What assumptions were made?

Reader Anonymous asserts Hubbert “…did not say under existing technologies” when peak oil production would be reached. However, on page 24 of the original Hubbert (1956) document, we find the following passage:

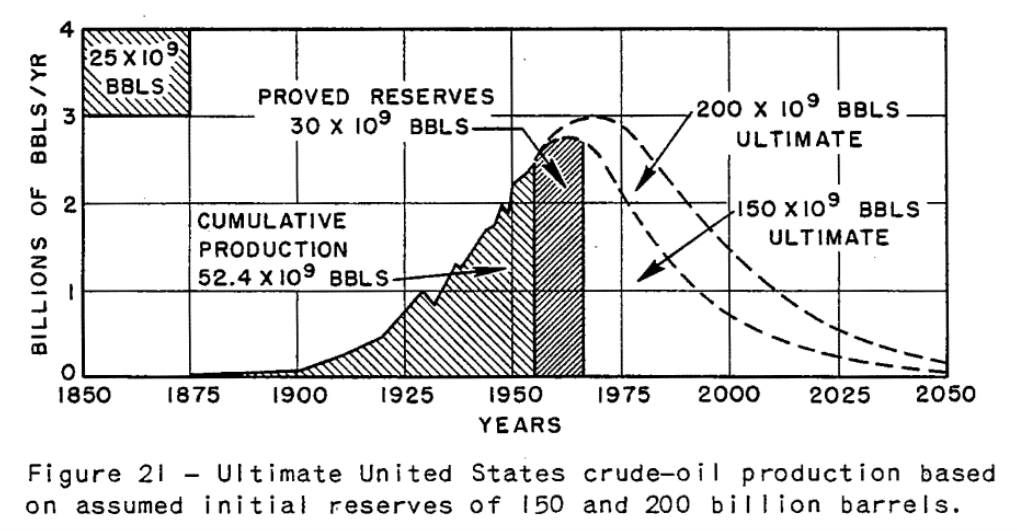

One other contingency merits comment. By means of present production techniques, only about a third of the oil ‘underground is being recovered. The reserve figures cited are tor oil capable of being extracted by present techniques. However, secondary’ recovery techniques are gradualy being improved so that ultimately a scmewhat larger but still unknown fraction of the oil underground should be extracted than is now the case. Because of the slowness of the secondary recovery process, however, it appears unlikely that any improvement that can be made within the next 10 to 15 years can have any significant effect upon the date of’ culmination. A more probable effect ot improved recovery will be to reduce the rate of decline after the culmination with respect to the rates shown in Figure 21. [emphasis added – MDC]

Here is Figure 21:

So I would say that Hubbert did indeed condition his prediction on the technologies available. He also essentially held pretty constant those assumed technologies for a 10-15 year window (so, to about 1966 to 1971).

Good grief – this paper is as old as I am. I do recall when I was in college people running around terrified that the world would run out of oil. But that was when Nixon was still President. The new “peak oil” debate seems to be less about production and more about demand:

https://www.oilandgas360.com/factbox-pandemic-brings-forward-predictions-for-peak-oil-demand/

Then again – we have all sorts of technological change since 1956.

On another topic, Kevin Drum has two interesting graphs on rents:

https://jabberwocking.com/the-rental-market-has-cooled-down-to-almost-normal/

The 2nd graph shows inflation adjusted rents. Note how much they jumped in 2021. Now Kevin is focused on how the explosion in real rents may have cooled but they are still really high.

https://jabberwocking.com/corporations-are-marking-up-their-products-far-far-beyond-the-inflation-rate/

Kevin Drum is also noting something ltr has been telling us about – certain companies have been increasing their profit margins. Yea – they whine about the cost of components and labor rising because of inflation but their output prices are rising even faster. Coca Cola, P&G, Nestle to pick on the companies ltr noted.

I will say the profit margins for certain beer companies have fallen. They whine about higher input prices but have not (yet) stuck us with much higher prices. But who knows – maybe I will have to pay more for my Brooklyn beer soon.

https://www.nytimes.com/2022/11/01/business/food-prices-profits.html

November 1, 2022

Food Prices Soar, and So Do Companies’ Profits

Some companies and restaurants have continued to raise prices on consumers even after their own inflation-related costs have been covered.

By Isabella Simonetti and Julie Creswell

A year ago, a bag of potato chips at the grocery store cost an average of $5.05. These days, that bag costs $6.05. A dozen eggs that could have been picked up for $1.83 now average $2.90. A two-liter bottle of soda that cost $1.78 will now set you back $2.17.

Something else is also much higher: corporate profits.

In mid-October, PepsiCo, whose prices for its drinks and chips were up 17 percent in the latest quarter from year-earlier levels, reported that its third-quarter profit grew more than 20 percent. Likewise, Coca-Cola reported profit up 14 percent from a year earlier, thanks in large part to price increases.

Restaurants keep getting more expensive, too. Chipotle Mexican Grill, which said prices by the end of the year would be nearly 15 percent higher than a year earlier, reported $257.1 million in profit in the latest quarter, up nearly 26 percent from a year earlier….

https://www.nytimes.com/2022/11/01/business/economy/fed-rates-company-earnings.html

November 1, 2022

Corporate America Has a Message for the Fed About Inflation

If Federal Reserve Chair Jerome H. Powell and his colleagues look at company earnings reports, these themes might catch their eye.

By Jeanna Smialek and Isabella Simonetti

Federal Reserve officials are battling the fastest inflation in four decades, and as they do they are parsing a wide variety of data sources to see what might happen next. If they check in on how executives are describing their companies’ latest financial results, they might have reasons to worry.

It’s not because the corporate chiefs are overly gloomy about their prospects as the Fed aggressively raises interest rates to control rapid inflation. Quite the opposite: Many executives across a range of industries over the last few weeks have said that they expect to see sustained demand. In many cases, they plan to continue raising prices in the months ahead.

That is good for investors — the S&P 500 index gained 8 percent last month as companies began reporting quarterly profits — but not necessarily welcome news for the Fed, which has been trying hard to slow consumer spending….

A. I would assert the opposite. “Are gradually being improved”. That sure implies ongoing!

A.5. Look also at his discussion of the IL basin on page 12, especially last para. Also, on page 16, he mentions an earlier estimate by Weeks being already likely too low, because of recent (at his time) improvements in technology. I also call your attention to the last para of page 24. He says technology improvements will help reduce the rate of decline after the peak….but he does not admit to a possible repeak. See also the last few sentences in the first para of page 26. (Both 24 and 26 acknowledge ongoing technology improvement, which he claims to factor in.)

B. It makes no sense to have a prediction based on technology not improving, when he himself SAID that it has previously! Giving the example of seismic in the IL basin. Several other sentences make the point of geological limits (initial production taking millions of years, “all the sedimentary basins”, etc.) So he is trying to predict ultimate recovery, regardless.

C. If he wanted to make a strong, emphatic, static technology prediction, he could have explicitly said so. And he didn’t. (Because people would have rightly laughed at such a caveat.) Now, that his prediction failed, his enablers want to try to lawyer up such an explicit caveat. AND IT IS NOT THERE!

Interesting news from Oklahoma (Moses – please tell us what is happening here if you wish):

https://time.com/6227182/why-oklahoma-governors-race-is-so-close/

In other words, she’s a Democrat in name only. The latest polling has Hofmeister with a slim three-point lead over Stitt, according to the Oklahoma City-based firm Ascend Action. The tight race is largely the result of a series of missteps by Stitt, from scandals that have plagued his administration to a bitter feud with Oklahoma’s 39 American Indian tribes.

Joy Hofmeister is not exactly a liberal but Republican governor Kevin Stitt has really angered the native Americans in Oklahoma and they want him out of office!

https://nypost.com/2022/11/01/megyn-kelly-on-paul-pelosi-investigation-in-podcast/

Does Megyn Kelly thinks she still works for Faux News. It seems she and Todd Cotton have decided the violent assault on Paul Pelosi was the fault of the San Francisco police. OK – the myth that Republicans support law enforcement just got tossed out the window.

We know his wife was a supporter of letting Donald Trump overturn our democracy but what role did Supreme Court justice Clarence Thomas play?

https://www.politico.com/news/2022/11/02/trump-lawyers-saw-justice-thomas-as-only-chance-to-stop-2020-election-certification-00064592

Donald Trump’s attorneys saw a direct appeal to Supreme Court Justice Clarence Thomas as their best hope of derailing Joe Biden’s win in the 2020 presidential election, according to emails newly disclosed to congressional investigators. “We want to frame things so that Thomas could be the one to issue some sort of stay or other circuit justice opinion saying Georgia is in legitimate doubt,” Trump attorney Kenneth Chesebro wrote in a Dec. 31, 2020, email to Trump’s legal team. Chesebro contended that Thomas would be “our only chance to get a favorable judicial opinion by Jan. 6, which might hold up the Georgia count in Congress.” “I think I agree with this,” attorney John Eastman replied later that morning, suggesting that a favorable move by Thomas or other justices would “kick the Georgia legislature into gear” to help overturn the election results. The messages were part of a batch of eight emails — obtained by POLITICO — that Eastman had sought to withhold from the Jan. 6 select committee but that a judge ordered turned over anyway, describing them as evidence of likely crimes committed by Eastman and Trump. They were transmitted to the select committee by Eastman’s attorneys last week, but they have not been publicly released.

Thomas should resign from the Court – today.

As I pointed out in the first sentence of my comment, in which I noted that Hubbert’s forecast was based on a particular technology, the debate over “peak oil” is largely people talking past each other. I the response from Anonymous here and earlier, that’s just what is happening. And from Anonymous, it’s pretty clearly intentional. Yes, Hubbert discusses the potential for technological improvement. Hubbert was a source of technological improvement, for goodness sake! Hubbert specified a fixed technology in the model he used in making his prediction of a peak in U.S. production, which is what I explicitly noted in in my comment. Anonymous pretends that all kinds of other things, including articles written by people who also don’t have a clear definition of Hubbert’s peak in mind, are relevant. Anonymous also resorts to the common trick of claiming knowledge he does not and cannot have, when he pretends that I don’t know the research citing.

The simple truth is that “drill baby drill” shills have long lied about the peak oil debate, as Anonymous does here. A big part of that lie is to mischaracterize their opponents’ position and Hubbrt’s research.

Peak resource production is logically unassailable as a theory. It has to be true for any non-renewable resource. Hubbert’s application of the theory in predicting a peak was successful under the terms specified by Hubbert. Any claim to the contrary is either ignorant or dishonest.

Ah, the return of peak oil.

Yes, it’s back.

I guess you did not read the link I provided. There is difference between peak oil production v. peak oil demand. And you claim to be an oil consultant?

This is perhaps the dumbest comment I’ve seen on an economics blog: “There is difference between peak oil production (supply) v. peak oil demand. And you claim to be an oil consultant?” And you claim to be an economist? Wow! There’s a difference between Supply and Demand of a product? Who’da thunk it?

Aren’t we all enlightened?

There are differences between the supply CURVE v. the demand CURVE. I guess you are too stupid to get how this applies to this discussion so as usual you go off barking at people like me that do.

Come on CoRev – either come up with a relevant and coherent point or just run away.

Bark, bark, now you want to explain the graph when they differ, a relevant and coherent point? Wow, who’da thunk it?! I am even more enlightened. You are an educated economist, no?

“now you want to explain the graph when they differ, a relevant and coherent point?”

Ah CoRev – your local community college has courses in basic economics. Maybe you should attend one. DAMN!

Now, ole Bark, bark has shifted from different data can give different curves on graphs to education sources, community colleges to others?

Such a muddled, unsteady and illogical series of comments still fails to explain: “There is difference between peak oil production v. peak oil demand. ” which he considers profound, and not explained by: “different data can give different curves on graphs”. Really!?

All this because he will not accept that policies that slow or destroy supply can be felt in prices.

If oil demand had peaked, we would expect to see all of declining consumption, declining production, and falling oil prices. None of these is true.

oil component of overall energy demand is probably decreasing. you need to look at the market share of oil in the energy landscape. that continues to make it less important over time. falling oil prices will not necessarily occur while there are still legacy oil driven machines in operation. it is simply that demand will not grow in proportion to the energy landscape. and people will stop investing in an energy source that has no growth future. it is a depressing field to be in. I have turned down jobs with Exxon multiple times, because unless they change their business model, I am not confident of its ability to exist through retirement. many other top talent have similar views of these majors.

Baffled considers themself ?top talent????? Wow, and several thought Menzie and others here were egotistical. Baffled carries their EGO as a shield. That’s hilarious.

Yes covid. People actively recruit me. Unlike yourself, who probably couldnt even get hired at McDonald’s because the cash register technology is too difficult for you to learn. Retirement is the only job you are qualified for. And you might yet get fired from that position.

Baffled, is that envy I detect? “Retirement is the only job you are qualified for. ” (A hanging preposition?)

No envy, covid. Simple fact. No legitimate employer would hire you today, as you have no valuable skill set. You should be thankful for social security. And worried about republicans cutting back on your entitlements. Or do you believe you should be untouchable? You certainly could not go back into the workplace and replace any entitlement cuts. You are not employable.

Wow! Baffled does not understand the meaning of retirement. Trying to compare a retiree to and employees is ludicrously dumb. The income and professional needs are totally different, which is why the comparison is ludicrous. Because of my prior professional successes, i no longer NEED to work for income.

I will reiterate, covid. You are lucky that you have access to social programs such as social security and medicare. You have no employable skills today, and probably lacked them during your last decade of work. You probably maintained your employment through union protections. Certainly not because you provided value. You benefited from rules making it hard to fire old workers. Count your lucky stars you lived through the baby boomer era. Your future would have been much bleaker had you been born later, when skills and knowledge were needed rather than promotion due to time spent at the job. A competitive world would not be kind to you covid.

Baffled, I see you are driven by retirement envy. Bet’cha I retired at an earlier age than you will. 😉

covid, we already discussed this. no envy on my part. why are you such a slow learner? just surprised you are so happy living off of social programs.

yes, you probably will retire before me. i enjoy the work that i do. and people think i am valuable. i am very good at what i do. i could work until i keel over if i wanted to, without much of a problem. on the other hand, i could probably retire today if so desired. we are in pretty sound shape financially. it is nice to have good choices.

I see that you have no ability to distinguish between short-run events and the long-run. Which is one of hundreds of reasons NO ONE should ever hire you as a consultant.

Steven,

OK, this is a comment somewhat after the other one by me here.

I have now gone back and looked at the old discussions here. The major round of them was in 2005, when I did not see you participating at all, indeed, very few people now here, but lots of people using their real names and being pretty civil even as they disagreed. There was an “Anonymous,” who seemed a lot more intelligent than the current one, and described himself as a “peak oil moderate.” My memory of both my and Jim Hamilton’s views proved pretty accurate, willing to consider the possibility of peak oil and the arguments of its advocates, such as Stuart Staniford of Oil Drum who participated a lot, while remaining fundamentally skeptical for various well known obvious reasons, with me indeed making the point about how we really do not konw how much oil there is in al Ghaewar, which remains the case.

There was then another round in 2014, when you showed up quite noisliy. By then fracking was coming on strong and production was clearly rising in both the US and the world. Jim declared “PieakOil is Over,” whjich you applauded. An “Anonymous” was atill around and being again a lot smarter than our current one. Bruce Hall also showed up, being singularly out of it, claiming that taxes and regulation are more important than prices or technology for oil production. Gag!

Most of the other regulars here did not appear in any of those discussions in either 2005 or 2013. One very intelligent one from 2005 was T.R. Elliott. We could use him around again.

Oooops, that second round was in 2013, not 2014.

Barkley –

I came to the oil discussion in 2007/2008 when I went to work for Dahlman Rose, a New York boutique investment bank focused on shipping. Our work expanded to offshore oil, and that’s where I enter the picture, late 2008 into 2008. I was doing research on oil markets and that’s when I came across the whole peak oil thesis. I found it compelling. I still do.

Of course, shales popped up in between. Nevertheless, this technical innovation took nine years to ease oil prices and limited supply. That is, the peak oil era can be said to start in 2005, and oil prices did not fall until 2014. That 2008-2009 stretch in the middle can be considered a peak oil recession (depression), as I have noted many times in the past.

I held, and still do, that high oil prices would return when US shales were no longer able to meet incremental demand. We have been there since late last year, as a practical matter and oil prices have returned to that $90 / barrel range. The question is whether there are any more rabbits to be pulled out of the hat, any remaining sources of oil which can add to supply at the pace of cc 1 mbpd / year. At a guess, probably not.

…2007 into 2008…

Steven,

Thanks for the clarification. I do not generally engage in this dredging through past rounds of discussions here, but this dragging up of Hubbert, which I guess was done by “Anonymous” who appears to have been around back then, with all the claims being made, pushed me to go back and look. Rather curious. I do think my own comments hold up pretty well from back then.

As it is, my main disagreement with your comment here is that I remain among those who see the 2008-09 crash/recession as much more due to the creash of the housing bubble and its impact on related financial markets. The record nominal high of oil prices in summer 2008 aggravated things, but was not in my view the main cause of the Great Recession. Heck, we had several years following where indeed the price was over $100 per barrel, and we did not have a recession, although growth was fairly slow.

That’s true. But look at pretty much any macro graph from the period, and you’ll see a long trough extending from 2008 to 2015/15/16, depending on the variable. For example, the FFR was effectively at zero from Dec. 2008 until Nov. 2015 and pretty close to zero until Nov. 2016. The only prior time you would see anything similar was the Great Depression. So the China Depression really lasted until, say, the beginning of 2016. It was a 7-8 year downturn.

Meanwhile, Europe suffered a brutal recession from June 2011 until June 2013. The difference between the US and Europe was that the US was increasingly oil production rapidly during that period.

Of course, the world was awash in savings due to the growth of China in 2005-2008, which led to a real estate bubble and a financial crash. Still, if you want to know what the Great Recession (the China Depression) really changed, it was oil consumption, which was brutally bid away from the OECD countries and transferred to China and its related suppliers (eg, Brazil and SE Asia).

By the way, the problem with the financial crisis thesis is that it happened virtually only to OECD countries. You have to explain why Ireland and Iceland went down and Indonesia and Argentina did not. All the countries which were net contributors of oil (ie, whose consumers were forced to use less oil) experienced financial crises. Those countries which gained oil consumption did not. See Fig. 2 of my 2018 article: Italy: Oil, the Euro and Populism

https://www.princetonpolicy.com/ppa-blog/2018/12/12/italy-oil-euro-and-populism

Steven Kopits: Wasn’t there something about the GIIPS somewhere in there?

See Fig. 1 for Italy, Menzie. You can see oil price, oil consumption and GDP per capita. Not hard to see the relationship of oil consumption to GDP.

https://www.princetonpolicy.com/ppa-blog/2018/12/12/italy-oil-euro-and-populism

Steven Kopits: Correlation is not causation.

And if you wanted to make the case that the Northern European countries used the Euro to export the European recession to the PIIGS, I might consider that a plausible argument.

Causation is causation.

https://www.reuters.com/article/us-dahlmanrose-idUSBRE8861E120120907

NEW YORK (Reuters) – Dahlman Rose & Co, an investment bank focusing on natural resource-linked companies, replaced its chief executive and fired more than 10 percent of its staff this week amid a broader Wall Street slowdown, its new CEO said.

That was 10 years ago. Oh well – Stevie had a nice 5 year run.

‘Steven Kopits

November 4, 2022 at 11:19 am

Causation is causation.’

Comments like this one have me wondering why Dahlman Rose & Co did not fire Stevie in his 1st month.

Thanks for the reminder of when, long ago, my future wife was a Freshman at Berkeley and I would read some of the books she had been assigned. Hubbert’s book was one. Her Freshman year was 1958-1959.

Your wife went to UC Berkeley? You married well!

Because of the slowness of the secondary recovery process, however, it appears unlikely that any improvement that can be made within the next 10 to 15 years can have any significant effect upon the date of’ culmination. A more probable effect ot improved recovery will be to reduce the rate of decline after the culmination with respect to the rates shown in Figure 21.

Hubbert was actually spot on. He saw the peak in the early 1970s, and the actual peak, per the BP Statistical Review, was in fact 1970, after which production declined until 2009. Hubbert did not anticipate the growth of offshore production in the Gulf of Mexico — which stabilized production for a decade — but offshore production really took off in the 1980s, well beyond the 15 year window Hubbert mentioned in his 1956 paper.

Of course, production rocketed up after 2009 due to shale oil. This, however, was the result purely of technological advances, not new discoveries. All of the Bakken, Permian, Eagle Ford and other plays were known for a century or more. It was merely that the extraction technology did not exist to frac the shales.

We are now likely seeing the end of the shale revolution, with US production essentially unchanged since last December, despite oil prices in the $95 range. In retrospect, March 2020 may come to be appreciated as the all-time peak of US production.

“We are now likely seeing the end of the shale revolution, with US production essentially unchanged since last December”

Again you confuse production with demand. Shale oil production relies on high oil prices. I guess one can pretend to be an oil consultant without getting basic economics.

Shale production depends on demand and supply. Can’t squeeze blood from a turnip or oil from a tapped-out reservoir. And you presume to correct others.

Steven,

I remember that somehen in the early aughties, I am not sure which year and I am not going to go digging back to find it, there was a substantial amount of discussion of “peak oil” here led by many posts by Jim Hamilton, witth you providing a lot of commentary at the time, and me providing somewhat less, but some. Jim seemed open to the possibility that we had passed peak oil, while also not totally buying into it. Neither of us jumped on it particularly, although I think my view was not too far from Jim’s at the time.

As it was, the matter of possible technological change and the possibility of getting more oil out of known pools than previously thought possible was an issue of discussion, alhough fracking had not yet appeared. I also remember having discussions about such matters as how we really do not know how muc oil is in certain locations, especially Saudi Arabia and its al Ghawar pool, by far the largest in the world, which remains even today somewhat unknown.

Jim wasn’t as crazy as the nutter peakers, who can be pretty daft. But he did push the scarcity argument too much. It is a factor, sure. But not like he discovered it and neoclassical economists like James Griffey had never heard of it. Also, James underestimated the effect of the cartel. And of shale (even as late as 2014 being too dismissive of the possibilities in his “hundred dollars here to stay” article, read the prescient John Kemp criticism.)

Also, his repeated emphasis on state by state peak charts and his “once a region peaks, unlikely to do so again” looks silly as both TX and US have repeaked. (As have FGOM, SD, ND, CO, NM, OH and Appalachia overall.)

“…he did push the scarcity argument too much.”

“…James underestimated the effect of the cartel.”

This is the kind of pretending to authority that we expect from high schoolers with unsatisfied ego needs. On what evidence does Anonymous make these claims? None whatsoever. A nobody pretending to be somebody.

Anonymous,

So, are you the same Anonymous who participated in those long ago discussions? If so, you seemed a lot more intelligent and knowledgeable then than you do now.

Funny that you say he underestimated the effect of the cartel. I think that part of his saying that “hundred dollars to stay” was based on cartel behavior, although indeed the price did come down eventually after staying up there for quite an extended period. That was what was offsetting the effect of fracking, which he certainly was aware of in many posts.

The hundred dollars was occurring partially because of the cartel. James did not acknowledge this, saw it as peak oil (ish) support. See for instance remarks by Fereidun Fesharaki (Ph.D. economist, but a lot of practical consulting and travel talking to customers and suppliers, and familiar with the ME.) He says SA arranged the high prices. And he’s pretty shrewd about how the sausage gets made.

I think many of us were surprised at just how much oil fracking could produce, and that included not only Jim, but also guys like Andy Hall, Steve Chazen (CEO of Occidental), and myself. Before fracking, we were really impressed by marginal additions of 200,000 bpd / year, or maybe for Brazil, 400,000 bpd / year. That was a really big deal, but not big enough to offset growing demand, driven principally by the growth of China.

And then along came shales. Many in the industry questioned whether they were economically viable. The initial breakevens were certainly high — I gave one presentation with an $85 / barrel breakeven, which appeared true at the time. Decline rates were also appalling. So shale oil looked suspect back in the early 2010s.

But shale continued to power on, gathering steam. By 2014, US shale oil production was growing at a 2 mbpd / year pace, more than enough to compensate for years of constrained supply and to cover incremental demand. In August 2014, this surge in supply collapsed oil prices, and from then until last December, shale set the marginal price of oil, typically in the $55-$65 range.

I would emphasize, however, that none of us thought in the early 2010s that any source of oil could put 2 mbpd / year into play. Not even Saudi Arabia could do that. It’s like being impressed that a high jumper can clear eight feet and thinking that a really impressive record would be 8’2″. And then someone comes along and clears 40′. That’s exactly what shales did. It was unprecedented productivity.

It’s important to note that peak oil did not end. The conventional system has not found more oil, or more precisely, new discoveries total about 10% of the oil we are consuming. The system ex-shales can be reasonably described as at peak. When the shale revolution ends — and the data says it has ended — we find ourselves back in the peak oil era, after a seven year hiatus.

On the demand side, the role of China is really important. It is often forgotten that prior to 1993 there was a period when China was a net oil exporter. It has been an inccreasingly important net oil importer since then, mostly driven by its growth, but also by it hitting peak oil, with its largest pool, Daqing, once one of the largest in the wold, declining, now only producing about 600,000 barrels per day, still pretty large on the global scalse, but in an inevitable dcline.

BTW, I gather this past year saw the first time in decades that net oil imports into China actually declined, although only slightly.

” In retrospect, March 2020 may come to be appreciated as the all-time peak of US production.”

then we should be advocating for different energy sources in the future. we should not advocate for energy sources that are going to become more scarce. they simply become more expensive. our energy demands are increasing, and need energy sources that will not constrain that growth. oil does not fit that bill, into the future.

The role of prices, my friend.

care to elaborate? currently, oil prices are simply accelerating the demise of the oil patch. and pushing us towards renewables. it is getting cheaper to obtain energy from the wind than dig it from the ground.

From today’s FOMC statement:

“In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial development.”

That wasn’t in the prior statement.

Ten’s rallied. Then Powell said the terminal funds rate will be higher than expected. Tens tanked.

There has been an inward shift in near-term funds rate pricing, an outward shift in pricing for December 2023. So the priced-in assumption for now is a slower path to a higher rate.

“…Committee will take into account… the lags with which monetary policy affects economic activity and inflation”

No they won’t. It’s already too late for that.

Relaxing here in Florida after a two-day drive. Saw less than 10 Teslas and no other identifiable EV along 1,000 miles of I-75. Most of the Teslas were going the speed limit or slower … probably trying to conserve juice between charging stations. Got me to thinking about the ownership costs which are claimed to be less than a gasoline powered comparable vehicle.

So, here’s the thing: if you plan to sell your EV after 5-7 years, you may find a buyer so you can get some residual value from your purchase. If you hold it for 8-10 years, you probably will not find many willing buyers because they will fear the traction battery could fail at any time. Now, if you have a gasoline powered vehicle with 150,000 to 250,000 miles, you can still find a buyer if the body, interior, and most mechanicals are decent. Or if you want to keep it going, you might want to repower it with an OEM engine/transmission which might run $12K-14K installed.

V8 Engine: https://parts.ford.com/shop/SearchDisplay?storeId=1405&langId=-1&dealerId=24180&catalogId=251&krypto=fK3g0ZXI9oF%2Bga0ANUkE3DJmxs1Bj8%2BIlONfJ7OSyssZK56faWTY7wTXH47nSro7tCJIJHWzO1M7tJSr9voJ3d%2FaK7Bg%2B4G2Rd5Z9HKO2TmQv%2B0gY%2FjWSUOh3thMtSdPrOgFz1Qk%2FgqLQGwVRGO4%2FA%3D%3D#facet:&productBeginIndex:0&orderBy:&pageView:&minPrice:&maxPrice:&pageSize:&

Transmission: https://parts.ford.com/shop/SearchDisplay?searchTerm=f150+transmission&storeId=1405&catalogId=251&langId=-1&searchType=keyword#facet:&productBeginIndex:0&orderBy:&pageView:&minPrice:&maxPrice:&pageSize:&

That’s a pretty good deal for a high end pickup truck or SUV. But that traction battery for that Ford F150 Lightning is another matter… and that doesn’t include the drive motors if they need replacement.

Traction battery: https://parts.ford.com/shop/en/us/electrical/battery-and-related-components/battery-14927123-1?pdp=y

Of course, that’s the current price before installation. Can’t imagine what it might be in 10 years.

We may see a lot more EVs in the junk yard in 10-12 years than the ICEVs … for purely economic reasons. Maybe the market is going to demand more oil than old uncle Joe is anticipating. Can’t see a $70K vehicle treated as a “throw away”.

A $70,00 vehicle?

Fisker Ocean $37,499

Aptera $23,000-$26,000

And so on.

“Of course, that’s the current price (of batteries) before installation. Can’t imagine what it might be in 10 years.” That’s true – Brucey can’t imagine. Could be batteries are prohibitively expensive in ten years. Could be they are quite affordable. Batteries are quite the hot research topic these days.

“Maybe the market is going to demand more oil than old uncle Joe is anticipating.” And maybe the market is going to demand less. Brucey wants to give the impression this is a one-way bet, but it’s a two-way bet. Brucey doesn’t know what the future will bring, but he sure wants to make us believe he does.

By the way, Toyota intends to sell 3.5 million electric vehicles by 2030 and be totally carbon-neutral. Ford has materials contracts to allow global production of around 600,000 EVs annually by late 2023, over 2 million annually by 2026. GM plans to sell only EVs by 2035, and tobe carbon-neutral by 2040. And so on. But Brucey, ruminating about his drive to Florida, has come to a realization more profound than all the plans of the big carmakers. Right.

Pure pablum.

I found it odd that Brucie is obsessed with the performance of cars that are over 10 years old in the same comment where he acted like the disgusting Rick Lowry claiming that Biden is too old.

I sense that Brucie boy does not get the used car market or basic finance either. Let’s say Brucie goes out and buys a 2022 gasoline powered Ford for $30,000 thinking in 10 years the residual value is going to be great. Now I doubt he would get $14,000 for the car in 2032 unless he did replace the engine and transmission, which by his own admission is going to cost him around $10,000 to get the old heap ready for market. So he nets $4000 in 2032. Of course with 10-year government bond rates at 4%, the present value of this expected residual value would be a mere $2700.

Now that he is crowing what an enormous value of his old heap in 2032 only proves no one shopping for a vehicle should ever take the advice of someone as clueless as Bruce Hall.

Speaking of clueless used car shopping, do you understand the value of a negative value of an EV after 10-years? At this time in their life cycle the battery will almost surely be on its last legs needing replacement at a cost of ~$135 KW h. The EV battery size is usually a compromise of cost v. capacity, ~150+ KW hs. (Even economists can do the math?) That replacement cost also does not include fees for labor or taxes, etc. These estimates are in 2019 dollars, so what will they be in 2032 after a 10 Yr life and 13 years of inflation on costs and fees?

For that hypothetical 150 KW h average battery, that cost is ~$20,000 + fees + inflation, for a 10 year used auto needing this investment. It is unlikely that there is more than a boutique market for this used auto leaving it at a NEGATIVE value. Boutique being virtue signalling buyers, or collectors of a less or no longer produced product.

I’ll still take the positively valued ICE auto versus the negative valued EV. But, I’m more a realist versus a virtue signalling unicorn chasing fantasist.

Hey clueless wonder. People here a lot smarter than you will ever be have already addressed your BS. Now CoRev – I do get Dr. Seuss tales are over your head but maybe you might try to READ the above comments.

Currently, it’s estimated that around 1 percent of the 250 million cars, SUVs, and light-duty trucks on American roads are electric. However, while it’s difficult to estimate future sales, an analysis by IHS Markit projects that 25–30 percent of new car sales could be electric by 2030 and then 40–45 percent by 2035. Using the rates for those projections, Reuters estimates that by 2050 more than half of the vehicles on U.S. roads could be EVs.

From Car and Driver Aug. 8, 2022

https://www.caranddriver.com/news/a39998609/electric-car-sales-usa/

After ten years of hype about electric vehicles, they represent a measly 1% of the US auto stock. EVs have consistently lost out to ICE vehicles for the last 120 years, and they are still losing. We’ll have to hit real peak oil to change the numbers much, I think.

Good grief. So technological progress is not feasible or what? It is thinking like this that dismissed shale oil production or the growth in LNG exports. I hear you pretend to be an energy consultant. I just hope there are not many fools that seek your advice.

1% after ten years. That’s pretty much corresponds to what Bruce saw.

Of course, technological progress is possible. Even likely. But EVs don’t look ready for prime time today.

“Steven Kopits

November 4, 2022 at 11:24 am

1% after ten years. That’s pretty much corresponds to what Bruce saw.”

Damn you are dumb. The past is not necessarily a predictor of the future. Yes some technologies take time to get going and then BOOM. Anyone who has followed the computer or telecommunications sector knows that.

Stevie copied and pasted the 1st bullet point but skipped over the 2nd bullet point:

American car shoppers appear to have discovered electric vehicles. After a decade of slow but steady sales growth, electric vehicle registrations in the U.S. shot up 60 percent in the first quarter of 2022, even as overall new car registrations dropped 18 percent, per a report by Automotive News that used data collected by financial data firm Experian. It’s the latest indication that domestic EV acceptance may have turned some important but invisible corner recently.

Look Stevie – your credibility is near zero. Such continuing dishonesty is not a good step.

So, Q3 sales per the website below, US sedans and light trucks (SUVs):

EV Sales: 162,508 4.9% +54% yoy (Q3 to Q3)

ICE Sales: 3,336,959 95.1% -2.9% (Q3 to Q3)

Total Sales 3,174,451 100% -1.2% (Q3 to Q3)

Given soaring interest rates, we might expect cars for middle income buyers to decline, and they did.

The growth in EV sales comes heavily from Tesla, up 36% and still 2/3 of the EV market. The other big mover was Mercedes with its EQ series selling 6,200 cars EVs in Q3. Audi has some EV sales, 3400 units of its etron series. Polestar and Rivian had new offerings.

At the budget end are Kia and Hyundai, with about 10,000 units sold in total. BNW EV sales have largely cratered and Chevy sold exactly zero Volts.

EVs remain the domain of the well-to-do, people who also have gasoline-powered cars. After a decade of hype, EVs remain a niche offering to the rich. EV sales by Mercedes, BMW and Audi are exactly enough to clock up hefty losses covering virtue signaling.

https://www.goodcarbadcar.net/2022-us-vehicle-sales-figures-by-model/

Another cut and past just for the erudite Ole Bark, bark. Data is quarterly starting in Q1 2021.

“TOTAL US EV sales 98,832 118,233 106,562 147,799 173,561 196,788 188,924” https://joinyaa.com/guides/electric-vehicle-market-share-and-sales/

And NADA estimates 2022 total sales to be: “NADA has reduced its 2022 new light-vehicle sales forecast to 14.2 million units,…” https://www.nada.org/nada/press-releases/nada-issues-second-quarter-2022-us-auto-sales-and-economic-analysis

That means EV sales are ~5% of the overall market. It also confirms that an increase of a small number is still a small number.

Of course the average voter has still to recognize the virtue of the liberal DEMANDS save the world. I thin that will be plain on Tuesday.

I get driving on I-75 can get tedious but damn did you have to bore us with one of your normally stupid rants?

“Of course, that’s the current price before installation. Can’t imagine what it might be in 10 years.”

I will bet the cost to replace major EV parts will be cheaper than ICE parts in 10 years. Batteries will continue to drop price significantly over the next 10 years. And car batteries that eventually lose their full storage capacity are not useless. they will form the basis for emergency backup and storage systems, which won’t care as much if they only hold 60% capacity.

“Now, if you have a gasoline powered vehicle with 150,000 to 250,000 miles, you can still find a buyer if the body, interior, and most mechanicals are decent.”

judging by trade in values, the user will not get much value for such vehicles. especially compared to new car prices. poor argument here.

Baffled, a poor argument here: “judging by trade in values, the user will not get much value for such vehicles. especially compared to new car prices. poor argument here.” Any buyers are better than very few or zero.

An EV with negative value due to needed battery replacement costing in excess of $20K cost and fees combined. That still doesn’t include any associated worn mechanicals costs, two to four electric motors and their running gear, brakes, suspension, etc. for a used car. If there is a market for a used E, it will be seriously OVER PRICED compared to the used ICE market.

Accordingly, I can foresee a growing market for used ICE vehicles and an almost negative market for used EVs. Come out of your unicorn fart fog and see more clearly the actual economics of a market.

I have to apologize to Princeton Steve. Now he is being dishonesty here but you have eclipsed by light years. See his entire link and not just the first bullet point he copied. DAMN!

“Saw less than 10 Teslas and no other identifiable EV along 1,000 miles of I-75.”

they are all over the place in Houston.

I have been on every inch of i75. what a miserable road to travel as far as sightseeing goes, except for some nice views through the mountain areas.

Well Brucie skipped riding I-75 when he got near Atlanta hoping he would only see white people driving on I-285.

Baffled, what a racist discriminatory comment.

Guessing here, but vehicle observations might be quite different while driving the 1000 miles between Portland and San Diego, either on I-5 or 101. (101 if you have time, the much more heavily traveled I-5 if you don’t). Quite different traveling western Ohio, eastern Kentucky and Tennessee, much of Georgia.

And while we’re on useless observations: last week returning from Reno on I-80 with gas prices still far above those elsewhere, I verified a long held suspicion. Setting my cruise control at 70, I wondered how many passenger vehicles (“cars”) I would pass—or be passed by—before returning home.

Easy answer: in a 62 mile stretch from Reno into California, I passed none, while dozens sped by me. Once I did pass one vehicle, that was it with dozens more roaring past into the distance.

Second useless observation: while there are plenty who are concerned about high gas prices, there are plenty more aren’t,Oh, I’ve ceased being surprised by seeing Tesla’s and other EVs on local roads. They pass me too.

Was Hubbert’s prediction that oil production today would be back to 1900 levels correct?

rsm, umm, you can’t ask such a question of a crowd who believes explicitly climate models can predict.

Ah, there’s CoVid, once again doing his mind-reader act. He assigns thought and beliefs to others thathe wants them to have. Kinda like the daily drivel from the Faux News crowd. One might conclude CoVid has no faith in his own positions, so eager is he to confront straw men rather than real ideas.

MD, so you do not believe climate models can predict? Where’s that list of non-modeled tipping points? Or is this just another subject to run from?

I know you have difficulty of following the topic of discussions but DAMN! Hey CoRev – do something useful and go watch the grass grow.

For conventional US Lower 48 oil production, yes, Hubbert was correct. Those were the sources of oil available at the time.

However, the oil supply grew after that. Notably:

1. Prudhoe Bay in Alaska. Began production in 1977 (21 years after Hubbert’s paper). Peak production: 1.5 mbpd. Current production: 0.45 mbpd

2. US Gulf of Mexico Offshore. From the early 1980s. Current production: 1.7 mbpd

3. US shale oil production: Began materially in 2010. Current production: around 7 mbpd

4. US natural gas liquids production (nat gas fracking by-product): Pre-horizontal well fracking: 1.75 mbpd (to 2008). Currently: 6.0 mbpd

5. Biofuels (biodiesel and ethanol): from early 2000s, currently 1.0 mbpd (this is not a category covered by Hubbert, but matters for our total supply)

Thus, we produce an astounding 16 mbpd from sources not anticipated by Hubbert in his 1956 paper. Note that 13 mbpd of our supply comes from fracking. That alone would make the US the world’s leading oil producer. Both the US and global dependence of US shale oil and natural gas liquids cannot be overstated.

And only land lines existed for phone calls in 1956. Hey Stevie – I got news for you. Smart phones have taken off. Get one.

Wow! Another cogent thought re: technology shift related to the impact of a technology shift comment. He shows the value of his education again?!? Isn’t he the commenter who claims others can’t follow the logic of a comment thread?

Get a clue dumbass. Your worthless comments will from now to entirety be ignored as they are a total waste of time. Now if you actually make a point in the decade I may go into shock. Then again a very low probability.

ISW has a nice summary of the effects of the war and sanctions on Russias economy. Partly sourced from an article on Reuters Europe.

https://www.understandingwar.org/backgrounder/russian-offensive-campaign-assessment-november-2

https://www.reuters.com/world/europe/ukraine-conflict-sanctions-set-blow-hole-russias-finances-2022-11-02/

The economic suffering of the Russian people is going to get worse.

Off that topic, it was interesting how fast Putin folded on the grain trade when Ukraine dared him to enforce a blockade close to their coast. He must have realized that there would have been spectacular fire works if he pulled his ships close to the far coast of the Black Sea. Ukraine would have been willing to sacrifice a few old grain transport ships in order to draw Russias Black Sea fleet into range of their drones and missiles.

Since I have made a fuss about it, without anybody else commenting, let me note some details about particular major oil pools, with this an issue Jim Hamilton noted back in earlier discussions, which seem to have been ridiculed to some extent by “Anonymous,” while given somewhat more credit by Steven Kopits, recognizing again that in 2014, Jim did miss the call that the surging shale production would indeed lead the price of oil to fall below $100 per barrel.

For perspective it is worth noting that “super” pools are those that produce more than 1 milllion barrels per day. I just tried to get the current list of those, but was unable to find it. Back in 2005 there were about 5 of those. Anyway, I did check on some individual ones to see patterns.

So, one that has really declined that Jim mentioned is Cantarell in Mexico. This used to be over a milllon and was even second in production at one point. Today it is at 250,000 and declining. Maybe they can frack it and get it back up a bit, but no way it will ever get back over a million. It has simply been seriously depleted. This does happen. Major pools do hit peak and never get back up again.

I was unable to get current production numbers for Abqaiq in Saudi, which used to be abou 1.5 million. There has been lots of noise about it, and the Saudis are apparently investing heavily into trying to keep it up, but I doubt it is more than 1.5.

The largest in China, once the basis for it being a net oil exporter, is Daqing, once over a million by a bit. But it is now at 600,000, still pretty impressive, but down.

For a long time the world”s second largest pool, and I suspect it is still currently, has been Burgan in Kuwait, the pool Saddam wanted to own. It peaked in 1972, the year before the first great OPEC price hike at 2.4 mbpd, definitely impressive. It is still pretty impressive, coming in at about 1.5 mbpd.

Which brings us to the one I identified as the big banana, whose highly complicated geology I noted back in 2005 here, with this part of why we really do not know its full capacity. But it has been the top producing pool for a long time, and I do not think is particularly declining, although I have not seen a time series of its production. It may be lower than its peak, but not by much. Anyway, it is currently coming in at about 3 million bpd, about 4% of global production.

BTW, Burgan and al Ghawar continue to constitute the bottom end of the global oil supply curve with production costs in range of $2-3 per barrel.