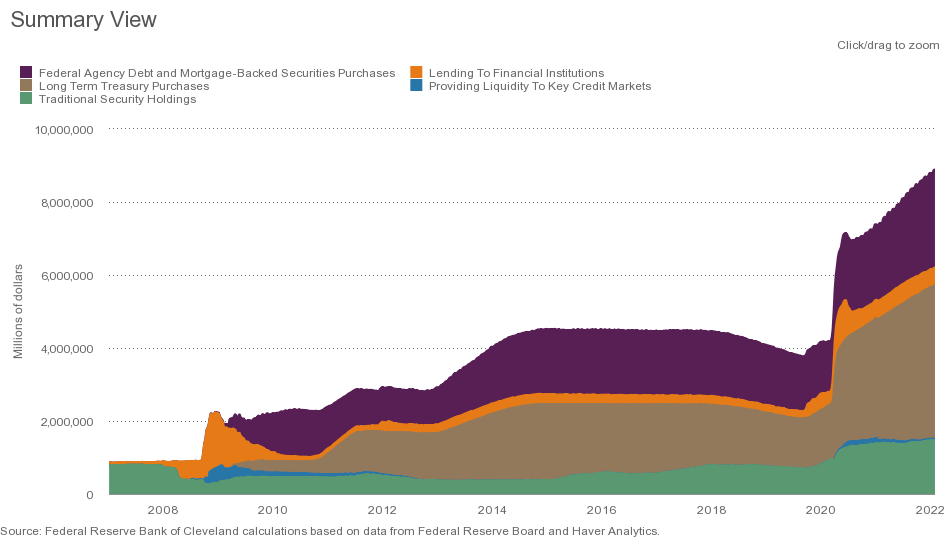

You can always see a nice graphic showing the broad breakdown of Fed asset holdings at the Cleveland Fed’s website:

Source: Cleveland Fed, accessed 2/1/2022.

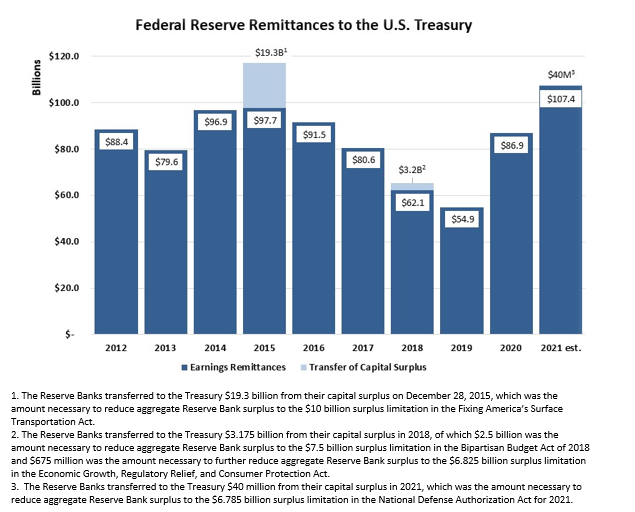

A short time series on remittances to the Treasury of earnings on Treasury assets is reported here (h/t pgl):

Source: US Federal Reserve.

For clarity, “taper” means reducing the pace at which new assets are purchased. That means the new purchases will end March 2022.

In the last reduction in the Fed’s balance sheet, as shown in the first figure above, holdings of MBS’s were reduced by allowing the securities to mature, without replacement.

@ Menzie

I have a respectful question for you Sir. If you had Republican control of both the Senate and a House in post-2024, and a hypothetical President who was willing to nominate FOMC and/or Fed Chair candidates such as Judy Shelton, Stephen Moore etc. And this hypothetical President had more than shown a willingness to “politicize” the Federal Reserve….. You’re willing to wager your future professorial pension payments that the Fed would “never sell MBS securities”??

Careful answering now……

Moses Herzog: I still don’t understand this entire exchange. Knowing the gross hypocrisy of politicians and some economists on the right, my guess is that they wouldn’t want to upset the apple cart by embarking on selling MBS’s (which would tend to raise mortgage rates), even though their current ideological stance is to say the Fed should get out of holding MBS’s.

OK, fair enough. NO, I think you understood the exchange. I guess i had a hard time admitting the loss in MBS asset values really wouldn’t effect the Fed balance sheet hardly at all because of them keeping it to maturity. i.e. had a hard time admitting I was wrong. I mean when you see what they did with soybeans and the southern wall expenses I still don’t think it’s completely out of the question. But I was grabbing at straws a little bit and my argument was a little bit ridiculous. Or maybe just plain ridiculous. sorry

I would say balance sheets v. income statements. But then I saw Moses attacking me for something I never said. His beef should have been with macroduck. But wait – baffling chimes in with an important point, which short of anticipated this latest post!

Look – I am not in the forecasting game for good reason. But folks – can we at least produce reliable financial statements before just making stuff up?

If I attacked you for something you didn’t say, I’d say I’ve got about 19-to-1 ratio more ticket punches to get equal with you on that score, and those are just the ones between you and me.

The total number of assets and composition of those assets is important. No one was arguing that income isn’t an important factor. If I say “We get a lot of light from the moon” We are not by extension saying “Light from the sun is not important”. And you pull that crap so often and continually on this blog that it becomes so damned annoying how you misrepresent others’ arguments, to the point they become so pissed off at you they want to taking the opposing side of whatever you said. Why don’t you just bring up a point–the income–without belittling the points being made on the balance sheet as “irrelevant”. The Fed is not existing in a vacuum, the asset composition and amount has real world effects, which have nothing to do with the Fed’s weird ass way of accounting, which says if we kick back money to the Treasury “all is sweetness and light”.

I am flattered that you took time off from harassing old ladies buying ice cream but that comment was your usual worthless whining. Yes balance sheets are important. But all I suggested is that someone take a look at the income statements too. Go back and look at Menzie’s hat tip when you are done reading NBA box scores – which is another thing you never understood.

https://www.nytimes.com/2022/02/01/opinion/inflation-recession-us-economy.html

February 1, 2022

Can the Fed let us down easy?

By Paul Krugman

American workers are quitting at record rates, suggesting that they’re confident they can easily find new jobs. Wages are rising rapidly, suggesting that labor currently has a lot of bargaining power. These are the hallmarks of an economy at or near full employment. At the same time, inflation is running uncomfortably high.

All of this says that it’s time for the Federal Reserve to cool things down, which it has indeed said it will do; it’s planning a series of interest rate hikes over the year ahead, with the pace of those hikes dependent on the data.

But can the Fed pull this off without sending us into a recession? It will be tricky, for reasons I’ll get to. But I keep seeing people drawing parallels between recent inflation and the inflation of the 1970s, with the implication that disinflation will be as ugly as it was last time. So it’s important to understand why that comparison is misleading.

The end of the ’70s inflation was indeed extremely ugly. Paul Volcker’s tight-money policies eventually brought inflation down to tolerable levels but only at the cost of a huge surge in unemployment:

https://static01.nyt.com/images/2022/02/01/opinion/krugman010222_1/krugman010222_1-jumbo.png?quality=75&auto=webp

The ghost of disinflation past.

Why was disinflation so hard? Because expectations of continuing inflation had gotten deeply entrenched in the economy, so businesses kept raising prices even in the face of high unemployment (which is what we mean when we say “stagflation”). It took years of pain to break the wage-price spiral.

What about now? …

Robert Reich: “ According to this week’s release from the commerce department, the US economy has been growing at its fastest pace in almost 40 years. Corporate profits are their highest in 70 years. And the stock market, although gyrating wildly of late, is still scoring record gains.

So why do most Americans remain gloomy about the economy? Mainly because their real (inflation-adjusted) wages continue to go nowhere.”

https://www.theguardian.com/commentisfree/2022/jan/29/share-the-profits-us-business-workers-economy-wages?fr=operanews

There is an illusion that wages are rising rapidly. Krugman doesn’t note that. Average real hourly wages are almost exactly what they were two years ago at the start of the pandemic. Workers are forced to change jobs quickly just to keep up.

Krugman did note the high inflation and the wage-price spiral. So excuse him for not parroting your pre-approved language. JohnH – worthless whining as usual.

It’s not a matter of approved language. Krugman’s leading argument is patently false. “Wages are rising rapidly, suggesting that labor currently has a lot of bargaining power.” In fact, real wages have barely risen since the start of the pandemic, and labor has negligible bargaining power.

With a false statement like that Krugman seems to want to ingratiate himself with the corporate world, a penchant sadly all too common among many economists and a tendency that pgl should easily recognise in himself.

Leave it non-economists like Robert Reich to tell it like it is…

In some sectors, real wage have increased. Our host have provided lots of data which of course you ignore. Now even if Krugman got one thing wrong, it pales in comparison to how many distortions you have put forth here.

“In fact, real wages have barely risen since the start of the pandemic, and labor has negligible bargaining power.”

just curious johnh. since this seems to be viewed as a failure, exactly how much of an increase in real wages do you think we should have seen since the pandemic?

JDH’s timely and thorough analyses of the Fed’s balance sheet in response to the economic downturn following the subprime financial crisis (does anyone call it that anymore???) was what brought me to Econbrowser many moons ago. Did anyone at that time imagine almost 15 years later that the Fed’s balance sheet would look as it does today? What a wild time for central banking. That was when the Peter Schiff and Ron Paul types were warning of what they perceived as a (perpetually) imminent explosion of Zimbabwe-style inflation. It was coming, just wait they would say. Reminds me of the blind squirrel.

I recall there were economists arguing that the increased balance sheet would not be a problem. their arguments convinced me that was the case. and low and behold, the balance sheet does not seem to be a major issue. in have considered both Schiff and Paul to be fools since first hearing their comments. they live in a fictional world. unfortunately, we still have similar people in the world today.

Thanks for posting this. Confirms pretty much the numbers I noted in the other thread. And indeed the tapering is the slowing of buying more, not necessarily actually selling off the MBSs.

I shall be having a parathyroid removed at UVa hospital in Charlotttesville early tomorrow morning. Going over shortly to avoid driving across a mountain in a forecasted freezing fog. Anyway, I may be out of commission for a bit.

Back under the other post – macroduck got around to present the 2019 and 2020 income statement for the FED while JohnH is bringing the theoretical possibility that the fair market value of the FED’s assets just MIGHT be less than their book value. Fair enough in theory and two years of income statements may not be enough to capture the long-term effects of holding MBS assets. But macroduck does have a point when he notes that JohnH still has not produced any reliable financial information.

My ONLY plea was that people produce actual financial data. And one would think I committed the mortal sin of eating Ben & Jerry’s ice cream!

pgl

Again, you are the only moron here who thinks assets are “not part of financial data”. I bet people like Warren Buffett, who has literally made multiple lifetimes of wealth spotting undervalued assets in financial statements, would find your statement that assets are not part of financial data a laugh riot. BTW, we know you are not an accountant, you don’t need to tell us that. …… As if we would all drop dead in shock you are not an accountant. That is plain observable from your comments,

‘you are the only moron here who thinks assets are “not part of financial data”.’

Now you have just LIED about what I said. And you put your little lie in quotes. Listen troll – you are the most worthless little POS ever. So take your long winded and pointless rants somewhere else as you are truly a waste of time.

“the fair market value of the FED’s assets just MIGHT be less than their book value”

Gee I mention the distinction between the fair market value of assets and their book value and some drunk little pest claims I said assets are “not part of the financial data”.

Not only is Moses a serial liar, his lies are so incredible STUPID that all the other kiddies are laughing at him as they eat their ice cream.

FRED has the history numbers for Fed UST and MBS holdings.

I was surprised that the Fed ‘only’ held $0.927 trillion [from $0 in December 2008] in MBS in December 2012; while it held $1.657 trillion in UST securities [up from $0.476 trillion in December 2008].

Can anyone explain why the Fed ‘needed’ to increase UST/MBS holdings by $1.6 trillion, or 62%, from December 2012 to $4.2 trillion in December 2014? According to FRED the Great Recession ended in June 2009.

In December 2008, the Fed system owned $476 billion [53% of assets] in UST and total asset was $906 billion. Now, it owns $8.4 trillion [94% of assets] in MBS/UST and total assets are $8.9 trillion.

It’s not only unprecedented assets purchases. Since December 2008 [with a two-year hiatus from 2017 to 2018], the FF rate targets were near-zero.

And, the US national debt just went above $30 trillion.

“What, me worry?”

For one thing, some US mega banks would have been revealed as insolvent if the fair market value of their mortgages had been reported. The Fed’s purchases got a lot of mortgages off the banks’ books. Curiously, no one seemed to report big losses on the sales! Of course, pgl will complain about a lack of evidence, but secrecy was paramount, as it is in much of the Fed’s dealings.

This may have been true back in the 1980’s for the S&Ls. But mark to market accounting has been the standard for a long time even if the banks hate it. Now if you know of ANY evidence that the market value of MBS is far less than the reported value – provide it for once in your fact free life.

“secrecy was paramount”.

Dude – their income statements and balance sheets have been available for many years. Macroduck is right – you refuse to even try to check them out.

But I will give you this. You note I have been mentioning the asset value issue. Your drunk BFF is claiming I said assets are not part of the financial data. Yea – he lies. A lot.

“Curiously, no one seemed to report big losses on the sales!”

This would have shown up in the FED’s income statement. Macroduck has tried to get you to check those out. You attacked him for using abbreviated ones only AFTER I provided more detailed information but of course you refuse to notice that.

Do we need to send the KPMG audit partner over to your house to mansplain basic accounting to you? He will be glad to bill you $1000 an hour for his time.

The Fed’s balance sheet… of course! If you have full faith and trust in an organisation whose financials almost never got…and one who’s accounting rules are not standard.

Whether or not you trust the reported value of their assets – you have not once taken a real look at their income statement which would report any alleged losses from holding MBS assets. Macroduck tried to help you here but then you went all whiney and ballastic. Come on troll – do you have even a clue how to provide income statements? It seems not.

BINGO!

I would have written that but I have no evidence/proof that the Fed bought at par not market – and I’m not a liberal. It isn’t available and I have not seen it anywhere.

Too Big To Fail.

Also, I thought Fed MBS holdings would have been more than $917 billion in December 20012 – seeing as there was about $6 to $10 trillion in deeply depreciated, often defaulted, garbage floating around the banks.

And, December 2014 is six years after the subprime mortgage global crash.

IMO, Wall Street’s gravest sin was selling the crap to widows and orphans.

At the time, the Fed said the purchases/Quantitative Easing were to keep long rates low. Liar, liar pants on fire.

Yeah…when you think about it, the Fed lowered interest rates, driving up asset prices, then bought higher priced assets, which were sure to lose value when interest rates normalised. And no large scale losses got reported. What could be wrong with this picture? Of course, if MBS are kept to maturity, the losses never materialise, and who’s know how much of their portfolio is truly carried on the books at market value.

pgl complains about a lack of evidence, which is true. Intentionally left in the dark, we the people are left to try to make sense of the little that is revealed.

And then very knowledgeable pundits can’t understand why there is so little trust in government! And rubes like pgl believe whatever the NYT feeds them

“the Fed lowered interest rates, driving up asset prices, then bought higher priced assets, which were sure to lose value when interest rates normalised.”

Stage 1 sounds like a smart business move. Now when did interest rates go back up to 5%? Oh wait – they haven’t! BTW – the financial statements for the FED were not prepared by accountants at the New York Times. But you seem to think the NY Times is a Big 4 accounting firm. You are THAT stupid.

Pgl’s smart business advice: buy high, sell low!

Intriguing article, hinting at a deal to secretly be done, making sure that FNMA losses would never become part of the federal debt.

https://www.institutionalinvestor.com/article/b150qd84yjjlmj/losses-at-fannie-freddie-may-hit-us-books

Hmmm…who could pull of such a deal yet hide the losses. As a politician once said, some things are just too important to be discussed in a democracy…

You are now relying on pure speculation from Institutional Investor and some babbling ala Larry Summers? OK. BTW – this babbling is not exactly a financial economic analysis of the FED’s return to MBS assets. Not even close.

Yes, it would be nice if the Fed understood the word “transparency.” In its absence people have no recourse but to speculate…or have blind faith, which is pgl’s preference.

Or maybe pgl has some credible explanation of how exactly FNMA avoided bankruptcy without adding to the federal debt.

Did you read this story?

“The U.S. government’s strengthened support of mortgage lending giants Fannie Mae and Freddie Mac has some analysts worried that absorbing unlimited losses for the companies for three years could increase the federal deficit by tens of billions of dollars, reports The Wall Street Journal. The Congressional Budget Office has said that it supports bringing the companies onto government books, a move which would essentially treat them as federal agencies for accounting purposes.”

There is no hiding of anything even according to your own link. BTW – these two companies routinely publish their income statements and balance sheets. Learn to use http://www.sec.gov. Everyone knows their losses from 2006 to 2011. I checked and since 2012 they have been making profits.

Of course you NEVER check the data as it would get in the way of your incessant lying.

I think the abbreviated answer to your question on 2012 MBS purchases is “Still cleaning up the mess ‘W’ Bush left on the White House toilet seat circa 2008”.

Kind of like when President Biden took over for orange Mar-a-Lardo and had to shift resources/funds from a MAGA border sloppily engineered chickenwire fence eroding at its base and back to its originally intended military projects, such as defense of nuclear attack from North Korea. The idea a nuclear warhead from North Korea might do more harm to America than some Mexican groundskeepers hopping over the MAGA fence isn’t too complicated for our resident “Vietnam Vet”, is it?? Or were you getting a stiffy thinking about a ride in a Huey over Pyongyang with your red sweatband wrapped around your head??

The Fed was not just engaged in monetary expansion during QE. The Fed was also absorbing risk. Private portfolios had shed risk during the financial crisis to the extent that credit markets broke down. Mortgages were the biggest part of that risk sell-off, though far from the only part. In fact, Fed officials tried briefly to distinguish in public statements between quantitative easing (Treasury purchases) and credit easing (absorbing risk to the point that markets would resume conventional functioning). The public mostly ignored the distinction, but market participants understood.

The Fed was not just interested in ending the recession, so it didn’t stop asset purchases when the recession ended.

Thanks for an informed response. My apologies for getting in the boring details of income statements and balance sheets that JohnH is now saying do not exist. Of course to the lying troll Uncles Moses, I have ignored the asset side as not being part of the financial data. This comment section has gone to toilet despite your best efforts.

Well yes, it is true, any time pgl’s brittle egg shell feelings have been hurt through criticism, whenever and wherever (or all the time??) , then that comment thread has been “ruined”. Tune in again for tomorrow’s next soap opera episode of “As the Fragile Ego Turns”

The thinnest skin little Sarah Palin writes more meaningless nonsense. Yea – Sarah Palin told a lot of meaningless little lies that had zero purpose back in that 2008 election. And she is clearly your role model.

Come after me all you wrote – but at least one time come after me with something I really said rather your made up stupid garbage. If you know how.

“credit easing (absorbing risk to the point that markets would resume conventional functioning).”

I think I noted over at Econospeak back in the day how credit spreads on BBB rated corporate bonds spiked to over 5% even as the FED was lower government bond rates. The absorbing risk part managed to bring down credit spreads which helped restore investment demand. One would think most people would see this as a good thing but maybe not.

@ Macroduck

I’m not really disagreeing with your statement. But I would like to say that, if the Federal Reserve wasn’t specifically purchasing the MBS in 2012 to stop a recession (which at that point most of the recession risk had passed) they were doing this because of things related to duration, long-term rates, and accommodating mortgage markets. No, I agree, it wasn’t to stop a recession, but it was a measure taken “downwind” of the effects of oddball weights in the Fed’s “portfolio”~~and was therefor still related to the earlier “W” Bush/derivatives recession.

One thing to keep in mind when comparing economic performance to policy stance is that economic performance is not influenced by policy. A rebound in growth under extremely accommodative policy probably jeeds continued accommodation for a while to keep going. Lots of judgement is required.

That’s one reason I wish we had much stronger automatic stabilizers. They’re self-adjusting. And they reduce the need for active policy, like QE zero rates for years. So that’s two reasons.

“The Fed was not just interested in ending the recession, so it didn’t stop asset purchases when the recession ended.”

this goes back to the distinction between a traditional business cycle recession and one caused by a financial crisis. you take the punch bowl away once the business cycle turns. as we have seen, if you do that after a financial crisis, you will be back in a recession. two different animals, require different solutions.

https://fred.stlouisfed.org/graph/?g=Lzm8

January 15, 2018

Federal Reserve Bank Assets and Treasuries, 2007-2022

https://fred.stlouisfed.org/graph/?g=LwS5

January 15, 2018

Federal Reserve Bank Assets and Mortgage-Backed Securities, 2007-2022

Nice chart of the asset side for the FED. Yes it is part of the financial data (sorry Moses but you are a lying idiot).

Now JohnH has his view that these recorded values are misleading but cannot provide a shred of evidence. He does not think he needs to, which tells me JohnH is a mentee of Judy Shelton.

Macroduck would also have us look at their income statements – which makes him one of few sane people here.

This cracks me up:

‘JohnH

February 1, 2022 at 8:59 pm

As I said, macroduck’s claim was unsubstantiated. MBS income and unrealised gains/losses were lumped together with other income, and the MBS portion was not identified.

Nice try, macroduck! Next time, get your act together and provide some real, relevant data before you claim that the Fed made $billions from MBS.’

The asset base for other income is trivial as is the other income. But JohnH thinks a rounding error turns a large MBS income figure into a negative number. It must be some version of higher order arithmetic. But JohnH telling the rest of to provide real, relevant data? JohnH is of the view he can spew nonsense supported by NO DATA. He does it 24.7!

Maybe it is time for our host to explain once again the importance of doing so as some people have not paid attention.

pgl still can’t read. The Fed’s statement said, “ Net income for 2020 was derived primarily from $100 billion in interest income on securities acquired through open market operations–U.S. Treasury securities, federal agency and government-sponsored enterprise (GSE) mortgage-backed securities (MBS), and GSE debt securities.”

How much came from which source is never mentioned, so the portion that came from MBS is unknown. A small amount came from recognised gains, which was to be expected in a year when assets appreciated because rates dropped.

The more interesting question is how the losses were booked when the Fed was assuming banks’ loans in the aftermath of the 2008 financial crisis.

JohnH: I…am…going…to…repeat…my…previous…comment…verbatim:

You, me, and macroduck should give up as JohnH clearly thinks the whoever prepares those income statements for the FED are lying. I presume JohnH is currently working for Judy Shelton or Rand Paul.

If you knew how to subtract 70 from 100 you would get the rest is 30 – not some negative number. If you knew how to READ – you would get my simple point. Please apologize to your preK teacher and at least try learning how to do basic reading and simple arithmetic.

“JohnH

February 2, 2022 at 7:15 pm

Pgl’s smart business advice: buy high, sell low!”

Follow this thread as I explain to the dumbest troll ever how stupid his clever little retort really is. Suppose I purchased a 20-year security back in 2007 when interest rates were fairly low but decided to sell it recently. Now had interest rates “normalized” (JohnH’s dip$hit term for going up to say 6%) it would seem I would be selling low. But WAIT – interest rates are LOWER today than they were when I purchased this security.

Of course JohnH’s little world is completely devoid of facts or any resemblance of reality.