What is the proportion of tariff increases passed through into domestic price increases for steel, in the wake of the Section 232 actions. Some of the oft cited estimates pertain to early on in the trade war. With the benefit of additional data, we have more evidence confirming that — unlike the tariffs imposed on most other goods — pass through is less for steel.

This point is made in a recent working paper by Ahmad and Ahmad (2022); from the abstract:

Recent studies report that the overall burden of tariffs has entirely passed to U.S. firms and consumers in terms of higher import prices. However, using 10-digits import data from U.S. Customs for 2018-2019, we find that import prices of steel products behaved differently: First, foreign exporters have gradually decreased their prices, sharing almost 50 percent of the burden of increased tariffs for all steel products mostly determined by industrial supplies and materials. Second, the price and import elasticities for consumer steel products are substantially higher at 5 and – 8, respectively. Third, the immediate increase in prices of industrial supplies was near 100 percent, which decreased to slightly below 50 percent in the long run. The elasticity of imports increased over time to near 1 in the long run.

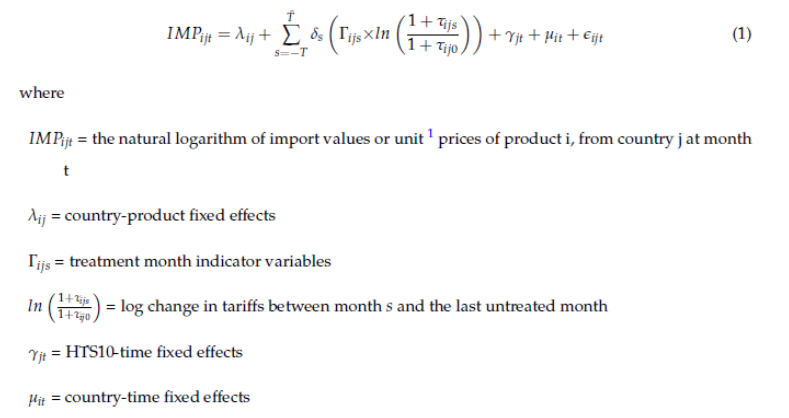

The analysis is an event-study using U.S. Customs department HTS10 digit and country-level information on monthly import values and volumes, further categorised by end- use categories i.e, capital, consumer, and industrial supplied and materials (delta parameters in equation 1)

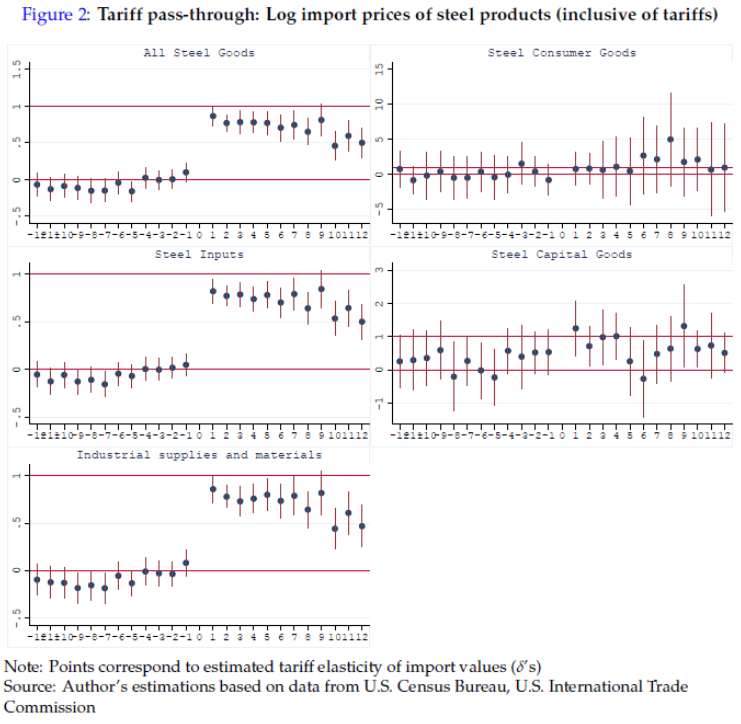

The estimates of the elasticity for each category of steel is shown in Figure 2 from the paper.

Source: Ahmad and Ahmad (2022).

So, unlike the behavior of other import prices in the wake of the Trump (Section 232 and Section 301) tariffs, steel prices have exhibited less than full pass-through (echoing Amiti et al (2020), noted in my previous post).

There was a lot of chatter on this specific issue so the results of a well thought analysis is indeed appreciated:

“using 10-digits import data from U.S. Customs for 2018-2019, we find that import prices of steel products behaved differently: First, foreign exporters have gradually decreased their prices, sharing almost 50 percent of the burden of increased tariffs for all steel products mostly determined by industrial supplies and materials. Second, the price and import elasticities for consumer steel products are substantially higher at 5 and – 8, respectively. Third, the immediate increase in prices of industrial supplies was near 100 percent, which decreased to slightly below 50 percent in the long run. The elasticity of imports increased over time to near 1 in the long run.”

Wait, wait – the Fox and Friends chief economist Bruce Hall told us over and over that all of the burden would be borne by the domestic importer. But this says that only half of the burden was borne by the importer and the foreign producers suffered the other half of the burden. It seems this reality is never to be told to the MAGA audience on Fox and Friends so I guess Bruce Hall is mandated once again from describing the real world,

Glad to see that economists strongly agree on this one:

https://kouryu-kyoju.net/who-really-pays-the-rates-trump-biden-tariffs-and-trade/

It’s just like physics where everyone agrees on the atomic weight of iron.

Bruce Hall: Yes, they agree — that for steel, pass through was incomplete (which you disagreed with in your earlier comments). To wit, in this article you are citing:

.

Which is what I was saying and you were taking issue with, and what is confirmed in the Ahmad and Ahmad paper.

So, please stop trying to convince people you were not in error in your earlier comments.

You are assuming he gets that his comments on the incidence of the steel tariffs were incorrect. I’m beginning to think Bruce has absolutely no comprehension of all those often contradictory things he writes.

“Using a slightly different methodology, economists Mary Amiti, Stephen J. Redding, and David E. Weinstein also found an almost complete pass-through of tariffs, noting that “US tariffs continue to be almost entirely borne by businesses and consumers. Americans ”. Certain differences appeared according to the types of products. For example, for steel, the authors found that an initial pass-through of 100% fell to 50% one year after the tariff was applied. Foreign exporters, mainly to the European Union, South Korea and Japan, lowered their steel prices somewhat, but American businesses and consumers still paid more than they expected. would have done without the tariffs.”

Like you said and this was from Bruce’s own link. New rule for posting comments. People need to actually READ their own links before making comments on them. Yea I get this will result in a ban of Bruce Hall since he never bothers to read anything.

So if I understand this correctly then (1 year in) the tariff import tax are covered/paid 50% by foreign exporters lowering their price and 50% by an overall increase in the consumer price of the imported steel. But presuming that the domestic producers would also be selling their steel at that inflated price, the actual dollar cost to steel consumers would more than just the 50% of tariff amounts – or is the increased cost of domestic steel somehow baked into these calculations?

Ivan: That’s correct. In other words, roughly half of the tariff revenue collected by Customs would then be effectively provided by domestic consumers (including households and firms) and the other half by foreign producers. In the graph, area c from domestic users, and area e from foreign producers.

Actually, reduction in consumer surplus is a+b+c+d (which Mr. Hall is apparently unable to understand), and the higher total amount that consumers are paying on imports coming in after the tariff is placed is a+b+c.

So, one study said US businesses and consumers bore the full brunt of the tariffs and another one said that they only suffered 50% after one year. Same link, same data, different conclusions.

Economists Pablo Fajgelbaum, Pinelopi Goldberg, Patrick Kennedy and Amit Khandelwal examined the tariffs on washing machines, solar panels, aluminum, steel and products from the European Union and China imposed in 2018 and 2019. They found that US businesses and end consumers bore the full burden of tariffs and estimated a net loss to the US economy of $ 16 billion annually, of which over $ 114 billion was losses for businesses and consumers, offset by small gains for protected producers and revenue gains for the government.

Good to know. I think the formula was something like:

(a+b+c+d)/øx∑(µ-ƒ(z)) where z = cost of hotdogs

Let the cherry-picking continue.

“So, one study said US businesses and consumers bore the full brunt of the tariffs”

Washing machines are not steel (since I have told you that some 100 times I’m assuming your IQ is in the low single digits). No – even the analysis of the impact on steel prices you cite confirms what Menzie wrote. But of course you are either too lazy or stupid to get that.

Bruce – please stop wasting our time demonstrating over and over that you are the dumbest troll ever. We got that years ago.

Bruce Hall: You do know every study that you have cited is in this Econbrowser post from December 2019 – written by me. Now, you should consider that the paper I just cited adds in two additional years of data to arrive at its conclusion. Moreover, the other studies cited (including the Amiti et al. paper, which you earlier also cited) note the exception of steel.

Will you just give up, and concede that as of 2022, the data is more supportive of the view of incomplete pass through than not — FOR STEEL? (I don’t usually go to ALL CAPS, but your sheer incompetence at reading/understanding/synthesizing/updating has pushed me to that recourse).

“Historically, economists have generally found that foreign firms have absorbed some of the tariff burden by lowering their prices, meaning that domestic firms and consumers have not borne the full cost of the higher tariffs in the past.”

But you insist that foreign firms never ever bear a portion of the incidence of the tariff. Your own link said otherwise. But I guess you think this time is different. Maybe for washing machines but not for steel. Oh wait – our host has already pointed this out to you once again. Seriously dude – did you ever learn to READ?

“Glad to see that economists strongly agree on this one”

Economists agree that the incidence of tariffs differ across industries – which you do not get.

Now economists agree that in a sector like washing machines, buyer not producers bore the incidence.

But even THESE very economists have noted that pass through is far from complete in the steel sector. But you say it was complete. So economists do agree on this – Bruce Hall is an idiot! On that we all agree.

A point not made too much of in the earlier discussions but important here and I was aware of but did not mention among the other complications is that what the rate of pass through is can change over time as it looks that it did with steel. The other aspect of that is that all of this depends in competitive markets on the various elasticities of supply and demand, but we know that these can change over time, with longer run elasticities tending to be greater than shorter run ones.

The whole issue comes down to elasticities. There is no one-size-fits-all answer to who pays the cost of tariffs (sorry Brucey). It is, as ever, funny in a sad way, to see commenters express strong opinions when they don’t have a grasp of the basics. Somewhere in this recent exchange on tariffs, Menzie brings up this elasticity business, so it’s not like commenters weren’t told.

There is mention in the literature (not to mention any standard textbook) of short-term and long-term elasticities, which is something producers, wholesalers, retailers and customers all understand, even if they don’t know what economists call it. That 100% to 50% shift has a clear explanation.

You and Barkley are trying quite hard to elevate this discussion to some semblance of reality. But note Brue Hall has a very long history of not caring about such things. He is a Trump troll and that is all he will ever be.