Using latest vintages of data:

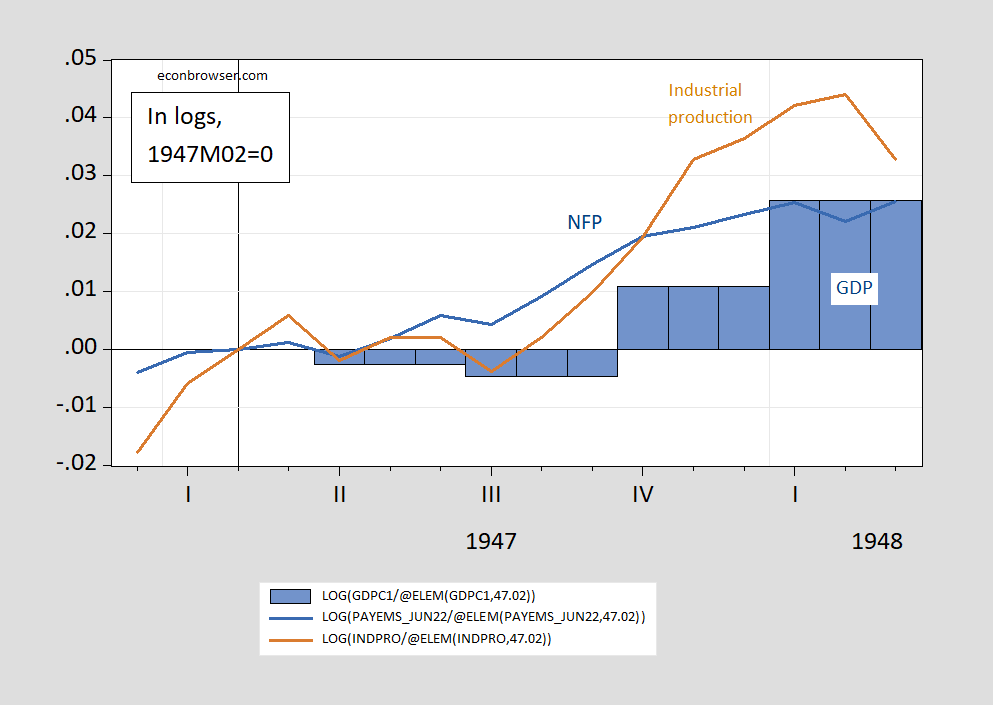

Figure 1: GDP in Ch2012$ (blue bar), nonfarm payroll employment (blue), industrial production (tan), all in logs 1947M02=0. All latest vintages. Source: BEA, BLS, and Federal Reserve via FRED, and author’s calculations.

Official GDP registered a 1% and 0.8% declines in Q2 and Q3 (SAAR). This period is not defined as a recession by the NBER BCDC.

The point of these fine posts in response to challenges, is that present conditions are simply not recession conditions. The problem as I anticipate is whether the Federal Reserve will slow the economy to a recession level but that will be months in coming. I understand worrying, and I wish we had looked at adopting a price “policy” by late last year, but a recession is just not here no matter the worry.

Well, the reason the NBER may have decided Q2 and Q3 of 1947 wasn’t a recession is that inventory adjustment accounted for most of (more than all of) the contraction in real GDP in those two quarters:

https://fred.stlouisfed.org/graph/?g=Scos

Inventory adjustment must not have been seen as enough reason for a “technical” recession.

Remind me – have there been other periods in which overall economic performance was good, but real GDP fell due to inventory adjustment? Wouldn’t one expect NBER to make similar judgements in similar periods?

By the way , the reason for all the attention from our host to the proper definition of “recession” is that partisan goons have worked ever-so-hard to say that a recession is underway now, despite evidence to the contrary. Why would partisan goons go to all that trouble? Allo mtheye to man-splain; they do it in order to blame President Biden for a recession ahead of mid-term elections this fall. Never mind that we are almost certainly not in recession. Because bad news for Biden must be bad news for Democrats at the polls.

Funny, though – people who follow politics for a living disagree with the partisan goons. Support for Democrats in “generic candidate” polls is more predictive of mid-term election results than is presidential approval. Turns out, generic Democrats are much more popular than Biden right now:

https://fivethirtyeight.com/features/why-democrats-midterm-chances-dont-hinge-on-bidens-approval-rating/

Republicans lead in generic candidate polling by 1 ppt on average in recent polls, with Democrats leading in several of those polls. That ain’t all good for Democrats, but it’s not the terrible case that headlines about Biden’s popularity suggest. It may also mean that the recession lying that lying liars have been doing about isn’t worth all that damage to thier souls. Biden isn’t the Democratic Party, so blaming him for a recession that isn’t happening may be a stupid waste of time. Go figure.

We may or may not be technically in a recession. But one thing is for certain: the economy isn’t doing that well, which makes Republican claims plausible. And inflation is high enough and economic growth low enough for Democrats to have to do a lot of spinning to try and convince voters that things are not all that bad.

Reminds me of most of the Obama years, when economic growth was anemic. Democrats had to do a lot of spinning back then, too…and we ended up with Trump.

Good job, Democrats!!! [sarcasm]

Horse apples, Johnny. Complete horse apples. Why do you write such…apples?

Job growth under Obama was strong, though it began weak because of the Great Recession. GDP growth was also strong after a weak start. Inflation was tame. As a result, consumer moods improved steadily during Obama’s presidency:

https://fred.stlouisfed.org/graph/?g=SeeA

Obama won a second term and left office with very high public approval. And Hillary won the popular vote. Johnny, you keep claiming that Obama’s economic record was bad and resulted in Trump being elected. Only ignorance or dishonesty, or perhaps a mixture of both, could lead you to make that claim.

Given you record, I’m gonna say it’s both.

“the economy isn’t doing that well”

Employment growth has been very strong and the unemployment rate is very low. Yea – the economy is in the crapper.

Yeah, according to Democratic partisan hacks rewriting history, the Obama economy was great. But bear in mind that real wages grew only about 3% under Obama.

And voters were the ultimate judge…though Democratic partisan hacks attribute Hillary’s loss entirely to Russia and racism…guffaw, guffaw…

Once it tuned around early in Obama’s term, its growth record was about the same as what Trump’s was prior to the pandemic arriving. Of course, when Trump took office, it looked a lot better than it did when Obama took office, thanks to the growth in the Obama period.

I guess you do not know this, do you, JohnH, you are so full of false “information”?

“Official GDP registered a 1% and 0.8% declines in Q2 and Q3 (SAAR).”

Followed by a decent increase in Q4. Now only someone who flunked preK arithmetic would get Princeton Steve’s 11% decline. The funny thing – he keeps repeating this BS even after we have shown him it is false.

@ pgl

I seem to remember you making a fair share of comments about the accounting profession on this blog, so on the chance you had missed it I thought I would pass this along to you:

https://www.reuters.com/business/finance/uk-watchdog-fines-kpmg-24-mln-over-carillion-regenersis-audits-2022-07-25

” KPMG was fined 14.4 million pounds ($17.27 million) on Monday after the accounting firm admitted to providing false and misleading information to its regulator during spot checks on audits of construction firm Carillion and outsourcing firm Regenersis. The Financial Reporting Council, the regulator involved, also ordered KPMG to appoint an independent reviewer into the firm’s current Audit Quality Review (AQR) policies and procedures.”

If KPMG wants to emulate what Andersen did some 20 plus years ago – they are risking all of their precious partnerships. Sorry but no one misses Andersen and no one will care if that golfer has to stop wearing his stupid KPMG hat.

What’s behind the effort to banish the suspicion that we might be in a recession? Politics?

The New York Times has a piece that talks addresses that: “Biden Insists There’s No Recession as He Confronts Latest Economic Risk.

Officials have tried to ditch a shorthand definition for what constitutes a recession and reassure skeptical voters about the U.S. economy.”

https://www.nytimes.com/2022/07/27/business/biden-recession-us-economy.html

You want to be Princeton Steve’s little minnie me now? So precious!

Spoken like the Democratic political hack that pgl is…

Sadly, the economics usually published by “experts” in the media and the in blogosphere is all too often nothing more tan spin:

“ Americans are caught in the middle of a showdown between dueling experts. While each side can score points in the short run, it comes at the price of economists’ credibility in the long run. Americans are already losing faith in public institutions. Congress and the bureaucracy are reaching new lows in popularity. Public health officials are now routinely ignored. Whatever our ideological disagreements, surely we can acknowledge Americans are better off when our institutions are functional and those who staff them competent. This applies to economics, too. Nobody wins when economists assume the role of court intellectual.

Economics is a science. It helps us understand human action and predict how societies produce and allocate resources. However, economists’ expertise does not give them a privileged voice in the public square. The art of self-governance is broader than the science of economics. Once upon a time, before they marched on Washington, economists understood this point.“

https://www.newsweek.com/how-politicized-economists-got-inflation-wrong-both-sides-opinion-1670746

So Democratic apologists waste their time arguing that it’s not so bad while Republicans argue that it’s worse. Lost in all this spin is the fact that the current economic situation is simply not acceptable, whether we’re technically in a recession now or whether it’s just around the corner. How about if economists focus on the problem rather than spinning it for partisan advantage?

“Spoken like the Democratic political hack that pgl is…”

You love this stupid little insult – don’t you? Never mind that is a total lie – that is what you do. We have asked you to grow up but it is clear by now that you are incapable of doing so.

“Economics is a science.”

This from someone who thinks blood leaching is modern medicine. Is anyone paying you for that incredible dumb babble? If he is – he is wasting his money big time.

ALEXANDER WILLIAM SALTER , PROFESSOR OF ECONOMICS IN THE RAWLS COLLEGE OF BUSINESS

Someone who teaches MBAs at a school no one ever heard of? Who you portray as experts tells us all we need to know – you are a clueless little clown.

JohnH,

There is a rather serious difference between the current argument over whether if GDP growth is negarive in Q2 that means there is a recession or not versus last year’s arguments over whether or not inflation was transitory. The latter actually had economists on both sides of the argument. In the end it turned out the non-transitory people were right, but for the wrong reasons: it had more to do with the delta variant and then Russian invasion of Ukraine than the ARP fiscal stimulus or monetary policy.

The current debate is not between economists. It is between economists, virtually all of whom know that recessions are defined by the NBER’s committee on business cycles based on varoius indicators and is not defined as two successive quarters of GDP decline. The people arguing for the latter are all non-economist politicians or journalists. This is not an argument among economists. It is one between economists and a bunch of politicized hacks and ignorant journalists looking for headlines.

As for this Alexander William Salter, he is an Ausrtrian libertarian. Checking on google scholar, he does have publications with citations, although none exceeding 100 citations, a very intermediate record.

https://www.awsalter.com/

is Salters page. He has a great pic of himself top page, could be the next Krugman or even a KPMG fellow.

So Barkley, it’s entirely acceptable to you that economists take sides on a partisan basis, rather than just calling it as it is and splitting hairs to say whether or not the economy is technically in a recession or not.

I’ll go with Kuttner on this one.

“ GDP declined at an annual rate of 1.4 percent in the first quarter; when the second-quarter numbers are released tomorrow, they will either show that it declined for the second consecutive quarter—the technical definition of a recession—or barely averted that fate.

It doesn’t much matter, the economy is clearly slowing; but the Fed is sticking to its perverse course. Sooner or later, tighter money will drive the economy into full-blown recession.” https://prospect.org/blogs-and-newsletters/tap/biden-talks-up-economy-while-fed-mashes-it-down/

What? An honest assessment of the economy? Perish the thought!!! Gotta spin this turkey to partisan advantage. (Even if it costs economists yet more credibility!)

And yes, Kuttner may have gotten the technical definition of a recession wrong, but his opinion is spot on…and it’s time for economists to put their professional duties above their partisan preferences.

JohnH,

Ah well, you sort of get it that Kuttner is wrong about “the technical definition of a recession.”

And, yes, GDP declined in Q@, but income rose by more than GDP declined, as happened in Q1, meaning their average rose, and the job market remains super hot.

Sorry, JohnH, not a recession in anybody’s book who is not either a political hack or a non-economist journalist.

“What’s behind the effort to banish the suspicion that we might be in a recession?”

Honesty. Knowledge. A distaste for lies.

Take your pick.

All the things JohnH hates!

“Honesty. Knowledge. A distaste for lies.” BS! Using technicalities to spin the current situation to partisan advantage…very transparent…

MD, how about fear, denial, desperation and political bias?

I’m still on record with the 3rd quarter will be a disaster and at least one of the 1st two quarters will be lowered.

The spinmeisters will still be shouting that it’s not over until the Fat Lady sings–the NBER makes its official declaration, and they’re praying that it won’t be until after the election. But their defense will get ever more shrill.

One thing for sure. Democratic partisan hacks will fabricate some diversion so that they won’t have to talk about the economy…and they’ll know that this strategy is a slam dunk based on Hillary’s successful lack of a coherent economic message in 2016. Anything but “it’s the economy, stupid!”

Actually, to both JohnH and CoRev, I do not think it matters what various spinmeisters say the economy is in terms of the election, although I know that CoRev and some of his partisan pals are really hoping that headlines saying there is a recession will help the GOP in the midterms. But I doubt they will have any effect.

Voters will vote on their own personal perceptions of how they feel about the economy. We know that they are very unhappy about inflation, and clearly a reason it makes them unhappy is that for many prices are rising faster than their incomes, so their real incomes are falling. If that is still going on in November, they will be tending to vote GOP on the economy, although many may vote Dem because of other issues such as abortion.

The electoral problem of recession is unemployment. But that is not happening, not now anyway, no matter what one calls the current state of the economy. One can say, “ooooh, it is a technical recession,” but electorally as long as people are not losing their jobs they will not be voting GOP because “the economy is in a recession.” If they vote GOP on the economy, it will be because inflation is still so high their real incomes are falling.

Now, we may yet fall into a real recession before November, with people actually losing their jobs. Then we would have a different story, and I get that CoRev is forecasting that. But that is not what we have now, no matter how much you two holler that it is.

https://www.msn.com/en-us/money/other/us-durable-goods-orders-post-surprise-gain-on-defense-aircraft/ar-AA101hQA?ocid=msedgdhp&pc=U531&cvid=923023dca2a747f99a6a3516335f8b3c

(Bloomberg) — Orders placed with US factories for durable goods rose unexpectedly in June, fueled by a surge in defense aircraft as well as sustained demand for equipment. Bookings for durable goods — items meant to last at least three years — increased 1.9% in June after a 0.8% advance a month earlier, Commerce Department figures showed Wednesday. However, the figures aren’t adjusted for inflation. The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, rose 0.5% for a second month. Shipments also advanced. Wednesday showed the US merchandise trade deficit narrowed for a third month in June, reflecting both an increase in exports and a drop in imports. The report also showed firm advances in inventories at retailers and wholesalers. Wednesday showed the US merchandise trade deficit narrowed for a third month in June, reflecting both an increase in exports and a drop in imports. The report also showed firm advances in inventories at retailers and wholesalers.

Good news or bad news? Stronger aggregate demand would be good news for most reasonable people. OK – not having a recession is going to ruin Princeton Steve’s life but who cares about that?

I sort of wondered earlier if this Ukraine war would lead to more defense spending on durable equipment and it seems to have at least a modest effect. But I like most sane people hope that Putin calls off his damn war crimes.

Prof. Chinn,

A visitor to Tampa from Saratoga Springs reports that the price of butter here is $4.99 and $3.49. He reports that other staple goods are similarly higher priced here.

What is the explanation for anecdotal and apparent regional difference in prices?

What factors might cause regional or state differences?

Local news reports that Tampa prices are rising unusually fast year to year compared to other metropolitan areas.

Left Coast Bernard

Could it be that Tom Brady and friends is making Tampa Bay too expensive? OK, I have always hated Tom Brady so pardon my quip.

Last Saturday grocery trip (or what I call my alcohol run) 453.6 grams unsalted name brand butter~~$4.48 (pre-tax).

Regular readers here can figure out very easy by deductive reasoning where I live, but I don’t like to specify. We’ll call it “southern plains”. Low-income, low-cost of living state.

Could it be that a company wants to increase its profit, whatever it takes ?

Where the wind blows wild across the plain?

Ssssssshhhhh!!!

I am not predisposed to say whether your subtextual answer is right or wrong. I will only offer one hint: In the next year the state license plates will be adorned with our new state slogan “Home of high domestic abuse, high female incarceration rates, and unfunded public education”. This is as specific an answer as I can commit to.