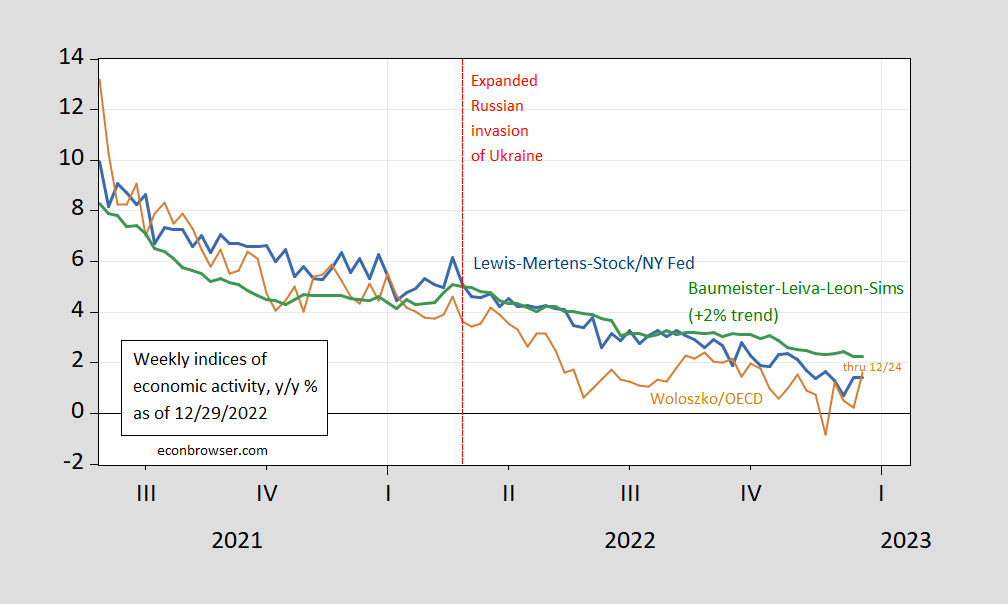

Weekly indicators from Lewis-Mertens-Stock (NY Fed) Weekly Economic Indicators, and Baumeister, Leiva-Leon and Sims WECI and Woloszko (OECD) Weekly Tracker through 12/24, released today.

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green). Source: NY Fed via FRED, OECD, WECI, and author’s calculations.

Rebound in the Weekly Tracker, which had dipped into negative for the week ending 11/26, now matching the WEI. The WEI reading for the week ending 12/24 of 1.4% is interpretable as a y/y quarter growth of 1.4% if the 1.4% reading were to persist for an entire quarter. The OECD Weekly Tracker reading of 1.6% is interpretable as a y/y growth rate of 1.6% for year ending 12/24. The Baumeister et al. reading of 0.25% is interpreted as a 0.25% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 2.25% growth rate for the year ending 12/24.

bv

Congrats to the Wisconsin Badgers for winning the bowl game last night vs Oklahoma State, It might not have been a “dream season” to the Badgers, but they put the racist Oklahoma State football coach in his place, which from my own viewpoint is worthy of a medal. I think a football team is an important part of campus life and creating school spirit and a sense of community. I hope students got to go out, enjoy the Arizona sunshine and have 2-3 beers and get a break from studies. I admire any student who has the ability and aptitude to attend a school like UW-Madison, so you earned a few moments of respite from your textbooks or laptops. Enjoy it

Moses,

Something I agree with you on. Go Badgers!

BTW, in that curioous study of WellBeing by Blanchflower and Bryson I linked on another thread here, Wisconsin comes in at #10, putting ahead of Denmark and Finland, although behind plucky Taiwan.

Moses,

And, of course, behind Minnesota, North Dakota, South Dakota, Iowa…

@ “w”

Hahahaha, I’m not sure what you’re getting at here. I have a lot of sentimental feeling to the state of Iowa because that is in fact where I was born and my family comes from. My Dad drove me to the “Field of Dreams” when I was a kid (even though he largely hated sports) for the sole reason to make me happy. And really a warm feeling to Minnesota as a neighboring state . So if you’re trying to get a dig in there, I’m a fan of the Midwest in general, the same way Menzie probably has a warm spot in his heart for the West Coast.

@ Professor Rosser

I skimmed your article you referenced (I didn’t thoroughly read it but I skimmed it). It was an interesting find, and I’m not trying to make any digs here, I was amazed Virginia was so high. Oklahoma was low for obvious reasons (I would argue mainly a lack or regard and funding of public education being one of the main causes). Wisconsin is a great place to live. I traveled there a few times when I drove semi, but didn’t really get to “experience” it, being busy in the work. But you get a “feel” for places, and I felt Wisconsin would be a great place to live. Just maybe slightly colder than Iowa that I also have high regard for as a place to live.

Why am I rooting for housing starts to go negative so loggers lose their shirts paying ppl to take vast timber surplus off their hands?

Timber surplus? What timber surplus? JohnH told us lumber prices were very high and would never come down. Oh wait:

https://tradingeconomics.com/commodity/lumber

Chicago lumber futures bottomed below the $400 per thousand board feet mark, down more than 70% since their March peak of around $1,450, as higher interest rates continued to depress real estate activity.

https://econbrowser.com/archives/2022/12/foreign-direct-investment-under-uncertainty-up-to-2019#comment-291882

December 29, 2022

“Looooooooooove is a maaaaaaany splendored thing……… ” Tell the truth, have you carved you and —– names on the tree bark with a heart??

“Looooooooooove is a maaaaaaany splendored thing……… ” Tell the truth, have you carved you and —– names on the tree bark with a heart??

“Looooooooooove is a maaaaaaany splendored thing……… ” Tell the truth, have you carved you and —– names on the tree bark with a heart??

[ Interesting what the disdain for an entire people elicits. Typically sexualized disdain. ]

ltr, quit complaining and cluttering up this blog with your incessant copy and paste. you whine more than econned. instead, pray for the continued freedom of Taiwan.

baffling,

You sound mighty whiny here.

From you, that’s funny, a case of the pot calli.g the porcelain black. You and rsm are the top whiners in comments here.

Here is an easy way to make Econned disappear. Ask him a question about actual economics. Every time I do – this worthless troll has nothing to say.

Macroduck,

Yes, baffling is the pot calling the kettle black. They’re literally whining about Itr whining. As for me, I’m glad I occupy your and baffling’s mind – happy new year ya filthy animals.

We ask Econned for one in his pathetic existence to say something substantive about economics and this is what we get?

Econned

December 31, 2022 at 4:41 am

Yep – Econned is a total waste of time.

Econned, I was not talking to you, loser. Go make up another fake name on this blog if you want to be a contributor. You bore me, boy.

Baffling,

You specifically called my name. As such, your intent is irrelevant. I see I’ve struck a nerve by replying to your comment which explicitly mentions me – maybe next time you’ll think twice before posting (it’s the holiday season so I’m feeling generous in providing you with the benefit of the doubt that you’ve thought at all).

As for fake names, I’ve never before heard of “Baffling” (or “baffling” fwiw) but we learn something new everyday. I’m curious, is utilizing a fake name the scapegoat of choice for your lack of contributions?

Just ignore Econned. He never ever contributes anything of substance here – even when we try to engage this worthless troll in a real discussion.

Econned, i was not talking to you before. But i shall direct my discussion to you now, as you will benefit if you are capable of reading. You use fake names on this blog to promote your views. It is childish and you should not do so. Your behavior on this blog is why i called you a loser. You bore me, boy.

Baffling,

1) If you mention my name, it doesn’t matter if you were talking to me. You are the one who decided (completely unprovoked) to mention my name.

2) you’re using a fake name and promoting your views

3) if I bore you, why am I on your mind? If I bore you, why did you feel it worthwhile to mention my name? If I bore you, why are you directing your discussion towards me now?

econned, you use more than one name on this blog. in an effort to deceive readers into believing others support you.

and I am certainly permitted to use your name and not address you. for instance, if I want to describe a loser, I invoke the name econned as an example.

you bore me, boy, because you do not contribute any value to this blog.

baffling (not Baffling),

To clear your confusion/illiteracy:

1) I never suggest you can’t use my name and not address. What I am suggesting, however, is how absolutely ludicrous it is that you think such a comment doesn’t justify my responding.

2) are you baffling or Baffling?

3) I didn’t ask if you bored me I asked “if I bore you, why am I on your mind? If I bore you, why did you feel it worthwhile to mention my name? If I bore you, why are you directing your discussion towards me now?”

Speaking of boring, I may just have to add you to my Econbrowser ignore list.

instead of demonstrating that you are case sensitive, why not address the question of why you use other names on this blog in an attempt to show more people agree with “econned”, an obviously deceitful action. I have asked this question multiple times, and you have continuously dodged the issue. quit deflecting.

just because I mention your name, for instance to illustrate an example of a loser, does not mean I expect a response. it is simply a statement.

you think adding me to your ignore list is a threat? as I have said, you bore me, boy.

baffling,

The reason I’ve used differing names on this blog is because I want to. I’ve never denied such. I’ve done it for humor (e.g. the moniker Joey Zanfino is related to a running joke from another forum that readers on this blog frequent) that you or others are not in on a joke is wholly irrelevant to me. Go cry to Diana Castle that Joey isn’t playing by your rules. Ahaha.

I don’t think that just because you mention my name that you expect a response. You obviously cannot read. You said my name. I commented because you said my name and it’s reasonable for someone to do so. You replied that you weren’t talking to me, I pointed out it doesn’t matter who you’re taking to – you said my name so I made myself present. All clear now?

I don’t think ignoring you is a threat – curious why you’d comment so. What I do know is that your reveled preference shows that I do not bore you – despite your repeated claims. Either I do not bore you or your life outside of repeatedly claiming I bore you is even more boring.

econned, that is a pretty piss poor excuse for the use of other monikers on this site. you commentary was explicitly meant to show that others on this blog agree with econned. it was deceitful, not a joke. try again boy. it is this immature behavior that demonstrates how you bore me, boy. but I will continue to correct your poor behavior, boy. some day you will need to grow up.

baffling,

Excuse? How about explanation. That you don’t like the explanation changes nothing. You’re likely just upset you weren’t in on the joke.

It’s deceitful of you to repeatedly suggest you’re bored with me as revealed preference clearly shows that’s a lie. You are both going out of your way to seek my replies and you’re responding. The moral high ground is not yours to traverse.

“pgl – I don’t see anything erroneous in the commenter Econned’s discussion on PredictIt markets. What is the “utter bs” that you see?”

that is a comment from “econned” in response to pgl, posing as j.zanfino. I see absolutely no joke in this whatsoever. but I do see somebody trying to imply others on the blog are in agreement with “econned”. you even tried to play dumb when prof chinn caught you in the act.

you just can’t make stooopidity like this up folks.

and just because you bore me, boy, does not mean I will not continue to correct you. unfortunately that is the approach one needs to take with a child or boy.

https://news.cgtn.com/news/2022-12-29/Trial-shows-China-s-new-VV116-COVID-treatment-is-similar-to-Paxlovid-1gabYglHhdu/index.html

December 29, 2022

Trial shows China’s new ‘VV116’ COVID treatment is similar to Paxlovid

By Gong Zhe

A new COVID drug from China has been proved to be as effective as Pfizer’s Paxlovid in a clinical trial published * by medical journal The New England Journal of Medicine (NEJM) on Wednesday.

According to the writer of the trial result, VV116 is an oral version of remdesivir, whose intravenous version is recommended by the World Health Organization as a COVID-19 treatment.

It’s obvious that pills are easier to take than drips, and that’s why many organizations and companies are trying to make remdesivir pills….

* https://www.nejm.org/doi/full/10.1056/NEJMoa2208822

https://www.worldometers.info/coronavirus/

December 30, 2022

a ) There were 5,226 coronavirus deaths in China on May 26, 2022.

b ) There were no coronavirus deaths from May 26, for nearly 6 months, through November 19.

c ) From November 20 through December 29, 2022 there have been 20 coronavirus deaths in China, bringing the total from 5,226 to 5,246.

d ) During the nearly 6 months of no coronavirus deaths in China, there were 300 to 500 coronavirus deaths each day in the United States.

e ) Coronavirus deaths in the United States continue at 200 to 400 each day.

f ) There have been 1,117,751 coronavirus deaths in the United States through December 29, 2022.

that is because china refuses to publish any data that indicates covid deaths in the country. however, the morgues tell another story. you continue to promote bogus statistics ltr.

Considering the bogus numbers on Covid, change in definitions and all, you have to question any numbers coming from official sources in China. In the case of doctored Covid numbers, the main objective seem to be making dear leader Xi look like an infallible statesman. Some have him suspected of being an evil dictator trying to fix his country’s demographic problem by letting old people die.

https://www.nejm.org/doi/full/10.1056/NEJMoa2208822

December 30, 2022

VV116 versus Nirmatrelvir–Ritonavir for Oral Treatment of Covid-19

By Zhujun Cao, Weiyi Gao, Hong Bao, Haiyan Feng, Shuya Mei, et al.

Abstract

BACKGROUND

Nirmatrelvir–ritonavir has been authorized for emergency use by many countries for the treatment of coronavirus disease 2019 (Covid-19). However, the supply falls short of the global demand, which creates a need for more options. VV116 is an oral antiviral agent with potent activity against severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2).

METHODS

We conducted a phase 3, noninferiority, observer-blinded, randomized trial during the outbreak caused by the B.1.1.529 (omicron) variant of SARS-CoV-2. Symptomatic adults with mild-to-moderate Covid-19 with a high risk of progression were assigned to receive a 5-day course of either VV116 or nirmatrelvir–ritonavir. The primary end point was the time to sustained clinical recovery through day 28. Sustained clinical recovery was defined as the alleviation of all Covid-19–related target symptoms to a total score of 0 or 1 for the sum of each symptom (on a scale from 0 to 3, with higher scores indicating greater severity; total scores on the 11-item scale range from 0 to 33) for 2 consecutive days. A lower boundary of the two-sided 95% confidence interval for the hazard ratio of more than 0.8 was considered to indicate noninferiority (with a hazard ratio of >1 indicating a shorter time to sustained clinical recovery with VV116 than with nirmatrelvir–ritonavir).

RESULTS

A total of 822 participants underwent randomization, and 771 received VV116 (384 participants) or nirmatrelvir–ritonavir (387 participants). The noninferiority of VV116 to nirmatrelvir–ritonavir with respect to the time to sustained clinical recovery was established in the primary analysis (hazard ratio, 1.17; 95% confidence interval [CI], 1.01 to 1.35) and was maintained in the final analysis (median, 4 days with VV116 and 5 days with nirmatrelvir–ritonavir; hazard ratio, 1.17; 95% CI, 1.02 to 1.36). In the final analysis, the time to sustained symptom resolution (score of 0 for each of the 11 Covid-19–related target symptoms for 2 consecutive days) and to a first negative SARS-CoV-2 test did not differ substantially between the two groups. No participants in either group had died or had had progression to severe Covid-19 by day 28. The incidence of adverse events was lower in the VV116 group than in the nirmatrelvir–ritonavir group (67.4% vs. 77.3%).

CONCLUSIONS

Among adults with mild-to-moderate Covid-19 who were at risk for progression, VV116 was noninferior to nirmatrelvir–ritonavir with respect to the time to sustained clinical recovery, with fewer safety concerns.

EIA 914 is out. (Monthly US production report, based on survey of top 90% of production.)

https://www.eia.gov/petroleum/production/#oil-tab

OCT oil is up about 60,000 bopd over SEP to 12.381 MM bopd. Would be ~100,000 bopd over last month’s report, which ended up revised up.

Texas flattish. FGOM flattish. ND flattish.

NM continues to grow, up ~40,000 bopd and drove most of the overall increase.

UT is interesting. Is up to 145,000 bopd. They have very limited areas of the state available for drilling because of the Federal parks. They also have a strange crude (Uinta) that is a very good crude (medium, low sulfur) for making products and processes great in refineries. But is waxy and viscous and is hard to transport (requires heated traincars or trucks). Little limited by transport as a result (and the local market is not huge). But it looks like they are making progress. FWIW, UT is at a (monthly, since 1980) record:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrfput2&f=a

[Natural gas was up very slightly, mostly due to AK, which is always worth factoring out…90% of AK gas is reinjected and the production can have large gyrations also….queers the numbers.]

Don’t have time to review those Trump tax returns. David Cay Johnston is here to help:

https://www.dcreport.org/2022/12/27/trumps-brazen-tax-cheating-revealed/

The picture of Trump behind bars in an orange jump suit made my day!

There was a sausage oligarch?

Lawyers suing lawyers – fun stuff! My favorites below:

https://news.bloomberglaw.com/business-and-practice/by-the-numbers-9-firms-lawyers-became-legal-targets-in-2022

“The Ohio Supreme Court declined to reconsider the award for RevoLaze Inc., a former Dentons client that alleged misrepresentation because a firm affiliate in Canada represented a company RevoLaze sued for patent infringement.”

“Proskauer Rose is facing renewed claims it conspired with a prominent accounting firm to promote tax evasion. Former firm clients Douglas and Jacqueline Coe originally sued Proskauer for legal malpractice and other claims in 2015—13 years after the firm and BDO Seidman LLP allegedly advised them to invest in distressed debt from a foreign company to offset tax obligations.”

Both Redbook weekly consumer spending (up over 9% yoy) and the 20 day average of tax withholding improved significantly this week.

On the other hand, Georg Vrba’s IM business cycle index flipped to signaling the onset of recession in 4 months.

I’m not one to link to a rightwing rag like The Daily Beast but this is sweet:

https://www.thedailybeast.com/maga-right-would-have-called-winston-churchill-a-welfare-queen?ref=home

The usual suspects got in on the action, including the former president’s son. Donald Trump, Jr., tweeted, “Zelensky is basically an ungrateful international welfare queen.” Put aside the irony of this trust fund “nepo baby” calling someone else a welfare queen.

https://www.worldometers.info/coronavirus/

December 29, 2022

Coronavirus

United States

Deaths ( 1,117,751)

Deaths per million ( 3,339)

China

Deaths ( 5,246)

Deaths per million ( 3.6)

https://www.worldometers.info/coronavirus/

December 29, 2022

Coronavirus

New York

Deaths ( 75,191)

Deaths per million ( 3,865)

China

Deaths ( 5,246)

Deaths per million ( 3.6)

https://www.aap.org/en/pages/2019-novel-coronavirus-covid-19-infections/children-and-covid-19-state-level-data-report/

December 27, 2022

Cumulative Number of Child COVID-19 Cases

As of December 22, almost 15.2 million children are reported to have tested positive for COVID-19 since the onset of the pandemic according to available state reports. About 165,000 of these cases have been added in the past 4 weeks. This week nearly 48,000 child COVID-19 cases were reported. This marks the third consecutive weekly rise in reported child cases, an increase of about 67% from the 29,000 cases reported the week ending December 1.

15,173,130 total child COVID-19 cases reported, and children represented 18.2% (15,173,130 / 83,506,442) of all cases

Overall rate: 20,159 cases per 100,000 children in the population

American Academy of Pediatrics

Children’s Hospital Association

https://www.worldometers.info/coronavirus/

December 29, 2022

Coronavirus

Arizona

Deaths ( 32,182)

Deaths per million ( 4,421)

China

Deaths ( 5,246)

Deaths per million ( 3.6)

110% C-L-A-S-S

https://www.pbs.org/newshour/show/judy-woodruffs-goodbye-message-to-viewers-as-she-departs-newshour-anchor-desk

For those who love “old school” journalism, Judy Woodruff will be greatly missed.

Judy is one of the best. Another great woman journalist just died:

https://www.msn.com/en-us/news/politics/news-legend-barbara-walters-recalled-for-savage-trump-takedown/ar-AA15Pupp?ocid=msedgdhp&pc=U531&cvid=c37115387d5541b3a9e74c0793778f24

Barbara Walters savaged Donald Trump back in 1990!

AP News: “Economists are baffled by a wider-than-usual divergence between long-term mortgage rates and the yield on the benchmark U.S. government bond that is driving a sharp rise in borrowing costs and helping to torpedo the U.S. housing market this year.

The gap, or spread, between the 10-year Treasury yield and the average rate on a 30-year mortgage widened this year as inflation hit the highest level in decades and the Fed began raising interest rates and taking other steps aimed at taming surging prices.

This spread has historically averaged around 170 basis points a month, but between March and October it averaged about 240 basis points, according to Federal Reserve data. In October, the spread widened to 292 points, the biggest monthly gap since August 1986…

Earlier this year, the Fed also began reducing its holdings of Treasury and mortgage-backed securities, or MBS.

”’What that means, practically, is there’s less money in the lending market to actually reach consumers,” Ratiu said. “That also has an upward effect on mortgage rates.’” https://apnews.com/article/federal-reserve-system-business-los-angeles-mortgages-off-the-charts-6c631b96bb8eabfe62c43ceb254632c7

Interesting lead line: “Economists are baffled…” That probably is probably a good summary of why there is so little discussion of the bleak prospects for new single family construction and for refinancing to capitalize on increased wealth from high prices.

Then again, when I raised this issue before, pgl barely knew that there was such a thing as a mortgage spread and was totally clueless for why it was happening. MacroDuck, despite dubious claims of having discussed the mortgage spread before, was also unable to articulate any explanation for the highest mortgage spreads since 1986.

“The gap, or spread, between the 10-year Treasury yield and the average rate on a 30-year mortgage”

Maturity matching is an important part of measuring spreads but you STILL do not use 30-year Treasury rates? Yea – you are dumb. BTW the spread is high but your earlier claim that it the highest ever recorded was one of your typical lies.

“Maturity matching is an important part of measuring spreads but you STILL do not use 30-year Treasury rates?” pgl shows his ignorance yet again.

The 10 year treasury is widely followed in the mortgage industry; the 30 year treasury is not. That is because the typical mortgage length, or average lifespan of a mortgage, is under 10 years. So that’s how the mortgage industry deal with maturity matching.

In fact FRED even puts the mortgage spread on a chart. (30 year mortgage less the 10 year treasury). But pgl insists that that’s the wrong way to do it!!!

https://fred.stlouisfed.org/graph/?g=i8HL

And pgl still is mostly clueless as to why the mortgage spread (a term new to pgl) is so high!

Ever notice that whenever you catch pgl saying something stupid, you can expect a blizzard of posts spewing trash talk, lies, insults and nonsense?

You can expect another such blizzard now.

“The 10 year treasury is widely followed in the mortgage industry; the 30 year treasury is not.”

Yea I get that there are a lot of fools out there. And Jonny boy follows fools better than anyone. Come on Jonny boy – try be an independent thinker for once in your foolish life.

Now if the duration of the typical mortgage were 10 years or less – maybe you would have a point. But wait – Jonny boy has no clue what duration even is. So he makes a claim he cannot back up. Fancy that – wait. Most of your claims have zero support.

“And pgl still is mostly clueless as to why the mortgage spread (a term new to pgl) is so high!”

We have asked you many times to provide us with your explanation. What’s the matter Jonny boy – you are incapable of doing so?

Let me educate you on the basics with regard to credit spreads:

(1) They often depend on the credit rating of the borrower. So do you know what the credit rating is for the average borrower in this market? Could it be that credit ratings have fallen? Oh I’m sorry – I’m using very basic concepts that go over your little brain. Sorry.

(2) Financial market imperfections do exist and some of this spread reflects liquidity issues. Oh wait – another concept that eludes little Jonny boy. Hey Jonny – we asked you to READ that NY FED paper and tell us how it applies to the current market. Oh I’m sorry that went over your head too. Never mind.

Boy little Jonny – he was invited to write a paper on this issue for the Journal of Finance but the mental midget has no clue where to start.

A pardon to the grown ups here for repeating myself but poor little Jonny has a reading problem. So here is a discussion of mortgage spreads that I linked to a while back. It summarizes some thoughts from William R. Emmons, lead economist with the St. Louis Fed’s Center for Household Financial Stability in an issue of Housing Market Perspectives. Yea Emmons is a smart fellow so we must pardon Jonny boy from missing what he said including his chart of spreads which showed how much higher they were in 1980 than they are today:

https://www.stlouisfed.org/on-the-economy/2020/july/mortgage-rates-not-matching-declines-in-treasury-yields

Now earlier claimed this spread was at a historical record high. Yea – he denies making that bogus claim now. But Jonny denies a lot of things. Also note:

‘That’s where individuals borrow from a financial institution when buying a home. By contrast, the secondary or wholesale market is where financial institutions sell mortgages to “securitizers” (Fannie Mae and others), which then sell mortgage-backed securities to investors, he noted. The last time the difference, or spread, was this large was in 2008, during the depths of the Great Recession, and the time before that was in 1986, as seen in the figure below.’

Oh wait – this supposed spread is not really a properly measured credit spread for an individual borrower at the end of the day. It is a weird statistic in so many ways but little Jonny boy thinks he has discovered something amazing that no economist comprehends. Fancy that. Oh wait – the spread was really really high in 1986 and in 2008 as I said. But Jonny boy as THE EXPERT assures us the recent levels were the highest in history. Yea – Jonny boy is that dumb.

“This spread has historically averaged around 170 basis points a month, but between March and October it averaged about 240 basis points, according to Federal Reserve data. In October, the spread widened to 292 points, the biggest monthly gap since August 1986”

I love it when Jonny boy’s own links contradict his previous lies. Yes – the 30-year mortgage rate was 10.4% during the first week of August 1986. The person who wrote this article used the 7.33% interest rate on 10-year government bonds to make this claim that the spread was higher back then.

But Jonny boy told us this supposed 2.92% was the highest ever. Yea – Jonny boy tells a lot of lies.

Hey Jonny – a little challenge. Compare the recent spread using the 30-year government bond rate compared to the spread properly measured by in early August 1986. I’ll even give you a tip. The 30-year Treasury rate back in early August 1986 was 7.46%.

We’ll wait as we know you will have to take your shoes off so you can count past 10.

Another blatant pgl lie…the particle said that “ the spread widened to 292 points, the biggest monthly gap since August 1986”

Nowhere did I say that that was the highest ever. pgl just loves to fabricate…and fabricate…and fabricate. It divers attention from his own inadequacies and ignorance.

“Nowhere did I say that that was the highest ever.” Deny, deny, deny. That’s what you do.

“when I raised this issue before, pgl barely knew that there was such a thing as a mortgage spread”

Dude – your dishonest insults are very childish. Macroduck and I have been talking about credit spreads way before you ever did. The difference – we calculate them properly with maturity matching. Oh wait – you do not know what that even means – do you? And you claimed this spread was the highest ever. I noted earlier that it was higher back in early August 1986. And your own links notes you were wrong.

Poor little Jonny – cannot keep his own lies straight!

Pal is still clueless about why the mortgage spread is so…and he covers his ignorance with a whole lot of trash talk!

Seriously dude? This is why all the kiddies are laughing at you.

When Jonny boy writes things like “economists are baffled” he runs around suggesting he is so much smarter than economists. Even though everyone here know Jonny boy is even dumber than CoRev and Bruce Hall. Notice this Know Nothing smug troll has no explanation for this recent rise in spreads. But hey – why would we expect Dr. Know Nothing to have an explanation.

Of course the grownups here likely have read this:

https://www.newyorkfed.org/research/staff_reports/sr674.html

Understanding Mortgage Spreads

May 2014 Number 674

Revised June 2018

Authors: Nina Boyarchenko, Andreas Fuster, and David O. Lucca

Most mortgages in the U.S. are securitized in agency mortgage-backed securities (MBS). Yield spreads on these securities are thus a key determinant of homeowners’ funding costs. We study variation in MBS spreads over time and across securities,and document a cross-sectional smile pattern in MBS spreads with respect to the securities’ coupon rates. We propose non-interest-rate prepayment risk as a candidate driver of MBS spread variation and present a new pricing model that uses “stripped” MBS prices to identify the contribution of this prepayment risk to the spread. The pricing model finds that the smile can be explained by prepayment risk, while the time-series variation is mostly accounted for by a non-prepayment risk factor that co-moves with MBS supply and credit risk in other fixed income markets. We use the pricing model to study the MBS market response to the Fed’s large-scale asset purchase program and to interpret the post-announcement divergence of spreads across MBS.

I linked to this paper a while back but I’m sure Jonny boy has no clue what this research says. But maybe I’m wrong – maybe Jonny boy can figure out how this might apply to the current situation. Go ahead Jonny – dazzle us with your expertise. This should be fun.

Pgl finally stopped trash talking long enough to do a little research and found that paper from the NY Fed. Good job!

Of course, there are other factors involved…but don’t tell pgl…he can’t handle the thought of having to do research twice in one day.

At least pgl finally knows that there is such a thing as a mortgage spread!

“there are other factors involved”

And what are those factors? Oh you have no clue. When you finally come up with something productive in your whiney little life, write up a paper and submit to the Journal of Finance. The editor needs a good laugh. Especially when you confuse the volatility of spreads with their levels.

Jonny boy missed an opportunity by once again not reading his own link:

‘And as recently as the second week of November, the spread swelled to 326 basis points as the weekly average on a 30-year mortgage climbed to a 20-year high of 7.08%.’

Of course as of 12/29, Freddie Mac puts the 30 year mortgage rate at only 6.42% while the 30 year Treasury yield was 3.92%. Look – a 2.5 spread is high but it does seem to be moderating.

Of course Jonny boy’s latest attempt to follow recent data was to look at some discussion of the VOLATILITY of spreads with a clearly labeled graph of the measure of VOLATILITY. Jonny saw the increase in VOLATILITY and tried to tell us how high the actual spread rose. Yea – he does not know the difference. He is after all, really, really dumb.

Trump apparently had one regret about the 1/6 rioters – he wanted them to dress up for the insurrection!

https://www.msn.com/en-us/news/politics/former-white-house-press-secretary-told-jan-6-committee-that-trump-said-capitol-rioters-looked-very-trashy/ar-AA15OTC4?ocid=msedgntp&cvid=8fd0560efee842ffbc1fda052d3d480d

While he’s since expressed solidarity and support for the mob of rioters who stormed the U.S. Capitol on his behalf in January 2021, Donald Trump was allegedly concerned with the optics of how his own supporters looked while the riot was ongoing….Grisham told the committee that she heard from “several people in the West Wing” that, as the riots began to unfold and footage began to be shared on television, Trump was taking it in from the White House, and making comments “that these people looked very trashy.” “I don’t know if he expected them to be wearing full suits of like Roman armor and that would have made them not trashy,” she added, “But he did feel they looked trashy, but he loved how they were fighting for him.”