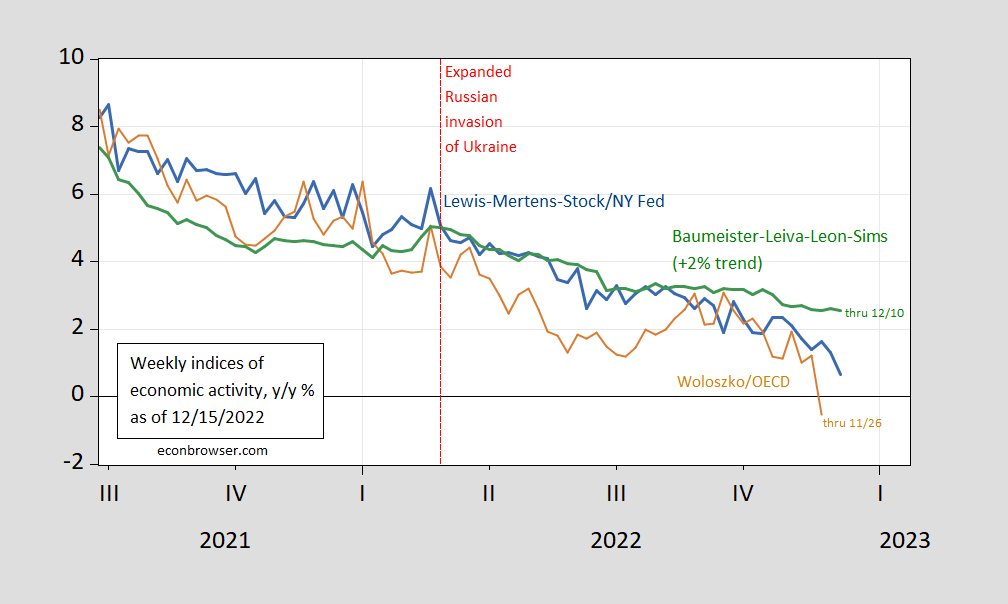

Weekly indicators from Lewis-Mertens-Stock (NY Fed) Weekly Economic Indicators, and Baumeister, Leiva-Leon and Sims WECI, through 12/10; and Woloszko (OECD) Weekly Tracker through 11/26 (not updated).

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green). Source: NY Fed via FRED, OECD, WECI, and author’s calculations.

The deceleration has been pretty consistent over time, and across indicators, with the exception of the Weekly Tracker. The WEI reading for the week ending 12/10 of 0.6% is interpretable as a y/y quarter growth of 0.6% if the 0.6% reading were to persist for an entire quarter. The OECD Weekly Tracker reading of -0.5% is interpretable as a y/y growth rate of -0.5% for year ending 10/26 (this series has not been updated in two weeks, and the interpretation of this reading is in last week’s post). The Baumeister et al. reading of 0.6% is interpreted as a 0.6% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 2.6% growth rate for the year ending 12/10.

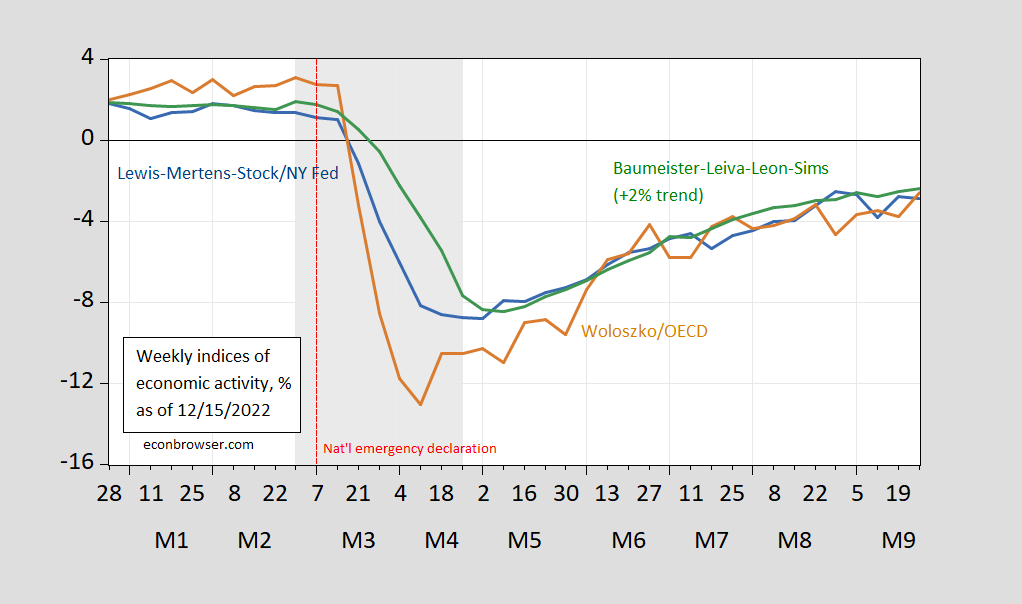

Are these most recent readings consistent with an ongoing recession? For reference, I show the same series for early 2020 in Figure 2.

Figure 2: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green). NBER defined recession dates shaded gray. Source: NY Fed via FRED, OECD, WECI, NBER, and author’s calculations.

Speaking of the business cycle:

Layoffs as a share of employment have been at a new low in the current expansion:

https://fred.stlouisfed.org/graph/?g=XHVd

Profits lead layoffs and profits are high:

https://fred.stlouisfed.org/graph/?g=XHV0

On the hiring side, openings (which diverged suspiciously from hires starting in mid-2017) drive hires:

https://fred.stlouisfed.org/graph/?g=XHVN

Level? Rate of change? I dunno, but profits lead openings:

https://fred.stlouisfed.org/graph/?g=XHXx

Except that this year, opening peaked either ahead of profits or simultaneously. Both remain high, though.

Anecdotally, the difficulty in finding qualified workers has limited layoffs, but that story has not been tested since this new period of low layoffs began. Except in tech and online retail, where employee retention seems to take a back seat to profits. Profits could provide a buffer for employment, allowing firms to hang on to employees. In fact, that pretty clearly does happen, but doesn’t happen to a great enough extent to cause a disconnect between profits and employment. Question is, if we head into recession, will firms focus on short-term profits or retention (medium and long-term profits)?

The JOLTS data clearly support the view that employment growth has been strong this year. That said, I don’t see a way to use this profits story to clear up the divergence between payroll and household employment. Profits remain high, and are only down for a single quarter from the cyclical peak, but business surveys indicate widespread expectation of decline. Realized profits or expected profits? Dunno. But since profits are reported with a considerable delay, profit forecasts are worth watching.

It’s hard to tell. What are “normal” profits?????

Financial economists might suggest having profits equal no more than the cost of capital times the value of tangible assets. Oh wait – I just suggested intangible profits and profits from monopoly power are above normal. Yea – I’m quite the socialist.

You won’t find “normal” in relation to profits in anything I have written here. Nor is “normal” part of the description of any of the data to which I have linked.

The logic of leads and lags has nothing to do with normal.

I could get cute here by asking if profits are mean reverting. Oh wait – that is Princeton Steve’s language rather than yours.

Inflation pressure continues to ease.

The BEA reports core PCE on Friday, December 23.

Bloomberg consensus is at 0.3% as of today. My FWIW forecast is for 0.2% same as last month.

A low inflation report may give the FED some pause in further aggressive rate hikes.

I doubt it.

The Fed seems to be working under the delusion that it will be seen as heroic if it causes a recession.

Here’s this layman’s barbaric criteria for gauging if/when ‘inflationary pressures easing.’

The month-on- month goes negative and the year-on-year is lower.

The only major interest rate that is above headline inflation is the prime rate @ 7.5%.

Last week the Fed’s MBS/UST balance dropped by less than $1 billion. They’re supposed to be tightening by $100 billion a month.

It appears the Super Villain Fed has not removed the free money/crack out of markets.

Found this website by watching PBS NewsHour, and thought others might be interested. Not all of the content is free, but a portion can be read for free.

https://yourlocalepidemiologist.substack.com/

Will recession slow down logging?

Be careful about these flawed indexes. Disinflation can give the illusion of a slowdown when it’s simply reduced prices with a struggling, lagging government trying to catch up. The fact is, we are heading to a period of -cpi reports. Inflation crashed in November.

Prof. Chinn, on the issue of the Establishment vs. Household survey this year, the Philadelphia Fed just had a major word to say on the subject:

https://www.philadelphiafed.org/-/media/frbp/assets/surveys-and-data/benchmark-revisions/early-benchmark-2022-q2-report.pdf

“Estimates by the Federal Reserve Bank of Philadelphia indicate that the employment changes from March through June 2022 were significantly different in 33 states and the District of Columbia compared with current state estimates from the Bureau of Labor Statistics’ (BLS) Current Employment Statistics (CES).…

“ Our estimates incorporate more comprehensive, accurate job estimates released by the BLS as part of its Quarterly Census of Employment and Wages (QCEW) program….

“ In the aggregate, 10,500 net new jobs were added during the period rather than the 1,121,500 jobs estimated by the sum of the states; the U.S. CES estimated net growth of 1,047,000 jobs for the period.…”

About the QCEW: “ The QCEW data make a significant contribution to the annual revisions. Whereas the QCEW data cover more than 95 percent of all employers, the CES sample represents just 6 percent of the QCEW total.”

The Weekly Economic Index first declined to this week’s level in March 2008, four months into the Great Recession. The only time in its 15 year history when it was at this level not during a recession was one month at the beginning of 2016.

Other weekly data:

Redbook *nominal* YoY retail sales: up 5.9% (2nd lowest level since March 2021).

ASA Staffing Index: up 0.1% YoY.

Federal payroll tax withholding for last 20 workdays YoY: up +2.0%. For the entire 75 day period since the beginning of the fiscal year on October 1 they are up only 0.6% YoY.

For those who don’t understand the tax withholding data. It is *nominal.* It is not a sample, but is the total amount paid in withholding taxes to the Treasury, updated daily. Average hourly wages are up 3.5% YoY, so even if *zero* jobs were added for the entire year, all else being equal payroll taxes should have gone up about 3.5% as well. That taxes paid have gone up less than that strongly implies that either (1) there have been actual job losses during the past 12 months, or (2) total earnings by all but the top 15% or so of all workers have actually gone down in real terms, or both.

On the subject of actual pay having decreased, the California Treasurer’s Office has suggested that it reflects a steep decline in stock options being paid. Even if so, that means that aggregate earnings have in fact outright declined in real terms, which is not good. They’ve supplied me with their data, but I haven’t had the time to crunch it yet.

New Deal democrat,

Are you finding the withholding data on a CSV file or on a PDF file. I see both types at FiscalData.Treasury.gov.

I see the monthly CSV file for November 2022 on the monthly data, but don’t see where the data are for the 75 days you cite.

I also see the Daily Treasury Statement, showing the published PDF file for December 14, 2022.

Let me point you directly to links to the data (I use the pdf file, just because it’s easier to read).

For example, here’s the report for December 13 this year:

https://fsapps.fiscal.treasury.gov/dts/files/22121300.pdf

Scroll down to Table IV, the first line, right hand column: $601.7 million. That’s the total amount paid beginning October 1.

Here’s the report for the same day last year:

https://fsapps.fiscal.treasury.gov/dts/files/21121300.pdf

Do the same thing: $586.9 million.

The difference is 2.5%.

The number jumps around somewhat from day to day, depending on how you measure.

For example, this November for the entire month:

https://fsapps.fiscal.treasury.gov/dts/files/22113000.pdf

Table IV, first line, 2nd column: $237.5 million paid for the month.

November of last year:

https://fsapps.fiscal.treasury.gov/dts/files/21113000.pdf

Table IV, first line, 2nd column: $243.7 million.

2.5% less paid this November vs. last November.

Usually I measure over a moving 20 day reporting period.

For example, I just calculated the last 20 days through Wednesday by subtracting the number in Table IV, first line, 3rd column for November 15 from the same number in the report for December 14. I then made the same calculation for November 16 through December 15last year. The resulting calculation was: $247.6 B for the last 20 reporting days this year vs. $242.8 B one year ago, +$4.8 B or +2.0%.

As I say, the number jumps around a bit from day to day and week to week.

But I can tell you this (because I’ve done all the calculations): the monthly comparison first turned negative YoY in December 2000, and remained below the YoY inflation number all through 2001. Actual job losses as reported in the monthly establishment survey started in February 2001 and continued almost non-stop throughout the year.

Similarly, the monthly withholding comparison first turned negative YoY in January 2008, the first month the establishment report shows actual job losses.

In 2020 withholding first turned negative YoY in April; actual job losses started in March.

As indicated above, last month – November – was the first outright negative month YoY for tax withholding payments this year.

The establishment survey says we added 3.3% new jobs in the past 12 months, with average hourly pay for those jobs over 5% higher. And yet in the aggregate in the past 4 weeks only 2% more has been paid in withholding taxes than the same period one year ago.

I say this time it isn’t likely to be different. We’ll see.

Hope that helps.

New Deal democrat

Thanks. Lots of information to follow-up.

I am sure your kind assistance will help.

Thanks Again

Right, except stock options being paid created a artificially created number. You just can’t seem to get it.

Since the California Treasurer’s Office estimated that their payments were only up 1% YoY excluding stock options, after which they were down about 5%., actually it might possibly be somebody other than me who doesn’t get it. Payments ex-stock options up 1% YoY in the aggregate vs. average wages for non-managerial employees up 5.8% YoY implies there are fewer employees, or the employees were working fewer hours, than there were a year before.

Have a nice day.

Donald Trump wants to extend the right of free speech to the spreading of lies, inciting racial hate, and conspiring to commit treason:

https://www.msn.com/en-us/money/companies/trump-vows-free-speech-reform-of-government-universities-media-tech-firms-if-elected-in-2024/ar-AA15kkqS?ocid=DE_20221215_ENUS_coronavirus_1&pc=U531&cvid=b99754abf7e44cab876bf64d24cd9347

Of course, the day we let this wannabe tyrant become King Donald I, the right of free speech for blacks, Hispanics, and Jews will be terminated. MAGA!

Plus, Trump will mitigate he myriad disasters the regime is inflicting on America.

I realized Dr. Chinn took down the endless debating from JohnH on his claim that real wages in the UK benefitted from Cameron’s fiscal austerity. Our host noted that real wages fell dramatically from 2008 to 2014 to have a couple of years where real wages came up a little. In that excellent post – out host also noted how the UK output gap which had been large during Cameron’s era of fiscal austerity did close by 2015/16 in large part because of BoE easy money.

Well guess what Jonny boy is BAAAACK with his usual disinformation and incredibly bad understanding of even basic macroeconomics. Since Dr. Chinn asked Jonny boy to consider the role of the UK output gap (Jonny boy of course could not bother), I looked for discussions of this key issue with this one being informative:

https://data.nasdaq.com/data/ODA/GBR_NGAP_NPGDP-united-kingdom-output-gap-of-potential-gdp

Note Cameron inherited a large output gap which persisted precisely because his stupid austerity JohnH has to defend offset the efforts of the BoE. This gap was still quite large as late as 2013 but did eventually close. And the standard view that a large output gap would mean falling real wages is precisely what we saw.

Now large output gaps do drive down inflation. And we did see a partial reversal of the real wage decline in 2015 when the economy finally got back to full employment. Which is to say the UK experience bore out the standard Keynesian view. But of course JohnH is and has always been a gold bug much like Stephen Moore. So I guess we will have to endure more of his economic stupidity. After all, Moore’s good buddy Lawrence Kudlow was Trump’s economic advisor. MAGA!

OK. “ Now large output gaps do drive down inflation.” But that’s precisely NOT what happened. Inflation was much higher when there was a large output gap.

And when the output gap went away, inflation went to virtually zero and real wages rose.

Further, per Krugman and standard economics dogma, inflation dropping to very low rates is a very worrisome sign, because it signals higher unemployment to force sticky wages down. But again, that is precisely NOT what happened. Employment continued to be high, and real wages continued to rise until inflation reappeared. Yet pgl continues to see no relationship between inflation and declining real wages!

pgl’s hilarious explanation is full of BS about what should have happened, when exactly the opposite is what actually happened! Seems to happen all the time!

“And when the output gap went away, inflation went to virtually zero and real wages rose.”

Jonny boy never understood macroeconomics at the most basic level. Thanks for confirming the obvious!

Yes, real wages fell by about 7% from December 2008 until 2014.

But pgl conveniently ignores the fact that almost half that decline occurred in 2011-2012, when inflation was 5%, exceeding wage growth by almost 3% The other half occurred in adjacent years, when inflation often exceeded wage growth by about 2%.

As pgl conveniently noted, inflation supposedly drops when there is a large output gap. But that is not what happened. In fact, exactly the opposite occurred. Inflation rose.

The rise in inflation accounts for the drop in real wages, but pgl acts as if inflation was nonexistent and played no role in declining real wages.

Then in 2015 inflation disappeared and real wages rose for a couple years…until inflation rose once again.

Upon a closer look at the data, about 2% of the 7% real wage decline occurred under Gordon Brown. Of the 5% real wage decline under Cameron, 3% occurred in 2011-2012 when inflation exceeded wage growth by 3%. The remaining 2% of the real wage decline occurred in adjacent years. This is not intended to support Cameron’s austerity, when inflation increased. But it does show that inflation was associated with the decline in real wages.

“But pgl conveniently ignores the fact that almost half that decline occurred in 2011-2012”

Oh please. Yea – when the economy was far below full employment real wages fell. Do you have a coherent model showing how your gold bug monetary policy and fiscal austerity leads to higher real wages? If not – then all of what4 you babble here is Jonny boy being dumber than a rock.

Dude – we all get you are a moron. Just relax.

pgl will just love this headline: “Real wages fall as inflation eats into UK pay…Wage rises are close to a record high but double-digit inflation continues to eat into the value of earnings, official figures show.

In the three months to October wages increased by 6.1 per cent, according to the Office for National Statistics, reflecting the highest rate of growth in regular wages, excluding bonuses, on record outside of the pandemic.

However, real wages, which is the value of earnings after adjusting for inflation, fell by 2.7 per cent over the same period. This is slightly smaller than the record 3 per cent decline recorded in June, but is among the biggest falls in real pay on record, the ONS said.

Households are facing a record fall in living standards because of the soaring rate of inflation.”

https://www.thetimes.co.uk/article/second-largest-fall-in-wage-growth-after-inflation-since-records-began-v9lnzmkx8?amp

pgl must be thinking. What a bunch of liars! Workers drive inflation. They are not the victims of inflation. Inflation doesn’t cause living standards to decline. Don’t believe your lying eyes. It must be Cameron’s austerity. No, that’s passé. I have to invent some other, more recent BS!

I hate bad policies that lower real wages. But you claim I love this? No – it is you that praised gold bug stupidity and fiscal austerity. You can falsely attribute motivations to others all you want. That in no way changes the fact that you are a liar, you are a moron, and you are utterly worthless.

“There were 417,000 working days lost because of labour disputes in October this year, the highest since November 2011”

Wait, wait – your own story said the economy was weak under Cameron. But you told us all about those amazing employment increases under Cameron. Gee Jonny boy – you found a link that confirms the conventional view of this pathetic era which you praised as a Cameron economic miracle.

WTF do you think brought inflation down? Oh yea the weak economy from Cameron’s fiscal austerity. Are you so stupid not to realize the obvious? It seems so.

Hey – keep bringing more of these stories. If you had half a brain – you might realize they are rejecting your stupid claims. But no – Jonny boy was born with no brains.

“And when the output gap went away, inflation went to virtually zero and real wages rose.”

This sentence is the central problem with your incessant babbling. High output gaps were the means to lower inflation but dumbass Jonny boy claims when we are in a depressed economy – that increases inflation. And when we decide to go back to full employment, inflation magically goes away.

This nonsense strikes me as the Chris Christie diet plan. Eating more junk food and never working out is his key to losing weight. How is that working out for Christie?

Come on Jonny boy – you are a lot like Princeton Steve. The more BS you write – the more we realize you along with Stevie boy are completely MORONs.

“that is precisely NOT what happened. Employment continued to be high, and real wages continued to rise until inflation reappeared.”

What happened under Cameron was very similar to what happened in the early 1980’s. Create a massive output gap and maintain it for years. Inflation did come down but real wages fell – in the case of the UK a lot. Yea eventually the monetary authorities got the economy back on track. After all – even prolonged output gaps do not last forever.

As far as real wages, they fell massively until 2015 when they showed a modest and temporary reversal. I guess Jonny boy never got the point of Dr. Chinn’s post that utterly mocked Jonny boy.

OK Jonny – keep it up as the other kiddies in your preschool class are falling on the floor laughing at you.

BTW—-at no time did I ever “claim that real wages in the UK benefitted from Cameron’s fiscal austerity.” That was purely a fabrication by pgl.

What I did claim repeatedly—and what pgl could not take in—is that workers did benefit from a close encounter with deflation, exactly the opposite of the deflation fear mongering that Krugman and others were foisting on a gullible public.

Deny, deny, deny. You had earlier denied you claimed UK real wages rose. Like I said – liars lie.

If you plot US and UK GDP growth during from 2010, they track almost perfectly. Both rose about 50% during the following decade.

But pgl insists on demonising Cameron but coddling Obama and the other Democratic chicken hawks…a true, hypocritical partisan hack.

Pgl insists on making this endless debate about Cameron austerity, which I opposed and said so many times.

I insist on making this about the relationship between inflation and real wages, and how very serious economists like Krugman engaged in fear mongering about the harm to workers that would be caused by inflation rates that got too low, when in fact the opposite happened: real wages rose during the two year period when UK inflation rates dropped below 1%.

UK workers also suffered a loss in real wages and purchasing power when inflation rates were higher—before and after 2015-2016.

Pgl simply can’t deal with the facts I’m raising, and for some strange reason insists on diverting attention to Cameron and austerity (reframing the endless argument.)

As Noah Smith pointed out, “the larger question here is: Why?? Why does inflation make (real) wages go down? In fact, this is a major macroeconomic mystery.” It’s a question that “economists” like pgl really don’t want to face…and they will bob and weave and divert attention elsewhere to avoid addressing it…weird!!!

“If you plot US and UK GDP growth during from 2010, they track almost perfectly. Both rose about 50% during the following decade.

But pgl insists on demonising Cameron but coddling Obama and the other Democratic chicken hawks…a true, hypocritical partisan hack.”

Of course I was the one over at EV that noted US and UK performance were virtually the same to which you made the claim it was all Obama’ fault. Hmm – praising Cameron the white guy while bashing Obama the black dude. No wonder Putin puts up with you.

Correction: “But pgl insists on demonising Cameron but coddling Obama and the other Democratic DEFICIT hawks…a true, hypocritical partisan hack.’

It is funny that you bash deficit hawks (capitalizing DEFICIT is cute since you used to tell EV readers that DEFICITS were evil) given the praise you laid on Cameron and his fiscal restraint. You have to be the most mixed two faced troll God ever created.

https://fred.stlouisfed.org/graph/?g=XM0W

August 4, 2014

Real per capita Gross Domestic Product for United States, United Kingdom, France and Germany, 2007-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=XM1a

August 4, 2014

Real per capita Gross Domestic Product for United States, United Kingdom, France and Germany, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=S71s

August 4, 2014

Real per capita Gross Domestic Product for United States, United Kingdom, France, Germany, Netherlands and China, 2007-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=S71y

August 4, 2014

Real per capita Gross Domestic Product for United States, United Kingdom, France, Germany, Netherlands and China, 2007-2021

(Indexed to 2007)

Kevin Drum gets his fair share of MAGA trolls as well. Kevin puts up a post noting that inflation adjusted price of gasoline is now lower than what it was a year ago. Fair enough but some troll who must be the love child of Bruce Hall and CoRev decides to annoy everyone with how gasoline prices were only $2.48 when Biden first took office. I know – trolls will be trolls but another comment shows up:

‘Now that they mostly failed to remove Democrats in the midterms, the greedy oil execs have stopped pumping the price up.’

That is handle a MAGA troll!

https://www.msn.com/en-us/news/politics/us-senate-passes-record-858-billion-defense-act-sending-bill-to-biden/ar-AA15l45U

The U.S. Senate passed legislation on Thursday authorizing a record $858 billion in annual defense spending, $45 billion more than proposed by President Joe Biden, and rescinding the military’s COVID vaccine mandate. Senators supported the National Defense Authorization Act, or NDAA, an annual must-pass bill setting policy for the Pentagon, by an overwhelming 83-11 bipartisan majority. The no votes came from a mix of liberals who object to the ever-rising military budget and fiscal conservatives who want tighter controls on spending.

I get our troops need a pay raise. I get supporting Ukraine. I get that the PRC is stirring things up. But DAMN!

That $858 billion NDAA just sent to the President’s desk is not the total amount of

Federal Government: National Defense Consumption Expenditures and Gross Investment (FDEFX)

https://fred.stlouisfed.org/series/FDEFX

Notice the large increase in defense spending under St. Reagan, which along with the 1981 tax cut for rich people ballooned the deficit. Now Clinton passed the 1993 tax increase and cut defense spending. Bush43 on the other hand had to balloon the deficit against with tax cuts for the rich and increases in defense spending. The Obama years were a lot like the Clinton years with tax increases and reductions in defense spending.

And then we got the King of Debt Donald Trump. More tax cuts for the rich and a massive increase in defense spending.

Republicans who talk about fiscal responsibility either cannot do first grade arithmetic or are lying to us. Your pick.

Lawrence J. Korb back in Feb. 2018 warned us that Trump would bloat the Federal defense budget:

https://www.americanprogress.org/article/trumps-defense-budget/

‘President Trump has proposed an unnecessarily large increase in the defense budget that will actually weaken national security.’

By 2019 Trump was even admitting that we spent a crazy amount on defense but his budgets kept on growing. In his first year President Biden had brought defense spending down a bit but then Putin invaded Ukraine.

I’m putting this comment here, as a “reply” because I’d rather not put my comment below 9 redundant “ltr” comments.

I always kind of imagined this is how Barkley Junior manages classroom discussion:

https://www.buzzfeednews.com/article/clarissajanlim/twitter-spaces-nuked-elon-musk

Or maybe possibly more like Fred Ryan??

https://twitter.com/anniegowen/status/1603071294316199937

My personal favorite (amongst the roughly dozen other straight Rosser requests that I be banned from Econbrowser) was when Barkley “threatened” never to regurgitate what he had seen in Russian state media “that no other American, but ONLY Barkley Junior had access to”, unless I was permanently banned from Econbrowser. Gosh…….. the possible loss of regurgitated Russian state news from Barkley Rosser, unless I was banned, must have kept Menzie up the whole night sweating that decision /sarc. But was the “threat” to Menzie carried out and we never heard again Barkley’s blathering about some relative’s third hand account from Russian state media outlets?? No, because Barkley can’t save himself from the self-delusion anyone here cares about his baloney that he somehow can access state controlled Russian media that ANY village idiot couldn’t also access.

I believe this is a Top Ten single off of “The Best of Barkley Rosser: Russian Expert” LP.

I shall follow this up with the second English language report (the first I just put up on Econospeak in much greater detail, although crucial details remain unclear) that about last Tuesday, Russian central bank Head Elvira Nabiullina left office. This is all over various substantial Russian language sources, but not reported in English language media until I just did so a few minutes ago on Econospeak.

It is unclear if she resigned or was pushed, but rumors have it she is being set up to be made scapegoat for current Russian economic problems, …… “

“I wish her and her husband, who ceased being Rector of the Higher Economic School in Moscow last year, all the best. This now looks to be a dangerous situation for them.”

https://econbrowser.com/archives/2022/08/us-and-euro-area-headline-inflation-compared

That “special insider’s report from Russia” we got from Barkley Rosser back in mid-August. Apparently, and “much to my amazement and shock”, 4 months later, Nabiullina is still showing up to work everyday, according to those jokesters over at Reuters.

https://www.reuters.com/markets/europe/russias-central-bank-governor-nabiullina-speaks-after-holding-rates-75-2022-12-16/

I guess Barkley Rosser would have us believe, just like Kramer on Seinfeld, Nabiullina shows up for work to a job she doesn’t have, because “she was just trying to get ahead”.

Moses Herzog: There were credible reports (in my opinion) that Nabiulina had attempted to resign. I would not say that was such a crazy recounting of the discussion at the time.

Menzie, I’m a little drunk now, OK?? Please give me semi-credit, if you believe I’m a “drunk” (I’ll accept that) you don’t just think I’m a dumb guy you just met off the street, ok?? Nabliullina is an incredibly, incredibly talented woman. Menzie. I know, you know, we don’t need to argue she’s an incredibly talented woman. Do you think they ask her to quite her job?? , or…… Menzie THEY asked her. don’t give me shit about this, Menzie my brother. Come on!!!!

Moses,

Wow, you are really obsessed with repeatedly dragging up certain old stories totally irrelevant to the current thread and adding all kinds of preposterous extra stuff to them.

Regarding Nabiullina, about whom I know far more than you or anybody else posting here does, in fact there have been two rounds to her possible leaving her job at the Russian central bank this year. The first one was back in March, which was what Dr. Chinn heard about and what one can find reported on in her Wikipedia entry. It looks that it was pretty serious, and I did comment on it here. She tried to resign, but Putin would not let her.

Of course, as I have already noted, I completely agree with Moses that she is highly competent and fully understand that Putin would or should want to keep her in her current job. Somehow Moses thinks that he is the one who first reported on her abilities a whopping four years ago. Well, I was aware of her capabilities long before that. he problem is that she may not want to be in her job, and there are serious sources who are even quoted in her Wikipedia entry wehre indeed ANY village idiot can find it, who think that some of her comments suggest that she is not, shall we say, an enthusiastic supporter of Putin’s “special operation.” But then, she is pretty smart.

Now you have made quite a fuss about the more recent matter, which dated to August. I reported on Econospeak and here about the serious outbreak of reports including from highly serious sources that she was going to be or might be fired, supposedly as a scapegoat for ongoing economic problems. In the end, that did not happen and there were next to no reports about the whole kerfuffle in the western media. I have not seen any clear explanation of what all that was really about and why and what precisely happened. it looks that there was indeed some kind of power struggle among the economic policymakers around Putin with this fight ending up centering on Nabiullina, who, given her earlier position, might well have wanted to get out of the job and even been behind the rumors. But there has basically been dead silence on that whole matter since, although for a couple of days there was a near frenzy of reports and speculation on the matter, again, all in the Russian language media, and again, some of this coming from highly placed and well informed sources, not just some fly by night loudmouths.

Now, Moses seems to think that I should be publicly flogged and maybe yet again fired from my job because, gosh, who knows how I handle classroom discussions? I might tell students who stupidly criticize famous public women that they do not like their mothers or something else truly awful. As it is, I do not think I am upsetting people here particularly, aside from maybe Moses, by letting people know about things going on in the Russian media that are not being reported on in the western media, even though Moses is convinced that “ANY village idiot” can access these things, especially all the ones who know zero Russian.

As noted elsewhere, when I report these kinds of things I do usually try to note that the reports need further confirmation and must be taken with some grains of salt until such confirmation is obtained. So, I would hope that nobody is going out and betting their mortgage on any of these reports. I would hope people are duly warned they may not end up being true. Nevertheless, I think most people here appreciate having access to such reports, even if they are village idiots not calling themselve “Moses Herzog” who supposedly can access them on their own.

Often times we hear/read snobbish, snide, and blanket style comments about populism.

https://econbrowser.com/archives/2016/10/guest-contribution-the-fed-and-inequality

There are many different brands of populism. Two small examples: You have the Bernie Sanders type populism, and the MAGA type populism. Both very different, but both just as accurately can be labeled “populist”.

The sometimes/often assumption that populists are uneducated, not well read, and “reactionary” is repeated over and over and over “The sky is red. The sky is red, the sky is red”. These arguments are often made in relation to Brexit, the EU, and killing off of individual nations’ sovereignty and individual citizens’ right to vote on issues affecting their lives. The arguments against populism often do seemingly “hit target” because they have a thread of truth to them. But what often isn’t asked as related to populism, is, “What is the alternative to populism??”

https://www.theguardian.com/world/2022/dec/16/a-tragic-affair-european-parliament-stunned-by-qatar-corruption-inquiry

Numbers are crunched on Brexit and we are told by people holding PhDs and British media with connections to the ruling elite that “the numbers do not lie” “It cannot be refuted…….” “the verdict is in” yada yada yada. Really??? Again, “Masters of the Universe” type extreme arrogance, with no alternative reality.

What will EU leaders do in the future as they corral more and more and more power?? We’ve only seen the tip of the iceberg. If I only have two choices—EU leadership/EU parliament vs populism??~~”Give me populism or give me death”.

https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDNdLCJkYXRhIjpbWyJjYXRlZ29yaWVzIiwiU3VydmV5Il0sWyJOSVBBX1RhYmxlX0xpc3QiLCI1Il1dfQ==

November 30, 2022

Defense spending was 56.4% of federal government consumption and investment in July through September 2022. *

$935.1 / $1,656.9 = 56.4%

Defense spending was 20.8% of all government consumption and investment in July through September 2022.

$935.1 / $4,486.5 = 20.8%

Defense spending was 3.6% of GDP in July through September 2022.

$935.1 / $25,699.0 = 3.6%

* Billions of dollars

56.4% than 20.8%? Be careful not to take a quarterly flow relative to an annual flow. Of we all know most nondefense government purchases are done by state and local governments not the Federal government.

As for government gross debt as a percent of GDP, the United States reached 100% in 2012 and has been above that level ever since:

https://www.imf.org/en/Publications/WEO/weo-database/2022/October/weo-report?c=156,132,134,136,158,112,111,&s=GGXWDG_NGDP,&sy=2007&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October, 2022

Government gross debt as percent of GDP for Canada, France, Germany, Italy, Japan, United Kingdom and United States, 2007-2022

https://fred.stlouisfed.org/graph/?g=XzNO

January 30, 2018

Government debt as a share of Gross Domestic Product for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2001-2021

https://fred.stlouisfed.org/graph/?g=XzNS

January 30, 2018

Government debt as a share of Gross Domestic Product for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2001-2021

(Indexed to 2001)

https://www.worldometers.info/coronavirus/

December 15, 2022

Coronavirus

United States

Cases ( 101,714,157)

Deaths ( 1,112,797)

Deaths per million ( 3,324)

China

Cases ( 371,918)

Deaths ( 5,235)

Deaths per million ( 3.6)

https://www.worldometers.info/coronavirus/

December 15, 2022

Coronavirus

New York

Cases ( 6,651,600)

Deaths ( 74,738)

Deaths per million ( 3,842)

China

Cases ( 371,918)

Deaths ( 5,235)

Deaths per million ( 3.6)

This is no longer just casual dishonest. China was suffering a new wave of Covid infections before the lockdown was lifted. Testing has been altered, so that figures are simply not comparable and undercounting is rampant. Yet ltr keeps reporting g the same stupid figures, as if they mean something. Casual lying is now gross lying, wholesale dishonesty.

Pseudo-economist Kudlow the Klown is BAAAAACK!

https://www.msn.com/en-us/news/politics/i-don-t-understand-kudlow-baffled-by-gop-senate-leadership-in-interview-with-republican-senator/ar-AA15nbVU?ocid=msedgdhp&pc=U531&cvid=11a9c40115f841d9a753246996978a0c

“The Senate Republican leadership’s apparent support of the omnibus bill is an unbelievable betrayal of the victorious House Republicans,” Kudlow said on Fox Business Network on Friday. “Kevin McCarthy and company don’t want an omnibus for all next year. They want a short-term CR – continuing resolution – that might carry through late January when they take over the House. This would give them the chance to restore regular budget order with 12 appropriations bills that would substantially cut back on all this inflationary overspending in the omnibus bill.”

Oh gee – Larry must think Brucie Hall is telling the truth about this alleged 13.3% inflation rate. So tell us LARRY – where would you cut spending? Defense? Of course not as during the Trump regime where you pretended to be an economist, defense spending soared. Social security and Medicare cuts – check. After all you represent the “investor class” which feeds your cocaine habit.

I just read a letter from the Republicans in Congress who HATE any effort to curb the ability of US based multinationals to evade corporate profits taxes. Their latest complaint is something called the undertaxed profit rule (UTPR):

https://www.taxpolicycenter.org/taxvox/bidens-undertaxed-profit-rule-would-complete-us-adoption-beps-pillar-2

President Biden’s 2023 budget would replace the current 10 percent base erosion anti-avoidance tax (BEAT) on US subsidiaries of foreign corporations with a 15 percent minimum tax called the undertaxed profit rule (UTPR). Together with global intangible low-tax income (GILTI) regime reforms proposed earlier, the UTPR would fully align the US corporate tax with the OECD’s Base Erosion and Profit Shifting (BEPS) plan. The UTPR would implement the latest Pillar 2 innovation, introduced in last December’s updated model rules: a “top-up” tax on the domestic income of companies with undertaxed foreign affiliates. Under the provision, US subsidiaries of foreign multinationals could be denied domestic deductions sufficient to raise the effective tax rate on offshore affiliates to at least 15 percent.

If you never heard of BEAT or GILTI – they were the incompetent provisions in the 2017 Trump tax cut for rich people. The fat cats have been spending the last 5 years figuring out how to neuter these provisions. Of course all of these absurdly complicated and ineffective provisions can be tossed aside if the US government effectively enforced transfer pricing. Of course that would mean giving the IRS the resources to do so which they same shameless Republicans refuse to let happen.

https://www.worldometers.info/coronavirus/

December 17, 2022

Coronavirus

Germany

Cases ( 36,980,882)

Deaths ( 159,884)

Deaths per million ( 1,906)

China

Cases ( 376,361)

Deaths ( 5,235)

Deaths per million ( 3.6)

https://www.worldometers.info/coronavirus/

December 16, 2022

Coronavirus

France

Cases ( 38,801,884)

Deaths ( 160,359)

Deaths per million ( 2,445)

China

Cases ( 374,075)

Deaths ( 5,235)

Deaths per million ( 3.6)

December 16, 2022

Coronavirus

New York

Cases ( 6,659,312)

Deaths ( 74,759)

Deaths per million ( 3,843)

China

Cases ( 374,075)

Deaths ( 5,235)

Deaths per million ( 3.6)

a) https://news.cgtn.com/news/2022-05-27/Chinese-mainland-records-102-new-confirmed-COVID-19-cases-1amUW6S96Bq/index.html

May 27, 2022

Chinese mainland records 102 new confirmed COVID-19 cases

The cumulative number of confirmed cases on the Chinese mainland is 223,837, with the death toll from COVID-19 standing at 5,226.

b) https://news.cgtn.com/news/2022-11-20/Chinese-mainland-records-2-267-new-confirmed-COVID-19-cases-1f6H3qEMe7m/index.html

November 20, 2022

Chinese mainland records 2,267 new confirmed COVID-19 cases

The cumulative number of confirmed cases on the Chinese mainland is 286,197, with the death toll from COVID-19 standing at 5,227.

c) https://news.cgtn.com/news/2022-12-17/Chinese-mainland-records-2-286-new-confirmed-COVID-19-cases-1fPxmzSKYHm/index.html

December 17, 2022

Chinese mainland records 2,286 new confirmed COVID-19 cases

The cumulative number of confirmed cases on the Chinese mainland is

376,361, with the death toll from COVID-19 standing at 5,235.

The level of dishonesty over COVID-19 vaccines just hit a new low:

https://www.usatoday.com/story/news/factcheck/2022/12/16/fact-check-no-pfizer-ceo-albert-bourla-not-resigning-vaccine-covid-19/10885195002/

“Pfizer CEO Albert Burla (sic) is stepping down and now says the mRNA technology was not sufficiently proven when launched,” reads the caption of a Dec. 10 Facebook clip (direct link, archived link). “He says they convinced him, but he wasn’t sure. He admits it’s not safe. Also worth noting he is NOT jabbed.”

So says a bunch of trolls on social media:

An Instagram post with the same claim generated over 1,000 likes before it was recently deleted. Many tweets with the same claim have generated hundreds of likes. But the claim is wrong on every front. A Pfizer spokesperson told USA TODAY Bourla remains in his position at Pfizer and has not announced any plans to resign. There is also no evidence that he said mRNA vaccines are dangerous. And Bourla has been vaccinated against COVID-19.

Stephen Miller led an incredibly racist immigration for the Racist in Chief Donald Trump. Of course Miller claims he was only protesting white men from the racism of others:

https://www.msnbc.com/opinion/msnbc-opinion/stephen-miller-crusade-help-white-men-working-rcna61538

Stephen Miller was one of the most strident anti-immigrant, white-nationalist sympathizers in former President Donald Trump’s administration. And, believe me, sticking out for that reason in that administration is really saying something. After spending his time in Trump’s administration maligning foreigners who want to come to America and promoting a zero-tolerance policy that ripped children from the arms of undocumented immigrants crossing the southern border, Miller is now on a mission to use the courts to eradicate what he says is bigotry targeting white men.

Huh? I guess he does not care about white women. Or blacks, Asians, Hispanics, Muslims.

You know every time I have to endure those Princeton Steve rants about immigration, I immediately think of Stephen Miller. Can you blame me?

So, it’s holidays and sometimes I like to give movie reviews. Hopefully it’s not time consuming hassle for Menzie. These aren’t necessarily Christmas films to watch with family, just films fun to watch. I saw “Pearl” and thought it was terrific. 8 out of 10 score. I very much felt like I was “lost inside” the film (in a good way) as I watched it. Maybe some part of why I like the film is to perv out on Mia Goth, but actually the film is well done and stands on it’s own if you like to be a little scared sometimes. The dark nature and isolated feeling of the film remind me a little of “The Lighthouse” with Willem Dafoe.

And another film I want to recommend is called “Infinite Storm” with Naomi Watts. I think Infinite Storm has deeper meaning. Especially towards the end of the film. Also 8 out of 10 score. “Pearl” maybe argued to be less substantive than “Infinite Storm”, but even “Pearl” has some deeper messages if you pay attention closely. I think some of the deeper meaning of “Pearl” (which can easily be missed in the Horror film fun) is that if a person is raised in a very repressed family with a lack of stimulation (social stimulation and otherwise) it can give a feeling of isolation and effect people psychologically. So even after the things “Pearl” does in this film, I found her to be a sympathetic character and person. (Or maybe I just thought she was hot?? I don’t know…… )

https://www.youtube.com/watch?v=pUMqic2IcWA

“It’s Morning Again in America”

I bring up what may be the most dishonest ad ever – the 1984 claim that Reagan saved America from that awful socialist Jimmy Carter. This ad appealed to low IQ votes like JohnH.

What happened was that we had a massive recession in 1982 under St. Reagan. Yea that massive recession lowered inflation. Yea the economy eventually recovered. But to claim the disasterous macroeconomic mix made Americans better off was a lie. We all know that.

But wait Jonny boy has FINALLY admitted that employment and real wages fell in 2011-12 under David Cameron. Of course the Cameron government a few years later wanted to take credit for the recovery around 2015 which only partially restored real wages. Cameron was lying Reagan style. And of course Jonny boy fell for the lies.

The problem is this troll has been going on and on and on trying to justify Cameron’s lies. He did so for years over at Mark Thoma’s place. And when this lying troll started wasting our time here – I warned everyone about his propensity to be Princeton Steve level of stupidity and dishonesty. But wait – all of you figured that out already. Well done crew!

I do not know that ‘we’ would be better off….

convince me.

I’m reading a LinkedIn post written by a young in-house transfer pricing practitioner who worked for Shell. His post discusses his problems with certain transfer pricing consultants which included this:

‘Consultants sometimes engage in fear-mongering, suggesting that companies will face dire consequences if they do not hire a consultant for their transfer pricing needs. This can create unnecessary anxiety for companies and undermine in-house expertise’s value.’

Gee I’m wondering if he is referring to Princeton Steve. Of course anyone who hired Stevie for any form of consulting advice is an outright fool.

If you are a sexist pig that owns an NFL team and abuses women in the workplace, you can count on your good Republican buddies in Congress to take any inquiry into your toxic sexist work place as an opportunity to post pictures of your cheerleaders in hot outfits. Being a sexist pig is seen as a great thing in Trump’s MAGA party:

https://www.nbcnews.com/politics/congress/house-gops-inclusion-salacious-commanders-cheerleaders-photos-official-rcna61566

Lawyers for more than 40 former Washington Commanders employees are demanding that House Republicans remove “sexualized and salacious photographs” of the NFL team’s cheerleaders featured in a GOP-written memo about the football team. The attorneys, Lisa Banks and Debra Katz, wrote a letter Tuesday to Rep. James Comer, R-Ky., ranking member on the House Oversight and Reform Committee, saying that their “clients are both humiliated and incensed by the GOP’s reckless dissemination of these photographs in an official Congressional document.” “They also feel retaliated against by Republican Committee members who have apparently chosen to embarrass them publicly for coming forward,” the lawyers said. “There was simply no legitimate reason for GOP members to have done this, and it has caused our clients additional and unnecessary pain.”

Hey it is the party of Matt Gaetz so what surprises anyone here?

Chris Christie is still a big fat Trump toadie – listen to the BS he uses to argue that the 1/6 committee should not do a criminal referral with respect to what Trump pulled:

https://www.rawstory.com/chris-christie-criminal-referrals/

Seriously – why is this fatso allowed to babble on the TV?

Austerity and political extremism –

https://cepr.org/voxeu/columns/political-disruptions-fiscal-austerity

Seems one leads to the other in more than a “post hoc, ergo blah, blah” kind of way.

Wonder what UK nurses would have to say…

The rise in support for extreme parties occurred in a period of significant fiscal policy interventions. Several European countries have implemented large-scale fiscal consolidation measures to reduce high levels of public debt. The massive reductions in public spending faced significant opposition and resulted in anti-austerity movements. In a recent paper, we investigate the link between fiscal consolidations and rising polarisation and provide new evidence on the political costs of fiscal austerity

OK this is interesting in terms of political science. Speaking of UK nurses, it seems economic Know Nothing JohnH is back to asserting Cameron’s fiscal austerity led to UK nurses and other workers enjoying real wage increases. Funny thing – he is schooling us with 2008 to 2018 data that clearly show that their real wages fell a lot over this period.

“To rationalise our main findings on the political consequences of austerity, we also estimate the economic effects of fiscal consolidations at the regional level. Austerity leads to a significant fall in regional output, employment, investment, durable consumption, and wages. Furthermore, the reduction in public spending lowers the labour income share, thereby inducing income redistribution away from working households. These findings highlight the close relationship between detrimental economic developments and voters’ support for extreme parties following fiscal consolidations.”

Ah – the economic effects of fiscal austerity is precisely what traditional macroeconomists like Krugman have often noted. Wait, wait JohnH keeps telling us Cameron’s fiscal austerity increased UK real wages. Yea Jonny boy is a political tool for the Tory Party.

Estimates of the consequences of China imposing a blockade on Taiwan:

https://rhg.com/research/taiwan-economic-disruptions/

Nothing having to do with GDP, but rather a catalog of some of the first-round effects. Useful input to further analysis.