Up, up and away. But that’s been true in the past too.

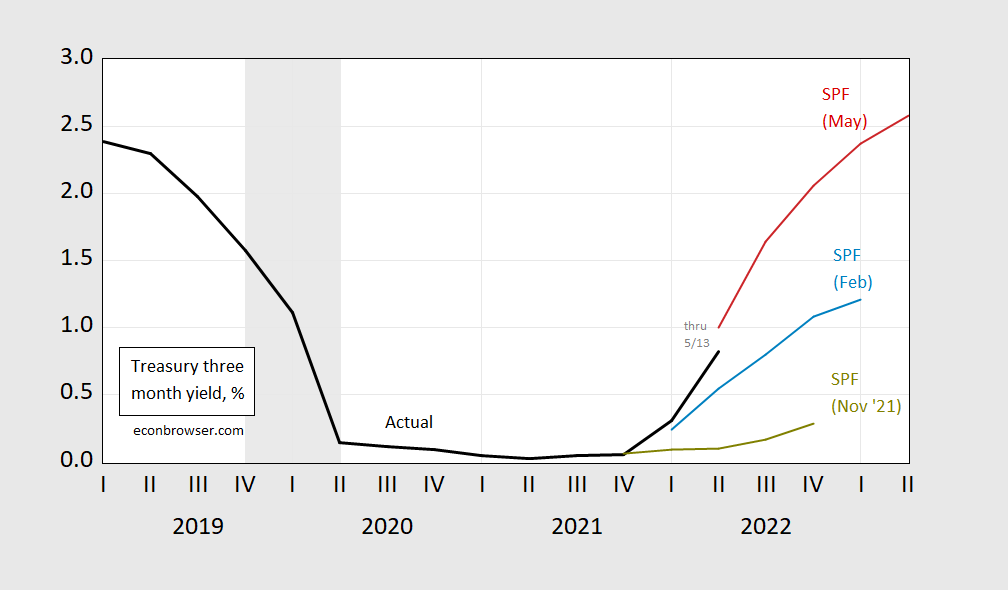

Figure 1: Treasury three month yields on secondary market (black), November 2021 Survey of Professional Forecasters media (chartreuse), February 2022 (blue), May 2022 (red). NBER defined recession dates peak-to-trough shaded gray. Source: Treasury via FRED, SPF, NBER.

Here’s the historical record for economists forecasting the 3 month yield, discussed in this post.

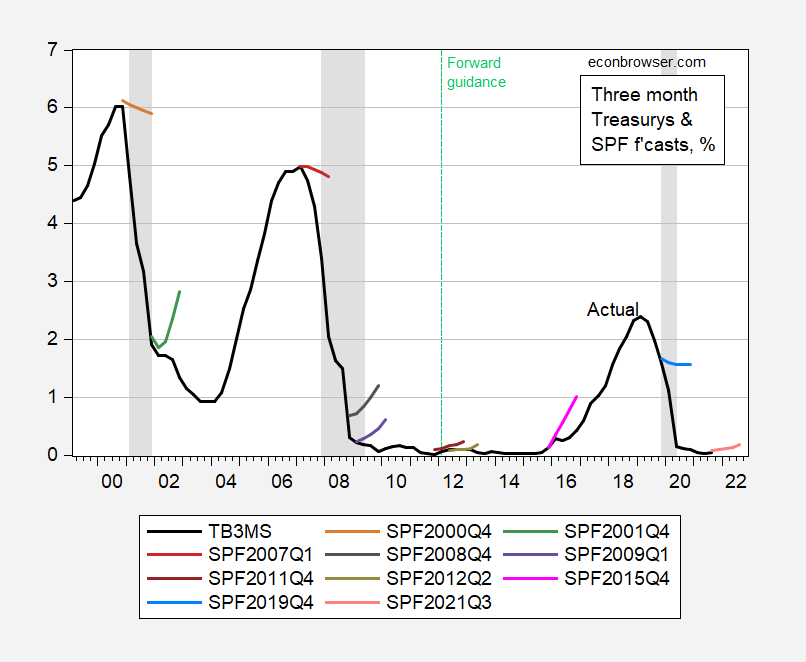

Figure 2: Three month Treasury yields on secondary market, monthly average of daily data (black), Survey of Professional Forecasters mean forecasts from indicated quarters. NBER recession dates shaded gray. Source: Federal Reserve and Philadelphia Fed Survey of Professional Forecasters, and NBER.

The difference between the current episode and the previous is that inflation is substantially higher (although the real natural rate is probably lower).

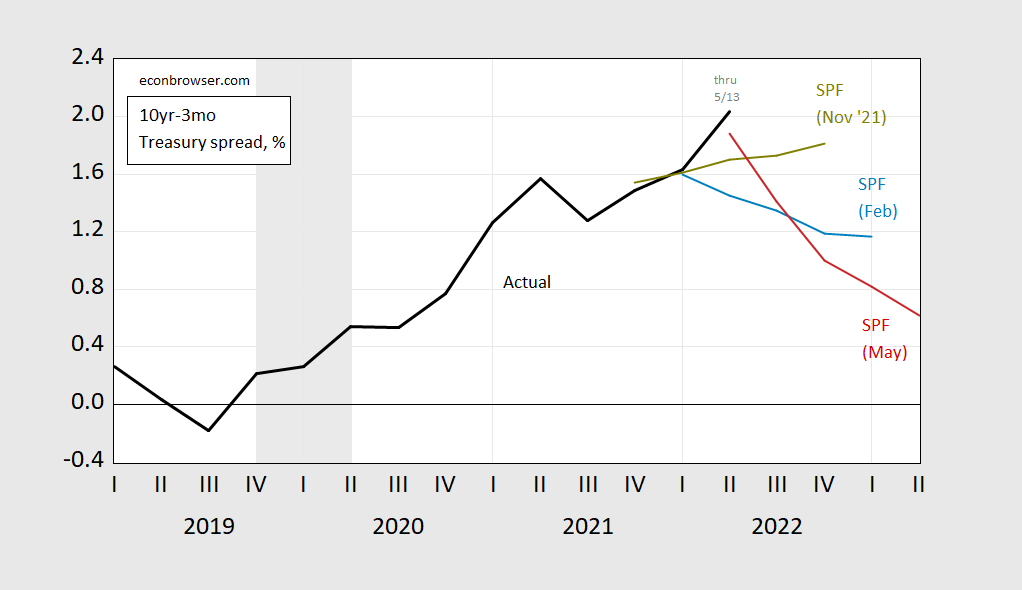

One interesting implication of these forecasts is that the 10yr-3mo spread is shrinking faster in the May survey vs. the February survey (you can see the evolving path for the 10 year in this post).

Figure 3: Treasury ten year – three month spread (black), November 2021 Survey of Professional Forecasters media (chartreuse), February 2022 (blue), May 2022 (red). NBER defined recession dates peak-to-trough shaded gray. Source: Treasury via FRED, SPF, NBER.

https://english.news.cn/20220516/2f290eb793fe44b589b6c7e30fb40ea2/c.html

May 16, 2022

China’s economy expected to recover gradually from Omicron impacts

BEIJING — China’s economy is expected to recover gradually as the country achieves major anti-epidemic outcomes and pro-growth policies take effects, Fu Linghui, spokesperson for the National Bureau of Statistics (NBS), said Monday.

The country’s economy took a hit from the domestic resurgence of COVID-19 cases in April, but the impacts are “short-lived and external,” Fu said.

“The fundamentals of the Chinese economy remain unchanged. The overall trends of economic transformation and upgrading and high-quality development remain unchanged,” he said.

“There are many favorable conditions for stabilizing the economy and achieving the expected development goals,” the spokesperson said.

With a super-large market, complete industrial and supply chains and huge domestic demand, the world’s second-largest economy has the resilience to ward off all kinds of challenges.

Fu said that despite the impacts of the epidemic, grain and energy production maintained growth during the first four months, laying a solid foundation for fighting the epidemic and promoting economic recovery. In April, the output of raw coal, crude oil and natural gas rose 10.7 percent, 4 percent and 4.7 percent, respectively, year on year.

Market supply of food and daily necessities was sufficient, with prices remaining stable. The consumer price index, a main gauge of inflation, rose just 2.1 percent year on year last month.

High-tech industries posted stellar performances, with the production of new-energy vehicles and solar cells surging 42.2 percent and 20.8 percent year on year in April.

China’s economy is expected to improve in May with the accelerating resumption of work and production in Shanghai and Jilin as well as the implementation of pro-growth measures.

Although some indicators saw contractions in April, it does not mean the economy will slow in the second quarter, Fu said, underlining the roles of investment and consumption in revving up the economy.

Manufacturing investment jumped 12.2 percent year on year during the first four months, while infrastructure investment maintained a growth of 6.5 percent year on year….

https://english.news.cn/20220516/e429233d0a054e39852622dcb9bcd619/c.html

May 16, 2022

EU revises growth forecast down, inflation estimate up

European Commissioner for Economy Paolo Gentiloni described the cut in projected growth as “one of the steepest” ever done due to higher commodity prices, including energy, which have increased further since the Russia-Ukraine conflict broke out in February.

BRUSSELS — The Russia-Ukraine crisis has forced the European Commission to slash its annual growth expectation for both the European Union (EU) and eurozone this year, it announced on Monday.

Real GDP growth in both the EU and the eurozone is now expected at 2.7 percent in 2022 and 2.3 percent in 2023, down from its February forecast of 4.0 percent in 2022 and 2.8 percent (2.7 percent in the eurozone) in 2023, according to its Spring 2022 Economic Forecast.

It also increased its inflation forecast to 6.1 percent in the eurozone in 2022 as steep increases in prices across the board continue to grow. Inflation for the whole of the EU is expected to reach 6.8 percent this year….

Lipstick on a pig. Government-sponsored economic commentary is not worth reading, but ltr keeps cluttering up comments with it. This sentence is incoherent and dishonest:

“With a super-large market, complete industrial and supply chains and huge domestic demand, the world’s second-largest economy has the resilience to ward off all kinds of challenges.”

It aims to say China’s size and isolation from the world are protection against China’s own Covid policie, against China’s own property and debtproblems and against the world’s poblems. None of that is true.

Reality is that industrial production is falling, retail sales are falling, property investment is falling, imports an exports are falling, debt defaults are mounting and public disaffection is rising.

A much more realistic assessment, not from tame government sources:

https://www.scmp.com/economy/economic-indicators/article/3177869/china-economy-slowdown-continues-industrial-production?module=lead_hero_story&pgtype=homepage

https://fred.stlouisfed.org/graph/?g=Igan

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 2007-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=Igau

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 2007-2020

(Indexed to 2007)

https://english.news.cn/20220516/2f290eb793fe44b589b6c7e30fb40ea2/c.html

May 16, 2022

China’s economy expected to recover gradually from Omicron impacts

Although some indicators saw contractions in April, it does not mean the economy will slow in the second quarter, Fu said, underlining the roles of investment and consumption in revving up the economy.

Manufacturing investment jumped 12.2 percent year on year during the first four months, while infrastructure investment maintained a growth of 6.5 percent year on year.

“This shows that investment will provide important support to economic growth,” he said.

Retail sales of consumer goods, a significant indicator of China’s consumption strength, went down 0.2 percent year on year to 13.81 trillion yuan (about 2 trillion U.S. dollars) in the January-April period, NBS data showed.

“With the epidemic coming under control and production and people’s lives returning to normal, the pent-up consumption will be gradually released,” Fu said.

China’s exports jumped 10.3 percent year on year to reach nearly 6.97 trillion yuan during the first four months.

Despite the complex and severe international situation, Fu listed favorable conditions that facilitate China’s continuous export growth this year, which include the country’s complete industrial system, strong supply capacity of manufacturing, further opening up, mutually-beneficial cooperation with trade partners and development of free trade zones, among others.

Looking ahead, China will strengthen macro policy adjustment and mitigate the epidemic’s impacts to ensure the economy runs within an appropriate range, Fu said.

You have likely heard the Fox News MAGA solution to the baby formula shortage which is to basically let immigrant babies die. Now the amount of baby formula we give to these babies is a drop in the bucket to the overall need for baby formula among babies in the US but MAGA hat people never missed an opportunity to dump on Hispanics.

Now I have a more effective solution that would allow us to provide safe baby formula to ever infant – import products from Europe. It seems the FDA is listening:

https://www.msn.com/en-us/news/us/fda-set-to-allow-sale-of-foreign-baby-formula-in-us-hoping-its-the-magic-bullet-to-end-shortage/ar-AAXlh1B?ocid=uxbndlbing

I love it. Even the conservatives at CATO will likely endorse this. But I’m sure Tucker Carlson will rail against feeding Hispanic babies tonight as he sees that as part of his racist arsenal fighting what he calls Replacement Theory.

https://news.cgtn.com/news/2022-05-16/Chinese-mainland-records-151-new-confirmed-COVID-19-cases-1a4EQgTyREs/index.html

May 16, 2022

Chinese mainland records 151 new confirmed COVID-19 cases

The Chinese mainland recorded 151 new confirmed COVID-19 cases on Sunday, with 140 linked to local transmissions and 11 from overseas, data from the National Health Commission showed on Monday.

A total of 1,076 new asymptomatic cases were also recorded on Sunday, and 52,798 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now number 221,955, with the total death toll from COVID-19 at 5,213.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-05-16/Chinese-mainland-records-151-new-confirmed-COVID-19-cases-1a4EQgTyREs/img/9a6e1a86f619437ca44b4f8ce5adb1a3/9a6e1a86f619437ca44b4f8ce5adb1a3.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-05-16/Chinese-mainland-records-151-new-confirmed-COVID-19-cases-1a4EQgTyREs/img/484e7e2ee9614464bd6637675aaa098e/484e7e2ee9614464bd6637675aaa098e.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-05-16/Chinese-mainland-records-151-new-confirmed-COVID-19-cases-1a4EQgTyREs/img/a94484909fcb47ac8f519e8c16cf2027/a94484909fcb47ac8f519e8c16cf2027.jpeg

https://www.worldometers.info/coronavirus/

May 15, 2022

Coronavirus

United States

Cases ( 84,230,829)

Deaths ( 1,026,670)

Deaths per million ( 3,068)

China

Cases ( 221,804)

Deaths ( 5,209)

Deaths per million ( 4)

https://fred.stlouisfed.org/graph/?g=PvEp

January 30, 2018

Life Expectancy at Birth for United States and China, 2000-2020

https://fred.stlouisfed.org/graph/?g=PvEu

January 30, 2018

Infant Mortality Rate for United States and China, 2000-2020

A critical question regarding Putin’s renewed war in Ukraine has to do with Putin’s own goals. Many Putin sympathizers have parroted his claims about Nazis and about NATO expansion as a threat to Russia’s security. Some have even repeated Putin’s assertion that Ukraine doesn’t exist – rather like China’s assertions about history, ignoring any periods which conflict with self-interested territorial claims. Toss Israel in here, too.

Here’s some speculation which takes the “no such think as Ukraine” claim seriously and works it into a theory about Putin’s motives:

https://theamericanscholar.org/putins-gambit/

Interestingly, the theory has almost nothing to do with the world outside Russia, as Putin conceives of it. It’s not all about us, as the “aggressive NATO” or “Azov Nazis” claptrap suggests. Rather, it’s all about Putin.

The author’s speculation is that Putin cares only about control over Russia and Russians. Impoverishing the average Russian is not a bug, but instead a feature of the plan. Closing Russia off from the world, with a closed border between the ethnic Russian areas of Ukraine and a diminished rump Ukrainian state, is part of a plan to isolate Russians from a tempting world outside of Russia.

The author recognizes this picture is a stretch, but it is consistent with Putin’s actions. Howling at Sweden af Finland when such howling makes them more likely to join NATO is also consistent with trying to shut Russians off from the world.

For what it’s worth.

it makes since if you believe that Putin is nostalgic for the Cold War era. personally, I think Putin is ill, and his actions are a last ditch effort to solidify his legacy before he dies. he has no concern for the long term. and that is what worries me about him.

Interesting suggestion but I don’t buy it to be anything except maybe one of many rationales. Like any other dictator he needs tight control to keep his head on his shoulders. Sure he want to be Emperor with total control, but he seems to be willing to make some serious gambles that would not be done if it was just about control over Russia. All the Vassal states with small Russian populations would be a big waste of money if he just cared about control of Russia. So much cheeper and easier to “extract” those expats back to the motherland. There are huge expanses of empty land where they could be resettled and become Russians in Russia. He has been out slinging his guns in Syria, etc., and taken more aggressive postures towards US, Sweden and others – testing airspace defenses. That is the kind of aggressive imperialistic acts that would suggest a need to prove he’s “a big guy”. I think he is buying into the “Russky Mir” right wing BS in his country. He want the old Russian glory days expansive territory, and influence sphere around it. He realized that the hydrocarbon wealth Russia enjoy right now is on the countdown clock so he had to make the push now, or never have the strength to realize that dream. He made a huge miscalculation, thinking Russian troops would be greeted as liberators. Now he is just stuck with nobody offering him an acceptable way out.

Peter Navarro, foaming at the mouth on NewsMax: “Here’s your future, Tony [Fauci]. Republicans are gonna take back the House. You’re gonna sit your ass down in a chair, in Congress, and you’re gonna confess to creating the virus .. and we’re gonna fit you for an orange jumpsuit.”

How did this loon manage to get an economics PhD? Was he always this way but managed to hide it? Or has he more recently suffered some brain injury or psychic trauma?

having a conservative mind set coupled with old age is a dangerous mix. I see it on an almost daily basis. conservatives do not age well. they become bitter.

A lot of them just know what it takes to get the uneducated masses wired up. This was pure right wing populist BS, uncoupled from reality and decency. But it is great for selling books, getting votes and being invited to “news” program again so you can do some more of the same. I am sure he was always an arrogant sociopathic opportunist, but it probably expressed itself in different and less public ways. Those words would have been damaging to him in his old world, but now he want to be a Prince in the MAGA kingdom and the more the Academic world despise him the better.

And people wonder why Dr. Fauci has decided to never work for a Trump White House again.

He got an economics PhD decades and decades ago.

Just sayin’.

Though I would consider your trauma theory.

“I don’t pay any attention to what economists say, frankly. You have all these economists with these 160 IQs who spent their life studying it. Can you name me one super-wealthy economist who’s ever made money out of securities?”

-Uncle Warren

Uncle Warren? I seriously doubt Mr. Buffett considers you a relative. Yea he did say in a 2016 interview that he does not give much credence to financial market predictions from economists.

https://www.cnbc.com/2018/05/18/warren-buffett-explains-why-he-never-listens-to-economists.html

I guess it was too much for you to state that more clearly or who “Uncle Warren” even was. BTW – NO ONE with a brain pays any attention to your worthless comments.

This comment leads any one *with* a brain to conclude that PaGLiacci either…

a) has no brain

or

b) PaGLiacci does not deem my comment to be worthless

I’m sure PaGLiacci will reply with some honking of their clown horn, but it’ll be interesting to see if the tragic clown provides any clarity to their word salad of a comment.

Yep – we all knew it. Another chance for the world’s most worthless troll to throw another temper tantrum. I would suggest you grow up someday but we all know that you are incapable of doing that.

The tragic clown has tacitly acknowledged their comment was a massive failure.

Also, what tantrum? That I called out your idiocy? You clown.

Can you name one person other than Warren Buffet who consistently beat the market picking stocks?

Do people get PhD’s (years in grad school + maybe a postdoc + years chasing tenure) in order to become wealthy?

Not Econned hero – Donald Luskin where his “clients” are realize “we’re poor because his is stupid”.

BTW – the post was about forecasting interest rates not the valuations of businesses. I guess Econned has no clue that these are different exercises.

BTW – You are a dolt. Full stop. Buffet’s quote is, to anyone with a brain, about securities. It’s literally laid out before you with zero need for assumption or extrapolation. Talk about having “no clue”. The volume and frequency of idiocy from PaGLiacci’s comments is quite astonishing. Comical and astonishing. And sad.

What. A. Clown.

Securities are equity claims on businesses. Now since you dispute this in your latest hate filled pointless comment – then you are the Klown. But we all knew that a while back.

To the first – nothing here is about equity. It’s about debt. Both Menzie’s post and Buffett’s quote are about debt.

To the second – who said they did and why would that be relevant?

Government debt v. corporate debt. Oh wait – you do not know the difference between these two either. Klown!

Front month lumber futures fell 14.5% on Monday. They are down about 50% from the peak. Soft new home sales, easing transportation and improved mill activity are all factors. So there’s one inflation concern that’s easing. Wouldn’t be surprised if lumber prices bounce after a single-session fall like that, but the trend is now downward.

That’s one price which is not directly the result of what’s happening in China or in Ukraine. What’s going to be interesting is how China’s slowdown interacts with Russia’s war in Ukraine. China is usually the biggest swing factor in a number of commodity markets. Copper, iron ore, cement, some agricultural commodities. Russia and Ukraine are driving grain prices, Russia and OPEC driving oil and gas prices. Lumber prices show that global factors aren’t everything. DRAM prices are in a slump, which is a bit worrying.

Turning points in economies and in prices tend to be raggedy – some markets turn before others – and these wobbles look kinda like that. China’s economy and, it’s beginning to look like, the U.S. housing sector are becoming drags on prices.

Mortgage rates going from 3% to 5% is going to have a huge impact on housing markets. Look for changes in new permits and starts to dive first. Builders will have to adjust and make smaller cheeper houses to keep up sales. If they don’t, we will get a big downturn in housing.

Yeah. Lumber down == good.

DRAM down not so great (could a wider downturn) but could just be supply problems being overcome.

macroduck: “Front month lumber futures fell 14.5% on Monday. They are down about 50% from the peak.”

Down 50% from the peak but still 100% above the pre-pandemic level, quite contrary to all the loud claims last summer that shortages were over. And a 14.5% drop in one day is not good news. It is pricing in a pessimistic view of future home starts due to rising mortgage rates.

Biden should eliminate the Trump tariffs on Canadian lumber — and all tariffs. There are things that Biden can do to reduce inflation with the stroke of a pen but he sits passively doing nothing. It’s not good.

Even if it’s temporary, eliminating tariffs and raising top income taxes are going to help. Biden can at least do the first. Has done so with baby formula apparently.