One of the interesting aspects of the current recovery is the relative small rebound in nonresidential fixed investment.

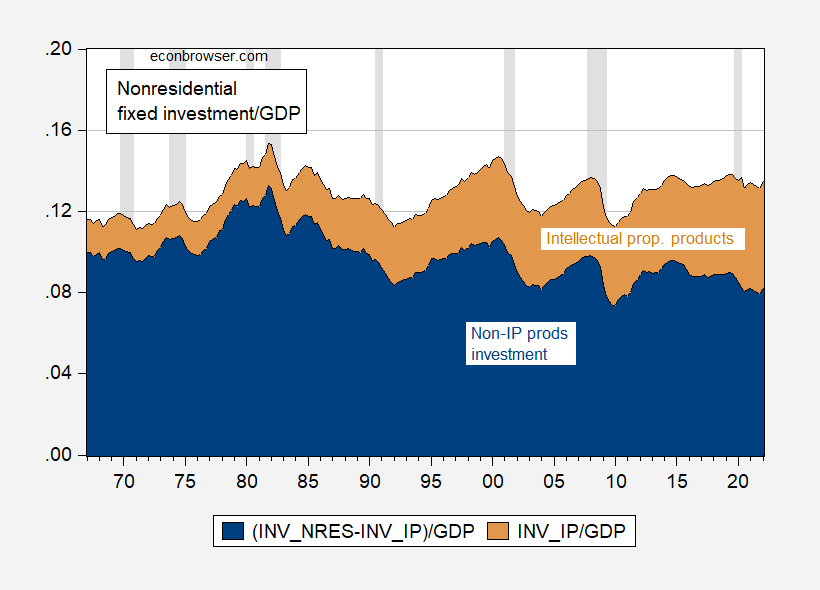

Figure 1: Non-intellectual property products nonresidential fixed investment share of nominal GDP (blue), and intellectual property products investment share of (tan), SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, author’s calculations.

Notice that the drop in nonresidential investment was fairly small, and the bounceback relatively small. Perhaps what is more interesting is that the share of IP products investment has been increasing over time. And in terms of nominal GDP growth, IP products investment has grown in importance — pre-Covid-19. In Figure 2, I show the q/q changes, but the share of GDP impact shows the same pattern.

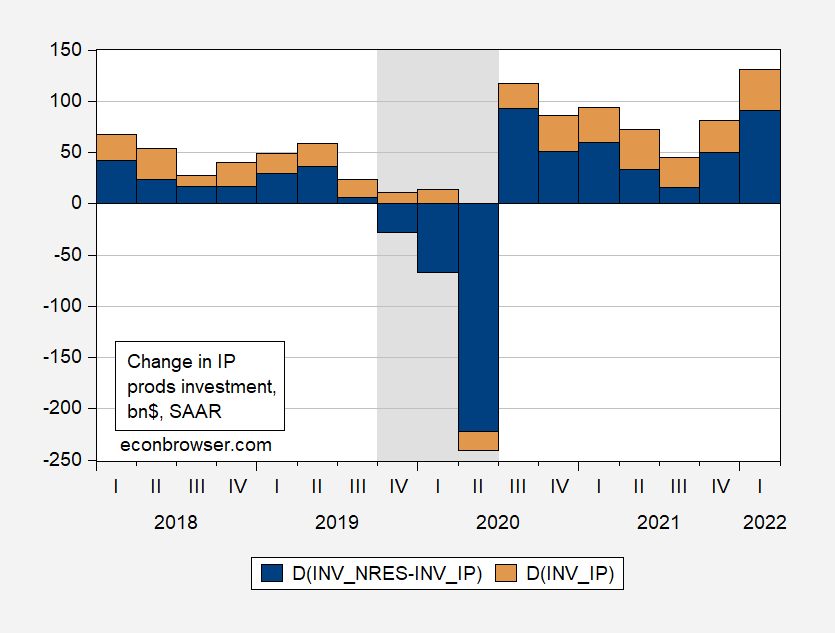

Figure 2: Quarter-on-Quarter change in non-intellectual property products nonresidential fixed investment (blue), and intellectual property products investment (tan), SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, author’s calculations.

Note that I have used the BEA aggregate series for IP products (the components are software, R&D, and entertainment, and literary originals) in these figures. Detail on the heterogeneity of the IP products investment is in Fixler and de Francisco (2022).

Now, there are two implications to draw from this observation. The first relates to what the final Q1 and Q2 GDP numbers are likely to eventually look like. Investment in IP has been revised upwards substantially in certain cases.

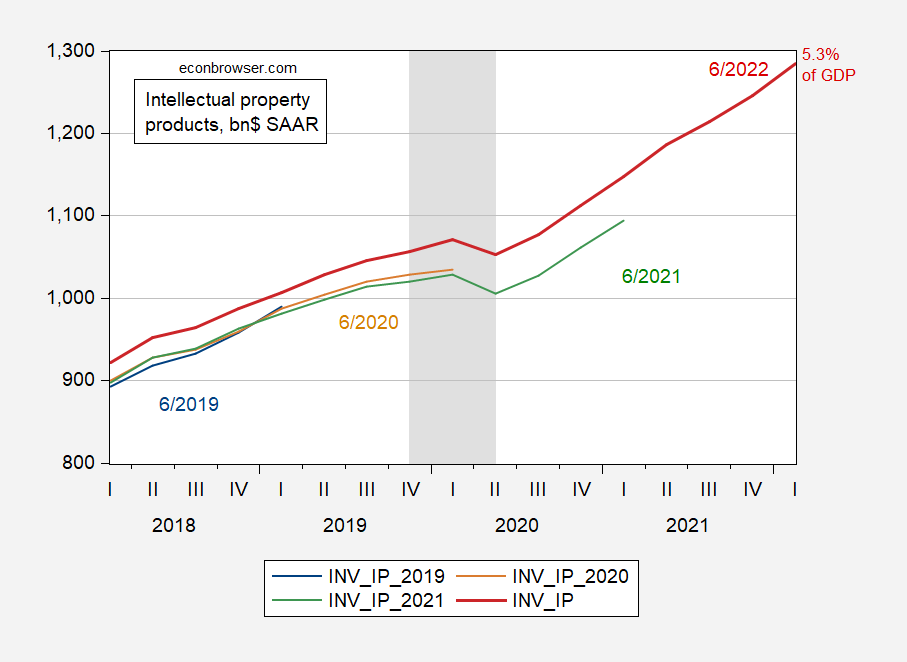

Figure 3: Intellectual property products investment from June 2019 release (blue), June 2020 (tan), June 2021 (green), and June 2022 (bold red), all in bn$, SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, author’s calculations.

Not only is the who series shifted up with the benchmark revision reported in July 2021 (by about one-quarter of one percentage point of GDP), but — what is important for GDP growth rates — the changes in IP products investment are typically revised up. Hence, an additional point for my belief that GDP growth in 2022 is likely to be revised upward as the GDP data are benchmark revised.

The second observation relates to the impact of tightening monetary policy. The view that intangible capital investment is less sensitive to interest rate changes (e.g., Crouzet and Eberly, 2019) implies that monetary policy might need to be tighter than otherwise in order to hit a given target reduction in aggregate demand.

https://fred.stlouisfed.org/graph/?g=z21W

January 15, 2018

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2017-2022

https://fred.stlouisfed.org/graph/?g=z21I

January 15, 2018

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=AuPM

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2022

(Indexed to 2020)

For whatever it’s worth, I’m strongly against a 75bps Fed hike. I think 25bps at the most, or even a pause to see where things are going.

Moses.

Having just given you a hard time on the nest thread, I shall be nicer here and say that while I think you may be a bit overstating it, I largely agree that probably a 75b[s boost is not necessary and might well overdo it. Heck crude oil prices, both WTI and Brent fell below $100 per barrel.

I just read in a few places that ARAMCO is jacking up supply as a reward for Biden’s visit—so that $100 barrel might even go lower. I wonder if some finance bros who dumped crypto immediately jumped into futures contracts for crude that assumed a price jump to $150 a barrel. I guess that’s why it’s called gambling, not winning.

I mostly agree with Moses on the Fed being more calm at the next meeting. The June CPI numbers are reflecting spring momentum that is clearly fading. I just might pull my “Team Transitory” t-shirt out of its hiding place.

@ David S.

Careful, wearing that transitory shirt was like a t-shirt with the scarlet letter A (damn, and I thought I was kinda clever beforehand, joking, mostly at myself).

I still hold, that Summers was wrong on stimulus. I admit he was right (and I was wrong) on the direction and amount of inflation. That doesn’t mean Summers was right that the fiscal stimulus was the main driver, or even much of a small one, from my viewpoint. I’ll bow down to Summers on his call on the level of inflation being largely correct, NOT in the fiscal stimulus having much to do with it~~which was a central part of Summers’ contentions.

Question: If I have 5,000 people and ONLY 5 apples to share for that day’s lunch, what amount of stimulus, high or low, or Fed set rate, high or low, solves the supply/pricing problem???

inflation is high because of the war in ukraine. absent the war, inflation would now be falling. summers does not get credit because his call for inflation was predicated on a completely different source. and that makes a difference when somebody takes action (or inaction) on inflation.

Davis S: “I just might pull my “Team Transitory” t-shirt out of its hiding place.” Conservative analysts right after the announcement were saying today’s stock market movement indicates a 100% chance for the 0.75% increase. Dunno, we’ll just have to wait and see.

https://www.imf.org/en/News/Articles/2022/07/11/CF-US-Economy-Inflation-Challenge

July 12, 2022

The US Economy’s Inflation Challenge

Policy action

The Fed increased its policy rates by 1.5 percent so far this year and is likely to increase them by another 2 or 2.5 percent in the coming months. It is also unwinding its holdings of Treasury bonds and mortgage-backed securities. As a result, the cost of borrowing has significantly increased. For example, the average fixed rate on a 30-year mortgage has already risen from 3 percent to between 5 and 6 percent since the start of this year. At the same time, the government is reining in spending, as a range of pandemic-era support programs are expiring.

We expect these policy actions will slow the growth in consumer spending to around zero by early next year, easing the strain on supply chains. At the same time, higher mortgage rates will reduce housing prices, which have grown strongly during the pandemic. Finally, slowing demand will increase unemployment to around 5 percent by the end of 2023, which should decrease wages.

All in all, we expect core PCE inflation to fall back toward 2 percent by late 2023, and economic activity to slow from 3.5 percent in the first quarter of this year to 0.6 percent by end‑2023.

— Andrew Hodge

Professor Chinn, you see, how the colors in the background and the fishies match the color of you and Professor Hamilton’s blog?? I mean, come on. I think it’s a nice color.