Mr. Steven Kopits writes:

Another is vehicle miles traveled, which is either very short term leading (ie, failing one month or so prior to the official onset of recession), coincident, or lagging by up to 4-5 months if one is using, say, 12 month moving sums.

I downloaded FRED series https://fred.stlouisfed.org/series/TRFVOLUSM227SFWA and plotted the series:

Figure 1: Vehicle Miles Traveled, millions, seasonally adjusted (blue). NBER defined peak-to-trough recession dates shaded gray. DOE FHA via FRED, NBER.

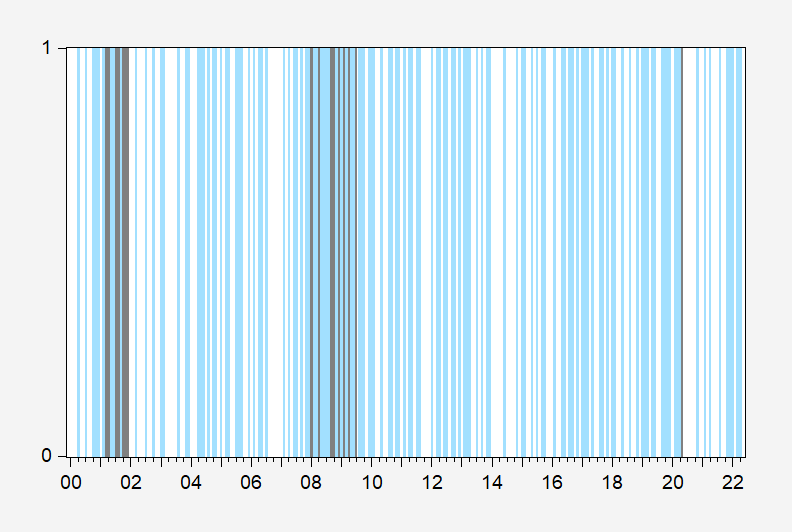

Is negative VMT growth a leading indicator of recession. I created a dummy variable that takes on a value of one when m/m growth is negative and plotted (light blue bar).

Figure 2: Negative VMT growth (blue bar). NBER defined peak-to-trough recession dates shaded dark gray. DOE FHA via FRED, NBER, and author’s calculations.

Note that negative growth precedes by a month recessions… but also many non-recessions.

Not very important, anecdotal economic trivia. $4.29 for gasoline tonight.

I think I F’d up. I gave them $40, and the tank was JUST barely under half full. and it read 9.3 gals on the station read out. But the pump kicked off like 3 times, and the tank only takes 18.5 gal. soooo?? Don’t these modern cars have a thing that feeds the gas back to the station when you overpump it?? I hope not. But I saw some guy on YT who is pretty smart about this stuff, I trust like 98% of what he says on cars, and he says the modern ones if you overfill the tank somehow the gas goes back to the station, er something?? Does anyone know anything about that?? This isn’t music or vulgarity Menzie, it’s 6 minutes explaining what I am trying (and failing) to say.

https://youtu.be/ULckI4VvVDM?t=248

I felt like a GD idiot, because I knew this before I kept trying to pump it, but was too lazy to go back without a receipt and get my $2 back, and I couldn’t stop myself from squeezing that last bit for the $40. Pretty dumb eh?? Oh well…… I probably just totally ruined the vapor intake and paid for $2 gas I didn’t get. No biggee. Just verified I’m a true Okie is all…..

When Eric Adams became Mayor of New York City, he announced that he would be taking a salary in Bitcoin. I have no idea what the Mayor actually has done, but Bitcoin was bought in significant amounts by many people and gains were acted on. This year there has been a severe price decline of 55 to 60% in Bitcoin, and I would think the loss experienced by many holders has become a personal problem. However, I have no idea what this means in terms of economic activity now or from here.

Are Bitcoin losses to be of no account through the economy? Supposedly, according to the New York Times, a significant amount of real estate in Puerto Rico was bought by Bitcoin holders. What now?

https://www.nytimes.com/2022/06/29/technology/crypto-crash-divide.html

June 29, 2022

Crypto Crash Widens a Divide: ‘Those With Money Will End Up Being Fine’

No cryptocurrency investor has been spared the pain of plunging prices. But the fallout from more than $700 billion in losses is far from even.

By David Yaffe-Bellany

ENGLEWOOD, Colo. — The cryptocurrency market was in ruins. But Tyler and Cameron Winklevoss were jamming.

The billionaire twins, best known for their supporting role in the creation of Facebook, twirled and shimmied across the stage with their new cover band, Mars Junction, at a concert venue outside Denver last week, the latest stop on a coast-to-coast tour. They belted out hits like the Killers’ “Mr. Brightside” and Journey’s “Don’t Stop Believin’.” Tickets cost $25.

The Winklevosses were moonlighting as rockers just weeks after their $7 billion company, Gemini, which offers a platform for buying and selling digital currencies, laid off 10 percent of its staff. Since early May, more than $700 billion has been wiped out in a devastating crypto crash, plunging investors into financial ruin and forcing companies like Gemini to slash costs….

Is a Decline in Vehicle Miles Traveled a 1 Month Leading Indicator for Recession?

[ Assuming I can read the graph properly, the answer is surely “no.” The relationship is meaningless in terms of recession prediction, but a person can nonetheless “wish” for the particular meaning. ]

https://www.nytimes.com/2022/06/29/business/economy/gdp-q1-economy.html

June 29, 2022

Consumer spending was weaker than reported, a bad sign for the economy.

Revised first-quarter figures show spending rose only 0.5 percent, a slowdown from the 0.6 percent growth recorded in the final quarter of 2021.

By Ben Casselman

Consumer spending was weaker in early 2022 than previously believed, a sign that cracks may be forming in a crucial pillar of the U.S. economy.

Spending, adjusted for inflation, increased 0.5 percent in the first three months of the year, the Commerce Department said Wednesday. That represented a sharp downward revision from the government’s earlier estimate of 0.8 percent growth, and a slowdown from the 0.6 percent growth in the final quarter of 2021. Spending on services rose significantly more slowly than initially reported, while spending on goods actually fell.

Gross domestic product, the broadest measure of economic output, shrank 0.4 percent in the first quarter, adjusted for inflation, the equivalent of a 1.6 percent annual rate of contraction. That was only slightly weaker than previously reported, because the government raised its estimate of how much companies added to their inventories, partly offsetting the weaker consumer spending….

https://fred.stlouisfed.org/graph/?g=vOAq

January 15, 2020

Advance Real Retail and Food Services Sales, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=ukfd

January 15, 2018

Advance Real Retail and Food Services Sales, 2017-2022

(Indexed to 2017)

I was thinking in my head I had made 2-3 comments on here, warning strongly about violence by MAGA “troops” weeks (months??) before the January 6 events. I have enough vanity in me and enjoyment of “I told you so” to kind of rummage through the December 2019 comments (Maybe I should look before that even??) to try and find those. Although it does nothing to verify I had made these 2-3 comments I am wavering in recollecting having made, I thought this comment by our “I’m one-half Asian” “sammy” kind of interesting:

https://econbrowser.com/archives/2020/12/inflation-looming-phillips-curve-vs-quantity-theory#comment-246152

The comment is made over 2 weeks before the January 6th sedition. Even this comment portends or seems to have a subtext of violence. Why?? Am I misreading that subtext of violence??

2slugbaits brought up a point that is still missed by the MAGA crowd:

https://econbrowser.com/archives/2020/12/inflation-looming-phillips-curve-vs-quantity-theory#comment-246159

Believing in “the big steal” is the logical equivalent of saying a football team down by 10 points with 15 seconds left allowed the other team to score a touchdown to go up by 17 points, so they could get their offense on the field more quickly. Yet roughly 18 months later, for more than 95% of the MAGA and QAnon crowd, this point simply doesn’t register with them at all.

https://whyy.org/articles/they-rejected-trump-but-stuck-with-republicans-down-ballot-meet-pa-s-ticket-splitters/

https://www.texastribune.org/2018/11/16/straight-ticket-voting-ed-emmett-harris-county-texas/

It’s a very simple concept and hard for some Republicans to handle: If you have a Biden ballot that you want to declare as “fraud”, and on that same Biden “fraudulent” ballot they voted for down-ballot Republicans, the down-ballot Republican winners lose the race when deprived of the “fraudulent” Biden ballots

This is what is coming next: https://www.politico.com/news/2022/06/01/gop-contest-elections-tapes-00035758

So which party is doing “the big steal”??

Our “I’m one-half Asian” “sammy” cannot figure this out. It’s a quandary similar to Chinese bureaucrats wanting everyone to think the RMB is the new hotshot reserve currency while refusing to relinquish Communist Party power to unobstructed capital flows. And that is why it’s so easy to see that even 10 years out RMB just isn’t going to be a true player.

https://www.bloomberg.com/news/articles/2022-05-17/china-stops-reporting-bond-trades-by-foreigners-after-selloff

https://www.reuters.com/article/china-bonds-holdings/china-halts-daily-publication-of-bondholder-data-sources-idUSL2N2X90SS

Thanks for the reminder. Note how Sammy was responding voter fraud lies. And the there was this MAGA hat ex-cop attacking the AC repairman.

https://talkingpointsmemo.com/news/ex-cop-allegedly-held-ac-repairman-at-gunpoint-convinced-he-was-voter-fraud-kingpin

We saw in yesterday’s testimony domestic terrorists perched in trees holding AR 15s. I wonder if Sammy was one of those terrorists?

“I’m one-half Asian” sammy might have a tough time in that January 6th crowd. If I was “I’m one-half Asian” at the January 6th event I would have brought an AR-15 for certain. But not to penetrate the U.S. Capitol:

https://twitter.com/Grace4NY/status/1346967836422451200

One never knows though. There were women MAGA at the January 6th event eager to get themselves killed by the mob.

https://www.vanityfair.com/news/2022/01/capitol-insurrection-rosanne-boyland-how-and-why-did-she-die

Maybe sammy is a self-hating “I’m one-half Asian”?? This is usually the part of the conversation when a 100% white behind a keyboard like sammy breaks in and says “Asians are not monolithic!!!” [ insert fake offended tone here ]. Great. Fine. Wonderful. Fantastic. New and Improved. Phone in the good news to Mom. Asians “are not monolithic”. I’d keep the MAGA-loving part of your diverse culture “on the lowdown” if I was you.

Just saying…… uuuuuuuhh “I’m one-half Asian” I love people who indirectly kill Asians sammy.

Steve reminds me of someone who has been fishing all week. He might eventually catch something but so far NADA.

Another chapter in the continuing saga of “Competence Matters”

https://www.cnn.com/2022/06/28/politics/turkey-finland-sweden-joe-biden-nato/index.html

Biden made the exact right moves. Staying in the background, then dangling the carrot, but not giving away too much. Now we will move forward with expanding NATO without needing to alienating the strategically important Turkey. This is what true leadership looks like – its not about the person its about the outcome.

$1.2 trillion infrastructure package.

$1.9 trillion COVID relief deal.

Most federal judges confirmed in since Kennedy.

Rejoined Paris Accords.

Unemployment rate down to 3.6% from 6.3% when he took office (though truthfully, that simply repeats the first 2 items).

Lowest child poverty rate on record, until the legislation expired (thanks to Manchin and that movie lady).

Unexpectedly broad coalition to confront Russian aggression, adopting unexpectedly aggression sanctions.

And handling NATO expansion.

Poor guy can hardly get out of his own way.

and traitor trump wanted to disband nato. and we have idiots in this country who would consider trump a hero. he wanted to storm the capital. but then stayed quiet on that front, and let his minions (marks) take the fall with prison sentences. notice how quiet trump has been on this issue. more fools taking the fall for trump behavior. his is a magnet who distorts the moral compass of those around him.

https://www.nytimes.com/2022/06/29/business/economy/mortgage-rates-housing-market.html

June 29, 2022

Highest Mortgage Rates Since 2008 Housing Crisis Cool Sales

As the Federal Reserve tries to fight high inflation, costly mortgage rates have begun to price people out of the housing market.

By Conor Dougherty

For the past two years, anyone who had a home to sell could get practically any asking price. Good shape or bad, in cities and in exurbs, seemingly everything on the market had a line of eager buyers.

Now, in the span of a few weeks, real estate agents have gone from managing bidding wars to watching properties sit without offers, and once-hot markets like Austin, Texas, and Boise, Idaho, are poised for big declines.

The culprit is rising mortgage rates, which have spiked to their highest levels since the 2008 housing crisis in response to the Federal Reserve’s recent efforts to tame inflation. The jump in borrowing costs, adding hundreds of dollars a month to the typical mortgage payment and coming on top of two years of home price increases, has pushed wishful home buyers past their financial limits.

“We’ve reached the point where people just can’t afford a house,” said Glenn Kelman, chief executive of Redfin, a national real estate brokerage….

https://fred.stlouisfed.org/graph/?g=R4C2

January 30, 2018

Case-Shiller National Home Price Index, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=R4CH

January 30, 2018

Case-Shiller National Home Price Index / Consumer Price Index, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=qVRC

January 15, 2018

Thirty- and Fifteen-Year Fixed Rate Mortgage Average, 2017-2022

https://fred.stlouisfed.org/graph/?g=BcSv

January 15, 2020

Thirty- and Fifteen-Year Fixed Rate Mortgage Average, 2020-2022

https://www.msn.com/en-us/news/politics/boebert-says-she-is-tired-of-separation-between-church-and-state-the-church-is-supposed-to-direct-the-government/ar-AAYZb8i?ocid=msedgdhp&pc=U531&cvid=5f8189a7f3cc428a8daaecad00a882fe

Rep. Lauren Boebert (R-Colo.) says she is “tired” of the longstanding separation between church and state in the U.S., adding that she believes “the church is supposed to direct the government.”

OMG! Does this hack understand the meaning of the First Amendment? Maybe she would repeal it and hail the Second Amendment as something more important to our lives and basic safety.

How disgusting are Trump and his minions?

https://www.msn.com/en-us/news/politics/cassidy-hutchinson-s-testimony-was-unique-the-aftermath-hasn-t-been/ar-AAYZnOa?ocid=msedgdhp&pc=U531&cvid=5f9c4e4fb5c3433ab3507955d9d15543

Perhaps the most revealing of Donald Trump’s numerous tirades about the House select committee’s hearing on Tuesday was one targeting the day’s sole witness. “Her body language is that of a total bull … artist,” Trump wrote, for some reason hiding his long-demonstrated predilection for vulgarity in an ellipsis. “Fantasy Land!” He’d posted on his bespoke social media site a number of other times about the witness, Cassidy Hutchinson, and about the hearing itself. It was a “Kangaroo Court,” Trump declared and Hutchinson’s writing, as displayed on a note shown during the hearing, “that of a Whacko?” If you’ve been conscious at any point during the past seven years, you can guess the sorts of complaints Trump offered. But that “body language” comment Trump posted to Truth Social evoked something other than Trump Trumping. It was immediately reminiscent of the response to another young woman who recently gave high-profile testimony in a heavily watched proceeding: that of actress Amber Heard. “Amber Heard 2.0” was soon trending on Twitter. The intent of using that phrase was to disparage Hutchinson as a liar and an opportunist, as supporters of Johnny Depp believed Heard to have been in the recently concluded defamation trial. The comparison was fostered by a rapid effort to undercut Hutchinson’s testimony and Hutchinson herself wherever possible. And describing the situation as “Amber Heard 2.0” is, in fact apt: not because the two women were particularly similar but because the reaction was.

I watched Cassidy Hutchinson testify. She is a brave woman who was very credible. The Trump minions are disgusting traitors.

For whatever it’s worth, I watched the Depp~Heard lawsuit/case. An embarrassing amount of time I’m very ashamed to confess. I watched 80% of Hutchinson and listened to 98% of Hutchinson. How much of Heard did I believe?? About 15% of her claims. Hutchinson?? 98%–100% I believe her. These aren’t the same. And how does sexual attack claims get compared to sedition and inciting mass violence?? It’s an asinine apples to oranges analogy.

First of all, I have no idea why you would begin this series in 2000, as the data goes all the way back to 1970. (But, hey, at least it’s not a log scale!)

For your convenience, I have again provided the longer term graph and the related data here:

http://www.prienga.com/blog/2022/6/29/vehicle-miles-traveled-and-us-recessions

You’ll see that VMT falls with recessions, with the exception of 2001, which, as Menzie has already pointed out, comprised only one down quarter and did not involve high oil prices.

I would bring your attention to the period from 2008-2014 highlighted in light peach color. This is the period of recession and then secular stagnation, as Larry Summers would have it. VMT begins to recover in 2014 for the obvious reason that oil prices collapsed then.

But here’s the interesting thing. Unlike other oil shock recessions, the oil supply was not falling either prior to the GFC, nor during the period of secular stagnation, with the exception of Dec. 2008 – Aug. 2009, when OPEC trimmed production marginally to offset collapsing oil prices. But other than those nine months, the oil supply was either steady or growing, in particular from 2010, when a growth rate of 2 mbpd / year was not uncommon. Nevertheless, US VMT and the US economy was struggling until oil prices declined in 2014. So where did all that incremental oil go? Of course, it was absorbed by China’s fast growing economy and those linked to China geographically as suppliers, for example, Brazil. Therefore, we can say that secular stagnation was related to China’s rise, at least with respect to oil. For this reason, I refer to the period from 2008-2014 as the China Depression, because the stagnation seen in the US is clearly related to the lack of oil, and the lack of oil did not result from supply issues, but rather from the demand in China, which was growing faster than the oil supply could accommodate at the time.

Even more interesting, that trough in the 2008-2014 period can be seen across a range of economic indicators, for example, remittances to Mexico, illegal immigration across the southwest border, and home equity withdrawals. Are all these things linked to the price of oil and the availability of oil for the economy? The recovery of VMT from 2014 — resulting from the collapse of oil prices — would seem to indicate so. The collapse of oil prices began to right the economy as a whole, and talk of secular stagnation gradually disappeared.

Finally, to turn to the topic de jure. I have highlighted, again in peach, the mooted current recession assuming it began in January. You can see VMT again beginning to dip. Now, four months of data is not very much, so maybe this stretch is just a blip. On the other hand, if you have faith in the VMT model, then it looks like a recession started in Q1.

First of all, I have no idea why you would begin this series in 2000, as the data goes all the way back to 1970.

REALLY? Dr. Chinn provided the FRED link which started at 2000:

https://fred.stlouisfed.org/series/TRFVOLUSM227SFWA

Now maybe you spliced two different series. But then was their some point here? Oh you just have to be the argumentative jerk. Never mind!

“You’ll see that VMT falls with recessions”

Well one would expect a recession to CAUSE VMT to fall. But no – you are trying to argue movements in VMT cause movements in real GDP.

Let’s do a weather analogy. When it rains, I take my umbrella. I guess in your mixed up little mind my umbrella caused the rain.

Then again you are the idiot who sees the fall in the government deficit from a booming economy is a measure of fiscal restraint. Yes anyone who has failed to read E. Cary Brown’s 1954 AER paper is not qualified to talk about fiscal policy. But you so anyway.

VMT normally falls due to high gasoline prices, ie, we’re back to oil shocks. But in either event, you can consider them statistically correlated, if entirely unrelated otherwise, if that makes you happier.

Correlated? Gee – have you run a single bit of statistical analysis on the roles of income v. price effects? Didn’t think so. BTW your attempt to define an oil shock is on par with your feeble abuse of “suppression”.

“I would bring your attention to the period from 2008-2014 highlighted in light peach color. This is the period of recession and then secular stagnation, as Larry Summers would have it.”

The Allman Brothers should sue you for degrading peach colors (Eat a Peach was a great album). First of all – you have no clue what secular stagnation even is. Secondly, real GDP and employment grew albeit slowly from 2010 to 2014. That you keep calling this a recession period proves either you are the dumbest troll ever or a serial liar.

Look – you have wasted too much of everyone’s time with your persistent stupid BS. It is time for you to stop as we all know you are nothing more than a worthless troll.

Go ahead, define it for me, Mr. Money-has-Nothing-to-do-with Aggregate Demand. Let’s see if you get it right this time.

“Mr. Money-has-Nothing-to-do-with Aggregate Demand.”

Dude – you were the one who suggested monetary policy had nothing with aggregate demand. Now I did mock you and now you just lie and lie about the exchange.

Thanks for proving my point – you are nothing more than a lying worthless troll who never grew up.

Steve,

Prof. Chinn has been very methodical about posting the NBER’s “big four” coincident indicators, only one of which is currently negative, so I won’t mention those here.

But in addition to that, in his 1993 tome, Prof. Geoffrey Moore listed a series of 11 short leading indicators, namely: The S&P 500 stock price index, Average workweek in manufacturing, Layoff rate under five weeks, initial claims for unemployment insurance, ISM manufacturing vendor performance, ISM manufacturing inventory change, Journal of Commerce change in commodity prices, change in deflated nonfinancial debt, new orders for consumer goods and materials, Dun & Bradstreet change in business population, Contracts and orders for plant and equipment.

Aside from the Dun & Bradstreet data, all of the rest of the series are publicly available.

As of this past January, with the sole exception of the manufacturing workweek, which had softened, and short term unemployment, which recovered after worsening for several months, every above indicator above was positive.

Source: https://seekingalpha.com/article/4479994-short-term-forecast-first-half-2022-expansion-continues

A direct link to Moore’s list of indicators can be found here:

http://bonddad.blogspot.com/2011/12/examination-of-model-for-ecris-black.html

As for Bill McBride identifying 2023 as the year to be worried about recession, he’s only 5 months later than me, but still, not too shabby:

https://seekingalpha.com/article/4482858-long-leading-forecast-through-2022-deceleration-near-recession

At any given time, there will be datapoints on which one can build a bull or bear case. But the vast majority of data with very good track records going back multiples of decades simply do not support the idea that the economy has been in recession at all so far this year.

“At any given time, there will be datapoints on which one can build a bull or bear case.”

Steve is clearly busy fishing for ANY such data point. And he is clearly ignoring any evidence to the contrary.

OK. Thanks. Did these indicators suggest -1.6% for Q1?

Also, I have to tell you, gasoline and diesel consumption say the consumer is going off a cliff.

http://www.prienga.com/blog/2022/6/29/is-the-us-economy-cratering

As a matter of fact, here is what I wrote when Q1 GDP first came out:

“ I’ve been expecting weakness to show up by now ever since last summer [i.e., since July 2021 – Link: https://seekingalpha.com/article/4451981-economy-softens-significantly-by-q2-2022%5D so here it is.

“But the big culprits were non-core items. Personal consumption expenditures, even adjusted for inflation, were positive. The three big negatives were a big decline in exports vs. imports, followed in about equal measure by a decline in inventories and a downturn in defense production by the government. The inventory adjustment is temporary. So, most likely, was the downturn in defense production. We’ll see about exports and imports (supply chain issues!).”

I have seen no reason to change that assessment since.

Like I said, at any given time if you look for something negative (or positive), you will find it.

Gas consumption, per the EIA, is down 2.0% YoY. Since I track it every week, I am very familiar with it. It has been down roughly 1-2% for about the past 3 months. It’s a negative, and certainly speaks to consumer reaction to higher gas prices. The question is, are consumers cutting back in their total spending, or so far just shifting spending from other things? I also track Redbook consumer spending and OpenTable restaurant reservations every week. So far Redbook is still consistently 10%+ higher each week YoY, and OpenTable is about flat.

Personal consumption expenditures, even adjusted for inflation, were positive. The three big negatives were a big decline in exports vs. imports, followed in about equal measure by a decline in inventories and a downturn in defense production by the government. The inventory adjustment is temporary. So, most likely, was the downturn in defense production. We’ll see about exports and imports (supply chain issues!).”

Exactly right but let’s also note that fixed investment demand had significant growth in Q1. Yet Stevie decides it is time to talk about Hansen’s secular stagnation hypothesis? Oh wait – he has no clue what that is!

Good point re the temporary fall in defense purchases. I wonder if anyone knows how much in the way of military equipment we have sent to Ukraine. Wars do tend to increase fiscal impact – even if Stevie still confuses fiscal impact with the change in the actual deficit!

You must have ADD. Gross Domestic Income rose by 1.8%. Are you too stupid to even read? Or just your usual dishonest troll?

Your own graphs show volatility not falling off a cliff. Come on dude – at least TRY to be honest.

I must admit that I missed this interview with Hillary Clinton:

https://www.msn.com/en-us/news/politics/hillary-clinton-sums-up-clarence-thomas-in-three-words/ar-AAZ0752?ocid=msedgntp&cvid=00f3594771894238bc5efbd1611cacc8

Her description of Clarence Thomas is spot on. The Court will be better off when he is no longer on it.

Why no confidence intervals, hm?

Stephen Colbert’s coverage of that alleged assault on RUDY (the lethal light tap on the back routine) is a joy to behold!

https://www.msn.com/en-us/video/comedy/rudy-giuliani-remains-undaunted-after-staten-island-attack/vi-AAYZgWj?ocid=anaheim-ntp-feeds&pc=U531&cvid=bb491698fa7147d293f515363b7c6641

https://www.msn.com/en-us/news/us/who-chief-u-s-abortion-ruling-a-setback-will-cost-lives/ar-AAZ0hk1?ocid=msedgdhp&pc=U531&cvid=6b5ae1ece47f4b34989b81f6b61c909c

The head of the World Health Organization on Wednesday criticized the U.S. Supreme Court decision to overturn Roe v. Wade. calling the decision to no longer recognize a constitutional right to abortion “a setback” that would ultimately cost lives. WHO Director-General Tedros Adhanom Ghebreyesus said during a media briefing that decades of scientific data prove that access to safe and legal abortion saves lives. “The evidence is irrefutable,” Tedros said. “Restricting (abortion) drives women and girls toward unsafe abortions resulting in complications, even death.” He said safe abortion should be understood as health care and warned that limiting its access would disproportionately hit women from the poorest and most marginalized communities.

Tedros is spot on with respect to the science. But it seems that MAGA crowd has been taught by Trump to hate the WHO. Calling these morons pro-life is misleading as they do not give a damn about the lives of women.

Trump proven unfit for power again

https://www.washingtonexaminer.com/opinion/editorials/trump-proven-unfit-for-power-again

Wow.

You needed a rightwing rag to tell you something the rest of the world realized over 6 years ago? WOW!

@ LiberalStates’ResidentKopits

I assume you’re “wowing” more because of the publication belatedly discovering this immutable fact, rather than the headline itself.

Yeah, this would be analogous to if Kopits went on FOX news and said “Funding the Russians’ mass-murder on Ukraine with oil purchases is really immoral”. The statement itself has zero shock value. Coming out of Kopits’ mouth?? Coming out of Kopits’ mouth it would induce physical symptoms in FOX/AON viewers similar to postpartum hemorrhage.

Maybe Steve is waiting for Fox and Friends to let him know the earth is round!

Similar to our California residents here, who keep telling us imaginative tales about the mass “exodus” from the “horrible” liberal state they choose to reside in, I’m miffed why Kopits chooses to live in two of the most blue states in the nation–New Jersey and Massachusetts. Could it be our fair-haired oil consultant enjoys living in the “dirty liberal” style of government he prescribes being off-limits to others??

Tune in next week when LiberalStates’ResidentKopits bites off the head of a chicken live on OANN TV after declaring the chicken is infested with violent Antifa chiggers. Drinks will be provided after the “Geek show” by sammy “I am one-half Asian”.

i would think if steven were serious, he would choose to live in texas. but he already knows it has few redeeming qualities, besides a better winter than new jersey.

The Examiner has historically been a pro-MAGA publication. For it to dump Trump like this, well, wow, that’s really something. Times have changed.

I guess that is why you read the Examiner. After all you serve as Fox and Friends chief “economist”!

@ LiberalStates’ResidentKopits

Kopits says in an above comment: “The Examiner has historically been a pro-MAGA publication.”

You’re speaking of the early years of MAGA?? Before the 2016 “reboot” of MAGA. Oh yes, I remember it well. Before the “dirty liberals” ruined America:

“. . . to see those—those monkeys from those African countries [President Nixon laughs], damn them, they’re still uncomfortable wearing shoes!!!!”

~~~Ronald Reagan

Just after the 6:25 mark. A moment that makes “sammy” “I am one-half Asian” gush in Republican pride.

https://vimeo.com/353811584

Kevin Drum notes one can purchase guns on Instagram but any mention of abortion pills is banned here as well as on Facebook:

https://jabberwocking.com/facebook-and-instagram-decide-that-abortion-is-too-icky/

So the 2nd Amendment protects domestic terrorists wanting AR 15s but the 14th Amendment does not protect the health of women.

guns have more rights than women in this nation.

Revised data for Q1 GDP and GDI were released today:

https://fred.stlouisfed.org/graph/?g=R5Y8

Real GDP still down. Real GDI still up. The average of the two still up, though only 0.1% (SAAR).

Real personwl consumption spending was revised lower, which means the base for Q2 PCE is lower – a minor drag on GDP.

All of these data are due for revision in late September with he annual update o national accounts.

“Real GDP still down. Real GDI still up. The average of the two still up, though only 0.1% (SAAR).”

New post from Dr. Chinn. Something else Princeton Steve will refuse to read.

Speaking of GDP, I kind think this component might be headed higher, though perhaps not enough to move GDP growth by a full tenth:

https://fred.stlouisfed.org/graph/?g=R62c

One would think that all those weapons we sent to Ukraine will show up in defense spending for Q2.

Steven,

One reason, I assume that Professor Chinn used the data series, TRFVOLUSM227SFWA Is that it is seasonally adjusted starting in 2000. He appears not to have used a rolling twelve-month sum similar to what I think is your method.

I may not clearly understand your indicator related to vehicle miles traveled but I’ll make an attempt.

There is a FRED NSA vehicle miles traveled series, TRFVOLUSM227NFWA, that does go back to 1970. If one seasonally adjusts the NSA series and then creates a dummy variable shown as “1″ when the monthly change Is negative similar to what Professor Chinn did, and then graphs the result with the recession indicator USREC that you use, the result seems to show many false readings.

I also tried to use a probit model to test the usefulness of the vehicle miles traveled indicator and found the model shows a McFadden R squared of less than 0.02. If the previously cited economic web site is correct, then this R squared result is far from the acceptable range of 0.2 to 0.4.

I leave it to the more educated readers to correct my thinking.

Ted Cruz need to pick on someone his own size.

https://www.cnn.com/2022/06/29/politics/ted-cruz-elmo-big-bird/index.html

Attacking little puppets is not manly – its silly.

Ted Cruz apparently has never read the final pages of Green Eggs and Ham!

One would think that all those weapons we sent to Ukraine will show up in defense spending for Q2.

will depleted pentagon stocks be resupplied along with refilling the 230 million barrels from the strat petrol reserve?

or will the deficit hawks stop it?

arms and ordnance donated to ukraine come out of pentagon training and ‘war’ stocks, they have already been paid for, most of them made years ago.

gdp activity of replacing those arms/ordnance is booked when the treasury writes the checks post physical delivery.

some of the stuff has long leads to procure, most are out of production and some of it was not that long in pentagon stores. finding out of date chips is a problem!

at least one small nato member has depleted their war stocks sent to ukraine.

how far off is pentagon from running low?

good thing no one will need any of it for taiwan!