That’s the title of a Bloomberg article yesterday. Every few years, there’s talk about concerted action to weaken the dollar, as in 2015. There’s good reason to wish for a weaker dollar at various times — a strong dollar and high interest rates strain emerging market external balances. But would such action matter? Here’s a look at the dollar and some covariates.

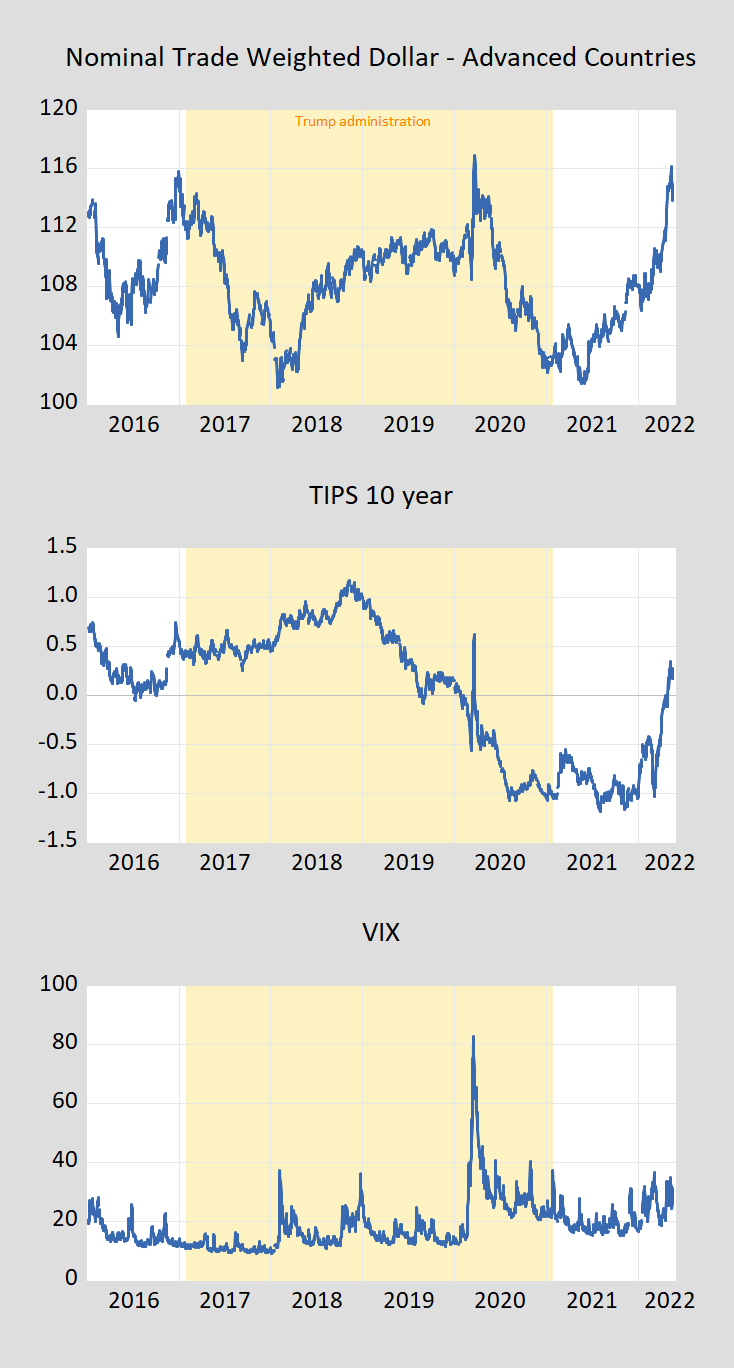

Figure 1, top panel: Nominal trade weighted dollar (vs. advanced economies); middle panel, TIPS 10 year yield, %; bottom panel, VIX. Light orange shading denotes Trump administration. Source: Federal Reserve, Treasury, CBOE via FRED.

Note that the current surge in dollar value is not tightly tied to the risk appetite, as measured by the VIX, but more so to the real interest rate, suggesting safe-haven factors are not the major driver of dollar strength. Figure 2 presents a detail of the graph.

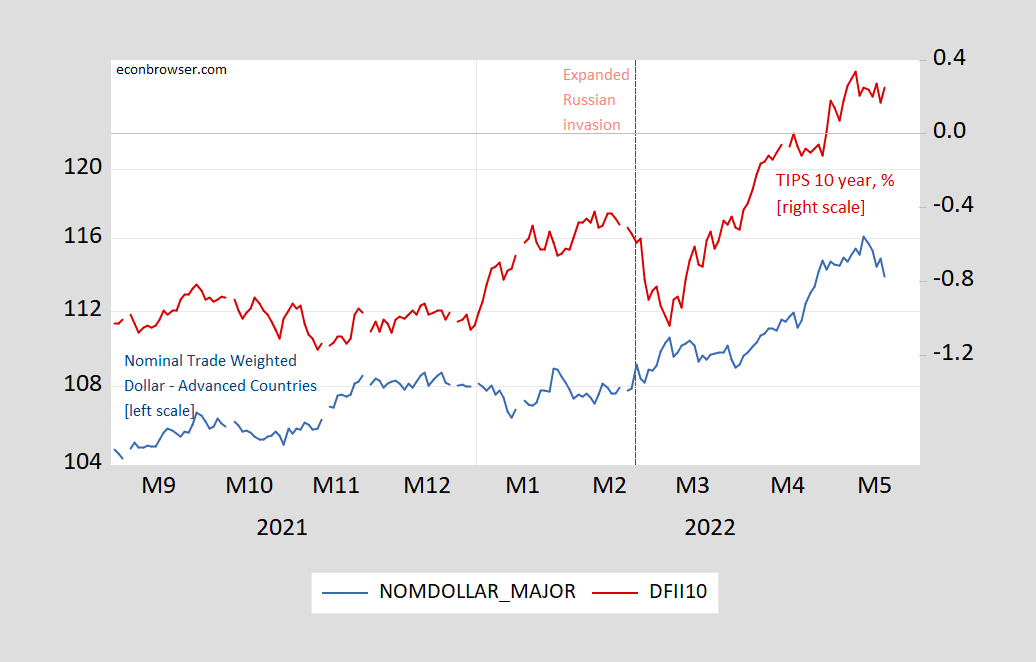

Figure 2, Nominal trade weighted dollar (blue, left log scale), TIPS 10 year yield, % (red, right scale). Last four days of exchange rate extrapolated using DXY. Source: Federal Reserve, Treasury via FRED, tradingeconomics.com, and author’s calculations.

There’s a long running debate as to whether sterilized foreign exchange intervention — that is central bank buying and selling foreign foreign currency while holding the money base constant — can influence the exchange rate. In earlier times (say pre-1990), the conventional answer was “no” (see description here). A few years ago, my view that a relatively small intervention wouldn’t make much of a difference. More recent assessments, from both theoretical and empirical perspectives, is more nuanced. A recent comprehensive survey of the literature on foreign exchange intervention is Popper (2022).

The practice of central bank intervention for a time ran ahead of either compelling theoretical explanations of its use or persuasive empirical evidence of its effectiveness. Research accelerated when the emerging economy crises of the 1990s and the early 2000s brought fresh data in the form of urgent experimentation with intervention and related policies, and the financial crisis of 2008 propelled serious treatment of financial frictions into models of intervention.

Current intervention models combine financial frictions with relevant externalities: with the aggregate demand and pecuniary externalities that now inform macroeconomic models more broadly, and with the trade-related learning externalities that are particularly relevant for developing and emerging economies. These models characteristically allow for normative evaluation of the use of intervention, though most (but not all) do so from a single economy perspective.

Empirical advances reflect the advantages of more variation in the use of intervention, better data, and novel approaches to addressing simultaneity. Intervention is now widely seen as influencing exchange rates at least to some extent; and sustained one-sided intervention and its corresponding reserve accumulation appears to play a role in moderating exchange rate fluctuations, and in reducing the likelihood and damaging consequences of financial crises.

Key avenues for future research include sorting out which frictions and externalities matter most, and where intervention—and perhaps international cooperation—properly fits (if at all) into the blend of policies that might appropriately address the externalities.

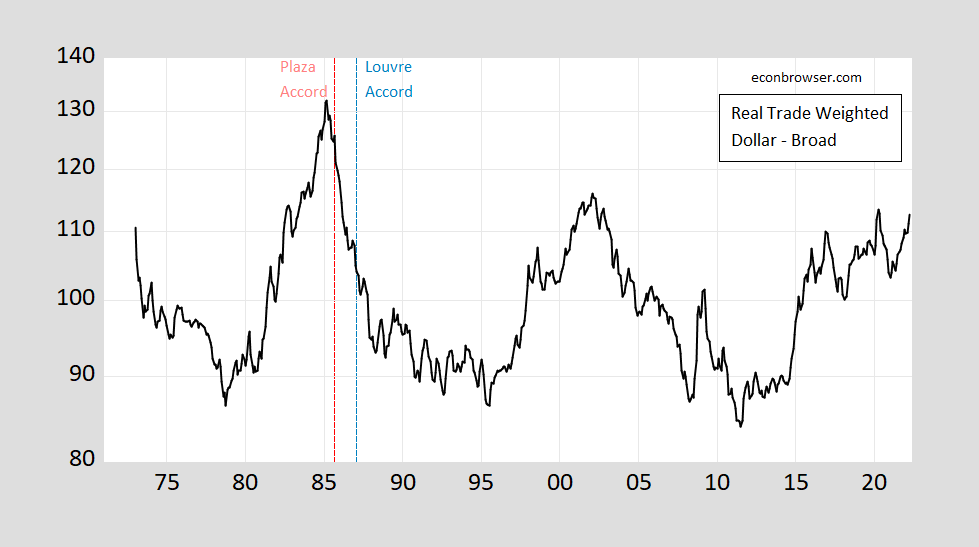

I’ve left out the question of whether the dollar is overvalued (for discussion of what that means, see this post). What is true is that based on prices, the dollar is strong — although not as strong as in 2002, and certainly nowhere as strong as in 1985. (This is perhaps why this topic doesn’t show up on the agenda of the ongoing G-7 Finance Ministers meeting.)

Figure 2: Nominal trade weighted value of the US dollar against advanced economy currencies (black, log scale). Source: Federal Reserve via FRED.

Menzie,

In looking at your link on why it was argued that sterilized intervention could have no effect, the argument seemed to be about whether different kinds of bonds are perfect substitutes or not. Is not another assumption in that argument that rational expectations holds as well?

I just had a random thought that is probably more obvious to others. I think it’s really kinda nice Janet Yellen is having this moment as Secretary of Treasury, because she is so deserving, and then after she was egregiously mistreated by the orange creature. She scored lots of points with me on what WaPo called her “mic drop” and she can do nearly no wrong with me after that one:

https://www.washingtonpost.com/news/powerpost/paloma/the-finance-202/2018/02/05/the-finance-202-yellen-s-mic-drop-lands-on-wells-fargo/5a77b59630fb041c3c7d762b/

Yellen has been much less of a camera hound than Rubin or Summers or any number of other Treasury Secretaries but has been the key cabinet official for financial sanctions on Russia, including the really impressive coordination with allies.

Truly a great public servant over a long career.

Two really solid tweets by Tracy Alloway:

https://twitter.com/tracyalloway/status/1527354715465404427?cxt=HHwWlsCq1a_BoLIqAAAA

https://twitter.com/tracyalloway/status/1527354259766857781?cxt=HHwW6sCqueymoLIqAAAA

I’ve said it before and I’ll say it again, bond markets will often tell you more of what is going on right now than equities. You know how when people say “It’s not about the money” (Amber Heard, NFL athlete signing a contract, White House official leaving their position for the private sector, celebrity who says they’re writing thier biography for “cathartic reasons” etc) Then you know for certain it’s about the money. When you start to hear banker/broker/dealers saying “There’s no need to worry about bond defaults right now” “There’s no need to worry about the interest coverage ratio in the non-financial corporate sector in a rising rate environment.” Do you know what that means?? They’re telling you to pull their index finger right before they fart in a small room.

The Bloomberg piece is one of those “write this headline before someone else does” stories. The article notes, a few paragraphs in, that nobody really expects intervention to weaken the dollar any time soon. This is a grab for eyeballs, not serious journalism.

Dollar strength is one of the ways that tighter Fed policy works to reduce inflation. Tightening policy and then watering down the effect of tighter policy through fx intervention would be counter-productive.

Treasury works for Biden. Biden’s biggest political weakness is inflation. Treasury is not about to instruct the Fed to intervene, nor is Treasury going to ask allies for coordinated intervention. It’s silly as policy and silly as politics.

Nailed it. Though I’m still glad Menzie made this long post because there is a lot to learn here. A lot to learn here for me anyway. And there’s treasure in the links also.

Absolutely. Menzie’s writing is useful as all get out. And in the past few days, he has really been eating his Wheaties. Bloomberg is the problem.

Bloomberg market writers tend to take market people at their word. No additional authority is needed if a trader, portfolio manager or market analyst makes a claim. Editors put production and eyeballs ahead of quality. It’s not that Bloomberg is bad. Bloomberg is so big that it can be both good and bad twenty times in the same day.

Outfits like Bloomberg are driven by their marketing types who know they have to kiss the rear ends of market people because they need to sell their information tools somehow. That these outfits have reporters create the kind of conflict of interest you alluded to.

I had the same problem with the title but an even bigger problem with the 2nd sentence which I note got our macroeconomic history quite wrong. Of course Princeton Steve thinks we are doomed for a recession merely because a strong economy had reduced the government deficit but increased the trade deficit. I guess there are a lot of economic know nothings writing some of the dumbest stuff ever.

interesting:

one should consider the conditions that made (don’t know if strong applies on 23 may 2022) the strong economy, and whether h=those conditions have any legs.

as well as how and which components of the deficit ‘declined’ against what baseline for the deficit and what point in the past.

you are so far civil!

https://fred.stlouisfed.org/graph/?g=lv0w

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 2007-2022

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=yCkY

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=PDFh

January 15, 2018

Real Broad Effective Exchange Rate for China, Indonesia, Brazil, France and United Kingdom, 2007-2022

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=PDFo

January 15, 2018

Real Broad Effective Exchange Rate for China, Indonesia, Brazil, France and United Kingdom, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=sxvX

January 15, 2020

Advanced and Emerging Country Trade Weighted Price of an American Dollar, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=sxvP

January 15, 2020

Real Advanced and Emerging Country Trade Weighted Price of an American Dollar, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=PE0e

January 15, 2018

Real Narrow Effective Exchange Rate for United States, 1971-2022

(Indexed to 1971)

https://fred.stlouisfed.org/graph/?g=PE07

January 15, 2018

Real Narrow Effective Exchange Rate for United States, Japan, United Kingdom and Germany, 1971-2022

(Indexed to 1971)

One currency the Dollar has considerably weakened against is the Ruble. Primarily due to European countries purchasing oil in Rubles.

https://tradingeconomics.com/russia/currency

Germany will regret this as Putin moves farther west into Europe. The lack of movement in stopping the German purchases of Russian natural gas is an open invitation to Putin “Come in and get us, we are here to be mauled and raped”.

” The ruble rallied to 58 per USD in late May, the strongest level in four years, as more companies are complying with Russia’s demand to pay for gas with rubles, the Russian government continues to prop up the currency through capital controls and the imports remain subdued. This week, the European Commission has confirmed how European Union companies can pay for Russian gas in the currency agreed in their existing contracts without breaching the bloc’s sanctions. Meanwhile, Italian energy group Eni is set to open a rouble account with Gazprombank. Also, although the CBR allowed buying freely foreign currency, the USD and EUR are exempted, and while the bank increased the limit of individual money transfers abroad to USD 50K per month from USD 10K it still prohibits transactions to entities from so-called unfriendly countries.”

European countries (and their finance/economics ministers) may have just brought a new term into the lingo (new to me anyway)~~”suicidal genocide”

Far from being rubble, “ Ruble Surpasses Brazil’s Real as Year’s Best-Performing Currency.”

Of course, capital controls played some role, but so did sanctions and so did Russia’s decision to accept payment only in rubles.

Biden wanted to wage economic warfare, and his main victim seems to be not Russia but Europe! Talk about incompetent leadership! Of course, LNG bandits and merchants of death are delighted, simply overjoyed.

I suppose you can tell us what you would have done. The Long Beach port has had its operations expanded to improve the supply chain problem. Instead of sanctions you’d prefer Biden have sent 2-3 Fabergé eggs to Putin’s palace?? Did you expect Biden to be clairvoyant??~~and predict that Abbot Nutrition was led by immoral scumbags. And now “this is the federal government’s fault” because they were supposed to nanny a private company that didn’t take the production of baby food seriously?? Apparently “the invisible hand” of free markets enjoys killing/starving babies while taking stock buybacks.

But wait and see sociopath Republicans like Ted Cruz run to Abbott Nutrition’s defense when Democrats attempt to hold them accountable:

https://www.cnbc.com/2022/05/18/senate-panel-investigates-abbott-tax-practices-after-contamination-shuts-down-baby-formula-plant.html

Wyden said Abbott appears to have benefited from using overseas tax havens. Abbott, in its annual report for 2021, said it benefited from lower tax rates and exemptions on foreign income from its operations in Puerto Rico, Switzerland, Ireland, the Netherlands, Costa Rica, Singapore and Malta.

Well Abbott can certainly diversify its use of tax havens but this domestic sector does no exactly diversify the production of baby formula.

I would have insisted that any US aid to Ukraine be contingent on their strict adherence to the Minsk Agreements. This whole fiasco should have been addressed diplomatically.

@ JohnH

When you first came on this blog you disguised yourself as a largely ignorant but well-intentioned do-gooder, and I, a person you generally considers themselves very perceptive about people, bit down on that fish hook and swallowed it whole. You have now shown yourself as 100% disingenuous. And knocking myself down a half-peg in the perceptive dept. Nobody could state the things you state and not have a darker purpose. Working for Russia?? Working for China?? You have to have some incentive to say the things you do, as they are not conclusions come to naturally or organically. You, are pure evil Sir.

The above comment should read “A person who generally considers themselves” [ insert self-disappointed sigh here ] Been a “rare morning” offline for a Saturday folks. Remember kids, no good deeds go unpunished and avoid narcissist relatives at all costs.

“JohnH

May 21, 2022 at 7:21 am

I would have insisted that any US aid to Ukraine be contingent on their strict adherence to the Minsk Agreements. This whole fiasco should have been addressed diplomatically.”

First of all – this is sort of off topic. And it ignores the fact that Russia never adhered to the Minsk Agreements. And Putin version of a diplomatic solution would be for Ukraine to become part of Putin’s empire. Sorry but Putin started this war and JohnH is his favorite spokesperson.

The real warfare is between Russian’s war criminals and the Ukrainian freedom fighters and YOUR side is not exactly doing all that well.

Your link correctly notes:

the Russian government continues to prop up the currency through capital controls and the imports remain subdued.

Capital controls which often means the exchange rate on the black market differs from the official rate which is reported here. I think Barkley has been trying to grasp where the black market rate is.

May 16th article from Bloomberg (Rachel Evans??):

“He eventually opted for the middleman and paid 15% more than the official rate to buy $2,000 for his his ex-wife and children. They needed cash on hand for a holiday in Turkey since sanctions stopped Russian-issued credit cards from working abroad. On Monday, banks were selling dollars on average for 20% more than the ruble price quoted on the Moscow Exchange, according to a survey of about 70 Moscow banks and exchange points by the RBC and Banki.ru financial websites. Black-market rates shown in currency exchange channels on messenger apps ranged from 73 rubles to 76 rubles in Moscow on Tuesday, while the ruble was little changed at 63.35 per dollar as of 2:22 p.m. in Moscow.”

Obviously the numbers have dramatically changed in just those 4 days, but “the commission” has ranged between 15%–30%. So Maybe Barkley can take the “official” ruble to US dollar quote currently, as it changes, obviously moment to moment and add in that 15%–30% rate. I’m no currency expert but I assume that would get him “in the ballpark”. I think I would go with about a 25% mark-up to “guesstimate” from the official number if I was crunching the numbers. AGAIN, as of today May 20, there is short-term upward pressure on the ruble, because of Europe’s masochistic policies on Russian gas purchases.

Moses,

Yes, this is about the markup I hear is operative.

I doubt if Barkley is a big “Telegram app” guy. But he might ask some of his better students or younger colleagues who use it. My understanding is there are some black market ruble price exchange quotes/queries made there, on “Telegram”, and that might give him a more “as it’s happening” picture of Black market ruble exchange rates.

Has Kevin Drum been reading the pro-Putin nonsense from JohnH?

https://jabberwocking.com/oppose-bad-wars-not-all-wars/#comments

Yes the 2003 invasion of Iraq was bad. Yes Putin is a war criminal for his invasion of Ukraine. But no – NATO is not wrong to help the brave Ukrainians out.

Open Letter to Noam Chomsky (and other like-minded intellectuals) on the Russia-Ukraine war

Yuriy Gorodnichenko, professor of economics | May 19, 2022

coauthored with Bohdan Kukharskyy (City University of New York), Anastassia Fedyk (UC Berkeley) and Ilona Sologoub (VoxUkraine)

https://blogs.berkeley.edu/2022/05/19/open-letter-to-noam-chomsky-and-other-like-minded-intellectuals-on-the-russia-ukraine-war/

Pattern #2 through #4 seems to be directed at Putin poodle JohnH!

Pattern #2: Treating Ukraine as an American pawn on a geo-political chessboard

Whether willingly or unwillingly, your interviews insinuate that Ukrainians are fighting with Russians because the U.S. instigated them to do so, that Euromaidan happened because the U.S. tried to detach Ukraine from the Russian sphere of influence, etc. Such an attitude denies the agency of Ukraine and is a slap in the face to millions of Ukrainians who are risking their lives for the desire to live in a free country. Simply put, have you considered the possibility that Ukrainians would like to detach from the Russian sphere of influence due to a history of genocide, cultural oppression, and constant denial of the right to self-determination?

Pattern #3. Suggesting that Russia was threatened by NATO

In your interviews, you are eager to bring up the alleged promise by [US Secretary of State] James Baker and President George H.W. Bush to Gorbachev that, if he agreed to allow a unified Germany to rejoin NATO, the U.S. would ensure that NATO would move ‘not one inch eastward.’ First, please note that the historicity of this promise is highly contested among scholars, although Russia has been active in promoting it. The premise is that NATO’s eastward expansion left Putin with no other choice but to attack. But the reality is different. Eastern European states joined, and Ukraine and Georgia aspired to join NATO, in order to defend themselves from Russian imperialism. They were right in their aspirations, given that Russia did attack Georgia in 2008 and Ukraine in 2014. Moreover, current requests by Finland and Sweden to join NATO came in direct response to Russia’s invasion of Ukraine, consistent with NATO expansion being a consequence of Russian imperialism, and not vice versa.

In addition, we disagree with the notion that sovereign nations shouldn’t be making alliances based on the will of their people because of disputed verbal promises made by James Baker and George H.W. Bush to Gorbachev.

Pattern #4. Stating that the U.S. isn’t any better than Russia

While you admittedly call the Russian invasion of Ukraine a “war crime,” it appears to us that you cannot do so without naming in the same breath all of the past atrocities committed by the U.S. abroad (e.g., in Iraq or Afghanistan) and, ultimately, spending most of your time discussing the latter. As economists, we are not in a position to correct your historical metaphors and, needless to say, we condemn the unjustified killings of civilians by any power in the past. However, not bringing Putin up on war crime charges at the International Criminal Court in the Hague just because some past leader did not receive similar treatment would be the wrong conclusion to draw from any historical analogy. In contrast, we argue that prosecuting Putin for the war crimes that are being deliberately committed in Ukraine would set an international precedent for the world leaders attempting to do the same in the future.

JohnH, I sincerely suggest you read the article I shared above.

Plaza Accord, 1985.

Japan got depression.

Germany got deflation.

China got East Asia’s manufacturing capacity.

Yeah, that worked real well.

David O’Rear: I think most mainstream economists believe Plaza was mostly irrelevant to subsequent macro events – in the graph you’ll see that the dollar started declining before Plaza.

Well Volcker did reverse his tight monetary policies well ahead to 1985. Fundamentals matter.

As someone who was at the coal face of the relocation of East Asian manufacturing capacity into China, ca. 1985-2015, I can confirm that the rapid and very steep increase in the value of the yen, won, and NT$ was decisive to convincing factory owners to take the risk, and move into China.

The yen rose from a pre-Plaza low of 270 to the dollar to a pre-(US) recession high of 120 (+120%); the NT$ from more than 40 to less than 26 (+57.6%; and the won from 810 to 666 (+21.4%).

We made a ton of money advising Asian companies how to enter China, and more importantly, how not to.

David O’Rear: I am not disagreeing with the view that the rapid appreciation of the yen caused a hollowing out of Japanese industry. I *am* disagreeing with the view that the Plaza accord was the main reason for dollar depreciation (and hence yen appreciation); rather it was the sharp drop in nominal and real US yields which (in an asset based model of the dollar, namely the real interest differential model of Dornbusch and Frankel) which induced in part the developments you mentioned.

For what it is worth, GDP grew at a slightly more rapid rate in the second half of the 1980s than in the first half.

That comment by me referred to Japan’s GDP growth rate. Sorry about not making that clear. So, there may have been some sort of movement of production from Japan to China after the Plaza Accord, but it did not show up immediately in a slower rate of GDP growth.

I think Menzie is being kind in his reply. That’s not the only false correlation being made in O’Rear’s comment.

Dr Chinn is (almost) always kind in his replies; that’s why I like this place.

The interest rate movements were wholly part of the Plaza accord, were they not?

Didn’t most major economies agree to raise their interest rates, while the US lowered its own, to drive down the value of the dollar?

And, didn’t my clients respond to this change in fortunes by relocating their East Asian manufacturing plants?

David O’Rear: I can’t speak for the other countries, but Volcker was dropping rates as a function of his belief that inflationary pressures were being crushed (and don’t be fooled by his talk of money supply – it was interest rates he was really focused on). For better or for worse, empirically US rates dominate in movements in dollar based exchange rates (even if simple theories say both US and foreign rates should matter).

Dude – Volcker was lowering interest rates well before the Plaza Accord.

“Didn’t most major economies agree to raise their interest rates”

I just checked with FRED and other sources on long-term government bond rates for the period after the Plaza Accords. UK rates did not rise. German and Japanese rates fell.

Come on dude – please check with the facts as your memory is inconsistent with the macroeconomic history of the time.

FRED’s got some data, but not much.

In Japan, 90-day CDs rose from 6.43 in Sept 1985 to 7.66 and 7.76 in Nov-Dec of that year.

In Korea, the discount rate was two percentage points higher in July 1986 (at 7%) than in Oct 1985.

I have always adored Bette Midler:

https://www.msn.com/en-us/entertainment/entertainment-celebrity/bette-midler-demands-newt-gingrich-and-tucker-carlson-face-prison-time/ar-AAXuduf?ocid=msedgdhp&pc=U531&cvid=1e1e54a90e16471996e533b4065f51a2

Yes – Tucker Carlson and Newt Gingrich should be in jail!

Sentence 2 in the Bloomberg piece:

‘It has happened before — most notably with 1985’s Plaza Accord — which took place against a backdrop of soaring inflation, an aggressive Federal Reserve rate-hike campaign and surging dollar.’

Well we did have high inflation during the very first part of the 1980’s and the FED did pursue tight monetary policies to offset the early Reagan fiscal stimulus. Hence the dollar appreciated.

But starting in mid 1984 the FED had reversed course and started running easier monetary policy as inflation had come down in large part because of a massive 1982 recession. Which would suggest a reversal of the dollar appreciation even without intervention.

Whoever wrote this line clearly has never really followed US macroeconomics at the time. This line strikes me as something Princeton Steve would have come up with.

I think you’re wrong about this. Fed hikes were about unleashing Volker to attack inflation. It worked, but we paid a steep price.

The lesson is that we shouldn’t let inflation get out of hand. If the Fed were credible back then, such extreme intervention wouldn’t have been necessary.

https://english.news.cn/20220520/b236412e0c7c459388645c34f931eec1/c.html

May 20, 2022

With lending rate cut, China increases support for economic growth

BEIJING — China on Friday cut the market-based benchmark lending rate, the latest move to shore up the economy.

The over-five-year loan prime rate (LPR), on which many lenders base their mortgage rates, fell by 15 basis points to 4.45 percent, said the National Interbank Funding Center. It represents the largest reduction in this rate since the country revamped the LPR mechanism in 2019.

The one-year LPR stood at 3.7 percent, unchanged from one month earlier.

The monthly-released data is a pricing reference rate for banks and is based on rates of the central bank’s open market operations, especially the medium-term lending facility rate.

The reduction reflects China’s strengthened efforts to support the real economy, said Wen Bin, chief analyst at China Minsheng Bank.

“This is a key step to anchor market expectations, bolstering market confidence,” Wen said, noting that it will spur financing demand by axing the financing costs for enterprises and funding costs for banks.

The five-year LPR was lowered by a “more than expected” margin, said Zhang Aoping, the dean of the Incremental Research Institute.

The latest rate cut followed a move on Sunday to allow commercial banks to reduce the lower limit of interest rates on home loans by 20 basis points for first-home buyers, based on the LPR.

These measures will help the real estate market sustain stable and healthy development and stimulate overall demand, said Zhang.

China’s property industry, a vital sector for economic growth, is taking a hit as recent COVID-19 resurgences and the volatile global situation impacted the economy.

The country’s economy took a hit from the domestic resurgence of COVID-19 cases in April. Authorities have stressed the negative impact will be short-lived.

China has taken steps to revive the economy and help enterprises tide over tough times. These steps include increasing re-lending quotas, launching re-lending arrangements for technological innovation, elderly care services, clean use of coal, and encouraging local banks to issue more inclusive loans for small and micro businesses through market-based means….

I was just skim reading a paper which stated that the argument for the effectiveness of sterilized intervention becomes much stronger when Fed (or central bank) signaling is used in tandem. Which to me, then brings up the immediate question “Then was it just the market’s reaction to the signaling??” I’m only like 2 pages into the paper, so……

Tucker Carlson told his pathetically stupid audience that the murders in East Buffalo’s Top Friendly grocery store had nothing to do with racism:

https://www.msn.com/en-us/news/us/tucker-carlson-says-racism-was-not-the-motive-in-buffalo-supermarket-shooting/ar-AAXwmA0?ocid=msedgntp&cvid=67e5efd84221479391d697a7e89c9805

I guess this punk was just angry that eggs cost $4 a dozen. Yea – this level of stupidity would be Bruce Hall’s take.

“The dollar’s 6.3% surge since the start of the year has clobbered the yen to a two-decade low and put the euro almost back to 1-to-1 parity with the US currency for the first time since 2002.”

It takes less than $1.05 to buy a Euro. Maybe time for that trip to Paris!

https://www.msn.com/en-us/news/world/zelensky-accuses-russia-of-trying-to-kill-as-many-ukrainians-as-possible/ar-AAXvXXP?ocid=msedgdhp&pc=U531&cvid=3f60602a37754e6cb8f23f2b42df1409

Putin’s defense minister claimed they are not trying to kill Ukrainian civilians. Of course they lie about everything.

During his one term as Senator from Georgia – David Perdue shamelessly used insider information in his rather extensive stock trader:

https://lawandcrime.com/high-profile/fbi-investigated-georgia-republican-sen-david-perdue-over-suspicious-stock-trades/

He now wants to replace Brian Kemp as governor and of course Trump supports the most corrupt of the two candidates. Look – I am no fan of the current governor and I’m hoping a Democrat becomes the next governor. But the Georgia votes who support Perdue because he is a business man are delusional.

David Perdue is one of those guys I just try to put completely out of my mind, because all he does is drive my blood pressure up. He’s just one of those guys, similar to donald trump, similar to Roger Stone, you just know is never going to be punished for the damage he does to humanity.

I was a bit puzzled why Biden on his trip to South Korea spent time marveling on of Samsung Electronics factories making semiconductor until it was mentioned that the same company was investing $17 billion to build another factory in Texas:

https://news.samsung.com/global/samsung-electronics-announces-new-advanced-semiconductor-fab-site-in-taylor-texas

Samsung makes great products and has for quite awhile. Arguably a better mobile phone than Apple (if you get the one with all the bells and whistles) Apple is #2 in mobile phones in my opinion. But people get used to an interface and you play hell getting them to switch.

I had an iPhone 4 for a while but have been using Samsung phones for many years. Best switch I ever made.

Now if we can get self styled semiconductor “expert” Bruce Hall to realize that the South Koreans are really good at that sector too.