Reader Steven Kopits writes:

I think 2011 has a decent call on being a recession. It’s the only time in US history when oil consumption fell — and fell substantially — without a called recession, and the next three years were not very good, hence, Summers Nov. 2013 secular stagnation speech. And of course Europe went down like a ton of bricks. They will this time, too.

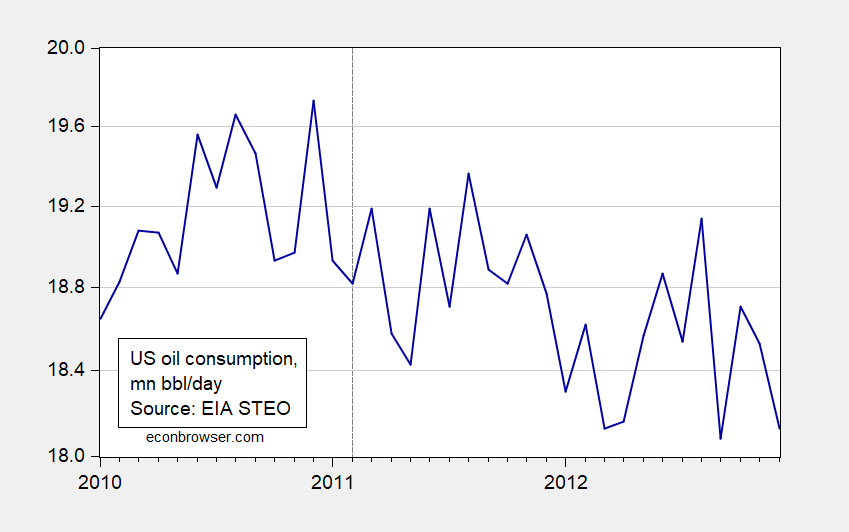

Here’s US oil consumption per EIA’s Short Term Energy Outlook (April data):

New FIgure 1: US oil consumption per day, in millions of barrels (blue). Source: EIA Short Term Economic Outlook, accessed 6/26/2022.

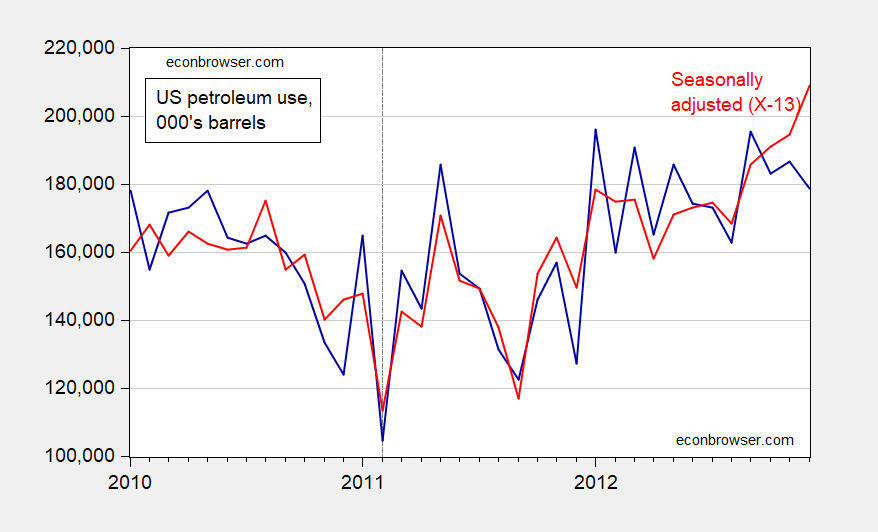

Here’s US petroleum use (US production plus imports minus exports):

Figure 1: US total petroleum use (blue), and seasonally adjusted (red), in 000’s of barrels. Dashed line at 2011M02. Seasonal adjustment using Census X-13. Source: EIA, and author’s calculations.

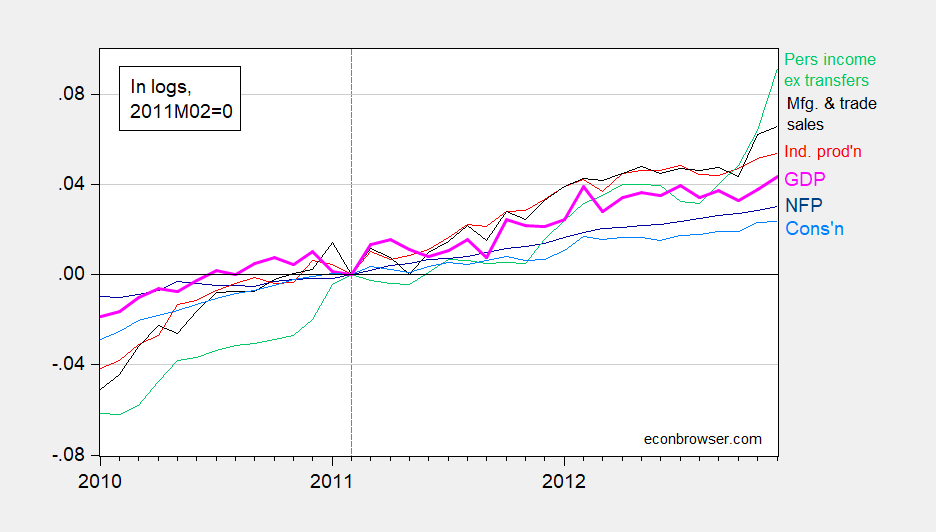

What do some of the key indicators follow by the NBER’s Business Cycle Dating Committee follow look like?

Figure 2: Nonfarm payroll employment (dark blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates, peak-to-trough, shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (6/1/2022 release), NBER, and author’s calculations.

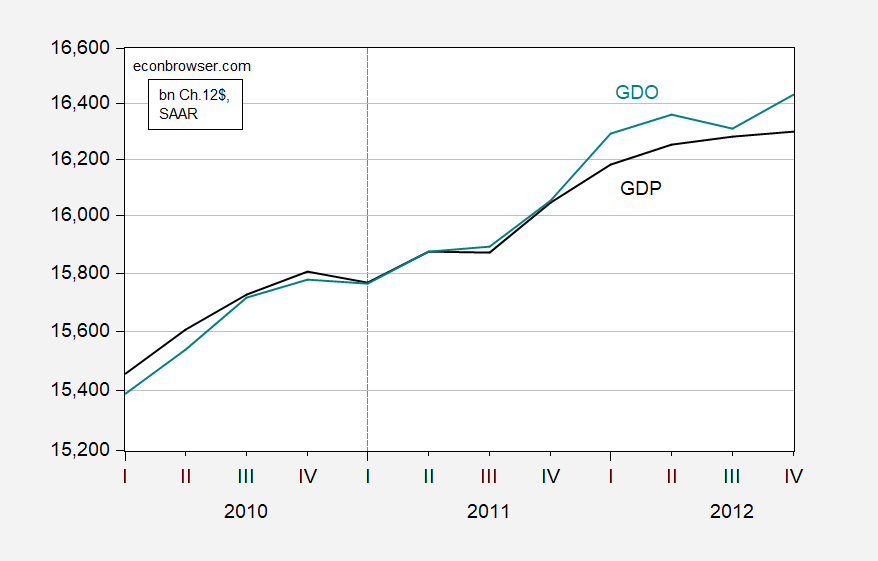

What about GDP and other broad measures at the quarterly frequency? Here’s GDP and Gross Domestic Output (the average of GDP and GDI). The latter is widely viewed as a better measure of output than GDP alone (see discussion by Furman (2016)).

Figure 3: GDP (black), and Gross Domestic Output (teal), both in billions of Ch.2012$, SAAR. Dashed line at 2011Q1. Source: BEA, and author’s calculations.

While we are on the subject –

4-week initial claims vs U3 jobless rate:

https://fred.stlouisfed.org/graph/?g=QWmI

Both are decent leading indicators of recession.

Neither shows recession on the way, much less a recession underway:

https://fred.stlouisfed.org/graph/?g=QWn5

Who are you gonna believe, the data or your lying trolls?

Trend remains on track from March 19

Trend? What trend? Come on Stevie – did you flunked preK writing? Try writing coherently assuming you know how.

Doesn’t do to make Menzie grumpy, apparently.

Nonfactual statements can make very reasonable people “grumpy”. In fact, generally, the more intelligent a person is the more nonfactual statements are apt to make them angry. Hence the age old cliché “ignorance is bliss” and why folks such as CoRev, sammy, LiberalStates’ResidentKopits, Peaktrader, Don Stryker etc have no fear of the Orange Abomination and zero fear over January 6th events. None of them lost any sleep over it or felt their blood pressure rise.

As regards the post itself I have nothing contributive to add. I have made no predictions on recessions recently. I have only stated that I believe strongly inflation will start to drop in a noticeable way (and “constant”/steady way) before the end of December 2022.

There is no such thing as:

A) very unique

B) slightly pregnant

C) a decent call on being a recession

Weasel words are for weasels.

Noticed when I call Stevie on his claims – he does not document his falsehood. No he first replies “what’s the other time” followed by “eh?”.

What’s the other time? Is he asking me when else has he gotten something wrong? OK – about 20 times each and every day. It is like he just keeps talking without paying a lick of attention to:

what other people are saying or

basic reality.

“US petroleum use (US production plus imports minus exports)”.

Nice! When Stevie claimed without a shred of evidence that US consumption fell, I looked for a series on consumption only to find petroleum production. But if we add imports net of exports, we get by definition consumption. Now I suspect Stevie will not understand what you reasonably did here. He never does.

You can find the numbers is the STEO data browser It is up and running.

https://www.eia.gov/outlooks/steo/data/browser/#/?v=6&f=A&s=0&maptype=0&ctype=linechart

OK I checked finding this series:

U.S. (50 States) Petroleum Consumption million barrels per day

I am presuming this is the series you were referring to but given your piss poor writing skills who knows. A bit of variance but a decline. The data says otherwise, So why do you keep LYING?

Barking Bierka – the NYC Jerk, note Steven’s reference is much better than the gibberish you just wrote.

Another episode of the dog chasing its own tail!

Stevie also wrote:

“1998 is also another interesting case, somewhat similar to 2001, albeit most of the action was in Asia.”

Of course the US economy was booming in 1998. But OK – maybe real GDP fell in some Far East nation. Does Stevie count a fall in North Korean real output as a US recession? Oh wait – that would be a suppression. Got it!

pgl,

The East Asia financial crisis of 1998 was a pretty serious business in quite a few countries, especially Thalland, Iindonesia, and South Korea, but not North Korea. It spilled beyond East Asia to some extent. But, no, it did not affect the US much, where indeed the economy was largely booming.

Thanks. I think most of us know about the East Asia financial crisis of 1998. And you are right – this had little impact on the US economy. As I have been saying = Stevie just makes up BS as he goes.

Among countries outside of East Asia that took hits following it were Argentina and Russia. It led to big changes in how most of the East Asian nations handled their international finances, with many of them shifting to trying to avoid having large debts denominated in US dollars.

Two points:

1. I don’t think vehicle miles traveled is at all a sufficient basis on which to call a recession. Fortunately FRED is your friend, so here is the graph of the YoY% change going back 50 years:

https://fred.stlouisfed.org/series/TRFVOLUSM227NFWA#0

Note since the data is very seasonal, YoY is the only reliable way to measure.

Sometimes YoY use has been down with no recession, and sometimes it has been higher YoY with recession. Looking at 1979 and 2019, I would say it is most consistent with a very weak economy that can be easily tipped into recession.

2. If I recall your colleague Prof. Hamilton’s data correctly, gas price spikes drive recessions when there is a true “shock,” and consumers cut back spending by more than the $ increase in gas. If they only divert 1:1, e.g., cutting out one $20 pizza night because of paying $20 more at the pump, there’s no recession.

At any time there will always be good and poor data points. For example, right now Redbook’s measure of consumer spending and Open Table’s measure of dining out are both holding up very well.

This is how it’s done, ladies and gentlemen. Thank you, NDD.

https://news.cgtn.com/news/2022-06-25/Chinese-neuroscientist-receives-2022-UNESCO-For-Women-in-Science-Award-1b8ZnjjY7ny/index.html

June 25, 2022

Chinese neuroscientist wins 2022 L’Oréal-UNESCO For Women in Science Awards

By Sun Ye and Cao Qingqing

Chinese neuroscientist Hu Hailan, 49, has won the 2022 L’Oréal-UNESCO For Women in Science International Awards for her work on depression, which has contributed to the development of the next-generation drugs to treat the disease, according to the UN body.

She and four other woman scientists received the awards at the headquarters of the United Nations Educational, Scientific and Cultural Organization (UNESCO) in Paris on Thursday evening.

Hu, professor and executive director of the Neuroscience Center of Zhejiang University School of Medicine, is the youngest recipient of the award this year, and the seventh Chinese winner of the award.

UNESCO said she was recognized for her “pioneering discoveries in neurobiology that have revolutionized our understanding of social emotional behavior and mental disorders.”

The awards, established by UNESCO and Foundation L’Oréal in 1998, are presented annually to five outstanding female scientists, who have contributed to overcoming today’s global challenges through their work.

Due to the COVID-19 pandemic, UNESCO had not held any offline ceremonies for the awards over the past two years. Ten winners of the 2020 and 2021 awards were also present at Thursday’s ceremony.

Hu told CGTN that the award was recognition for a long line of women scientists.

“Chinese women scientists are ‘blooming’ and everyone is racing to get better. We’re seeing so many leading scientists in so many fields, including for this award,” she said.

“I’m honored to join the ranks of those icons. They’ve been my heroes and inspired me in my work. I hope to pass on that encouragement to other young women and share our love for science.

“There is no better career than being a scientist for me. You are sponsored and encouraged to do what you love.”

Hu also explained the mission that drives her work.

ltr: I am loathe to make suggestions about comments, but I really do wish you would (1) refrain from posting entire or most of entire columns, and (2) posting off-topic on such numerous occasions. I wish as well that (3) you would stop posting so much propaganda, or at least post from 3rd-party sources, rather than state-run media. This is not a forum dedicated to spouting uncritically the views of governments.

Thank you so much for the advice and appreciated efforts, but my posts are the finest and most necessary and important I am capable of making. My posts are always intended to be fair and are always documented. Also, I am always polite.

I have been as fine a contributor as I am capable of being and should be appreciated as such.

There is of course no “propaganda” and no “spouting” to the likes of such a wonderful and needed post as

“Chinese neuroscientist wins 2022 L’Oréal-UNESCO For Women in Science Awards.”

At a time of intense prejudice, I will continue to try ever so hard to be of value in lessening and resolving prejudice.

You are not “a fine contributor” and do spout propaganda. Your refusal to respect our hosts wishes belies your claims to good behavior.

In a nice coincidence, you recently asserted, without evidence, that a critique of China’s intellectual culture was untrue. The point of the critique was that government interference undermines innovation. Now, here you are, proving the point. Chinn and Hamilton work to provide a forum for intelligent discussion of economics and policy. You dilute their effort by cluttering up comments with off-topic, politicized claptrap. Day after day, repetition of the same statistics which I suspect no-one reads – it’s litter on the sidewalk. You are China’s government and you are getting in the way of intellectual progress.

I cannot speak for others, but I have lost respect for China’s government, culture and people as a result of your actions. You represent much of what is wrong with China.

Now now, macroduck, given my incipient and well-documented dementia, I keep forgetting that China has had 4 per million deaths from Covid-19, so it really is necessary to remind me on a regular basis, or, you know, I might be inclined to make something up and start moving goal posts somewhere or other. Only constantly knowing that very important fact keeps me even remotely semi-functional, :-).

I will say this in defense of mainland China’s people and culture. I believe most of the culture to be good. Mainland Chinese people’s cherishing and valuing the importance of Education in Society. Mainland Chinese people’s respect for the elderly (though not quite as altruistic as they represent, still probably better than America’s). Their inner drive to be “the best nation in the world” (not always nationalistic in flavor BTW). This is prior thing I just mentioned very similar to American culture. Their loyalty to close friends. Filial piety to their parents (which arguably I was the “victim” of but nonetheless an admirable trait. Their deep and comprehensive knowledge of their own long and accomplished history (I should stress roughly pre-1930 here).

There are some things about Mainland Chinese culture that I strongly dislike. There is a noteworthy “vein” or “seam” of the mainland citizenry that seems to think nothing at all of lying. and a problem with the issue of trust between mainland Chinese citizens even between themselves. I am sure if you got 5-6 strong drinks in me I could pontificate ad nauseam on all the negative parts. But to me it’s old ground, and does not outweigh the positives of the Chinese people, when judged on an individual basis, and less so on the problematic systemic issues of their government which often force them to behave in less admirable ways.

If that seems a “lukewarm” defense, I can only say it is a defense, and doing my best to type out my honest internal feelings about the mainland situation. There ARE many good people there.

These are some of the very similar type things that I remember vividly in China.

https://www.yahoo.com/news/chinese-father-breaks-down-son-231834062.html

Parents who love their children incredibly deeply, but not very good at knowing young people’s emotional/social needs. Intense intense pressure, when often times a bit of space might do wonders. Mostly I taught college age. But I did pretty much teach/tutor every age while I was there. Most of my students were female. I think females tend to have more interest and higher natural ability/capacity at languages (Yeah, the “misogynist” just said that). The college entrance exams create so much pressure for mainland Chinese parents, it’s really hard as an outsider to even hint at giving advice to “back off the child” or “give them some personal space” in that context. You just kind of observe the parent~child relationship in semi-frustration. One of my best friends there, we will call him “Teacher Fang”. I would invite him to the teacher’s dorm for a free beer and a Snickers bar just to BS and pick his brain (one of the sharpest men I ever met in my life, he majored in Law when he started college and then switched over to English). For his generation in mainland China it was extremely rare to switch majors. HIs father worked the railroad, and he never went hungry growing up, like, again, many mainland Chinese of his generation. He used to dream of his daughter either going to Tsinghua or Beida University. And he was very different from most Chinese, he had his hair in a single long gray ponytail (which was very odd for a Uni prof) and he would say to me “If my daughter goes to Tsinghua or Beida University I will die my hair rainbow color.” I said “Why??” smiling but curious. He said “What bad thing can they say about me then?? Do they dare to laugh at me or talk bad about me if my daughter is going to Beida or Tsinghua??” And I had no verbal reply for him. just a silent contended happiness agreement with him, because he was right. No one could say anything about about him if he got his daughter there, to that “destination”.

*dye his hair, excuse me.

ltr:when I see a series of your posts back to back, I either skip or give a quick glance to the content. Normally, you’re short on economics and long on China with lots of backslapping re: Chinese “successes.” Post what you will—and what Dr.Chinn will tolerate— but I’m in agreement with our host , macroduck, and Dr. Rosser.

I am assuredly a superb contributor and the ceaseless expressions of prejudice will surely not deter me.

I do appreciate all the confidence.

Thank you so very much.

https://english.news.cn/20220625/cf845611f4794f649ea8e63a91729962/c.html

June 25, 2022

China’s sci-tech talent is becoming more youthful

CHANGSHA — The age structure of China’s science and technology workers has decreased over the past decade, according to a report released on Saturday.

The China Association for Science and Technology (CAST) has released a report on the country’s sci-tech human resources development in Changsha, central China’s Hunan Province.

The report shows that sci-tech talent aged 39 and below accounted for 73.89 percent of all sci-tech personnel by the end of 2019, with 9.94 percent aged 50 and above.

The proportion of female sci-tech talent grew rapidly from about 33 percent in 2005 to approximately 40 percent in 2019, according to the report.

By the end of 2020, China had more than 112.34 million people working in the sci-tech field, the report noted.

For the record, let me reprise my comment linked above:

I think 2011 has a decent call on being a recession. It’s the only time in US history when oil consumption fell — and fell substantially — without a called recession, and the next three years were not very good, hence, Summers Nov. 2013 secular stagnation speech. And of course Europe went down like a ton of bricks. They will this time, too.

As I recall, in August and September of 2011 we here at Econbrowser were debating policy uncertainty linked to the debt limit increase. The Obama administration was at the time releasing the largest quantities of oil ever from the SPR (second only to the one currently underway). Consumer sentiment was at recession levels; oil prices near oil shock levels. Employment was stuck above 9% and people were unhappy. Meanwhile, Europe succumbed to a recession even worse than that 2008, one which lasted from Q3 2011 (ie, the period under discussion) to Q1 2013. Thus, Europe was indeed in a stiff recession during the period in question, and often, but not always, recessions in Europe coincide or overlap with ones in the US. Two years later, in November 2013, economist Larry Summers would revive Alvin Hansen’s depression era term, ‘secular stagnation’, to describe the economy in the US.

So, yes, I think 2011 has a decent call on being viewed as a recession, certainly as a near-recession, notwithstanding the GDP prints. By the way — and this is even more true today — the US is prone to regional recessions very possibly with national aggregates intact. The 2011-2013 period, and I was active in the oil industry at the time, was really a good period for us. There was no recession for Houston of the mid-continent with oil above $100 / barrel. Of course, the oil consuming sectors, including the coastal states, were struggling. We will see something even more compelling this time around, as the US is now independent in oil, and hence ostensibly insulated from an oil shock. At the same time, oil independence means that the coastal states cannot count on dollar devaluation to help their economies, even in the event of an oil shock at the aggregate level. So, yes, 2011-2014 had many recession-like qualities outside the energy sector, which had a ripping few years.

I had stated that US oil consumption, excluding 2011-2014, had not declined outside recessions. Actually, there is an interesting period between August 1980 and June 1981 when the US was not in technical recession. Thus, the second modern oil shock (Iran revolution and Iran-Iraq war) is treated by the NBER as two recessions bracketing a short recovery. If you look at many of the graphs from the period, however, it looks like a single oil shock, with US consumption falling from 19.0 mbpd in April 1979 to an astounding 15.0 mbpd in August 1983. It was really a dreadful period for the US economy.

In this earlier case, Europe was also deemed to be in recession the entire time. Thus, Euro recession dating is deemed to extend from Jan. 1980 through November 1982, with no recovery in between. I generally use the Euro dates for the recession for analytical purposes, because I think this better describes the situation in aggregate, including in the US.

In any event, we have two events with falling US oil consumption but no recession. Both had recession-like qualities and in both cases, Europe was in recession.

I stand by my statement.

I’m taking one claim in your usual worthless writing:

“Employment was stuck above 9% and people were unhappy.”

Employment? I guess you meant the unemployment rate. Learn to write – DAMN!

I just checked with FRED and it seems the unemployment rate was 10% as of October 2009 to even a high rate such as 9% was an improvement. And do go back and check like I did – the unemployment rate fell the next month and the next several months and a lot. Now maybe you are too stupid to realize that unemployment is a lagging indicator even though it has been said here MANY TIMES.

BTW your claim that 1998 was an interesting example of the possibility of an impending recession is about as stupid as someone worried that NYC would get 3 inches of snow this morning.

“I had stated that US oil consumption, excluding 2011-2014, had not declined outside recessions.”

Pardon me if I’m looking at Dr. Chinn’s graph as no one trusts your graphs. His graph does not show that US oil consumption fell during the 2011 to 2014. So it is settled – this claim of yours is FALSE. Now – are you lying? Or are you this INCREDIBLY DUMB?

I am using EIA data. If you don’t trust them, well, that’s your problem.

You are arguing in bad faith as usual. I trust EIA. I do not trust you. Now if you knew how to label and explain WTF you are doing – that would be fine. But you don’t. You are not only a liar, but stupid as it gets, and all along the most arrogant moron ever. Of course your arrogance and stupidity are not my problem.

I use EIA data. You could have easily confirmed that for yourself, as the very first source on the graph is listed as ‘EIA’.

“Steven Kopits

June 27, 2022 at 11:15 am

I use EIA data. You could have easily confirmed that for yourself, as the very first source on the graph is listed as ‘EIA’.

Your graph had multiple sources with more than one series. Any decent person would have told his reader which series came from what source with at least some detail. But not you. Your writing sucks. Your graphs suck. And your “analysis” is a joke.

But you THINK you have the right to insult Dr. Yellin and other bright and articulated economists? Sorry dude but you do not have the right to shine their shoes.

Yellen.

Well, those geniuses at the Fed and Treasury brought us 9% inflation, so thank God we’re not being governed lesser mortals.

Steven Kopits: Also brought us 8% inflation in euro area, UK, etc.? https://econbrowser.com/archives/2022/06/advanced-country-headline-inflation-rates-may-2022

Apparently, there are geniuses everywhere.

Two years later, in November 2013, economist Larry Summers would revive Alvin Hansen’s depression era term, ‘secular stagnation’, to describe the economy in the US.

I can guarantee that Stevie pooh has no clue what Hansen meant by secular stagnation. Now it is something that most students of macroeconomics has seen but what does Stevie know about macroeconomics? You guessed it – nothing!

“Employment was stuck above 9% and people were unhappy.”

Of course Stevie is referring to the UNemployment rate which was 10% as of October 2009 and was as he noted was 9% as of September 2011. Gues what happened to the employment to population ratio from August 2011 to September. It rose? And yes real GDP was rising albeit slowly.

Of course the fall of 2011 was a period of stupid state fiscal austerity in terms of reduce state and local government purchases. Oh wait – Stevie does not even consider this in his “measure” of fiscal policy, which seems to be the actual Federal debt. Of course his measure is highly misleading as E. Cary Brown noted in his classis AER 1954 paper. Something else Stevie has never read.

You’re data sourcing appears a bit bizarre. However, this may be because the EIA website is down and has been since last Tuesday. The simple read is that Russia has launched a successful cyber attack on DOE. This is, of course, speculation. However, I have used the EIA website multiple times per week for the last fifteen years, and it has never been down for more than a few hours. It has now been out of service for six days. You may apply your own interpretation.

For your convenience, Menzie, I have published the graph you are looking, as well as the source data in an attached excel file. You can find it here: http://www.prienga.com/blog/2022/6/26/us-oil-consumption-and-recessions

It was not a Russian hack. Had you bothered to read the EIA updates – they said it was not a hack on Thursday. Even if you are too stupid to read the EIA discussions, Kevin Drum has been following this for several days:

https://jabberwocking.com/whats-happening-at-the-energy-information-administration/

Then you are too arrogant to read even Kevin Drum’s excellent blog as you prefer to just make up intellectual garbage about everything under the sun.

Drum writes:

“So what’s going on? And why won’t EIA tell us—aside from explaining that it’s not a hack, so it must be some kind of internal fuckup? I mean, what kind of “systems” issue can bring their IT infrastructure to its knees so fully that they can’t even manage to post new gasoline prices for a full week?”

That’s the question, isn’t it?

That’s the question? You said it was a Russian hack. Even the EIA says that is not true. Damn – you write such garbage.

You believe the EIA. I’m with Drum. You think a plain vanilla software problem would take the EIA down for six days? I have my doubts.

‘Steven Kopits

June 27, 2022 at 7:13 am

You believe the EIA. I’m with Drum.’

Kevin never said it was a Russian hack. You were the only that did that. But now you do not trust the EIA even if you use that for certain data? Oh wait – you misrepresented the EIA data. I get it all now.

Look – you are resorting to bad faith arguments. Which is par for the course for you.

I did not say it was a hack. I said that, given that I have used the EIA website weekly for the last 15 years without issue, a hack looks the more plausible explanation.

The website is still down, with this on the banner:

U.S. Energy Information Administration product releases scheduled June 27, 2022, will be delayed while we continue system restoration.

So it’s not maintenance. It was a systems collapse. And they’ve been down for seven days now. Whatever the problem is, it’s not of the reboot variety. It’s something a lot more serious than that.

Steven Kopits

June 27, 2022 at 11:20 am

I did not say it was a hack. I said that, given that I have used the EIA website weekly for the last 15 years without issue, a hack looks the more plausible explanation.

Seriously Stevie? Such utter waffling is one among MANY reasons why everyone here absolutely hates you.

Still down. Day 8. You still believe the EIA’s story?

I’m looking at your own graph and thinking – does this support your multiple bozo claims? The short answer is NO. First of all you claim we had a big fall in oil consumption in 2011 is not supported by Dr. Chinn’s graph or yours.

Secondly we do see recessions in the past that were FOLLOWED by declines in oil consumption. They were not CAUSED by your really bizarre oil shock thesis.

Then again – who should be surprised that a self important economic know nothing writes such utter intellectual garbage.

Steve,

First of all, thank you for posting your data.

But I continue to believe that the data does not demonstrate what you think it does.

Note that in 1974, 1979, and 2008, oil prices / gdp blew right through the 4% threshold.

By contrast, in 2006 it approached the threshold and then backed off. In 2010-14, it repeatedly touched the threshold and then backed off. Back then, I called this the “oil choke collar.” When gas prices approach the critical threshold and stop, or approach slowly, consumers cut back on consumption just enough to cause prices to back off without causing a recession. The economy heats back up, gas consumption and prices rise, and the cycle repeats.

So far what I see is the 2006 and 2010-14 scenarios. There isn’t evidence yet, in my opinion of the psychological “shock” that causes consumers to overreact. It could certainly still happen, but as I said above, I don’t see it yet.

Oil price/GDP?

You wanna have another think about that?

Let me point you to

1) the title of the graph, which reads “Oil Consumption, Oil Spend / GDP, Recessions”, and

2) the left y axis on the graph, which is entitled “Oil Consumption Expenditure as a Percent of GDP”

3) Oil prices are not listed on any axis

If you read the graph, you will find you’ve answered your own question.

http://www.prienga.com/blog/2022/6/26/us-oil-consumption-and-recessions

Your graph is about as poorly labeled as it gets. Your excel file is even worse. You are pathetic at presenting data. That is not his problem. It is yours.

Dividing a price by a quantity is a bit like dividing spaghetti by quarter notes.

Wrong again, Duckie.

Oil Spend, I think that’s what you’re referring to, is calculated like this:

$ / barrel * barrels / year = $ / year nominal spend on oil consumption

GDP is in nominal terms in dollars per year

So it’s spend on oil in aggregate in nominal terms / GDP in nominal terms, just as the left axis reads: “Oil Consumption Expenditure as a Percent of GDP”

I just realized I could open your excel file which is sort of a mess. First of it – it nowhere tells me where your got your US oil consumption numbers from. Yea – I’m calling you on that.

But here’s the thing – there are TWO columns showing oil consumption and their figures differ. So which one is more reliable? If either.

BTW – raw numbers do not support your claim US oil consumption was low during the 2011 to 2014 period as you have asserted.

Seriously dude – you have no clue what you are doing.

pgl: What Steven Kopits is calling petroleum consumption is actually petroleum consumption expenditure (expressed as a share of nominal GDP, to be precise). Why this should be a coincident indicator for recession, I don’t know.

I’m glad you figured out what on earth he was doing. His writing is so horrific, I had no clue what he was babbling about.

pgl: I take it back, in his graph, he has two series. Oil consumption is correctly identified as a quantity. “oil spend” is correctly oil spending to nominal GDP. Why oil spending to GDP should be a coincident indicator, I don’t know.

Menzie –

Oil consumption is generally a coincident indicator for the business cycle, sometimes to the month. (I would note it could be a slightly lagging indicator if you’re using a 12 month moving sum.) Generally oil consumption peaks at the top of the cycle and bottoms at the trough of the cycle. As one indicator or rule of thumb, it’s not a bad guide, historically.

Oil spend, that is oil consumption as a percent of GDP is generally an indicator of an oil shock. If that measure exceeds 4% of GDP, then you’re in oil shock territory. Jim uses a similar measure, although he focuses, as I recall, a bit on the increase in the oil price, and not just the level. I am more of a level guy, but both approaches have their merits and limitations.

Both Jim and Bill McBride use Energy Spend / PCE as their measure of stress resulting from high energy prices, including oil. This is not my preferred measure, both for conceptual and practical reasons.

On a conceptual level, we have to address whether oil is the same as, say, coal or hydro power or wind turbines. From my perspective, it is not. The reason: Oil is our monopoly transportation fuel, as a practical matter. (Yes, pgl, I know we have electric trains and Teslas. But if you do the math, the overwhelming share of mobility is derived from refined petroleum products.) Mobility is essential to large portions of GDP. All the physical goods we purchase depend on transportation. Many of the services we consume depend on transportation. If you have a dentist’s visit, you have to drive to the dentist’s office, in most cases. If you want to go to the opera, you probably drove there, etc. etc. As a result, a loss of mobility implies a loss of GDP to the extent the loss cannot be offset in real time by efficiency gains or substituted another way.

This is not true for our use of coal, natural gas, nuclear power, renewables or other sources of energy or power. We have been reducing our coal consumption, to pick one example, for a long time, with power prices dropping due to an abundance of natural gas. Indeed, most of us have a pretty good idea of the price of oil and, even more so, gasoline. I don’t know the price of coal within a zero without looking. Nor is there a single global price for any of natural gas, electricity, or coal, which makes a transnational analysis that much harder.

About 2/3 of our oil consumption goes to transportation. Therefore, although the correlation between oil and transportation is not perfect, it’s pretty good for analytical purposes. Thus, my preference for oil spend results from its role as a de facto monopoly transportation fuel and because mobility is closely linked to GDP.

I also prefer oil for practical reasons. First, oil has, more or less, a single global price which can be accessed online 24/7. Similarly, oil consumption is reported by country by month by the EIA every month. GDP numbers are similarly available by country, generally on a quarterly basis if one cares to dig a bit. Therefore, calculating oil spend as a share of GDP is relatively easy from primary sources available to the public. These numbers, again, are not strictly ‘true’ in the sense that the share of transport in oil consumption is not the same everywhere and the same at all times, but the ratio tends to be relatively stable and therefore suitable for time series analysis.

Nor is the price of oil strictly the same everywhere. For example, the EIA publishes the U.S. Refiner Average Acquisition Cost of oil, which typically varies from benchmark prices by a few dollars. Nevertheless, it does not distort the overall interpretation of the data. If the analysis suggests an oil shock using WTI, it will usually do so using Brent, LLS, Maya Sour or Refiner Average.

I would note that I use nominal to nominal, because the oil price is stated in nominal terms and GDP is available in nominal terms. You could do real to real using some deflator, but why go to the trouble? If both oil and GDP as stated in nominal terms, then the share of oil spend in GDP will be calculated in a consistent fashion.

Finally, oil spend / GDP can be calculated pretty much at will without relying on delayed statistics from some agency. GDP does not vary that much month to month in most cases, and generally one can take a ballpark guess about the coming month based on trends and news reports. This is also true of oil consumption, most of the time. At the same time, oil prices can vary radically over a short period, but the price is available in real time. Therefore, one can make an estimate of oil spend / GDP pretty much at will; something which is not true of energy spend / PCE.

So, for all these reasons, I prefer oil spend / GDP over energy spend / PCE, which is the alternative measure most commonly used. I think oil spend gives a better and more timely view of the impact of energy prices on the consumer and GDP and is far easier to use from the analyst’s perspective.

You have a real talent for making easy concepts incompresensible. Then again you do not know the difference between the change in the actual deficit and changes in fiscal policy. And you are also dumb enough to think the Quantity Theory of Money is the same as Friedman-Phelps. Dumbest troll ever.

You’re struggling with oil consumption expenditure as a percent of GDP?

If you do not wish to use my file, you are free to access the data from public sources.

Your file is a confused mess. So thanks for letting us know we do not need to use your utter confusion.

Oh one more thing about your little Excel file, It has oil consumption and GDP through Dec. 2023? Oh I see – you have a perfect forecasting record now? Or you just make things up as you go.

The EIA forecasts oil consumption through the next calendar year. So, for a 2022 STEO, the forecast will cover calendar year 2023. I am using EIA numbers, which you yourself could check, here:

https://www.eia.gov/outlooks/steo/

For a guy wholly unfamiliar with sources, you sure make a lot of aggressive statements.

EIA does not forecast GDP. That was my point moron. So tell us old wise forecaster – how do you forecast GDP and what is the track record for your forecast errors.

Um, actually, it does. Tab 9 of the STEO.

So let me repeat, for a guy wholly unfamiliar with sources, you sure make a lot of aggressive statements.

Steven Kopits

June 27, 2022 at 11:23 am

Um, actually, it does. Tab 9 of the STEO.

The STEO tables do seem to have lots of macroeconomic forecasts. But they do not say it was THEIR forecast. I kind of doubt that they are in that business. If you do – you are dumber than I ever gave you credit for.

But hold to your own demands. How did they make that forecast? What model did they use? Oh – you have no idea. But you trust those figures even as you berate the economists at the FED for being allegedly incompetent. After all – you actually think the abandoned and discredited Quantity Theory of Money as being some advanced macroeconomic model. Yep – you are THAT DUMB.

The table says, if you care to check the footnotes:

U.S. macroeconomic forecasts are based on the IHS Markit model of the U.S. Economy.

This suggests that the EIA starts with the IHS model but may make modifications at its discretion. If the EIA publishes the number, then it is the EIA’s forecast, ie, that is what the EIA thinks will happen going forward, regardless of the source. That is the official EIA view, at least with respect to the STEO (the EIA makes other forecasts as well).

As for oil and recessions:

Oil consumption is not the metric used by the NBER to date a cyclical peak and trough.

However, oil consumption is generally a coincident indicator for the business cycle. As both GDP and NBER business cycle dating are lagging indicators — in the case of NBER dating, by potentially up to years later — those of us interested in the current condition of the US economy may look to coincident indicators suggestive of the state of the economy.

One of these is, as mentioned, oil consumption, which is generally a coincident indicator for economic activity, that is, is generally varies directly with the business cycle.

Another is vehicle miles traveled, which is either very short term leading (ie, failing one month or so prior to the official onset of recession), coincident, or lagging by up to 4-5 months if one is using, say, 12 month moving sums.

Finally, U Mich Consumer Sentiment is also historically a good coincident indicator for recession.

So what do these tell us? Oil is suggesting a downturn in Q1; consumer sentiment is saying downturn in Q1; VMT is saying a downturn in Q1 or early Q2; and, of course, GDP to date is saying a downturn in Q1. IUC is consistent with a downturn materially from late Q1 or early Q2.

As for GDP forecasts, Atlanta Fed is holding steady at 0.0% for Q2; NY Fed is -0.6% Q4/Q4.

There are, of course, other forecasts with more rosy expectations. We will see. For the moment, historically indicative indicators are suggesting a recession starting in Q1 or Q2. If the Q2 GDP print is negative, then it is hard to avoid the conclusion that the recession started in Q1, as the Q1 GDP print was a pretty hefty -1.5%.

“Oil consumption is not the metric used by the NBER to date a cyclical peak and trough.”

Gee – I wonder why. The economist who make up this committee are very smart and well informed. You clearly are neither.

BTW – the way your little graph provide sources is incomplete and incoherent. Yea – you said you had sources but did not tie the source to the alleged series in any way. Did Deloitte Hungary put up with this level of utter incompetence when you were there? I hope not as your graphs provide no meaningful information. None.

Steven,

I mentioned this before, but it seems not to get mentioned, so again.

Q1 was negative for GDP because of an unexpected surge of imports and a sharp decline of inventories. I do not know what is happening with imports, but bet they will not repeat Q!, but I have read that inventories have been sharply rising. They will be pushing the Q2 number up rather than what they were doing in Q1.

Steve does not read what we wrote. He is too busy with his next bloviating BS.

Then you are suggesting, Barkley, that the NBER would avoid calling an H1 recession even if the Q2 print is negative. Right now, the credibility of the Fed and Treasury is approaching zero. I guess the NBER might be inclined to join them there. Otherwise, I don’t see how you post two negative quarters without calling a recession when the public, by a ratio of 2.6:1, believes we’re already in a recession.

“Right now, the credibility of the Fed and Treasury is approaching zero.”

That is not even remotely true but YOUR credibility is negative.

” Otherwise, I don’t see how you post two negative quarters”

BEA has yet to report Q2 figures. Oh wait you have this perfect forecasting model. Never mind!

I am aware that the advance estimate for Q2 GDP is issued on July 28.

Steven Kopits

June 27, 2022 at 11:28 am

I am aware that the advance estimate for Q2 GDP is issued on July 28.

Can we buy Princeton Bloviating a calender please? This troll actually thinks it is late July. He is truly dumb as a rock.

I am sugggesting that Q2 is likely not to be negative, even if it looks sort of like maybe it should be, which I am not expecting. The situation is the opposite of Q1 where things really did not look like a recession with surging jobs market and so on, only to have the number comin in negative due to the unexpected numbers on imports and inventories.

Again, those look to be going the other way this quarter, especially inventories, so expect the unexpected outcome to go the opposite of Q1. Are you actually not understanding this, Steven?

I used to think you were a pretty smart guy, but you have recently gone way off the dumb deep end between your apparent lack of high school knowledge of logarithms, along with your bizarre effort to revive a seriously dead version of the QTM that even Milton Friedman would not support if he were alive to comment.

OK, you’re plus for Q2, I’m minus. Fair enough.

As for logs, Menzie’s graph was wrong for the point.

https://news.cgtn.com/news/2022-06-25/China-completes-main-structure-of-its-neutrino-detector-1b9KuWBXWyA/index.html

June 25, 2022

China completes main structure of its neutrino detector

China has achieved a major breakthrough in the building of its next-generation neutrino detector, Jiangmen Underground Neutrino Observatory (JUNO), with the completion of the detector’s main structure, some 700 meters underground in Jiangmen City, south China’s Guangdong Province.

The main structure, a huge spherical stainless-steel grid, China’s largest so far, will support the core of JUNO, a 13-story-tall spherical detector which will be covered by 20,000 light detecting photomultiplier 20-inch (50.8cm) tubes and filled with 20,000 tonnes of specially formulated liquid. The whole structure is constructed at the center of a water pool under a huge cave in Jiangmen.

A steel elevating platform has been made in the water pool so that an acrylic sphere can be constructed inside the steel grid layer by layer from top to bottom. The photomultiplier tubes and other parts will also be mounted to the steel grid simultaneously. Upon completion, the acrylic sphere will be filled with a liquid scintillator, and the water pool will cover the whole detector to protect it from the natural radioactivity of the surrounding rocks.

With neutrinos going through the detector, a very small part of them will interact with the liquid scintillator, producing scintillation light detected by the photomultiplier tubes as neutrino signals for further calculation and study. Besides neutrinos from nuclear reactors, JUNO can also study neutrinos from supernova, the sun, earth and our atmosphere.

JUNO is operated by the Institute of High Energy Physics under the Chinese Academy of Sciences (CAS). Reactor neutrinos for JUNO to detect and measure will be provided by Yangjiang and Taishan nuclear power plants, both over 50 kilometers away….

I’m taking one claim in your usual worthless writing:

“Employment was stuck above 9% and people were unhappy.”

Employment? I guess you meant the unemployment rate. Learn to write – DAMN!

I just checked with FRED and it seems the unemployment rate was 10% as of October 2009 to even a high rate such as 9% was an improvement. And do go back and check like I did – the unemployment rate fell the next month and the next several months and a lot. Now maybe you are too stupid to realize that unemployment is a lagging indicator even though it has been said here MANY TIMES.

BTW your claim that 1998 was an interesting example of the possibility of an impending recession is about as stupid as someone worried that NYC would get 3 inches of snow this morning.

Central Banks Should Raise Rates Sharply or Risk High-Inflation Era, BIS Warns

Given that inflation has spread to a broad variety of goods and services, such gentle policy moves are unlikely to work, said Stephen Cecchetti, a former senior BIS official who is now a finance professor at Brandeis International Business School. He estimates U.S. unemployment will likely need to reach 5% for several years to bring inflation down.

“The question is whether you can drive it all out in one recession, or if it could take more than one recession,” Mr. Cecchetti said.

That’s not a stimulus problem; that’s a money supply problem.

https://www.wsj.com/articles/central-banks-should-raise-rates-sharply-or-risk-high-inflation-era-bis-warns-11656234002

“That’s not a stimulus problem; that’s a money supply problem.”

WTF? Money has nothing to do with aggregate demand in your little avocado model? Come on dude – stop writing such stupid things. DAMN!

“Money has nothing to do with aggregate demand”

Precious.

I was referring to your claim. Damn – you are so utterly stupid you cannot remember what you wrote an hour ago. Which is just as well as everything you write is STUPID.

Still precious.

As an old boss of mine once said: “Economics has nothing to do with it. It’s all supply and demand!”

Steven Kopits

June 27, 2022 at 11:29 am

Stevie makes a dumb comment and we call him on it. Then he tries to blame his dumb comment on me.

Like I said – this troll is a liar arguing in bad faith. What did your old professor say about students of his who lie all the time?

Well, good to know economics has nothing to do with supply and demand. Now THAT is precious

I laughed when my boss said it.

Marc Jones of Reuters wrote about what BIS said:

The world’s central bank umbrella body, the Bank for International Settlements (BIS), has called for interest rates to be raised “quickly and decisively” to prevent the surge in inflation turning into something even more problematic. The Swiss-based BIS has held its annual meeting in recent days, where top central bankers met to discuss their current difficulties and one of the most turbulent starts to a year ever for global financial markets. Surging energy and food prices mean inflation in many places is now its hottest in decades. But the usual remedy of ramping up interest rates is raising the spectre of recession, and even of the dreaded 1970s-style “stagflation”, where rising prices are coupled with low or negative economic growth. “The key for central banks is to act quickly and decisively before inflation becomes entrenched,” Agustín Carstens, BIS general manager, said as part of the body’s post-meeting annual report Annual Economic Report published on Sunday. Carstens, former head of Mexico’s central bank, said the emphasis was to act in “quarters to come”. The BIS thinks an economic soft landing – where rates rise without triggering recessions – is still possible, but accepts it is a difficult situation. “A lot of it will depend on precisely on how permanent these (inflationary) shocks are,” Carstens said, adding that the response of financial markets would also be crucial.

Carstens remarks strike me as sensible. Unlike the insane hysteria we have to routinely endure from Princeton Steve.

Cecchetti is a bit of a hawk. BIS is traditionally hawkish. Cecchetti wrote his doctoral these on monetary issues and has been a monetary policy guy all od his career. So while he is a fine economist (and you are not), the fact that he sees a inflation as a monetary problem is a bit of a hammer-and-nail issue. One opinion, even from Cecchetti, doesn’t really shift the debate, much less amount to proof.

https://www.heraldbulletin.com/news/nation_world/biden-g-7-to-ban-russian-gold-in-response-to-ukraine-war/article_d392fbcb-5583-540e-acf7-0901e2d0495d.html

Biden gets the G7 to ban imports of gold from Russia. Uh oh – isn’t Tucker Carlson a major marketer of gold from Russia? Expect another insane rant from little Tucker on his racist show tomorrow night!

NYC is celebrating Pride week. Turkey is doing all it can to ban any celebrations including peaceful gatherings:

https://www.foxnews.com/world/turkish-police-break-up-lgbt-pride-parade-istanbul-detain-dozens

Of course they are some MAGA hat wearing Americans who are actively attacking people simply because of their sexual orientation.

Steven,

I defer to our expert readers but will venture a comment on trying to use the log difference in the consumption of oil from your data to forecast recession within one month. The McFadden R squared for the model is about 0.08. The model predicts about a 9% chance of recession within one month. I also tried a model using the Y/Y percent change in oil consumption. The McFadden R squared is also about 0.08. However, according to an online economic source, the McFadden R squared should be between 0.2 and 0.4 to be an acceptable model.

https://spureconomics.com/goodness-of-fit-for-logit-and-probit-models/#:~:text=McFadden%20R-square%20This%20measure%20is%20used%20to%20compare,and%200.4%20of%20McFadden%20R-square%20is%20considered%20acceptable.

For comparison, I looked at new claims for unemployment insurance to forecast recession within one month. The new claims model has a McFadden R squared of 0.4. The new claims model forecasts a very low probability of recession within one month.

This is how it’s done.

Thanks, AS.

Then you have your view of the matter. I have stated my view. We’ll see next month where the numbers come out.

There he goes again. Steve is “on the record”. Like anyone cares.

Hi Steven,

Apologies for being unclear on the thread of your view. To be clear, is your view that we are already in a recession or will be in a recession within one month.

You certainly have fortitude based upon the abuse you receive.

I like the quote said to be popularized by Ruth Bader Ginsberg.

Ruth Bader Ginsburg was often heard to ask, “Why can’t we disagree without being disagreeable?”

https://www.quora.com/Who-coined-the-phrase-disagree-without-being-disagreeable-and-why-how-when-etc

Invoking RBG to praise Princeton Steve? You are disgusting.

I am not invoking RBG to praise Steve. I am just saying why do we need the personal attacks.

Superior knowledge can be used to educate, but personal attacks spread and multiply increasing bad behavior.

Look in the mirror. There is no call for using words like “disgusting” in this discourse when all that is asked is some decorum in the discussion.

Many of us who do not have advanced degrees in economics welcome educated enlightenment from those who have advanced degrees, but not name calling and pejoratives.

I disagree with Steve as my writings show, just don’t have the need to attack him and belittle him.

.

pgl,

I happen to agree with AS on this. While you and I agree on the vast majority of things, I do think you have been overdoing it on the personalistic attacks on Steven. AS is probably our straightest player here, certainly much better behaved than I have been. Heck, he has actually brought forth the best behavior by my own personal nemesis, Moses, who has dug up actually useful data links for AS, for which I must applaud Moses, among the rare occasions I feel like doing so. However, on the matter of you and Steven, while I think you have been overdoing it, I also think his attempt to try and make it look like you have been treating him as badly as Moses does me is also overdoing it. No way. Moses’s conduct towards me is in another league compared to how you bash him.

AS, your conduct here is clearly admirable and fair-minded. I commend you for it. I am also duly impressed with your efforts to check on estimates and calculations that Menzie has made, and I think Menzie is as well and respects those activities by you, including when Moses assists you, with you being an inspiring good influence on him, who so often is not so well behaved here.

To macroduck, I do not think having a political difference justifies getting too personalistic. I recognize that it becomes more difficult when it looks like somebody is consciously lying and distorting the truth just for indulging in political hackery, and there are several of the Biden Derangement Syndrome crowd who seem to veer into that.. But I also recognize that disliking particular politicians or particular views on economics or even the matter of abortion, about which I have strong views, well, political differences do not themselves justify getting excessively personalistic in my view.

I shall note there is one issue where I really find myself not willing to tolerate some views, and it is not domestic. It is Putin’s invasion of Ukraine, which is seriously evil and without a shred of justification. Thousands of innocent people are being killed, and I find none of the arguments being made to support this remotely justifiable, So I find myself tending to get personalistic with those who seem to spout Putin’s lines, with those around here doing so so well known. And what-aboutism regarding past bad behaviors by the US does not cut it and does not justify what Putin is doing and doing right now massively Heck, he just bombed a mall with a thousand civilians in it.

My one exception for this is people who are ethnic Russians in Russia, some of whom I know personally and like and respect, but whom I also know are in a milieu where they are overwhelmed with a massive media blitz telling them lies that it is hard to separate out and are surrounded by people who also believe the lies. They are not like the people here who believe Trump’s Big Lie about the election who have plenty of alternative media sources telling them the facts. The semi-independent media that was in Russia is gone. It makes me think less of those people than I did, but it is not the same as what I think of people in the US defending Putin, who really have no excuse or justification for doing so. He really is getting to be as bad as Hitler.

To Menzie,

I had forgotten about Steven’s faux pas with the “China virus” bit. That really was over the top. The other area where I find him being downright creepy is the whole immigration issue, especially in connection with his remarks about Puerto Rico. That whole area is one where when I have seen pgl and Moses calling him names and gong after him hard and personally I have had some sympathy with it.

Steven,

I continue to respect your knowledge on certain topics, even when I disagree with your conclusions or analysis. I also catch that some who are down on you for political reasons do not quite get what your views are. Thus I remember that you actually opposed Trump, even as you criticized both Hillary and now Biden. I think pgl is off on identifying you as a big fan of Orban’s, although you have said that he is politically capable. But so is Putin, whom I know you despise. It is my impression, perhaps incorrect, that you do not support Orban, although you note that he is better than the right wing Jobbik opposition, a subtle point. Personally I like Hungary and Hungarians, so I find it disturbing that it seems that so many there hold such awful views that both Jobbik and Orban are so popular. Gag, as I like to say.

It is curious that you say pgl is not as good an analyst as he used to be. I happen to agree that he is overdoing the personalistic attacks on you, even as I think they pale beside what Moses dumps on me. But, sorry, I think you are the one who seems to be sort of declining on the analysis side, with pgl holding up on that pretty well. I have noted several times now about how on two matters you have been disturbingly not on top of things. I do not think that back in the old days of this blog you would have made such elementary errors as not seeming to know how to read figures in log terms or somehow thinking that V for any measure of M has been remotely constant in recent years.

AS, thank you. I agree fully.

CoRev,

Ah, you agree with AS, while you keep going on about “Barking Bierka” here. You really are quite a spectacle.

I think we’re in a recession, yes. So that would put me down for a negative print for Q2.

As for abuse, there are two problem commenters on Econbrowser: Moses and pgl. Back in the day, before those two came on the scene, we had lively and at times personal debates on Econbrowser, but it was mostly smartest-guy-in-the-room stuff. Mostly not too personal, a lot of, “Yes, but have you considered Card and Krueger” — that sort of thing.

With Moses, and in particular with pgl, it has become all ad hominem stuff. Pgl is a weird guy. Historically, he was a pretty good analyst. Then something happened in his life and he has become engulfed in anger and bitterness. Nowadays, he leads with his emotions, and I routinely tag him for it, which just makes him more enraged. “Money has nothing to do with aggregate demand.” I had to laugh. But pgl knows that money features prominently in aggregate demand, else we wouldn’t have monetary policy, would we? So why did he write it? Because he’s carrying around a lot of stress, a lot of stress about where he is in life. He’s striking back emotionally, not intellectually. He’s not in a good place.

So what to do?

Well, Menzie could ban pgl, and I have suggested this multiple times. As I have written about conservative theory, it has three basic requirements: safety, propriety and conformity. By propriety, I mean written rules. Menzie has them, but he does not enforce them, at least not impartially. By conformity, I mean acting in accordance with accepted customs. In a technical dialogue, that would mean directing your comments towards the substance of the other’s argument, not towards the individual’s personal merits. If these two don’t work, then a liberal system will — paradoxically — collapse. The right of a person to express themselves in a function of being saved from intimidation. If the group does not enforce these rules, then the playground will be run by the local bully. Put another way, liberalism rests on conservative foundations. Menzie does not understand this, and hence the mean tone which the blog has taken. He equates liberalism with anarchy. They are not the same thing.

Alternatively, pgl could also get a life, by which I mean

1) he should put down the bottle and go outside for a walk around the block

2) he should get regular exercise

3) he should heavily ration the time he spends on Econbrowser (not the only one with this affliction, I would add), and

4) he should find a topic and make it his own

Let me elaborate of the last point. Nowadays, you can become an expert in pretty much any topic you choose. The source data is almost all public, and if you have the technical skills, you can make good headway in almost any topic you choose. I am often criticized for ‘pretending to be an expert’ in something. What I do is check the data sources and run some analyses. Since this appears a rare activity, yes, in the topics that interest me, I will be sometimes be an expert by comparison with the other commenters here.

Let me give you an interesting example of something pgl could do. We are having an implicit debate about whether V, the velocity of M2, is ‘constant’ (ie, mean reverting), as Milton Friedman and I imply in our respective analyses; or whether V can have permanent displacement to some new level, implicitly the pgl, Menzie and Slugs camp. This is a pressing issue in our time, and I’d note that pgl made a trenchant comment about M2 and GDP after 2008. I have added that line to my graph, but not published it. However, it is true that GDP-adjusted M2 rose substantially more than observed inflation would suggest over the 2008-2019 period. Was this due to the depression? (I think so.) Was it due to demographics? (Maybe.) A comparative decomposition of V on a sources-and-uses basis would be enlightening, I think. I am pretty sure pgl has the technical skill to do that analysis. I would be interested in what he finds, and I think it would be useful to the economics community as a whole. That would be a more constructive use of his time and make him feel better about himself. It would be more about building himself up than tearing others down.

Finally, people ask why I continue to comment here. First, it is probably habit. Econbrowser is really the only place I have historically commented in volume, in part because the venue was friendly to longer and more involved debates about given topics. Just to make the contrast, MR is not really good for this sort of thing. The comments are too short and jumpy for my taste. So partly I am here out of habit, perhaps bad habit.

Implicitly, though, the assumption is that the playground should be ceded to the bully. That’s really the same argument as abandoning Ukraine to Russia because, well, why fight it? Many commenters have left. I am still here. Maybe I am just the kind of guy who resists the playground bully or perhaps tries to get on with it, regardless.

“We are having an implicit debate about whether V, the velocity of M2, is ‘constant’ (ie, mean reverting), as Milton Friedman and I imply in our respective analyses; or whether V can have permanent displacement to some new level”

This is your shining example? Milton Friedman would agree with me on this one – not you. This has been pointed out to you many times buit did you pay a lick of attention? Dr. Chinn has written on this many times but did you notice? Of course not. And I have said the obvious – velocity is a dumb ration that has nothing to do with economic behavior. But did you notice that? Of course not.

No – you do not even try to address actual economics. But you do routinely insult actual economists who know a lot more than you ever will.

Steven Kopits: If I can remind you, you accused me — without a shred of evidence and tremendous ignorance — of being intimidated by China. And yet you remain free to post on this blog. If I applied the stricture of no personal attacks, pretty much nobody would be able to comment. And your defense of the use of the term “China virus” strikes me as coming very close to tipping you into the racist category, akin to crying “fire” in a crowded theater.

Menzie –

I think the balance of evidence suggests that the virus came from the Wuhan lab. Per John Stewart:

“A chance?! Oh, my God,” Mr. Stewart replied incredulously. “There’s a novel respiratory coronavirus overtaking Wuhan, China. What do we do? Oh, you know who we could ask? The Wuhan Novel Respiratory Coronavirus Lab. The disease is the same name as the lab. That’s just a little too weird, don’t you think? And then they ask the scientists, like, ‘How did this — so, wait a minute. You work at the Wuhan Respiratory Coronvirus Lab. How did this happen?’ And they’re like, ‘A pangolin kissed a turtle? Hurrrm. … Maybe a bat flew into the cloaca of a turkey and then it sneezed into my chili — and now we all have coronavirus.’ Come on!”

“Oh my god, there’s been an outbreak of chocolatey goodness near Hershey, Pennsylvania,” Stewart exclaimed. “What do you think happened? Like, oh, I don’t know. Maybe a steam shovel mated with a cocoa bean — or it’s the f-cking chocolate factory! Maybe that’s it!”

We’re this close to a world war with China, and tell me, Menzie, where does the Chinese-American community stand on the matter? Where are the protests supporting democracy in China? I haven’t seen them on the news. Maybe you can dig up a list of them for me.

You think it could be bad for the Chinese-American and Chinese expat community if we lose a couple of carriers in the South China Sea? Yeah, it could be. So where are the “Down with Xi!” posters, where are the “Democracy now for China!” protesters?

Steven Kopits: Well, I don’t keep in touch with the “Chinese-American” community much, as it is wide and heterogenous. There are some who are descendants from before th 1800’s pre-Exclusion Laws, there are some who came over in the past 40 years, as China opened up; there are some who are from Hong Kong; there are some from Taiwan. Heck, some who you would call Chinese-American are from or descended from people from Singapore, Malaysia or even Vietnam. Where do these people stand? I don’t know. All I can speak for is me, and where my community of Chinese-Americans from the rural areas of Guangdong would generally think. They would view negatively the actions of a CCP bent upon expanding power by threatening war. Among the socioeconomic group associated with my family, war is not usually something viewed positively.

Steven,

Ooooops! I guess you have not been keeping track on the whole origin of Covid debate. I am the one who was on the receiving end of massive amounts of ridicule from dear old Moses (and some from pgl as well) for bringing up that US intel was still thinking the lab might be the source at a certain point, reporting on David Ignatius reporting on this in WaPo, whom Moses made a fool of himself by mocking. I have even pushed variants of this here, such as that maybe it came from the less well-known lab in Wuhan closer to the notorious market rather than the bigger one most of the attention was paid to..

But, as a matter of fact, some months ago new information indeed came out that makes it much more likely that origin was directly from nature through the notorious market. They seem to have pinned down the part of the market if came from, along with some other pretty strong indicators. Are there still some loose ends? Yes, and as I have repeatedly argued on this we shall probably never fet an absolutely definitive answer. But the hard fact is that a lot of the serious people who were arguing for the lab as the source have changed their minds due to this more recent information. You do not make yourself look too serious by actively pushing this lab origin story now as a still credible view.

Like Keynes, I am willing to change my mind when confronted with new information. Did you see that new information?

BTW, glad to see it confirmed as I noted above that you indeed did not support Trump, despite your lack of enthusiasm for his opponents. I also agree that it will be too bad if voters in the US put in pro-Putin politicians because of inflation this fall, although, who knows? Maybe anger over the Roe v Wade decision will turn the politics around. There are some signs that might happen. And, heck, inflation might even come down sufficiently to weaken the anger over it, although I am not gong to call just how much it will decline, if at all.

AS,

If we were all dispassionately discussing economics, as you do, getting along while disagreeing would be a great thing to do. However, when politics enter the discussion, things change. Motives become suspect.

You may have noticed that some commenters turn everything into a reason to condemn the President. He’s to blame for inflation. He shouldn’t have stood up to Russia when it re-invaded Ukraine. The assertion that the U.S. is in recession or that recession in going to begin next month (before the mid-term elections, in any case) when no credible evidence exists is part of propaganda effort aimed at affecting political outcome. Being polite toward schemers and liars can carry a high cost.

We are in the middle of the biggest threat to the Union since the Civil War. Mr. Kopits has snuggled up to Steve Bannon, who was instrumental in the current threat to democracy rolling. Kopits has ginned up this notion that oil consumption is an important indicator of recession not just because he tries to make money talking about the oil market, but because he wants voters to believe the U.S. is in recession ahead of the mid-term elections.

I like your approach; demonstrating that Kopits is wrong about economics is one way to serve the greater good. You’re good at it. It is not, however, the only way to deal with schemers and liars.

“Mr. Kopits has snuggled up to Steve Bannon, who was instrumental in the current threat to democracy rolling.”

I cannot confirm or deny that Stevie is BFF with Bannon but we do know he has written some things that come close to Bannon’s hate of Hispanics. We do know Stevie’s grand achievement is to appear as some sort of expert on Fox and Friends. And we do know he is all in with that fascist who is in charge of Hungary.

But none of this is my problem with Stevie. My problem is that Stevie THINKS he knows more economics than people like Janet Yellin so he THINKS he has the right to insult her and other smart people. Why do I call him an arrogant moron? Well – he knows nothing about economics which he proves hourly. And he is the most bombastic bozo I have ever met.

Duckie –

This is full of falsehoods and misrepresentations. First, I voted for Biden and Hillary. So let’s start with that.

As for standing up for Russia, I said that Biden should have told the Russians we would meet them in the field, and further, right here in Econbrowser, that we should have intervened militarily in 2014. I am among the uber-hawks on the matter, with the proviso that I believed a negotiated, financial settlement over Crimea and Donbas would have been preferable to the war. Perhaps you think differently. But, yes, I see Ukraine as a catastrophic failure of deterrence by the Biden administration. It is a frank failure of understanding the role of the hegemon.

The assertion that the U.S. is in recession or that recession in going to begin next month (before the mid-term elections, in any case) when no credible evidence exists is part of propaganda effort aimed at affecting political outcome.

Right now, 55% of Americans think we are already in recession. Do you really think that millions are milling about Econbrowser seeking my advice about the business cycle? Do you think they’re waiting for my go-ahead to vote Republican? Of course not. They are going to vote inflation, housing prices, interest rates, gasoline prices and unemployment, if we get there. Nothing any of us writes here is going to swing the election. People are going to vote their personal experience and the Democrats are going to be obliterated, I suspect. I have written about this at length with UK Labour as a template of the outcome. This is not good for the country, in my opinion, but that’s where I think we are heading.

If you want some ulterior motive for thinking about recession, it’s Ukraine. Right now, Ukraine probably needs on the order $15 bn / month in support if I include budget shortfalls, military equipment purchases and refugees costs, figure $150 / year, something like that. As much as 2/3 of that — close to $100 bn / year — could land up on the Federal budget. We’re well over $40 bn now, and we’re only four months into the war.

So, if the US goes into recession and the Democrats are obliterated in November, what is the outlook for Ukraine support going forward? Will the US swallow a potentially punishing recession and be willing to pony up $40-50 bn at a pop when its own population is struggling? Don’t-worry-be-happy is not a sufficient strategy. Playing ex-post armchair quarterback is not sufficient. You have to look ahead at take the ball early. That’s what’s on my mind.

As for Hispanics (technically being one myself):

50 migrants dead after being found inside sweltering semitruck in San Antonio, with more hospitalized

https://www.cnn.com/2022/06/27/us/san-antonio-migrants-found-truck/index.html

This is the direct result of US immigration policy and it is entirely avoidable with a market-based approach.

Sreven,

It may well be that 55% of Americans think we are in a recession, but it is pretty clear that lots of them do not know what that means or is. Clearlyi people are upset about inflation is higher than they either have ever seen, lots of them, or not for a long time, and for many or most it is rising more rapidly than their nominal incomes, so they are feeling real economic pressure. They think that is bad, and it is for them, and they know “recession” is bad, so they say that is what is heppening.

But there is this crucial part of this, which you do know well, the matter of employment. And so far we are not seeing anything noticeable with that going on other than the contnuation of what is just about the hottest job market ever seen. But somehow that does not impress them, or most of them anyway.

Here you go. Gasoline and distillate consumption with today’s EIA data. Looks bad.

http://www.prienga.com/blog/2022/6/29/is-the-us-economy-cratering

“AS

June 27, 2022 at 12:33 pm

I am not invoking RBG to praise Steve. I am just saying why do we need the personal attacks.”

Look – you are right. But note how this started. Stevie has been attacking some of the best economists in the business. Take this out with him.

New orders for durable goods remain strong.

Econoday consensus forecasted an increase of 0.1% for the month of May.

The Econoday forecast range was from -1.3% to 1.0%.

Bloomberg consensus also forecasted an increase of 0.1% for May.

Actual new orders for durable goods increased by 0.7%.

May YTD new orders showed a change of 11% compared to 12% for April YTD.

https://us.econoday.com/byshoweventfull.asp?fid=541697&cust=us&year=2022&lid=0&prev=/byweek.asp#top

https://www.bloomberg.com/markets/economic-calendar

https://fred.stlouisfed.org/series/DGORDER

Although there is not enough data for a confident forecast using readily available data starting in 1992, a probit model suggests a very low probability of being in a current recession or within one month.