A 2.6% q/q dive in Chinese GDP is unsurprising, but unwelcome nonetheless:

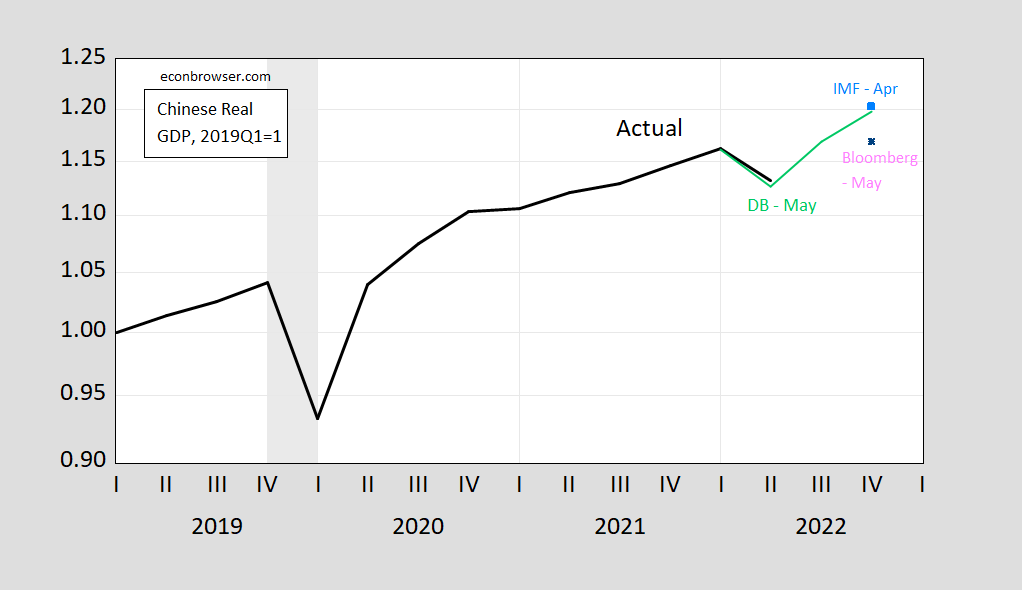

Figure 1: Chinese real GDP, 2019Q1=1 (black), IMF April World Economic Outlook forecast (sky blue square), Deutsche Bank May 17 forecast (light green), Bloomberg Economics May 20 (pink triangle). ECRI defined recession dates shaded gray. Source: NBS via Tradingeconomics.com, IMF, Deutsche Bank, Bloomberg Economics, ECRI, and author’s calculations.

As I noted three months ago, both Goldman Sachs (not shown above) and Deutsche Bank foresaw a sharp drop, partly as a consequence of the government’s zero covid policy , as well as the deteriorating real estate sector. (Bloomberg consensus just before the release was for -1.5% q/q versus actual -2.6%.)

Garcia Herrero and Xu at Natixis (7/15) note:

Moving forward, we expect the Chinese economy to fare slightly better in H2 2022 on the back of eased measures to reopen the economy, but the weak GDP performance in H1 2022 makes it hard to achieve the government’s initial growth target (5.5%). We would expect the Chinese government to review it downwards. Given the information so far, we maintain our annual growth prediction of 3.5% for 2022, but some relevant downward risks remain. First, the pandemic continues to evolve with new infectious variants, namely, BA.4 and BA.5, which could bring more challenges for China to contain Covid spread. Second, the sluggish property market sees little sign of recovery. If anything, it is getting more complicated as problems are moving beyond developers to households and, through their mortgages, potentially to banks. Finally, the global economic environment is worsening very fast as the odds for a global recession increase, with a special focus on the US due to inflation and a very hawkish Fed but also Europe due to the war in Ukraine and high energy prices.

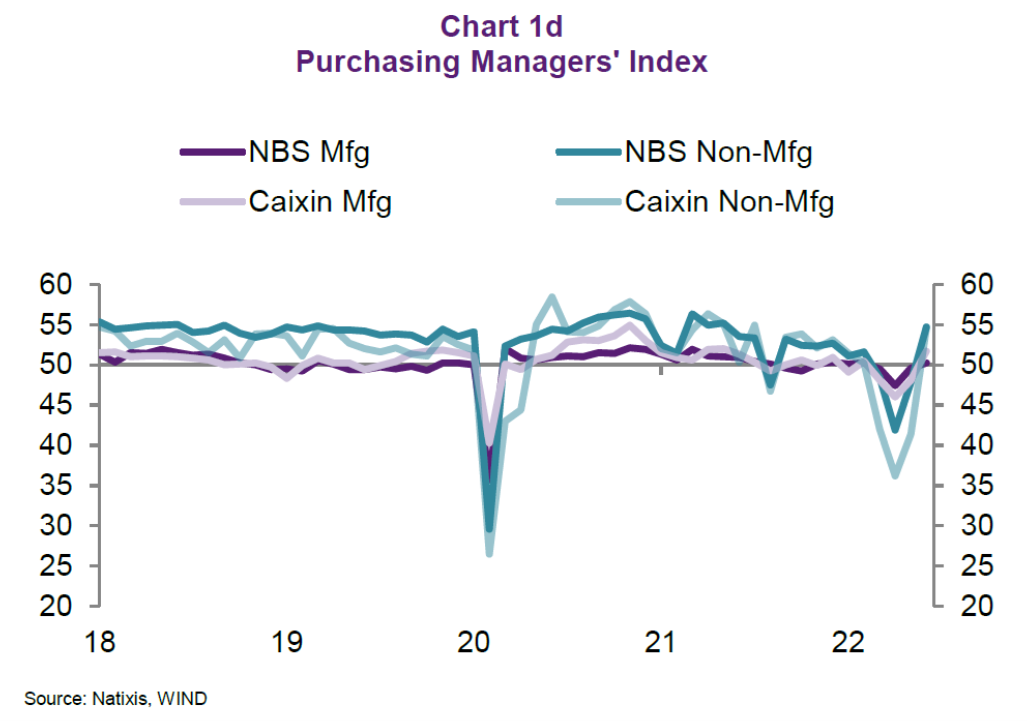

For now, a resumption of growth seems apparent in forward looking data:

Source: Natixis, 15 July 2022.

The news regarding the challenges for Chinese growth has obvious implications for the global economy. From Reuters:

Friday’s frail data adds to fears of a global recession as policymakers jack up interest rates to curb soaring inflation, heaping more hardship on consumers and businesses worldwide as they grapple with challenges from the Ukraine war and supply chain disruptions.

“A 2.6% q/q dive in Chinese GDP is unsurprising, but unwelcome nonetheless”

As you note Goldman Sachs forecasted this temporary decline in China’s real GDP. Goldman Sachs is forecasting a modest increase in real GDP for the US for 2022QII. But of course Princeton Steve has told us that Goldman Sachs does not have a reliable economic model (actually they do but never mind that) as Princeton Steve knows we are in a recession.

https://news.cgtn.com/news/2022-07-16/Chinese-mainland-records-129-new-confirmed-COVID-19-cases-1bHTL172DN6/index.html

July 17, 2022

Chinese mainland records 154 new confirmed COVID-19 cases

The Chinese mainland recorded 154 confirmed COVID-19 cases on Saturday, with 106 attributed to local transmissions and 48 from overseas, data from the National Health Commission showed on Sunday.

A total of 537 asymptomatic cases were also recorded on Saturday, and 3,673 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 227,426, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-07-17/Chinese-mainland-records-154-new-confirmed-COVID-19-cases-1bJzOMe7Xmo/img/93909c4ec618441f82b4b636c0dc000e/93909c4ec618441f82b4b636c0dc000e.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-07-17/Chinese-mainland-records-154-new-confirmed-COVID-19-cases-1bJzOMe7Xmo/img/bd1361e7f0564455a3fa78dc3620b363/bd1361e7f0564455a3fa78dc3620b363.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-07-17/Chinese-mainland-records-154-new-confirmed-COVID-19-cases-1bJzOMe7Xmo/img/9f993ec0bbcf4eb5bc64c35d1f2513ff/9f993ec0bbcf4eb5bc64c35d1f2513ff.jpeg

https://www.worldometers.info/coronavirus/

July 16, 2022

Coronavirus

United States

Cases ( 91,250,392)

Deaths ( 1,048,822)

Deaths per million ( 3,155)

China

Cases ( 227,272)

Deaths ( 5,226)

Deaths per million ( 4)

https://english.news.cn/20220715/80dc0937df4f4efa93f8e12dce1e7632/c.html

July 15, 2022

China’s economy secures positive Q2 growth, steam gathering for further recovery

* The Chinese economy has achieved positive growth in Q2 despite downward pressure.

* A growing raft of monthly economic data indicates that the economy is regaining footing.

* The foundation for the sustainable and steady recovery of the economy will be further consolidated.

BEIJING — The Chinese economy has achieved positive growth in the second quarter (Q2) of 2022 despite downward pressure, with a recovery trend building up on the back of swift and strong policy support.

The GDP of the world’s second-largest economy expanded 2.5 percent in the first half of this year, data from the National Bureau of Statistics (NBS) showed Friday.

AN UNUSUAL JOURNEY

In Q2, the economy grew 0.4 percent. Due to the complex international environment and the impact of the COVID-19 outbreaks at home and other factors that exceeded expectations, downward pressure on the economy increased in Q2, NBS spokesperson Fu Linghui told a press conference Friday.

China saw steep falls in major economic indicators in April. Thanks to a slew of supportive policies, the country’s major economic indicators posted narrowed declines in May and rebounds in June.

“The economic growth didn’t come by easily,” Fu said.

The wide-range economic recovery came after central and local governments rolled out a package of pro-economy policies while the country’s COVID-19 flare-ups waned thanks to effective prevention and control efforts.

In late May, the State Council rolled out 33 measures in six areas to bring the economy back onto a normal track. Some taxes and fees were scrapped or deferred to reduce business burdens, digital coupons were given to residents to spur spending, and more jobs were created to keep employment stable.

“In the face of the impact of domestic and overseas periodic and unexpected factors, the Chinese economy has stabilized and rebounded in a relatively short period of time, demonstrating its strong resilience and huge potential,” Yuan Da, an official with the National Development and Reform Commission, China’s top economic planner, told a press conference Thursday.

STRONG RECOVERY SIGNALS

A growing raft of monthly economic data indicates that the economy is regaining footing.

The country’s purchasing managers’ index showed China’s factory activities returned to expansion territory in June after three consecutive months of contraction, sending a clear signal of economic recovery.

Friday’s data showed that China’s retail sales of consumer goods went up 3.1 percent year on year in June, reversing the negative growths in April and May.

China’s surveyed urban unemployment rate stood at 5.5 percent in June, down from 5.9 percent in May.

Data aside, visitor flows to shopping malls, cinemas, and restaurants are increasing.

“Our June business revenue grew 45 percent over May. The long queue of customers waiting for our food is back,” said Zhang Shengtao, director of operations with Beijing-based popular crayfish restaurant Huda.

KEEPING UP THE MOMENTUM ….

https://english.news.cn/20220715/ac1df34da88148dab19dc7005c61ef3a/c.html

July 15, 2022

China’s industrial output up 3.4 pct in H1

BEIJING — China’s value-added industrial output, an important economic indicator, went up 3.4 percent year on year in the first half (H1) of this year, data from the National Bureau of Statistics (NBS) showed Friday.

In June alone, industrial output growth quickened to 3.9 percent year on year, expanding by 3.2 percentage points from that in May, according to the NBS.

The industrial output measures the activity of designated large enterprises with an annual business turnover of at least 20 million yuan (about 2.96 million U.S. dollars).

June’s figure put the average growth during the second quarter at 0.7 percent, after logging a 2.9-percent decline in April and a 0.7-percent rise in May, the NBS data showed.

In a breakdown by ownership, the output of share-holding enterprises led the gains with a year-on-year growth of 4.8 percent in H1, followed by that of the private sector and state-controlled enterprises….

This iarticle s another example the reason many of us, including our host, have asked that you stop posting government-sanctioned economic reporting out of China. At best article lies by omission. Maybe it lies outright.

Chinese GDP fell in Q2, but his article claims it rose. At a guess, I’d say the rise reported in the propaganda piece compares year-ago GDP to Q2 GDP. In essence, it hides the contraction in Q2 under expansions in prior quarters. Hiding bad news is what China’s press is forced to do.

ltr, by posting this article, you are complicit in the lie. That’s so racist!

Kevin Drum notes how the dollar has appreciated since Biden became President:

https://jabberwocking.com/raw-data-the-us-dollar-is-the-strongest-currency-in-the-world/

‘The US may be suffering through high inflation, but so is everyone else. And our overall economy looks pretty good. The rest of the world sure thinks so, anyway … That’s the exchange rate of the dollar against a broad basket of other currencies, and it’s been going nowhere but up for the last year and a half. This is an indication that nearly everyone on the planet is betting that the United States is the best positioned economy in the world right now.’

Yea I get it – a lot of people see a strong currency as being the same thing as having a strong economy. But is it? We had a strong dollar in 1982 but no one with a brain would say the US economy was doing great. It all depends on what drove the dollar appreciation.

Now we do know it was a combination of Reagan’s fiscal irresponsibility with Volcker’s tight money that led to a macroeconomic mess in 1982 including that massive trade deficit.

This time may be different. We are enjoying a strong economy for now. But there are calls for tight money to rein inflation. I’m not forecasting the future and those on the board who are MAGA hat politically motivated clowns. But stay tuned as for once I would suggest Kevin sort of revisits the blog post.

The Biden Derangement Syndrome gang can only see bad things happening, and they are all Biden’s fault! Of course a strong dollar is a bad thing! Look what it will do to our trade balance!

A week ago WaPo conservative columnist Mark Thiessen was busy explaining what a terrible thing the low unemployment rate is. It shows we have a “worker shortage”!! And it is all Biden’s fault, the ARP making it possible for lazy workers to sit at home and not get out thwre and work!!! How Awful.

https://www.msn.com/en-us/news/world/russia-threatens-swiss-newspaper-with-legal-action-for-publishing-image-of-putin-with-a-clown-nose/ar-AAZFdly

Russian officials threatened a Swiss newspaper with a legal action after it published an image depicting President Vladimir Putin as a clown. Zurich newspaper the Neue Zürcher Zeitung, published the piece “Between Superheroes and Villains: The Power of Memes in the Ukraine War.” It discussed how viral images played a part in discussion of Russia’s invasion of Ukraine. The lead image featured Ukraine’s President Volodymyr Zelenskyy as Iron Man next Putin with a clown nose and colorful face paint.

OMG – Putin is more a thin skinned wuss than Trump.

If China continue its insane zero Covid policies, they will continue to see negative GDP growth. With the new Omicron B5 variant it will be impossible to control the pandemic with vaccines (it is quite immunity evading) and with lock-downs (it is just way to infectious). What their zero Covid policies can do, is wreck the economy and supply lines. If they actually do that, a lot of multinationals will lock China out of their future supply lines.

Yeah, the rebound in higher-frequency PM data suggest maybe a rebound n GDP in Q3, but that’s t likely to last if wide-spread shutdowns resume – and they are.

I say “maybe” for math reasons. The contraction seems to have bottomed in June, setting a weak base for Q3. In that circumstance, slow growth in each month of Q3 may not be enough to produce higher output in Q3 than Q2.

None of ltr’s “nothing to see here, move along” obfuscation changes the math

In addition, credit provision in China looks to be in disarray. Real estate trouble, the shadow banking crackdown, and now increased reliance on local and regional government finance all add up to grit in the gears. Henan’s ugly episode was one reflection of the problem. There is an increasing reliance on short-term borrowing and that’s never good.

https://chattek.com/blog/2022/07/17/china-growth-hopes-rest-on-troubled-local-government-financing-vehicles/

Speaking of which…

https://www.scmp.com/tech/big-tech/article/3185463/too-easy-borrow-debt-plagues-young-people-despite-chinas-scrutiny

This also points to the inferiority of authoritarian regimes. When your dictator is a germaphobe he can make very bad decisions that wreck the economy and make absolutely no sense from an unemotional science based perspective. In a democracy the germaphobe(s) would be voted down – to the benefit of short- and long-term economic growth. Both Australia and New Zealand have followed the science and scrapped their zero Covid approaches at this time.

No they aren’t