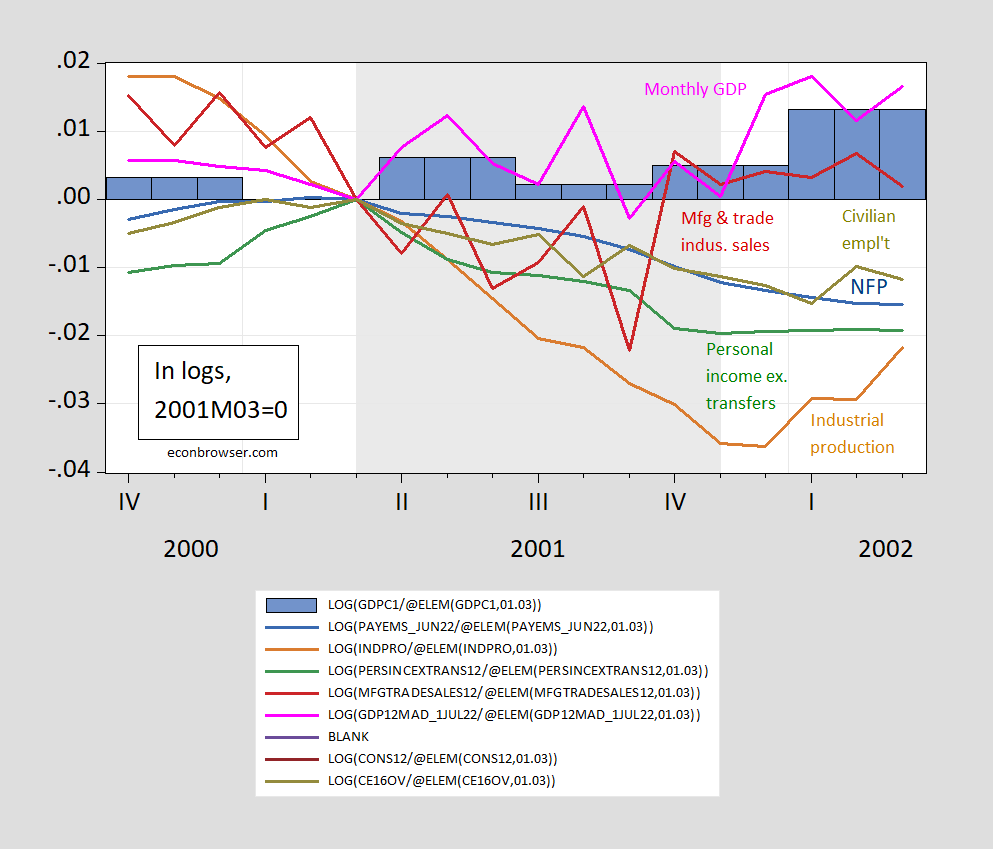

Here are data around 2001, for GDP, employment, industrial production, manufacturing and trade industry sales, personal income. Note: no consecutive quarters of negative growth, as in the Chris Cillizza rule.

Figure 1: GDP in Ch2012$ SAAR (blue bar), nonfarm payroll employment (blue line), industrial production (tan), personal income excluding current transfers, in Ch2012$ (green), manufacturing and trade industry sales, in Ch2012$ (red), All series latest vintage. Macroeconomic Advisers monthly GDP (pink), civilian employment (chartreuse), in logs, 2001M03=0. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, BLS, Federal Reserve, Census all via FRED, IHS Markit, NBER, and author’s calculations.

Use the two quarter rule, et voilà, there is no 2001 recession.

More on this in this post.

Huh – wasn’t Mankiw’s justification for the 2001 tax cut was that we needed more aggregate demand to counter this recession that never was. Oh wait team Bush43 also told us that tax cuts would raise national savings somehow (lower aggregate demand). Well at least the FED lowered interest rate keeping them “too low for too long” according to John Taylor who did not say that until 2010.

All I know is that the employment to population ratio remained depressed until around 2004 when the FED was raising interest rates.

Did we have 2 quarters negative in our last recession ?

If we fiddle around enough with the definition, then we can have a recession whenever we want and as long as we want.

“If we fiddle around enough with the definition, then we can have a recession whenever we want and as long as we want.”

That does seem to be Princeton Steve’s sole mission in life!

A story where I get to mock Princeton RECESSION Stevie and American cannot make semiconductors JohnH:

https://www.msn.com/en-us/money/markets/texas-instruments-rosy-forecast-counters-fears-of-slowdown/ar-AA100bkl?ocid=msedgntp&cvid=e2450ab5421249209cdf7961b8463f4d

(Bloomberg) — Texas Instruments Inc., the maker of chips used in everything from washing machines to satellites, gave a bullish forecast for the current period, countering concern that a slowing economy is hurting demand for electronics. Third-quarter revenue will be $4.9 billion to $5.3 billion, Texas Instruments said in a statement Tuesday. That compares with the $4.94 billion average estimate from analysts. Profit will be as much as $2.51 a share, the company said, ahead of projections. That helped lift the stock 2.6% in extended trading Tuesday and gave a boost to shares of chipmakers such as Qualcomm Inc. and Intel Corp., which also report their results this week.

OK we have wasted enough time with the fact free rants from these 2 trolls. I would say the Senate should pay pass the semiconductor bill the House passed and the President supports. Such good news needs to continue.

The question is not whether America can make semiconductors or not. The question is how long it will take Intel to catch up to Taiwan and China. And how much more the chips will cost. As I noted, China’s SMIC is already at the leading edge while Intel has yet to break ground in Ohio and will still be behind years down the road when product eventually starts to get shipped.

My guess is that if Intel gets on the dole, it will milk it for all it’s worth, just as US military contractors do—lots of delays and cost overruns. Somehow China seems to have avoided this kind of rampant exploitation by companies delivering strategically important products.

Am I cynical? Yes. But as Lily Tomlin once said, “ No matter how cynical you get, it is impossible to keep up.” Moreover you will be closer to being right far more often than most of the BS artists in the commentariat.

Dude – it seems you never got the fact that TSMC as a “foundry” is a contract manufacturer. Intel designs the chips which TSMC does not. And Intel is quite capable of setting up its own factories if they needed to.

Of course understanding the difference between designing a product and simply assembling the product is way over your little pea brain.

pgl: “Intel is quite capable of setting up its own factories if they needed to.”

And how long does that take? [Hint: I have a relative who spent the better part of a decade helping Intel build two plants.] And right now, Intel’s plans in Ohio are on hold pending the promise of US government pork. Anybody remember how well Scott Walker’s FoxConn deal worked out?

Intel’s best designs are in the 12-14 nm range; SMIC’s is 7 nm.

China has been shipping its leading edge chips for months now. So Intel is probably years away in both technology and construction.

But pgl thought it would be a brilliant idea to sabotage TSMC, the Taiwanese company that supplies the US with leading edge semiconductors, as a way to “get” China and deprive it of leading edge chips. Brilliant! Simply brilliant!! [What an idiot]

JohnH,

Looks like the pork will be arriving. Senate has passed the bill.

FocConn is a Taiwanese company. Intel is a US one.

You somehow think that both TSMC and the Chinese have a tech more advanced than Intel. Sorry, but likely Intel will jump over both of them and be more advanced.

“Intel’s best designs are in the 12-14 nm range; SMIC’s is 7 nm.”

Repeat after me – SMIC is a foundry aka contract manufacturer. It did not design anything – Samsung Electronics owns the designs.

Oh wait I’m using language you do not understand. Never mind.

This blog is the pits.

There’s always Peter Schiff. You’re roughly at the appropriate literacy level of his fanbase.

https://www.zerohedge.com/political/peter-schiff-white-house-recession-denial

The Pits, Exhibit A: “Moses Herzog”

I never enter the pits, because my tires never go flat and I’m a big hairy winning machine. Econned, like the frightened baby chipmunk, you are scared by anything that is different.

[ If you feel those may be lines stolen from a movie, please consider you may just have indigestion ]

Indeed, your comments are very much akin to indigestion… unproductive, undesired, uncomfortable, and underwhelming.

I’ll add you to my list of commenters to ignore.

Tyler Durden column? Damn it – I had to read it, which is almost as DUMB as a Princeton Steve blog post.

I can live without 2001. A marginal recession, really. And while we’re at it, what about that 1991 thing?

Are you starting a shadow NBER or what?

As a person who was in the construction industry, I can tell you for sure that there was a slowdown in construction in both 1991 and 2001, give or take. But whatever. When you are in that industry you get used to getting kicked in the teeth pretty regularly. I’m pretty happy not to be doing that any more.

I’m looking at the 2021 income statement for TEXAS INSTRUMENTS since JohnH is incapable of doing so. JohnH has told us the US cannot make semiconductors like the Chinese do. Seriously? Sales in 2021 were a mere $18.3 billion with a profit margin near 50%. I guess this proves Americans are so incompetent in this sector!

Fab plants are enormous, expensive installations. My guess, and it is merely a semi-educated guess, is that the capital investment in a fab plant is large enough that operating costs once it’s built aren’t all that significant. It’s probably cheaper to build a fab plant in China, since construction labor is less expensive, but once it’s in place, that advantage is far less important. There are probably geopolitical reasons for companies like TI to build in the US, Canada, and maybe Mexico.

Semiconductor contract manufacturing is indeed very capital intensive. This is why their cost to revenue ratios are quite modest. I had encouraged JohnH to check out the financial statements of these companies. After all they are publicly traded. But real research is not something JohnH ever does.

https://www.nytimes.com/2022/07/26/opinion/recession-gdp-economy-nber.html

July 26, 2022

Recession: What Does It Mean?

By Paul Krugman

There’s a pretty good chance the Bureau of Economic Analysis, which produces the numbers on gross domestic product and other macroeconomic data, will declare on Thursday, preliminarily, that real G.D.P. shrank in the second quarter of 2022. Since it has already announced that real G.D.P. shrank in the first quarter, there will be a lot of breathless commentary to the effect that we’re officially in a recession.

But we won’t be. That’s not how recessions are defined; more important, it’s not how they should be defined. It’s possible that the people who actually decide whether we’re in a recession — more about them in a minute — will eventually declare that a recession began in the United States in the first half of this year, although that’s unlikely given other economic data. But they won’t base their decision solely on whether we’ve had two successive quarters of falling real G.D.P.

To understand why, it helps to know a bit about the history of what is known as business cycle dating.

A modern economy is a constantly changing thing, in which individual industries rise and fall all the time. (Remember video rental stores?) At some point in the 19th century, however, it became obvious that there were periods when almost all industries were declining at the same time — recessions — and other periods during which most industries were expanding.

To understand these fluctuations, economists wanted to compare different recessions and search for common features. But to do that, they needed a chronology of recessions, one based on a variety of measures, since G.D.P. didn’t even exist yet as a concept, let alone a number regularly estimated by the government.

A seminal 1913 book * by the American economist Wesley Clair Mitchell is widely credited with beginning the systematic empirical study of business cycles. In 1920, Mitchell helped found the National Bureau of Economic Research, an independent organization that soon found itself devoting much of its research to economic fluctuations, and began offering a chronology of business cycles in 1929.

Since 1978 the N.B.E.R. has had a standing group of experts called the Business Cycle Dating Committee, which decides — with a lag — when a recession began and ended based on multiple criteria, including employment, industrial production and so on. And the U.S. government accepts those rulings. So the official definition of a recession is that it is a period that the committee has declared a recession; it’s an expert judgment call, not a formula….

* https://fraser.stlouisfed.org/files/docs/publications/books/mitch_buscyc/mitchell_buscyc.pdf

ltr,

My only wiggle on this is that Krugman makes it look like Mitchell and NBER were talking about “recessions” from 1920 on. Of course, there were lots of economists who studied business cycles much earlier, far back to the beginning of the 19th century. But it is true that Mitchell and his people at the NBER really began doing so by the systematic gathering and analysis of data.

Anyway,, the point I want to make is that the term “recession” does not date back as far as 1920. Declines were called “depressions,” as in the 1870s and 1890s. The term “recession” originated with the downturn of 1937, essentially a smaller secondary decline within the larger Great Depression. I think what happened is that the Great Depression was so “great” that it made it difficult to use that word for subsequent declines. Arguably what is now called “the Great Recession” of 2007-90 was deep enough and long enough to count as a depression, with it having the major financial collapse involved that it could quality. But there is it is, merely a “Recession,” if at least a “Great” one.

pgl: “Intel is quite capable of setting up its own factories if they needed to.”

And how long does that take? [Hint: I have a relative who spent the better part of a decade helping Intel build two plants.] And right now, Intel’s plans in Ohio are on hold pending the promise of US government pork. Anybody remember how well Scott Walker’s FoxConn deal worked out?

Intel’s best designs are in the 12-14 nm range; SMIC’s is 7 nm.

China has been shipping its leading edge chips for months now. So Intel is probably years away in both technology and construction.

But pgl thought it would be a brilliant idea to sabotage TSMC, the Taiwanese company that supplies the US with leading edge semiconductors, as a way to “get” China and deprive it of leading edge chips. Brilliant! Simply brilliant!! [What an idiot]

You repeated your latest stupidity?

One more time for the peanut gallery. SMIC is a foundry aka a contract manufacturer. They do not own the designs. Maybe Samsung Electronics does.

Of course you are so incredibly stupid you have no effing clue what I just said. So you just repeat your incessant BS ignorant of the fact that the rest of us are laughing at you.

“So Intel is probably years away in both technology and construction.”

Once again our Village Idiot proves he does not know the difference between designs (technology) and contract manufacturing (construction). JohnH claims he worked for a Fortune 200 company but refuses to tell us which one. Oh yea – it went bankrupt because of the incompetence of employees like JohnH!

Have you ever checked the 10K filing of Intel? They clearly talk about their push for technological innovation. SMIC and TSMC do not.

Intel’s profits margin is near 25% on $80 billion per year in sales. This after deducting the $15 billion per year in R&D on new designs. Tell me this since you think you are now a semiconductor expert (snicker), how much did SMIC spend on R&D for new designs? We will wait as this should be fun.