And similarly for the Two Year Treasury?

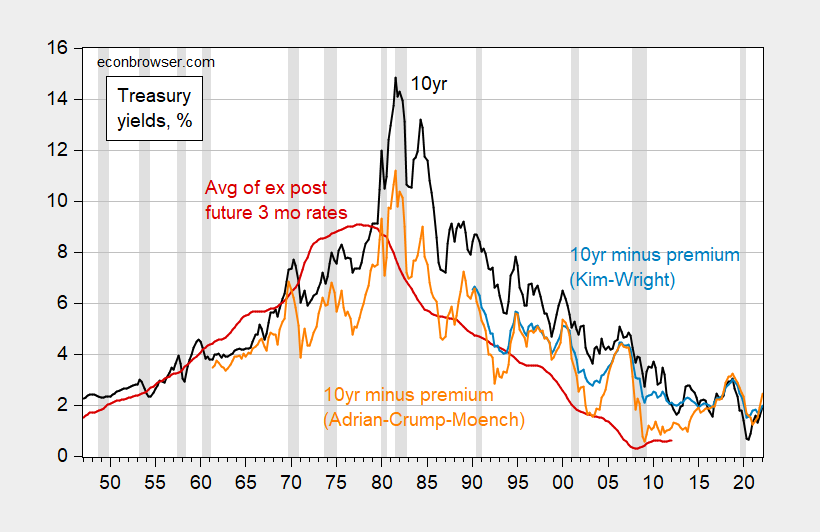

A standard decomposition of the ten year rate is (for quarterly data):

Where the first term on the right hand side (call it z’) would be a representation of the expectations hypothesis of the term structure – the long term interest rate is the average of the expected future short rates.

We don’t observe the expected values, but we do observe the ex post realizations. Calculate the average of the ex post realizations, to obtain z.

Figure 1 plots the i10y,t (black line), z (red line), and

where the estimated rp is the Kim-Wright estimate (blue line) or the Adrian-Crump-Moench estimate (orange).

Figure 1: Ten year constant maturity Treasury yield (black), ten year minus Kim-Wright term premium (blue), ten year minus Adrian-Crump-Moench term premium (orange), and average of future three month Treasury yields on secondary market (red). NBER defined recession dates peak-to-trough shaded gray. Sources: Treasury via FRED, Shiller, Fed via FRED, NY Fed, NBER and author’s calculations.

If full information rational expectations held, and the estimates of the 10 year term premium on a zero coupon bond were accurate, then the light blue line or orange line should match the red line, more or less. This characterization does not hold, although it does better for the Adrian-Crump-Moench estimates than the Kim-Wright.

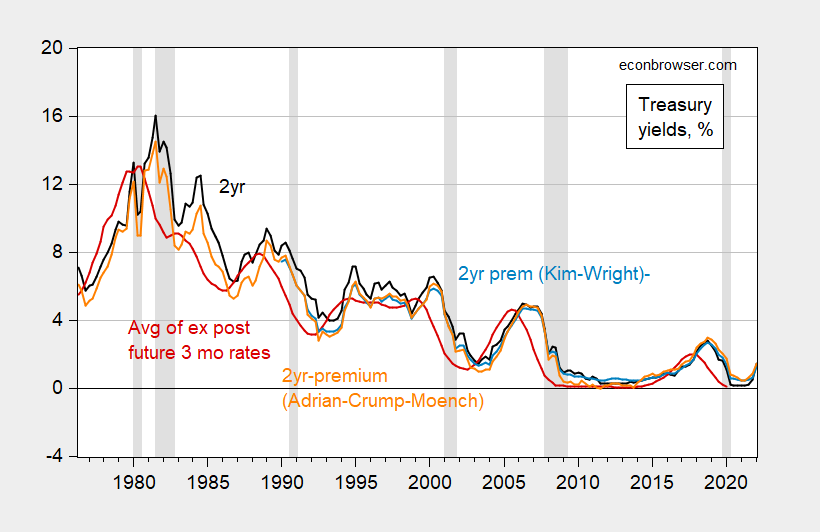

A similar point applies to the two year horizon.

Figure 2: Ten year constant maturity Treasury yield (black), ten year minus term premium (blue), ten year minus Adrian-Crump-Moench term premium (orange), and average of future three month Treasury yields on secondary market (red). NBER defined recession dates peak-to-trough shaded gray. Sources: Treasury via FRED, Shiller, Fed via FRED, NY Fed, NBER and author’s calculations.

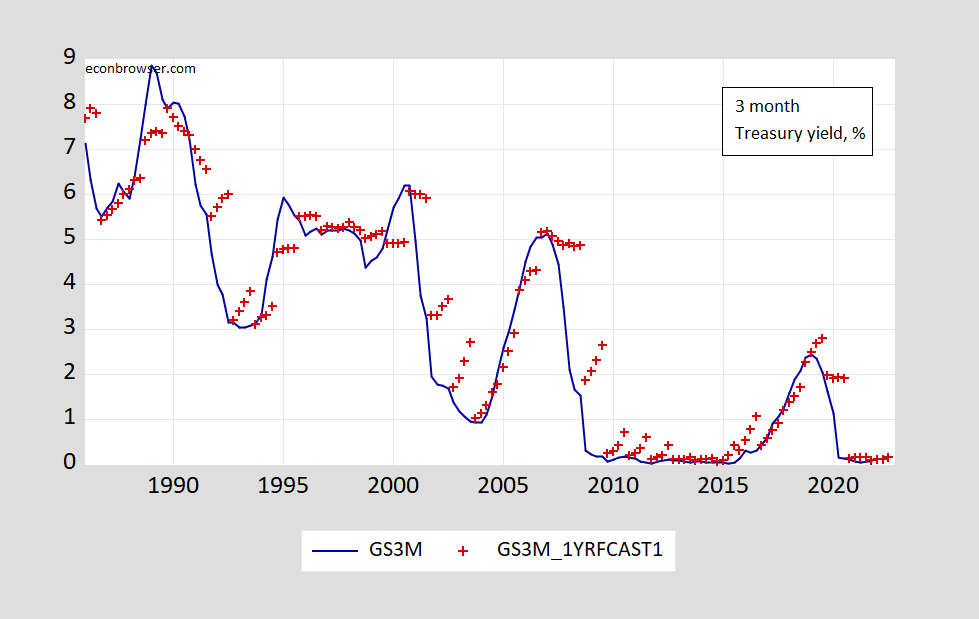

The finding that long yields — even after adjusting for risk premia — are too high are consistent with market observers overestimating how high interest rates will go. For some concrete evidence, see the Survey of Professional Forecasters expectations of future 3 month Treasury yields, vs. the actual.

Figure 3: Three month Treasury yield (blue line) and Survey of Professional Forecasters mean forecast (red +) as of Q3, in %. Green shading denotes early, late periods. Source: Federal Reserve Board, Philadelphia Fed.

None of the foregoing invalidates the expectations hypothesis of the term structure (which relies upon expected future rates). But it does cast into doubt whether future short rates will actually go as high as implied by the current long rates (even after adjusting for estimated term premia).

Tiny edit may be needed:

“…are too high are consistent with market observers overestimating…”

My mistake. No edit needed.

The picture inFigure 3 is cousin to pictures of forecasts long-end rates. It is a well-known feature of the Treasury market that rate expectations have been too high far more often than too low, and very rarely close to the actual result. If expectations of funding costs are systematically hiher than realized fundig costs, that would explain systematic errors in expected long-end yields.

None of which means the end of low borrowing costs is not upon us. We may be entering a period of persistently high yields, just not as high as market participants and forecasters expect. The long period of downward trend in term premium may have ended:

https://fred.stlouisfed.org/graph/?g=O6hm

http://www.nytimes.com/2016/04/25/business/dealbook/how-argentina-settled-a-billion-dollar-debt-dispute-with-hedge-funds.html?ref=world

April 24, 2016

How Argentina Settled a Billion-Dollar Debt Dispute With Hedge Funds

By ALEXANDRA STEVENSON

A six-week flurry of secret negotiations resulted in a deal that ended 15 years of contention between bondholders and government officials.

Remembering the Argentina bond default of 2002, that was not settled till 2016 but that the economy has still not recovered from.

https://fred.stlouisfed.org/graph/?g=mu3b

January 15, 2018

Real Broad Effective Exchange Rate for Argentina, Brazil and Chile, 2000-2022

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=vq78

January 15, 2018

Consumer Prices for Argentina, 2017-2022

(Percent change)

Can’t read behind the firewall, but I will assume the NYT reporter mentioned strengthening of “pari passu” clauses in international lending in response to “vulture fund” behavior in the Argetine cases.

The problem in case of reparations is that debt contracts generally do (to my knowledge) envision reparations payments. If courts have guidance in such cases, solutions can be reached more quicksand if they don’t.

That’s “do not envision reparations payments.” Sorry.

https://www.nytimes.com/2016/04/25/business/dealbook/how-argentina-settled-a-billion-dollar-debt-dispute-with-hedge-funds.html

April 24, 2016

How Argentina Settled a Billion-Dollar Debt Dispute With Hedge Funds

By ALEXANDRA STEVENSON

The Waldorf Astoria hotel in Manhattan has long been a location for secret diplomacy, but few meetings there would have seemed as unlikely as the one that took place one day in early December.

In a hotel conference room, a top Argentine politician drank coffee with two hedge fund executives — a meeting that was nothing short of remarkable after more than a decade of bitter legal skirmishes between Argentina and a group of disgruntled debt holders who at one point seized an Argentine Navy ship. The previous Buenos Aires government reviled the hedge funds as “vultures.”

That meeting on Dec. 7 between Luis Caputo, who days later would be sworn in as Argentina’s finance secretary, and Jonathan Pollock and Jay Newman from Elliott Management, the $27 billion hedge fund founded by Paul E. Singer, was the start of a rapprochement leading to a momentous debt deal that has now allowed Argentina to rejoin the global financial markets that it had been locked out of for 15 years.

Last week, Argentina successfully sold $16.5 billion in bonds to international investors, a record amount for any developing country. And on Friday, Elliott and the other bondholders finally received their reward in the form of billions of dollars in repayment, representing returns worth hundreds of times their original investments.

“Today, we have put a definitive close to this chapter,” Alfonso Prat-Gay, Argentina’s economic minister, told an Argentine radio station on Friday.

The negotiations that led to the deal were set in motion by the election in November of President Mauricio Macri, who ran on a promise to reignite Argentina’s flailing economy. Striking a deal with the country’s aggrieved bondholders was central to getting that done.

How Argentina and the hedge funds were able to break the long stalemate and reach a deal in a matter of weeks is a story of furious back-channeling and clashes that nearly derailed an agreement. Details of those negotiations have emerged from interviews with eight people who were involved in those meetings, as well as court filings and emails reviewed by The New York Times. Many of those people spoke on condition of anonymity because they were not authorized to speak publicly.

There were moments when the talks nearly fell apart. Three days before a deal was signed with Elliott, Mr. Caputo, exasperated by a back-and-forth with bondholders over whether they would return government assets they had seized, emailed the court-appointed mediator: “THIS IS A JOKE; NO DEAL.”

That mediator, Daniel Pollack — who had not previously met Mr. Pollock at Elliott — was appointed by the court in June 2014 and played a central role in the final negotiations.

Indeed, hours before his December assignation with the Elliott executives, Mr. Caputo had been just a few blocks down Park Avenue at the offices of the McCarter & English law firm. There, he introduced himself to Mr. Pollack, a prominent trial lawyer best known for arguing two landmark mutual fund cases before the United States Supreme Court in 1979 and 1983.

Mediating in closed-door negotiations, Mr. Pollack cajoled both sides, at times resorting to theatrical moves like getting a court order to summon Mr. Singer, the founder of Elliott, to his office.

Mr. Pollack’s rule of no pens and paper during crucial negotiations frustrated some, with two hedge fund managers complaining privately that the mediator was an obstacle to the settlement process….

https://en.wikipedia.org/wiki/Pari_passu

Pari-passu is a Latin phrase meaning “equal footing” that describes situations where two or more assets, securities, creditors, or obligations are equally managed without preference.

https://www.nytimes.com/2016/04/01/opinion/how-hedge-funds-held-argentina-for-ransom.html

March 31, 2016

How Hedge Funds Held Argentina for Ransom

By MARTIN GUZMAN and JOSEPH E. STIGLITZ

PERHAPS the most complex trial in history between a sovereign nation,Argentina, and its bondholders — including a group of United States-based hedge funds — officially came to an end yesterday when the Argentine Senate ratified a settlement.

The resolution was excellent news for a small group of well-connected investors, and terrible news for the rest of the world, especially countries that face their own debt crises in the future….

Off topic – Anybody else notice that, once Brown is sworn in, the Supreme Court will nearly be boys-against-girls?

Let’s hope the boys mind their mouths.

Let’s hope that Clarence Thomas refrains from making moves on her.

Let’s hope if he leaves, ahem, hair in anyone’s Coke, it’s on his way to the press conference announcing his retirement.

T.Shaw,

Oh, you want to get on the bandwagon with this totally sick QAnon groomer mongering crap? This stuff is truly disgusting and you should be ashamed of yourself, although I get it that a lot of GOP Fox News listeners have not yet figured out how nauseating this stuff is.

As for this bit about Jackson refusing to answer the question about what is a woman, have you seen the pathetic crackbrained answers various GOP pols have given when they have tried to answer the question? They have pretty much all made total fools of themselves. Jackson looks competely wise and careful in her reply.

So, bozo, if you want to play this game: how do you define what a woman is? And saying XX chromosomes will not do it. And try not to post more on this meme that will lead to people wanting to puke all over you, because that is where this stuff quickly leads, when it does not lead to fools attacking pizzerias without basements to save the children not on them being abused.

OK [], T. Shaw. You are disgusting.

I ask Menzie to throw you the h out of here, or at least seriously censor you. This “groomer” scheiss is unacceptable.

I am a close personal friend of Deirdre McCloskey. Do you know who she is? If you do not, well, I suggest you check her out. Menzie and Jim definitely know who she is and have very great respect for her.

You are way out of line here if you play this crap. This stuff makes the Putin bots look good, although clearly you are either too stupid or too immoral to understand that.

T.Shaw: In accord with the guidelines, I have banned you for use of inappropriate language.

《in 2012 I treated Covered Interest Parity as an empirical fact enforced by riskless arbitrage, and focused my attention on explaining persistent violation of Uncovered Interest Parity (as well as the Expectations Hypothesis of the term structure) as a consequence of the profit-seeking activity of dealers in foreign exchange markets. Today, however, Covered Interest Parity also fails persistently. 》

From https://sites.bu.edu/perry/2019/03/12/liquidity-changes-everything/

Why is Mencius so ignorant of the Money View? Would he learn a lot from Mehrling’s MOOC?

rsm: Well, I’ve been writing about violations of CIP since (at least) 2011. So there!

Geez, you do think you can do a “gotcha” on me. And Mehrling notes he learned a lot at Harvard about Durkheim, etc. Heck, I probably took the same class. I hardly think you can claim I’m a narrowminded scholar – like Mehrling, I had to fulfill the GenEd and Core requirements (if you don’t know what those are, you should investigate).

Why is rsm so ignorant of basic linguistics? He/She continues to make (false) declarative statements in the form of questions.

In rhetoric, this behavior is known as “begging the question” and is generally recognized as cheating.

Here’s another demonstration of question begging: Why is someone as ignorant as rsm so insistent in the ignorance of others? I mean, how could rsm think she/he knows enough to have an opinion of what others know?

See? It’s easy once you get the hang of it.

https://www.msn.com/en-us/entertainment/news/john-lennon-s-son-performs-imagine-for-first-time-to-benefit-ukraine/ar-AAW4rNM?ocid=msedgdhp&pc=U531&cvid=af79a6eab4034ab084f9f00e62a71c00

Julian Lennon had never song his father’s Imagine until now – in a benefit for the citizens of Ukraine.

Everything seems to be a joke to you. Of course your comments are pathetic trolling nonstop so hey.

《In rhetoric, this behavior is known as “begging the question” and is generally recognized as cheating.》

What do you call lying by omission as Mencius did by leaving out that Mehrling has disproved Expectations Hypothesis of the term structure?

rsm: (1) In the link you provided, Mehrling didn’t disprove EHTS (or CIP). He linked to a for-pay course on finance. I wasn’t going to pay for the course. So I have no idea what he proved or didn’t prove. Apparently he doesn’t have a publication that shows his proofs. (2) Do you not know how to spell?

Actually, does our Mencie even understand yet that the Expectations Hypothesis of the term structure has been invalidated by Mehrling?

《None of the foregoing invalidates the expectations hypothesis of the term structure (which relies upon expected future rates). 》

Does that sound like Menschie still thinks EHts is valid?

Does Macrosmurf really think it’s cheating if I now ask, can you see me face-palming?

《In classical rhetoric and logic, begging the question or assuming the conclusion (Latin: petitio principii) is an informal fallacy that occurs when an argument’s premises assume the truth of the conclusion, instead of supporting it.

For example, the statement “Green is the best color because it is the greenest of all colors” claims that the color green is the best because it is the greenest – which it presupposes is the best.》

Anyone else notice how “begging the question” has zero to do with simply asking questions? Who’s the ignorant Macrosuck now, eh?