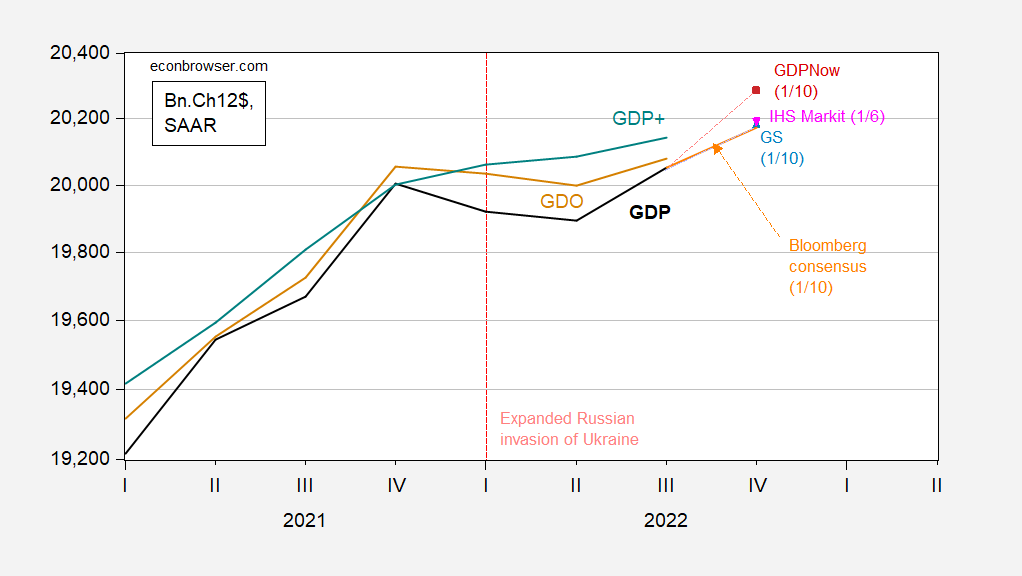

Nowcast from Atlanta Fed (GDPNow) plus tracking from GS out today.

Figure 2: GDP (bold black), GDO (tan), GDP+ (green), GDPNow for Q4 (red square), Goldman Sachs (sky blue triangle), IHS Markit (inverted pink triangle), Bloomberg consensus as of 1/10 (orange line), all in billions Ch.2012$, SAAR. GDP+ level calculated by iterating on 2019Q4 GDP (when GDP and GDO matched). Source: BEA (Q4 3rd release), Federal Reserve Bank of Philadelphia (12/22), Federal Reserve Bank of Atlanta (1/10), Goldman Sachs (1/10), IHS Markit (1/6), Bloomberg, and author’s calculations.

GDPNow is substantially higher (4.1%) than the Bloomberg consensus (2.4%), as well as recent readings from Goldman Sachs and IHS Markit.

IHS Markit/S&P Global view as of 1/6 [not online]:

Despite solid headline growth in the fourth quarter, according to our estimate, the narrative of our near-term outlook for the US is still one of mild recession beginning in the first quarter of 2023, with a peak-to-trough decline in GDP of 0.6%.

Mark Zandi (Moody’s) and Heather Boushey (CEA) have indicated that a “soft-landing” is possible, while Jan Hatzius has in the past indicated a likely soft landing, which he interpreted as more likely given the employment situation release for December.

Speaking of the employment situation in December, here’s tha Atlanta Fed’s labor market spider chart:

https://www.atlantafed.org/chcs/labor-market-distributions

Note that for many labor market measures, December data were about as goodas it gets, and for all measured, better than the median result since 1994. If you compare December 2022 to December 2021 and June 2022, you’ll see deterioration in the upper right quadrant, mostly in the “employer behavior” category of factors. In other words, firms are less eager for new hires now. Anyone tracking wage gains could probably have guessed that.

Of course, if you’d rather take a holistic view, you could rely on a single study from some researchers at the Philly Fed.

https://www.worldometers.info/coronavirus/

January 10, 2023

a ) There were 5,226 coronavirus deaths in China on May 26, 2022.

b ) There were no coronavirus deaths from May 26, for nearly 6 months, through November 19.

c ) From November 20 through January 9, 2023 there have been 46 coronavirus deaths in China, bringing the total from 5,226 to 5,272.

d ) During the nearly 6 months of no coronavirus deaths in China, there were 300 to 500 coronavirus deaths each day in the United States.

e ) Coronavirus deaths in the United States continue at 250 to 450 each day.

f ) There have been 1,121,298 coronavirus deaths in the United States through January 9, 2023.

https://www.worldometers.info/coronavirus/

January 9, 2023

Coronavirus

United States

Cases ( 103,123,617)

Deaths ( 1,121,298)

Deaths per million ( 3,349)

China

Cases ( 503,302)

Deaths ( 5,272)

Deaths per million ( 3.6)

https://www.worldometers.info/coronavirus/

January 9, 2023

Coronavirus

New York

Deaths ( 75,654)

Deaths per million ( 3,889)

China

Deaths ( 5,272)

Deaths per million ( 3.6)

https://www.worldometers.info/coronavirus/

January 9, 2023

Coronavirus

France

Deaths ( 162,990)

Deaths per million ( 2,485)

China

Deaths ( 5,272)

Deaths per million ( 3.6)

I was very sorry to hear that Barkley Rosser died.

Rick Stryker: That is indeed sad news. Thank you for telling the Econbrowser community.

may he rest in peace.

Here is a profile (via Tyler Cowen).

https://www.jmu.edu/news/2022/01/14-barkley-and-marina-rosser-profile.shtml?fbclid=IwAR13K42jM7H8ZB4ty2TY5WdUdzo0jsSes_1ixxyPRSuHYLUH32ywrXf45is

Tyler – nicely put!

That is all information I didn’t know. It’s been an honor to read his comments, and it’s sad he’s gone. I will miss reading what he had to say.

“I was very sorry to hear that Barkley Rosser died.”

How devastatingly sad such news.

I am deeply saddened, and will write immediately to the family.

https://en.wikipedia.org/wiki/J._Barkley_Rosser_Jr.

John Barkley Rosser Jr. (born 12 April 1948) is a mathematical economist and Professor of Economics at James Madison University in Harrisonburg, Virginia since 1988. He is known for work in nonlinear economic dynamics,[1] including applications in economics of catastrophe theory,[2] chaos theory,[3] and complexity theory[4][5][6] (complex dynamics, complexity economics). With Marina V. Rosser he invented the concept of the “new traditional economy”.[7] He introduced into economic discourse the concepts of chaotic bubbles,[8] chaotic hysteresis (op. cit., p. 326), and econochemistry.[9] He also invented the concepts of the megacorpstate[10] and hypercyclic morphogenesis.[11] He was the first to provide a mathematical model of the period of financial distress in a speculative bubble.[12] With Marina V. Rosser and Ehsan Ahmed, he was the first to argue for a two-way positive link between income inequality (economic inequality) and the size of an underground economy in a nation.[13] Rosser’s equation has been used to forecast ratios of future Social Security benefits to current ones in real terms.[14] …

RIP Barkley.

First of all, let me join in the condolences on the passing of Barkley Rosser. He was an excellent commentator.

On the issue of this post, that there was substantial growth in Q4 certainly is supported by the data; although to cut to the chase: a sharp decline in the price of gas can do wondrous things!

But the three forecasts leave me unmoved. Jobs are a classic coincident indicator, and forecasting based on the trend in a coincident indicator is a classic mistake. Most importantly, many recessions in the past before 2001 began immediately after job gains of +.15%/month as we had in December. Most importantly, the 1981 recession induced by Volcker’s tightening began in the face of a much stronger jobs market just before.

Further, while the unemployment rate cited by the forecasters *is* a leading indicator going into recessions (but a lagging one coming out), there is a 50+ year record that the unemployment rate follows initial jobless claims. The three forecasters appear to hand their hats on the *levels* of initial claims and the unemployment rate, whereas the historical record is more consistent with their *change.* If initial claims were about 270,000 in 1999 or 2007, that would signal a strengthening expansion; now it would be a 10%+ increase above their 2022 levels, enough to signal a recession is imminent or nearly so.

Meanwhile the ISM manufacturing index and the decline in the manufacturing workweek – very reliable old school leading indicators – are at recessionary levels. Industrial production and manufacturing production look like they are peaking or have already peaked. Wholesalers’ sales reported yesterday also look very much like they have on the cusp of prior recessions.

On the other hand, housing units under construction is a big plus, as that continued to rise through November. I doubt a recession begins until that rolls over.

My best guess remains that a recession begins by mid-year. The best argument against that is simply that so many people, including senior management of large companies, are of that opinion. It’s not that the majority is usually wrong, it’s that when everybody expects Event X to happen, they change their behavior accordingly. Reductions that may have been done abruptly only after the sea-change is obvious instead occur gradually well in advance, thus changing the trajectory of the data.

https://www.msn.com/en-us/news/politics/watch-gop-lawmaker-dodges-after-msnbc-host-asks-him-to-identify-woke-policies-in-the-american-military/ar-AA16c9db?ocid=msedgdhp&pc=U531&cvid=098550b695a545b3a3978c0aadba802f

On MSNBC Tuesday, Rep. Byron Donalds (R-FL) claimed that “woke policies” are destroying the U.S. military — but swiftly tried to change the subject when anchor Joy Reid asked him to provide an example of this.

I watched Joy Reid interview Byron Donalds. This was bad but not nearly the BS this alleged financial expert spewed about the Social Security program. First of all – he said the Trust Fund will be bankrupt in 2 years which is a pathetic lie. He also tried to tell us that the stock market was a better place to put our funds simply because he can cherry pick periods when the average return on stocks was higher than the return on government bonds. Excuse me but we endured this pseudo finance under Bush43’s attempt to privatize the Social Security system. If Donalds is so incredibly incompetent with basic finance that he does not get systematic risk and expected return – NO ONE should trust this clown with their finances.

Sorry to hear that Barkley Rosser passed.

He lived a long rich life.

pgl:

Would you describe US obesity-sitting-dementia policies as ‘woke’? I ask because the US military is experiencing difficulty finding healthy recruits.

My impression is that US obesity-sitting-dementia policies enjoy widespread multi-partisan support similar to the strong US consensus behind the cheap energy entitlement.

Please recall that the nominal US federal excise taxes on gasoline and diesel have not budged in roughly a quarter of a century.

That’s a sharp electronic pen you wield, sir.

Thank you.

I worry. Those of us in small rich western countries have a vested interest in the USA remaining strong and self-confident.

In the interim, US domestic and foreign policy decisions are accelerating US hegemonic decline. This preference for superficial morality, us versus them demonization, both domestically and internationally, and for letting US political elites to blatantly misinform US voters appears to me to have accelerated the hegemonic decline of the USA.

The Biden Democrats are just as much a part of the problem as MAGA Republicans.

In passing, Stephen M. Walt has yet another excellent op-ed out in Foreign Policy. His explicit suggestions will be ignored unfortunately.

Off topic, Turkey and Greece –

Near the end of December, Turkey’s Erdogan threatened war if Greece extends it claim of territorial waters to 12 nautical miles of the south and southwest coast of Cyprus:

https://www.politico.eu/article/turkey-mevlut-cavusoglu-threat-war-greece-territorial-sea-dispute/

While there is ever so much history to this spat, including barely-avoided military conflicts in 1987, 1996 and 2020, the timing of the Greek decision to extend its claim may indirectly have something to do with the timing of natural gas development in and around Crete:

https://www.ekathimerini.com/economy/1201793/drilling-for-gas-in-crete-to-start-earlier/

Both cases have to do with Greece claiming rights over a continental shelf, with Turkey claiming Islands do not have continental shelves, and so no claim to mineral rights in shelf waters.

Here’s the first paragraph:

“US energy giant ExxonMobil, which has partnered with Greece’s HELLENiQ Energy (formerly Hellenic Petroleum) in searching for natural gas and oil west and southwest of the Aegean island of Crete, not only is unconcerned about Turkish aggressive rhetoric against Greece but plans to accelerate its timeline for exploratory drilling by a year, Kathimerini understands.”

As a side note, were tensions between Greece and Turkey to result in actual military conflict, no matter how limited, NATO’s southern flank would weaken substantially. Meanwhile, Turkey is a principal obstacle to a substantial strengthening of NATO in the North. Erdogan surely knows his tether with NATO is not limitless, and Article 5 provides Turkey a massive deterence against attack. NATO members, meanwhile, surely don’t want to explore the implications of action against a member. Dragging Greece and Turkey into some process to come to terms over the Aegean would be optimal, but ain’t happened yet.

Russia has a new top general for the don’t-call-it-war in Ukraine, Valery Gerasimov, author of the Gerasimov doctrine, the essence of which is:

‘… a 4:1 ratio of non-military to military action. Gerasimov emphasizes “the importance of controlling the information space and the real-time coordination of all aspects of a campaign, in addition to the use of targeted strikes deep in enemy territory and the destruction of critical civilian as well as military infrastructure.” Also he proposes to cloak regular military units in “the disguise of peacekeeper or crisis-management forces.”‘

https://en.m.wikipedia.org/wiki/Gerasimov_doctrine

In discussing his doctrine in 2013, Gerasimov noted that modern war involves “special-operations forces” and “internal opposition” to establish a “permanently operating front.”

https://thehill.com/policy/international/3809299-who-is-valery-gerasimov-the-new-leader-of-russias-war-in-ukraine/

Permanently operating front? Internal opposition? Disguised as peacekeepers? Sounds like a prescription for perpetual war. Ukraine’s future could be grim.

Russia’s Defense Ministery, in announcing the appointment, stated:

“The increase in the level of leadership of the special military operation is connected with the expansion in the scale of tasks … the need to organise closer contact between different branches of the armed forces and improve the quality … and effectiveness of the management of Russian forces.”

https://www.reuters.com/world/europe/russia-appoints-gerasimov-top-commander-ukraine-2023-01-11/

‘Closer contact between branches’ addresses one of the shocking failures of Russian forces in Ukraine so far in the war. This amounts to a root-and-branch effort to reform Russia’s military mid-harvest. We’ll see how that goes.

Of course, Gerasimov is the third (fourth?) guy in a year, and he has been very high up in the war effort till now. Despite the fancy promise to shape up coordination between services, this guy may get his butt handed to him, just like the others.

Putin is reminding me of Bush43 during the Iraq debacle. “I trust my generals” is something he often said but only after he replaced the last general in charge with the next lackey that adopted Bush43’s political agenda.

that is going to embarrass putin immensely!

that is going leave a mark, embarrass putin immensely!

Ukraine will be the end of Putin and maybe even the Russian Federation. But that’s got nothing to do with whether we have a recession next year. Spending on military equipment for Ukraine and to update US systems will take a while to ramp up but might kick in at about the right time to prevent a recession. Provided the lunatics in Congress don’t do something incredibly stupid like playing games with the debt limit.

could look at the move as a reorganization, the present operational leaders remain.

if you know of the us’ civil war you know in winter 1863-64 lincoln kept halleck, moved grant in as overall commander in the field (tennessee, and other armies) and kept meade as cg of army of potomoc…..