier stocks had increased bc low wti price and slow economy.

The reason for lower refinery margins is demand response to the supply driven price increase. When oil prices go up becuase of lowered supply (all else equal…and yes it never is, but to explain a case), than consumption drops. You’re moving the entire supply curve up while holding demand constant. Examples could be cartel action, depletion, production restrictions, etc.

When supply curve moves up, regardless of the exact amount of pass through (which involves refining, taxes, transport, retail margins, etc.), obviously gasoline prices must go up somewhat. (And diesel and jet and everything else from the barrel.) In response to that, volume consumed drops (remember, we kept the demand curve fixed, we’re just moving the intersection point). The amount of volume consumed will depend on elasticity. For example diesel is less elastic than gasoline or jet. But they all drop.

Now refineries are big huge fixed assets. What happens when a fixed asset loses volume? You compete harder and drop margin. You don’t cut capacity until CASH margins go negative. The classic simpler example is LNG liquidation plants, but this applies for any heavy industry: steel, mining, etc. Now refineries have some ability to mitigate the damage. They have SOME flexibility to try to make more of the inelastic products than the elastic ones. But the overall effect is still one of less volume. This puts pressure on margins. The opposite occurs of course if there is a sudden external price drop that is supply induced–classic example is when the cartel loses cohesion and shifts to free competition.

This is really basic supply and demand microeconomics. MBA level stuff. And well understood in the industry. But it is helpful to think about impact on refining sector for supply curve moves (essentially oil production) and demand curve moves (essentially economic activity) and how they give different impacts on refining. A price increase for supply rationing (OPEC has several million bopd offline) has different impact on Valero than a price increase from economic recovery.

Timing issues have to do with costs of storage, etc. Markets are very rational and forward looking. It is important to understand that RBOB (pre-EtOH gasoline) has much more seasonality and is both more expensive/difficult to store and more likely to degrade. Mixed gasoline is even worse in terms of storage cost and degradation over time. Other issues can occur because of the separate markets (gasoline has different specs in different parts of the country, during different parts of the year). But these issues are nuances. The key thing to realize is that refineries are heavy fixed assets and have the normal issues of making hay when demand goes up (very hard to add refining capacity quickly) and getting squeezed when volume drops (are a few games you can play like moving up a shutdown for maintenance, but in general you just get squeezed.)

The study is interesting and I will look at it. But it is important to realized that any time series has a lot of confounding factors and have low data (if you consider the amount of large changes/trends). So it is also important to understand basic supply and demand microeconomics rather than just being a macro chartist.

OK, just skimmed it. It’s OK, I guess.

1. But feels limited in that there’s no discussion of the microeconomics. Just we crunched the EIA price numbers and here’s what we got. But no comparison to micreconomic insights. Even if contrary (or conversely even if only as expected), still have the discussion. It’s helpful in analyzing the industry. See my comments about refinery margins previously. Important to understand that capital additions are slow and are sunk costs after making them. Even people are sunk costs on a short term basis (hard to fire people immediately and for that matter not really an up/down knob you can turn like buying electricity…not as fast).

2. Also, refiners do think in terms of “crack spread” (essentially all the products they sell minus cost of crude purchased). Of course this is not all their costs. But it’s a simple way to think about what is going on in the industry. And it’s something that they will look at when optimizing (which crude to buy and how to operate the plant, with the limited flexibility it has, in order to prioritize certain products over others). And on an industry basis, it basically tells you if refining capacity itself is a bottleneck or not. A high crack spread means we have a shortage of refining and capacity will be added eventually (not quickly). And visa versa. In terms of rapid impacts though, of course capacity doesn’t fluctuate much…so margins get squeezed or blow out….normal commodity industry cycle effect. I worry a bit that the average reader (or an economist with low industry experience) may not think about this issue. Just oil -> gasoline. Even if authors are smart and knew this (I’m sure they do), some discussion is warranted. Need to point out that all the gasoline came from crude. But only 40% (or whatever) of the crude turns into gasoline. This has some impact on how we think of pass through. It’s helpful for the readers (and even the authors) to consider this. Not just crunch the graphs.

2.5. There is some gasoline/diesel switching ability just from operating parameters (not new equipment). Very well discussed in the industry. Impacts (partially mitigates) the impact of oil price shock. Allows more pass through.

3. There are some trade aspects as well of course. Products can be shipped to and fro (with transport cost though). E.g. there’s a pretty classic effect of us sending more diesel to Europe in summer and them sending us gasoline. Has changed recently but those dynamics occur. (Not sure how vital to the discussion, so not criticizing the paper per se. Just including here as another complicating factor to watch out for when thinking about industry supply demand.)

Minor thing but noticed when Googling. It’s Hakan, not Hasan. Also it’s a single author paper–I think I used “we” and “they” to refer to the author(s).

Anonymous: Thanks, have fixed.

Oops…one more pretty off topic thing. Noticed the author is a Turk. My (American) father said they were the bravest soldiers in the world…saw them in Korea. Much tougher than the Americans. Later he spent time in Ankara during Cold War. Was a Turkophile and learned the language, brought home awesome brass tables and the like.

I spent several months there last year, working in a heavy industry (not refining). Loved it but didn’t learn much more than Gunaydin and Nasilcanez. Was in a very remote part of the country, not Istanbul or Ankara. On the Euphrates River (like you hear about in history class!)…it starts in the hills of Turkey before heading to Mesopotamia. Definitely a social split between the liberal engineers from Ankara and Istanbul and the local workers (very Muslim area). But still…had a great experience. Ate bread and cheese with the workers. Drank raki with the engineers. Was during a travel warning (not Covid, terrorism…embassy briefly shut). I felt pretty safe in an industrial setting and local town though. And I decided “making money” equaled “essential travel”. I did decide not to add an Istanbul stop on way home as they said that was area of greatest warning (wanted to go buying stuff in the Bazaar). Had seen Istanbul 20y before though for touristy stuff (tagged onto a work project). Incredible city. Only comparison I know is Rome.

Can’t do this purely in percentage terms, due to fixed refining and distribution costs.

Agreed. Or at least have some reasonable discussion of the situation. Fixed and non fixed costs, etc. Those that scale, those that don’t (taxes for example are often purely volume based). But when you just 100% ignore it, makes me worry the author doesn’t get it. And even if he does, why not discuss with the reader?

This is going to sound super nerdy-academic snarky (apologies Menzie and not meant that way…but have to share partial insights), but the author produces a vast amount of papers over time. Check out the CV. Make a histogram of papers per year. 😉 Now, I actually respect that. And am even a FAN of doing “LPUs” (least publishable units)…really I am, feel they are more easy to deal with, more helpful in the literature). But I’m not crazy about ignoring important discussion. And probably doing papers that are more “crunch and algorithm and report, sans discussion of implications/insights” makes it easier to achieve this high volume.

Anonymous,

Much of the territory in Turkey that drains into the Euphrates is populated by Kurds. Were you in a Kurdish or Turkish ethnically dominated area?

The bazaars of Istanbul are simply fabulous.

I do think you are being a bit snarky about this Hakan guy. Yes, he has really cranked out a lot of papers recently. Maybe a lot of them are not all that good. But he has had several big hits recently: two papers in the Journal of International Economics, one in the Journal of Monetary Economics, and this one Menzie links to is his second in JIMF, which is the top field journal in international macroeconomics. Does not look too shabby to me.

Bark,

It was Turkish. Not that close to the border. Maybe Armenian (population, not governance) 100 years ago. Erzincan is the nearest big town, but I was a distance from that. Almost literally BFE. But…driving through several highway armed checkpoints always…interesting. And the cab drivers with the ME music and all. Like a movie and all. But real life. I liked the adventure aspect of it.

Good on him for the big hits. A little more micro discussion would be good. I Major props for the production. Especially at a non R1 school. I just want a little more. After I get the finger, I move up the arm. 😉

While I admit refinery margins and distribution margins should be factored in – these margins are certainly not fixed. And we thought you understood the oil market.

JohnH tried to draw an analogy to the idea of using the revenue from carbon taxes to provide transfer payments to average Americans to the 2010 reduction in gasoline price subsidies which was accompanied with modest transfer payments to Iranians.

I think he entirely missed the point that Iran exports a lot of oil and the nation enjoys enormous economic rents especially when market oil prices rise. Now the authors of this discussion have done much more serious thinking and research into the role of oil rents and how average Iranians are doing:

https://theforum.erf.org.eg/2021/05/23/oil-rents-irans-middle-class/

They have also authored a couple of similar papers. Let no one pretend to be an expert on the Iranian economy if they have not read their research.

An interesting piece that adds virtually nothing to the discussion of Iran’s successful program to raise gasoline prices and gain public buy-in by distributing the proceeds to lower income Iranians at a amounts that exceeded current US proposals for universal basic income. In the end proceeds were distributed to all Iranians in equal amounts, but still boosted the income of the poor in percentage terms much more than higher income folks.

What’s mystifying to me is why pgl seems to be vehemently resisting the eminently reasonable idea that the public needs to be incentivised to support higher energy prices. Raising energy prices is a particularly fraught exercise for politicians, many of whom have been thrown out as a result is rising gasoline prices. But Iran did it. The Iranian experience is both informative and instructive.

I am also mystified at why economists and other policy makers are not recognising that public buy-in is as important a part of a fossil fuel reduction program as carbon taxes. Until they realise that elemental fact, they have no prospect for success and are not working seriously to address climate change

My lord. Your stupidity is off the charts. They add nothing.? I astound take my. Own advice and talk to those trees which have something that resembles a brain

PGL, word salad meaning?

Having trouble following this CoRev? Well it did start with one of JohnH’s patented bouts of stupidity so hey!

Only the dumbest troll ever would claim this research by Mohammad Reza Farzanegan adds nothing to the conversation. And you did make the incredibly pathetically stupid claim. Look troll – he gets the Iranian economy. You do not.

BTW this childish parade of yours that economists like Jeff Frankel are centrists who do not care about the poor is your usual clown show. The idea of using carbon taxes to provide income for the poor has been around for at least 20 years. But JohnH the King Klown thinks he is the only one talking about this? Have you noticed a lot of other folks here are treating you like a clown? I wonder why.

I’m so old I can remember the days when the oil futures market would pay you $37 to take delivery of a barrel of oil. A $120 increase in oil prices in just over a year is quite extraordinary. These are strange times.

The fracking boom has turned into a flop and I don’t think it’s ever coming back at the same scale. It’s capital intensive and the returns are too short to pay off. As each expensive well dried up, the only way to keep going was to drill another expensive well. Investors lost a lot of money and I think are going to reluctant to spin up again. It was a decade of cheap oil but that’s over and done forever — and better for the environment.

You’re comparing the prompt (or spot) over time. If you look at the price of the current contract (DEC21), it was ~+$30 at the lowest point during Covid scare. It’s now ~$80. So has gone up $50, not $120. Markets are not omniscient but are forward looking.

https://www.cmegroup.com/apps/cmegroup/widgets/productLibs/esignal-charts.html?type=p&code=CL&title=DEC_2021_Crude_Oil_&venue=1&monthYear=Z1&year=2021&exchangeCode=XNYM&interval=1

A few years ago, before his retirement Professor Dave Giles shared some of his work and the work of others on the price of oil and gasoline. May be of interest.

http://web.uvic.ca/~dgiles/downloads/VICTORIA_GASOLINE1.WF1

Here is the link I meant to post.

https://davegiles.blogspot.com/2014/08/on-rockets-and-feathers.html

Brent Crude and WTI are highly correlated and the the WTI discount has narrowed in recent years.

But if one is studying gasoline and/or diesel prices, Brent Crude might have been a better choice as from my limited understanding, the Brent benchmark is used more frequently to price gasoline.

It would be interesting to see the same models applied to economies with high excise taxes on gasoline and diesel fuel. Presumably the pass-through to both fuel and consumer prices would be relatively subdued by comparison.

Erik Poole: Jim Hamilton mentions this back in 2013. Don’t know if still true.

Barklely Rosser wrote: “Crude oil prices have been gradually declining for the last three weeks.”

Good observation. If I recall correctly, the catalyst or coincidental event that drove Brent Crude over US$80/bbl was the storm along the coast of the Gulf of Mexico. At the time, I expected oil prices to back off into the $70 range relatively quickly. Wrong on that bet so far….

OPEC+ has not changed its policy and is not making any gestures to placate the cheap fuel-entitled Americans. But OPEC+ has to be worried to the extent that if WTI says near $80/bbl, in the not too distant future US tight oil production will ramp up again.

Oddly enough, attempts to reduce methane emissions could help stabilize global oil prices. Natural gas is co-produced with most tight oil. Sever flaring restrictions would increase initial costs and slow the pace of development as well as favour scale. Such restrictions would help upstream companies make a better return on capital. Though it is rather clear that US voters do not care about the welfare of producers and that nebulous concept of social wealth but simply care about the cost of fuel and how they are individually impacted.

wti will settle to what the market says….

i expected a wti decline but the infrastructure bill passed means more demand for construction which is diesel and macadam (whatever road tar is called today).

i also suspect usa inflation is a rising breeze for world oil pricing, cheaper dollar and so forth.

i see the 5 or so % drop in usa crude output as political, not price driven.

opec+ would not be motivated to pump more, and lower price!! bc politics drove usa production down, they could be caught in a biden attempt to reverse recent usa stock declines.

also opec+ is not ‘confident’ that this winter will be any better than 2020-2021 wrt covid impacts on economic activity.

usa voter skepticism is clear and it does not permit the ‘modelers’ to describe what is ‘good for them’. covid/vaxx skepticism is easily transferred to not letting climate warriors define ‘social wealth’.

while eia reports on stocks suggest a worry if usa north gets a cold snap that looks like texas last february……….

“predictions are hard especially about the future”

So, where I am in Harrisonburg, VA, yesterday gasoline prices suddenly dropped by 5 cents per gallon in most stations, from $3.29 to $3.24. I do not find this surprising after three straight weeks of declining crude oil prices, both Brent and WTI. Indeed, I have been forecasting this would happen, although still possible this will turn around and start going back up again. But so far I see zero commentary or even recognition of this in the media anywhere. The talk is still all inflation, inflation, inflation, and how much Biden and the Dems deserve to have low ratings because of it.

I remind folks that when I forecast victory of Youngkin over McAuliffe in VA gov race, I noted locals where I am complaining about price of gasoline above all other things, with the exception of all that crazy education stuff. I also forecast then the increase would stop after the election, but nobody would notice.

So, anybody else out there seeing declines in retail gasoline prices where you live? Or am I in some kind of non-standard error zone? But, if crude prices do not start rising again, I expect most of you will see at least some modest declines in those retail gasoline prices, even if all the people and media who were carrying on and ranting about them rising proceed to say nothing about it at all.