From the Article IV consultation:

Source: IMF, Article IV consultation report for US, July 2022.

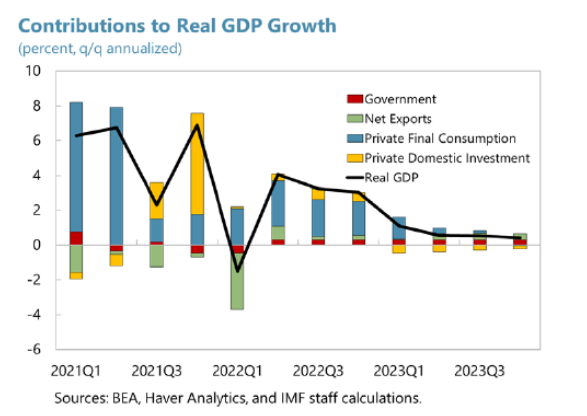

The sharp rebound in GDP in Q2 is at variance with nowcasts. A big change in the contribution of net exports accounts from big negative to small positive (in a mechanical sense) for the resumption in projected growth. The report notes:

All in all, growth is expected to fall to 0.7 percent q4/q4 by end-2023 and then pick up gradually into 2024. The U.S. is expected to narrowly avoid a recession. Nonetheless, the risk of the economy “stalling” and tipping into a short lived downturn are significant. In particular, if the economy again gets hit by a negative shock, the predicted slowdown will likely turn into a short-lived recession. PCE inflation is expected to fall steadily as activity decelerates and supply-demand imbalances are resolved, reaching 2 percent on a year-on-year basis by end-2023.

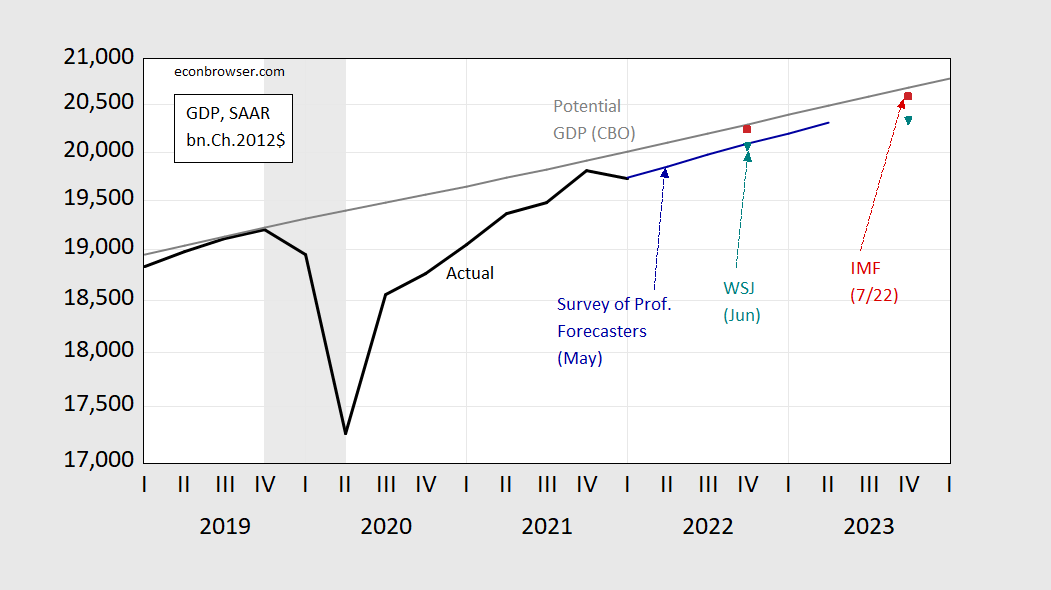

Figure 1 below shows the IMF forecast of 2.2% q4/q4 2022 (which is a downgrade from the 2.9% forecast at the end of the team visit last month) in comparison to other forecasts and potential GDP.

Figure 1: GDP (black), potential GDP (gray), Survey of Professional Forecasters May consensus (blue), WSJ June survey mean (teal), and IMF Article IV consultation forecast (red), all in billions Ch.2012$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, CBO, Philadelphia Fed, WSJ (June survey), IMF, NBER, and author’s calculations.

The IMF forecast is — in level terms — more optimistic than the WSJ June consensus, as well as the May Survey of Professional Forecasters consensus.

Professor Chinn’s post reminded me to check on something. I don’t check Twitter often anymore because my account was suspended some years back. I thought this picture (if the link doesn’t morph for once) is very very very very very very very very….. cool:

https://twitter.com/GitaGopinath/status/1544788244667240450/photo/2

I think the institution will miss her. But people move on as they always do. She did herself proud.

Moses Herzog: She moved within the building – she’s now Deputy Managing Director (the number 2).

Oh wow, I gotta pay attention better. I’m glad she’s staying on~~the world needs it right now (Ukraine, GVC issues etc). Someone had said something about Harvard and most schools have “leave of absence” rules (or whatever that is when Uni profs take uh “sabbatical”??) They can only do that for a limited period?? I said I was hoping exceptions could be made with Harvard for her to “keep on” at IMF. She is so well deserving. I know all of those people are exceedingly exceedingly talented almost without exception, but I would think she is the most exceptional individual since Stanley Fischer held that post.

Moses,

Now now, we know that “cool” is not the temp you have usually IDed her with, although you have sort of figuted out that Menzie doee not approve of you going on about such matters. Anyway, I happen to agree that she is highly competent, although you seem to spend most of your time talking about her temp, even as you continue to insist ltr is a man, duuuuuuuuuuuuuuuh.

Isn’t there SOME retirement community nearby with board games and card games for you when family got sick of you, so you can find other forms of entertainment than put-downs on blogs?? You notice I don’t mix words with CoRev often, really mostly the short haha quip?? Because I don’t find it “entertainment” to cross swords with people having brains about the size of a squirrel’s. For most normal people, emphasis on normal here, there’s no “charge” to be taken out of that. People with PhDs should generally be bored with that undertaking as well. If you don’t get an epiphany here sometime before death (no kidding) as regards the problem discussed just above I can sincerely (and with some small degree of melancholy about some sectors of humanity) tell you any advanced degree you got in your life was pretty much a waste of time for UW-Madison and similar.

Moses,

“normal”? You are the only person here who has ever seen fit to comment on the attractiveness of female economists, until Menzie made it clear he really did not appreciate that. You are also the only person here who somehow thinks ltr is male. Sorry, but you are probably the last person here who can make a claim about what is “normal” or not.

While we are at it, and you think I should retire, something my dean has made it clear he does not wish me to do soon, are you retired? We never hear anything about you being currently employed at anything. We heard you briefly worked for a bank after your undergrad degree in finance. We have heard a lot about how you were a commercial truck driver for some period of time. And then we have also heard about how you taught English in China, now also in the past. But do you actually have a job at this time? If so, it does not appear to be any of those things you have gone on about having done in the past.

Also, for the record, you have made far more off-topic, unwarranted, untied-to-any-comment here blasts at me than I have of you over time, way more. Everybody knows that. And this was a pretty minor one where I actually agreed with you about the competence of GG, but you had to go all whiny because I reminded everybody of silly stuff you have said in the past. Oh you poor pathetic thing.

So recession is well within the margin of error, nay?

The role of net exports is interesting. How much of this is driven by developments in the EU or in China?

I have no idea, you might ferret around on Peterson Institute or something. Key word search recent NBER papers.

Get ready for some serious disturbances in the housing markets:

https://www.calculatedriskblog.com/2022/07/homebuilder-comments-in-june-someone.html

Remember, houses are sold for total price but purchased on monthly payments.

The seller that expects $500,000 for their house (based on previous sales or even their own purchase price) will be reluctant to accept substantially less. Yet the buyer who could afford $500K with a 3% interest rate loan ($2100/month) is almost certainly not going to be able to afford $500K on a 6% loan ($3000/month). To get to that $2100/month payment (on a 6% loan) they can afford, the house would have to sell for $350K.

We are not likely to see a 30% drop in prices and nor are we likely to see a 40% increase in what people can afford to pay in monthly mortgage payments. Most likely we will see a downsizing in the houses purchased and build. However, it will take time and a lot of disruption to get there.

The desperate tea leaf reading continues. Hoping there will not soon be a “R”ecession also is obvious. What is painfully obvious is that economists are clueless when predicting major economic events, inflation and “R”ecessions.

Also painfully obvious is the liberal denial of the impacts of their policies. “Fighting Climate Change” in one of those policies, now being more fully implemented, that has resulted in some catastrophic economic results, inflation and “R”ecessions, as well as the Russo/Ukraine war.

As I wrote the above comment the June CPI announcement was made: 9.1% increase.

Denying the policy causes will continue, but the voters will have the last word. Your policies are in effect, and the results are yours. Continue following Europe down this swirling economic hole.

Mostly based on the last days in May/early June. As I hinted on a AS post, .1% increase the last 50% of June.

Careful. Fall off that soapbox and you could but yourself.

“Denying the policy causes will continue”? What policies? Oh wait you did list Fighting Climate Change. Which has nothing to do with the current inflation situation.

Unless you mean how sound policy has led to a booming labor market. Oh wait, I need to stop as I’m asking a MAGA hat wearing moron to actually discuss actual economics. Silly me for expecting CoRev to bother having a real conversation based on facts and logic.

Barking Bierka -the Disgusting NYC Jerk claims: “… Fighting Climate Change. Which has nothing to do with the current inflation situation. ”

Such ignorance is the cause of bad policy continuance. One article: https://investmentstrategyin.com/how-much-is-the-transition-to-net-zero-contributing-toward-inflation/

The core comment: “The transition to net-zero has probably contributed to the recent surge in energy inflation alongside other and probably more significant drivers.

In this complex context, where several interacting factors have converged, it is hard to quantify the exact contribution from greenflation to current inflation.”

Everything is well considered until this falsehood: “Going forward, fossil fuels are set to be replaced by cheaper and more efficient energy sources.”

Its false because they do not replace they just temporarily preempt them until their inherent unreliability appears, when those old fossil fueled sources provide the lost source.

Or this news article: https://www.telegraph.co.uk/news/2022/07/13/hypocritical-germany-brought-knees/?mc_cid=29710b8e07

which concludes: “Once admired and envied, Germany is now the textbook example of how much damage a misguided foreign and energy policy may do. ”

US voters do recognize the issue.

This is the person who wrote that fluff in your first link?

Silvia Dall ‘Angelo is a senior economist at Federated Hermes Limited

Seriously CoRev – even Lawrence Kudlow would have been more credible. Oh wait – you Googled and found a story you liked without bothering to check the credentials of its author.

Barking Bierka -the Disgusting NYC Jerk, I don’t know if your comment about Silvia Dall ‘Angelo is misogynistic, anti-italian or both? Help us out here.

CoRev

July 14, 2022 at 4:53 pm

Barking Bierka -the Disgusting NYC Jerk, I don’t know if your comment about Silvia Dall ‘Angelo is misogynistic, anti-italian or both? Help us out here.

What a pathetically STUPID comment. I questioned the reliability of Kudlow, Moore, and most of Trump’s male morons too. But I guess if some hot Italian lady tells you some right wing BS then you eat it up. I would suggest you are in love with Maria Sara Bartiromo but then I consider her rather fat and ugly. But hey!

It seems CoRev cannot be bothered with finding a bio for Silvia Dall’Angelo. Two seconds on Google:

Senior Economist, Federated Hermes Limited

Silvia joined in October 2017 as Senior Economist. As an experienced global economist, she is responsible for providing macroeconomic analysis and commentary, non-standard macroeconomic modelling, and developing relationships with key central banks and monetary authorities. Silvia previously spent 10 years at Prologue Capital Ltd, latterly as a global economist responsible for the team’s macroeconomic view. She holds a Master of Science in Economic and Social Sciences, as well as a Bachelor’s in Economic and Social Sciences, from Bocconi University in Italy.

OK – she is Italian with an MS in economics from a school I never heard of. But I bet CoRev has been hanging out in Italy hoping to meet this lady. I hope the Italian police makes sure she is OK even if they have to arrest CoRev.

Barking Bierka -the Disgusting NYC Jerk, Help us out here. How does your Bio make any difference? This comment doesn’t add confidence to your statement.

I still don’t know if your comment about Silvia Dall ‘Angelo is misogynistic, anti-italian or both?

CoRev You sound positively gleeful over the prospect of a future recession…and you aren’t even in the least bit embarrassed. You really are one of Putin’s Poodles.

If we had been a lot smarter 30 years ago about climate change, then the spike in fossil fuels prices would have had a smaller effect on inflation and the economy. Drill, Baby, Drill is a recipe for making future fossil fuel crises even worse. But keep eating those donuts. No need to restrain your appetite.

Your support for Russia is about as immoral a position as I’ve heard. Then again, you have lots of weird views; e.g., UFOs, ghosts, being “raptured” at the end times, etc.

“If we had been a lot smarter 30 years ago about climate change”

Notice every time someone mentions climate change, CoRev goes off on one of his patented rants that the issue is “weather” as climate change does not exist. In other words, his intelligence was suspended back in 1990. The word smarter does not apply to CoRev.

Here’s the pattern:

– CoVid lies about the economy

– Menzie corrects CoVid’s lie, telling the truth

– CoVid says “they’re getting desperate ”

CoVid really, really, really wants a recession so he can blame Democrats.

And I thought Bruce Hall was the chief cheerleader for a recession. Silly me.

Will be interesting to see, with the trade defecit seeming to bottom, inflation still surprising to the upside, and fed increasing rates during q2 I suspect domestic investment and consumption will be lower than these forecasts expect.

CPI inflation is poorly constructed. GDP does not use it. So your point……is dead.

my call was 9.3%

not like all the 8.8 and lower from the accredited forecasters

https://news.cgtn.com/news/2022-07-13/China-s-foreign-trade-up-9-4-in-first-half-of-2022-1bCZ8Xs3XhK/index.html

July 13, 2022

China’s June exports growth quickens as production recovers, imports grow slower

By Zhang Xinyue

China’s exports growth gained pace in June as production continued to recover from the pandemic, while imports expanded moderately, the General Administration of Customs (GAC) said on Wednesday.

The June exports grew by 17.9 percent year on year in U.S. dollar terms, 1 percentage point higher than the previous month, GAC data shows, beating Reuters’ forecast of 12 percent.

However, the import growth slowed down to 1 percent from 4.1 percent in May, missing market expectations.

https://news.cgtn.com/news/2022-07-13/China-s-foreign-trade-up-9-4-in-first-half-of-2022-1bCZ8Xs3XhK/img/7459d911733442d0952e661b9e5780ba/7459d911733442d0952e661b9e5780ba.jpeg

https://news.cgtn.com/news/2022-07-13/China-s-foreign-trade-up-9-4-in-first-half-of-2022-1bCZ8Xs3XhK/img/02ebb955e759456bbdd24df436dec0aa/02ebb955e759456bbdd24df436dec0aa.jpeg

“The growth of foreign trade picked up significantly in May and June,” said GAC spokesperson Li Kuiwen.

Since March, a new wave of COVID-19 spreading across China slowed down business activities and production, as many places, including the capital Beijing and financial center Shanghai, implemented different degrees of closed-off management.

The easing of the pandemic and the government’s policy measures have helped foreign trade companies resume work and production since May in an orderly manner, said Li.

Regarding the first half of 2022, China’s exports climbed by 14.2 percent from a year earlier and imports rose by 5.7 percent.

The value of exports stood at $1.73 trillion during the six-month period, while imports came in at $1.35 trillion….

Trade as a % of GDP for China was 37.4 in 2021, according to the World Bank.

The trade % of GDP for the United States was 25.5 in 2021:

https://fred.stlouisfed.org/graph/?g=RJbi

January 15, 2018

Exports and Imports as Share of Gross Domestic Product, 2017-2022

https://fred.stlouisfed.org/graph/?g=FmWS

January 15, 2020

Consumer Price Index for Food and Energy, 2020-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=MMHi

January 15, 2020

Consumer Price Index for Food and Energy, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=Fn2B

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=HKys

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=CgJo

January 15, 2020

Sticky Consumer Price Index and Sticky Consumer Price Index less Shelter, 2020-2022

(Percent change)

Headline inflation up but core inflation down. Kevin Drum provides the graphs:

https://jabberwocking.com/chart-of-the-day-inflation-in-june/

interesting

the bls html said all prices less food ain’t energy were +.7 up from .6 for the May report.

link to the html @ bus gov main page

So how much credibility should we extend to the IMF, those geniuses who thought lending $45 bn to Argentina was a good idea?

Well, let’s look at their most recent track record, their forecast for 2008 and 2009. (The IMF could be forgiven for not forecasting the suppression of the pandemic. It came on fast, I don’t know that anyone had a good feel for how events would play out.)

So, in the April 2008 WEO — that is, four months after the start of the Great Recession per NBER dating — the IMF was predicting positive GDP growth for 2008 and 2009 for every country in the world bar Zimbabwe. For example, for the US, the IMF was predicting 0.5% GDP growth in 2008 and 0.6% growth in 2009.

Meanwhile, BoA is now calling for a mild recession in H2 2022.

Should we take the IMF forecasts as gospel? I think we should view the forecasts as political statements intended to not offend the funders of the institution.

https://www.imf.org/en/Publications/SPROLLS/world-economic-outlook-databases#first=20&sort=%40imfdate%20descending

“So how much credibility should we extend to the IMF”

More credibility to a pompous bozo known as Princeton Steve. Hey dude – you are STOOOPID. And you vain attempts to attack those who at least try to offer credible analyzes as opposed to your insane babble only proves my general point. You are as arrogant as you are incompetent. So it might be nice if you decided not to smear people who are 100 times smarter than you.

“Well, let’s look at their most recent track record, their forecast for 2008 and 2009.”

2009 was their most recent forecast? Excuse me moron but they did not suspend operations for over a decade. The only thing worse than your feeble analytical skills is your pathetic lack of ability to write in the English language. DAMN!

I would imagine you did not progress that far in your career, but those involved in making forecasts of this sort are aware that analysts have an asymmetric forecasting bias. If an analyst is, in this case, forecasting growth, then whether their number is high or low is generally unimportant. No one is going to give the IMF flack if their GDP forecast for the US is 1.3% when the Fed is expecting 2.3%.

However, at inflection points, particularly those prior to a recession, analysts are typically constrained in the numbers they can publish. This is true at investment banks, other financial institutions, the IMF. And, by coincidence this week, the EIA made just such a political forecast. ‘Forecasts’ for downturns will typically be made only after the fact or only after the conventional wisdom sees a recession coming.

Thus, were the IMF to forecast a recession for the US, this would have political implications. It would certainly annoy the Biden administration, and, according to an IMF press release: “The United States contributes $117 billion to the IMF quota (17.46%). In addition, the United States has contributed $44 billion to funds at the IMF that supplement quota resources.” Not someone you want to tick off.

As a result, analysts will tend to be more careful about making negative forecasts, including one for a recession. In an up-cycle, it doesn’t really matter, because no one cares whether growth projections were off by one or two percent. Therefore, the analyst has greater leeway making a call.

It is because of this asymmetry that I wanted to check the IMF’s forecasting record just prior to a recession, with the most recent precedent being the Great Recession. Here, the IMF not only failed to call a recession in the April 2008 WEO, but in the November 2008 WEO!

I might add that the IMF blew the recovery call as well — as did, for example, the CBO. And why is that? Because they mistook a d______________ for a r______________.

“I would imagine you did not progress that far in your career”

You are one arrogant arse. FYI – I am considered THE expert for some forthcoming litigation involving a seminal paper I wrote which the government is citing even though I have been hired by the other side. Now I have signed an NDA so no – cannot tell you what this is about. Like a moron like you would even understand it.

Why do you give us the title of the paper, Mr. Expert.

BTW – that is one disjointed little dissertation for someone who has yet to bother reading that review of the IMF’s forecasting record.

I would ask what is your forecasting record? Oh wait – you make up BS as you go never bothering having anyone review your forecasting record. But I am sure if you had bothered to allow someone to review your forecasting record, it would absolutely suck. Just like your average comment.

July 28 will tell.

Steven Kopits: Sorry, what is your specific forecast for Q2 growth in the advance release? (By the way, just so you know, about 1/3 of the data sources for the advance release are estimates, e.g., we don’t have the advance release for trade when advance GDP is released). And what is your estimate for Q2 3rd release? Or are asserting that you predict negative Q/Q growth, and that is your estimate?

<0%. I think Atlanta Fed is around my expectation.

Steven Kopits: OK, I put you down for -1.5% Q/Q SAAR for advance.

And what’s your expectation for Q2, Menzie?

Why don’t you do a pool post, Menzie: “Make your Q2 GDP predictions!” Just for fun.

I have dibs on -1.5%.

“no one cares whether growth projections were off by one or two percent.”

You actually said this twice. It was stupid the first time and yet you repeat it? You do say the dumbest things ever.

“So how much credibility should we extend to the IMF, those geniuses who thought lending $45 bn to Argentina was a good idea?”

In case you are wondering WTF Stevie pooh was referring to – I have decided to provide the story which Princeton Incompetent could not be bothered with:

https://www.voanews.com/a/argentina-signs-45-billion-imf-deal-to-help-restructure-debt/6470602.html#:~:text=Argentina%20has%20signed%20a%20%2445%20billion%20agreement%20with,country%E2%80%99s%20debt%20payments%20have%20taken%20almost%20two%20years.

Now is this a good idea or should we just let Argentina collapse into a needless recession. Oh wait – Stevie never wanted to help Puerto Ricans out after Maria. I guess Hispanics should just be allowed to die so Stevie can buy more bagels.

But whether this debt restructuring was a wise move or not does not have a damn thing to do with the reliability of WEO forecasts. None that arrogant old Stevie pooh bothered to explain.

So this is an example of IMF idiocy, agreeing a restructuring before the associated conditionalities are implemented. That’s how Argentina got in trouble in the first place.

The IMF, like so many vaunted institutions of the past, is now a shell of its former self.

https://www.voanews.com/a/argentina-signs-45-billion-imf-deal-to-help-restructure-debt/6470602.html#:~:text=Argentina%20has%20signed%20a%20%2445%20billion%20agreement%20with,country%E2%80%99s%20debt%20payments%20have%20taken%20almost%20two%20years

“So this is an example of IMF idiocy”

Doubling down on a pathetically stupid comment does not add an ounce to its credibility.

I guess you are too stupid to note that it was me that first provided that link. BTW I read it so unlike you I noticed:

The IMF says the executive board will meet once the Argentine National Congress signs off on a bill to assent to “the economic and financial program embodied in the Memorandum of Economic and Financial Policies.” “The law that enables the treatment of the Memorandum of Understanding with the IMF for its approval or rejection will formally enter into this chamber,” the head of Argentina’s lower house said in a statement on Wednesday.

The agreement contains measures to promote growth and protect social programs as part of a 30-month Extended Fund Facility to confront “the country’s most pressing economic challenges,” according to a statement from the IMF on Thursday.

I doubt you read these documents so when you write “agreeing a restructuring before the associated conditionalities are implemented” you are basically lying once again. But hey – lying is what you do best.

Hmmm. Let’s see:

The International Monetary Fund (IMF) has wired US$ 3,980 million to Argentina, thus boosting the country’s reserves to US$ 42,139 million, it was reported in Buenos Aires.

Argentina’s Central Bank (BCRA) Tuesday confirmed it had received the IMF disbursement, which was made after the South American country met all performance criteria verified during an IMF audit for the first quarter of this year as per the Extended Facilities Agreement signed earlier this year.

IMF Chief Kristalina Georgieva acknowledged that Argentina had met “all quantitative targets by the end of March 2022, making progress in the implementation of the program’s structural commitments.”

This was on June 29th. OK. So what’s happened since? Here was the state of play on July 11th:

Last week’s pessimism stems from uncertainty over how Batakis, a [newly appointed and] little-known bureaucrat with ties to the government’s leftist faction led by Vice-President Cristina Fernández de Kirchner, will run the economy.

For now, Batakis is signaling she’ll continue on the path laid out by her predecessor, saying in a TV interview on July 6 the government wouldn’t devalue the official exchange rate, that it wouldn’t increase export taxes further, and that its fiscal deficit target of 2.5 percent of gross domestic product for this year will remain in place.

But in an economy beset by a litany of problems including 60 percent inflation, a slumping parallel exchange rate and falling demand for local debt rollovers, there is little confidence the country will meet targets laid out in a US$44-billion lending programme with the International Monetary Fund. And that is the only thing keeping Argentina’s foreign currency reserves afloat and with it, dollar debt payments.

So the IMF ponied up $4 bn on some faint hope that Argentina might get its act together, and yet there is little prospect that Argentina will comply with the IMF program, implying that the $4 bn issued just three weeks ago is already dead money.

https://en.mercopress.com/2022/06/29/imf-wires-nearly-us-4bn-to-argentina-s-coffers

https://batimes.com.ar/news/economy/argentine-debt-plumbs-new-depths-as-political-tensions-mount.phtml

I asked if Stevie had bothered to read the underlying documents. He hasn’t but he did find some press report which he partially quoted leaving off this:

Argentina’s US$ 44 billion 30-month arrangement, approved by the IMF Board on March 25, seeks to “contribute to the economic recovery that Argentina is experiencing,” said the IMF.

The IMF had announced on June 8 that the annual targets of the financial program with Argentina would remain unchanged, while the quarterly targets will be modified due to the difficulties inherent to the current international context.

Among the macroeconomic targets contemplated in the Extended Facilities Program is a reduction of Argentina’s primary fiscal deficit to 2.5 % of Gross Domestic Product (GDP) in 2022, 1.9 % in 2023, and 0.9 % in 2024.

The Central Bank’s monetary issuance to the Argentine Treasury during 2022 is also expected to be 1 % of GDP in 2022, and 0.6 % in 2023, achieving convergence (zero) in 2024.”

Why did he leave this off? Because he has not read any of this information either.

Look I get Stevie loves to appear on Fox and Friends to degrade Latin Americans. I get he would not lift a finger to make sure their economies do not fail their own citizens. But could this heartless lying troll bother to read beyond some press report which of course he does not even properly cite in full?

“The IMF, like so many vaunted institutions of the past, is now a shell of its former self.”

The topic of this blog post was an IMF WEO forecast which you declared (without basis) was not to be trusted. I provided a thorough review of their forecasting record which notes it has been improved over time.

To write that the IMF is “now a shell of its former self” within this context shows what an utter BOZO you really are. We have asked you to stop this intellectual garbage but as usual you are so arrogant yet idiotic to have noticed.

Look we get it. We know you are the most arrogant moron in the history of time. So just go away as your comments are beyond repugnant.

As for IMF credibility:

My uncle was a 26 year IMF veteran and departed the Fund in, I think, 2001 over the large IMF package extended to Argentina at the time. He felt the amount to large and the conditionalities too small, and of course, he was 100% correct.

Then came the 2015 round. From the WSJ:

In December 2015 when center-right President Mauricio Macri took office, expectations were high that he would tackle the age-old Argentine practice of printing pesos to pay government bills. But he failed to right-size public spending, preferring a gradualist approach to working with a Congress he didn’t control.

By May 2018 international financing was drying up as markets began to lose faith in Mr. Macri. When the peso came under attack, the IMF stepped in with a $30 billion emergency package that soon became part of a $57 billion standby agreement. Mr. Macri lost his re-election bid in October 2019, but when he left office a few months later Argentina had drawn down $44 billion from that agreement.

Oops! Another $30 bn of IMF funds lost in Argentina.

And now the lost $4 bn. So three rounds of handing money over to Argentine deadbeats, with the IMF suckered every time.

In Argentina, the Fund has lost both its money and its credibility.

https://www.wsj.com/articles/argentina-heads-for-another-crack-up-imf-rescheduling-sovereign-debt-inflation-peso-martin-guzman-batakis-11657476599

‘Steven Kopits

July 15, 2022 at 7:03 am

As for IMF credibility:

My uncle was a 26 year IMF veteran and departed the Fund in, I think, 2001 over the large IMF package extended to Argentina at the time.’

Wow – Stevie’s uncle resigned from the IMF because the organization tried to keep ‘Argentinas from extreme poverty. Good to know Stevie’s hatred for Latin Americans runs in the family.

Of course none of this has a thing to do with the reliability of those WEO forecasts. But I’m glad Stevie is so proud of his family’s racism!

I am a born Argentine. My uncle grew up there. What racism are you referring to? And exactly what race are Argentines, in your mind?

Argentina problems are not principally associated with ‘extreme poverty’. It is a middle income country in the range of Mexico, Thailand or Serbia, and with greater per cap GDP at PPP than China. Rather, Argentina has a problem with extremely poor governance.

For example, this:

“Argentina began the 20th century as one of the wealthiest places on the planet. In 1913, it was richer than France or Germany, almost twice as prosperous as Spain, and its per capita GDP was almost as high as that of Canada. Until the 1930s, the French used the phrase ‘‘riche comme un Argentin’’ to describe the foolishly rich. The century’s golden beginning was followed by far less prosperous decades.

You seem to be wholly unfamiliar with Argentina.

https://www.hbs.edu/ris/Publication%20Files/LAER%20Introduction%20to%20Argentine%20Exceptionalism_3c49e7ee-4f31-49a0-ba21-6e2b726cd7c5.pdf

Steven,

I gather that your ancestry is at least partly Hungarian, but there is an oooold wisecrack that “they typical Argentine is an Italian who speaks Spanish and thinks he is English.”

Of course, you are right that the history of IMF-Argentine relations are pretty embarrassing. However, that does not mean that their forecasting shop is incompetent. Analysts and policymakers are often poorly connected, as I think you know in many organizations.

My ancestry is completely Hungarian. I just happened to be born in Argentina. And believe me, it has absolutely nothing at all to do with those Russian guys on the streets of Budapest in 1945.

So, the quick test is: how did they do last time? The last time, the failed to forecast the recession before Nov. 2008!

Not so good, is it?

Yes, that’s correct, Barkley. Forecasting analysts are often quite good. What is published is determined by management. I think there are a lot of smart people at the IMF, but I don’t think it’s a smart organization any more. Could be, though.

more to note: democrats want to authorize $650 in sir’s

sdr are issued by imf and can be “sold” to us treasury for us$

how much more $ for Kiev.

https://www.xe.com/currencyconverter/convert/?Amount=1&From=EUR&To=USD

The Euro is worth less than $1.01. I guess this means the world is coming to an end!

It is if you’re an oil importer. As I noted earlier, US energy independence in oil means that the US dollar will not devalue in the event of an oil shock. However, the currencies of those countries importing oil will tend to devalue. Thus, they will be hit wit a double whammy: high oil prices and a strong dollar. A lot of the ills plaguing the emerging economies will be linked to this, as well as to underlying economic mismanagement in those countries.

Do you have oil on your brain? Come on dude – maybe you can do us all a favor and STFU.

https://www.msn.com/en-us/news/politics/trump-tried-to-contact-a-jan-6-committee-witness-liz-cheney-says/ar-AAZuJ9F?ocid=msedgdhp&pc=U531&cvid=482ec328e236466cb4a9f9d415c8b47d

“Rep. Liz Cheney (R-Wyo.) said former President Donald Trump attempted to contact a Jan. 6 committee witness. During a hearing Tuesday, Cheney said the witness, who has not yet appeared publicly, did not answer a call from Trump and informed their attorney about the attempted contact. The committee turned over information about the attempted contact to the Department of Justice, Cheney said.

Something tells me that people are watching reruns of The Godfather movies as Trump is reminding everyone of a mob boss. Such interference is clearly a felony and the Justice Department has no reason not to prosecute the Criminal in Chief.

The problem in this case is that the mob boss can simply claim that he just wanted to wish them a happy birthday. Without a taped call there is no prosecution – even though we all know what the intended call was all about. The fact that they released this information means they don’t want the political problems associated with charges filled against Trump at this time – it was basically a yellow card against him.

The Atlanta Fed (unofficial) nowcast model continues to show negative GDP for the 2nd quarter … although less negative than a couple of weeks ago.

https://www.atlantafed.org/cqer/research/gdpnow

While gasoline prices have pulled back somewhat (less for diesel which affects the transportation of goods via trucks and trains)…

https://gasprices.aaa.com

the effect of the 40+% increase in energy costs yr/yr continues to work its way through the economy…

https://www.atlantafed.org/research/inflationproject/stickyprice

and could upset some forecast applecarts.

gasoline stock is now just 4% less than year ago

while distillate inventory is down ~20% y on y

not enough demand destruction in transport and utility/heat fuel.

Where are we going? Inflation is much worse than expected.

Recession seems not close, but transitory inflation seems less likely.

Category******* M/M%**Y/Y %**M Annualized

Food****************** 1.0**10.0****12.1

Energy**************** 7.5**41.5**138.9

Core****************** 0.7**5.9 *****8.8

All items*************** 1.3**9.1****17.1

So Princeton Steve thinks he has the expertise to call the IMF WEO forecasts unreliable. By now I’m sure most of you realize we should not trust this troll to take out the garbage so I decided to see if there was a smart, honest, and comprehensive review of their forecasts:

https://www.bloomberg.com/graphics/2019-imf-forecasts

A Bloomberg analysis of more than 3,200 same-year country forecasts published each spring since 1999 found a wide variation in the direction and magnitude of errors. In 6.1 percent of cases, the IMF was within a 0.1 percentage-point margin of error. The rest of the time, its forecasts underestimated GDP growth in 56 percent of cases and overestimated it in 44 percent. The average forecast miss, regardless of direction, was 2.0 percentage points, but obscures a notable difference between the average 1.3 percentage-point error for advanced economies compared with 2.1 percentage points for more volatile and harder-to-model developing economies. Since the financial crisis, however, the IMF’s forecast accuracy seems to have improved, as growth numbers have generally fallen.

There is a lot more discussion so check it out for yourselves. And yea this was written 3 years ago. If there is a most recent update – please provide it. But never ever trust a word Princeton Steve writes. We know he thinks he is the expert on everything even though he clearly is not. And we also know he has a very serious credibility problem.

https://tradingeconomics.com/commodity/lumber

In early March lumber prices were nearly $1450/1000 board feet. We were told by JohnH that oligopoly power would make sure these prices would stay high. Huh – this price has dropped below $650/1000 board feet.

I raise this now as we heard just the other day from JohnH that his prediction was panning out. I’m sorry but the data was already clear that this was not true.

Dr. Ronny Jackson keeps embarrassing himself:

https://www.msn.com/en-us/news/politics/obama-sent-fiery-email-to-ex-white-house-doctor-who-questioned-biden-e2-80-99s-mental-fitness-for-office/ar-AAZxqEu

Presidential physician turned GOP congressman Ronny Jackson’s unfounded campaign attacks on then-presidential candidate Joe Biden’s mental state drew a sharp rebuke from one of his former patients: Barack Obama. Dr Jackson, an emergency medicine specialist, served as a physician in the White House Medical Unit from 2006 to 2018, a period of time covering the George W Bush, Obama, and Trump administrations. He held the title of physician to the president under Mr Obama and former president Donald Trump, but only came to widespread public attention after a bizarre, rambling press conference held to present results of Mr Trump’s annual physical in January 2018. During the hour-long briefing, Dr Jackson praised Mr Trump’s “good genes” and claimed the clinically obese then-president could have lived to be 200 years old had he eaten a better diet for the prior two decades. Mr Trump was pleased by his physician’s performance, and attempted to reward him with a nomination to run the Department of Veterans Affairs. But Dr Jackson’s nomination was derailed amid allegations that he’d improperly dispensed prescription medications and driven government vehicles while intoxicated. After retiring from the Navy at the rank of rear admiral, Dr Jackson cashed in his Trumpworld celebrity status with a run for a Texas congressional seat during the 2020 election. As a Republican candidate for Congress, he posted a tweet suggesting a malapropism by Mr Biden was evidence that the 2020 presidential candidate needed a cognitive exam. In his new memoir, Holding the Line: A Lifetime of Defending Democracy and American Values, Dr Jackson writes that his tweet about Mr Biden drew a response from Mr Obama within 20 minutes. “I have made a point of not commenting on your service in my successor’s administration and have always spoken highly of you both in public and in private. You always served me and my family well, and I have considered you not only a fine doctor and service member but also a friend,” Mr Obama said in an email, according to Dr Jackson’s book. “That’s why I have to express my disappointment at the cheap shot you took at Joe Biden via Twitter. It was unprofessional and beneath the office that you once held. It was also disrespectful to me and the many friends you had in our administration. You were the personal physician to the President of the United States as well as an admiral in the U.S. Navy. I expect better, and I hope upon reflection that you will expect more of yourself in the future,” the former president added.

Off topic, but I just can’t leave this one alone –

The longer-term outlook fot finance is obviously tied to the outlook for climate change. Attention to the issue is increasing. Here’s a fresh look:

https://voxeu.org/article/climate-change-risks-sovereign-debt

One worry raised in the article is the likelihood of positive feedback between debt costs and climate change – a doom loop, says the author Climate change raised borrowing costs. Higher borrowing costs increase the cost of dealing with climate change, which limits the response. More climate change.

The author sticks to sovereign borrowing, but that’s just the government side of the problem. The private response to climate change will be costly and will also be financed with debt.

MD, how costly, sovereign and private, will it be? With the inauguration inflation became a major factor and was largely caused by Biden’s climate, energy, war on fossil fuels and environmental policy shifts. What portion of today’s announced 9.1% inflation rate do you apply to that ole doom loop?

I know how much I think applies. Hint: Trump’s non-covid years averaged 2.1% and in Biden’s 17 months inflation has averaged 6.2. I definitely see a climate change doom loop, and we are currently in it.

They’re your bad policies, but we all have to pay the price for your doomed policies.

Damn – your word salad has become rotten. Your little question is so badly worded that your preK teacher has asked the school to kick you out of the class as you are interfering with the smart kiddies getting an education.

Good golly! My policies! I never realized how influential I’ve been.

We’ve been over this before, but some students need extra help, so here you go:

Inflation is worldwide. Energy prices are high everywhere that governments don’t subsidize energy purchases. The idea that my policies (woo hoo!) are to blame for a spike in gasoline prices un the U.A.E. is crazy. You keep blaming me (yay, me!) or Biden or Democrats but that’s just dumb. Biden doesn’t make policy for Europe. Neither do U.S. Democrats. Even I don’t have that power.

But you just keep trying to blame Americans for problems in the wider world,, without ever trying to explain how that wors.

And I can’t wait to see you try!

MD, “Good golly! My policies! I never realized how influential I’ve been.” What kind of weak minded arrogant fool takes your as singular, then talks about personal policy influence? You’re absolutely correct you are neither influential nor correct in your selection of policy to support.

So let me fix my statement so that even the peanut gallery understands.

They’re your SUPPORTED bad policies, but we all have to pay the price for your doomed policies.

Yes, they are similar in Europe, but you knew all that. Denial is first and acceptance will come eventually.

Weak minded arrogant fool? Like the guy who proudly proclaimed himself a “citizen of the world” and a spokesman for,oh, the other citizens of the world? That guy?

Nonecon, are we not all citizens of the world? Or are you a citizen of another world. I never claimed to be a spokesman for: “… the other citizens of the world?”

I’m still trying to see a view point where there are “other citizens”. Help us out here.

Hey CoRev – look up Post Hoc Ergo Propter Hoc. Huh – I changed my mask a little over a year ago. I guess my act there caused inflation.

OK – that is a totally nonsense explanation. But it makes more sense than your babble.

Speaking of climate change risk, in some parts of the country it’s becoming increasingly difficult to get homeowners insurance at any price. And some of the big agriculture crop insurers are looking to get out of that business as well. One of my nephews is a project manager for a big ag insurer in Des Moines and he tells me that his company is preparing to get out of that market due to climate change risk. Farmers are going to come to a rude awakening in the near future. It’s all about the difference between variability and Knightian uncertainty. Knightian uncertainty is an uninsurable risk.

2slugs makes another silly claim re: climate change when he actually means WEATHER. “Speaking of climate change risk, in some parts of the country it’s becoming increasingly difficult to get homeowners insurance at any price. ”

https://homeguides.sfgate.com/reasons-denial-homeowners-insurance-1647.html

“Location of Property

Insurance companies can deny homeowners insurance if the house is located in a high-risk area for weather or crime. A home located in an area prone to tornadoes, hurricanes, windstorms or hail may mean an increased risk of property loss and more money to settle those claims….”

When haven’t insurance companies been concerned with risk? It is the core of their business. The mistake is confusing climate change with weather. Areas prone to more frequent weather events have had higher insurance rates, and fewer source. Insurance companies often reduce particpation in those areas. Weak companies may even withdraw.

So what else is new or different? That wasn’t.

Golly gee – when we think you could get more stupid, you exceed expectations. I can see why no insurance company would hire a lying troll like you as an analyst.

Pure denial, CoVid. Yes, insurance companies care about risk. When risks change, they adjust. They are adjusting to climate change. Your desperate effort to erase “climate change” and substitute “weather” doesn’t change facts.

They insure against weather. They don’t want to insure against climate change. Why? The changey part. Backward-looking actuarial calculations don’t give the right answers when permanent change is underway. Permanent, as in “climate”.

You might want to avoid this “say anything to derail the discussion ” approach you’ve adopted. You end up saying really dumb stuff.

In case you hadn’t noticed, CoRev is utterly clueless about basic statistical concepts. So when you explain why “backward-looking actuarial calculations don’t give the right answers when permanent change is underway,” he simply won’t understand what you mean. Remember, this is the same guy that gave us something called an “anomaly process” to describe “trends” in employment. That entire discussion about deterministic trends versus stochastic trends went right over his head.

MD, more gibberish.

CoRev You don’t get it. That article was talking about quantifiable risk with known parameters. Insurance companies have always denied coverage if quantifiable risks are so high that no one would buy the insurance. But now the reason insurance companies are getting out of the business is that, because of climate change (NOT weather), those risks are not quantifiable; i.e., they reflect Knightian uncertainty, which is different from variability. That’s what’s new and different. If it were just a problem with weather, then the risks would be quantifiable; but that’s not the case. Under conditions of uncertainty not only do you not know the second moment, you don’t even know the first moment. And that’s why my nephew’s ag insurance company is getting out of the ag insurance business.

12slugs, even more gibberish. Please stop digging.

I guess your nephew’s insurance company wasn’t making enough, while better companies were. Competition!

A smart explanation which went WAY OVER CoRev’s puny brain. So our village idiot dubs your comment gibberish.

I take it back as Barkley was right when he said CoRev is even dumber than Bruce Hall.

The attention is kind of growing on this one isn’t it??~~ and not all-together by choice. Thanks for noticing Sir and feeling it needs to be talked about. I guess Professor Chinn would be discussing this more, if he hadn’t got tired of people calling him liberal every time he discussed important issues. I’m dizzy now, who spinned me around by my shoulders?? (joke)

Pursue Happiness with diligence,

https://fred.stlouisfed.org/graph/?g=G5WZ

January 4, 2020

Real Average Hourly Earnings of Private Production and Nonsupervisory Workers, * 2020-2022

(Indexed to 2020)

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

https://fred.stlouisfed.org/graph/?g=G5Ya

January 4, 2020

Real Average Hourly Earnings of All Private Workers, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=twAi

January 15, 2018

Real Average Hourly Earnings of All Private Workers, 2017-2022

(Indexed to 2017)

Also off topic –

China has agreed to make up for bank “deposits” sequesterd in April, recognizing fraud was involved. This article suggests it ain’t over. Bad lending practices, sick real estate, poor stress testing by government authorities and Covid are all part of a toxic brew:

https://www.reuters.com/breakingviews/chinas-rural-bank-scandal-has-300-bln-tail-risk-2022-07-12/

https://www.washingtonpost.com/nation/2022/07/13/john-bolton-coup/

Then Bolton claimed to have firsthand experience orchestrating coups. “As somebody who has helped plan coups d’etat — not here, but, you know, other places — it takes a lot of work, and that’s not what [Trump] did,” Bolton told Tapper. Bolton’s comments were unusual, as U.S. officials have generally avoided using the term “coup” when speaking about U.S. foreign policy matters. The remarks went viral, with one clip on Twitter amassing more than 2 million views by early Wednesday.

John Bolton is another person who should NEVER be in a position to influence our foreign policy. He was a mistake under Bush43 and a mistake under Trump. BTW – of you have not wasted your money on his book, DON’T.

bolton would be behind a lot of failings….

And yet again, off topic –

A wet-bulb temperature of 35c has for some time been seen as the theoretical safe upper limit for healthy humans. That limit was based on what was known about human physiology, without experimental validation. Well, crud, a beemsit off empirical work and it looks !Ike that number is to high:

https://journals.physiology.org/doi/abs/10.1152/japplphysiol.00738.2021

A wet-bulb temperature of 31C looks more like the limit past which, under moderate activity (making lunch) body temperature rises steadily among healthy young individuals. For the older crowd, it’s worse.

This new, empirical finding means that much of the sustainability and “planetary limits” literature may not be panicky enough. Meanwhile, other new research suggests wet-bulb extremes are higher than had previously been measured:

https://news.climate.columbia.edu/wp-content/themes/sotp-foundation/dataviz/heat-humidity-map/

So wet-bulb heat extremes are higher and human tolerance for wet-bulb heat extremes lower than we had previously thought. Anybody reading weather headlines from Australia, India, Japan, Pakistani or Tennessee already had reason to suspect that was true, but now we’re seeing evidence.

But please, let’s keep pretending there’s a “war on fossil fuels”.

FWIW: Costco gas comparison 7/13, 1:40 PDT

Sacramento. $5.39

Reno. $5.09

Boise. $5.09

My foothills station where I buy gas (“Top Tier”) $5.99, down from $6.49

Still plenty of “Now Hiring” signs up, some $16, some $17. State minimum is $15 or $15.50 depending on number employed

Well, the technobureaucrats of the IMF may not forecast recession, but some disagree.

https://markets.businessinsider.com/news/stocks/recession-us-inflation-bank-of-america-sticky-prices-markets-housing-2022-7

“A deep recession would be needed to bring down soaring inflation, and high prices are going to be very sticky, BofA says”

“Inflation has proved anything but transitory, and it’s going to take a deep recession to tame the sticky high prices, according to Bank of America.

In a Friday note, the bank’s analysts said market pricing implied inflation would fall to or below the 2% target in about two years but that the economy would need to see a severe downturn to achieve that.”

Inflation has proved anything but transitory… and so go Janet Yellen’s protestation of lore.

But more to the point, I wonder what BofA know that IMF does not, and of course, viceversa.

Me thinks Manfred is trying too hard for the Stupidest Man Alive award. Is it not possible that the US economy could maintain solid economic growth with inflation continuing to be something near 5%? That would not be a bad situation – even one who even remotely gets economics knows this.

But not Manfred. The only way his latest stupid rant makes any sense is a belief that the FED must immediately lower inflation to no more than 2% even if it means a recession. Of course such a suggestion is beyond STUPID. But hey – your typical Manfred comment!

with jun final demand ppi at +11.3…..

i will wait for the prints.

call me what you will!

Canada raises rates by 1.0%. Is that the next move by the FED?

https://www.msn.com/en-us/money/companies/bank-of-canada-surprises-with-largest-rate-hike-in-decades/vi-AAZxFdW

Canada’s 10-year government bond rate was already 3.26% – higher than the 3.08% rate in the US. Now if they want the Canadian dollar to appreciate against US$, I bet we would enjoy the increase in net export demand.

Looks like the odds of 100 basis point increase have increased since June 14, although currently at 43% down from 80% on July 13.

https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

Current money market prices put odds of 75 basis points at 57%, 100 bps at 43% for the July meeting. That leaves room for a rate-hike shock, but time for adjustment before the FOMC meeting.

The dissent against 75 bps last time was because it was too abrupt, but 75 bps was already mostly priced in, more than a 100 bp hike is priced in now. A week ago, odds of 100bps were priced at zero, though, so I guess that’s still pretty abrupt.

https://news.cgtn.com/news/2022-07-12/Chinese-mainland-records-107-new-confirmed-COVID-19-cases-1bBgBOHyWis/index.html

July 12, 2022

Chinese mainland records 107 new confirmed COVID-19 cases

The Chinese mainland recorded 107 confirmed COVID-19 cases on Monday, with 69 attributed to local transmissions and 38 from overseas, data from the National Health Commission showed on Tuesday.

A total of 317 asymptomatic cases were also recorded on Monday, and 3,208 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 226,811, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-07-12/Chinese-mainland-records-107-new-confirmed-COVID-19-cases-1bBgBOHyWis/img/f07c8d2898cb47179432a31158442862/f07c8d2898cb47179432a31158442862.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-07-12/Chinese-mainland-records-107-new-confirmed-COVID-19-cases-1bBgBOHyWis/img/86043dfa239f4b8d994ca960d6d7e934/86043dfa239f4b8d994ca960d6d7e934.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-07-12/Chinese-mainland-records-107-new-confirmed-COVID-19-cases-1bBgBOHyWis/img/9f1e760485864a1f86315c673b9ac55f/9f1e760485864a1f86315c673b9ac55f.jpeg

https://www.worldometers.info/coronavirus/

July 12, 2022

Coronavirus

United States

Cases ( 90,683,223)

Deaths ( 1,046,613)

Deaths per million ( 3,149)

China

Cases ( 226,811)

Deaths ( 5,226)

Deaths per million ( 4)

With the latest inflation numbers, it is almost certain that the Fed will overreact. The damage done already in real estate is more than enough to tame the temporary spike in inflation. Another 2% added this year would take a bad situation and make it a disaster.

You may be right – alas. Hey check out the latest from Manfred. You’ll get a chuckle out of this troll’s idiocy.

is over correcting worse than presuming it was transitory

Problem is, demand management when supply-side pressure is largely responsible for inflation may not be very effective. We’ll get back to a lower pace of inflation, but the Fed should be thinking about avoiding fueling additional inflation while supply problems are sorted out. It should not be trying to defeat supply-side inflation. That would be disastrous.

How low can those MAGA hat wearing pigs at Faux News go?

https://www.thedailybeast.com/fox-news-host-jesse-watters-suggested-10-year-old-rape-victims-abortion-was-a-hoax-before-arrest

On Monday evening, Fox News host Jesse Watters spent the opening segment of his primetime show suggesting the case of a 10-year-old Ohio girl who was forced to travel to Indiana to get an abortion after she was raped was fabricated to benefit a left-wing agenda. The following night, Tucker Carlson straight-up called her story “not true.” On Wednesday, that girl’s alleged rapist was arrested.

She was raped. Of course Jesse Watters basically raped her again. I would say Tucker raped her again but girly man is not up to anything but spewing racist vile.

Is Kevin Drum accusing the Washington Post of letting CoRev write their headlines? WaPo claimed there was no good news in the June report on consumer prices:

https://jabberwocking.com/yes-there-was-good-news-in-the-june-inflation-report/

But wait! Core inflation down. Wage inflation not nearly as high as headline inflation. Kevin also reports the producer price index just before he notes:

There’s no trick here. Inflation is high and headline CPI is especially high. But if you want to understand the underlying inflationary pressures in the economy—not the effects of OPEC and bad weather and a war in Ukraine—you look at core inflation. And that’s been going down since February.

But hey – why bother these details if you are not even remotely interested in an honest conversation. MAGA.

More on the Faux News pig

https://www.msn.com/en-us/news/politics/fox-news-jesse-watters-boasts-about-his-own-reporting-after-claiming-child-rape-report-was-actually-a-hoax/ar-AAZzTT3?ocid=msedgntp&cvid=e65fca0dd7b441ddaddeff07b014ad3b

‘Fox News’ Jesse Watters recently boasted on his own reporting as he attempted to take credit for adding “pressure” to push the investigation into the rape of a 10-year-old girl in Ohio although he was one of the many conservatives who claimed the reports were only a hoax.’

WTF? Watters was not helping law authorities at all – he was attacking the victim. Hey the next time that a slime ball defense attorney accuses a rape victim of being a whore, the slime ball attorney could simply say he was helping the prosecutor Jesse Watters style.

Leave it to Jim Jordan to support Jesse Watters attacking the 10 year old girl who was raped:

https://www.alternet.org/2022/07/jim-jordan-faces-criticism-for-his-opinion-on-a-recent-child-rape-case/

Check out how the Twitter went after Jim Jordan. You will be glad you did!

Is this the beginning of the end of China’s insane real estate market?

https://www.cnn.com/2022/07/14/economy/china-property-crisis-homebuyers-bad-debt-intl-hnk/index.html

The model of forcing people to begin monthly payments on a condo even before it is build is a risky one. It is much more tempting to walk away from a bad deal if you are not yet living there.

WTI drops below $95/barrel!

Barking Bierka – the Disgusting NYC Jerk, keep praying. Maybe that ole war on fossil fuels will come to an end before the elections.

You do need to take your meds. I guess reporting the latest market news compelled you to chase your own tail for the rest of the day.

corev, why are you excited about high oil prices? just as a reminder, high oil prices from this point forward simply accelerate our move towards renewable energy sources. or do you like the damage to the public that high oil prices induce? do you hate your fellow citizens that much? because when you cheer for high oil prices, you are simply hurting your neighbor out of contempt.

Actually CoRev has become dizzy as this old dog cannot stop chasing his own tail!

JohnH choose to exemplify his oligopoly leads to high inflation thesis by claiming that surge in lumber prices would never reverse itself. In fact he claimed lumber prices had not yet declined just this week even though they have. And now this story?

https://www.msn.com/en-us/money/markets/lumber-plays-e2-80-98canary-in-the-coal-mine-e2-80-99-cues-downturn-in-commodities/ar-AAZA7GU?fromMaestro=true

The lumber market has taken some big hits from rising inflation and a slowdown i n the housing market, with lumber prices down more than 40% in the first six months of the year. They could fall still further before bottoming out. Lumber has bucked the overall uptrend in the commodities market. The S&P Goldman Sachs Commodity Index composed of 24 exchange-traded commodity futures contracts, jumped 26% in 2022’s first half, though has moved lower in the third quarter. “Lumber truly has its Ph.D. in trading and is the ultimate canary in the coal mine when it comes to being a leading indicator for all other commodities,” says Greg Kuta, president and CEO of lumber broker Westline Capital Strategies. “The inherent volatility in lumber pricing is highly sensitive to both demand and supply dynamics, and is very quick to reflect changes in demand and supply on a micro level.”