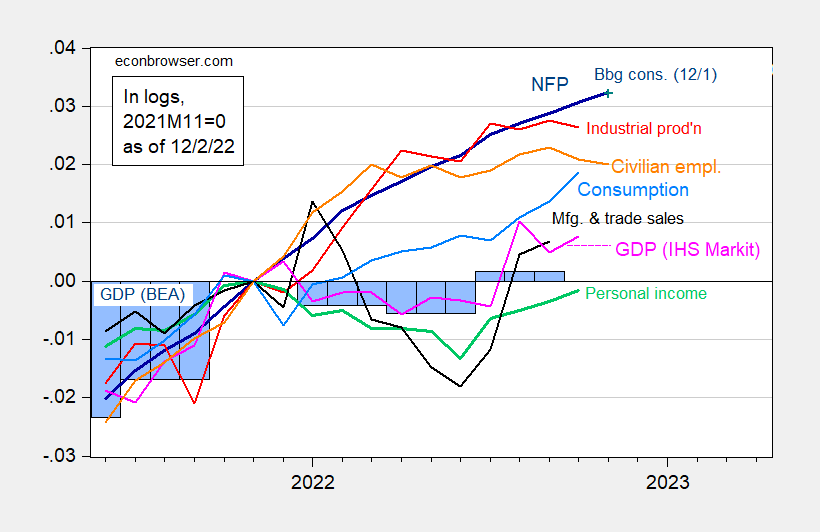

NFP employment increase of 263K surprises on upside (vs. Bloomberg consensus of 200K). This is the resulting picture for some key indicators followed by the NBER Business Cycle Dating Committee.

Figure 1: Nonfarm payroll employment, NFP (dark blue), Bloomberg consensus as of 12/1 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Q3 Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (12/1/2022 release), and author’s calculations.

Note that despite the upside surprise in employment, the picture of the economy’s overall trajectory barely changes (vis a vis the consensus change shown as the blue + in Figure 1).

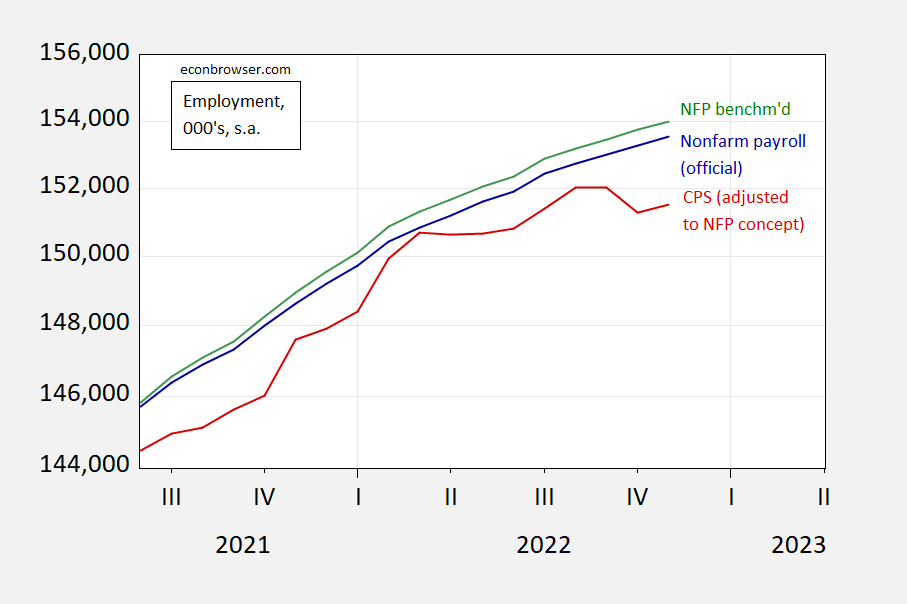

Note that the employment release showed a continued divergence in trends between the establishment (CES) and household (CPS) surveys. That being said, the establishment series usually gets near full weighting in a measure tracking the economy — largely because of the greater relative stability of the CES measures (see Furman, 2016, or CEA, 2017) I show below the NFP series, the NFP series accounting for the preliminary benchmark which raised the March 2022 employment, and the household employment series adjusted to the NFP concept.

Figure 2: Nonfarm payroll employment (blue), NFP employment adjusted for preliminary benchmark revision for March 2022 (teal), and civilian employment adjusted to the NFP concept (red). Source: BLS, and author’s calculations.

The household employment series adjusted to the NFP concept shares the downward movement in the overall household civilian employment series, generally, but not in the last month’s data. This means there’s a (possibly local) peak at 2022M09 in the household series, which is taken by some observers to signal the onset of a recession — i.e., the household series signals a recession earlier than the establishment series.

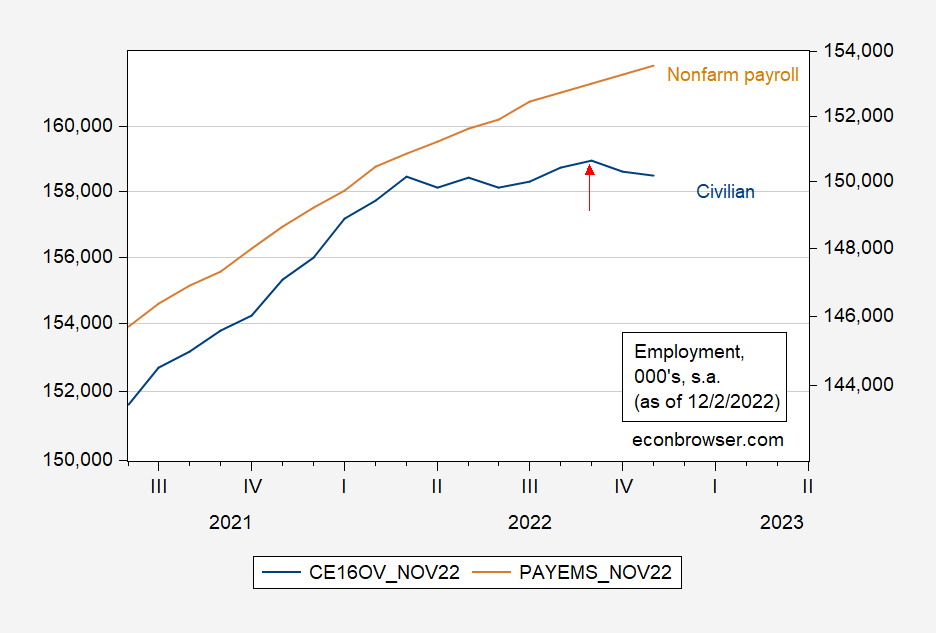

Figure 3: Civilian employment over age 16 (blue, left log scale), nonfarm payroll employment (tan, right log scale), both in 1000’s, seasonally adjusted, both as of 12/2/2022. Source: BLS via ALFRED, NBER.

As I previously noted, the strength of the proposition that the household series has this enhanced predictive power is quite weak (at least assessed using the last four recessions in the United States).

As an aside, further note that looking at a 2022M09 peak in civiian employment suggests no recession in 2022H1.

The Sahm rule, based on the U3 jobless rate, tells us when we are in recession, and works pretty flawlessly. As discussed here in the past, the Sahm rule made clear we were not in recession prior to this year’s elections, contrary to the desparate claims of partisan trolls. The Sahm rule also indicates that we aren’t in recession now:

https://fred.stlouisfed.org/series/SAHMREALTIME

For the purposes of looking ahead, which is what the Fed claims it does in making policy, coincident indicators aren’t all that helpful. The U3 rate can work as a leading indicator, though not as reliably as the Sahm rule as a coincident indicator. In over half the cases since 1948, the U3 rate has risen noticably from its cycle low a few months ahead of the onset of recession.

https://fred.stlouisfed.org/graph/?g=X7iX

The rate has risen a couple of tenths this year, but “noticably” in the sense of just staring at it? Not really:

https://fred.stlouisfed.org/graph/?g=X7kT

The most common recession call among (non-partisan) professional forecasters has been for recession to commence in Q2 or Q3. I’m still a little skittish about the holidays, but with the rail strike apparently averted and China easing Covid restrictions (Well done, protesters!), odds of immediate trouble are reduced. Is it time to rethink timing?

Many moons ago, when I started babbling about recession risk, it was housing which had me thinking Q2 or Q3 were likely to be the beginning. I assume others were relying on similar thinking, given similar lags. Housing troubles are developing right on schedule, but other troubles are not – aside from the retail inventory overhang which imposes a risk for Q4 and Q1.

What happens if housing doesn’t, by itself, drag the rest of the economy into recession? Will we dodge the bullet? The change in the funds rate (which is only one element of Fed tightening) says “no”. This much tightening leads to recession. The Fed didn’t (directly) induce the last few recessions, but Fed-induced recessions are characteristic of inflationary periods. Fed chatter remains backward-looking, focused on realized inflation rather than on inflation expectations or the growth outlook. Only when it comes to the labor market does the Fed sound forward-looking. Oddly enough, average hourly earnings have recently risen at just about the pace of core inflation, whereas prior to the Covid recession, it was common for AHE to outpace core inflation slightly:

https://fred.stlouisfed.org/graph/?g=X7oG

Which, to me, makes the labor-market gremlin not all that scary. Perhaps a shortage of wokers will induce recession. Like that time…sort of like in…Wait a minute… Has a shortage of workers ever been the direct cause of recession? I read that it’s a concern, but I’m not aware it has ever happened. And isn’t a wage-price spiral characteristic of economies with a high rate of unionization?

The most common recession call is for Q2 or Q3, 2023.

Has labor shortage ever caused recession? Don’t know, but social distancing is contributing to labor scarcity:

https://www.nber.org/digest/20212/social-distancing-desires-keep-some-out-labor-force

That’s voluntary social distancing, by the way. The effect is estimated at a 2% drop in the participation rate in February to July of this year.

The continuing low labor force participation rate is indeed the key statistic. Their conclusion is well put:

The researchers estimate that long social distancing reduced the US labor force participation rate by 2 percentage points in the period February–July 2022, and by 1.4 percentage points on an earnings-weighted basis. They calculate that this labor supply reduction lowered potential output by 0.94 percentage point, which translates to a flow output drop of about $250 billion a year.

That the propensity to social distant rises with age but falls with earnings is interesting.

https://fred.stlouisfed.org/graph/?g=IBTh

January 4, 2020

Average Hourly Earnings of All Private and Production & Nonsupervisory Workers, * 2020-2022

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Percent change)

https://fred.stlouisfed.org/graph/?g=Qe7j

January 4, 2020

Real Average Hourly Earnings of All Private and Production & Nonsupervisory Workers, * 2020-2022

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=Q9pS

January 4, 2018

Average Hourly Earnings of All Private and Production & Nonsupervisory Workers, * 2017-2022

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Percent change)

Been reading that conditions for peace talks between Ukraine and Russia are ripening. One argument is that U.S. politicians, particularly House Republicans, are growing reluctant to continue spending. Well, there’s this:

https://www.washingtonpost.com/national-security/2022/12/01/ukraine-us-military-training/

Of course, this is consistent with getting the best deal for Ukraine in peace talks. The simple truth is that wars end, when they end, in one of two ways; either one side defeats the other side and completely dominates the disputed territory or peace is negotiated. Assuming Ukraine can’t defeat Russia in Crimea, negotiation is necessary. Assuming Putin will not negotiate away any territory occupied by Russian forces, Ukraine has to win every inch that it can get beforehand. Concern for a peaceful future means holding territory that is defensible and in which local insurgency is limited. Russia is driving Ukrainian speakers out of territory held by its forces in preparation to make constant, low-grade war with Ukraine for the indefinite future. Ukraine has to make every effort to prevent constant violence in its border territories in the future.

Not a great set of circumstances for peace negotiations.

In the past few months it seems like the war has been wearing down Russian military more than Ukrainian military. In Zaporizhzhia oblast there seem to be Russian moves similar to what was seen on the west bank of Dnipro river before the Russians retreated. Russians have been taking the nuclear war heads out of old missiles and used them as dummies, in the last barrage against civilians (to saturate the defense systems). That is pretty desperate. Russia seems to be running low on everything except cannon fodder “soldiers”.

constant low grade war was perpetrated on Donbas from 2014 thru….

slow leaking Minsk and Normandy is duels noted. slow leak is a term common in dealing with the usa

Anonymous: I am afraid that what you write is incomprehensible. Can you clarify, perhaps using proper syntax and grammar?

Also spelling would help. I suspect “duels” is supposed to be “duals,” although indeed maybe not.

unemployment rate unchanged 3.7%, while U6 at record low 6.7%.

https://www.calculatedriskblog.com/2022/12/comments-on-november-employment-report.html

wow, those Biden policies covid likes to complain about are simply decimating the economy. this is why the last midterm election allowed democrats to gain a majority in the senate. that and trump politicking.

Yes, and the U6 rate, though it has only a 27-year history, also tends to turn high before the onset of recession, like the U3 rate. Hasn’t turned higher yet. Isn’t falling either, for what that’s worth.

A panel of federal judges has unanimously eliminated the requirement that a special master review documents seized at Mar-a-Lago:

https://apnews.com/article/donald-trump-mar-a-lago-criminal-investigations-government-and-politics-16748b82a502c0eec977d3ec51390027

Let jury selection begin!

Most of the better lawyers had predicted this is indeed what would happen. But it’s still great to see it come to fruition in print. Even though he gave up on vlogging, I try to keep an eye on Neal Katyal on this particular space/topic.

Speaking of lawyers – it does seem famed defense attorney Rick Stryker had no clue at all.

https://fred.stlouisfed.org/graph/?g=X7CL

January 4, 2018

Average Hourly Earnings of All Employees in Manufacturing, 2020-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=TRE7

January 4, 2018

Real Average Hourly Earnings of All Employees in Manufacturing, 2020-2022

(Indexed to 2020)

https://jabberwocking.com/how-many-new-jobs-have-we-created-this-year/

Kevin Drum notes the difference in reporting of employment – payroll v. household survey – and starts to doubt the payroll series.

The number of people out of work fell by nearly one-third (-32%) in the first 11 months of 2022, as compared to the same 2021 period. The labor force was up 2%, and civilian employment by 3.9%. In seasonally adjusted payroll terms, employment rose 4.2%, and non-supervisory manufacturing production jobs by 4.7%.

Unemployment averaged 3.7% this year, down from 5.5% in Jan-Nov 2021. The number of new weekly unemployment claims fell by 56.8%, from an average of 498,000 in the first 48 weeks of 2021 to 215,200 this year.

Anyone still confused as to why inflation seems higher than it should be is invited to reread the above.