The price of oil has doubled from its value a year ago and could increase much more if there are significant reductions in the quantity of Russian oil that reaches world refineries. This is the first in a series of two posts on what these events could mean for the U.S. economy. Today I focus on the implications for inflation, and in a follow-up post I will discuss implications for real GDP.

Oil prices had already risen quite dramatically before there was any indication of Russia’s intention to invade Ukraine. The factors behind this earlier run-up were similar to the causes behind the surge in many other prices: demand recovered more quickly than production.

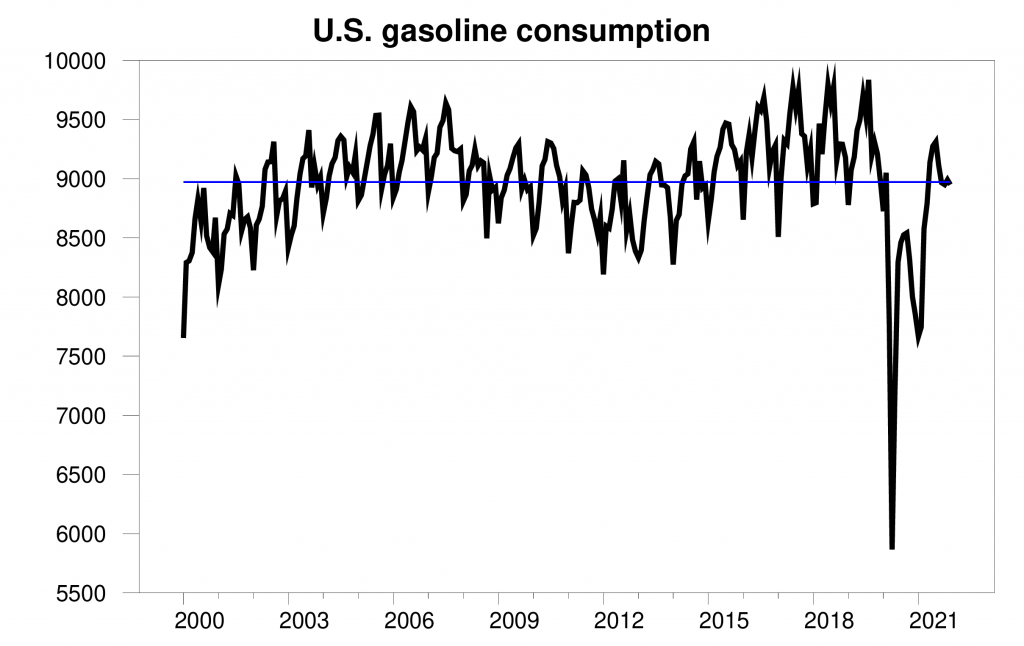

The figure below plots an estimate of monthly U.S. gasoline consumption. The usual seasonal pattern was highly disrupted by COVID. But by December, U.S. gasoline consumption had returned to the level of December 2019. In the absence of a big increase in gasoline prices, I would have expected a strong seasonal surge in gasoline demand this spring and summer.

U.S. product supplied of finished motor gasoline in thousand barrels per day, monthly, Jan 2000 to Dec 2021. Source: EIA Horizontal line drawn at Dec 2019 value.

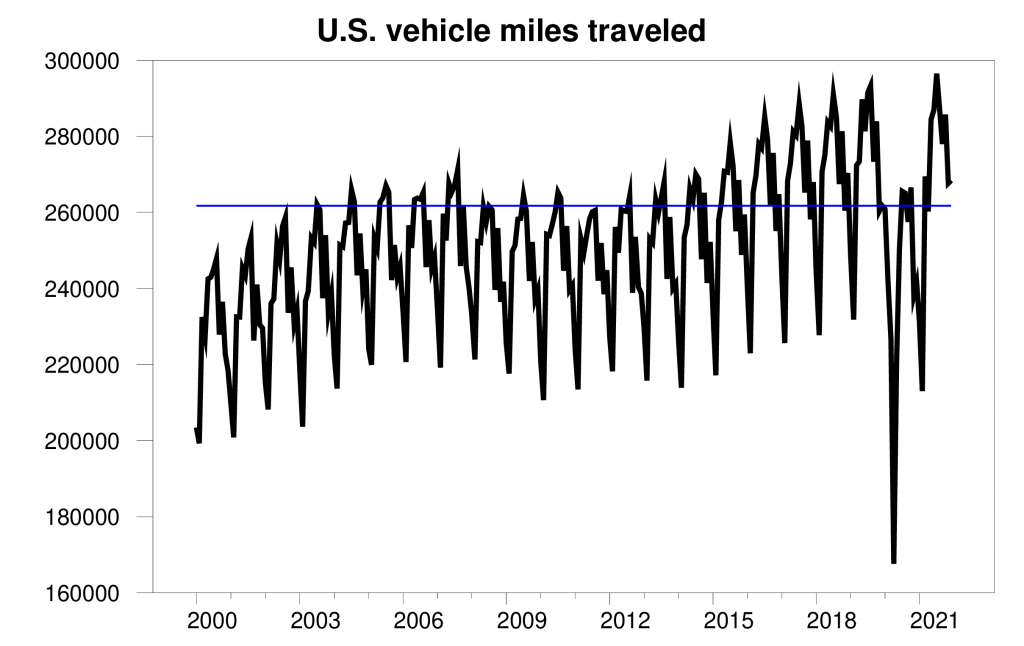

The same pattern is seen in estimates based on counts of vehicles on the road of the number of miles Americans are driving. This is up 2.5% compared to two years ago.

U.S. vehicle miles traveled, in millions of miles, monthly, Jan 2000 to Dec 2021. Source:

FRED. Horizontal line drawn at Dec 2019 value.

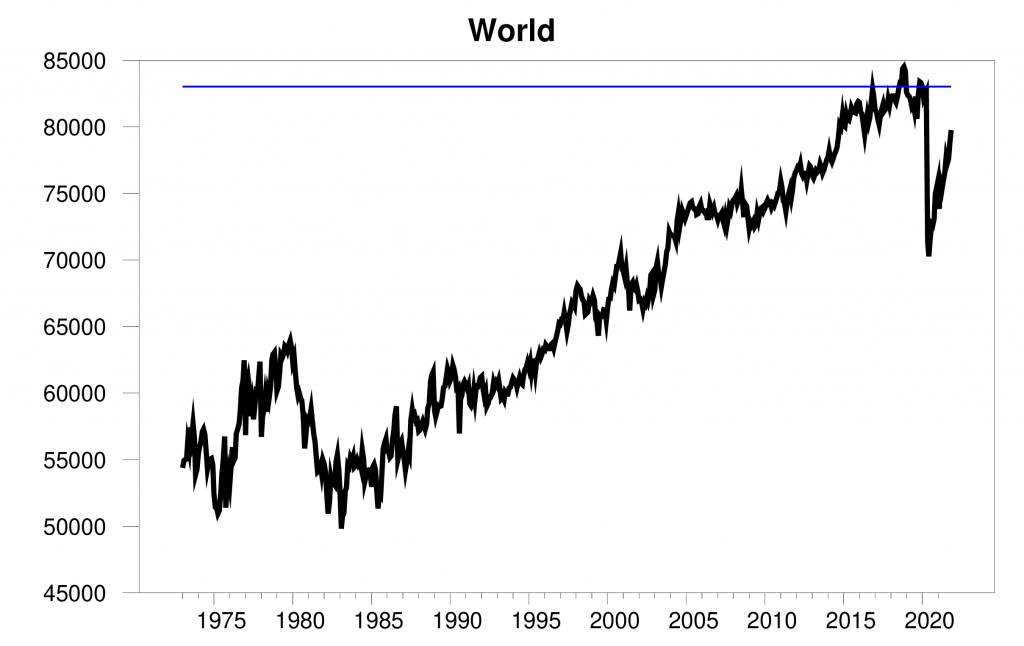

While demand may have returned to pre-COVID levels, supply has not. Even before any of the developments in Ukraine, world production of crude oil in November was 3.3 mb/d lower than its level at the start of 2020.

World field production of crude oil, in thousands of barrels per day, monthly, Jan 1973 to Nov 2021. Source: EIA. Horizontal line drawn at Jan 2020 value.

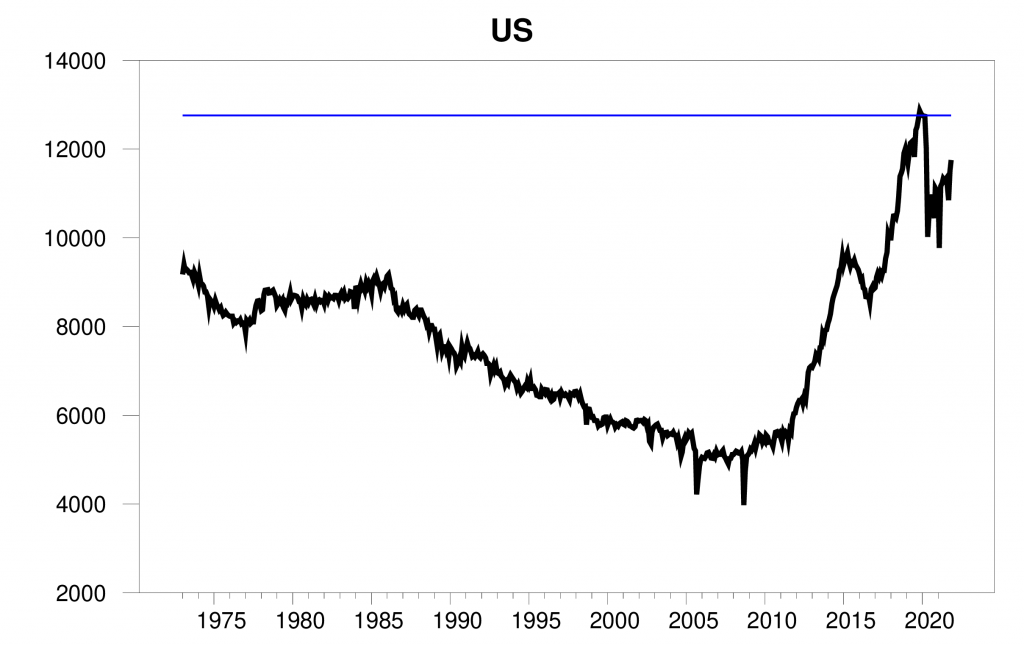

The U.S. supplied a sixth of the world total pre-COVID crude production, but accounts for almost a third of today’s world shortfall relative to pre-COVID. U.S. production is still 1 mb/d below where it had been at the start of 2020.

U.S. field production of crude oil, in thousands of barrels per day, monthly, Jan 1973 to Nov 2021. Source: EIA. Horizontal line drawn at Jan 2020 value.

A big part of the story is that it is easier to tear something down than it is to put it back together. The negative oil prices in April 2020 marked a definitive end to some of the enthusiasm for U.S. shale oil production and was followed by a collapse of lending and drilling. Higher oil prices have been gradually but steadily bringing resources back in. That process would continue even without the recent prices over a hundred dollars a barrel, but it takes time. Perhaps by the end of summer U.S. production would be back where it was at the start of 2020.

Weekly Baker-Hughes count of number of drilling rigs active in the United States. Source: Trading Economics.

Demand grew faster than supply, and that caused the price of oil to go up. Some economists argue that this does not necessarily mean more inflation. If the increase in the dollar price of oil was matched by a decrease in the dollar price of other goods or services, we need not see inflation in the overall price level. But in practice it often takes unusual events to cause the prices of many goods and services to actually fall. If oil prices go up and other prices don’t go down, it means overall inflation. For this reason, it’s sometimes useful to consider a counterfactual calculation of what the inflation rate would be if the dollar price of oil had gone up but the dollar price of all other goods had not changed as a summary of the direct contribution of oil prices to inflation.

In 2019, U.S. production and imports of crude oil had a market value equal to about 2% of GDP. That suggests a quick-and-dirty rule for getting an approximate answer to the above what-if question. If we multiply the percent change in the price of crude by 0.02, that should give us a rough idea of what inflation would have been if the change in the price of crude oil was the only source of inflation. This is consistent with the rough rule of thumb used by Fed Chair Jerome Powell that a $10 increase in the price of oil (about a 10% increase at current prices) leads to a 0.2% increase in inflation.

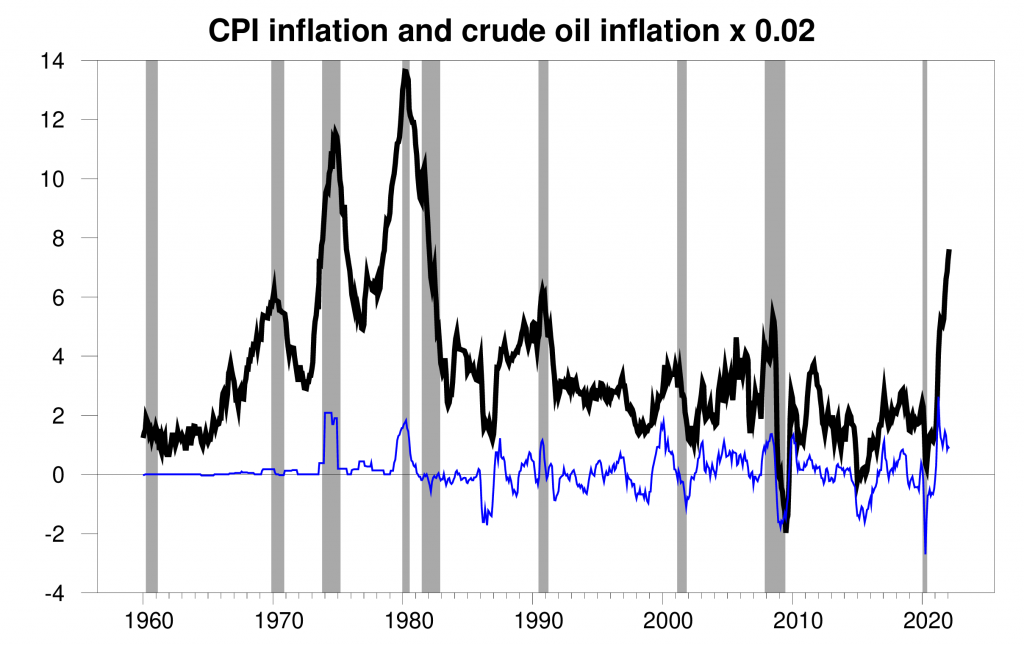

I used that approximation in the figure below to calculate the direct contribution of oil prices to U.S. inflation each month since 1960. This quick calculation suggests that oil contributed about two percentage points to the surges in inflation in 1974 (following the OAPEC oil embargo) and 1980 (followiong the Iranian revolution). Oil contributed 2.6 percentage points to the U.S. inflation rate over the 12 months ending April 2021.

100 times the year-over-year change in the natural log of the U.S. consumer price index (in black), and 2 times the year-over-year change in the log of the dollar price of West Texas Intermediate crude oil (in blue), monthly, Jan 1960 to Feb 2022.

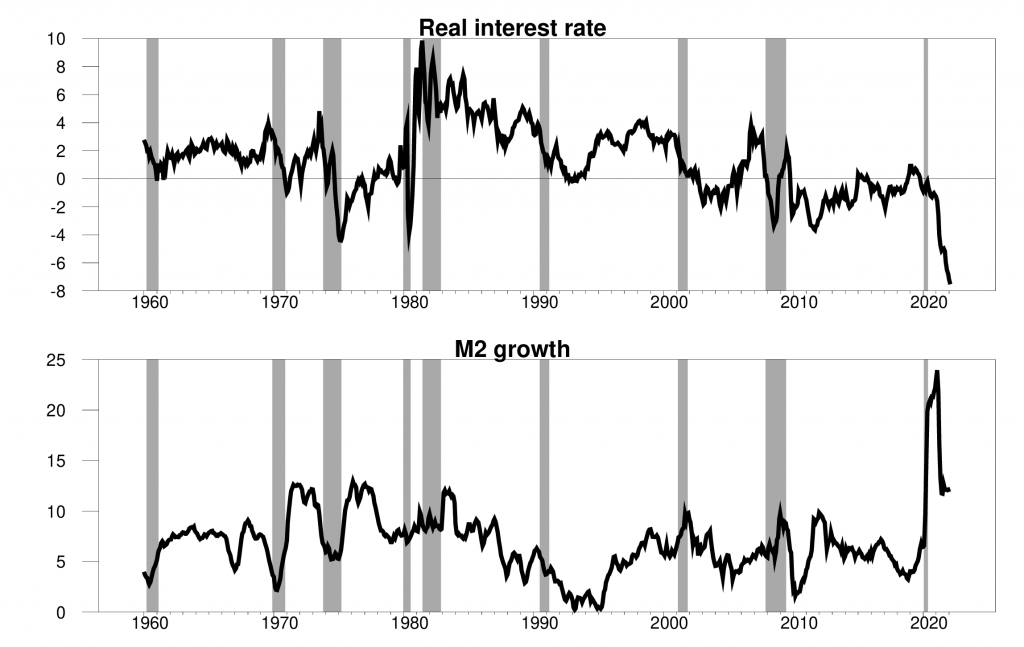

In the 1970s, the contribution of oil in blue is a step-up step-down function — it goes up when oil prices are rising but returns to zero when oil prices stop rising. But the path of actual inflation in black did not follow a step-up step-down function. Instead the inflation rate seemed to be ratcheted up to new higher levels with each spike in oil prices. Monetary policy in the 1970s essentially ratified what would have been temporary surges in inflation, turning them into persistent trends. Two indicators of the mistakes in monetary policy that led to this are shown in the figure below. The top panel plots the real interest rate, calculated as the difference between the nominal fed funds rate set by the Federal Reserve and the year-over-year inflation rate as measured by the CPI. According to policy prescriptions like the rule proposed by John Taylor, the measure of the real interest rate plotted here should increase when inflation rises in order to return inflation to a lower target value. The large negative values for the real interest rate through much of the 1970s are one indicator that the Fed was overdoing the stimulus. The bottom panel provides a second indicator, plotting the growth rate of the money supply as measured by M2. Surges in money growth coincided with the two surges in oil prices in the 1970s and helped these spill over into a more general and sustained inflation.

Top panel: nominal fed funds rate for indicated month minus 100 times the change in the logarithm of the CPI over the previous 12 months. Bottom panel: 100 times the year-over-year change in the logarithm of M2.

Both of these indicators also send a pretty clear signal that the Fed overdid it during the last year as well.

The Fed’s view was that last year’s price surges resulted from temporary supply problems, of which the developments in the oil market that I described are one example. They hoped (as did I) that we would see significant progress on these supply challenges in the the months ahead. That perspective motivated the Fed’s plan to lift their foot off the accelerator only gradually as this year unfolds.

But given the tragic turn of events in Europe, the supply problems are likely to get much worse before they get better. And that is going to make the Fed’s job a whole lot harder.

As Paul Volcker pointed out, his objective in raising interest rates was to impose brutal hardship on American households and make them poorer so they would spend less. In this case, Putin is performing the same function. There’s no need for drastic rates increases by the Fed at this time.

A couple weeks ago Powell says he was on board for a 25 basis point rate increase and I hope he sticks to it.

Well, your hopes came true and the market loves it. !/4% to combat 8% inflation (CPI) or 10% (PPI) whichever you want to pick (yeah, Lucy, I know CPI is the “accepted” measure). Basically, the Fed just said to the markets that they were not tooo serious about trying to dampen inflation, but had to appear to “do something” without actually doing much of anything.

Meanwhile, the spendthrifts in Congress just loved the idea of another $1.5T government funding package because it contained a few thousand “earmarks” that really had nothing to do with keeping the government going. BAU.

The Biden spin doctors are getting vertigo trying to land on whether to blame Putin or Trump for the inflation. Yeah, like that’s going to be believable regardless of which one they choose. People know who has been in charge since the inflation line went straight north and it wasn’t Putin or Trump.

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

inflation started from the supply chain fiasco brought on by the ineptitude of trump. I am more concerned about a potential slowdown in the world economy brought on by war in Europe, energy constraints in Europe, and covid shutdowns in China. Also a new variant spreading worldwide. So to be clear, with all of those potential headwinds, bruce hall thinks we should slam on the economic brakes with higher fed funds rates. do you want a recession for political reasons, bruce, or do you simply hate your fellow citizens?

Wishes do come true. Thank you, Professor Hamilton.

JDH: “The negative oil prices in April 2020 marked a definitive end to some of the enthusiasm for U.S. shale oil production and was followed by a collapse of lending and drilling.”

I think petroleum production is headed the same direction as coal plants and nukes — not going out with a bang but with a fizzle. Investors are losing their appetite for dinosaur markets with a declining future. The only investors left are those hoping for one last puff on the cigar butt.

And yet US oil consumption is testing record highs.

spoken like a true oil bull, steven. but look how fast EV are becoming mainstream. steven, you did not believe EV would have an impact a couple of years ago. but they are making dramatic changes, and quickly. so quickly that the most valuable automaker is an EV. and the old dinosaur automakers are seriously considering splitting up their gas and EV manufacturing into two independent companies. oil’s days are numbered.

EVs were about 2% of vehicle sales in the US in 2021.

https://www.greencarreports.com/news/1133143_us-ev-sales-have-been-record-breaking-so-far-in-2021-despite-supply-chain-issues

And your forecast is that this market share will never grow??? Seriously?

and it only goes up from there. especially with many large automakers transitioning to EV only in the near future. or are you ignoring that fact? Steven, you are living in a legacy world because it puts money in your pocket. but it is not the future. nobody is investing in internal combustion engine vehicles right now.

The prices of gas and other sources of energy move in sync with oil prices. Together they account for about 6%of GDP.

Philip George:

It is true that if you consider refined petroleum products instead of crude oil, you get a number like 4% rather than 2% of GDP. However, crude only accounts for about half of the final market cost of gasoline once you include taxes, refining margins, mark-ups, and other costs. When the price of crude goes up 10%, the price of gasoline typically goes up about 5%. If you multiply the share of crude by 2 to get to refined products but then divide by 2 to get the effect of crude on refined prices, you arrive at the identical final answer as the one from my simple rule of thumb of just using the 2% share directly.

《A big part of the story is that it is easier to tear something down than it is to put it back together.》

Isn’t finance the real bottleneck? If the Fed funded shale, would oil go back to $10/barrel in a jiffy?

《Monetary policy in the 1970s essentially ratified what would have been temporary surges in inflation, turning them into persistent trends.》

Why weren’t COLAs the answer? If your income increases in lockstep with your expenses, why should nominal inflation even be a concern?

You have this habit of making assertions in the form of questions, presumably to avoid any responsibility for supporting your views. Time to grow up a little.

So tell us, what evidence do you have that finance is a “bottleneck” in the production of petroleum? Your answer should account for the fact that inflation-adjusted borrowing rares are negative and that major oil firms generate gobs of cash.

Similarly, you ought to take at least some responsibility for understanding whether Inflation imposes any social costs that are not remedied by inflation-adjusting wages.

By the way, isn’t “nominal Inflation” simply non-inflation-adjusted Inflation?

“Why weren’t COLAs the answer? If your income increases in lockstep with your expenses, why should nominal inflation even be a concern?”

inflation also serves as an impetus to increasing productivity. if inflation were not at least an issue to be aware of, many companies and households would have little reason to become more efficient.

Thanks a lot James,

Paradox of the cost-share theorem … Oil is 2% of GDP, but without it …

I have been working on the forecast methodology of oil price by central banks (Fed ; BoE ; ECB). Its a kind of self-fulfilling prophecy that, as oil price will stabilise Y+2/Y+1 in their model -mostly future markets-, so inflation will stabilise …

An OECD confidential archive of July 1973 on the unstable oil world, a few months before the so-called “oil price shock” of October 1973 :

“(…) The O.E.C.D. countries face the prospect, for the next ten years at least of relying in the main for their oil supplies on the oil producers of the Middle East and Africa. The agreements recently concluded with the main oil producing states in that area should ensure that O.E.C.D. requirements for oil will be met, albeit at an increasing cost, provided the agreements are observed and provided production is raised to levels which are physically possible. The balance of availability over expected demand is likely, however, to be so narrow that is in the interest of all O.E.C.D. members to do what they can to ensure stability and orderliness in the oil market. (…)”

That’s why I refer to oil as an ‘enabling commodity’. Other things depend on it. Take away Facebook or even Amazon, both huge companies, and nothing much happens to everyday life. Take away oil, and life is over as we know it.

“Take away oil, and life is over as we know it.”

you are being overly dramatic. of course anything that disappears overnight will cause short term consternation. but a dedicated national program to move us from oil to other energy sources, especially autos, would be a net positive not negative. and over a ten year transition period, this could occur with limited disruption. it is only fear mongering from folks like steven, who have a vested interest in the status quo of oil, that keeps this transition from happening more quickly than it is. if oil and natural gas were not needed, we would not be dealing with the issues in ukraine today. the west could have shut down all funding sources to russia, rather than leave the oil and gas spigot open. there is nothing good in the world today resulting from our dependence on fossil fuels. even if you throw out climate issues, the geopolitics of fossil fuels are the biggest threat to mankind in the world today.

If you took away oil, life as we know it would end virtually overnight.

In New England, we could not heat our houses or shop at the store. The stores would be empty because trucks would have no fuel.

I stand by what I said.

Such drama! The antithesis of insight.

“I stand by what I said.”

and it is about as accurate as your stance on electric vehicles. your analysis is the result of money in pocket and wishful thinking, not the reality of technology and where businesses are headed. they are going to renewables, and quickly.

if you took oil away over a five year period, the world would not collapse.

Sure it would. Look at Italy or eastern Europe. All have seen oil consumption declines and have GDP no higher than 2008. And that’s not losing all of oil consumption, only part of it.

that is a pretty poor argument Steven. i can play that kind of game.

I consume far less oil today than I did twenty years ago. and my standard of living is much greater today.

I am glad for you, but that is not true for the Italians and eastern European per IMF numbers.

it means oil consumption is probably not the primary driver. for a consultant, you can be rather dense.

Nonserious mind game. All nominal.

How much was a gallon of gas when you started driving, and gold ounce price, and DJIA?

Me [1968]: $0.26 gas; $35 gold; about 800 [high] DJIA. Today’s prices, these are up 17-times gas; 56-times gold; 41-times – DJIA. Give or take.

Increased oil prices ultimately gives incentives for electric vehicles and alternative energy. Those are permanent long-term shifts.

If they are permanent long term shifts, then they don’t require a subsidy. I have said that EV’s would gain market share when the Permian was no longer able to grow by 600,000 bpd / year. We’ll be there within three or four years, if not sooner.

The subsidies are about the speed at which you get there. Smart countries are at the forefront of the future, not in the caboose of the past. At this point we can all agree that the sooner we get away from energy dependence on Russia, Iran and Venezuela – the better.

Subsidies are generally a waste of money and a huge gift to rich people.

@ Kopits

As a man posing as an expert on oil, you would know.

https://e360.yale.edu/digest/fossil-fuels-received-5-9-trillion-in-subsidies-in-2020-report-finds

For anyone who wants to download the IMF paper on the topic of fossil fuel subsidies.

https://www.imf.org/en/Publications/WP/Issues/2021/09/23/Still-Not-Getting-Energy-Prices-Right-A-Global-and-Country-Update-of-Fossil-Fuel-Subsidies-466004

then the oil companies should start to repay all of those defense dollars used to safeguard crude transport around the world. and then we can move onto the subsidies paid to keep kuwait and other middle east oils available. tax dollars at work steven. be careful what you criticize steven. the fossil fuel, and especially oil, industries are record holders for their subsidies. and not being forced to cover the cost of pollution is probably the biggest subsidy of all. steven you are blind to how the world operates. or willfully ignorant. the word subsidy should never even be uttered from your mouth if you had any integrity at all.

Moses –

In many countries, fuel prices are set administratively, and thus motorists may become explicitly subsidized. True enough, but not in the US or Europe.

As the report writes: “The remaining 92 percent were implicit subsidies, which took the form of tax breaks or, to a much larger degree, health and environmental damages that were not priced into the cost of fossil fuels, according to the analysis.”

Implicit subsidies mostly means ‘stuff we made up but which is not a subsidy as economists typically think of it, that is, as a transfer of funds from the national budget to either producers or consumers to maintain or elevate production or consumption levels.”

“As the report writes: “The remaining 92 percent were implicit subsidies, which took the form of tax breaks or, to a much larger degree, health and environmental damages that were not priced into the cost of fossil fuels, according to the analysis.” Implicit subsidies mostly means ‘stuff we made up but which is not a subsidy as economists typically think of it, that is, as a transfer of funds from the national budget to either producers or consumers to maintain or elevate production or consumption levels.”

Tax breaks are not transfer of funds? They have no impact on prices? Not charging for environmental damages is not a subsidy? What planet are you living on? This is even worse than fake macro terms like “suppression”.

Oil companies pay huge amounts of taxes at various levels.

If you want a carbon tax, put on a carbon tax. No one knows what the amount should be, but okay, put one on.

Oh, yes, and with all three branches in the US fed gov, has Biden proposed a carbon tax? Will they put it to a floor vote?

Please.

“Oil companies pay huge amounts of taxes at various levels.”

they do not overpay any taxes.

they better approach is to let the epa levy fines for pollution.

You’re going to be fined when you drive your car? Or breathe?

most cities have emissions standards for vehicles. you are fined if your vehicle fails those standards. these have been in effect for decades. i am surprised you are not aware of these rules, already on the books. you can drive. you just cannot pollute. instead of smart alec responses. think about the world you live in steven.

SK is correct. Not only do oil companies pay a high federal tax rate, they also pay local taxes. (e.g. Texas charges businesses a 4.6 percent tax rate on oil production and a 7.5 percent rate on natural gas production.” Their net taxes are some of the highest of any industry.

Explicit subsidies are small, and often overstated. People with an agenda count things like accelerated depreciation, even though those same “subsidies” are used by all sorts of industries.

Pointing the finger at oil and gas is just another example of modern cognitive dissonance. We want bananas from Ecuador, cows fed from corn that used hydrocarbon based fertilizer, and our Amazon package delivered 2 days later, but don’t want to be personally responsible for the oil that made it possible. So we point our fingers at the suppliers. Worse, we discourage local production, and become dependent on foreign regimes. And here we are, trying to cut a deal with Iran and Venezuela because we no longer approve of Russian supply.

We rely on natural gas electrical generation to switch on when renewables aren’t producing, as we are nowhere near a grid scalable form of storage that could last a day, let alone a week.

Next time you eat a meal, think about all the different places the ingredients came from. The average EV drivers are wealthier than the average American. Wealthier people typically have larger homes to heat and cool, and fly more frequently. One long distance flight a year offsets the CO2 benefit of an EV for a year. Eating plant based also reduces emissions more than an EV.

Global warming is real and EVs and renewables are a part of the solution. But the smug judgement of the oil and gas industry is wildly hypocritical for anyone living in a “first world” country.

“Not only do oil companies pay a high federal tax rate, they also pay local taxes. (e.g. Texas charges businesses a 4.6 percent tax rate on oil production and a 7.5 percent rate on natural gas production.” Their net taxes are some of the highest of any industry.”

texas also touts a zero personal income tax rate. how do you think they get by without a personal income tax? big oil management living in texas do not seem to mind that state tax. any wonder why?

“But the smug judgement of the oil and gas industry is wildly hypocritical for anyone living in a “first world” country.”

actually, I appreciate what big oil has done. it showed how dependent we are on oil, and also what we can do once we master the use of energy. but its time is up. and has been so for a long time. dragging our heals on the inevitable is not an intelligent thing to do. as you said, green energy is part of the solution. we need to move forward, rather than fighting that. the sooner the better.

Not true — renewables need subsidies despite long term shifts moving in their favor because the amount of subsidies fossil fuels receive dwarfs those of renewables. How many tens of trillions of dollars have oil companies received over the past century? I wonder if anyone has ever made a calculation?

Are renewables competitive, or a way to make Germany vulnerable to Russia? Are renewables a way to ensure California burns to the ground? Sure seem to be.

Here in Cape Cod, in Provincetown, they are installing a battery to cover for power outages. Now, power outages really only matter in the winter because no power, no heat. That was the situation a few weeks ago, when we lost power for 25 hours and it was 18 degrees outside. The house was getting colder at the pace of about 1.5 deg F / hour. It was see-your-breath cold by the next day.

In the winter, about 7,000 people live in the Wellfleet-Truro-Provincetown stretch which this battery would serve, let’s call it 4,000 occupied residences. You can buy a backup generator with necessary in-home modifications for about $1,000. That would be enough to run the heat, internet, a few lights and the fridge. It would bridge for a gap or a day or two during apower loss. So, $1,000 x 4,000 house equals $4 million.

Now, how much do you think that battery in Provincetown costs?

$46 million.

That’s right. $46 million.

And it’s so much richer than that. We did not lose the backbone power coming up the spine of the Cape. We lost power because trees had fallen locally on power lines, so Eversource shut down 512 houses in our part of town. That P-town battery would be using the same backbone. Therefore, it would not have prevented the loss of power in Wellfleet or much of Truro. So, we’ll have a battery and still have to have a portable generator.

That’s renewable policy for you!

in your example, the backup was not there for storm damage loss. this was not an example of renewable policy. that said, as new england prepares for the offshore wind turbines to be built soon, this is a smart long term strategy. this will assist with the intermittency that wind could generate. now that is smart policy, a solution to a problem. very solvable.

“You can buy a backup generator with necessary in-home modifications for about $1,000.”

this is not accurate at all. and this assumes natural gas or heating oil as a source of heat. that will not be realistic within a decade or so.

The P-town battery is backup power in the case of a loss of normal power during a storm. Of course, you can’t use wind turbines in a nor’easter. We clocked 80+ mph winds here during the snow storm. Also, the wind turbines, if they are ever built (bear in mind that they will be off the coast of Martha’s Vineyard and Nantucket), will be up to 70 miles from P-town.

This $46 million battery provides 10 hours of backup power, 3 hours during the air conditioning season.

I will happily bet you $100,000 that oil or natural gas (in practice, propane, we have no gas lines) will be the dominant source of heating on Cape Cod in a decade. Electric heat would be punishingly expensive.

for both baffling and you……

ferc requires regional transmission org’s to have back up fuel for gas fired generation. bc in the north home heating gets the gas pressure and generation supply is limited. most use oil in tanks, but ferc leave them to make their mistakes….

transmission and distribution outages during storms are another failure mode that green cannot effect.

solar electric requires huge acreage and is seasonal at best.

wind; the germans and texas found out about using wind as part of ‘base load’… it is not feasible or suitable.

using batteries to back up the variability and insure base load is theory!! ms granholm seems to advocate battery, an alternative is green hydrogen gas. both are theories!

as back up to individual home electric a large battery, or your hook up from you ev in theory might replace that gas/propnae run generator for a few hours! not suitable against a refuelable generator.

the grid, with any level of energy security is decades away from wind or solar.

nuclear is an answer if we can get commissioning down to years instead of decades.

“wind; the germans and texas found out about using wind as part of ‘base load’… it is not feasible or suitable.”

incorrect. texas grid collapsed because the natural gas capacity froze. it was not due to wind. in fact, those turbines can easily be winterized and would have then supplied power during the winter storm. they have been working through the winter in the Dakotas for years. the companies simply did not winterize them. that is a businessman flaw, not a technology flaw.

“the grid, with any level of energy security is decades away from wind or solar.”

the grid can work perfectly fine with wind and solar.

anonymous, most of your comments seem to be without merit. please educate yourself before commenting.

the problem in Texas last year wasnt caused by lack wind generated power, but because a large number of power plants went down. note they were all natural gas powered plants. in part it was because those plants werent prepared for the weather that they encountered. cant for forget that the gas producers were also not ready for the weather they encountered. then there was the lack of knowledge on the electric power plants that the natural gas suppliers needed to be high priority customers (mostly because the suppliers didnt tell them).

The fact that you’ve said something is beside the point.

Ivan is right about subsidization allowing faster adjustment. Moving to non-hydrocorbon energy elinimates massive negitve externalities associated with hydrocarbon use. Subsidization is entirely justified.

ev’s are the commercial equivalent of f-35’s not particularly good at any use, and incredibly expensive to try and use.

in 15 or 20 years some of the product defects currently challenging ev’s (solar, wind) may be overcome.

subsidisies do not motivate developing suitable technology/product.

subsidies are needed bc ev’s fail to be competitive to internal combustion in a number of performance and suitability product measures.

presently, subsidies are rewarding virtue signalling.

“subsidies are needed bc ev’s fail to be competitive to internal combustion in a number of performance and suitability product measures.”

by every performance measure an EV beats an internal combustion powered vehicle. its not even close. where do you get this garbage?

“subsidisies do not motivate developing suitable technology/product.”

Even if that ere true – and you have given us no reason to believe it is true – some other thing can motivate product development, while subsidies overcome other problems. Insisting that subsidies provide incentives for any old thing you can think of a is just a dishonest rhetorical trick.

Subsidies for technology that is less environmentally harmful offset subsidies for technologies that are more environmentally harmful. (Good old theory of the second best.)

Subsidies for technologies with fewer negative externalities result in a reduction in negative externalities. (Good old Pigou.)

When (quasi-) market-based choices lead to bad outcomes – such as climate change and geo-poliical vulnerability – government intervention is justified to improve welfare. (Good old market failure.)

So what have we learned, boys and girls? We’ve learned that when, instead of slinging aroud phony assertions that use words borrowed from economics, you instead you take an honest look at economic reasoning, you can arrive at answers which are both valid and honest.

“subsidisies do not motivate developing suitable technology/product”

That is the most ridiculous Faux news talking points on your list. Subsidies are used for that exact purpose. Subsidies are applied when market forces are not able to drive development of suitable technology/products at the speed desired by society. Subsidies can be given in the form of tax breaks, underpriced/free access, government contracts or direct grants – always with the understanding that government want something to happen that he free market forces cannot deliver. You may personally not agree with those goals, but its not your decision.

F35 pilots dont seem to agree, they seem to think that they are better than the planes they came from (f15,f16,etc). but then just asbout any plane that is in development is always restricted (since they are still prototypes…expensive to loose the plane, etc).

oddly enough those subsidies arent available for all EVs, some have no subsidy. seem to still sell well.

Although those problems may have been finally fixed, they have plagued the F-35 jet

https://www.thedailybeast.com/f-35-stealth-jets-are-choking-their-pilots

https://s3.documentcloud.org/documents/21180828/f-35-joint-strike-fighter-jsf-program-jan-14-2022.pdf

Pilots aren’t necessarily going to bad mouth a jet they know the Pentagon and “the brass” (to use an old school term) are promoting as the answer to all life’s problems. The U.S. military doesn’t like soldiers/airmen/sailors who rock the boat. However I think if you were to give truth serum to the pilots who passed out mid-flight because there was no oxygen in the cockpit being delivered to their lungs, they just maybe might tell you the F-35 was a flying piece of cr*p. No marketing campaign by a Pentagon with a “revolving door” on sweetheart jobs with U.S. weapons contractors will change that fact.

Alternative energy means nuclear.

“Alternative energy means nuclear.”

You post in a economic discussion forum, then at least try to get the economic facts straight: NPPs are much too expensive and die/are NOT built for very simple economic reasons. Check amount of money that already goes into PV and wind power, for each USD nuclear power getes, there are 10 USD around for wind and PV, the investors vote with their feet.

And then there are some ugly physical facts too: 2021 was the first year in which wind and PV has generated more electricity than NPPs, it is much easier and more risc free to built wind power and PV, the scalability and duration of construction of NPPs is completely uncompetitive. Hint: Per year more than 70 green equivalents of 1 GW NPPs are added, nuclear power struggles to defend the status quo.

It is always funny that proponents of NPPs sell themselves as rational but are unable to cope with economic and physical reality. 🙂

Where are you, Ulen? Lights still on? Are you warm today?

If you want a jackass power policy, Germany tops the list.

are home prices so high because they are almost all hand built? and NPP are also. there are technologies that will make them less hand built. that will reduce their cost

@ Kopits

Interesting, I thought alternative energy covered a whole wide gambit of choices, including solar and wind. Glad you’re not just saving these precious gems of knowledge exclusively for Menzie’s posts on this blog. So enlightening.

Wind and solar are both intermittent and non-dispatchable, as well as expensive when all the costs are factored in. So in Germany, for example, they have managed to combine high power prices with zero reliability of supply beyond acting as a subsidiary to Moscow.

where do you get your zero reliability number? hogwash. exactly what have you got against renewables, other than they threaten your livelihood?

if you are figuring an incentive for electric vehicles due to the price spike of oil, you should also figure spiking costs involved in producing those EV’s,….nickel prices, for instance, spiked to $100,000 a ton last week, roughly five times it’s previous high…palladium, aluminum and copper also hit record highs…

“nickel prices, for instance, spiked to $100,000 a ton last week, roughly five times it’s previous high”

this is a pretty poor example for you to use rjs. first, manufacturers will have hedged their purchases, so this spike will not impact manufacturers as much as traders. and second, this was the result of a financial crisis of a company that produces the nickel. it is not representative of supply and demand. this will resolve and I don’t see it materially impacting EV in the long term. nickel prices are already dropping. this is very different from oil prices, which will remain elevated throughout the geopolitical events we face today and probably into the next year. the Russian sanctions and their impacts will not go away immediately, even if Russia withdraws.

The jubilation expressed by some at the perceived ending of fossil fuels is quite premature. Most users of energy want reliable energy sources. Electric vehicles are dependent on a grid that, in many places, is insufficient to handle the charging needs of an all-EV environment. The combination of reliance on solar/wind power and an EV vehicle environment is well beyond the reach of the current infrastructure. Plus, the purchase cost of most EVs is well beyond the means of a large portion of the population.

Realistically, the only non-fossil fuel energy environment will depend heavily on 3rd and maybe 4th generation nuclear power. The economics of a solar/wind/battery storage power infrastructure are just not there. Meanwhile, we’ve all seen what disruptions to oil and natural gas supplies can and will do to the world’s economies. Any transition from fossil fuels will be disruptive and very expensive and inflationary in the absence of less ideologically driven policies.

I get that you had to write that last line in order to get paid by Kelly Anne Conway but it was pure intellectual garbage. Dr. Hamilton got this right here:

“Some economists argue that this does not necessarily mean more inflation. If the increase in the dollar price of oil was matched by a decrease in the dollar price of other goods or services, we need not see inflation in the overall price level. But in practice it often takes unusual events to cause the prices of many goods and services to actually fall. If oil prices go up and other prices don’t go down, it means overall inflation. For this reason, it’s sometimes useful to consider a counterfactual calculation of what the inflation rate would be if the dollar price of oil had gone up but the dollar price of all other goods had not changed as a summary of the direct contribution of oil prices to inflation.”

Now try reading his very excellent discussion as it takes about your “ideologically driven” drivel that it was Biden that led to less oil production. Hate to tell you this Bruce – but it was something called the market place.

Since I have called out a couple of other trolls for interrupting an excellent post, I don’t want you to feel left out. So when Dr. Hamilton is kind enough to provided us with such an able analysis – it would be nice if you just kept quiet even if that means you do not pick up your daily pay check from Kelly Ann.

Lucy,

Your “market driven” decline in oil production was a direct result of government mandated shutdowns and has remained suppressed as a direct result of Biden-driven anti-oil policies which are discouraging investment (Keystone/stopping new oil leases on federal lands and waters). So, don’t go attributing something to the market when it is the government screwing up the markets. If there was ever a “green” troll, you’re one.

When/if the US takes the idiot’s plunge into abandoning fossil fuels, you’ll see massive price increases in energy to accommodate the required nuclear power plants (to provide continuous power), huge costs to produce/install level 3 (or faster) charging stations, and even more massive costs to upgrade the whole grid to distribute the power needed for the EV fleet.

Germany jumped the “green” energy shark early and consumers paid for it.

https://www.euractiv.com/section/energy/news/german-energy-prices-50-higher-than-eu-average-mckinsey/

Today in Germany:

The German government plans a new relief package to help consumers cope with rising energy prices. The price increases overburden many people, Green economy and climate minister Robert Habeck told newswire dpa according to an article carried by Der Spiegel. “Extremely high heating costs, extremely high electricity prices, extremely high fuel prices are a burden on households, and the lower the incomes, the more so. The federal government will therefore launch another relief package,” Habeck said. He added the package must ensure relief for rising electricity, heating as well as mobility costs, and provide incentives for energy efficiency.

https://www.cleanenergywire.org/news/germany-plans-new-energy-price-relief-consumers

Germany has had to rely on massive subsidies to push its alternative energy agenda to the detriment of its citizen’s pocketbooks. Despite that, it is still on the hook with Russian gas and wants to stay on the hook.

https://www.politico.eu/article/germany-rejects-calls-for-banning-russian-oil-and-gas/

Germany remains the model for US “greenies”.

“So, don’t go attributing something to the market when it is the government screwing up the markets”

I see you have not read Dr. Hamilton’s account which noted the role of markets. You to trust on energy economics – Dr. James Hamilton v. Kelly Anne Conway’s Steno Sue?

BTW Bruce – I read your links. Apparently you did not as neither one supported that Kelly Anne supplied rightwing spin of yours. Look – we have been over this before. if you are going to provide credible links – try READING them.

Germany relies on natural gas. From russia.

“Meanwhile, we’ve all seen what disruptions to oil and natural gas supplies can and will do to the world’s economies.”

you make a great point bruce. this is EXACTLY why we should wean ourselves off of these sources. you complain that wind may be unavailable for a day. well russian oil and gas could go missing for months, or even years. why rely on energy sources with such geopolitical risks? it is foolish. wind now produces electricity on par with fossil fuels, even without subsidies. it is becoming cheaper to save the planet than destroy the planet, as the saying goes.

Baffling,

Actually, wind/solar derived power does not really produce electricity on par with fossil fuels. The simple test of that is the cost of operating the grid without fossil fuels or nuclear energy.

It can’t be done.

On the other had, the fossil fuel/nuclear power grid works just fine without wind/solar. The true cost of wind/solar power is the direct cost of producing electricity from those sources plus the necessary costs of having fossil fuel backup plants (which in most/many instances could simply handle all of the power needs all of the time).

bruce, renewables will continue to get cheaper with time. and the Ukraine situation shows that relying on natural gas and nuclear is very problematic. Russia very well could let those nuke plants melt down, a worldwide disaster. and Germany (and Europes) reliance on natural gas from Russia is…well you can see the issue for yourself on tv every night. what kind of an idiot would double down on those disasters? it is simply silly. why you are so against renewables is weird, other than you are hard wired to resist any position environmentalists ever took.

nuclear power is a solution that is a decade away. by then, renewables will be much cheaper options. it should not even be in our discussion today.

depends on what you mean by grid isnt able to deal with EV charging? are we talking that the pp arent arent able to generate the power ? note EVs (almost every one of them) can set when charging starts, usually to reduce the cost (off peak times). which are set up to reduce the load on the grid. and i guess we should also be worried about gas stations, they also use a lot of electricity too you know? course you might be talking about the power lines, which has more problems in some cases because of deregulation (Texas for example…and California for another where the utility companies just treated keeping the wires as a place to cut costs). so while for now, other than maybe geothermal sources, they can be intermittent. and fossil fuels have always been subject to disruption, from war, to weather, to natural disasters, and now the global supply chain. course we can also add pandemics to that list.

while Tesla and others are not permitting it YET, the transition to EV automatically places a backup battery pack in every house that owns one. the combination of a power wall, solar roof and EV in the garage is a pretty powerful electrical system. yes there is a cost to this, today, but that cost will only go down with time. and it will result in a more resilient power grid. which is exactly what some on this blog argue cannot be achieved. energy from a diversity of sources, providing grid resiliency, and domestically sourced. we know what the future looks like, its simply a matter of how quickly we want to get there.

“The jubilation expressed by some at the perceived ending of fossil fuels is quite premature. ”

its not jubilation. its simply common sense, backed up by the data. fossil fuels are simply a foolish way to continue providing for our energy needs. foolish. in the long term, they are catastrophic. this cannot be denied. so why would you continue to promote and use a resource that is catastrophic? bruce, your animosity against renewable energy simply makes no sense.

One of the many US political objectives that Biden just bagged by being tough on Putin rather than just roll over like Trump

https://www.cnn.com/2022/03/11/energy/europe-russia-energy-end-date/index.html

Europe is planning to become independent of Russian hydrocarbons in 5 years. This is huge for energy prices, global warming and political freedom. It will hit Russia hard regardless of the final outcome in Ukraine.

Europe will not wean itself of Russian energy, although it will decrease its proportional dependence. For a while.

europe has a lot of investing: ports, processing, pipelines, to do to switch to maritime delivered liquid natural gas (lng) at purchase prices that either increase lng production or take supply from existing buyers.

iow eu energy cost will rise,

5 years is a stretch!

A good part of the plan is to build up solar and wind. Also increase energy efficiency. Finally get more natural gas from the north sea. LNG is a very expensive way to ditch Russian natural gas. That was one of the reasons Trump couldn’t get them to do it. They have to change the mixture of energy sources and reduce overall imports.

Intermittent and non-dispatchable.

“Intermittent and non-dispatchable.”

OMG. It is stupid to argue with realible power when we are actually talking about ENERGY.

If I want 10 GW reliable power, then I build 10 GW open gas turbines/diesel generators, they only run a few days per year (CF ~15%), 80-85% of the ENERGY is delivered by PV and wind. The whole construct is much cheaper than conventional baseload.

Where did you get your gas and diesel? Not Russia, I hope.

“Where did you get your gas and diesel? Not Russia, I hope.”

OMG. Get real and check numbers first. To argue with electricity generation as issue for NG demand tells me that you are clueless.

What is the capacity factor of a peaker? How much NG goes into electricity generation? How much can easily be substituted?….

You mean in Germany? The Germany of ‘send them helmets’? That Germany?

“A good part of the plan is to build up solar and wind. Also increase energy efficiency.”

amen brother. and i would only consider your nat gas as a temporary solution, perhaps only implemented alongside a hydrogen growout. start with blue hydrogen, but anticipate green in the next decade or so. provide some incentives so that the blue can be built in the near term, but understanding in the long term is will be green hydrogen that is a solution. but some of the infrastructure is needed for both. why does the world continue to rely on energy sources from russia and the middle east? geopolitically it is silly. by continuing to promote oil in the us, we are simply funding the russian war machine. like we did for the past two decades. that needs to change. or steven, you may end up sending your boy to fight the russians in eastern europe.

I have two boys. I understand they could fight there. A good cause, in my opinion.

@ Kopits

Are your sons currently in the U.S. military??

NOTE: Club Med ROTC doesn’t count.

Steven, have you told them they could be fighting so that the world can keep using Russian oil and gas? bet they are thrilled with your position.

I think we are pretty close to WWIII. Depends on what the Chinese do in the next two weeks.

I think we are further away from wwIII today than a couple of weeks ago. Russia has shown they may be a nuclear threat, but they are no match for nato. the military deficiencies of the Russians has been quite surprising. the Chinese could probably learn a lesson in overconfidence here.

Russia really needs to end the war now.

Read my piece for Feb. 12th: Absolutely spot on: https://www.americanthinker.com/articles/2022/02/it_is_possible_for_putin_to_get_crimea_without_force.html

Read the rest, too. All good analysis, I think.

https://www.americanthinker.com/author/stevenkopits/

Stevie is doing a Hare Krishna imitation, bothering people to get money for his cult.

American Stinker is a brietbart wannabe with falling readership. Rightwing echo-chamber stuff:

https://www.similarweb.com/website/americanthinker.com/#overview.

4 million visits per month; 130k / day. I had the second highest viewed piece over the weekend, so figure 10,000+ reads. That’s not too bad from where I sit.

How many people read your work over the weekend?

“Steven Kopits

March 14, 2022 at 11:27 am

4 million visits per month; 130k / day. I had the second highest viewed piece over the weekend, so figure 10,000+ reads.”

It is sad that Steve continues to do his self promotion here. But hey – the ratings of Tucker Carlson are much higher even if his show promotes intellectual garbage ever night.

“Alternative energy means nuclear.”

You post in a economic discussion forum, then at least try to get the economic facts straight: NPPs are much too expensive and die/are NOT built for very simple economic reasons. Check amount of money that already goes into PV and wind power, for each USD nuclear power getes, there are 10 USD around for wind and PV, the investors vote with their feet.

And then there are some ugly physical facts too: 2021 was the first year in which wind and PV has generated more electricity than NPPs, it is much easier and more risc free to built wind power and PV, the scalability and duration of construction of NPPs is completely uncompetitive. Hint: Per year more than 70 green equivalents of 1 GW NPPs are added, nuclear power struggles to defend the status quo.

It is always funny that proponents of NPPs sell themselves as rational but are unable to cope with economic and physical reality. 🙂

In addition, I think Ukraine has discovered the disadvantages of large centralized plants such as NPPs. Enemies can take them over and control your ability to get power to cities. They can also threaten to destroy them and contaminate your country. The distributed or even individual dwelling solar power is much better. You have full or partial power no matter what happens to the grid. I hear a lot of Californians have gone off grid and are very happy to be without power outages.

A few general comments:

The graphs nicely show the difference between recessions, depressions and suppressions.

Recession: Can you see the 2001 recession in the data? No? Neither can I. That’s a recession.

Depression: Can you see the depression in the data in Fig. 1 and Fig 2. Sure. Gasoline consumption still has not recovered its 2007 peak, now 15 years later.

Suppression: Can you see the downward spike in 2020 in Fig 1 and 2? Note that it looks nothing like the depression trough. Easy to identify purely with visual inspection.

So: recessions, depressions, suppressions, all different things.

Powell’s hot labor market policy is successfully pulling retirees back into the labor force. Look at Tom Brady.

speculation: tb12 thinks the bucs have a shot next year…..

Normally I cringe at anything related to Tom Brady but this made me laugh! Of course Renaldo is making 3 times what Brady makes.

What seems the most confusing is the effect of money supply on inflation. When Milton Friedman said that “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output” there seemed to be clarity. I understand that regression models no longer seem to validate a simple relationship between money supply and inflation, but it seems like money supply is part of this inflation discussion. Are we in general experiencing a more rapid increase in money supply than in output? Is that comment still valid? Apologies for being dense.

We have absolutely experienced faster koney supply growy than nominal output growth. “Nominal” is important here, because nominal growth includes Inflation and real output growth.

The idea Friedman had in mind was that economies can only increase real output so fast, so that increase in money supply faster than the increase in real output would necessarily result in inflation; excess money growth would be absorbed in prices. An underlying assumption of this view is that money turns over in the economy at a stable rate. In economic parlance, the velocity of money was stable in Friedman’s view. That turned out not to be true. This page will take you to a couple of standard velocity measures for the U.S.:

https://fred.stlouisfed.org/categories/32242

Friedman eventually conceded that velocity isn’t stable and that his scheme for economic management through steady money supply growth was flawed. Friedman’s initial view was that excess money growth was a necessary and sufficient cause of inflation. It turns out that excess money supply growth is necessary for inflation, but not sufficient.

@ Macroduck

” It turns out that excess money supply growth is necessary for inflation, but not sufficient.”

Would that be true during an extreme supply shock??

I’m gonna guess here, because no example come to mind…

If there were a supply shock causing one category of goods – energy goods, for instance – to increase sharply in price while monetary policy starts out neutral and doesn’t respond to the schock, then there is an income effect which would put downward pressure on all other prices. Energy, as an input to production, would drive up the cost of other things, more or less relative to the energy used to produce and deliver them. But you still have the income effect. So you end up with some prices falling, some rising. Not sure how much inflation could be generated ( Professor Hamilton suggests a step-up when energy is the culprit), but not much. Mostly just relative price change driven by the relative energy intensity of products.

If there is a general supply shock – say a pandemic – there is a recession. Assuming no policy response – fiscal or monetary – there’s not enough stuff to buy in just about equal proportion to not enough income to buy it with. We would be in an MV=PQ world in which we hold M steady (’cause that’s what we’re talking about here), Q falls, so P and V are the things we have to figure out. With no policy response, V falls because lots of people are out of work and cut back on purchases. (I know, I know – there’s more to V than shopping, but this is the best I can do.)

I can’t quantify the drop in Q or V, but I don’t see much here to push P higher except an initial bout of hoarding. Hoarding would draw savings down, so inflation would die out.

If money growth isn’t the source of Inflation, then I think dis-saving is the only other source, and that’s short-lived.

Dr. Friedman was a much deeper thinking than that. But sometimes he realized he was addressing an audience of simpletons so he would at times dumb things down. Alas some of those simpletons pretended to be economists who took this dumb down sayings all too seriously.

It’s an intelligent question~~not “dense”. I think money supply has very little to do with inflation (certainly in a 2022 world). I’m sure you can find some archaic minded economists who are holdouts. Short answer—money supply has minor effects on inflation.

In my non-economist simple mind, there would seem to be a concern about the increase in money supply as it relates to inflation. If we double the money supply in a short period of time without output increasing significantly, it seems like prices would go up considerably. So, where is the tipping point on inflation as money supply increases compared to output?

When I have dug up academic papers in the past on other topics you seem less than enthused. But I think you can understand them well if you take the time to read them (you can probably grasp them better than I sometimes do), I will see If I can find 3–4 papers and put them in this thread. I’m pretty certain Menzie has put up relevant papers by other profs, and it’s a good bet Prof Hamilton has as well, certainly if it relates to oil in some fashion, or time series maybe.

@ AS

I want to make it clear I do not necessarily agree with all the arguments expressed in this paper. However I think the paper is relatively “neutral” on the topic of monetary aggregates, and is extremely useful from an explanatory standpoint. You can skip the more complicated equations on the paper and still get A LOT of edification out of the paper. I hope it’s useful to you AS

https://ippr.in/index.php/ippr/article/view/44/24

There was also a recent speech by Mervyn King that you might find useful on the topic. I’d give you the link, but it was a little to “old fogey” for me in terms of theory. But you might like it. If you request I will go ahead and hunt down the link for you.

If there is a tipping point, it doesn’t appear to reside in money supply growth. Real-side factors may be the right place to look. Note Professor Hamilton’s point about stepped-up inflation after energy supply shocks.

macroduck,

Per Professor Hamilton,

“The bottom panel provides a second indicator, plotting the growth rate of the money supply as measured by M2. Surges in money growth coincided with the two surges in oil prices in the 1970s and helped these spill over into a more general and sustained inflation.”

“Both of these indicators also send a pretty clear signal that the Fed overdid it during the last year as well.”

Seems like Professor Hamilton is saying increased money supply coincided with inflation, if through oil prices.

Yes, money supply growth is necessary, but again, not sufficient. A real shock, through petroleum, was part of the mix. If you look at a subsequent periods of rapid money supply growth without a similar supply shock, you don’t get accelerating inflation.

Now, we have both, which is probably a worry to Fed folk.

it seems not, the initial arrival of inflation seems to have arrived after there were some hints of covid-19 slowing down (becoming endemic instead of pandemic). problem was that a large section of manufacturers use JITM , so when demand crashed when COVID-19 was still raging, business shutdown, moth balled plants, and that lead to transport sector that moved goods around to do the same. so when the economies started to wake up, suppliers had to restarts, get workers, oh and materials (which leads to getting previous suppliers having to restart too and oh get workers) , then companies had to restart plants (hiring new workers or trying to rehire old ones…not always successfully), then there was the restarting of their supply chain transportation (which had to get their ships/planes, etc serviceable, oh and get workers), each step also has the need for meeting any regulations that apply to operations. and possible having to move their equipment where it was needed, if they still had it. all of these takes time and money. in some cases (chips) a lot longer than others. today we have more demand than supply (i seem to recall from college econ 101, they more than supply = inflation). now we add on the fossil fuel crunch. can only make it worse. so exactly how does economics deal with these issues, or can it? price is up, supply is down. companies are still working on restarting global supply chain (which seems unable to deal with any thing that doesnt work perfectly 99% of the time.

The Baker Hughes rig count can be found here.

https://bakerhughesrigcount.gcs-web.com/na-rig-count?c=79687&p=irol-reportsother

The best table is the one entitled “North America Rotary Rig Count Pivot Table (Feb 2011 – Current)”

You can slice and dice that to your hearts content. Published every Friday at 1 pm.

The frac spread count comes from PVMIC. But if you want the early edition, Mark Rossano typically has the numbers on YouTube usually at 4-5 pm every Friday afternoon. Here’s the latest: https://www.youtube.com/watch?v=cpzAacizERU

It’s important to distinguish between rigs and frac spreads nowadays. Rigs drill wells but produce no oil; frac spreads complete wells and produce oil. Therefore, spread counts are more directly linked to production than rig counts are. When DUC (drilled but uncompleted) well counts are steady, then rig counts and spread counts should yield the same result in production. However, operators have been cannibalizing their DUC inventory since the start of the pandemic, with DUC counts falling from 7,135 in Sept 2019 to on 3,555 in Jan. 2022, a drop of 3600, or more than half. This on-going cannibalization equals about 35 additional horizonal oil drilling rigs.

DUC and well numbers numbers can be found in the EIA’s Drilling Productivity Report (DPR), with the next edition out by mid-week.

We have more recent numbers that Nov or Dec for most of these categories.

Gasoline supplied, from the weekly data (4 wma), is

9,089 for Dec. versus 8,949 from the cited monthly data

8,215 for Jan

8,774 for Feb

https://www.eia.gov/petroleum/supply/weekly/

The time to have a pro US oil/gas production policy, not an anti one, was before there was a geopolitical crisis, not after.

As I’ve posted, rig count versus price is depressed:

https://twitter.com/RobertClarke_WM/status/1453017667137323010/photo/1

Yes, I realize they didn’t turn off the taps completely, but there have been several actions taken as well as public statements from this administration. This creates political risk. and inhibits investment, increasing the hurdle for development.

Some evidence of the anti policy:

*Democrat primary debate comment, since walked partially, but he still said it.

*Permits freeze, since removed, yes…fine now thanks, but still shows the risk, from them doing it for FEB21.

* Leasing stop…requiring court action to reverse, but still shows administration sympathy.

*Appointing a DOE Secy (JenniG) without energy experience or technical skills.

*Keystone stoppage.

*Anti-development FERC commissioner added. And subsequent policy put out to increase the hurdles for pipelines, LNG plants.

*JenniG laughing (literally) at the idea that US production helps reduce prices.

*Methane regs.

*Other regs (current and more importantly risk of more)

*Export control trial balloon (“looking at ALL tools”). Since walked back, but shows risk.

*And now the trial balloons about windfall profits taxes.

The industry knows where the Democrats’ hearts are. And even…just on this forum…several left wingers see high gas/oline prices as a feature, not a bug. Sure, Biden admin doesn’t want to pay any political price, like with the inflation. But they are not pro fossil fuels. Are anti. Companies and their investors know they are in the gun sights.

Yes, the industry grew like crazy under Obama. But it came out of nowhere (he even said you can’t drill your way to lower prices). Towards the end, they started taking some credit. And as they raced out the door threw some exec actions that were anti FF, that Trump reversed. But in general, it was a policy of benign neglect, which was enough for the industry to flourish.

Higher oil prices come and go. Climate change is a persistent and growing threat to our way of life, and threatens to accelerate the mass extinction o species already underway. Policies to wean humanity from burning hydrocarbons is entirely justified. The price of hydrocarbons is a good tool for the job.

World oil production

Two comments here. There is some debate whether ‘oil’ is properly understood as crude and condensate, or more generally as petroleum liquids, which includes natural gas liquids and biofuels, for example.

Consider the situation at the end of 2005. World crude and condensate production (C+C) was 74 mbpd and all petroleum liquids was 85 mbpd, a difference of 11 mbpd of non-crude petroleum liquids. Now let’s look at the situation in Nov. 21: C+C production was 80 mbpd (the number shown on the graph above) and total liquids was 99 mbpd, a difference of 19 mbpd. During the interval, C+C production was up 6 mbpd, but other liquids (mostly natural gas liquids) were up 8 mbpd. Most of the growth in the petroleum liquids supply has not come from crude, but from natural gas production. If you miss that, you’ll miss a big chunk of the dynamics of the oil business.

Therefore, I agree with the EIA and believe that petroleum liquids is the correct way to view the oil supply.

The oil supply has been changing month to month, so a November number is not quite representative at the moment.

If we use the total oil supply, then numbers look like this:

Nov. 21: 98.5 mbpd from the Mar. STEO, 98.5 mbpd per cited source

Dec. 21: 98.4

Jan. 22: 99.0

Feb. 99.8

Mar (forecast): 100 mbpd

In other words, the oil supply is up a very impressive 1.5 mbpd since November.

See the STEO: https://www.eia.gov/outlooks/steo/

As for the US oil supply: The EIA sees the total US liquids supply back at historical highs during Q2, that is, in the next couple of months. I don’t think we should be too negative on US shales, bearing in mind that US C+C production is not the whole story.

Finally, let’s keep in mind that OPEC is still sitting on something close to 2 mbpd of spare capacity above normal levels. OPEC has been slow to release this, given that US shales have not been able to make up the difference. This is as we would expect from a cartel, the very purpose of which is to restrict production to maximize per unit prices. This thinking under-pinned my report from a year ago entitled ‘Sucker Punch’, where I warned that the EIA was vastly under-estimating prices and creating substantial political risk for the Biden administration. I expected that OPEC could take prices back to the $100 range, and WTI this morning is $101, albeit about $10 is due to Russia. And I’d note that the Biden administration has headaches a plenty with oil prices.

It is also important to note that, if the Permian becomes de facto cartelized (most of the productive capacity owned by relatively few players) or the play loses its resilience, then Permian operators may well become de facto members of OPEC. That is, it’s a lot nicer to make money by jacking up prices than drilling more wells. Note that this does not mean active collusion of any sort, but rather a willingness to let OPEC set prices with perhaps insufficient enthusiasm for breaking the cartel’s grip down in Texas.

Just for the record, the EIA’s WTI forecast in the February 2021 STEO for March 2022 was $51, exactly half of current levels.

Anonymous: “Some evidence of the anti policy: …

*Appointing a DOE Secy (JenniG) without energy experience or technical skills.”

That’s hilarious. You are comparing Jennifer Granholm to the stupidest man alive, Rick Perry!

Granholm graduated Berkeley Phi Beta Kappa in political science and then Harvard Law with honors.

Rick Perry’s highest honor was football cheerleader and senior class social secretary at Texas A&M where he got a degree in animal science (cows and pigs). Perry is best known for his “Oops” moment in the debates where he couldn’t even remember the name of the Department of Energy that he vowed to abolish. Then Trump appointed him secretary of the department he couldn’t remember the name of.

Not incidentally, Rick Perry was knee-deep in Trump’s scheme to extort Ukraine to help Trump’s election campaign, helping to embolden Putin and get us to where we are today. And Anonymous has the chutzpah to blame the situation on Granholm.

Perry has way more experience with energy as a governor than jennie. as for politics, no duh, the Republican presidential had a conservative and the Democrat s liberal. but Perry still has more energy experience.

Experince not matched with the public interest is not much of a recommendation. Parry’s experience with energy policy never involved the public interest.

don’t overlook some of the positives for Perry (admittedly there are few). he oversaw the construction of the high voltage transmission lines that allowed the electric producing wind fields to transmit power to the cities. this opened up wind in texas. some people believe that texas wind is some greenies plot. it was signed, sealed and delivered by republicans a decade ago. along with deregulated energy.

Ha! Perry’s only experience with energy while governor was collecting campaign donations from Texas oil producers. When Perry took the Energy Secretary job he thought it was going to be about being a lobbyist for the oil industry. He had absolutely no idea that half of the department’s budget is devoted to development and maintenance of the nuclear weapons program. (From your comments, I’m guessing you are just as ignorant.) Scary that a person this dumb was placed in such a critical position.

And here is Perry commenting on last winter’s collapse of the Texas energy grid while millions froze in the dark: “Texans would be without electricity for longer than three days to keep the federal government out of their business,” Recall the Perry was governor during the previous 2011 Groundhog Day blizzard when there was a similar breakdown and Perry did nothing in the face of recommendations to prevent a future disaster. So 10 years later when it happens again, Perry just says “Stuff happens. Suck it up.”

Energy expert, indeed!

He still had way more energy industry awareness, since it is a big deal in TX (including campaign contributions). And not in MI. If we were talking automotive industry, I’d give it to Jenni.

Plus interesting how you want to debate one of 11 items, versus the totality. Which is that this administration and the left as a generalization are anti-FF. Heck one of the commenters here already said again that the high prices are a feature, not a bug. https://econbrowser.com/archives/2022/03/oil-prices-and-inflation#comment-270437

“He still had way more energy industry awareness,”

Perry really has no awareness, of anything. he is a snake oil salesman. he would sell his own mother up the river if he thought it gave him an advantage.

“Which is that this administration and the left as a generalization are anti-FF. ”

its not that they are antiFF. if you do the analysis, then it is quite obvious that FF is not a good fuel source for the future. why would you invest in something that has no real future? what kind of businessperson is that? its just like your comments that internal combustion engines provide better performance than an EV. in what world are you living? this has nothing to do with antiFF. an electric motor is FAR superior to an internal combustion engine in almost every way imaginable. and you still think it is intelligent to promote internal combustion engines? silly.

An important insight:

“A big part of the story is that it is easier to tear something down than it is to put it back together. The negative oil prices in April 2020 marked a definitive end to some of the enthusiasm for U.S. shale oil production and was followed by a collapse of lending and drilling. Higher oil prices have been gradually but steadily bringing resources back in. That process would continue even without the recent prices over a hundred dollars a barrel, but it takes time. Perhaps by the end of summer U.S. production would be back where it was at the start of 2020.”

When I read it, I was reminded of some lecture from decades ago on the corn-hog cycle. Some ag economists use such reasoning to support farm price stabilization policies, Maybe the world should have followed similar policies back in 2020 but stock =piling a lot of oil and avoiding that sharp price decline.

Using data for Vehicle Miles Traveled (VMT) NSA (2014m1 to 2020m05), FRED series, trfvolusm227nfwa, a Covid intervention model dynamic forecast, forecasted December 2021 VMT at 270,573 compared to actual VMT of 268,398. January 2022 VMT are forecasted at 269,714, February 2022 VMT are forecasted at 252,911 and March 2022 VMT are forecasted at 287,375. It will be interesting to see how the actual data compares considering the recent rise in gasoline prices. If I had thought of the VMT data series introduced by Professor Hamilton, perhaps this model would have been encouragement to purchase shares like XOM.

The gasoline supply series seems more difficult to forecast.

studied eia stock data last night.

looking at gasoline stocks over the years, this past fall/winter had a small unusual dip, but gasoline stock is about seasonal normal, it is a ziggy stock chart, lots of up and down lines. prices likely caused some relief on stocks.

the issue will be distillate fuel which 4 mar report was wow -5 mbbl, multi year lows! there are refining concerns if distillate were maximized, too much kerosene (airlines may enjoy but refiners do not) and slightly lower gasoline yields.

looked at another eia report on ex/im and usa is a net exporter (dec 2022 41 mbbl) of distillate fuel and so doe/doc might curb that……?

that is priced in everything that moves.

crude stocks are not worrisome ….. while imports and domestic crude supply are up.

so opec+ will be opec+ and be wary to raise supply.

Moneyball helps with oil supply:

https://twitter.com/MOAR_Drilling/status/1501762759209504769

WTI closed at $103.01 today, down another $6.32 from Friday, and it had briefly traded under $100….you should all be able to tell from this oil price graph that it was priced just over $90 two weeks ago, ran up a record $24.09 in one week to $115.68, then hit $130.50 last Sunday before tumbling back to below $100 earlier today…

in comments at Angry Bear last week i pointed out that the oil companies have no control over the price of oil, that they have to take the price set by speculators…John Kemp, senior energy analyst at Reuters, keeps track of trading in oil by hedge funds each week…here’s what they were doing before the price run-up began:

their "net long" position of 731 million barrels is interesting, because as i’ve previously reported, our commercial supplies of crude oil in storage fell to 411,562,000 barrels on March 4th….that means that hedge funds were holding 178% of all of the oil that was available…

so what happened after that? as John Kemp documented earlier today:

so it appears the hedge funds have been on the winning side of both the price runup and its recent drop….but it’s important to recall that futures market trading is a zero sum game, and oil companies trying to set their own positions in the middle of all that trading were most likely losers…

“…they have to take the price set by speculators…”

I think you mean the price set in markets. Speculators have influence, but not price-setting power. They can induce a lot of volatility when they get frisky, but they don’t dictate price.

maybe i’m wrong, but i tend to use the words like traders, markets, peculators, and casino interchangeably….i can’t discern much else could be going on when the oil contract trading volume in new york on most days is more than 100 times the volume of physical oil that’s moved around the country each day..

macroduck, re: “Speculators have influence, but they don’t dictate price”

so who dictates price?

probably those who actually take delivery of the commodity.

There is no particular who. All the whos. Price is set where “S” and “D” intersect.

Brad DeLong once described people who work in finance as having smeared themselves with glue and stepped into a stream of money. If they are halfway competent a their jobs, they do very well wiyout producing much of value. We look at the result, see that they’ve created no real value, and look for how the game is rigged. It is rigged, but not by speculators setting prices. The game is rigged through rent-seeking.

ok, “speculators” was a poor word choice (and it wasn’t even used in my original AB comment)….try substituting “Wall Street” for a term that’s more inclusive…

my original point was to counter the widespread idea that “Big Oil” is somehow gouging us on the price of fuel, whereas they actually have so very little to do with setting that price…

ok, the oil price graph i cited is a screenshot i took Friday evening, so it doesn’t show today’s prices…this where it’s from: https://www.barchart.com/futures/quotes/CLJ22/interactive-chart

that’s an interactive and continuously updated price graph, so it will no longer end at today’s closing price (it shows $99.09 as i type this); to get the all price movement nuances that i described, you’ll have to reset the graph’s range (menu on top) to one month, or even better, to 15 days as i had done…

April WTI is now trading at $94.30…so it has now risen from $91.30 to $130.50 back to $94.30 in a little over 2 weeks….i don’t know, but my best guess would be that the hedge funds that drove the price up are now short, forcing those who are long in this heavily margined market to sell, driving prices even lower, and hence increase the profits of the shorts who initiated the recent price action…..this would be analogous to, but the opposite of, a short squeeze…

There may be a gamma trade at work. I don’t know what level of price volatility would induce a switch from gamma selling to gamma buying, bt I’d bet a week’s pay long-gamma is a crowded trade now, boosting volatility.

《futures market trading is a zero sum game,》