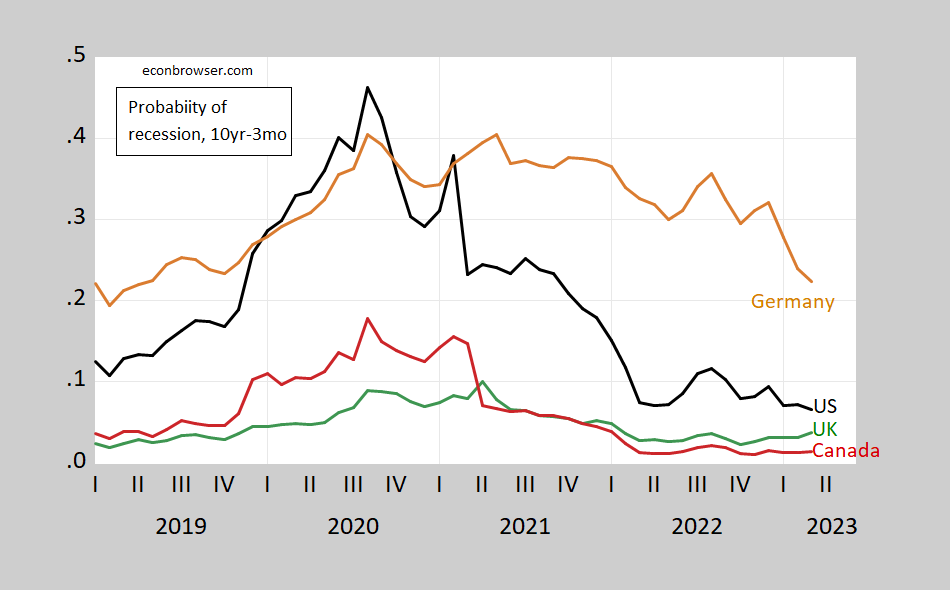

For the US, Germany, UK and Canada:

Figure 1: Estimated probability of recession for indicated months based on 10 year-3 month spread lagged 12 months for US (black), Germany (brown), UK (green) and Canada (red). Recession probability from probit model. Source: Federal Reserve via FRED, OECD, NBER, and author’s calculations.

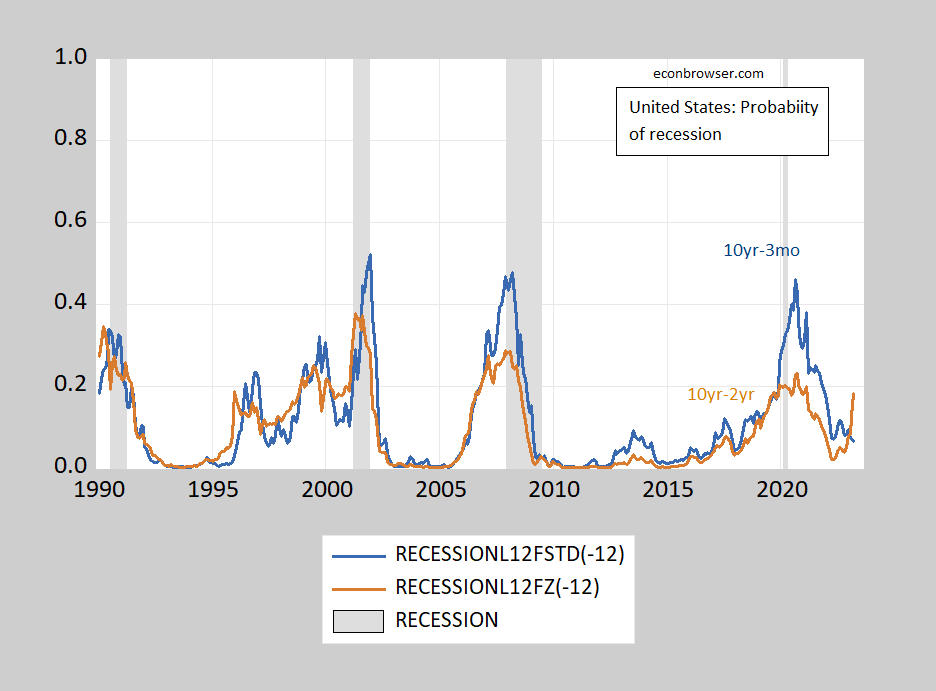

Of course, most of the concern has arisen due to inversion of the 10yr-2yr spread (e.g., Deutsche Bank) As noted in Chinn and Kucko (2015), the 10yr-3mo spread has had more predictive power. However, one can see the divergence in predictions in the US case in Figure 2 below (compared against Germany, UK, and Canada).

Figure 2: Estimated probability of recession for indicated months based on 10 year-3 month Treasury spread lagged 12 months US (blue), for 10 year-2 year spread (brown). Recession probability from probit model. NBER defined recession dates peak-to-trough shaded gray. Source: Federal Reserve via FRED, OECD, NBER, and author’s calculations.

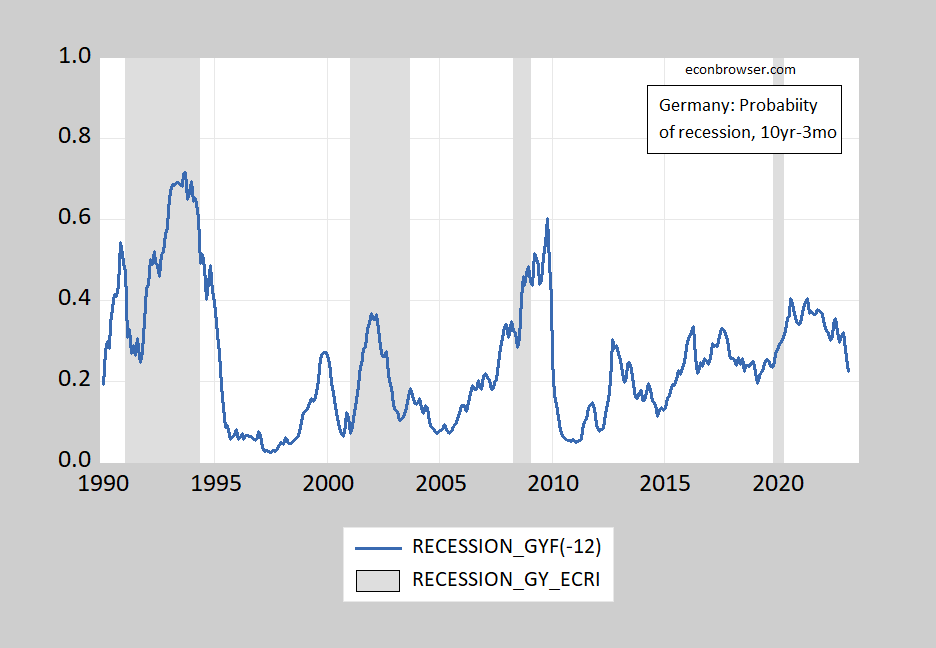

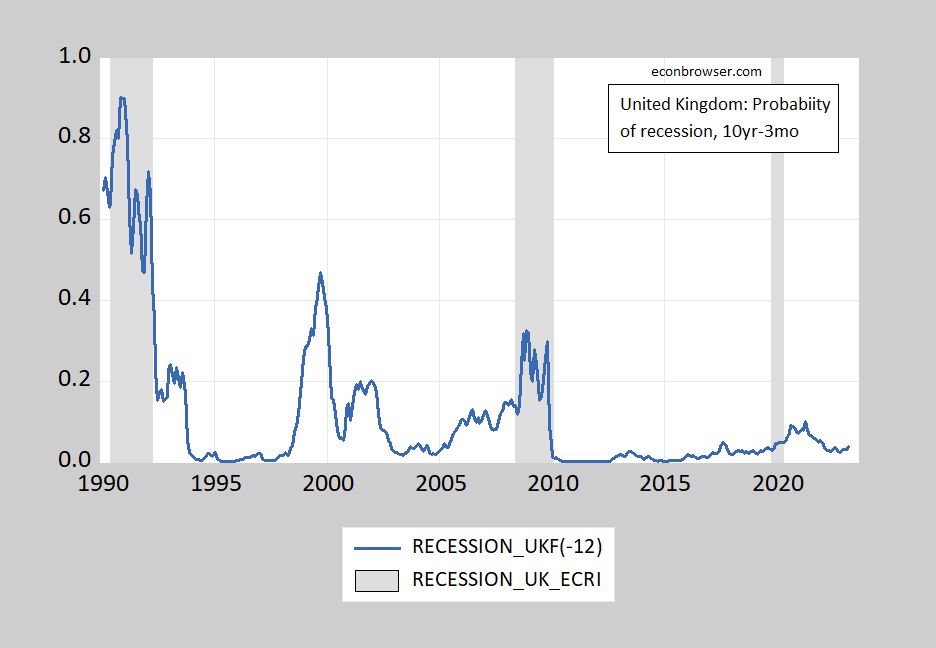

I didn’t have ready access to 2 year government bond yields for the other three countries (snapshot for several G-20 countries as of March, see here), so here are the estimates based on 10 year-3 month spreads. Keep in mind, Chinn and Kucko (2015) find the spread works well for US and Germany in the 1990’s and 2000’s, less well for the other countries examined.

Figure 3: Estimated probability of recession for indicated months based on 10 year-3 month spread lagged 12 months for Germany (blue). 3 month yield is interbank rate. Recession probability from probit model. ECRI defined recession dates shaded gray. Source: OECD via FRED, ECRI, and author’s calculations.

Figure 4: Estimated probability of recession for indicated months based on 10 year-3 month spread lagged 12 months for United Kingdom (blue). 3 month yield is interbank rate. Recession probability from probit model. ECRI defined recession dates shaded gray. Source: OECD via FRED, ECRI, and author’s calculations.

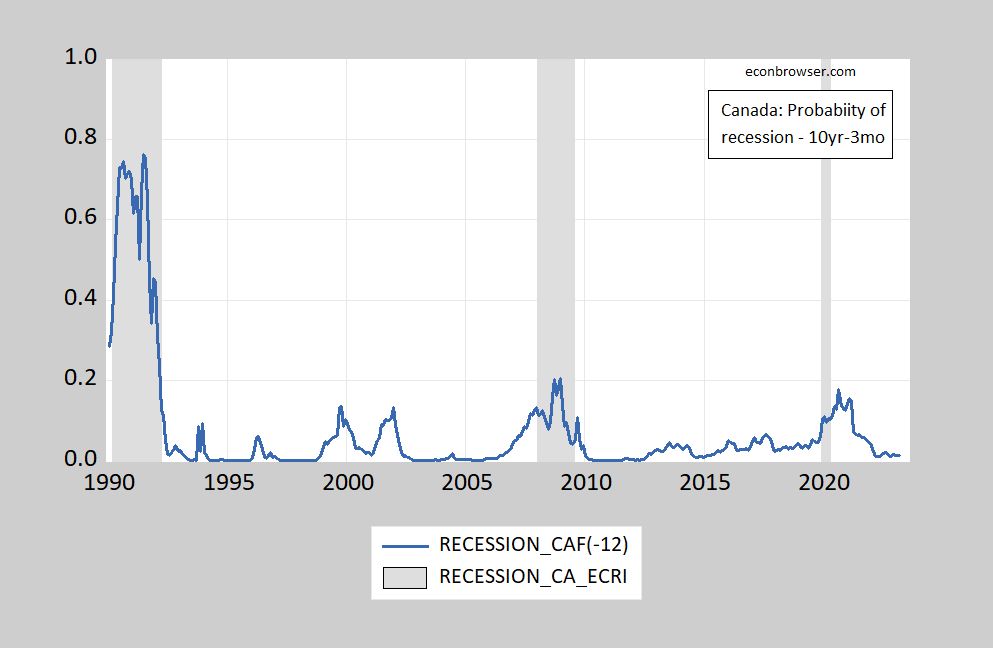

Figure 5: Estimated probability of recession for indicated months based on 10 year-3 month spread lagged 12 months for Canada (blue). 3 month yield is interbank rate. Recession probability from probit model. ECRI defined recession dates shaded gray. Source: OECD via FRED, ECRI, and author’s calculations.

How well do the models fit? One can see that depending on the threshold used, the German model misses one recent recession (i.e., false negative), and UK model would have given one false positive. And the Canadian model would have signalled the last two recessions with only a very low threshold. The McFadden pseudo-R-squareds are 0.21, 0.33, and 0.37 for Germany, UK, and Canada respectively. The corresponding figure for the US is 0.26, 1960-2022M03 (0.23 for 10yr-2yr, 1976M06-2022M03).

While the current fad is to focus on the 10yr-2yr spread (for the US, see discussion here), Engstrom and Sharpe (March 2022) argue this spread has no incremental predictive power over the near term forward spread (6 month forward 3 month yield minus 3 month yield). Miller (2019) examines many combinations of spreads, and finds for the 1984-2018 period, the highest AUROC (ratio of predicted positives to true positives) at the 12 month horizon is the 10yr-Fed funds and 5yr-Fed funds, followed closely by the10yr-3mo spread.

https://news.cgtn.com/news/2022-04-11/China-s-CPI-up-1-5-in-March-198B3KcdtMk/index.html

April 11, 2022

China’s consumer-price growth accelerates to 1.5% in March

China’s consumer price index (CPI), a main gauge of inflation, rose 1.5 percent year on year in March, driven by the rising cost of global commodities as well as epidemic outbreaks, data from the National Bureau of Statistics (NBS) showed Monday.

The figure surpassed the unchanged 0.9 percent reading for the past two months, and beat Bloomberg economists’ projection of a 1.4 percent increase.

Food prices fell by 1.5 percent year on year in March, compared with a drop of 3.9 percent in February, contributing to a 0.28 percentage-point decline in the CPI, NBS data showed.

The price of pork dropped by 41.4 percent on an annual basis, further down from a 42.5 percent drop in February. The price of vegetables rose 17.2 percent, compared with a drop of 0.1 percent in February.

https://news.cgtn.com/news/2022-04-11/China-s-CPI-up-1-5-in-March-198B3KcdtMk/img/b48419fa4f814f21b647ceaf8e5411ce/b48419fa4f814f21b647ceaf8e5411ce.jpeg

Non-food prices increased by 2.2 percent year on year last month, contributing to a 1.77 percentage-point increase in the CPI.

Gasoline, diesel and liquefied petroleum gas prices rose 24.6 percent, 26.9 percent and 27.1 percent, respectively, year on year. Air ticket prices fell 0.2 percent in March from an 18.0 percent increase in the previous month.

Dong Lijuan, a senior NBS statistician, said among the 1.5 percent year-on-year increase in March, the impact of last year’s price changes was about 0.4 percentage points, and the impact of new price increases was about 1.1 percentage points.

https://news.cgtn.com/news/2022-04-11/China-s-CPI-up-1-5-in-March-198B3KcdtMk/img/d29f6f7480a74524916cde20ff5ba88d/d29f6f7480a74524916cde20ff5ba88d.jpeg …

https://www.msn.com/en-us/news/politics/should-the-wealthy-pay-taxes-on-expensive-art-and-wine-joe-biden-thinks-so-here-s-how-it-would-work/ar-AAW5odh?ocid=msedgdhp&pc=U531&cvid=a0f04a770f78429aa2f10b3d1ebf2541

The ultra rich can “invest” in expensive art and wine and avoid paying taxes. Biden wants to close that loophole. I would argue this is good idea long overdue. Of course the ultra rich are gonna scream SOCIALISM.

Likely would fail the “stink test” in the courts.

https://www.ntu.org/foundation/detail/is-a-wealth-tax-constitutional

As such, the Sixteenth Amendment concedes that income taxes are direct taxes, consistent with the Pollock decision, instead removing the barrier of apportionment. The new tax was broadly upheld against uniformity, apportionment, and Fifth Amendment challenges in Brushaber v. Union Pacific Co. (1916), although four years later the Court struck down an attempt to tax unrealized capital gains as beyond the power to tax income, in Eisner v. Macomber (1920) (“Enrichment through increase in value of capital investment is not income in any proper meaning of the term.”).[22] In 1955, the Court summarized that taxable “gross income” encompasses “undeniable accessions to wealth, clearly realized, and over which the taxpayers have complete dominion.”

I’m a bit unclear how a billionaire purchases these assets without having paid taxes on the money used in the purchase (barter?). I’m sure some ingenious tax advisor could figure out a way, but it would certainly not be the way ordinary people would purchase some land or art or jewelry. Usually it is an exchange of one asset (money) for another for which taxes have been paid.

Another issue might be that those making less income than the arbitrary cutoff line would not be taxed on “unrealized” income. It’s basically a scheme to extract value from an asset before the funds from the asset are available. How would that work? What if the asset goes down in value? Does the government own the payer a refund? How is that calculated and who establishes the “official” value of a piece of art or jewelry? Some expert who thinks something has a certain value and then the real market value is revealed with the asset is actually sold?

This sounds like an “I’m doing something” ploy to eke out a little revenue with a lot of bureaucracy to obfuscate the profligate spending of the current administration.

Oh, and wait until the government then decides that it has to apply such taxation to everyone in the name of “equity”.

The stink test? Is that what your bathroom smells like? Now I get you want to play Constitutional lawyer since you flunked out at everything else but be careful old clueless wonder. If you are saying what turns out to be another form of sales taxes – then you are undermining the core means of taxing the poor instead of the rich.

Now if you can find something in the Constitution that says excise taxes can never be progressive even as we have all sorts of regressive excise taxes, then youi have a point. Oh wait – my precise language is WAY OVER YOUR HEAD. Never mind.

Okay, so you’re good with personally paying a tax on the unrealized income from the value of your home or other physical assets such as land? How noble of you. You can be first in line.

Oh gee I started to read your link but the title was … wait for it … Is a Wealth Tax Constitutional?

The proposal was to tax the purchases of certain (an excise tax) so WTF does the issue of a wealth tax have to do with this idea. Come on Bruce – I never imagined anyone could be THAT stupid but you proved me wrong.

“The early Supreme Court in Hylton v. United States (1796) upheld Congress’s view that a tax on the carriages for the conveyance of persons (an early excise tax on consumption transactions) was an indirect tax. There is the sense that direct taxes are those that Congress could extract from the person paying it, while indirect taxes were taxes where an intermediary was required and the tax shiftable to others.”

Your link dumbass. Even this 1796 decision knew the difference between excise taxes v. income or wealth taxes. But not Bruce Hall. Hey Bruce – you should never practice tax law as your do not understand even the basics.

Kumquat,

You can call it a “wealth tax” or and “unrealized income tax”, but it all boils down to confiscating assets based on an arbitrary class of individuals. How about we just set the line at $50,000 and apply the same rules? Oh, that’s so unfair! (whine)

Just another class warfare scheme from the uber envious. Let’s hear it for the higher income group to pay more taxes so that they pay their “fair share”. Why can’t they be like those lower income groups who pay more than their “fair share”?

https://www.yardeni.com/pub/ecoindirstax.pdf

The philosophy behind this is that all work is equal in value, hence all rewards should be the same. If some people reap more rewards than others, then those people are parasites and their rewards should be taken from them.

Sound familiar?

“I’m a bit unclear how a billionaire purchases these assets without having paid taxes on the money used in the purchase (barter?).”

First, congratulations on the misdirection. Not that this misdirection is clever, because it certainly isn’t. It’s a rich-person approved misdirection, so you can get a pat on the head from your local tax-avoiding rich person. You have snuck in the old “double taxation” whinge that anti-tax whingers love to whinge, but there is nothing in principle wrong with double taxation. Or triple taxation. Anti-tax tyoes have repeated the old double-taxation whinge over and over in order to make us think it’s a legitimate objection to a tax, so congratulations for doing their bidding.

Second, let me clear up that question of where the money comes from. It’s borrowed. Rich people borrow against unrealized capital gains in order to avoid realizing those gains and paying taxes on them. The cool part is, the interest payments are tax deductible, so other tax payers pay to help rich people avoid taxes.

I realize you couldn’t have know that because…everyone knows it. Rich people live on borrowed money to avoid taxes. This is the point where I ask whether you are ignorant, dishonest or both. We just keep comin back to this question. The tax dodge of borrowing against capital gains is so widely known that that I can’t believe you tried to sneak it past us. But ya did, so props for trying.

Oh, bonus explanation for ya, since you’ll probably get around to defending another tax dodge for the rich. Rich art owners often donate art to museums and charities. In doing so, they get credit for charitable donations on their taxes. Buy a work of art for $1. (Borrow the dollar.). Have it appraised for $10. Donate it to a charity. Get a $10 tax deduction for the low, low price of $1 plus the cost of the appraisal. And I’m pretty sure the cost of the appraisal is tax deductible. The borrowed dollar has not been taxed. Borrowing the dollar means using one tax dodge to pay for another.

Anything else you’d like me to explain for you? ‘Cause I will, even if you don’t want me to.

Tax law is complex but it does have to be. Except for the fact that the rich want to put so many involved loopholes that it is near impossible for the IRS to keep up with those clever tax attorneys who serve the rich. But pity poor Bruce Hall as no one is going to hire someone who is so utterly clueless.

Second, let me clear up that question of where the money comes from. It’s borrowed. Rich people borrow against unrealized capital gains in order to avoid realizing those gains and paying taxes on them. The cool part is, the interest payments are tax deductible, so other tax payers pay to help rich people avoid taxes.

I suppose this would work if you never had to pay back the principle with after-tax dollars.

Putin aid Oleg Morozov thinks he is some big shot that can threaten war against NATO:

https://www.msn.com/en-us/news/world/russian-legislator-calls-ukraine-total-war-demands-attack-on-nato-convoys/ar-AAW6oft?ocid=msedgdhp&pc=U531&cvid=be59f51fc1694c9095e4de98fc4b1e

If Russian soldiers decide to attack NTAO forces, it does not strike me that this is going to turn out well for Putin.

pgl,

This guy claims NATO wants long war in Ukraine. No, I think we want a short war that ends in a clear Ukrainian victory, although that may be hard to achieve.

But I note that the people at Daily Kos seem to have been calling things pretty accurately. Latest report out of them has Ukrainians destroying a 12.8 km long column that was heading south to Izyum, their main takeoff point to try to fully conquer the rest of the Donbas provinces. This kind of looks like what happened to that 40 mile long column northeast of Kyiv that never did get going again. If this is true and holds, this could be the end of the Russian effort to take the rest of Donbas, and looks like the door is open for the Ukrainians to really push them back But still probably too early to tell.

But this guy may be in lala land, with the near term issue not being Russian forces even remotely attacking NATO ones (unless they do something totally wreckless like using tactical nukes to do so), but trying to hold their positions in Donbas and Kherson and so on from being beaten as badly as their forces that tried to take Kyiv were.

This report of the Ukrainians having destroyed a 12.8 km column does not seem to be supported by subsequent reports, although it is raining hard now in the Donbas, so the Russian convoys will be stuck on the roads, making them more vulnerable.

Have you checked Bellingcat about this 12.8 column going to Izyum?? Frankly Bellingcat strikes me as more reliable than Daily Kos.

It’s been my experience in the past that Euromaidan is a relatively reliable source for information.

Some interesting video from Luhansk. The Ukrainian soldiers do not look afraid.

https://www.rferl.org/a/ukraine-luhansk-shelling-russia-popasna-artillery/31825350.html

Here’s a fun map to play with I just noticed now:

https://maphub.net/Cen4infoRes/russian-ukraine-monitor

Notice they categorize events/topics in the upper right with a pulldown menu. Such as “Russian Military losses” and they are dated.

Here is a database detailing “disinformation” (I’m assuming mostly from the Russian side, but I hope they debunk it even if it’s from the goodguys.) If you skim down you can click a link that will take you to a spreadsheet where they list out the disinformation from the war:

https://www.bellingcat.com/news/2022/02/23/documenting-and-debunking-dubious-footage-from-ukraines-frontlines/

An even bigger threat is the out-of-control Covid situation in China. Shanghai and over a dozen cities are in partial or full lock-down. Much worse than the lockdowns at the beginning of the pandemic. That will hit the economy and create China-related supply chain issues worse than ever before.

https://www.nytimes.com/live/2022/04/11/world/covid-19-mandates-cases-vaccine#shanghai-lockdown-zero-covid

Yet with all this heavy handed approach to control spread, there is an explosion of cases in China

https://www.nytimes.com/interactive/2021/world/china-covid-cases.html

In a couple of days China will have more daily new cases than US.

Ivan,

Apparently Shanghai partially reopening.

Ever wonder why the Putin bots here are supporting Putin’s war crimes? Could it be that they are MAGA hat wearing Trumpians who are just hoping Putin does in 2024 what he did in 2016 – put Trump in the White House? Well … Putin is making it official!

https://www.msn.com/en-us/news/world/russia-airs-its-ultimate-revenge-plan-for-america/ar-AAW5HB1?ocid=msedgntp&cvid=380def21d85b4429b50a614e32884948

Here is a bit of research at the NY Fed which suggests a reason to expect a Fed-induced recession:

https://libertystreeteconomics.newyorkfed.org/2022/03/disinflation-policies-with-a-flat-phillips-curve/

From the conclusion:

“…in the New York Fed DSGE model, monetary policy faces an unfavorable trade-off when attempting to stabilize inflation in response to cost-push shocks, due to an extremely flat Phillips curve. Lowering inflation requires a deep and protracted contraction, regardless of the policy strategy underlying the pursuit of this objective. One silver lining in this pessimistic conclusion is that, if the model is right and cost-push shocks are the main reason behind inflation, their effect should dissipate over time, at least according to historical patterns. If the model is wrong and inflation is driven instead by demand shocks, monetary policy is well-positioned to reduce their inflationary effects.”

In a nutshell:

– A flat Phillips curve means (by definition) that inflation is not very responsive to interest rates, so a substantial rise in rates is required to bring down inflation.

– Inflation driven by a cost-push supply shock is less response to interest rates than demand-driven inflation, so a substantial rise in rates blah, blah…

These are points that have previously been discussed here. Because the historical predictive power of the yield curve doesn’t distinguish between supply shocks and demand shocks (unless asked too, which is not the case in research that I am aware of), the curve may currently show a lower risk of recession than the actual risk.

The paper observes the inflationary effects of supply shocks are more likely to diminish with time than the effects of demand shocks. Since we seem to have a healthy dose of both, what’s a central bank to do?

In Greenspan’s day, Fed research suggested beating down inflation cost 3 times the output loss of preventing inflation. If that view is still accepted, there will be a bias toward preventing further inflation.

I think I”m talking myself into higher recession risk than implied by any yield curve model.

macroduck,

I think there is reason to believe that the Phillips curve has gone negatively sloped again. One piece of evidence I have already noted here is comparison of US and Eurozone in last two years. Started out with about same inflation rate and not too different on fiscal deficit and unemployment rate. But now US has 2% higher inflatino rate with 3 percent lower unemployment rate and about twice the percent of GDP as a budget deficit.

“– A flat Phillips curve means (by definition) that inflation is not very responsive to interest rates, so a substantial rise in rates is required to bring down inflation.

– Inflation driven by a cost-push supply shock is less response to interest rates than demand-driven inflation, so a substantial rise in rates blah, blah…”

(and agreeing with Barkley) It’s *hard* to believe that:

a) the Phillips curve is still dead, and that

b) this is all or mostly cost-push.

And with medium-term inflation expectations still looking not that bad, a soft(ish) landing looks possible.

https://www.msn.com/en-us/money/markets/ukraine-economy-to-fall-45-in-2022-russia-11-world-bank-says/ar-AAW4nOf?ocid=msedgdhp&pc=U531&cvid=45b1864434a64ceeb7a470892a7fbf18

World Bank forecasts Russian economy to shrink 11% in 2022 while Ukraine’s economy will shrink by 45%. Ukraine will need a Marshall Plan when Putin ceases his war crimes.

Why not look at external finance premium, which because of repo is pretty independent of blah blah blah spreads like our Mentos presents here?

Why doesn’t the Fed just say out loud that prices are arbitrary so they will index everyone’s income and savings?