Initial claims hit expectations, while continuing claims surprise on upside (1710K vs 1686K consensus).

I was recently asked — in light of these numbers — what the high profile layoff announcements meant for the economy, now and going forward. My answers — not much in terms of the short term horizon, and secondly, expect more layoffs as the economy slows further.

Here’s my reasoning. First, initial claims might be taken as an indicator of layoffs — but if so, they are stil remarkably small relatively speaking (1.7 million vs. a nonfarm payroll employment level of about 153 million, or about 0.6 percent), and one has to take into account the flows going both ways, most importantly hires. Second, many of these high profile announcements are in the information and finance sector. For information, it’s important to recognize there has been an unprecedented boom in IT-related hiring, so some re-trenchment for specific firms is unsurprising (see discussion from GS). In fact, information sector hiring continued to rise through November according to the last employment situation release (up 5.6% over pre-pandemic peak).

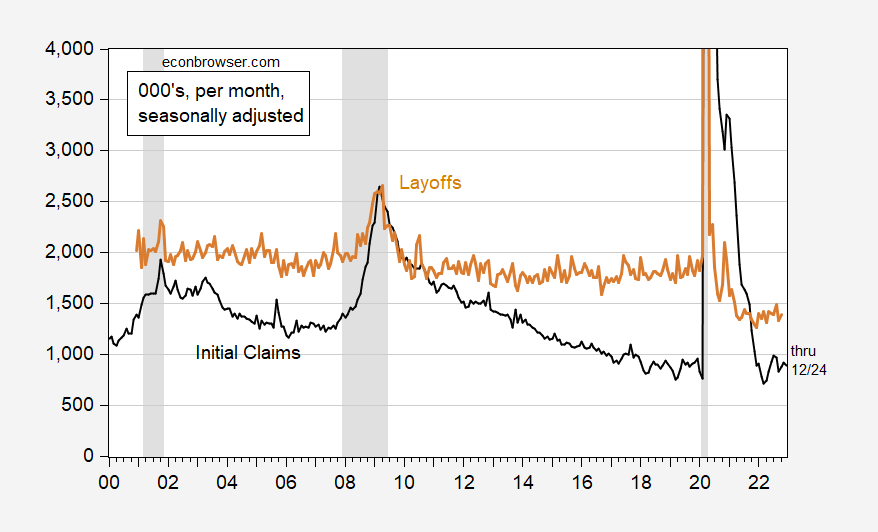

There is another issue of whether initial claims correlates well with layoffs (this will change with coverage, which has changed over the course of the pandemic and afterward). With respect to initial claims and layoffs as measured by JOLTS, one can see there’s a substantial difference between the series.

Figure 1: Initial claims, average of weekly series adjusted to monthly rate (black), and layoffs and discharges from JOLTS (tan), both in 000’s, seasonally adjusted. December 2022 observation for Initial Claims is for December ending 12/24. NBER defined peak-to-trough recession dates shaded gray. Source: DoL via FRED, BLS, NBER and author’s calculations.

While the two series had a high correlation pre-pandemic, they have not had a particularly high correlation post-pandemic. Hence, one should be careful about making inferences regarding layoffs using the initial claims data.

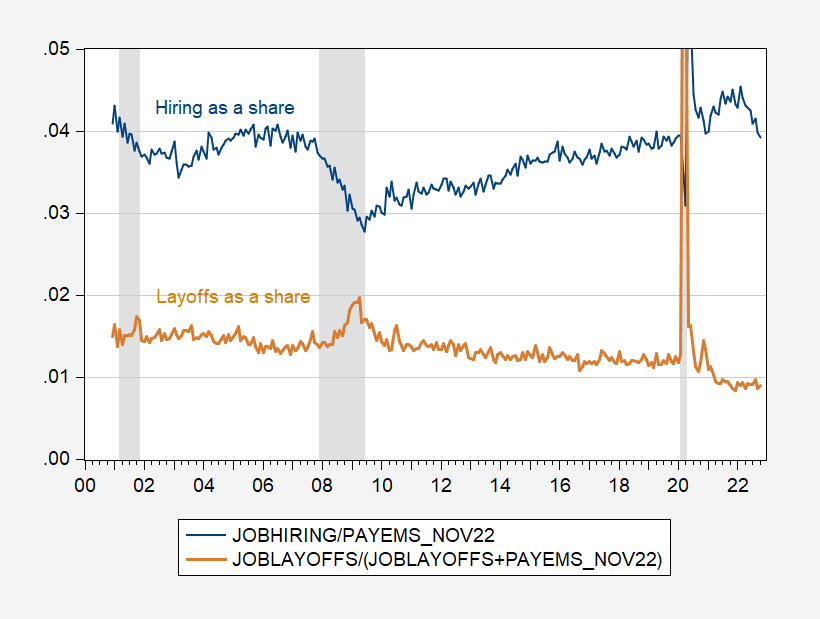

Both initial claims and layoffs (through October) are near record low levels. For a recession, we want to see hirings down and layoffs up. Typically hirings decline months, perhaps a year or more, before the recession (as dated by the NBER BCDC) begins. Here is the picture from JOLTS.

Figure 2: Hiring as a share of nonfarm payroll employment (blue), and layoffs as a share of layoffs plus nonfarm payroll employment (tan), all seasonally adjusted. NBER defined peak-to-trough recession dates shaded gray. Source: DoL via FRED, BLS, NBER and author’s calculations.

While hiring is declining, this is from a spectacular peak. As noted in Breyers et al. (2011), in the pre-pandemic era, employment growth slows because of hiring declines, much before layoffs.

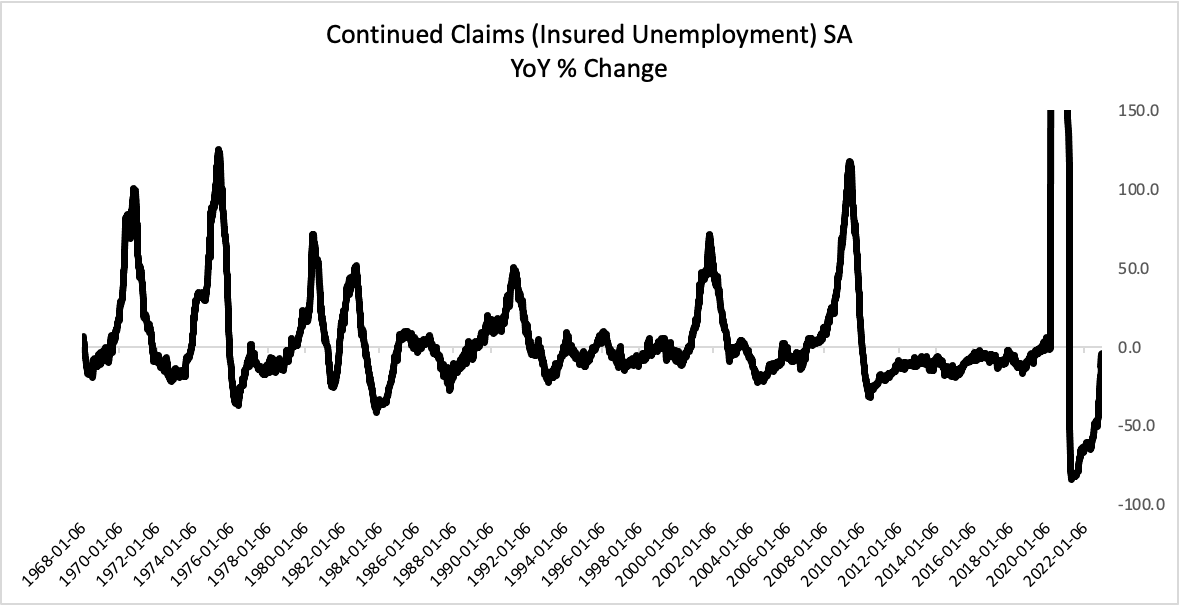

What’s this mean for recession? My coauthor Rashad Ahmed points out to me that each time continuing claims y/y growth bumps up (eyeballing, around 10%), in a recession. We’re just hitting -4.6% — essentially zero based on the variance — as of week ending 12/17.

Here’s a picture he provided.

Source: Rashad Ahmed, communication, 12/29/2022.

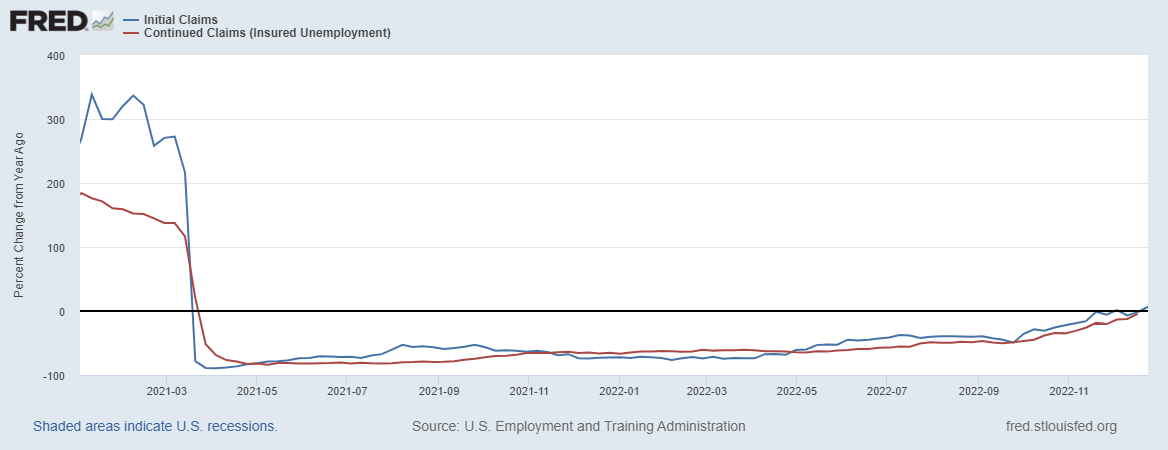

And here’s a detail on initial claims and continuing claims (tan line).

https://fred.stlouisfed.org/series/ICSA

Initial Claims (ICSA) – on a weekly basis.

Remember when this series went up slightly during the summer and Princeton Steve went on another one of his RECESSION freak outs? By the end of September, this series had declined from 261,000 to 190,000. Funny thing – Stevie never acknowledged that decline.

Here’s the FRED graph of the YoY% change in the 4 week average of initial claims, continuing claims, and the unemployment rate:

https://fred.stlouisfed.org/graph/?g=Yerw

Initial claims *always* lead both continuing claims and the unemployment rate.

Continuing claims more often than not cross the zero threshold before the unemployment rate.

Continuing claims are generally noisier than the 4 week average of initial claims. Both are noisier then the unemployment rate.

So the trick is to filter out enough noise to get a decent signal. My threshold is when the 4 week average of initial claims is both higher by 10% from the lowest reading of an expansion, and 10% higher YoY for longer than 2 months, there is high risk of a recession following shortly, or one may have just begun (excluding the pandemic; the only false signal is 1996).

As of this morning, the 4 week moving average is 750 lower than one year ago.

Micron Technologies, a chip maker, said they would soon cut about 10% of their workforce. One wonders if Juris Doctor Georgetown Jerome has noticed at all. Most of the U.S.A container shipping ports are now no longer jammed and there’s a surplus inventory of chips, and increased inventory of many other products. How many Juris Doctors does ti take to screw up a well humming economy?? Maybe just one.

https://www.reuters.com/technology/micron-forecasts-quarterly-revenue-above-expectations-2022-12-21/

Micron sets 10% job cuts in 2023 due to ‘supply-demand mismatch’???? What’s this mismatch? Well they are incurring operating losses so their stock is declining. But this is the case for much of the semiconductor sector right. Sales are temporarily down but many analysts seen long term growth.

There has been a reduction in unemployment benefits coverage since the Covid recession which probably complicates analysis:

https://fred.stlouisfed.org/graph/?g=Yevp

Some of that change is probably due to length of tenure in jobs, which will be self-correcting. We’ll find out in time about other effects.

Which is to say that,for now, we might want to increase the wight given to JOLTS data relative to claims data.

Well I tell you folks, you know WSJ is on the cutting edge, when in the past few days they had one front page story about two white male British “rappers” in their 70s who WSJ claim “are really popular with the kids”, and an editorial bemoaning how they just don’t make them like Pat Boone anymore. You know, the fraud who put a white face on Black music (couldn’t even do that right). Now he sells shit products to naive elderly people on TBN. Pat Boone~~hero to sham product TV marketers everywhere.

Poor man’s Andy Williams.

You flatter the bastard.

Well, every 70,000 years the “Leonard” comet passes relatively near to the Earth. At roughly the same interval of time Hoover adds something valuable to America’s public dialogue. Rejoice children, the time has arrived:

https://hanushek.stanford.edu/sites/default/files/publications/Hanushek%202022%20HESI%20EconomicCost.pdf

There are homes, I promise you they exist people, where children have no internet connection or desktops/laptops inside their living quarters. And they are told “you will have at home instruction”. Some of them are lucky just to have any food at lunchtime. While donald trump tells them “just drink some bleach”. Not that that bothers your average Republican, they’re worried about low income women “sinning” by using condoms. The “conservative”/MAGA brain is a fascinating walk at the carnival.

One tiny quibble with the language used. Nothing to do with content, just the tendency to repeat canned phrases. This is wrong:

“The abstract nature of test score declines, however,

often obscures the huge economic impact of these learning losses.”

Test scores don’t “obscure” economic impact. Test scores measure whatever test scores measure. The economic impact of educational shortfalls is another issue, an additional step in the analysis. Economic impact isn’t “obscured”. It’s not what’s being measured, not there to be obscured.

I know how hard good intros are to write, and that there is a temptation to settle for things which seem right at first reading. Fussy me, but that sort of writing shouldn’t make it past the editor.

@ Macroduck

First I wanna say I 100% agree with what you are saying, The sentence he uses doesn’t express very well what I think he is trying to say. And keep in mind as I say that, as a person who considers themselves above average intelligence, but I am also, sometimes extremely poor in interpersonal communication, (Even much worse “IRL” than I am here on the blog), I mean I often struggle in communicating my exact meaning to others, and fail in communicating my exact meaning to others, even after putting in much effort. But I think what Hanushek was trying to say was “The general public doesn’t perceive or have a perception of the strong relationship between test scores (as they related to good quality public education) and how those test scores relates to economic efficiency in general.

Well, that’s the best I can do anyway, trying to say what a man at least one standard deviation above me in intelligence didn’t quite succeed in saying.

i.e. No, economic impact isn’t what test scores measure. Kind of like “Average daily time of sunlight doesn’t measure daily temperatures” but people should maybe be more aware the relationship.

maga brains belong to human beings….

Not a terribly good argument for Darwin’s evolution, is it??

abject poverty of critical thinking in this world is something else.

Would you like to give us an example of where your “critical thinking” ( real world example ) will open all of our eyes?? I’d Love so dearly to hear your version.

mo,

six sigma folks talk about the 5 whys.

logic and evidence

it is how [rational] conclusions are drawn,

compensate for uncertainty,

recognize you may be wrong,

and don’t call ltr or johnh names.

Is it just me?

Every time I see an official data release “miss expectations,” I think “Wow. The consensus really blew it.”

Let me rudely attempt to put words in your mouth (I’m half-joking). I think when it’s a consensus of “experts”~~investment bank notes etc, proprietary pay up-front newsletters~~ where it seems to be surprising to us when we see the misses.

I’m thinking “WSJ” or Philadelphia Fed type thing (others), I think you know what I mean. And like you say, it does happen.

Late 1990s.

Senior Kodak executive: “May I ask why you downgraded our stock?”

20-something stock analyst: “Well, you missed a number, so we had to punish you.”

[Me, to myself: “Ahem, WHO missed calling the number?”]