As forecasts are marked down (IMF releases new forecasts on Tuesday), here in two pictures is my answer:

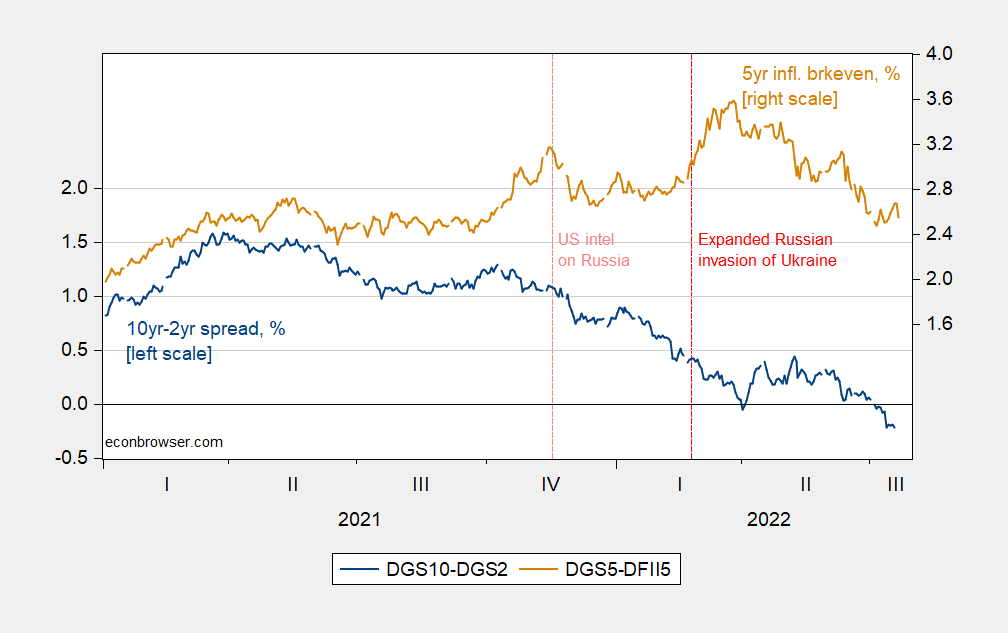

Figure 1: 10yr-2yr Treasury spread (blue, left scale), and 5yr Treasury-TIPS spread (red, right scale), both in %. Source: Treasury via FRED, and author’s calculations.

Inflation expectations at the 5 year horizon rise with the increasing perceived likelihood of an expanded Russian incursion into Ukraine, in early November. The 10yr-2yr spread also shrinks the. Inflation expectations again rise with the discrete elevation of aggression starting on February 24 (as oil prices move up).

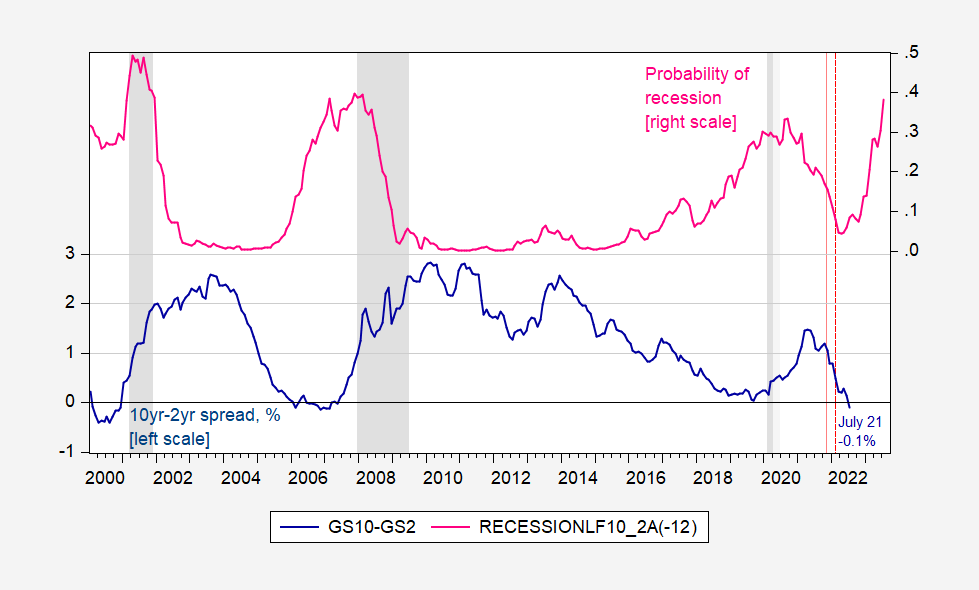

Using the term spread, we can estimate probabilities of recession based on historical correlations. These are shown in Figure 2.

Figure 2: 10yr-2yr Treasury spread, % (blue, left scale), and spread based probit model recession probability 12 months ahead (pink, right scale). July data and probability based on data through 7/21. Dashed line at 2021M11, and 2022M02. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, NBER, and author’s calculations.

If one uses a 30% threshold for calling recessions (this catches essentially all past recessions, but also predicts a recession in 1999/2000), then we’re headed to one starting in June 2023.

One’s answer will differ depending on whether to use the 10yr-3mo instead of the 10yr-2yr. In addition, if you wondered if somebody’s policies enabled/encouraged Mr. Putin to engage in this expanded invasion of Ukraine, well, you might lay the blame somewhere else.

https://www.nytimes.com/2022/07/22/opinion/italy-draghi-ecb.html

July 22, 2022

Wonking Out: What’s the matter with Italy?

By Paul Krugman

As president of the European Central Bank, Mario Draghi saved the euro. In my estimation, this makes him history’s greatest central banker, outranking even the former Fed chairs Paul Volcker, who brought inflation under control, and Ben Bernanke, who helped avert a second Great Depression.

In a way, then, it wasn’t surprising that last year Draghi was brought in to lead Italy’s new coalition government — often labeled “technocratic,” but actually more a government of national unity created to deal with the aftermath of the Covid-19 pandemic. In a properly functioning democracy, nobody should be indispensable; but Draghi arguably was, as the only person with the prestige to hold things together.

But even he couldn’t pull it off. Facing what amounted to sabotage by his coalition partners, Draghi simply resigned, creating fears that the coming election will put antidemocratic right-wing populists in power.

I have no idea what will happen. Italy, like any nation, is unique in many ways, but not in some of the ways many people imagine. No, it isn’t fiscally irresponsible. No, it’s not incapable of running its internal affairs. And the threat of a takeover by the authoritarian right is hardly special to Italy; if you aren’t terrified by that prospect here in America, you haven’t been paying attention.

True, Italy does have a problem with economic stagnation. Even before the pandemic struck, Italy was noteworthy in having experienced two decades without growth in real gross domestic product per capita:

https://static01.nyt.com/images/2022/07/22/opinion/krugman220722_1/krugman220722_1-jumbo.png?quality=75&auto=webp

Italy’s long stagnation.

That stagnation is important, and also a major economic puzzle. But it doesn’t seem central to current events.

In other ways, Italy seems surprisingly functional given its reputation. Notably, it did a far better job than the United States in getting its population vaccinated:

https://static01.nyt.com/images/2022/07/22/opinion/krugman220722_2/krugman220722_2-jumbo.png?quality=75&auto=webp

Italians have taken their shots.

And while Americans on average have higher incomes than Italians, we’re also far more likely to die younger:

https://static01.nyt.com/images/2022/07/22/opinion/krugman220722_3/krugman220722_3-jumbo.png?quality=75&auto=webp

They may not be prospering, but they’re living longer.

What about Italy’s reputation for fiscal irresponsibility? …

https://fred.stlouisfed.org/graph/?g=RMpJ

August 4, 2014

Real per capita Gross Domestic Product for United States, United Kingdom, Germany, France and Italy, 2000-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=RMpN

August 4, 2014

Real per capita Gross Domestic Product for United States, United Kingdom, Germany, France and Italy, 2000-2021

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=NvUs

November 1, 2014

Total Factor Productivity at Constant National Prices for United States, United Kingdom, Germany, France and Italy, 2000-2019

(Indexed to 2019)

https://fred.stlouisfed.org/graph/?g=NvUz

November 1, 2014

Total Factor Productivity at Constant National Prices for United States, United Kingdom, Germany, France and Italy, 2000-2019

(Indexed to 2000)

https://www.imf.org/en/Publications/WEO/weo-database/2022/April/weo-report?c=136,&s=NGDP_RPCH,PPPGDP,NID_NGDP,NGSD_NGDP,PCPIPCH,GGXWDG_NGDP,BCA_NGDPD,&sy=2017&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2022

Italy, 2017-2021

Real GDP, percent change

Inflation rate, percent change

Investment, percent of GDP

Savings, percent of GDP

General government gross debt, percent of GDP

Current account balance, percent of GDP

What about Italy’s reputation for fiscal irresponsibility?

[ Italy’s debt has been continually above 100% of GDP since 1990; above 130% since 2013 and now is above 150%. ]

“What about Italy’s reputation for fiscal irresponsibility? …”

Maybe the reputation is racist. Seems to be the answer to everything.

@ AS

See, I don’t think most white people (or Italians in this specific instance) are bothered by this, but at the same time, I think you make a strong point on the hypocrisy. You hear from many Blacks (my paraphrase) “If you are in the disadvantaged group or the underprivileged group you can’t exhibit or commit racism”, and I have had, for a long time, a very hard time of “buying that one”. It’s an excuse/rationalization to partake in the same behavior that said member of disadvantaged group cries about ALL day long 24/365. And at the risk of drawing fire from Professor Chinn, what I feel a large part of it is, is an inferiority complex by member of “said minority”. Because I think when many Italians read that (the sentence you wrote on Italy) they mostly go “yeah, they kinda got us on that one”. The same as Germans might tend to agree with the statement “Germans are emotionally distant and stoic”. Most Germans would be like “Yeah, what’s your point??” But if whites make a general observation [ mind you not a blanket or absolutist observation, but a generality, a character trait that is often, but NOT always true ] oh no—-now you have crossed the line.

If you don’t weight yourself down with an inferiority complex, you just go “Yeah, that’s kinda true” or “No, it’s not true, so why will I let it bother me??” But when a general comment about your own race XYZ “hits the bullseye” of your soul (is accurate) Example: “Germans committed very possibly (probably) the worst crime against humanity ever/ the Holocaust.” THEN it hurts. Because why?? Because it hits the mark.

I think Professor Chinn has mildly mildly mildly hinted he thinks donald trump has played an indirect part in Russia’s invasion of Ukraine, but I’m not sure if he feels as strongly about it as I do. The obvious question, even to be fair with the orange abomination squatting in the White House in 2017–2020 is “Would Russia have invaded Ukraine if donald trump hadn’t been so soft on Putin on election meddling etc, and would Russia have invaded Ukraine if donald trump hadn’t showed how little America cared about Ukraine by attempting extortion through the withholding of military defense weapons??” That’s actually a hard question to answer. My feeling on it is, it could have very well been “the tipping point” or “where the fulcrum point tilted” and that indeed donald trump is to blame. To be totally fair to donald trump I would say 66% to 75% he has to take a large part of the blame for this more aggressive invasion. There’s arguments on Crimea with President Obama, which indicate Putin would have done all this either way. i.e. Putin might have invaded Ukraine whether or not donald trump wasn’t so soft/weak with Russia.

Bottom line~~I don’t know, and I don’t think anyone, even wily types like Fiona Hill, Susan Rice, Leon Panetta, I don’t think even they could answer this in a definitive fashion.

The Blame:

The Technical Recession: Blame it on the reversal of stimulus spending, ie, blame Biden and the Democrats.

The Oil Shock: Probably partly the result of US monetary and fiscal policy, with oil shock prices firmly the result of EU sanctions policy, which I have already described as ‘insane’.

Asset Price Bubble and Housing Crash: Blame the US Federal Reserve. They own it 100%.

If the reversal of stimulus proves to be the cause of recession, then blame the party which did most to end stimulus. Two Democratic senators opposed additional spending packages. All Republican senators did.

Leave it to CoVid to get both math and politics wrong.

You think the US can afford to borrow 30% of GDP every two years? That’s absolute insanity.

Do you think anyone cares about your dumb but arrogant babble? Trust me fool – no one here trusts a damn thing you write. No one.

Oh, and “technical recession” is just weasel words meant to claim a recession when no recession occurred.

It’s like when Newt Gingrich urged a “technical default ” on U.S. debt. What he meant was “don’t blame Republicans if the U.S. defaults on its obligations because we engaged in reckless brinksmanship”. Technical default is default. Technical recession isn’t recession. How’d that happen? Because in each case, political hacks try to corrupt the language to their own benefit.

To me, a ‘technical recession’ means a recession without a business cycle underneath it. 1947 qualifies, to my mind. 2001, arguably. 2020 as qualifies as a technical recession as a suppression. A reversal of a stimulus could lead to a technical recession, in my view, because you could see two quarters of negative GDP numbers — which I think we likely will — without material unemployment, as in 1947.

At the same time, I think it’s clear we’re sliding into a general recession irrespective of stimulus run-off.

Steven Kopits: Well, this is gibberish. Recession in the NBER parlance is conceptually the sustained and broad decline from peak economic activity.

https://econbrowser.com/archives/2022/06/business-cycles-in-the-nber-business-cycle-dating-committee-framework-edition-xlxiv

Technical is just a way of saying you’ve a different definition than what NBER has defined.

What you’re pointing out is a disjuncture between two different metrics for economic activity — of which one, which is the unemployment rate — is not one the NBER typically focuses on.

If you’re saying all recessions are the same, then I disagree, as I have in the past. Is, say, 1947 the same as 1974? I would argue not. We saw an 11% drop in GDP in 1947 but no material unemployment. I would consider that a ‘technical recession’, as it lacked some important features we normally associated with recessions, for example, high unemployment. You’re saying 1947 was just a plain ol’ recession like the rest of them. Well, let me again disagree.

The profession needs a little more vocabulary, because policy is being royally screwed up for a lack of it. The economics profession has become way too political and way to stuck in its ways. The world is changing. Macro theory development did not end in 2000.

https://fred.stlouisfed.org/series/UNRATE/

FRED reports unemployment rates starting in January 1948 when this rate was a mere 3.4%. Yea it rose when we had the late 1948/1949 recession but if Princeton Steve thinks 1947 was a recession year, someone needs to check out whether he still has a functioning brain.

FRED data shows two consecutive quarters of declining GDP in 1947, and numerous sources speak to an 11% decline in GDP from February to October 1947.

https://fred.stlouisfed.org/series/GDPC1

https://www.cnbc.com/2020/04/09/what-happened-in-every-us-recession-since-the-great-depression.html

Steven Kopits: Well, the FRED link is correct, and as pointed out by AS, this was 2 quarters of final revised/benchmark revised data of negative growth not declared a recession by NBER. The CNBC link correctly did not list the 1947 period as a recession. So, QED, not every 2 qtr period of negative growth is declared a recession by NBER.

Right. That’s why I called it a technical recession. We saw a pretty steep GDP drop, but no corresponding drop in employment. If employment had also dropped, it would have been called as a recession, I think.

I think we could see something similar this time, if the effect is limited to merely the run off of the stimulus. I am guessing that’s not going to be the case, but I don’t think it’s out of the question.

I think we can start to distinguish between types of downturns using, you know, like different words for them.

“To me, a ‘technical recession’ means a recession without a business cycle underneath it. 1947 qualifies,”

It is very clear you have no clue what these terms even mean. Which for you is par for the course. You have no clue about anything.

Steven Kopits

July 23, 2022 at 11:51 am

If you’re saying all recessions are the same, then I disagree, as I have in the past. Is, say, 1947 the same as 1974? I would argue not. We saw an 11% drop in GDP in 1947 but no material unemployment.

First of all Dr. Chinn has NEVER said all recessions are the same. Secondly, real GDP rose in 1947. To say it fell by 11% shows you are both a liar and a village idiot.

“Steven Kopits

July 24, 2022 at 9:13 am

FRED data shows two consecutive quarters of declining GDP in 1947, and numerous sources speak to an 11% decline in GDP from February to October 1947.”

Just wow – FRED data which this lying troll linked showed a very modest drop in real GDP in early 1947 followed by a modest but larger increase in the 2nd half of the year. And yet this arrogant moron concludes it fell by 11% even after he linked to FRED? Oh numerous sources that this liar never refers to told him real GDP fell by 11% in 1947? I did link to RELIABLE sources which indicate we had a drop in 1945/46.

No – I claimed earlier that CoRev was the most dishonest and dumb troll ever. Sorry – this award goes to Princeton Steve who lies about his own damn link!

The 1947 recessionn? WTF?

A nice list of US recession which notes a downturn in 1945 and well as the recession that started in late 1948. But there was not a 1947 recession. Except in Princeton Steve’s fact free mind that just makes up BS as he goes!

https://second-renaissance.fandom.com/wiki/List_of_recessions_in_the_United_States

Stevie actually claimed real GDP fell by 11% in 1947. I just checked a reliable source on annual GDP figures (BEA reports quarterly figures starting in 1947) and it seems that real GDP was only 89% of that inflated 1945 (something called WWII) but we did not have a recession in 1947. Of course we all know Steve has no clue about our economic history and just makes up BS as he goes.

https://www.history.com/news/us-economic-recessions-timeline

A nice discussion of recessions since WWII. Yes – the economy slumped when the war was over but we did not see a 1947 recession. Yes – there was a recession that started in late 1948. But no – there was NO 1947 recession.

Now it takes two seconds using a tool called Google to find out the facts. But consultant Princeton Steve does not know how to do even the most basic research. Which is funny as he makes all sorts of bravado claims which turn out to be utter lies.

Wait – Stevie screams there is too much demand. Oh no – there is too little demand. Look dude – writing big sounding words does not mean you have a clue about anything.

You won’t have to wait until 2023. Next Thursday will be sufficient.

Then the recession is over. 2023 a return to growth. How about all that gas found???? Looks like disinflation is being priced in. Asset bubbles in housing are irrelevant considering the low borrowing people do from them nowadays. Nonbank control of new lending has essentially replaced the Federal Reserve system. A microrecession in white collar fat cats ain’t no recession in my book.

Which finger was that you just stuck in their eyes?

Someone should buy you an advanced tool called a Calendar for Christmas. After all 1945/46 is not 1947. Neither is 1948/49.

If your “numerous sources” have told you that real GDP fell by 11% in 1947 – they are either lying to you or they are as dumb as you are. Now wonder you do not provide your pathetic sources.

Maybe bannon and navarro will get to share bunks while in prison?

So many sick prison jokes here. I’ll save them for the dark net.

Bannon’s attorney strikes me as loud and incompetent as Princeton Steve. Well almost.

I think I feel happy that I haven’t seen his attorney up to now, but now you have gone ahead and made me curious. Bird’s of a feather?? This also makes me think (although I must have seen him in the Jan 6 depositions and it absent-mindedly didn’t register for me) I have no idea who Giuliani’s attorney is. I’m guessing more competent than Bannon’s but still some kind of an oddball. You have to think, that even as F’ed up in the head as Giuliani is that as a former attorney he would pick a half-decent one. But then he stood on stage right next to Sidney Powell, so…… It’s really hard to gauge the MAGA circle.

Dershowitz seems to be campaigning to represent Bannon on appeal. I say his interview on this. Me thinks Harvard will disavow any association with him.

Blame can be assessed in terms of ultimate cause,as you do here. It can also be assessed in terms of national contributions to the global downturn. The U.S., China, EU and Japan are the largest economies, so fluctuations in their performance will almost always matter most.

China’s recent deviation from trend was very large:

https://tradingeconomics.com/china/gdp-growth-annual

Eurozone deviation was smaller:

https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Quarterly_national_accounts_-_GDP_and_employment#Quarterly_GDP_growth

U.S. deviation depends on the measure considered, maybe intermediate between China and the EU, maybe smaller than either:

https://fred.stlouisfed.org/graph/?g=S2wV

Japan, well, you know Japan:

https://fred.stlouisfed.org/graph/?g=S2x6

Now, this comparison to do with recent performance, which is not the period in question (or so people of good will hope). If a global recession is timed from Q1 or Q2 of this year, China looks like the winner – biggest deviation from trend. If that’s the case, then a number of smaller economies will join China – Sri Lanka, Pakistan, those guys.

If recession is instead timed from some future quarter, the latest rise in Cocid cases may determine which countries are thought to have led the decline. China is still a good bet. Housing sector troubles and credit troubles add to China’s “advantage” in this contest. Europe with Covid and fuel problems is another good bet. For the U.S., it’s Covid and housing and consumption.

Japan? What we know about Japan is that its Phillips Curve looks like it as the famous paper by Alan Blinder in the JPE once published, :-).

https://www.chinadaily.com.cn/a/202207/22/WS62da635fa310fd2b29e6de84.html

July 22, 2022

Chinese scientists identify gene that can boost grain yield by 30 percent

By ZHAO YIMENG

Chinese scientists have identified a gene that is expected to boost grain yield by at least 30 percent and shorten the time taken for rice to grow, says a paper published in the Science Magazine online on Friday. *

The high-yielding gene, called OsDREB1C, can simultaneously improve the photosynthetic capacity and nitrogen use efficiency while triggering early flowering of rice, according to Zhou Wenbin, leader of the research team at the Chinese Academy of Agricultural Sciences.

Zhou, a researcher at the Institute of Crop Sciences of the CAAS, said field trials with OsDREB1C rice were being conducted since 2018 in Beijing; Sanya in Hainan province; and Hangzhou, capital of Zhejiang province.

The gene led to rice variety Nipponbare’s yield increasing by 41.3 percent to 68.3 percent. In the case of Xiushui 134, another variety, yield increased by at least 30.1 percent.

Overexpression of the gene in Nipponbare helped rice ears to develop 13 days early. According to the paper, the gene also helps in increasing yield and shortening flowering time of wheat. It is estimated that the production capacity of rice, wheat, and corn in China will increase by more than 20 percent by 2030 to help feed 1.45 billion people in the country. This is particularly helpful at a time when there is need to increase grain yield to meet the challenges posed by the COVID-19 pandemic and extreme climate change.

Breeding of dwarf varieties of rice in the 1960s and successful hybrid rice breeding, a concept invented by late agronomist Yuan Longping, are the two major breakthroughs in grain production, according to Zhou. The industrialization of hybrid rice increased production by 20 percent to 30 percent. These breakthroughs were achieved following the identification of a key gene, Yuan said.

This time round, a dramatic increase in yield and shorter growth duration is being achieved by genetically modulating the expression of a single transcriptional regulator gene, OsDREB1C, the paper said.

In addition, by enhancing photosynthetic capacity and the efficiency of nitrogen use, the gene offers the promise of more sustainable food production in the future….

* https://www.science.org/doi/full/10.1126/science.abi8455

https://www.science.org/doi/full/10.1126/science.abi8455

July 22, 2022

A transcriptional regulator that boosts grain yields and shortens the growth duration of rice

By SHAOBO WEI, XIA LI, ZEFU LU, HUI ZHANG, XIANGYUAN YE, et al.

Abstract

Complex biological processes such as plant growth and development are often under the control of transcription factors that regulate the expression of large sets of genes and activate subordinate transcription factors in a cascade-like fashion. Here, by screening candidate photosynthesis-related transcription factors in rice, we identified a DREB (Dehydration Responsive Element Binding) family member, OsDREB1C, in which expression is induced by both light and low nitrogen status. We show that OsDREB1C drives functionally diverse transcriptional programs determining photosynthetic capacity, nitrogen utilization, and flowering time. Field trials with OsDREB1C-overexpressing rice revealed yield increases of 41.3 to 68.3% and, in addition, shortened growth duration, improved nitrogen use efficiency, and promoted efficient resource allocation, thus providing a strategy toward achieving much-needed increases in agricultural productivity.

https://www.science.org/cms/10.1126/science.abi8455/asset/d0b0f81d-089f-4f9b-86fa-c97659d72040/assets/images/large/science.abi8455-fa.jpg

If it is mild enough everybody get to blame their favorite villain.

Say we are in a recession by a mere $200 billion in missed GDP. Pretty much anything or anybody you wish can be blamed for reduction, or lack of growth, of $200 billion. So pick your favorite what /who and blame away.

What will be certain is that the GOP will blame it on Biden – just like they blame him for world wide inflation.

Ivan, What will be certain is that the GOP (and much of the press, as well as many Dem presidential hopefuls) will blame it on Biden ….

And just because when we look at the US inflation start date.

There you go – CoRev will blame it on inflation !

https://fred.stlouisfed.org/graph/?g=Rqd6

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 2007-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=Rqdi

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=RqcN

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=RqcV

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2021

(Indexed to 1977)

I am more of a policy wonk. I am on record saying that I believe the world-wide “War on Fossil Fuels” policy. Messing with the supply and demand of the ?most? fundamental commodity is never good for the economy.

That policy coupled with the previous already mentioned Covid policies account for a larger portion of the world-wide inflation. Of the Covid policies I think that the lock downs have been the most economically detrimental.

CoRev: You’re a policy wonk doesn’t understand the difference between source data and a database that includes the original source data (i.e., difference between getting series from BLS directly and from FRED), engages in data paranoia, doesn’t understand how to do seasonal adjustment, who doesn’t know the difference between and I(0) and I(1) process, doesn’t know how derivatives might or might not forecast, doesn’t understand basic statistics (including things like RMSEs, MAEs, mean errors), etc.

Menzie, just what in that comment set you off? I know it must be hard to admit most of the policies you’ve supported for decades, now being more fully implemented are trashing the economy.

You are an economist who often writes about climate, but doesn’t know the basics of how temperature change is presented in anomalies. You don’t appear to know the difference between weather and climate. You cite NOAA record temperature claims as if there is never any question on how that sausage was made, anomalies again.

Your recent failures:

1) You have failed to list any of Biden’s successful policies.

2) You have not refuted my claim that solar can never fulfill daily peak demand.

3) You have not refuted my claim that US inflation was caused by Biden’s War on Fossil Fuels, and the inflation started around the time of his inauguration.

In response to item 2 of those above examples you wrote 2 articles that did not address the base claim. For 1st response you wrote about renewables: Texas: Peak Load Use and Renewables And actually quoted my claim. ” Solar can never supply the power needed during peak demand. Peak demand occurs as the Sun diminishes.” https://econbrowser.com/archives/2022/07/texas-peak-load-use-and-renewables Why change the subject from solar to renewables?

In your 2nd response to 2 above, you even doubled down and wrote an article about battery use to fulfill peak load “(Or…, are renewables useless because of peak load issues?) ” https://econbrowser.com/archives/2022/07/battery-storage-costs-for-utilities Why change the subject from solar to batteries?

Again in response to item 3 you wrote an article quoting my claim: “I estimate (don’t kinda think) that a large portion of today’s inflation is due to environmental policies, in particular the war on fossil fuels.” while writing an article about oil prices: https://econbrowser.com/archives/2022/07/did-oil-prices-start-rising-when-biden-started-his-war-on-fossil-fuels Why change the subject from inflation to oil?

I’ve again referenced that ole “world-wide “War on Fossil Fuels” policy. Messing with the supply and demand of the ?most? fundamental commodity is never good for the economy.” And again you are changing the subject, only not as gracefully as you did previously.

I’ll repeat my opening response: I know it must be hard to admit most of the policies you’ve supported for decades, now being more fully implemented are trashing the economy.

Prove me wrong, especially on the solar claim.

CoRev,

You have fallen on your face so hard already, you broke the floor and fell through and down into the sub-basement. But here you are attempting to octuple down by putting on an imitation of Steve Kopits and pretending somehow to be a “policy wonk.” Pgl is on his case all the time, and I think he is wrong about a lot of things, but he is at least a consultant who does have some clients. I am quite certain that your policy wonkery is purely an amateur fantasy.

So, since you have dragged back your totally embarrassingly idiotic claims about solar, let me answer for Menzie, although this has already been pointed out. Yes, peak solar production does occur a few hours earlier in the day in the summertime than does peak energy demand. So, what is the relevance of bettery storage? It is quite good at short-term storage for some hours, just enough to cover that difference. End of problem.

Of course, this has been repeatedly pointed out to you, but you have been too busy trying to divide by zero and thinking you are going to get an answer, so, of course you are not able to put this obvious point together: battery storage completely resolves this completely silly problem you have made so much noise about regarding the few hours difference in a day between peak solar power production, which conveniently happens before peak energy demand by a few hours.

Got it yet, idiot?

Barkley, such a dumb response re: batteries it’s hard to find a starting point. You say:

1) ” Yes, peak solar production does occur a few hours earlier in the day in the summertime than does peak energy demand.”

You are so clueless here its embarrassing. Peak Solar production occurs near mid day everyday of the year. Weather permitting. Peak demand occurs ~6PM every day almost every where in the world. What changes is sunrise and sunset when solar can even start and end generating electricity. For many, many days of the year sunset, and ZERO generation) occurs before peak demand.

2) ” So, what is the relevance of bettery storage? It is quite good at short-term storage for some hours, just enough to cover that difference.” Yup! Batteries can be used for short term storage. The NREL report cited in Menzie’s article used 4 hours for its test period. “In this work we describe the development of cost and performance projections for utility-scale lithium-ion battery systems, with a focus on 4-hour duration systems….” Battery use to backup solar is ridiculously expensive. “Figure ES-2 shows the overall capital cost for a 4-hour

battery system based on those projections, with storage costs of $143/kWh, $198/kWh, and $248/kWh in 2030 and $87/kWh, $149/kWh, and $248/kWh in 2050. ” That’s capital costs and doesn’t include charging costs, which conservatively would add 25 to 50% to daily electricity charges, or on a grid basis add capacity. Those are the costs increases to solve a nonexistent problem solar electricity backup.

There are so many other problems associated with battery backups, it explains why they are seldom used today. A recent estimate for total battery capacity in use today provides a whopping 11 minutes of world-wide backup. Woefully inadequate.

How can democrats’ policies have been so wrong and still not admit and recognize the issues. I now expect another rant of name calling a profanity. It’s sad really.

I have to admit that CoRev’s self serving tirade of disinformation trumps anything that either Bruce Hall or Princeton Steve have tried to pull. OK CoRev – you won the gold model for most dishonest and stupid troll ever. Hands down.

“The dark side of the force is strong in this one”

: )

I actually respect Professor Chinn’s efforts here. But…….

Is there some kind of Confucius or Socrates saying here?? “A teacher who cares for his worst student, cares for ALL his students” ??? NO??? OK I just wanted to try that out./

Dark Vader cannot even remember what his own sources claimed:

“Peak Solar production occurs near mid day everyday of the year. Weather permitting. Peak demand occurs ~6PM every day almost every where in the world.”

I guess 4PM is midday if your boss is the Evil Emperor. BTW – production was still at 50% as of 6PM per Dark Vader’s own sources but I guess he cannot see that with that ugly helmut blocking his vision.

It is sad when one has to go to the bottom of the barrel with little details that even then he has to lie about.

Barking Bierka – the Disgusting NYC Jerk, I been ROFLAO at the last couple of your comments. Can you explain to the peanut gallery the relevance of this statement: “I guess 4PM is midday if your boss is the Evil Emperor. BTW – production was still at 50% as of 6PM per Dark Vader’s own sources but I guess he cannot see that with that ugly helmut blocking his vision. ”

To what does it even relate?

“Menzie, just what in that comment set you off?”

Seriously dude – you blatantly lie and then ask questions that would embarrass Steve Bannon. That our host has not addressed your dumb questions shows he has some self restraint. Any other blog host would have banned your worthless rear end years ago.

Barking Bierka – the Disgusting NYC Jerk, show us all the lie(s).

I, you, everybody know you can/will not show where I lied. You’re even less knowledgeable than Barkley about climate.

Maybe after finding that lie of mine, you can refute my solar comment.

If that’s too difficult for you, perhaps you can answer my policy comment:

” I am on record saying that I believe the world-wide “War on Fossil Fuels” policy. Messing with the supply and demand of the ?most? fundamental commodity is never good for the economy.

That policy coupled with the previous already mentioned Covid policies account for a larger portion of the world-wide inflation. Of the Covid policies I think that the lock downs have been the most economically detrimental.”

Answering any of these requires some thought. I’ll wait.

“CoRev

July 24, 2022 at 11:17 am

Barking Bierka – the Disgusting NYC Jerk, show us all the lie(s).

I, you, everybody know you can/will not show where I lied.”

How do we know when CoRev is lying? When his lips are moving. CoRev – you lie more than your hero Donald Trump. EVERYTHING you write is dishonest to the core. Now go back to chasing your own tail.

You are as much of a policy wonk as I am a star NBA center (at 5’6″). But “on the record”? You are now using terms from the arrogant clown known as Princeton Steve? Figures!

corev, you believe in ghosts. your credibility is not even limited. it is zero.

2slug got the language right … CoRev is a policy wank!

His credibility is zero divided by zero, which is a ghost, :-).

ROFLMAO