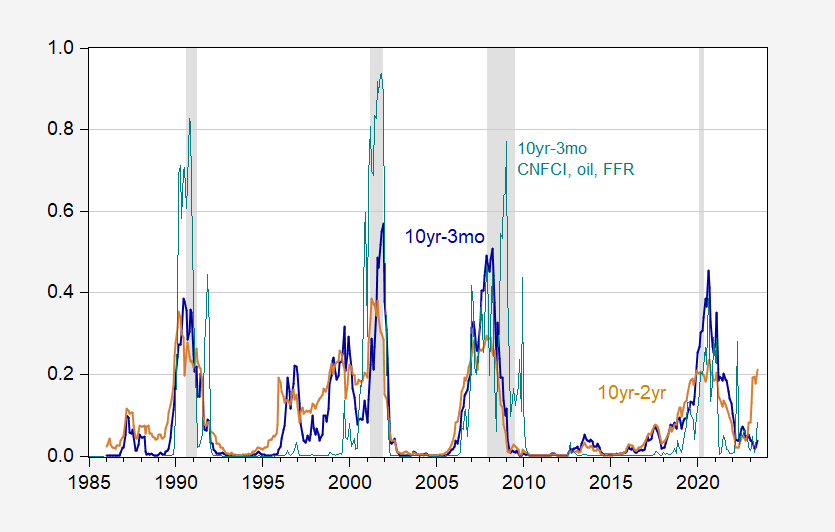

Probabilities from 10yr-3mo and 10yr-2yr spreads:

Figure 1: Probability of recession for indicated month, using 10yr-3mo spread (blue), using 10yr-2yr spread (brown), and 10yr-3mo spread augmented with Fed funds rate, Chicago Financial Conditions Index, 12 month change in oil price (teal). NBER defined recession dates peak-to-trough shaded gray. Source: Treasury via FRED, NBER, author’s calculations.

Probabilities for June 2023 are 3.8% and 21.2% for the 10yr-3mo and 10yr-2yr spreads. If one augments the 10yr-3mo with Chicago Financial Conditions Index, Fed funds rate, and 12 month change in oil price, then the probability is 8.4%. Note this specification is similar to the one used by Ahmed (2022), except for the exclusion of foreign spreads and stock market variables (the McFadden R2 is 0.51, vs. 0.28 for unaugmented).

I’m certain alternative term spread models, including other variables, could lead to higher implied probabilities of recession, but the plain vanilla ones don’t at the moment lead to higher than 22% (10yr-2yr) at the 12 month horizon (26% at the 18 month horizon for 2023M12).

https://www.nytimes.com/2022/06/24/opinion/inflation-unemployment-prices-economy.html

June 24, 2022

Hot economies and high prices

By Paul Krugman

It is a truth universally acknowledged — well, anyway, a truth acknowledged by everyone I know who thinks about the subject — that a hot economy leads to higher wages and prices. When demand for labor is strong, workers can and do demand wage hikes; when demand for goods and services is strong, businesses have “pricing power,” or the ability to raise prices without losing customers.

But does a hot economy lead to a higher level of prices? Or does it lead to a higher rate of change in prices, i.e., ongoing inflation? Or maybe even to accelerating inflation, a higher rate of change in the rate of change?

These may sound like abstruse questions, but they aren’t. On the contrary, they have frequently been at the heart of debates over economic policy; they are, in fact, central to current debate. Yet I’m not sure everyone writing on economics right now understands these distinctions. Nor am I even sure that all academic macroeconomists are fully aware either of the history or the importance of these questions: Much modern academic macroeconomics (as opposed to policy analysis) is wrapped up in the study of dynamic stochastic general equilibrium models (don’t ask), which in a way assume away the whole issue.

So I thought I’d use today’s newsletter to talk about what a hot economy does to inflation — in particular, about how both the evidence and widely held views about that relationship have changed over time. It’s a story that is, frankly, not very encouraging for those who want to think of economics as a science.

A note to professional colleagues: This newsletter is not intended as a research paper. I present some data, but only for illustrative purposes, not as part of a serious empirical analysis. If you want a state-of-the-art look at the empirical evidence, I recommend you start with this highly influential paper by Emi Nakamura, Jón Steinsson and associates. Or if you want detailed analysis of what the current inflation data seem to be saying, you might want to read Matthew Klein and this Brookings discussion.

But if you want a quick and dirty look at what the real issues seem to be, read on.

In the beginning was the aggregate supply curve — a putative upward-sloping relationship between output and the overall price level, or more or less equivalently a downward-sloping relationship between unemployment and prices. And I do mean in the beginning: It’s right there in John Maynard Keynes. It’s also clearly visible in Depression-era data. Overall prices slumped when the U.S. economy plunged into depression, rose back up as the economy recovered, then fell again as the economy relapsed in 1937. Here’s what the scatterplot for those years looks like:

https://static01.nyt.com/images/2022/06/24/opinion/krugman240622_1/krugman240622_1-jumbo.png?quality=75&auto=webp

The way it used to be….

https://www.nytimes.com/2022/07/01/opinion/inflation-fed-stagflation-recession.html

July 1, 2022

Taking the “flation” out of stagflation

By Paul Krugman

A funny thing happened on the way to the Federal Reserve’s latest rate hike. The Fed went big on June 15, raising the interest rates it controls by 75 basis points, or 0.75 percentage points — a sharp rise for an institution that usually tries to move gradually. Why the urgency? As Jerome Powell, the Fed chairman, made clear, he and his colleagues were afraid that expectations of inflation were becoming “unanchored,” which some economists argue could lead to inflation becoming “entrenched” (The trench is losing its anchor? Time to call in the mixed-metaphor police? Never mind.)

According to Powell, one factor in the decision was a jump in the University of Michigan’s measure of long-term inflation expectations, which he described as “eye catching.” I and others warned about making too much of one month’s number, especially because other measures of expected inflation weren’t telling the same story — and to be fair, Powell acknowledged that this was a preliminary number that might be revised. Sure enough, the number was revised down; apparently, inflation expectations aren’t losing their anchor after all. Oopsies.

In fact, the big story right now seems to be a quite sharp decline in market expectations of inflation over the medium term. Here’s the five-year breakeven — the spread in interest rates between ordinary U.S. government bonds and inflation-protected bonds that are indexed to consumer prices:

https://static01.nyt.com/images/2022/07/01/opinion/krugman010722_1/krugman010722_1-articleLarge.png

Getting our anchor back.

This spread is an implicit forecast of inflation over the next five years; it’s down about a percentage point since March. And the underlying picture is even better than this number suggests, because investors appear to believe that we’re only going to have a year or so, if that, of elevated inflation, and after that we’ll be back to roughly the Fed’s long-run target of 2 percent inflation as measured by the personal consumption expenditure deflator, which tends to run a bit lower than the Consumer Price Index….

https://eml.berkeley.edu/~enakamura/papers/StateLevelCPIs.pdf

May 26, 2022

The Slope of the Phillips Curve: Evidence from U.S. States

By Jonathon Hazell, Juan Herreno, Emi Nakamura and Jon Steinsson

Abstract

We estimate the slope of the Phillips curve in the cross section of U.S. states using newly constructed state-level price indexes for non-tradeable goods back to 1978. Our estimates indicate that the slope of the Phillips curve is small and was small even during the early 1980s. We estimate only a modest decline in the slope of the Phillips curve since the 1980s. We use a multi-region model to infer the slope of the aggregate Phillips curve from our regional estimates. Applying our estimates to recent unemployment dynamics yields essentially no missing disinflation or missing reinflation over the past few business cycles. Our results imply that the sharp drop in core inflation in the early 1980s was mostly due to shifting expectations about long-run monetary policy as opposed to a steep Phillips curve, and the greater stability of inflation between 1990 and 2020 is mostly due to long-run inflation expectations becoming more firmly anchored.

From the Atlanta Fed… unofficial estimates.

https://www.atlantafed.org/cqer/research/gdpnow

Gee Stevie has company in someone who is praying for a recession. I wonder if this troll is as dumb as Stevie thinking that the chief economist for Goldman Sachs has no clue about forecasting.

The Atlanta Fed is praying for a recession? Damn, pgl, you can rant incoherently all of the time.

Your retorts are the most feeble things I have ever seen. Everyone knows I was referring to our favorite Village Idiot. Now run along as your mommy is calling.

There are some who are Pollyannas…and this one was one of the few who got it right in 2008…

https://fortune.com/2022/06/21/nouriel-roubini-recession-prediction-inflation-federal-reserve/

I hate to use this rotten old rag of a critique, but you need to learn to read your sources before using them:

“Nouriel Roubini said the U.S. economy is not yet in a recession…”

“My baseline would be one of a recession by the end of this year…”

So the guy you choose to back up your view doesn’t offer any support for “even upon us now!!!!!!!!!!!!!” (Love exclamation points almost as much as ALL CAPS!!!!!) What he does offer is that there is considerable risk of recession relatively soon, an idea that is widely held, though you seem to think otherwise.

I can’t tell whether you just aren’t smart enough to offer opinions, or you just prefer squawking to intellectual effort. Either way, what comes out is shamefully thin. Grow up, kid.

You see – JohnH has this amazing ability to grasp the entire discussion from just reading the headline. He does it all the time!

Interesting that my comment about economists in denial about the possibility of a recession being nigh or even upon us never got posted. Roubini is obviously NOT among those suffering from herd instinct or whatever keeps others in denial.

Gee – you still have not read your own link! Typical.

No one is downplaying anything. Now we might be making fun of the latest tweet from MAGA land but I guess some folks thinks such tweets are economic gospel.

Johny, Johnny, Johnny,

You were doing so well for a while. Then you decided to write a comment and it all went to…wait, this his is a family blog, right?

The desperate need to downplay the possibility of being in recession now grows out of a love of facts. Menzie kindly posts those facts on a regular basis. There is no evidence of recession now.

Recession could be nigh? Define “nigh”. While you’re at it, name names. Who here has said there is no recession on the horizon? Who? Name one person. One.

Or maybe you have in mind someone in the wider world, not a commenter on this blog. Name one. Come on. You flapped and squawked, now say who you mean.

Your preference for fantasy and desperate need to draw attention to yourself aren’t likely to change the thinking of those who rely facts. Give us some facts. Who?

I just completely my weekly compilation of over 40 long and short leading and coincident indicators. The US Treasury term spread is one of the few unalloyed positive indicators left. The remained mainly are centered on employment and consumer spending.

Realistically, there is no longer a question as to whether a recession is near. I am discounting the term spreads because, among other things, after WW2 there were 2 recessions that followed inflationary economic booms, where the Fed never raised interest rates meaningfully and the term spread never inverted.

The remaining question are: when does it begin; and how deep will it be? Since a big part of the answer has to do with the war in Ukraine, and the price of gas as a result, I don’t know of any good answer yet.

http://english.news.cn/20220625/1e39dc5bf0f84d98bb073dcc210050ab/c.html

June 25, 2022

Airbus to set up China research center to boost innovation

BEIJING — Airbus will establish the Airbus China Research Center in Suzhou, east China’s Jiangsu Province, to strengthen the company’s footprint and innovation partnerships in China, the company announced Friday.

The Airbus and Suzhou Industrial Park signed a framework agreement on Friday on the establishment of the center. The new move by Airbus is aimed at reaffirming its long-term commitment to cooperating with and investing in China, according to Airbus China.

“China not only has a promising aviation market, but also has advanced technological advantages in many fields,” said George Xu, executive vice president of Airbus and chief executive officer of Airbus China.

“Airbus hopes to jointly contribute to the high-quality development of China’s aviation industry by taking advantage of the high-quality business environment, unique industry chain and talent pool here,” Xu said.

The Airbus China Research Center is located in China’s Yangtze River Delta, one of the country’s economic hubs.

It will carry out research work on advanced technologies, such as hydrogen energy infrastructure, advanced manufacturing, and the aviation industry’s upgrading with digitalization and intelligence….

https://www.globaltimes.cn/page/202207/1269583.shtml

July 2, 2022

Three Chinese airlines to purchase nearly 300 Airbus aircraft

Three state-owned airlines – China Southern, Air China and China Eastern – announced on Friday a deal with France-based Airbus to buy 292 aircraft valued at around $37 billion in total….

Airbus probably figured out that unless they work with China that China would set up its own airplane multinational. After all the duopoly of Airbus and Boeng needs some real competition.

China is even now manufacturing a mid-range passenger jet, the wholly domestic C919, comparable to Airbus and Boeing aircraft. The Chinese jet is being trialed for domestic and international certification:

https://news.cgtn.com/news/2022-05-14/China-s-first-C919-plane-completes-maiden-test-flight-before-delivery-1a1x2AclLfa/index.html

May 2022, there were 815 orders for the C919 jet from 28 customers worldwide:

https://www.globaltimes.cn/page/202205/1265609.shtml

And China figured out that their C919 is still an inferior product, and that they need to steal some Airbus technology to get up to snuff. The Chinese market is big enough to allow them to pressure a big corporation – and the corporations are all about next quarter profits, even at the expense of their own long-term survival.

Since 1955, the average time from the first Fed rate hike till the onset of recession has been a little over three years:

https://fred.stlouisfed.org/series/FEDFUNDS

A lot depends on when one decides the Fed starts hiking, because there have been episodes of the Fed hiking, then cutting, then hiking again – the 60s, 80s and 90s.

Anyhow, the Fed first hiked rates in this round on March 16, just three and a half months ago. So if the economy were a clock, we’d have another couple of years to wait before recession would arrive. It ain’t and we don’t, but it is a bit early to expect recession, based on the behavior of the Fed or on term spreads.

Since the beginning of the “Great Moderation” the ten year yield has generally been falling when the yield curve inverted, after the 3-month rate had already risen substantially:

https://fred.stlouisfed.org/graph/?g=ReO2

Of course, the ten year yield has fallen, on average, since late 1981. But anyway, it is the anticipation of Fed easing and of falling inflation due to economic slowing which (in my version of history) leads to curve inversion, not just rate hikes.

If you believe that an inventory correction is a recession (as Bruce Hall and anonymous have hinted, but apparently lack the stones to say out loud), then you must believe either that the Fed will continue hiking rates into a recession or that market pricing is wildly wrong about Fed behavior:

https://www.atlantafed.org/cenfis/market-probability-tracker

Markets are pricing in the first real chance of a rate cut in May of next year. And by the way, the Fed has cut rates prior to every recession beginning in 1990. If that pattern holds, no recession for the next 12 months or more. But then, Menzie has already figured that out by looking at term spread.

Personally, I don’t believe the economy is a clock. I think supply-chain troubles and an inventory overhang and a housing overhang and war all matter. I also think that when enough people put political gain over the well-being of the country, it may be possible to talk us into recession under certain conditions. Right guys?

So I worry that recession may arrive in a year or a little less. The Fed is back in inflation-fighting mode for the first time in a long time, and that matters. Fiscal policy, as written in current law, will be contractionary through 2023, and that matters. Our economy and financial markets have lived so long with stimulative monetary and fiscal policy that adjustment to tightening policy may be a big shock.

I worry, but I am neither stupid enough to think we are in recession now nor evil enough to cheer for recession.

Airbus already has an engineering center in Beijing and an innovation and research & development center in Shenzhen:

https://news.cgtn.com/news/2022-06-26/Airbus-sets-up-China-research-center-for-hydrogen-technology-1baRTyqWK64/index.html

Correction: some who are NOT Pollyannas

Hey John! Has the Pentagon ever commented on alleged Russian atrocities? Any where? You previously advised readers not to believe the government, then advised we should wait for the Pentagon to verify any possible atrocities. Who knew the Pentagon and the government were not related?

Any updates?Thousands of media baddies still picking on the Russians who appear to have done nothing worse than blow up a mall , some apartments, maybe a school.?

No peace, no justice, Right, o wise one?

Poor little Johnny – Russian’s no longer occupy Snake Island so Ukraine gets to export their grain. Putin is throwing a fit and his little pet poodle is terrified that his daily treat may be threatened.

Kevin Drum has a problem with this good news on prices from CNN

https://jabberwocking.com/todays-worker-can-buy-80000-klondike-bars-per-year/

You don’t hear about many products getting cheaper over time, but technically at least, people can pay less for a Klondike bar today than they did 100 years ago. When it first came out, in 1922, the Klondike bar cost just 10 cents, the equivalent of $1.75 in 2022 dollars. A six-pack of the original bars costs about $4 today — or 67 cents each.

I love Klondike bars so the fact that its relative price today is lower than it was 100 years ago makes me happy. But yea – a lot of products have lower relative prices than they did a century ago.

I am attending the Western Economic Association meetings in Portland where I also have two grandsons living.

I just heard Christina Romer give a presidential address on “Fed Timidity,” which argued that on many occasions in the past the Fed has been slow to respond to forecasts by the Fed staff about where the economy is going, with those both on the upside and the downside. It was not in her data, but she effectively said they were at it again this past year, being too slow to move against inflation. She also said that in more recent decades the tendency has been for the Fed to act, if slowly, but often to do so in too limited a fashion.

However, the tidbit I really want to report, which I think Menzie may have reported on previously here, and which I gather Rome and her husband, David, have previously published on, is that the forecasting track record of the Fed staff has been consistently superior to that of expert private forecasters. She attributed that to them simply having more resources to do it. A major issue is that those staff forecasts are apparently not publicly releasued until five years later, something aI think I was unaware of before, which means they are not publicly available now for people to contemplate, and with them not the same as the models some regional Feds are using like Atlanta to make public forecasts.

Someone in the audience asked her if she thought the Fed staff forecasts should be publicized much sooner, but she said she did not think so because that might put pressure on them not to be honest and to possibly skew forecasts in response to outside pressures, political or otherwise.

“the forecasting track record of the Fed staff has been consistently superior to that of expert private forecasters. She attributed that to them simply having more resources to do it”.

Makes sense but the Usual Suspects here think that the FED staff gets it all wrong because the Usual Suspects are producing politically motivated forecasts with no professional supervision that have different forecast. And please avoid telling this crowd they have no clue as they get all whiney when we do.

https://www.federalreserve.gov/econres/feds/who-killed-the-phillips-curve-a-murder-mystery.htm

May, 2022

Who Killed the Phillips Curve? A Murder Mystery

By David Ratner and Jae Sim

Abstract

Is the Phillips curve dead? If so, who killed it? Conventional wisdom has it that the sound monetary policy since the 1980s not only conquered the Great Inflation, but also buried the Phillips curve itself. This paper provides an alternative explanation: labor market policies that have eroded worker bargaining power might have been the source of the demise of the Phillips curve. We develop what we call the “Kaleckian Phillips curve”, the slope of which is determined by the bargaining power of trade unions. We show that a nearly 90 percent reduction in inflation volatility is possible even without any changes in monetary policy when the economy transitions from equal shares of power between workers and firms to a new balance in which firms dominate. In addition, we show that the decline of trade union power reduces the share of monopoly rents appropriated by workers, and thus helps explain the secular decline of labor share, and the rise of profit share. We provide time series and cross sectional evidence. *

* https://www.federalreserve.gov/econres/feds/files/2022028pap.pdf

So Christina Romer is arguing that more information available to the investing public and private market forecasters to make better decisions is a “bad thing”?? Interesting stance for someone who is a teacher/educator working at Berkeley. I wonder what her colleagues working in higher education think of this stance?? Surely her higher education colleagues will be there to defend her, “for the benefit of the great unwashed”, of course…….

These type views of “safeguarding” information from “the great unwashed” seem to hold up well over time.

https://www.britannica.com/biography/William-Tyndale

https://www.csmonitor.com/2001/0726/p21s1.html

https://www.washingtonpost.com/archive/local/1997/06/14/dangerous-reading-in-its-day/57a4136d-1168-40d4-adb6-eeab72f66154/

https://www.newstatesman.com/culture/2016/09/bloody-history-bible-why-owning-printing-or-even-reading-word-god-could-be

Well, I guess Christina thinks only ecclesiastical members can get the keys to the Kingdom or all hell will break loose:

https://money.cnn.com/2016/08/03/investing/goldman-sachs-fine-federal-reserve/index.html

Does Christina think “inadvertent leaks” to the Wall Street good ol’ boys club are cool, if money is exchanged under the table or we get multiple free 5-star meals from pals or “magically”/”arbitrarily” we can get our kids into “XYZ” private school??

https://www.cnbc.com/2017/04/05/former-fed-policymaker-lockhart-says-lacker-leak-could-very-well-be-inadvertent.html

Nothing to make a man gush in embarrassment more than those “inadvertent” leaks to our Wall Street friends, and our friends’ friends who make money off the “inadvertent” leak. I mean how was he to know?? Really. People at the Fed aren’t that sophisticated. They are a quite innocent/gullible type for the most part. When Richmond Federal Reserve President Jeffrey Lacker’s old pal told him “I work on Wall Street” Lacker naturally assumed his old pal was running a cupcake shop at the physical location of Wall Street. It was “inadvertent”. Lacker shared the info because talking to a cupcake shop owner located on Wall Street made Lacker less apt to skew Fed forecasts, and venting to the cupcake shop owner made Jeffrey Lacker “less apt to respond to pressures outside of the Fed”.

Remember, these guys have to “protect” the public. They have that “heavy burden” of “duty” to the public.

https://www.wsj.com/articles/dallas-feds-robert-kaplan-was-active-buyer-and-seller-of-stocks-last-year-11631044094

https://apnews.com/article/business-economy-2729bb94a89912b1bab18665a1f82dbd

Yes, we can’t have these FOMC officials with “heavy accountability” and “weight on their shoulders” “skewing forecasts” “due to outside pressures” (You know, like the Supreme Court and Roe, we don’t want to violate their swagger, er something)

The new 2022 headline “Higher Education Scholar Says MORE Information For Investors and Consumers Is Very Bad” News at 11

BTW, Romer is on that official NBER recession dating committee.

A funny finding she reported is that from a shock being reported by the staff to the final impact countering it on the economy through decisionmaking lag and then impact lag is a full five years, the time staff forecasts are kept confidential, for better or worse.

I don’t even dislike her overall, I just think that specific stance is asinine and as a higher education teacher, she needs to re-think what F— is coming out of her mouth.

Moses,

I actually think five years is an awfully long time to sit on those staff forecasts, but I note that nobody in that audience of professional economists seemed to be bothered by her remarks defending the fact that the forecasts are not publicized. Do you think lthat her argument that such publicity might cause the staff to hedge or skew their actual views is unreasonable? Your odd anecdote about Jeffrey Lacker certainly was not remotely convincing in this regard.

Whether or not John Cipollone testifies could be a very import pivot point (for lack of a better descriptor to come to mind) in the January 6th hearings. If Cipollone refuses to testify to the committee it’s a hit to the lower gut on the committee’s efforts.

https://www.politico.com/newsletters/politico-nightly/2022/06/29/jan-6-committee-closes-in-on-pat-cipollone-00043332

i.e. If Cipollone testifies in a forthright manner, it will be very contributive in eventual criminal charges against the Orange Abomination formerly inhabiting the White House.