Today, we’re pleased to present a guest contribution by Laurent Ferrara (Professor of Economics at Skema Business School and Board Member of the International Institute of Forecasters).

On Friday 21 October, we organized with Catherine Doz at Paris School of Economics (PSE) an international workshop on macroeconomic nowcasting, with the support of the PSE Chair “Measurement in Economics”. In times of global uncertainties, it is of crucial importance to know where we currently are, before trying to forecast where we will go in the future. Macroeconomic nowcasting is a concept initially put forward by Giannone et al. (2008) with the idea of optimally using all the current available information to assess economic conditions of the current quarter, well in advance of official figures generally released with a lag by statistical offices around the world.

Most of the papers presented during this workshop focus on recent methods developed to nowcast important macro variables, by using either standard or alternative high-frequency variables. Alternative high-frequency variables are data that can be collected through various channels (web sites, satellites, social networks, tensors …). They are generally quite large databases, available on a daily basis, not structured and with a weak signal-to-noise ratio. Therefore, statistical/econometric techniques have to be implemented to filter out the data and extract a readable signal. The recent Covid crisis has underlined the need of high-frequency tools able to track in real-time economic activity (see for example the tool put forward by Lewis et al., 2020, at the New York Fed to closely follow U.S. economic activity on a weekly basis).

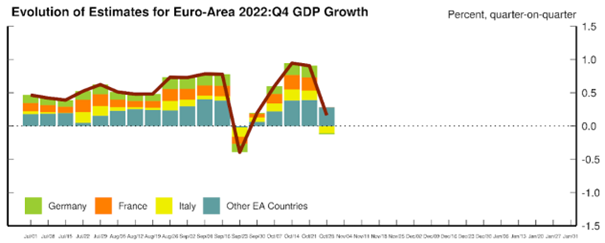

Modugno (Federal Reserve Board), joint with D. Cascaldi Garcia (Federal Reserve Board), T. Ferreira (Federal Reserve Board) and D. Giannone (Univ. of Washington & Amazon), presented a new tool developed to track economic activity in the euro area through Dynamic Factor Models estimated for each of the main euro area countries (Germany, France and Italy). The main idea is to account for leads and lags between business cycles of the countries in order to improve nowcasting ability. Opinion surveys are proved to be extremely useful against this background. Weekly updates of euro area GDP are available in real-time on the web site euronowcast.com. The last GDP estimate for 2022q4, computed on October 28, stands at 0.2% (see Figure 1) and points to a sharp slowdown in euro area economic activity, in line with extremely high inflationary pressures putting growth at risk.

Figure 1: Euro area GDP growth (quarter-over-quarter) nowcast for 2022q4. Source: euronowcast.com

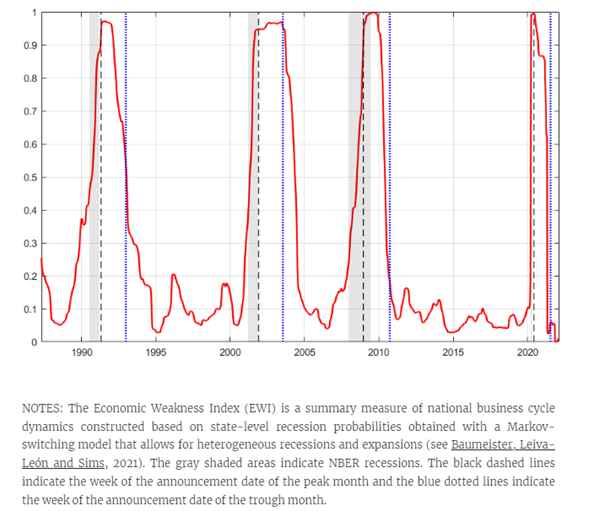

Danilo Leiva-Leon (Banco de España), joint with C. Baumeister (Univ. Notre Dame) and E. Sims (Univ. Notre Dame), have constructed a new tool able to track weekly U.S. economic conditions at the state level. They managed to collect a public database of economic indicators at the state level, including labor market, mobility, real activity, expectations, financial conditions and households. Estimation of state-space models for each state leads to a dashboard of economic conditions for each state at various frequencies. All the estimation results are available on web site fuelled by the authors. This piece of information turns out extremely useful for economists interested in tracking U.S. economic activity at the state level. Note also that they compute an economic weakness index that summarizes the number of states estimated to be in recession at each point in time (see Figure 2).

Figure 2: Economic Weakness Index for the U.S.

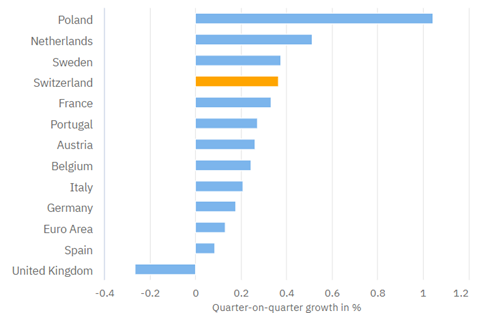

Heiner Mikosch, with P. Kronenberg and S. Neuwirth (all ETH Zürich KOF), have created a tool to track economic activity in many various European countries with alternative data sets and various econometric models. The Nowcasting Lab of the KOF collects all the available information in real-time for all countries. Models are updated on daily basis as soon as a new data point is available. Interestingly all the nowcasting estimation stemming from all the various models are available in a transparent way to users, making that each user can focus on its favourite model. Latest nowcasting results for GDP growth rates for 2022q4 are presented below in Figure 3.

Figure 3: Current GDP growth nowcasts for 2022q4. Source: KOF, Nowcasting Lab

The U.S. monthly retail trade index is one of the most watched economic indicators by market participants and economists as it reflects household consumption, the most important component of U.S. GDP growth. Scott Brave (Morning Consult) and colleagues from the Chicago Fed have developed a tool to track this index on a weekly basis: Chicago Fed Advance Retail Trade Summary (CARTS). The methodology relies on a mixed-frequency Dynamic Factor Model that incorporates both official data and high-frequency data from private companies that reflect credit and debit card transactions, retail foot traffic, gasoline consumption or consumer sentiment. Unfortunately, in April 2022 the Chicago Fed has temporarily paused the release of the CARTS index because of changes in private data providers. The staff is currently working on a new version to be soon released.

Two other more technical papers were also presented during this workshop. Gabriel Perez Quiros (Banco de España), joint with S. Delle Chiaie (ECB), question the use of models that only contain high-frequency alternative data, as those data have a weak signal-to-noise ratio and generally do have a small sample size, leading to complex estimation procedures. By using a simulation exercise, they show that high-frequency alternative data alone lead to poor nowcasting performances and a good strategy for practitioners would be to mix both high-frequency alternative data (i.e. daily or weekly) and low-frequency official data (i.e. monthly or quarterly). Ivan Petrella (Warwick Business School), joint with T. Drechsel (Univ. Maryland) and J. Antolin Diaz (London Business School), put forward a new mixed-frequency Dynamic Factor Model for nowcasting that incorporates various important data features, such as long-run time-varying GDP growth, heterogeneous dynamics among variables and stochastic volatility. This latter feature proves extremely useful to account for large shocks in economic time series, as those observed during the Covid-19 period. Real-time estimation of this model points out its ability to efficiently track U.S. economic activity including the most recent period. In this respect, the integration of high-frequency data into the model proved extremely useful, in addition to more standard monthly and quarterly macro indicators.

This post written by Laurent Ferrara.

Thinking back as these models suggest should be done, why were differences in per capita growth for Euro Zone economies so sharp since 1998 or 2000? How could it be that an Italy has not experienced per capita GDP growth since 1998? After all, a fine technocratic government led by Mario Draghi evidently made no difference for Italy. What has been wrong with Italian policy or Greek policy? Reasonable models should have suggested problems for Italy years and years ago or were models generally paid no attention?

https://fred.stlouisfed.org/graph/?g=VtD2

August 4, 2014

Real per capita Gross Domestic Product for Portugal, Spain, Italy, Greece and Germany, 2000-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=VtD5

August 4, 2014

Real per capita Gross Domestic Product for Portugal, Spain, Italy, Greece and Germany, 2000-2021

(Indexed to 2000)

Policy is what policymakers and politicians talk about when discussing growth, mostly because policy is their business. In fact, policy, within reasonable limits, may be a weak tool for changing longer-term economic outcomes. Italy’s economic structure, demographics, natural endowments and such have a great deal to do with longer-term performance.

Italy is also lo ked in to the behavior and policy of other EU members. Germany’s high saving rate is outside Italy’s control, but influences Italy’s economy.

https://fred.stlouisfed.org/graph/?g=VtDr

August 4, 2014

Real per capita Gross Domestic Product for Ireland, Portugal, Spain, Italy and Greece, 2000-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=VtDk

August 4, 2014

Real per capita Gross Domestic Product for Ireland, Portugal, Spain, Italy and Greece, 2000-2021

(Indexed to 2000)

As a point of information, several of these approahes make their appearance in Econbrowser. The Lewis et al. approach — in the Lewis-Mertens-Stock Weekly Economic Indicator as well as the Baumeister et al. Weekly Economic Conditions Index make their most recent appearances in this post. The Ferreira et al. Euro area nowcast is cited in this post.

This post and additional comment are helpful and appreciated.