Expected economic activity, medium term market based inflation expectations, and risk/uncertainty measures.

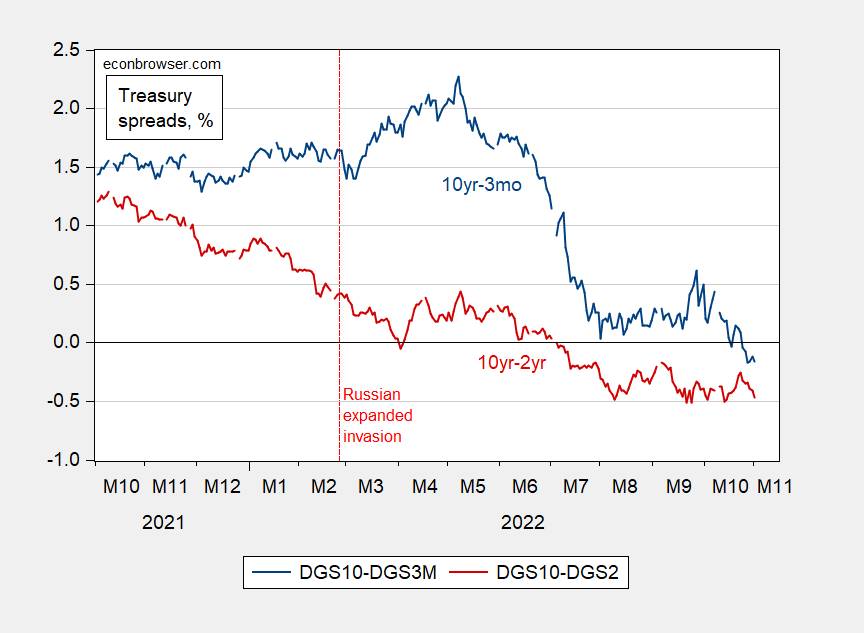

Figure 1: Ten year-three month Treasury spread (blue), ten year-two year spread (red), both in %. Source: FRB via FRED, Treasury, and author’s calculations.

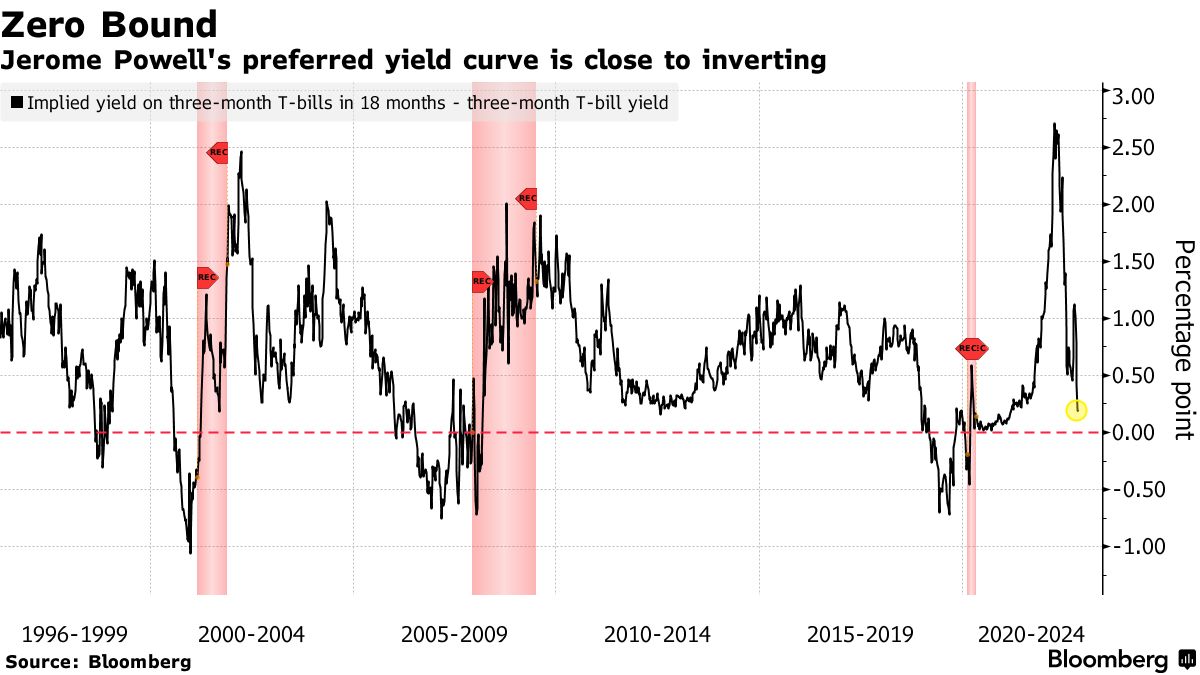

Inversion of both term spreads is a pretty sure harbinger of a recession in the next year. Powell’s favored term spread — 3 month spread relative to 3 month forward 18 months — is also coming close to inversion.

Source: Reynolds, Geldhill, Bloomberg, 11/1/2022.

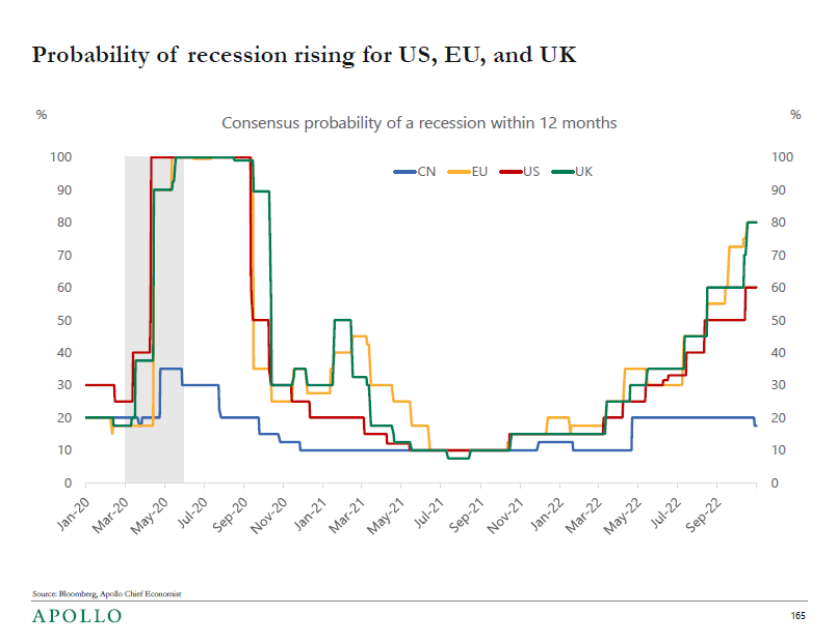

Economists seem pretty convinced of impending recession as well (across countries). From Torsten Slok (11/1/2022):

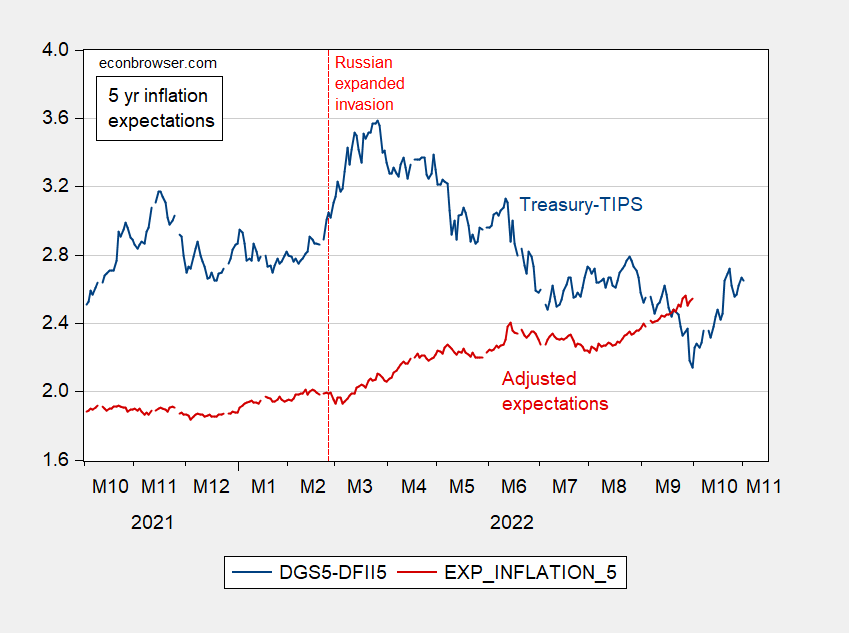

What about market based inflation expectations? At the five year horizon, expectations inferred directly from Treasury-TIPS spread is back up to levels at end-August, but still far below March 2022 peaks.

Figure 2: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red), both in %. Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 11/2, and author’s calculations.

That being said, the estimated inflation expectations accounting for premia has been trending upward through the last date available, end-September.

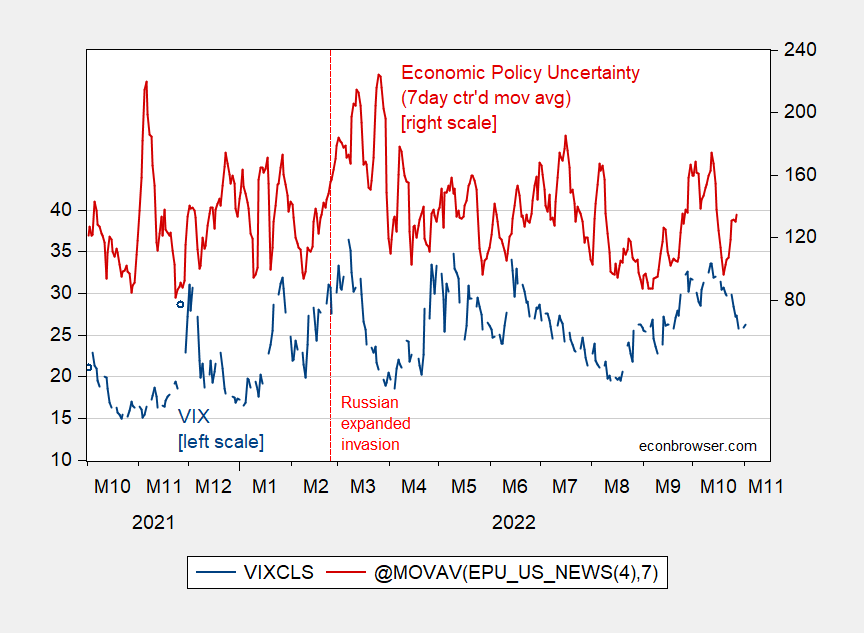

Finally, the VIX has cycled up and down while the EPU has trended downward since the month following the expanded Russian invasion.

Figure 3: VIX (blue, left scale), and 7 day centered moving average of EPU (red, right scale). Source: CBOE via FRED, policyuncertainty.com.

So do I have this right? Expected inflation is around 2.5% and there is a serious risk of a 2023 recession. So why isn’t the FED lowering interest rates?

Because the Fed sees itself as a mythic hero in a battle – that in reality is not actually happening.

They have delusions of Volker-like adulation.

Kevin Drum: “Corporations are increasing prices with abandon and blaming it on inflation. But it’s not because of inflation. It’s a cause of inflation. Prices are rising not because of workers, whose income is going up more slowly than inflation, and not only because raw materials are more expensive. It’s mainly because companies are raising prices above and beyond that for no special reason except that they can. And all of us are paying the price.”

https://jabberwocking.com/corporations-are-marking-up-their-products-far-far-beyond-the-inflation-rate/

Robert Reich has made the same point a couple times in the past year.

https://robertreich.org/post/685804888044765184

Neither Drum nor Reich have PhDs in economics.

Yet in a January Booth IGM survey found that only 7% of economists agreed with the statement that “A significant factor behind today’s higher US inflation is dominant corporations in uncompetitive markets taking advantage of their market power to raise prices in order to increase their profit margins.”

https://www.igmchicago.org/surveys/inflation-market-power-and-price-controls/

I got a lot of push-back here for my mild statement that corporate American was CONTRIBUTING to inflation. I never claimed that corporations are a cause of inflation.

Who to believe? Based on the FRED data, I put my money with the non-economists.

https://fred.stlouisfed.org/graph/?g=VtLa

I am so old, a few years older than pgl, that Econ prof’s called retailer raising prices in spite of marginal product flat: demand pull.

which implies the cash is free enough to allow the consumption side to pull up prices.

which is why larry summers is old like pgl!

or for consumers financial conditions are too soft.

why blame the sell side?

Off topic, China’s Covid problem –

This is not new, just worse:

https://www.scmp.com/news/china/politics/article/3198004/coronavirus-chinese-authorities-race-contain-new-waves-dire-and-complicated-outbreaks

Apparently, Chinese authorities are resorting to deceit to keep the public ignorant of the severity of the problem:

https://www.bloomberg.com/news/articles/2022-11-01/china-covertly-locks-down-cities-as-covid-zero-pushback-rises

https://www.google.com/amp/s/amp.theguardian.com/world/2022/nov/01/chinese-city-zhengzhou-accused-of-performative-lockdown-lifting

I haven’t been able to find a tally of the total number of people under lockdown, which makes comparison to earlier periods difficult, in turn making estimates of economic impact difficult. The press seems engrossed in the threat to IPhone. I don’t share that interest.

It would take an immense amount of anger/fear for FoxConn workers to jump the fence to escape shutdown measures. They are either being treated horrendously on the FoxConn campuses or afraid of getting the virus or both. I think an argument could be made this is the 2nd largest source/cause of USA inflation, only behind the Russian invasion of Ukraine.

Xi is choosing politics over the economy. It’s a shaky strategy requiring tactics which are likely to make him unpopular. Why make the intentional public exhibition of the perp walk of Hu Jintao out of the party congress??~~it was an intentional theater show because Xi knows a large section of the party doesn’t like him, and he wants them to know he’s going straight for the jugular if they conspire against him.

Torsten Slok putting it at 60% (or he’s just tabulating the mean consensus)?? Surely enough to catch my eye. Similar to my admiration for PhD Chinn, I gotta lotta respect for Mr. Slok. Wish he wasn’t hid for only the paying at Apollo, but I guess that’s how it goes. This here beggar cannot be a chooser.

Saw some domestic violence inside a grocery store I visit regular. Kind of shocking really. Some of the odder people among us (myself) might describe as “white on white crime”. I just spectated mostly. I like to think if the guy had taken it further I would have done something to stop it, but I can’t say that totally confidently. Next time I shop I’m not wearing my Lebowski slippers though, I can say that much. They must have made quite the romantic couple because the very obviously abused female party was begging the clerk/ grocery staff not to call the police around the time her betrothed had his hands around her neck. Talk about “unconditional love”…….. I was tempted to interrupt the proceedings with a loud “hault!!!” and then say “So, both of you are MAGA people, right??” but then went back to packing the sack with my eyes not very inconspicuously averted. My next idea was to ask the girl why she used deep purple eyeshadow and thought our checkout clerk was some kind of bulletproof vest and then thought it might be in poor taste.