Drop in GDP trajectory, rise in inflation expectations, and expected long rates up.

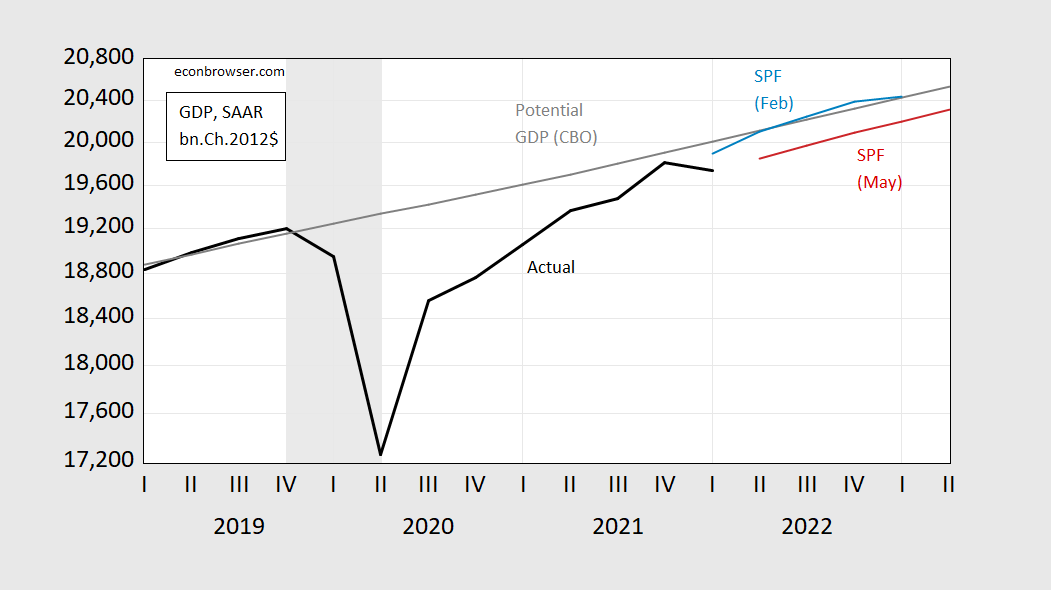

Figure 1: GDP (black), February Survey of Professional Forecasters mean GDP (blue), May (red), CBO potential GDP (gray). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, SPF (various issues), CBO (July 2021), and NBER.

Interestingly, if one believes in CBO’s July estimates of potential (new ones out on May 25), then we’re nowhere near full employment, and given the May Survey, not likely to come close soon.

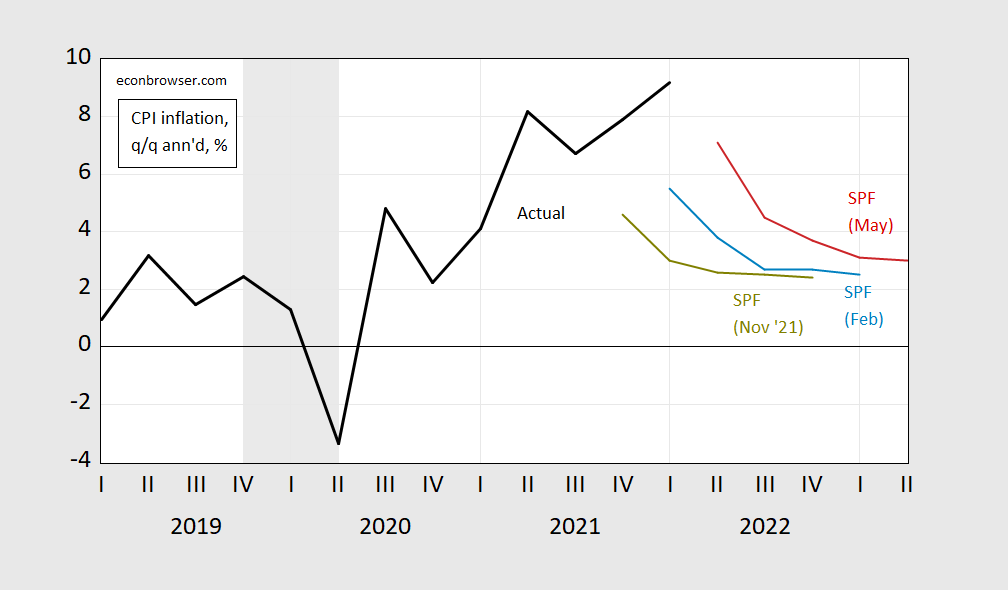

As inflation has increased, near term inflation forecasts have risen – but continue to converge to at lower levels. The May survey tags the 2023Q2 rate at 3%, up from the February survey for 2023Q1 at 2.5%

Figure 2: Quarter-on-quarter annualized CPI inflation (black), November 2021 Survey of Professional Forecasters mean inflation (chartreuse), February 2022 (blue), May (red), CBO potential GDP (gray). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, SPF (various issues), and NBER.

Higher inflation with a persistent (negative) output gap suggests that demand pull is not the only reason for accelerated inflation. Of course, the estimate of potential could be too high, in which case demand pull would be the interpretation. But if potential is as shown above, then inflation is at least in part cost-push.

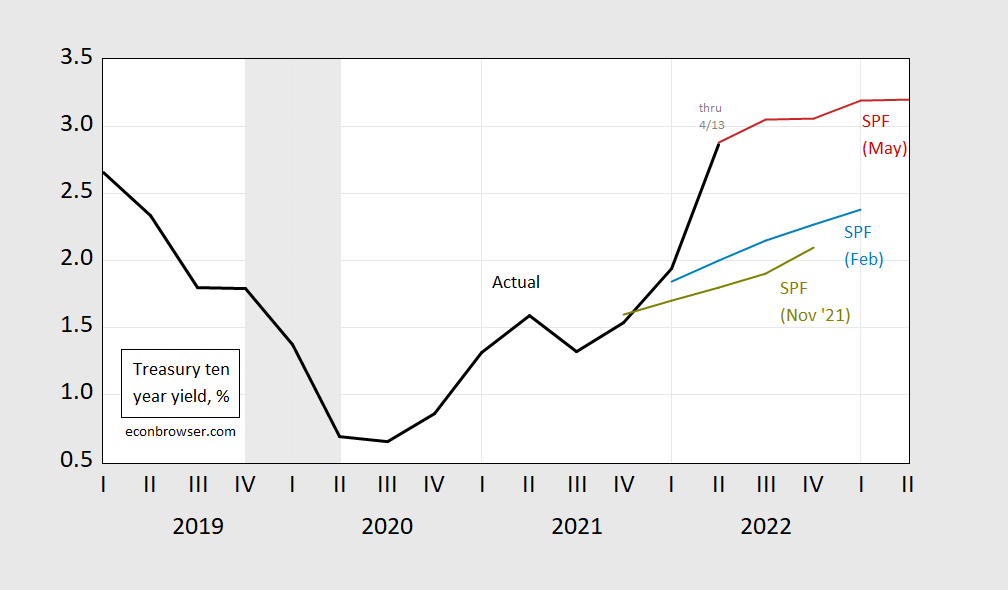

Long term (10 year) Treasury yields are now slated to be substantially higher, reflecting the jump in actual rates since the February survey.

Figure 3: Ten year Treasury yields (black), November 2021 Survey of Professional Forecasters mean inflation (chartreuse), February 2022 (blue), May (red). 2022Q2 actual yield is through 5/13. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury, SPF (various issues), and NBER.

https://www.nytimes.com/2022/05/16/business/ben-bernanke-predicts-stagflation.html

May 16, 2022

Ben Bernanke Sees ‘Stagflation’ Ahead

The former chairman of the Federal Reserve has a new book out on Tuesday explaining the powers of the Fed and Congress to juice or slow our economy amid a supply-chain crunch and sky-high demand.

By Andrew Ross Sorkin

Standing in his kitchen one morning in Washington, D.C., and drinking a glass of lightly flavored water, Ben Bernanke is wearing a gray suit, a button-down shirt, no tie and a pair of Brooks running sneakers. He looks a far cry from his time at the Federal Reserve, where he presided as chairman for eight years during what was — until recently — considered the most precarious financial moment of the past half-century.

But the coronavirus pandemic and its economic impact — the overnight pullback in employment coupled with an infusion of money not seen in history and now, seemingly, runaway inflation — have had Mr. Bernanke thinking. And writing. Mr. Bernanke has been in a self-imposed quarantine of sorts writing a book, “21st Century Monetary Policy: The Federal Reserve From the Great Inflation to Covid-19,” which will be published on Tuesday.

Mr. Bernanke describes the book as “academic,” but at this particular moment, it may be a uniquely practical book as the public tries to better understand the powers of the Federal Reserve and Congress to juice or slow our economy amid a supply-chain crunch and sky-high demand. The former chairman’s book itself is an example of the crosscurrents playing out in our economy: “Given supply-chain disruptions, this book took six months to go from final manuscript to appearing in the store,” he said.

Mr. Bernanke, who wrote the book “when it became evident that I was not going to be traveling a lot and that we were home for a while” amid the early days of the pandemic, provides a history of the Federal Reserve — his own graduate thesis was on the crash of 1929 and its aftermath, which he says provided valuable lessons for how he responded to the recession in 2008. His focus this time, however, is not on 2008 but on how the Federal Reserve has reacted to various economic scenarios over more than a century, touring readers though the reins of different Fed chairs like Alan Greenspan. Readers will very likely be particularly focused on Mr. Bernanke’s analysis of the 1970s, which may be the closest analogue to what’s happening in today’s economy.

He is hopeful that Jay Powell, the current Federal Reserve chairman, can help tame inflation without having to put in place the extreme measures that the former Fed chairman Paul Volcker did in the 1970s or send the economy into recession….

Nice share – always interesting to read about Bernanke’s take on the economy.

But Andrew Ross Sorkin’s superficiality never ceases to amaze.

‘But he also suggests it is possible the nation could be in for a period of “stagflation,” a word Mr. Bernanke says was invented in the 1970s. “Even under the benign scenario, we should have a slowing economy,” he said. “And inflation’s still too high but coming down. So there should be a period in the next year or two where growth is low, unemployment is at least up a little bit and inflation is still high,” he predicted. “So you could call that stagflation.”’

That’s *barely* stagflation.

In other words, Sorkin threw out the word ‘stagflation’ in the interview because he wanted it in the title. In contrast, Bernanke’s response is academic, not alarmist.

Yes the goal seem to be a sensationalist click-bait headline – not an informative headline. He even had to fish really deep in order to get Bernanke to utter the word “Stagflation”; so he didn’t have to go completely Faux and just make a false claim. Pathetic.

Thank you for this thought provoking post.

https://www.msn.com/en-us/news/politics/liz-cheney-says-house-gop-leaders-have-enabled-white-supremacy-antisemitism/ar-AAXkRpo?ocid=msedgdhp&pc=U531&cvid=39bb3cc6d77841b483d5605d928c4570

Liz Cheney calls out the House GOP leaders for enabling white supremacy and antisemitism. Good for her!

https://www.rawstory.com/marjorie-taylor-greene-unintelligent/

Marjorie Taylor Greene whines when people call her angry or crazy or even unintelligent. OK I will not call her any of these things. But she is stupid, racist, and a total waste of time.